Nitheesh NH

What’s the Story?

In this report, we discuss how grocery retailers are seeking to lock in the loyalty of a more digitally engaged customer base through fixed-fee membership programs that offer benefits such as unlimited delivery or pickup. We present five key trends that are shaping the grocery e-commerce subscription market. E-commerce subscriptions differ from traditional loyalty programs offered by retailers: In exchange for a recurring membership fee, subscriptions offer enhanced, immediate benefits including instant discounts, free shipping and VIP experiences that can be used at any time. Traditional loyalty programs, by contrast, offer free enrollment, but require members to make purchases over time for rewards that come later (for example, after accumulating points).Why It Matters

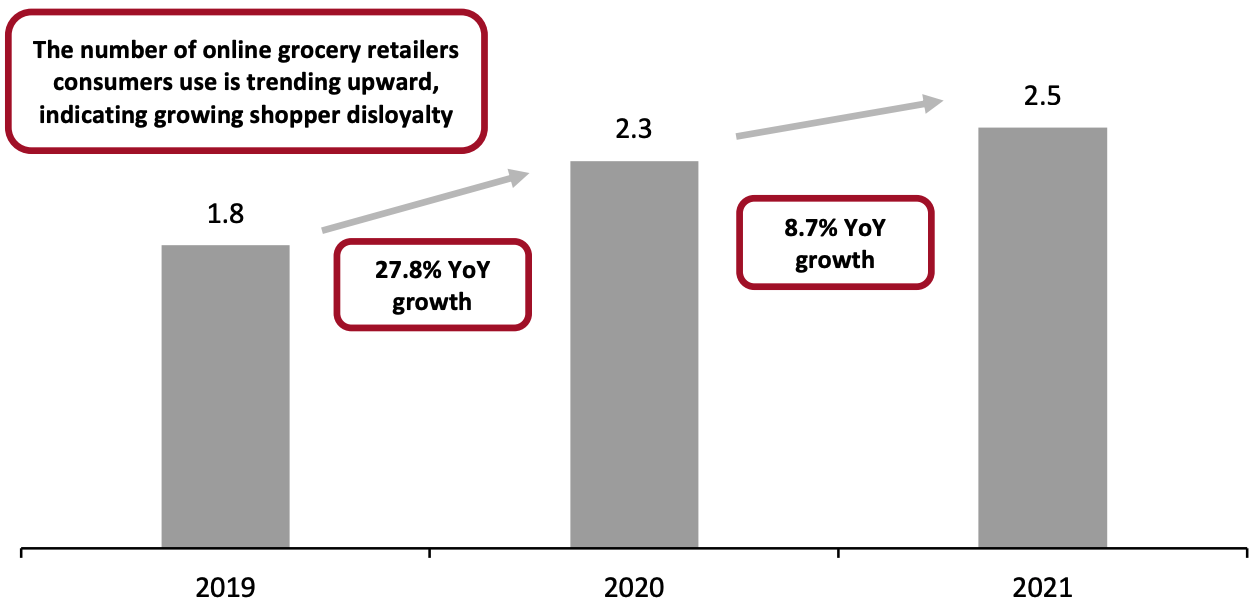

As more consumers moved their grocery shopping online during 2020, their habits and expectations shifted accordingly. Online shopping gives consumers a much wider choice of retailers, making loyalty difficult to secure: Our annual US online grocery survey, undertaken on April 1, 2021, found that respondents purchased from an average of 2.5 retailers online in the 12 months prior to the survey, up from 2.3 in 2020, as shown in Figure 1. We interpret this as primarily a reflection of more frequent online shopping, but it also implies a segment of promiscuous shoppers that remains up for grabs.Figure 1. Online Grocery Shoppers: Average Number of Retailers They Bought Groceries from Online in the Past 12 Months [caption id="attachment_133617" align="aligncenter" width="700"]

Base: US respondents aged 18+ who have purchased groceries online in the last 12 months (695 in 2019, 599 in 2020 and 975 in 2021)

