DIpil Das

What’s the Story?

Online grocery crossed the tipping point for mass adoption in 2020. The pandemic rapidly accelerated the e-commerce pivot, leading to unprecedented growth in online grocery shopping. Grocery retailers are therefore placing greater emphasis on expanding their e-commerce and omnichannel capabilities. In this report, we discuss the grocery e-commerce market in the US, covering the following topics:- Online food and beverage market size and growth

- Key operating models in the online grocery market

- Review of major themes across the market

- The outlook for online grocery retail

Why It Matters

Covid-19 has amplified the ongoing digital disruption in the grocery industry. The penetration of e-commerce into the grocery space has lagged behind most other retail sectors, but the pandemic shook this status quo by fueling a dramatic acceleration in online grocery growth with the rapid collapse of consumer uptake barriers. We expect the online channel to see permanent gains as consumers retain their changed shopping behaviors post pandemic. According to a Coresight Research survey conducted on August 19, 2020, a substantial 36.4% of online grocery shoppers do not expect to change their online grocery shopping habits once the crisis eases or ends. Grocery retailers therefore cannot afford to be anything but aggressive and proactive with their e-commerce strategies to thrive in a post-pandemic future.US Online Food and Beverage Market Size and Growth

The Covid-19 upheaval has strengthened e-commerce in the US grocery industry. With the pandemic keeping consumers at home and away from stores, we expect total US food and beverage e-commerce sales to grow to $55.5 billion in 2020, up 82% year over year—a vastly greater increase than any previous year. The outlook for 2021 remains uncertain, given the current very high rates of infection fueling a recent acceleration in grocery e-commerce. However, on the assumption of an improvement in case numbers through the year and that a vaccine helps bring a return to more normalized spending, and against the lockdown-driven online surge in 2020, we estimate that retailers will see a single-digit year-over-year decline in online demand: We model an approximate 3.0% decline in 2021. Any (partial) return to dining out and regular attendance at workplaces, which could be weighted toward the second half of the year, would hit overall food retail spend in 2021, while online would likely see a second impact from a return to physical grocery stores for food retail purchases. However, if we instead see sustained high case numbers well into 2021, we could see a flat-to-low-positive market. That said, the contraction would be temporary and in part a function of the demanding comparatives from 2020, as the channel stickiness from the pandemic will support solid online growth of retailers for 2022 and beyond. We expect online food and beverage sales to reach almost $85 billion in 2024, growing at a CAGR of 11.1% from 2020 to 2024 (see Figure 1).Figure 1. US Food and Beverage Online Sales (Left Axis; USD Bil.) and YoY % Change (Right Axis) [caption id="attachment_121387" align="aligncenter" width="725"]

Source: IRI E-Market Insights™/Coresight Research [/caption] The state of online grocery in late 2020 was completely different than it was at the beginning of the year. Online food and beverage growth stayed widely above pre-pandemic growth figures as consumers continued to gravitate toward e-commerce for shopping. The channel was resilient even after the lockdowns were lifted and has shown signs of reacceleration in the latest period. We believe that food and beverage e-commerce will continue to post higher growth figures in the first couple of months of 2021 due to a recent resurgence of Covid cases in the US and a shift of dollars from food services to retail. Once we get to March and April 2021, we begin to lap the heightened growth rates from 2020.

Figure 2. US Food and Beverage Total and E-Commerce Sales Growth (YoY % Change) [caption id="attachment_121388" align="aligncenter" width="725"]

Source: IRI E-Market Insights™/Coresight Research [/caption] Many traditional retailers accommodated the grocery surge by ramping up their e-commerce and omnichannel fulfillment capabilities during the crisis. As a result, these retailers reported exceptional quarterly growth in their online sales during the pandemic. Figure 3 shows the estimated online share of total grocery sales of selected retailers in their latest fiscal quarters, based on company reports.

Figure 3. Approximate Digital Share of Grocery Sales at Selected Retailers in Their Latest Quarters [caption id="attachment_121389" align="aligncenter" width="725"]

Source: Company reports/Coresight Research [/caption]

Key Operating Models

Fulfillment Models Fulfillment models in the US online grocery market fall under two umbrellas: centralized and store-based fulfillment.Figure 4. Online Grocery Fulfillment Models [caption id="attachment_121390" align="aligncenter" width="725"]

Figure 5. In-Store Fulfillment, Centralized Fulfillment and Micro-Fulfillment Centers: A Comparison [wpdatatable id=669 table_view=regular]

