DIpil Das

What’s the Story?

Private-label sales are continuing to grow in the US grocery market. We discuss the sector’s recent growth and market share, as well as the impact of price inflation on private-label sales. We also explore private-label offerings from Albertsons, Costco and Kroger. This report provides insights into two key trends in the private-label grocery segment in the US and the opportunities that these trends present to retailers.Why It Matters

Private label has come a long way from its generic roots and copycat phases. Consumer interest in purchasing private-label products has grown due to continuous innovations in quality, packaging and product concepts. Retailers also increasingly view private labels as a way to drive consumer loyalty, to increase their profitability and as a point of difference in a crowded retail market. 2020 proved to be a major milestone for private-label evolution, where private-label products captured increased customer spending on the strength of greater value and quality. Many retailers cited a shortage of name brands amid supply chain disruptions as pushing consumers toward private-label products for the first time, leading to year-over-year sales growth in grocery private labels of 13.7% in 2020. Impressed by trial use of private-label brands, many consumers appear likely to retain the shopping decision. According to a US survey conducted by research firm Hartman Group in August 2020, almost one-fifth of respondents stated that they now rely more on private-label products than prior to the pandemic and 52% said that they expect to continue purchasing private-label brands once the major concerns of the pandemic subside.US Grocery Private Labels: In Detail

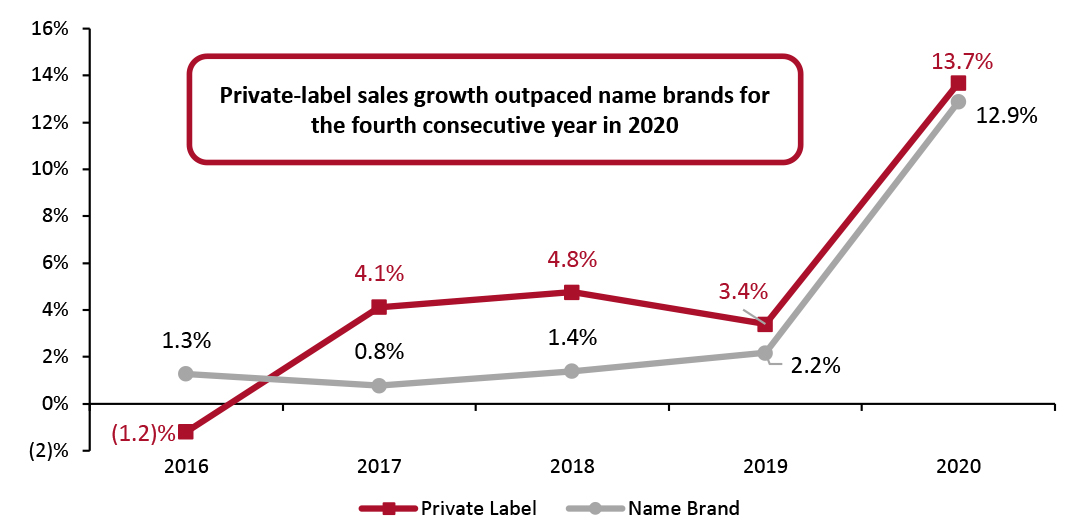

Private-Label Growth Continues To Outpace Name Brands Grocery private-label sales growth outpaced name brands for the fourth consecutive year, increasing by 13.7% year over year in 2020 versus a 12.9% increase in name brand sales growth. As the economy struggled in 2020, consumers with tighter budgets prioritized value in their buying decisions and increased their private-label purchases. Shortages of name brands in stores caused by supply chain disruptions also prompted many consumers to seek alternatives to name brands. On the other end of the spectrum, premium private labels also gained popularity as discretionary spending previously directed toward restaurant dining and out-of-home entertainment was reallocated to more lavish meals cooked at home. Although the private-label category witnessed record growth in 2020, the degree of outperformance compared to name brands was relatively low compared to previous years: As a percentage of a percentage (charted below), the outperformance came in at 6% in 2020, compared to 55% in 2019, 243% in 2018 and 413% in 2017. That narrowing of outperformance underscores that grocery retailers cannot depend on underlying momentum and must continue to invest in product and brand development.Figure 1. US Food and Beverage Private-Label and Name Brand Sales Value Growth (YoY %) [caption id="attachment_126866" align="aligncenter" width="725"]

