DIpil Das

Introduction

What’s the Story?Private labels (also known as “own brands” or “store brands”) are goods manufactured directly for—and sometimes by—a retailer and marketed under its brand identity, to varying degrees. We explore key trends in the US food and beverage private-label market and analyze data sourced from analytics firm IRI.

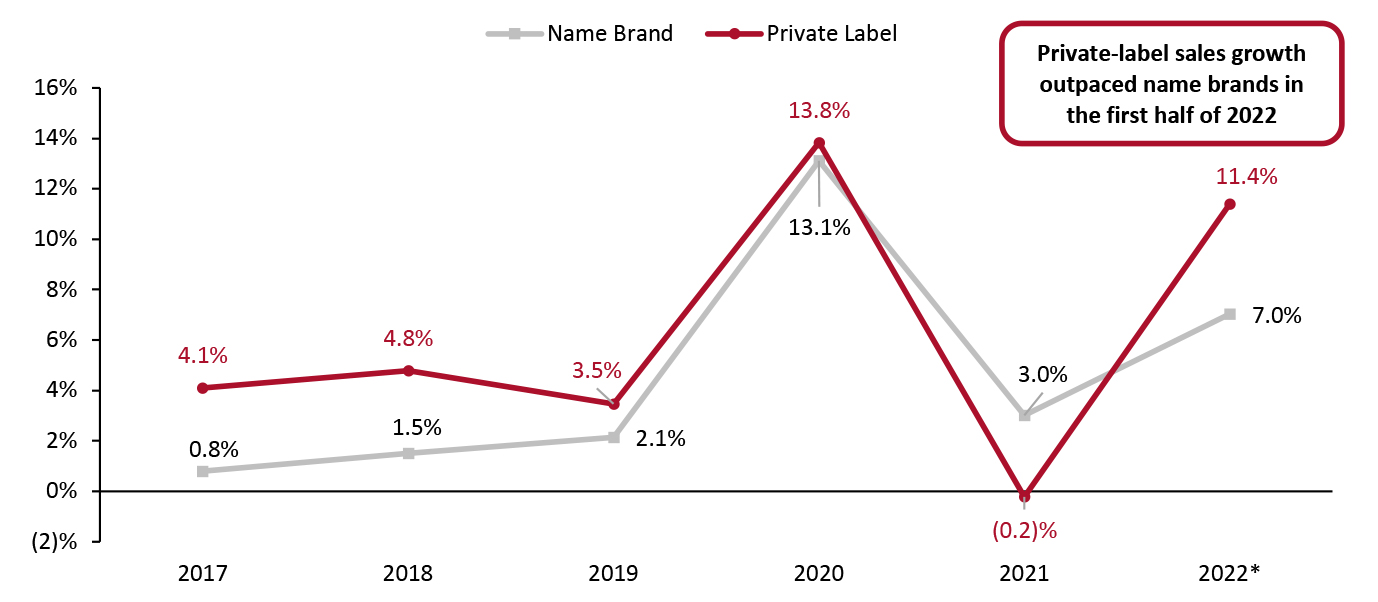

Why It MattersWith grocery inflation taking a toll on the US consumer finances, many are turning to private labels as they prioritize value over name recognition. As shown in Figure 1, year-over-year growth of private-label sales outpaced name brands for the year through July 10, 2022, effectively reversing last year’s trend.

Figure 1. US Food and Beverage Private-Label and Name Brand Sales Value Growth (YoY % Change) [caption id="attachment_153452" align="aligncenter" width="700"]

Excludes online sales

Excludes online sales *YTD July 10, 2022

Source: IRI POS Data/Coresight Research [/caption]

The consumer shift toward private label is a boon for retailers with a strong private-label portfolio. With relatively high inflation on the cards for at least the remainder of 2022, retailers likely have an expanded audience for their private-label products as more consumers trade down.

We expect stickiness to remain even as economic circumstances begin to improve, especially among consumers that fall within the middle and lower-income segments, as they will likely maintain their expectations of value for money for grocery items.