Base: US respondents aged 18+ who have purchased groceries online in the last 12 months (695 in 2019, 599 in 2020 and 975 in 2021)Source: Coresight Research[/caption]

US Grocery—Redefining Loyalty via E-Commerce Subscriptions: Coresight Research Analysis

Given the pandemic-induced shift in grocery shopping habits toward online, many retailers are seeking to foster loyalty among newly active online shoppers with new e-commerce subscription programs or additional benefits on existing schemes. Below, we discuss five key trends in the US online grocery subscription market. 1. A Crowded Sector Spurs Retailers To Reward Customer Loyalty Amazon Prime had a sizeable head start over its competitors, and has expanded considerably since its 2005 launch without a true rival, but has only moved into the grocery sector relatively recently. Amazon has been building up its private-label grocery portfolio, increasing omnichannel engagement by opening Amazon Fresh stores and simplifying its array of grocery delivery services, prompting its competitors in grocery retail to launch rival subscription programs. As online grocery gained traction during the pandemic, many retailers launched new subscription services or expanded their existing programs in an effort to capture the loyalty of high-value customers and drive new revenues:- Ahold Delhaize-owned Giant Company launched Choice Pass in January 2021, an e-commerce subscription program that offers unlimited free delivery and pickup for $98 per year or $12.95 per month. The company noted at the time that as one-third of its customers already engaged digitally, the launch of the Choice Pass would position it for future growth in the expanding digital landscape.

- In July 2021, Albertsons rebranded its Unlimited Delivery Club subscription as FreshPass, priced at $12.99 per month or $99 per year. The company has updated the subscription membership with new rewards and a bigger emphasis on fresh offerings.

- Hy-Vee launched its premium membership program, Hy-Vee Plus, in December 2020 at a price of $99 per year. It offers free delivery, a two-hour express pickup service, additional fuel savings and exclusive monthly discounts and offers.

- In June 2021, SpartanNash expanded its Fast Lane subscription service (launched in July 2017), to offer discounted delivery fees, fuel and grocery products.

- Walmart launched its Walmart+ membership program in September 2020, priced at $98 per year or $12.95 per month, which offers members unlimited free delivery. The program also offers Scan & Go checkout, fuel discounts, free curbside pickup and other benefits. In its earnings call for the quarter ended April 30, 2021, Walmart CEO Douglas McMillon said grocery is the key driver for Walmart+ signups. In June 2021, the company added prescription drug discounts to the Walmart+ subscription service.

Figure 2. Comparison of Major Retailers’ Subscription Programs in the US [wpdatatable id=1292]

Source: Company reports/Coresight Research

Except Giant Company’s Choice Pass, all of the abovementioned programs offer free same-day shipping on orders above a minimum amount. However, in Amazon’s case, since the company does not have a large store footprint, its Amazon Fresh service is unavailable to many Prime shoppers. Walmart, by contrast, can fulfill online orders from its many brick-and-mortar locations. Amazon has addressed some of the blind spots conferred by its origins as an online-only retailer through strategic acquisitions and partnerships: Its ownership of Whole Foods, which it acquired in 2017, enables it to offer grocery delivery through those stores. Although Amazon Prime costs more than other subscription services, the company’s breadth allows it to offer a wider range of benefits, including music and video streaming, seasonal discounts, and cloud photo storage. Competing online grocery retailers focus more on shopping itself, through pricing and store-based perks that online-only competitors cannot match, such as fuel discounts. 2. Disruptive Third-Party Entrants Have Overtaken Established Grocers Retailers’ e-commerce subscriptions also face competition from third-party delivery providers such as Instacart, Shipt, Uber and DoorDash, whose subscription programs have soared in popularity amid the pandemic. Their services allow shoppers to shop from multiple retailers without paying additional fees, although they do not provide any additional perks and add a markup on in-store prices. Shipt, for example, has indicated that its prices will usually exceed in-store prices, stating that, for a $35 order, “members can expect to pay about $5 more using Shipt”—indicating a markup of over 14%. It also noted that a service fee is added when ordering from select retailers. Instacart also adds a 1.9% fee for its Express members and over 5% for other customers.Figure 3. Comparison of US Hyperlocal Delivery Providers’ Subscription Services [wpdatatable id=1293]

