Web Developers

As we enter the final 10 shopping days till Christmas, Coresight Research looks at the opportunities for US retailers to make the most of this exceptional shopping season.

There are many positive macroeconomic indicators for how we’ll finish the 2018 holiday shopping season:

- GDP growth accelerated from 3.2% in 3Q2017 to 3.8% in the same period this year.

- Unemployment slipped slightly from 4.1% in Q32017 to 3.7% in the same period this year.

- Average hourly wages are up slightly from $26.54 in 3Q2017 to $27.35 year on year.

- Importantly, consumer sentiment rose from 95.9 to 97.5, according to the University of Michigan Index of Consumer Sentiment.

- Thanksgiving online sales rose 27.9% year over year to $3.7 billion in 2018.

- Black Friday online sales rose 23.6% year over year to $6.2 billion.

- Cyber Monday online sales rose19.3% year over year to $7.9 billion.

Location, Location, Location

Or, in this case, lack of specific location may be the more appropriate meme, as browsing and buying continues to switch from desktop to mobile devices.Yet, desktops remained a disproportionately popular device for completing online purchases. According to Adobe, desktops accounted for 42% of traffic but 63% of online purchases during the period November 1–December 6, 2018; smartphones accounted for 49% of traffic and 30% of purchases (tablets accounted for the remainder). Smartphones consistently see lower conversion rates. On Cyber Monday, for example, Adobe recorded conversion rates of 7.4% on desktop versus 3.9% on smartphones. This difference in conversion rate is in part because it’s easier to comparison shop on the larger screens of desktops. We also suspect that cross-channel shoppers’ tendency to compare prices and products on their smartphones while they are in-store, rather than with an intention to buy via their mobile device, has a suppressing effect on conversion. In other words, smartphones are disproportionately used for research:some 58% of US consumers used smartphones in stores to shop for deals on Black Friday 2018, according to IBM data cited by Retail Dive.So, What’s There to Worry About?