Source: IRI/Coresight Research[/caption]

Impact of Price Inflation on Private-Label Sales

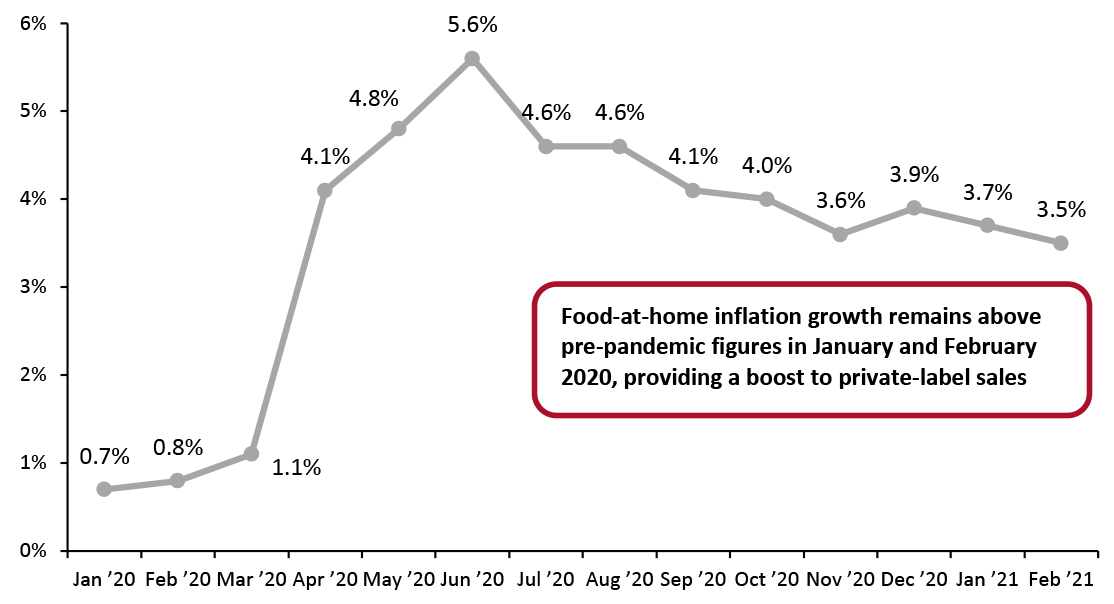

Private labels perform better in an inflationary environment. In 2020, the US food-at-home price inflation rate increased at the onset of the pandemic in March and stayed above pre-pandemic figures well into February 2021, providing a tailwind for private labels. However, given that the outperformance of private labels over name brands was relatively low in 2020, this likely did not have a meaningful impact on private-label growth.

The US Department of Agriculture’s 2021 consumer price inflation (CPI) forecast indicates that retail food price inflation will revert over the course of 2021. According to the forecast, food-at-home prices will see increase by 1–2% year over year in 2021 and food-away-from-home prices will increase by 2–3%.

The anticipated easing in retail inflation will likely prompt some consumers to switch back to name brands, with an incremental return to on-premise consumption in 2021 also creating a headwind for overall food retail spend, including private labels. More affluent consumers, most of whom have retained their main sources of income during the pandemic, will likely lead the return to dining out.

Nevertheless, we believe that private-label stickiness could remain, especially among consumers that fall within the middle and lower-income segments, as they will likely maintain expectations of value for money in grocery. If shoppers are won over by price and quality, turning them into permanent buyers, we will likely see a long-term swell in the private-label category.