Source: Company reports

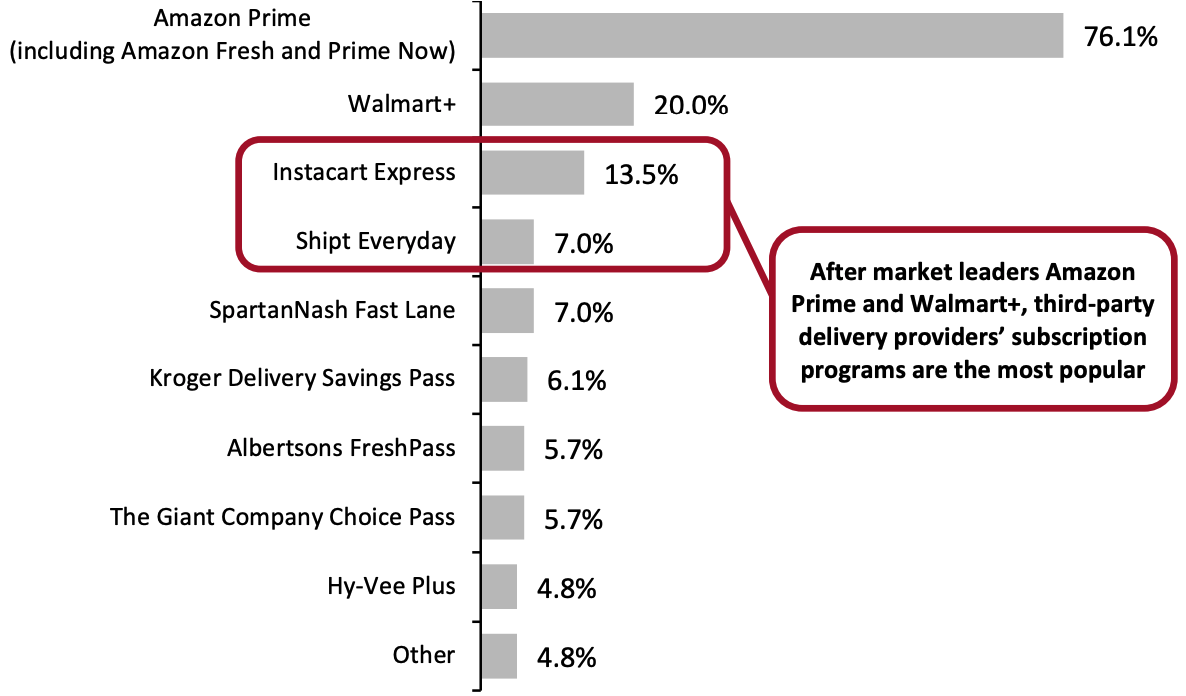

In Coresight Research’s survey dated August 9, 2021, around 56% of respondents said that they belong to paid-for online subscription programs from grocery retailers or services such as Amazon Prime or Instacart Express. Of those, a large majority—over three-quarters—indicated that they are members of Amazon Prime. Although Walmart+ only launched in September 2020, it has gained traction in a short amount of time: Some 20% of those with an online grocery subscription had joined the program.Figure 4. Respondents with Any Paid-For Online Grocery Subscription from Grocery Retailers or Services Such as Amazon Prime or Instacart Express: Programs They Are Currently a Member of (% of Respondents) [caption id="attachment_133618" align="aligncenter" width="700"]

Base: 230 US respondents aged 18+ who are members of an online grocery or other delivery subscription program[/caption]