The Return of Grocery Private Labels: Coresight Research Analysis

1. Grocery Private Labels Are Clawing Back ShareWith the onset of the pandemic in 2020, many industry analysts predicted that private label would repeat the phenomenal share gains it saw during the Great Recession.

Unlike the scenario that played out in 2008 and 2009, however, the private-label share of the total market remained relatively stagnant in 2020 and declined in 2021. Federal stimulus programs and reallocation of household budgets due to reduced spending on dining out enabled many shoppers to trade up during the pandemic.

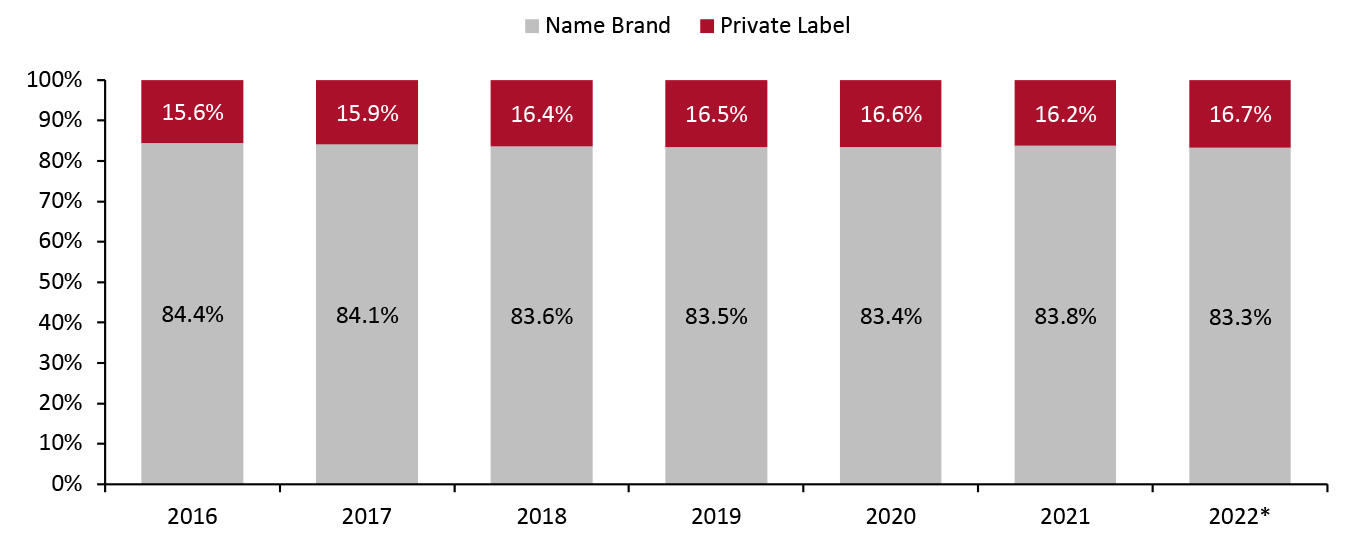

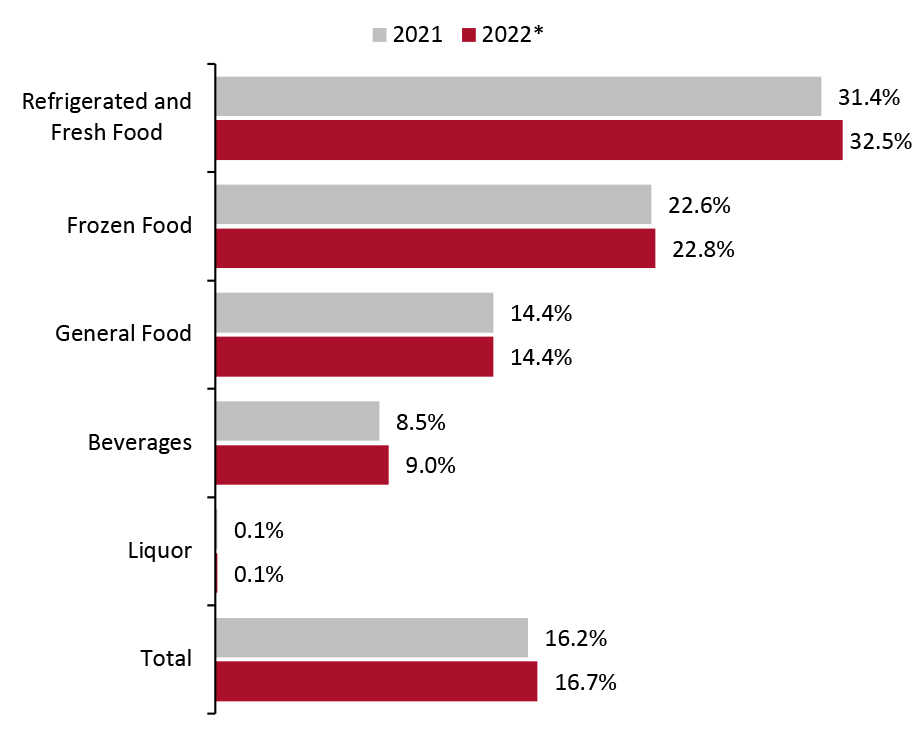

In 2022, private label is clawing share back from brands as consumers seek to stretch their budgets due to inflation. As shown below, private labels accounted for 16.7% of total food and beverage sales for year-to-date July 10, 2022, the highest penetration relative to the last five calendar years. We believe that categories where name brands are not perceived by consumers as particularly differentiated or do not offer a clear functionality or taste preference are more at risk of trade down to private labels.

Figure 2. US: Market Breakdown, by Food and Beverage Name Brand and Private-Label Sales Value (% of Total Sales) [caption id="attachment_153453" align="aligncenter" width="701"]

Excludes online sales

Excludes online sales *YTD July 10, 2022

Source: IRI POS Data/Coresight Research [/caption]