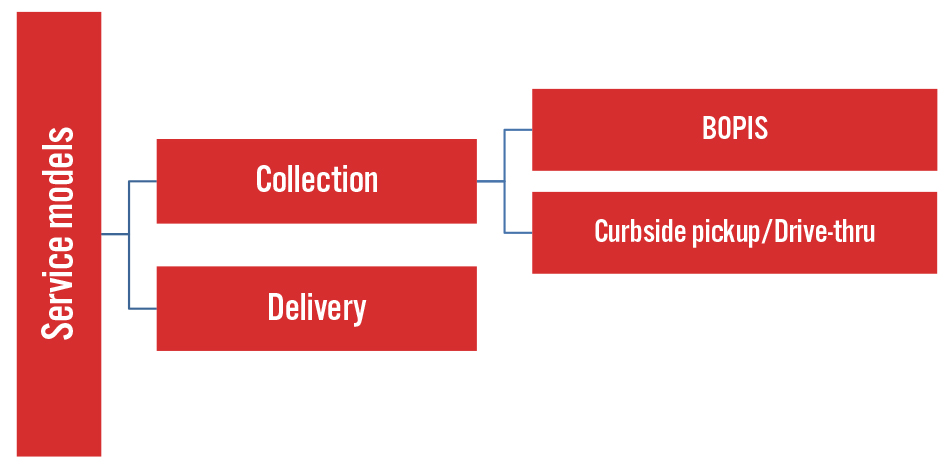

Source: Coresight Research Service Models There are also two types of service models in online grocery, which we discuss below.

Figure 6. Online Grocery Service Models [caption id="attachment_121397" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Home Delivery

Delivery is the older of the two service models. Many consumers are attracted to delivery due to its convenience, as it allows them to shop for groceries without ever leaving their homes.

BOPIS & Curbside Pickup

BOPIS (buy online, pick up in store) and curbside-pickup service models have gained immense popularity amid the Covid-19 pandemic. They are less margin erosive for retailers compared to delivery, and many price-conscious consumers also prefer in-store pickup and curbside services to delivery, as assessed fees are typically lower than those on delivery orders. However, retailers may need to optimize store space and surrounding areas to better support these services.

Curbside pickup/drive thru emerged as the principal growth driver of the US online grocery market amid the pandemic, proving a big hit with US consumers by providing a safe and convenient alternative to in-store shopping—and the US boasts high vehicle ownership rates, with almost 93% of households owning a car in 2019.

Many retailers ramped up their curbside-pickup access points amid the pandemic and reported unprecedented growth in the service. For example, Target saw more than 500% growth in its curbside-pickup service, Drive Up, and stated that it was entering the holiday season with more than double the number of Drive Up parking spaces versus the year-ago period. Similarly, Albertsons noted in its 2Q20 earnings call that its Drive Up & Go (DUG) service was the fastest growing digital segment—growing over 1,000% during the quarter—and the company plans to have 1,400 DUG locations by the end of its current fiscal year and 1,800 locations by the end of fiscal 2021.

We expect that consumers will be more likely to use such services even when the pandemic subsides, and BOPIS/curbside pickup will become a part of a suite of service options that shoppers will expect from retailers in the future.

Fulfillment and Service Models Employed by Selected Retailers

Grocery retailers are adopting a mix of fulfillment strategies, using different service models to best serve their customers. Walmart, with its large store footprint and strong digital capabilities, is well positioned to employ store-based fulfillment models. On the other hand, Amazon uses a dual-pronged approach in the online grocery market through two separate services: Amazon Fresh (which uses centralized automated fulfillment) and Prime Now (which uses store fulfillment through Whole Foods and other local stores).

Source: Coresight Research[/caption]

Home Delivery

Delivery is the older of the two service models. Many consumers are attracted to delivery due to its convenience, as it allows them to shop for groceries without ever leaving their homes.

BOPIS & Curbside Pickup

BOPIS (buy online, pick up in store) and curbside-pickup service models have gained immense popularity amid the Covid-19 pandemic. They are less margin erosive for retailers compared to delivery, and many price-conscious consumers also prefer in-store pickup and curbside services to delivery, as assessed fees are typically lower than those on delivery orders. However, retailers may need to optimize store space and surrounding areas to better support these services.

Curbside pickup/drive thru emerged as the principal growth driver of the US online grocery market amid the pandemic, proving a big hit with US consumers by providing a safe and convenient alternative to in-store shopping—and the US boasts high vehicle ownership rates, with almost 93% of households owning a car in 2019.

Many retailers ramped up their curbside-pickup access points amid the pandemic and reported unprecedented growth in the service. For example, Target saw more than 500% growth in its curbside-pickup service, Drive Up, and stated that it was entering the holiday season with more than double the number of Drive Up parking spaces versus the year-ago period. Similarly, Albertsons noted in its 2Q20 earnings call that its Drive Up & Go (DUG) service was the fastest growing digital segment—growing over 1,000% during the quarter—and the company plans to have 1,400 DUG locations by the end of its current fiscal year and 1,800 locations by the end of fiscal 2021.

We expect that consumers will be more likely to use such services even when the pandemic subsides, and BOPIS/curbside pickup will become a part of a suite of service options that shoppers will expect from retailers in the future.

Fulfillment and Service Models Employed by Selected Retailers

Grocery retailers are adopting a mix of fulfillment strategies, using different service models to best serve their customers. Walmart, with its large store footprint and strong digital capabilities, is well positioned to employ store-based fulfillment models. On the other hand, Amazon uses a dual-pronged approach in the online grocery market through two separate services: Amazon Fresh (which uses centralized automated fulfillment) and Prime Now (which uses store fulfillment through Whole Foods and other local stores).