Source: IRI/Coresight Research[/caption]

Impact of Price Inflation on Private-Label Sales

Private labels perform better in an inflationary environment. In 2020, the US food-at-home price inflation rate increased at the onset of the pandemic in March and stayed above pre-pandemic figures well into February 2021, providing a tailwind for private labels. However, given that the outperformance of private labels over name brands was relatively low in 2020, this likely did not have a meaningful impact on private-label growth.

The US Department of Agriculture’s 2021 consumer price inflation (CPI) forecast indicates that retail food price inflation will revert over the course of 2021. According to the forecast, food-at-home prices will see increase by 1–2% year over year in 2021 and food-away-from-home prices will increase by 2–3%.

The anticipated easing in retail inflation will likely prompt some consumers to switch back to name brands, with an incremental return to on-premise consumption in 2021 also creating a headwind for overall food retail spend, including private labels. More affluent consumers, most of whom have retained their main sources of income during the pandemic, will likely lead the return to dining out.

Nevertheless, we believe that private-label stickiness could remain, especially among consumers that fall within the middle and lower-income segments, as they will likely maintain expectations of value for money in grocery. If shoppers are won over by price and quality, turning them into permanent buyers, we will likely see a long-term swell in the private-label category.

Figure 2. US Consumer Price Inflation for Food at Home (YoY % Change) [caption id="attachment_126867" align="aligncenter" width="725"]

Source: US Bureau of Labor Statistics[/caption]

Private-Label Share of US Grocery Market

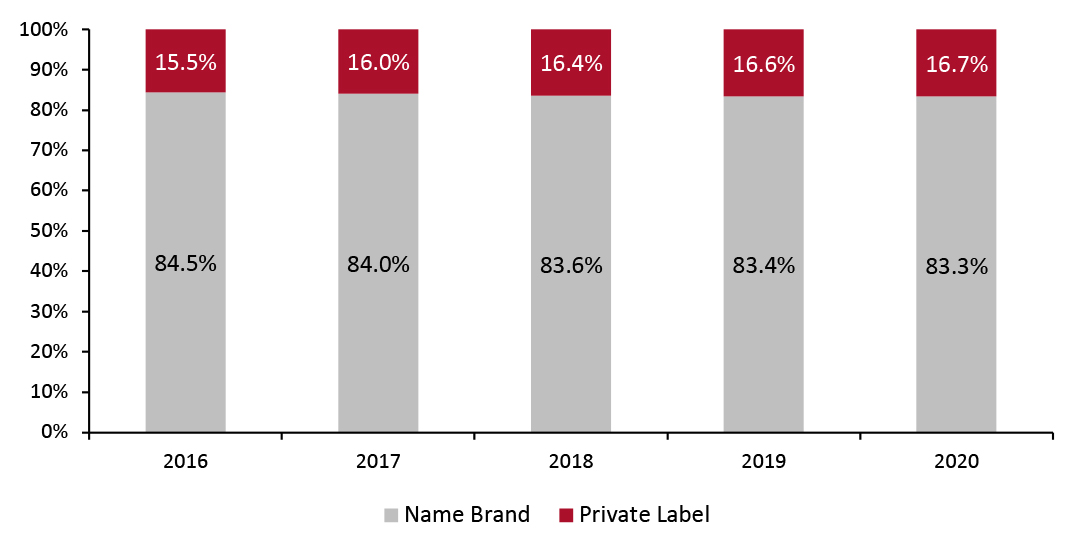

Sales of grocery private-label products accounted for 16.7% of the overall US grocery market in 2020. Although the US private-label penetration rate trails behind comparable Western markets, including France, Germany and the UK, it is on an upward trend.

While grocers have stepped up their private-label efforts over the past few years as they seek attractive margins and means to differentiate themselves, many retailers fast-tracked new private-label products and scaled up distribution of existing portfolios with the onset of the pandemic. Encouraged by customer responses amid the economic slowdown, retailers are continuing to extend their private-label offerings and move into new categories.