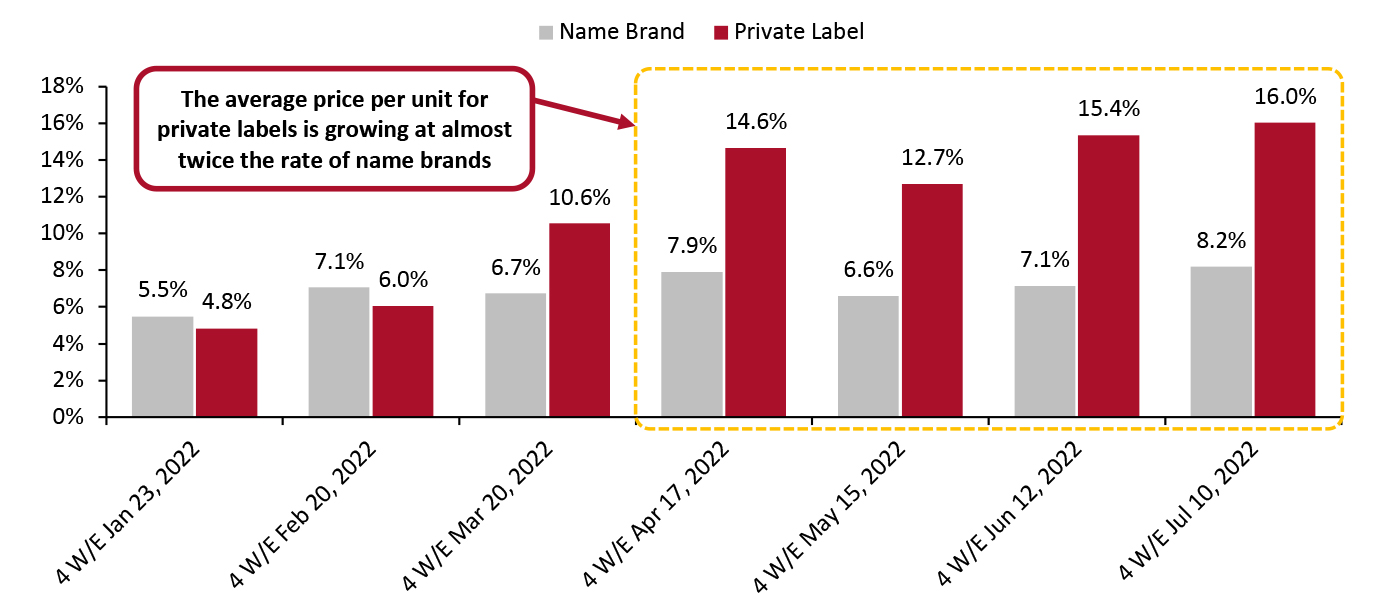

Although private-label penetration is growing, gains are modest. We expect that this is partly due to private-label pricing increasing at a faster rate than name-brand pricing, which may disincentivize some consumers. In absolute terms, private labels are still typically priced at a discount to branded equivalents, which should help store brands deepen their share in the current inflationary environment.

Figure 3. US Food and Beverage Private-Label and Name Brands: Average Price per Unit Growth (YoY % Change) [caption id="attachment_153454" align="aligncenter" width="700"]

Excludes online sales

Excludes online sales Source: IRI POS Data/Coresight Research [/caption] 2. Private Labels Gain Share in Inflation-Impacted Categories