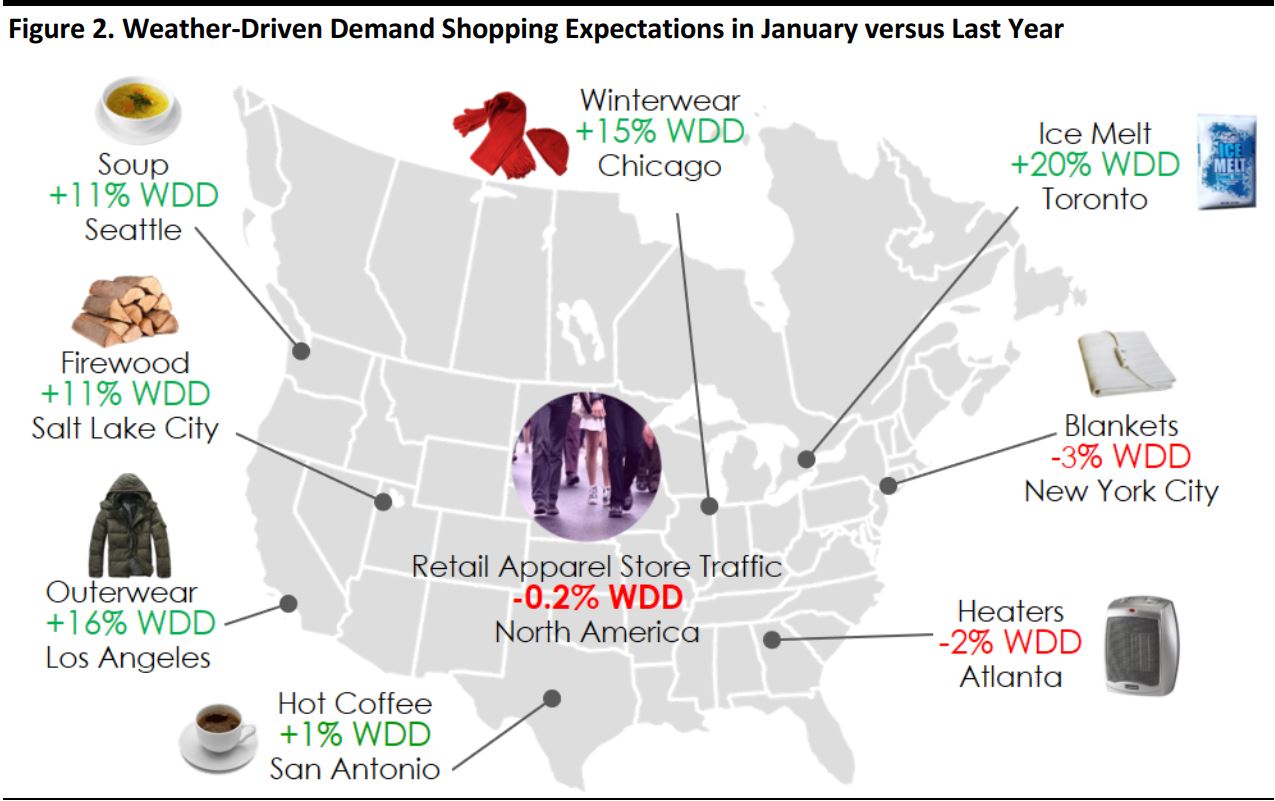

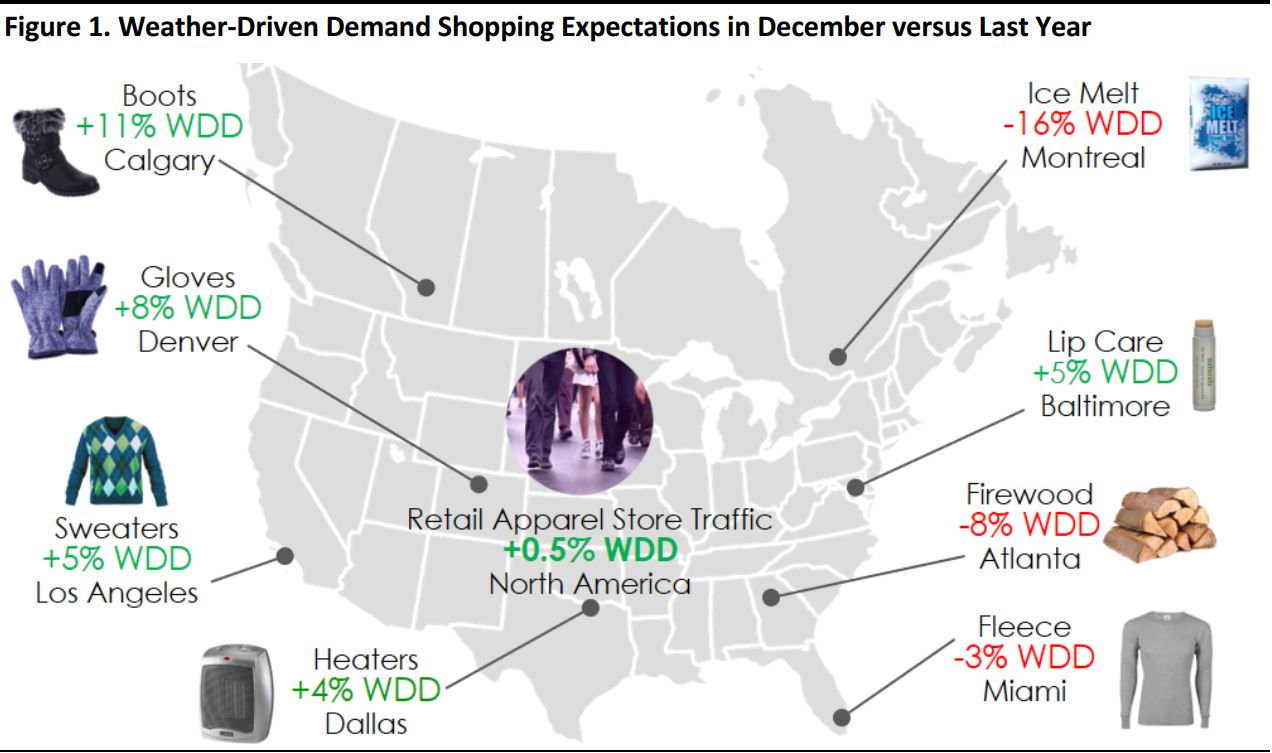

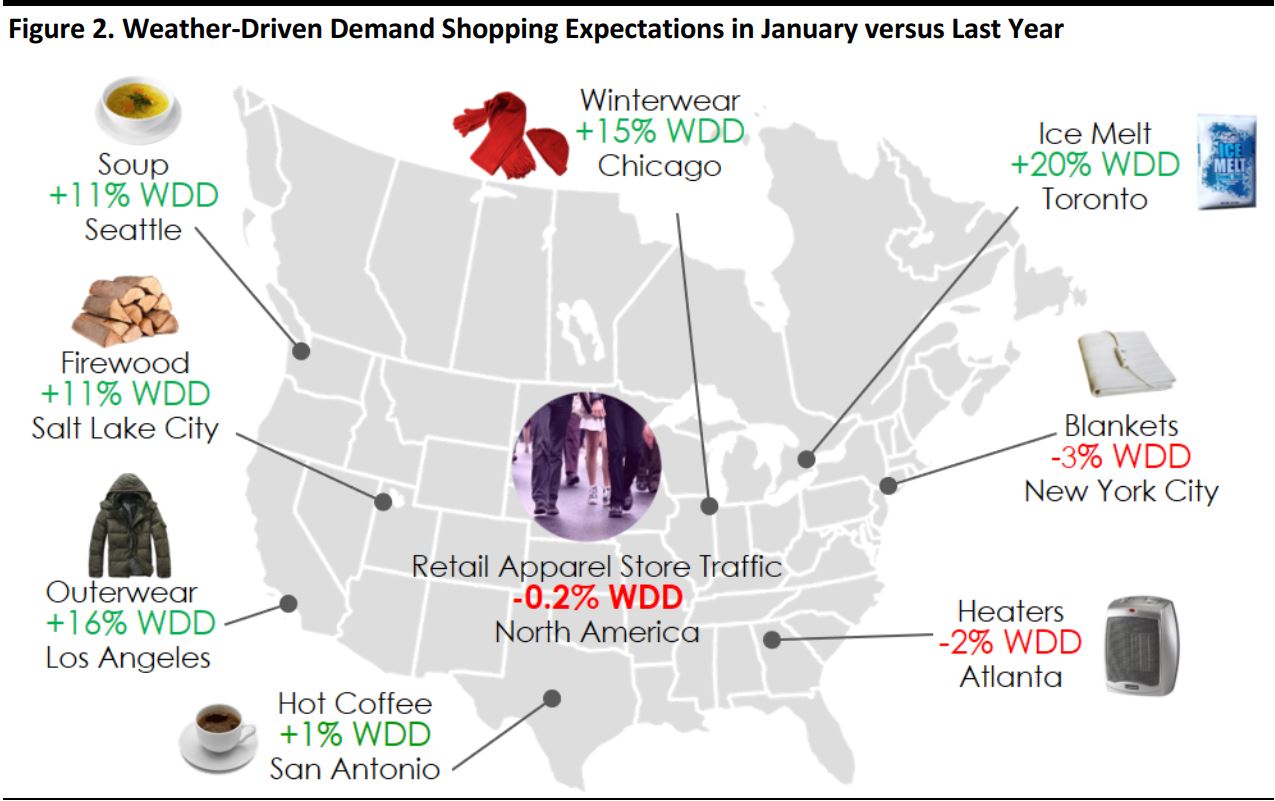

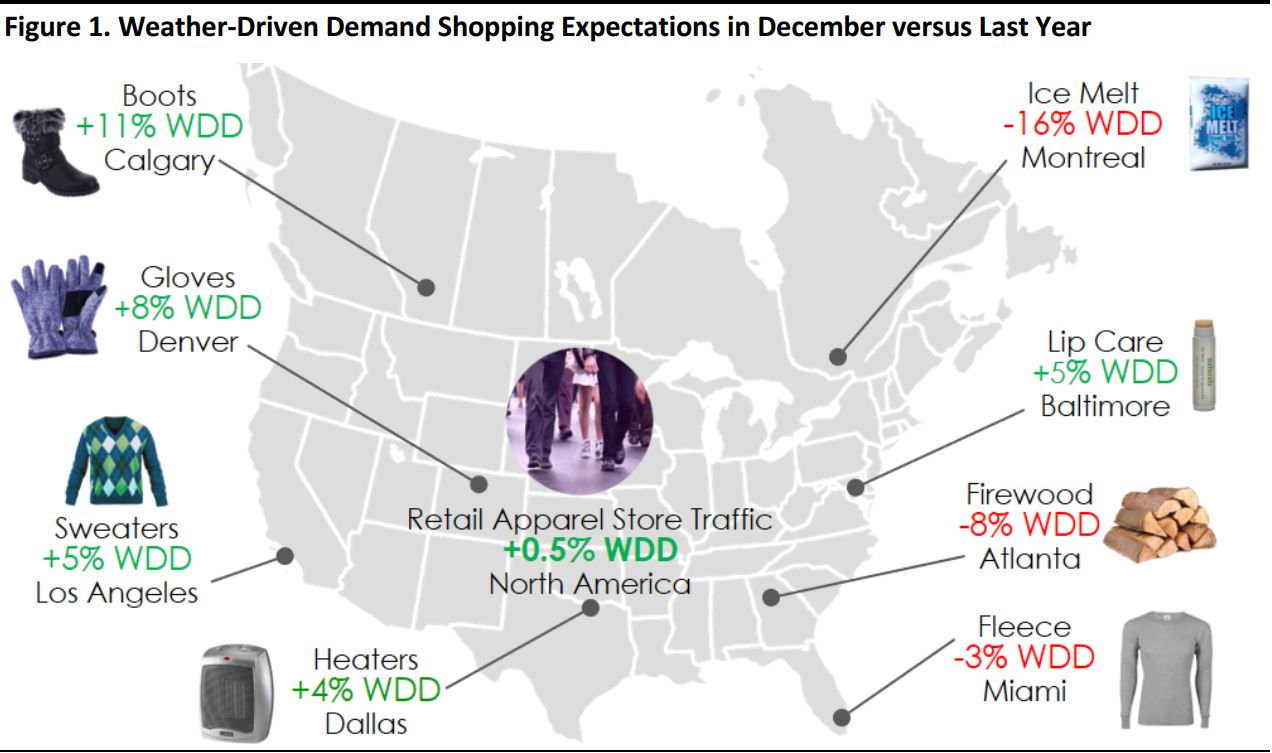

Lots of things, of course. First, in-store traffic on Thanksgiving was 1.2% lower in 2018 than in 2017, Black Friday traffic fell 1.5% and Cyber Monday in-store traffic was down 7%, according to ShopperTrak. This shows that brick-and-mortar stores may have trouble attracting customers into physical locations. But it is also a measure of how digitally enabled consumers are now better informed and more focused when they go to stores: they know what they want and they know where to go. As we pass deadlines for shopping online in time for delivery before Christmas, physical store-shy consumers may have no choice but to hit the bricks to finish their holiday shopping in time. Plus, this year we have one of the longest periods possible between Thanksgiving and Christmas: 32 