The following retailers have established successful private-label ranges that significantly exceed the market average:

Source: US Bureau of Labor Statistics[/caption]

Private-Label Share of US Grocery Market

Sales of grocery private-label products accounted for 16.7% of the overall US grocery market in 2020. Although the US private-label penetration rate trails behind comparable Western markets, including France, Germany and the UK, it is on an upward trend.

While grocers have stepped up their private-label efforts over the past few years as they seek attractive margins and means to differentiate themselves, many retailers fast-tracked new private-label products and scaled up distribution of existing portfolios with the onset of the pandemic. Encouraged by customer responses amid the economic slowdown, retailers are continuing to extend their private-label offerings and move into new categories.

The following retailers have established successful private-label ranges that significantly exceed the market average:

- Albertsons reported that its private-label penetration reached more than 25% in its third quarter, ended December 5, 2020.

- Costco’s Kirkland Signature private-label products accounted for 32% of total sales for its fiscal year, ended August 30, 2020.

- Private labels captured a 21.3% share of total Kroger sales in its fiscal year ended January 30, 2021 .

Figure 3. US: Market Breakdown, by Food and Beverage Name Brand and Private-Label Sales Values (% of Total Market) [caption id="attachment_126868" align="aligncenter" width="725"]

Source: IRI/Coresight Research[/caption]

Albertsons

Albertsons introduced 650 items in its Own Brands portfolio in its second quarter, ended September 12, 2020, and announced plans to introduce 800 new Own Brand items annually over the next few years.

On its second-quarter earnings call, the company said that it remains on track to reach 30% private-label penetration in the coming years, which it plans to achieve by driving further growth in underpenetrated markets and expanding into new categories.

Consisting of around 12,000 items across 500 categories, Albertsons’ Own Brands portfolio is worth $14 billion business, according to the company. Its Own Brands items, on average, drive a 1,000 basis point gross margin advantage compared to name brands.

Costco

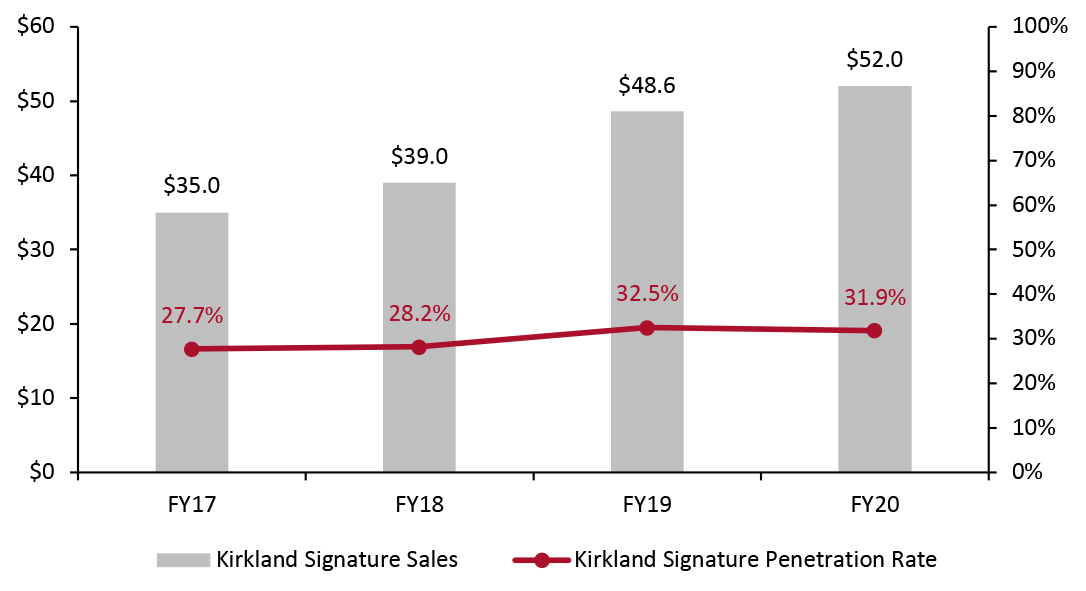

Costco’s private-label brand Kirkland Signature saw strong sales of around $52 billion in its fiscal year, ended August 30, 2020, which the company stated was driven primarily by grocery, as well as health and beauty products and home cleaning goods.