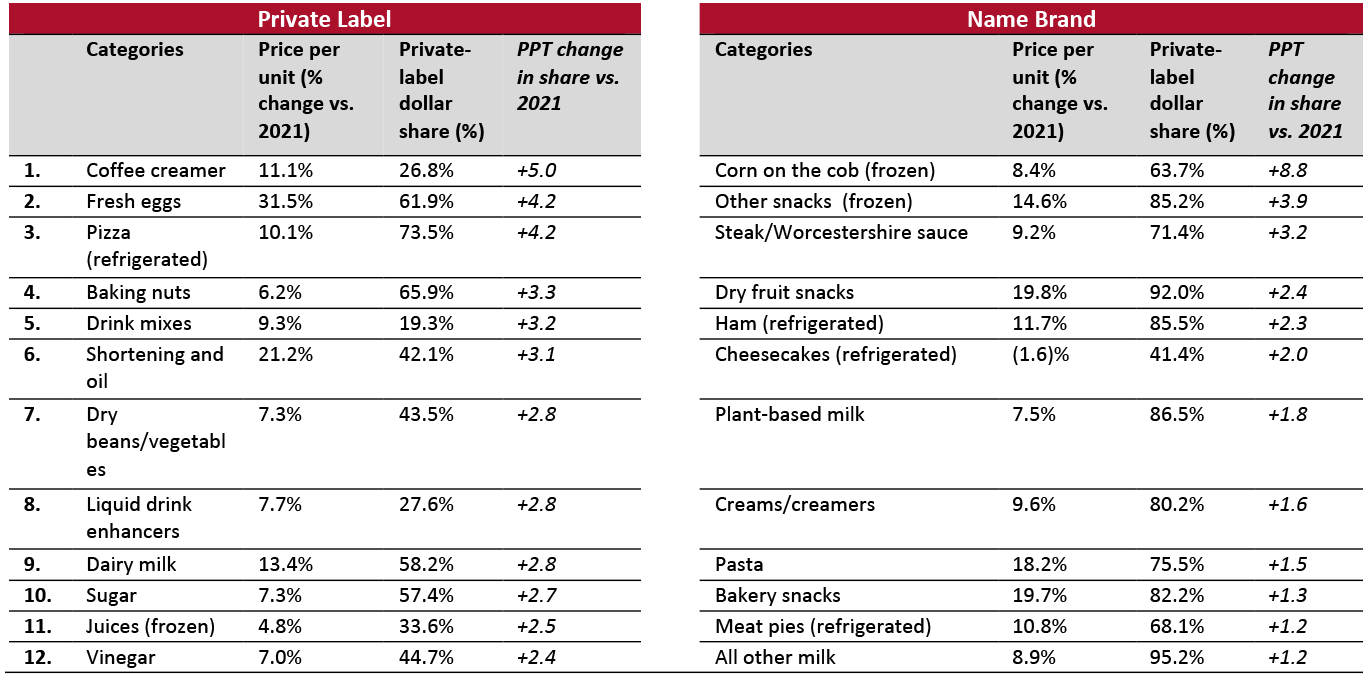

Private labels have seen an increased share in categories with high inflation exposure for the 26 weeks ended June 26, such as dairy and eggs. In categories including snacking, where packaged goods companies have a strong presence, name brands stood their ground and gained share despite high inflation.

Figure 4. US: Top Edible Categories in Which Private Label and Name Brands Gained Share* [caption id="attachment_153455" align="aligncenter" width="700"]

Excludes online sales

Excludes online sales *For the 26 weeks ended June 26, 2022

Source: IRI POS Data/Coresight Research [/caption] 3. Private Labels Overindex in Fresh Categories

Grocery retailers are seeing a steady, incremental consumer shift toward fresh foods and away from packaged and processed products. This shift presents a growing opportunity around natural and organic foods, which can serve as a springboard for private-label growth. Fruits and vegetables, seafood, meat and dairy products are typically commodity goods rather than brand-led categories, which boosts private-label’s share in these categories.

Figure 5. US Food and Beverage: Private-Label Sales Value, Share by Department (%) [caption id="attachment_153456" align="aligncenter" width="700"]

Excludes online sales

Excludes online sales *YTD July 10, 2022

Source: IRI POS Data/Coresight Research [/caption]

Many retailers are developing natural and organic private-labels options to capitalize on growing interest in health, wellness and sustainability among consumers:

- Ahold Delhaize offers a store brand named Nature’s Promise with ranges that are free from genetically modified organisms (GMOs), artificial flavors, synthetic colors or preservatives. The company adheres to the Guiding Stars nutrition program and aims for the majority of private-label brands to achieve at least one star by the middle of 2025.

- Kroger’s Simple Truth and Simple Truth Organic ranges are free from artificial preservatives and ingredients and GMOs, according to the company.