3. Free or Expedited Shipping Most Attracts Subscribers

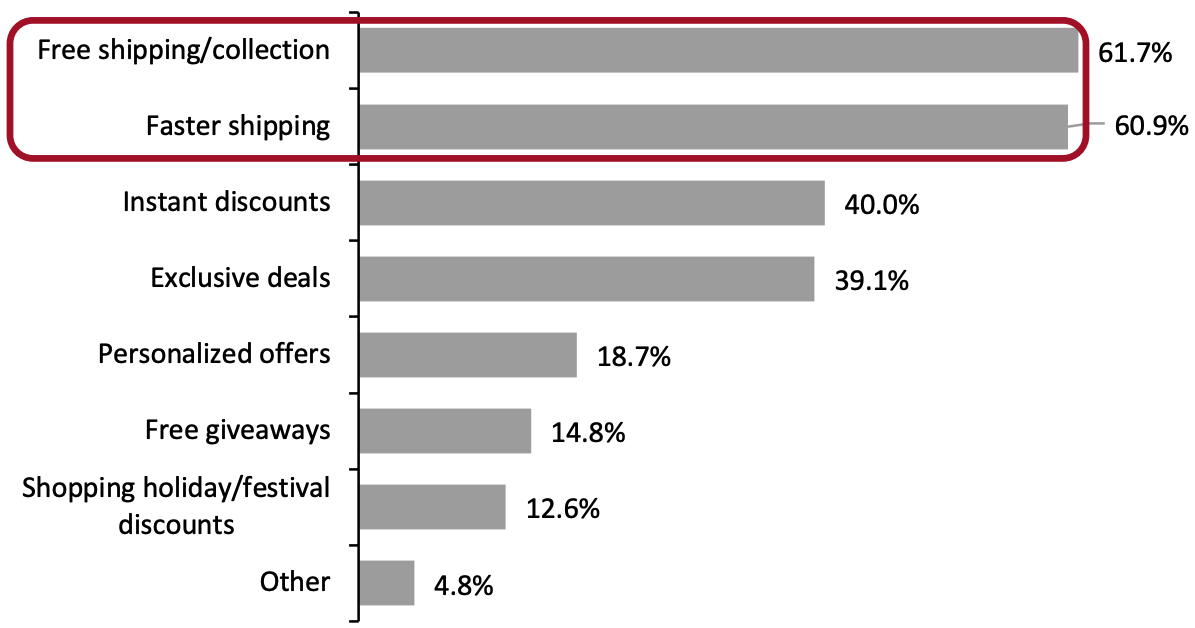

Retailers that launch an online subscription program must find the right mix of benefits to attract consumers. A small number of key benefits form the core of most of these programs, partly due to Amazon Prime’s outsized and sustained influence on consumer behavior.

Free delivery or pickup and expedited shipping are the perks customers want most from a subscription service. Almost 62% of respondents who have a subscription said free delivery and pickup would motivate them to invest in or renew a subscription, while 60.9% said that faster shipping would attract them to do so. Other benefits are also important, including instant discounts that shoppers can conveniently use whenever they shop (40.0%) and exclusive deals (39.1%).

Base: 230 US respondents aged 18+ who are members of an online grocery or other delivery subscription program[/caption]

3. Free or Expedited Shipping Most Attracts Subscribers

Retailers that launch an online subscription program must find the right mix of benefits to attract consumers. A small number of key benefits form the core of most of these programs, partly due to Amazon Prime’s outsized and sustained influence on consumer behavior.

Free delivery or pickup and expedited shipping are the perks customers want most from a subscription service. Almost 62% of respondents who have a subscription said free delivery and pickup would motivate them to invest in or renew a subscription, while 60.9% said that faster shipping would attract them to do so. Other benefits are also important, including instant discounts that shoppers can conveniently use whenever they shop (40.0%) and exclusive deals (39.1%).

Figure 5. Respondents with Any Paid-For Online Grocery Subscription from Grocery Retailers or Services Such as Amazon Prime or Instacart Express: Top Benefits that Motivate Them To Join or Renew (% of Respondents) [caption id="attachment_133621" align="aligncenter" width="700"]

Base: 230 US respondents aged 18+ who are members of an online grocery subscription program

Base: 230 US respondents aged 18+ who are members of an online grocery subscription programSource: Coresight Research[/caption] Transactional benefits such as free shipping and discounts may lure consumers into joining but may not be sufficient to create enduring loyalty. To retain customers in the long term, retailers should seek to provide more personalized and experiential benefits beyond transactional discounts and savings. Examples of these incentives include:

- Albertsons FreshPass includes a monthly Starbucks deal that can be used at participating Starbucks cafes and is personalized to members.