Source: IRI/Coresight Research[/caption]

Albertsons

Albertsons introduced 650 items in its Own Brands portfolio in its second quarter, ended September 12, 2020, and announced plans to introduce 800 new Own Brand items annually over the next few years.

On its second-quarter earnings call, the company said that it remains on track to reach 30% private-label penetration in the coming years, which it plans to achieve by driving further growth in underpenetrated markets and expanding into new categories.

Consisting of around 12,000 items across 500 categories, Albertsons’ Own Brands portfolio is worth $14 billion business, according to the company. Its Own Brands items, on average, drive a 1,000 basis point gross margin advantage compared to name brands.

Costco

Costco’s private-label brand Kirkland Signature saw strong sales of around $52 billion in its fiscal year, ended August 30, 2020, which the company stated was driven primarily by grocery, as well as health and beauty products and home cleaning goods.

Figure 4. Kirkland Signature: Sales (USD Bil.; Left Axis) and Share of Total Costco Sales (%; Right Axis) [caption id="attachment_126869" align="aligncenter" width="725"]

Kirkland Signature includes clothing and luggage, grocery, health and beauty, household and cleaning, home and kitchen, baby products, hardware, pet food and supplies, and office products

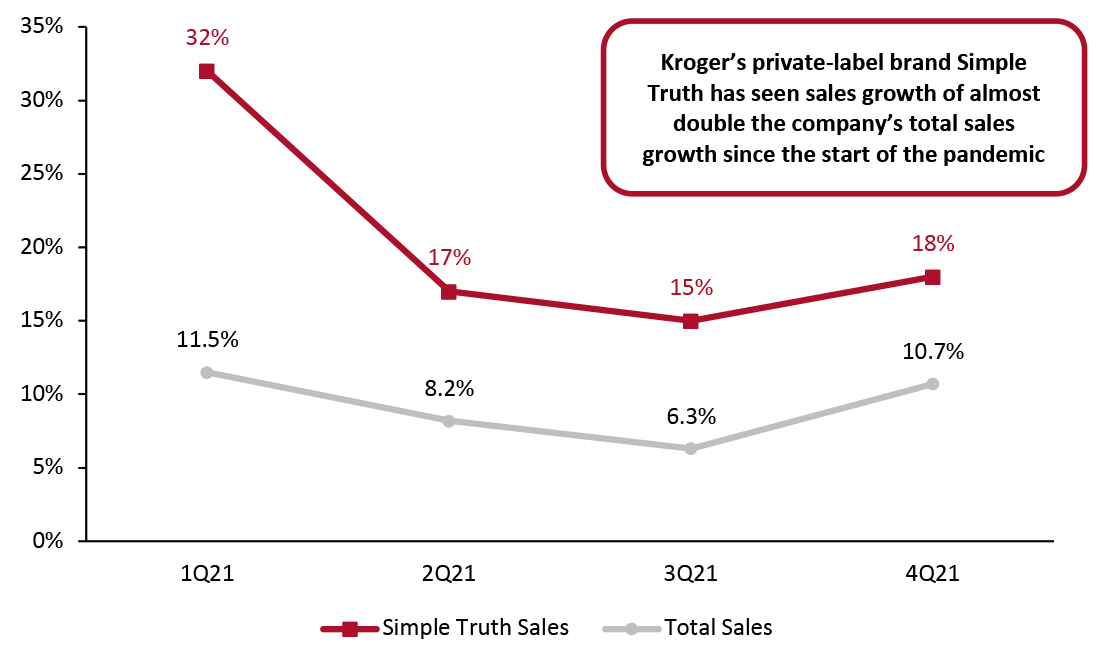

Kirkland Signature includes clothing and luggage, grocery, health and beauty, household and cleaning, home and kitchen, baby products, hardware, pet food and supplies, and office products Source: Company reports [/caption] Kroger On its earnings call for its latest fiscal year, ended January 30, 2021, Kroger stated that sales of items in the company’s Our Brand private-label portfolio reached $26.2 billion in the year, equating to 13.4% year-over-year growth. Moreover, sales growth for the company’s Simple Truth private label, which comprises natural and organic foods, has outpaced Kroger’s total sales growth since the start of the pandemic.