- Albertsons created the Responsible Choice logo in 2020 for own-branded frozen seafood and shelf-stable tuna products. The logo signifies that the products meet the guidelines of the grocer’s Responsible Seafood Policy, which requires seafood to be caught or farmed in ways that protect future supplies and help keep ecosystems thriving. In June 2021, Albertsons announced that 100% of its store-prepared sushi products are aligned with the retailer’s Responsible Seafood Policy.

We think the strength of private label in refrigerated and fresh foods gives retailers a strong position from which to develop natural and organic ranges. Retailers should capitalize on the ongoing health and wellness trends by offering an expanded selection of organic and natural goods as well as products with eco-friendly attributes, such as minimal packaging.

4. Retailers Continue Expansion of Private-Label PortfoliosRetailers are exploring ways to maximize margins on the items they sell to offset higher overhead costs. Private labels draw higher margins than their branded counterparts and help retailers to drive consumer loyalty and differentiate themselves from competitors. As such, we expect retailers to double down on their private-label push in the short to medium term.

We discuss private-label revenues and growth at Albertsons, Ahold Delhaize and Kroger’s. These grocers have established successful private-label ranges that significantly exceed the market average:

- On its April fiscal year earnings call, Albertsons stated that sales of its private-label portfolio, Own Brands, reached more than $15 billion in its fiscal 2022. it introduced 837 new private-label products during the period. In its fourth quarter, ended February 26, 2022, private-label penetration reached 25.6%. The company aims to achieve 30% penetration in the coming years, by driving further growth in underpenetrated markets and expanding into new categories. The company stated in 2020 that its Own Brand items, on average, drive a gross margin advantage of 1,000 basis points compared to name brands.

