DIpil Das

Introduction

Millennials are a relatively young consumer demographic and are often looked to as trendsetters and changemakers, with the power to influence the way people shop and spend. However, in the wake of the coronavirus pandemic, consumer behavior across all age groups has seen significant changes, with far-reaching implications. In this first report in our US Generations and Spending series, we focus on the buying behaviors of millennials, which have recently been altered by the coronavirus lockdown. During Covid-19, millennials seem to have adapted their shopping habits according to the demands of their changed lifestyles, such as working from home while managing families with young children. We explore these changes and discuss how they may impact millennials’ spending in the long term.What US Millennials Were Buying More Of, Due to the Coronavirus Outbreak

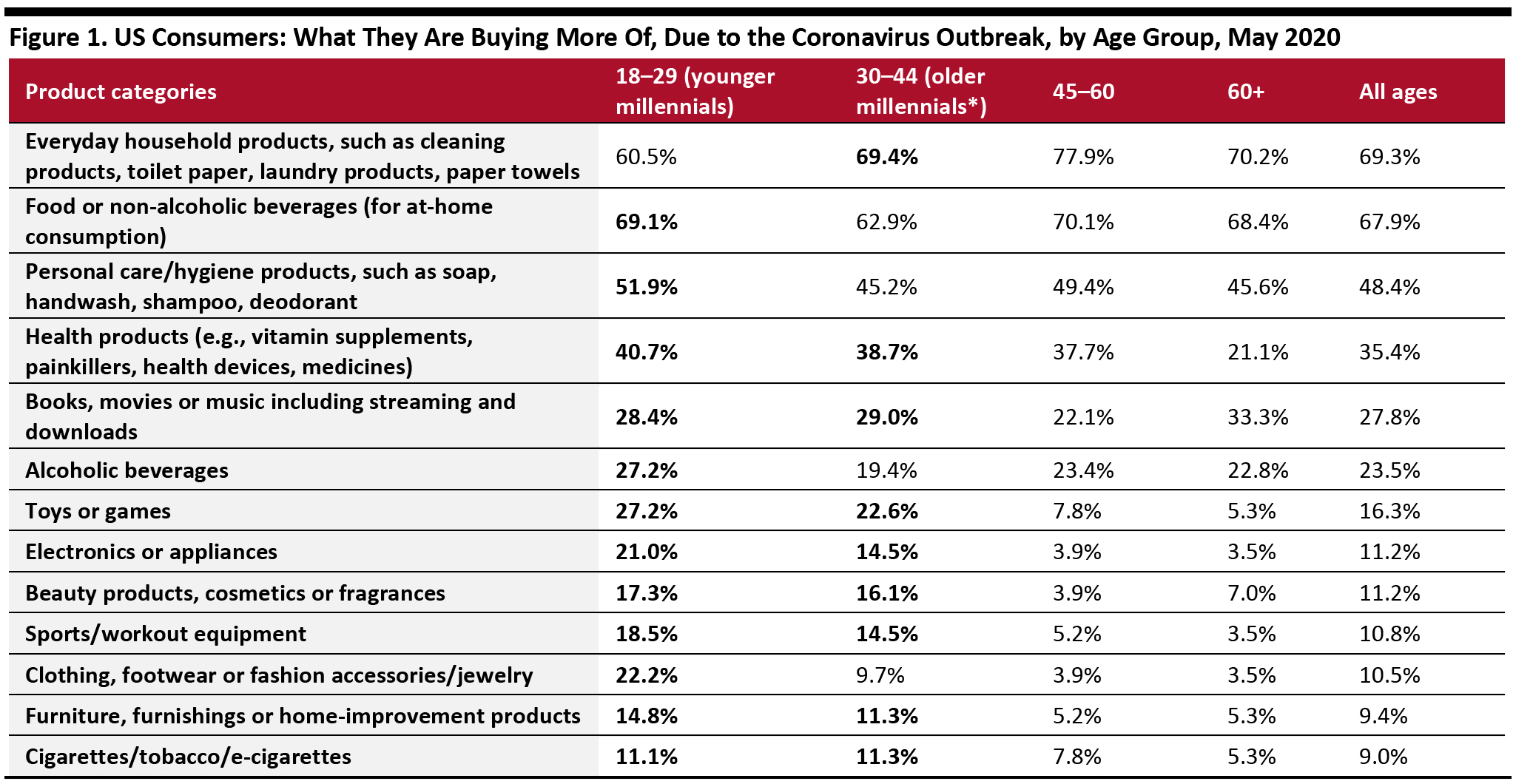

The Covid-19 pandemic resulted in the temporary closure of nearly all nonessential stores in the US from March 2020, and residents have been required to stay indoors to curb the spread of the virus. In this context, millennials have been buying more in several product categories. Coresight Research has been conducting weekly surveys of US adults to understand what products consumers are buying more of due to the outbreak. For the purposes of this report, we consider consumers in the age groups of 18–29 and 30–44 as a proxy for millennials. In Figure 1 below, we highlight the product categories where a greater proportion of millennials have indicated that they have purchased more than the national average, from our May 6 survey. In general, younger consumers indicate that they were still buying more across multiple categories than other age groups in early May, suggesting that millennials may have more firmly embedded stockpiling behaviors into their shopping habits. Millennials have been driving the wellness as a luxury trend for several years now—participating in premium workout and fitness classes, using wearables to track fitness and wearing athleisure fashion as a signifier of their lifestyle. Reiterating the wellness trend, Figure 1 shows that the proportions of consumers in the 18–29 and 30–44 age groups that bought more sports and workout equipment during Covid-19 are significantly higher than in older age groups. Lockdown appears to have fueled a nesting trend among millennials. Around 15% of younger millennials and 11% of older millennials indicated that they were buying more furniture, furnishings and home improvement products—whereas the proportion of older consumers doing so stood at around 5%. [caption id="attachment_110258" align="aligncenter" width="700"] *Proxy for older millennials. Numbers in bold indicate the categories where the proportion of millennials surpass the average across age groups.

*Proxy for older millennials. Numbers in bold indicate the categories where the proportion of millennials surpass the average across age groups. Source: Coresight Research [/caption] Some of this buying is driven by new behaviors and practices that consumers have adopted through the lockdown, and many expect to retain these new behaviors even after the lockdown ends.