Figure 5. Kroger: Simple Truth Sales vs. Total Sales, Fiscal 2021 (YoY % Change) [caption id="attachment_126870" align="aligncenter" width="725"]

Kroger’s FY21 ended January 30, 2021

Kroger’s FY21 ended January 30, 2021 Source: Company reports [/caption] Recent Launches from Other Companies We discuss other major retailers that have recently added new brands to their private-label portfolios:

- Amazon: On April 14, 2021, Amazon unveiled private-label food brand Aplenty, which will comprise hundreds of products across categories, ranging from confectionery and savory snacks to pantry staples and frozen foods, by the end of next year. Aplenty products will be available online and at Amazon Fresh grocery stores.

- Target: On April 5, 2021, Target launched food and beverage brand Favorite Day, which is set to feature more than 700 products. The new brand is focused primarily on snacks and treats, including bakery items, premium ice-creams and mocktails. According to the retailer, Favorite Day will serve as a “sweet and savory” complement to its existing Good and Gather private0label line, which generated $2 billion in sales in 2020.

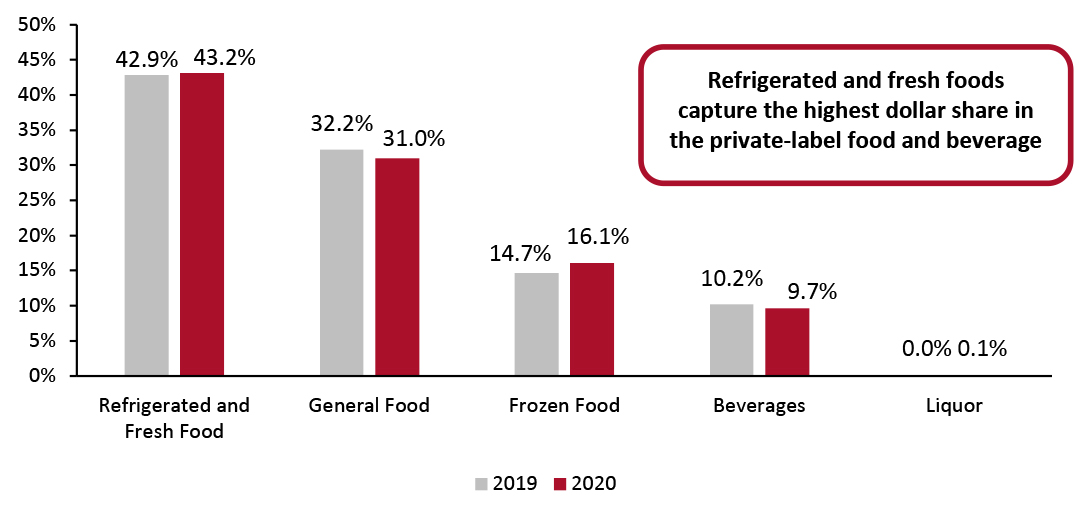

- Organic and Plant-Based Products

Figure 6. US Food and Beverage: Private-Label Sales Value, Share by Category (%) [caption id="attachment_126871" align="aligncenter" width="725"]

Source: IRI/Coresight Research[/caption]

Consumers are increasingly seeking out ways to reduce their intake of meat and dairy products and are looking for healthier alternatives with similar nutritional values and tastes. Many retailers are enthusiastic about the emerging plant-based food category, which directly replaces animal products such as dairy, eggs and meat.

Kroger launched a plant-based Simple Truth collection in 2019 and added 53 new plant-based items added in its fiscal 2020. The retailer expects to see increased consumer demand for plant-based products in 2021 and beyond.