Figure 7. Online Grocery Models Employed by Selected Retailers [wpdatatable id=670 table_view=regular]

Source: Company reports/Coresight Research Online Grocery Models: Profitability Traditional store shopping tends to have an operating margin of 3–4%. With online grocery shopping, the margin is slimmer, as grocery retailers take on tasks such as picking and transporting items but often are reluctant to charge the same amount or higher to make a profit out of the transaction. Coresight Research estimates that the operating margin of the manual, in-house store pick and delivery model drops to (0.3)–(0.5)% when the customer retrieves the order through a free in-store/curbside-pickup service. This decreases even further to an estimated (5)–(6)% with home delivery, even when the retailer charges $7 for the service. Although retailers pivoted quickly to manual models to facilitate increased online orders during the pandemic, the current picker method needs further adaptation to be a viable model going forward. Grocery retailers must stem the cycle of negative operating margins by moving toward more automated fulfillment methods, especially to serve the demand of high-density areas and satisfy consumer demand for increasingly narrower delivery windows. Automation can help grocers to more efficiently scale their online capabilities, both at centralized facilities and micro-fulfillment centers installed within an operating store or dark store. However, such technologies require significant capital expenditure, which the retailers will have to earmark by compromising with other investment opportunities.

Major Themes Across the Market

Hyperlocal Delivery Services Capitalize on Grocers’ Need To Scale Online Quickly The pandemic-induced online shopping surge caught many retailers off-guard as they did not have a substantial—or in some cases, any—e-commerce business to fall back on. Additionally, developing omnichannel capabilities in-house would be an expensive proposition—one that may be unaffordable for all but the most well-resourced brick-and-mortar grocery operators. Hyperlocal delivery companies such as Instacart and Shipt capitalized on this situation by allowing retailers to step up quickly and offer same-day delivery from their stores, without having to invest in building complex e-commerce infrastructure and proprietary delivery networks. Hyperlocal delivery providers benefited strongly from the rapid uplift in online grocery demand amid the pandemic. Instacart has seen a dramatic spike in order volume since the onset of the pandemic in the US, reportedly reaching 500% growth in the first half of 2020. Since March, the company has added more than 100 retail partners and 15,000 store locations across more than 5,500 cities in the US and Canada. Similarly, Shipt’s order volume during April, May and June almost tripled, year over year. Parent company Target saw revenue on orders fulfilled by Shipt grow more than 280% year over year in the third fiscal quarter, ended October 31, 2020. The chart below shows Instacart food and consumables sales as tracked by IRI.Figure 8. Instacart Food and Consumables Sales (USD Mil.) [caption id="attachment_121392" align="aligncenter" width="725"]

What We Think

This year has been the year of inflection for the US online grocery industry, and offering a robust online shopping and fulfillment platform has become table stakes for grocery operators. Although e-commerce has its share of challenges in terms of shopper satisfaction, lost impulse sales and increased service costs, retailers have opportunities going forward to erase fulfillment friction and create new meaningful ways for online shoppers to buy and engage with them. Implications for Brands/Retailers- We believe that there is no one-size-fits-all approach in online grocery, and retailers must look at their inherent strengths to choose a mix of fulfillment and service models that can best reach the greatest number of consumers efficiently.

- Hyperlocal business will become a norm as e-commerce purchase habits continue post pandemic. This opens even more avenues to existing big grocery operators and provides a fair battleground for small and medium-sized retailers that lack a fully fledged e-commerce business, by allowing them to ramp up quickly. It also offers tremendous scope for growth in several sectors beyond grocery, including medicines, apparel and home merchandise. It is in the retailers’ interests to capitalize on this growing trend and make the most of hyperlocal partnerships to stay ahead of the competition in future.

- In light of the current health crisis, grocery brands are realizing that they cannot rely on a single distribution channel and are gearing up to engage directly with consumers. However, doing so may irrevocably harm their partnership with retailers, potentially reducing their primary income source, traditional retail sales. To reduce the channel conflict, we believe that grocery brands must employ an omnichannel strategy, where online engagement with consumers begins on their website but ends at a retailer’s store, thus creating additional foot traffic at their partners’ locations.

- As more grocery shopping shifts online, it becomes easier for retailers to gather and analyze data—technology vendors can help retailers predict demand and create actionable insights from these data, thus helping grocery retailers to forecast accurately, minimize inventory costs and create personalized shopping experiences for consumers.

- Against the backdrop of upward e-commerce trends, we expect retailers and warehouse technology providers’ partnerships to quickly move beyond pilot phases toward wider implementation. Retailers are likely to invest in warehouse automation infrastructure in the next few years to streamline their supply chains and achieve profitability in their online operations. Technology companies must be able to provide flexible automated fulfillment systems that can fit different types of retail locations.

IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.