- Supermarket chain Heinen’s, which operates 23 stores across Northeast Ohio and Illinois, launched a nutrition-focused membership program in February 2021 that includes one-on-one nutrition counseling with dietitians and personalized coaching sessions at its wellness centers.

- Hy-Vee offers its Plus members a personal concierge service in which they have exclusive access to a “Red Line,” a dedicated telephone number staffed by Hy-Vee customer assistance experts and personal shoppers.

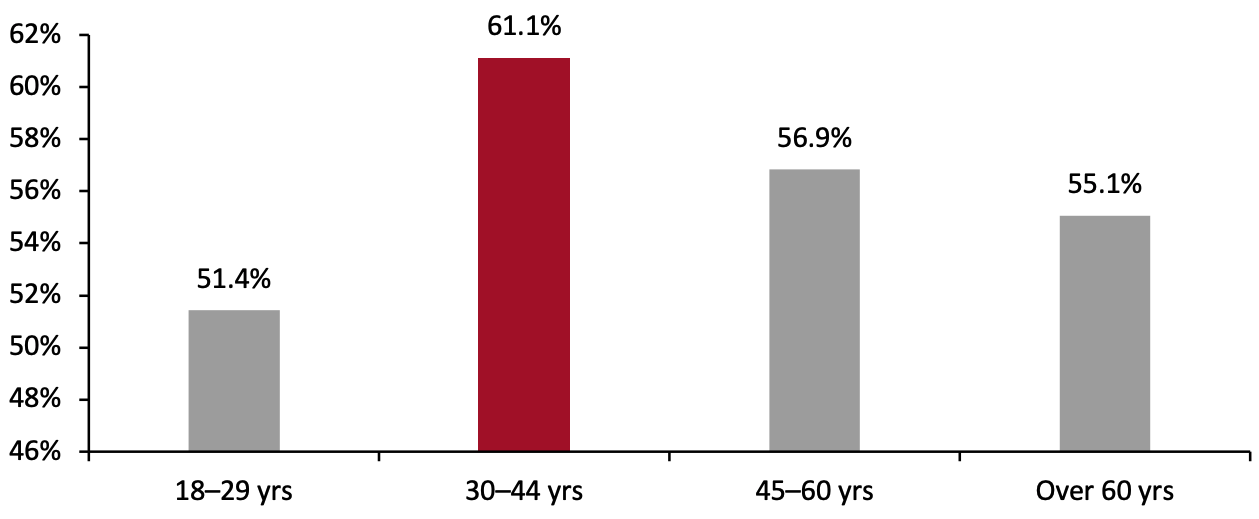

Figure 6. All Respondents: Proportion That Currently Belongs to Any Paid-For Online Grocery Subscription from Grocery Retailers or Services Such as Amazon Prime or Instacart Express, by Age Group (% of Respondents) [caption id="attachment_133620" align="aligncenter" width="700"]