Similarly, Albertsons noted in an Insight call held on December 7, 2020, that it would introduce 50 new plant-based products to its O Organics and Open Nature brands in 2021, following their launches in 2019. The two private labels saw strong growth of 12% on a combined basis in the company’s third quarter, and are recognized by Albertsons as a “key segment of growth” for the future.

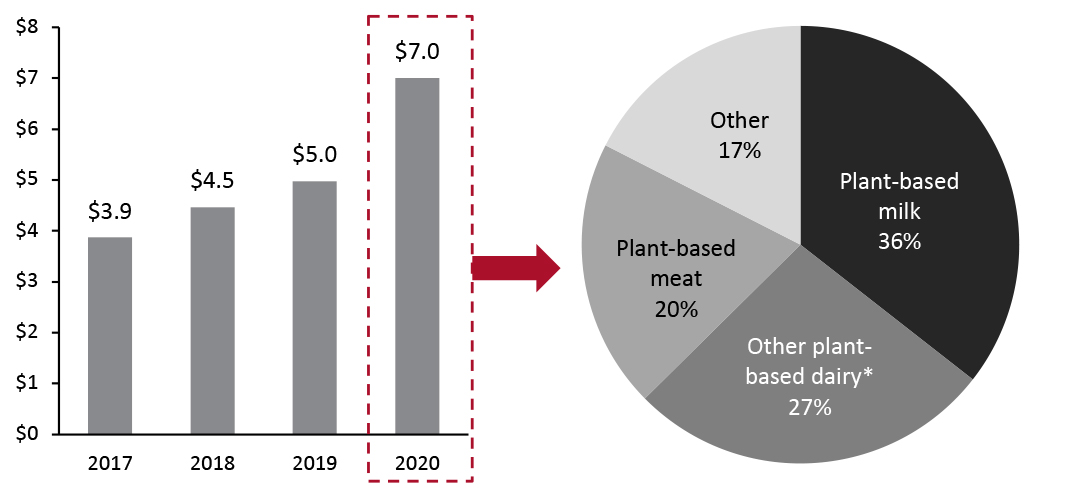

According to The Good Food Institute, plant-based products saw a 40% increase in retail sales in 2020, with plant-based milk and other dairy products taking the highest market share in the year. The category breakdown in Figure 7 category indicates product categories with expansion opportunities for retailers.

Source: IRI/Coresight Research[/caption]

Consumers are increasingly seeking out ways to reduce their intake of meat and dairy products and are looking for healthier alternatives with similar nutritional values and tastes. Many retailers are enthusiastic about the emerging plant-based food category, which directly replaces animal products such as dairy, eggs and meat.

Kroger launched a plant-based Simple Truth collection in 2019 and added 53 new plant-based items added in its fiscal 2020. The retailer expects to see increased consumer demand for plant-based products in 2021 and beyond.

Similarly, Albertsons noted in an Insight call held on December 7, 2020, that it would introduce 50 new plant-based products to its O Organics and Open Nature brands in 2021, following their launches in 2019. The two private labels saw strong growth of 12% on a combined basis in the company’s third quarter, and are recognized by Albertsons as a “key segment of growth” for the future.

According to The Good Food Institute, plant-based products saw a 40% increase in retail sales in 2020, with plant-based milk and other dairy products taking the highest market share in the year. The category breakdown in Figure 7 category indicates product categories with expansion opportunities for retailers.