- In its June quarterly earnings call, Kroger stated that its Our Brands range saw “tremendous growth” during the previous quarter, ended May 21, 2022, with identical sales growth of 6.3%, outpacing name brands. The grocer said it added 239 new private-label products in the quarter and is investing heavily in the quality of its private labels to preserve its strong price position and drive higher profitability.

- In its Analyst Day call in March, Kroger said Our Brands saw $28 billion in annual sales in fiscal 2022. The company manufactures nearly 30% of its Our Brands products, enabling it to gain greater control of supply and quality, and increasing its ability to offer innovative products, according to the company.

- Ahold Delhaize stated in its May quarterly earnings call that its private-label penetration in the US stands at approximately 30%. The company added that it will continue to expand and invest in its private labels throughout the fiscal year.

Against the backdrop of an inflationary environment, we expect retailers to fine-tune their private-label assortments by building up both premium and value offerings. They should ensure adequate opening price points and value products for price-conscious shoppers while targeting premium products toward a more affluent demographic that might otherwise be reluctant to purchase private labels.

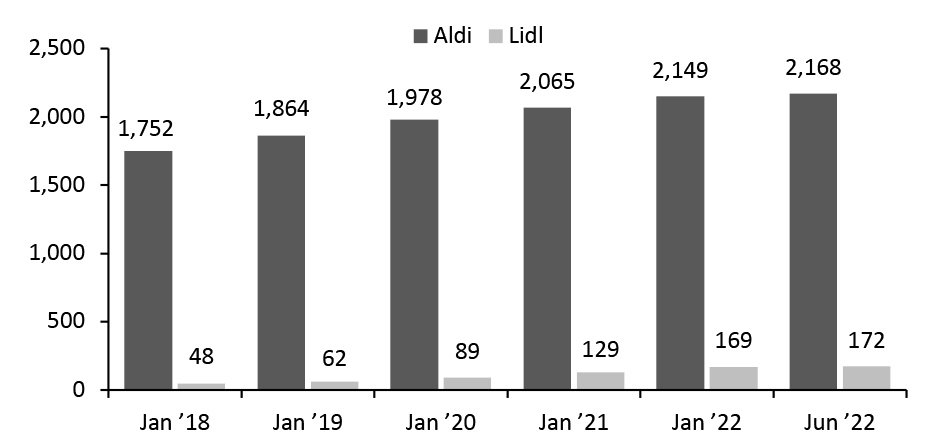

5. Private-Label Share in the US To Increase as Discounters ExpandGerman grocery discounters Aldi and Lidl have deepened their foothold in the US over the past few years by attracting a broad base of budget-conscious consumers. Private labels feature prominently in the assortment of both retailers, with private-label sales accounting for 90% of Aldi’s revenue compared to around 80% at Lidl. Both the retailers are set to be clear beneficiaries in the current inflationary environment as consumers attempt to stretch their dollars by shifting to retail channels that emphasize value.

Aldi has established a strong presence in the US, with 2,168 stores as of June 2022. In keeping with its tradition of rapid growth, in February 2022, Aldi announced its plan to open approximately 150 new stores in 2022. The expansion plans follow Aldi’s 2017 announcement of becoming the third-largest grocery retailer by store count in the US by the end of 2022, which it is on track to meet, according to the company.

Contrary to Aldi’s longtime US presence, Lidl only entered the US market in June 2017 and currently operates 172 store locations as of June 2022. However, the retailer has made its intentions clear by announcing in April 2020 that it is building a network of distribution centers along the Eastern Coast that will service supply chain needs for around 1,500 stores.