Base: 410 US respondents aged 18+

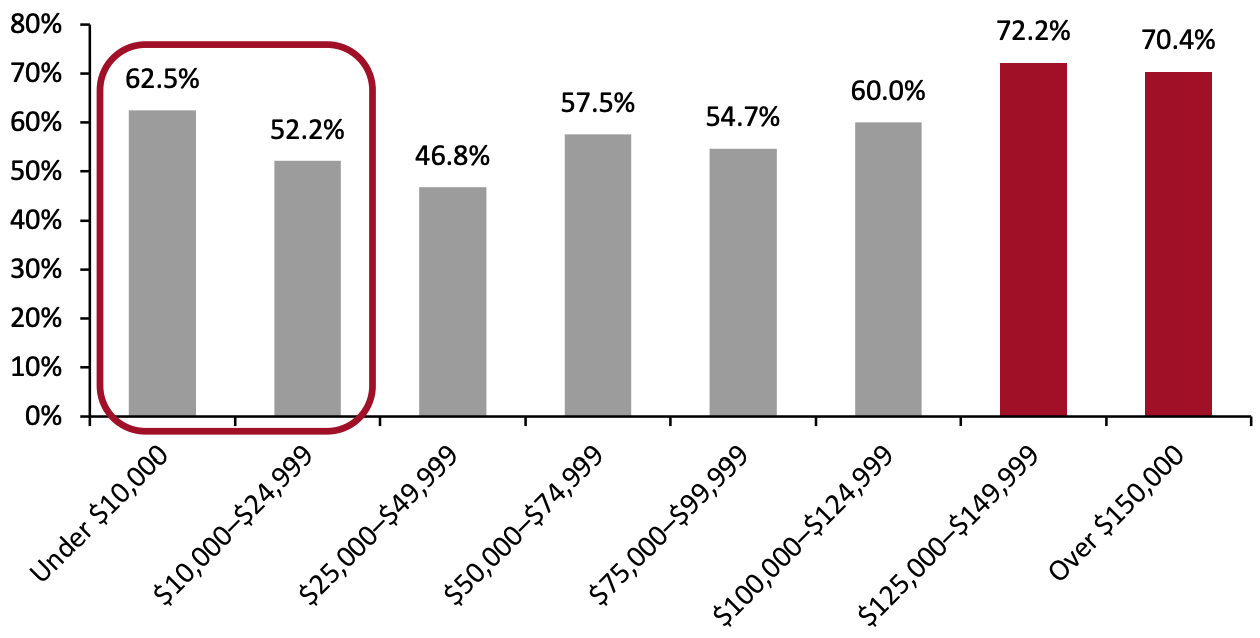

Base: 410 US respondents aged 18+Source: Coresight Research[/caption] Over 60% of respondents with household incomes above $100,000 reported belonging to a grocery subscription program, and membership peaks in the second-highest income group, as shown in Figure 7. Unsurprisingly, membership of grocery subscription programs is highest among higher-income consumers, but even among the lowest income groups (those with household incomes below $25,000), membership of grocery subscription programs stands at over 50%—indicating that retailers should still prioritize offering good value and discounts.

Figure 7. All Respondents: Proportion That Belong to Any Paid-For Online Grocery Subscription from Grocery Retailers or Service Such as Amazon Prime or Instacart Express, by Income (% of Respondents) [caption id="attachment_133622" align="aligncenter" width="700"]