Figure 7. US Plant-Based Food and Beverage Sales, in Total (USD Bil.; Left Chart) and by Product Category (% of Total; Right Chart) [caption id="attachment_126872" align="aligncenter" width="725"]

*Includes butter, cheese, creamer, ice-cream and yogurt

*Includes butter, cheese, creamer, ice-cream and yogurt Source: The Good Food Institute [/caption]

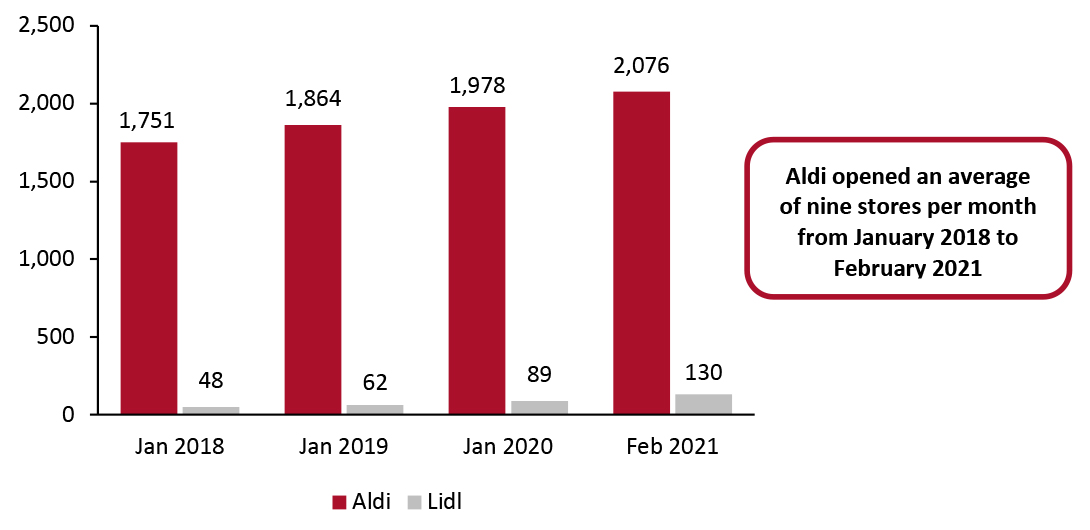

- Expansion of Physical Footprints by Grocery Discounters

Figure 8. Aldi vs. Lidl: Total US Store Counts [caption id="attachment_126873" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Relentless store expansion by grocery discounters will give US shoppers more access to private labels, consequently raising the share of private labels in the US grocery market in the coming years. It will also likely spur established retailers to strengthen their own private-label offerings.

Source: Coresight Research[/caption]

Relentless store expansion by grocery discounters will give US shoppers more access to private labels, consequently raising the share of private labels in the US grocery market in the coming years. It will also likely spur established retailers to strengthen their own private-label offerings.

What We Think

Private labels have been attracting significant consumer attention for many years, and the unique circumstances of the pandemic have provided retailers with additional opportunities to convert customers to their own brands. However, IRI data suggest that the food market saw a narrowing of the outperformance in private labels in total versus brands in 2020—and that trend underscores that retailers must continue to invest in product and brand development to sustain growth. Implications for Retailers- Retailers must focus on introducing or expanding sustainable and natural private-label options to capitalize on shifting consumer trends. Natural and organic products, including those without synthetic color and artificial preservatives or those that meet certain criteria (such as non-GMO), represent a significant growth opportunity for retailers in the private-label market. Retailers should also look to promote a message of wellbeing and sustainability around these products, for instance, by displaying product origin and sourcing details on packaging.

- To tap into pandemic-induced trends of treats and indulgence, retailers should curate private-label product assortments to include products such as cakes, ice-creams and desserts. In contrast to health foods, we expect this category to also boost sales and help to sway consumers in their decisions on where to shop.

- Retailers with existing plant-based products should continue to take advantage of the rising popularity of plant-based dairy and meat categories by expanding their lines to contain new and exciting goods. Retailers that have not yet introduced a private-label plant-based product line must consider developing one.

- Covid-19 has catalyzed the widespread adoption of online shopping in grocery, and e-commerce provides further pockets of opportunity to boost private-label sales. Compared to offline channels, e-commerce allows retailers to have more control over what shoppers see and the recommendations they receive. Retailers can leverage this opportunity to direct consumers toward their own private labels. For instance, retailers can create dedicated website pages and search functions on their websites for private labels. Retailers should also look to drive private-label engagement through integrated online content that positions their private-label products as solutions.

IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information