Figure 6. US Store Count: Aldi and Lidl [caption id="attachment_153457" align="aligncenter" width="701"]

Source: ChainXY[/caption]

Source: ChainXY[/caption]

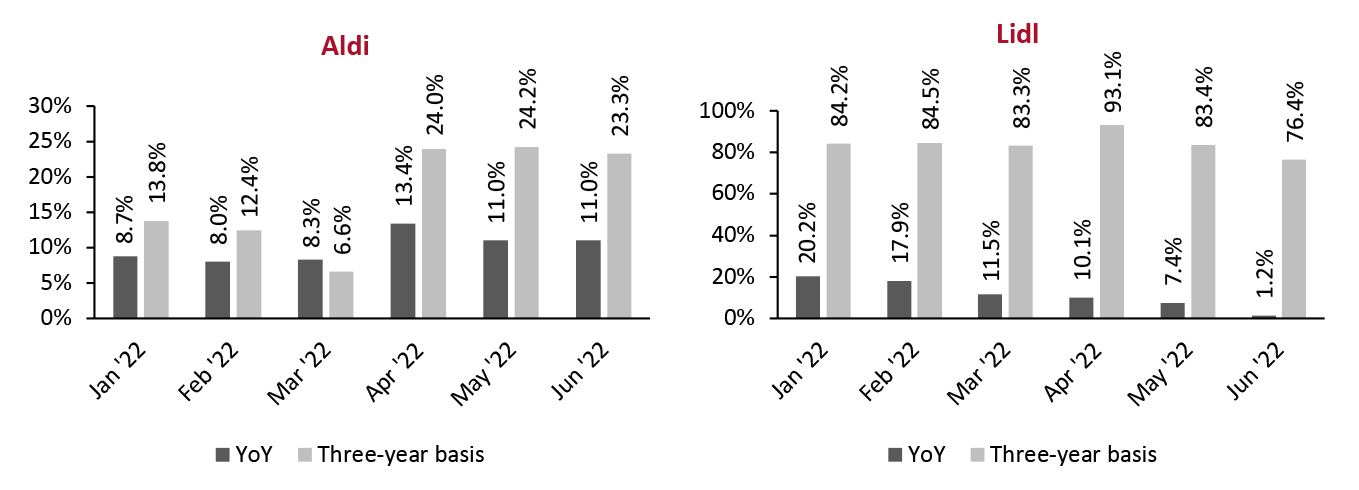

The growth in Aldi and Lidl’s foot traffic data suggests that consumers are shopping for less costly alternatives. Aldi saw an 11.0% year-over-year increase in June 2022 and a 23.3% increase relative to June 2019. Although the Lidl brand is still comparatively new in the US, it is seeing strong growth compared to three years ago. Much of the foot traffic growth is largely due to new store openings by Aldi and Lidl, but we believe low prices are also playing a role in attracting high visit volumes.

Figure 7. Aldi and Lid Monthly Visit Growth (% Change) [caption id="attachment_153458" align="aligncenter" width="699"]

Source: Placer.ai[/caption]

Source: Placer.ai[/caption]

Relentless store expansion by grocery discounters will give US shoppers more access to private labels, consequently raising the share of private labels in the US grocery market in the coming years. It will also likely spur established retailers to strengthen their own private-label offerings.

What We Think

While private labels were historically associated with generic items and copycat branding, demand for store brands is now drawing serious attention. Continuous innovations in quality, packaging and product concepts have driven increasing consumer interest over the years. As such, retailers should continue investing in private-label product improvements, aggressively market unique attributes and maintain a strong new product pipeline.

Implications for Retailers

- In 2022, we expect inflation to test consumer loyalty to name brands, giving private labels their best opportunity in years to gain market share. We expect that retailers’ recent investments in own-brand expansion and quality improvements will position them better than ever to attract inflation-weary customers.

- While high inflation is one driver of consumers opting for private labels, we believe low price points are driving this shift above all else. As such, retailers can expect their lower-end private labels to cannibalize sales of their premium private brands to some degree in the short to medium term.

- Retailers should promote their private brands as much as possible in the current climate to persuade more shoppers to try their products, as those that opt for private labels now will likely continue to patronize them even as inflation subsides. Retailers can use social media to increase brand awareness and promote a message of wellbeing and sustainability around these products.