days. There is also a full weekend just before Christmas, which will give last-minute shoppers plenty of opportunity to spend. And, Hanukah was early this year, leaving more space for Christmas shopping. A further positive for the retail sector is that, in a context of strong consumer demand, major retailers are discounting less than they did last year.On Black Friday 2018, we saw seven of 10 major retailers offer discounts at lower rates than they did last year. The average discount over the Black Friday period was 37.0%, slightly below last year’s 37.1% figure, according to data from WalletHub. So, what are people buying? Thanks to unusually cold weather over the Thanksgiving weekend through much of the country, we saw strong demand for items such as winter clothes, scarves, gloves etc. Weather in November influenced purchases, with stronger than usual demand for rain jackets, winter coats, snow throwers and even soups, however, December weather is expected to be warmer than a year ago, except in the Western US, so demand for winter items is expected to be lower in the East. As we noted in our report on holiday gifting, gift cards are consumers’ most-wanted type of gift this holiday season, with 60% of respondents to a Prosper Insights & Analytics survey stating that they would like to receive a gift card. This means January will be a critical period for retailers to encourage consumers to redeem those cards to clear inventory, as well as capitalize on the opportunity to make additional sales when customers enter the store. To do this, retailers should be stocked, staffed and ready to go immediately after Christmas. In the meantime, retailers must also continue to engage shoppers with the right merchandise and experiences to ensure a successful holiday season. As always, an unanticipated snow or ice storm could be a wildcard, driving consumers online.

Source: Planalytics