Base: 410 US respondents aged 18+

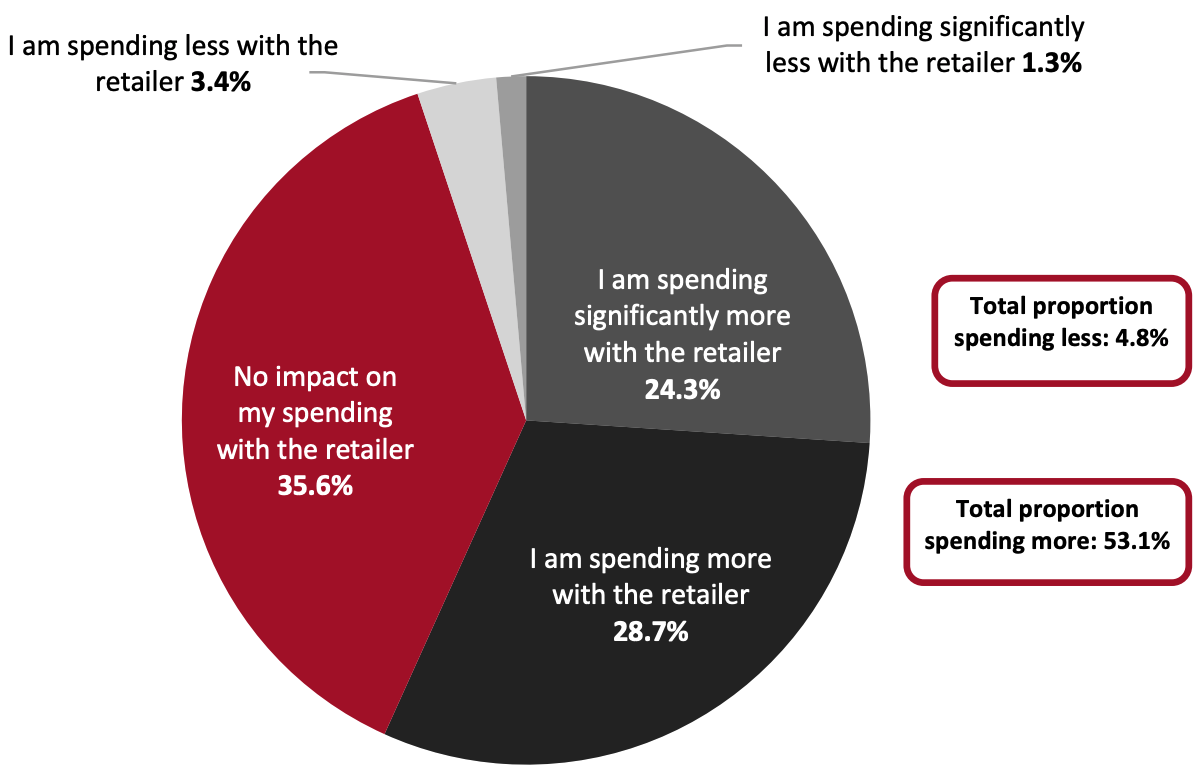

Base: 410 US respondents aged 18+Source: Coresight Research[/caption] 5. Consumers Spend More After Subscribing Coresight Research’s US consumer survey from August 9, 2021, found that subscription programs can increase consumer spend and drive higher revenue for retailers, even after setting aside income from membership fees themselves. Over half of respondents—53.1%—said they are spending more with retailers after joining their programs, and nearly one-quarter of respondents indicated that they are spending significantly more with those retailers.

Figure 8. Respondents with Paid-For Online Grocery Subscriptions: How Much They Are Spending After Joining the Program (% of Respondents) [caption id="attachment_133623" align="aligncenter" width="700"]

Base: 230 US respondents aged 18+ who are members of an online grocery subscription program

Base: 230 US respondents aged 18+ who are members of an online grocery subscription programSource: Coresight Research[/caption]

What We Think

E-commerce subscriptions offer an attractive option for grocery retailers both to engage new customers and to cement their existing customer base amid a shift in consumer behavior and preferences toward online shopping. Memberships can also help retailers to align their entire businesses toward the most profitable segments of the customer base, as those who buy and renew subscription are likely to spend more, shop more frequently and engage with a broader suite of offerings to make the most out of the service. Implications for Retailers- The formation of online grocery shopping as a sustained consumer habit will be the key growth driver for online subscriptions. However, for an e-commerce membership program to succeed, grocers must ensure that their core proposition, including delivery and pickup service, is strong. Retailers must enhance their last-mile delivery capabilities to offer smooth and prompt services to drive member retention and spending.

- Retailers should continue to mine data from loyalty programs to understand, segment and reward their customers, including fine-tuning personalized recommendations based on their interests.

- As grocery shopping is repetitive, with consumers habitually buying the same set of products, retailers who are not already doing so should curate shoppers’ carts automatically for convenience, in order to discourage shoppers from switching to other retailers.

- Launching e-commerce subscriptions should not mean retailers end the standard points-based loyalty model. Traditional, free loyalty programs are an attractive entry point for new consumers and enable mass signups of customers—many of whom may later migrate to a paid subscription tier.

- Technology vendors can help retailers enhance and expand e-commerce subscription loyalty benefits and customer engagement strategies through ongoing customer data review and analysis. They should analyze the key metrics, such as customer acquisition, subscriber retention rates, purchase frequency, average order value and engagement scores, to uncover opportunities for retailers to improve personalization and maximize return on investment.