Covid-19 May Alter Millennial Consumers’ Behavior Permanently

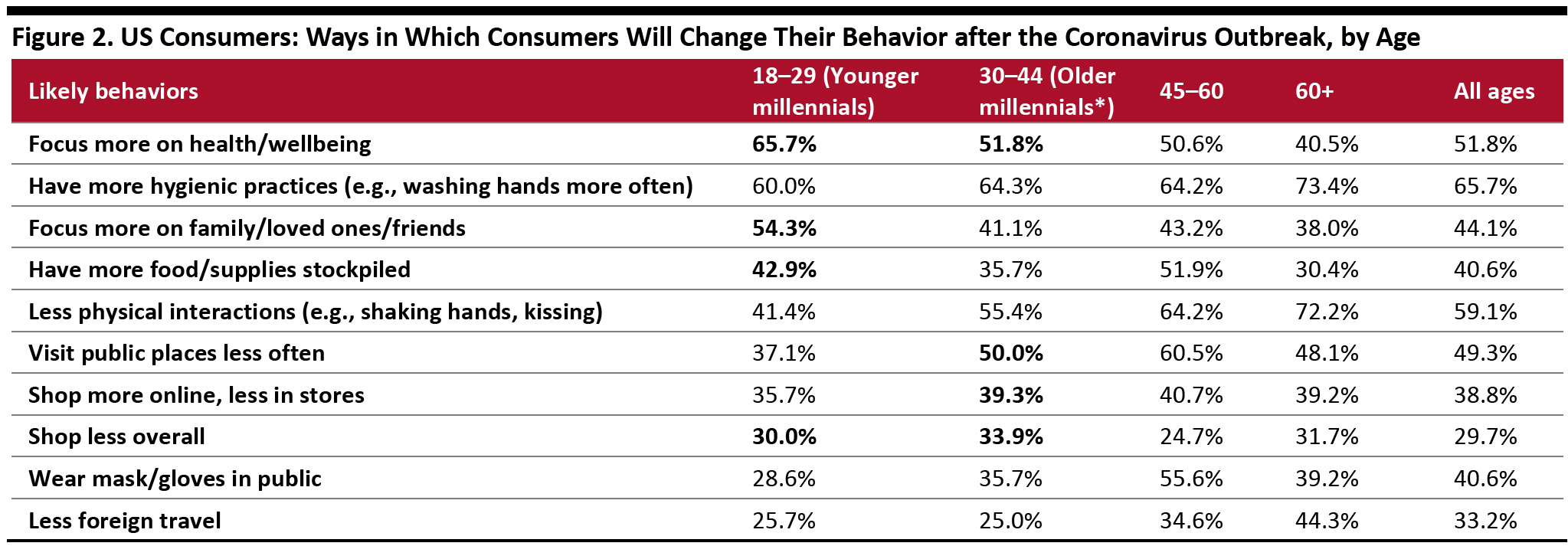

The inherent fear of contracting the coronavirus combined with the prolonged shelter-at-home orders put in place by governments around the world have led consumers to rethink several activities or behaviors that previously seemed “normal.” Our survey indicated that overall, 64% of consumers across all age groups expected to retain changed ways of living from the outbreak, such as focusing more on health and wellbeing or adopting more hygienic practices. In Figure 2, we outline the ways in which consumers expect to change their behavior after the outbreak ends. Ever greater focus on health and wellness: Millennials have long placed a significant emphasis on living well, and during recovery from the coronavirus and beyond, we think millennials will reassess their health and wellness efforts and step up their efforts to become or remain healthy and fit. Some 66% of consumers who expect to retain changed behaviors in the 18–29 age group said they will focus more on health and wellbeing after the coronavirus outbreak, versus 52% of consumers across age groups. [caption id="attachment_110259" align="aligncenter" width="700"] *Proxy for older millennials. Numbers in bold indicate the likely behaviors where the proportion of millennials surpass the average across age groups.

*Proxy for older millennials. Numbers in bold indicate the likely behaviors where the proportion of millennials surpass the average across age groups. Source: Coresight Research [/caption] Use social media to commune rather than exhibit: Millennials typically use social media as an exhibition of their lifestyle. However, lockdowns and social distancing have driven users to be more innovative in communicating with their network. Instagram Stories and Facebook Live saw a surge in video content during the weeks in lockdown. Fidji Simo, Head of the Facebook app, told Bloomberg in late March that the number of US users watching video livestreams on Facebook Live had increased by 50% since January. As of May 18, the hashtags #quarantineworkout and #quarantineworkouts had together garnered over 300,000 posts on Instagram, with various users (including influencers and celebrities) posting workout routines that they do at home and “challenging” others to do the same. Social media users around the world have also been “challenging” each other through the #dontrushchallenge to show their purported “instant” transformations from at-home clothing to getting dressed up. As of May 18, this challenge had garnered over 600,000 posts on Instagram. Another trending social media “challenge” is the Dalgona coffee challenge, where users post pictures or videos of the preparation of the drink, which involves whipping the ingredients into a frothy mixture and presenting the finished recipe in glass tumblers. There were over 500,000 post related to this challenge on Instagram on May 18. Users have also been posting screenshots of group calls they have had with colleagues or friends and family, games they have played with their networks, activities with their children at home and what they have been cooking. We believe that millennials will continue to be spontaneous and look for ways to bond with people in their network rather than merely post media that showcases their lifestyle.

- Partake in more virtual experiences: While the pandemic has prompted the closure or deferral of numerous events, including concerts, sporting events and trade conferences, several of them moved online to digital formats—including Shanghai Fashion Week. Many millennials will continue to attend events in person, but after having experienced events digitally, we think they will be more open to attending events virtually in future.

- Look to sharpen traditional life skills: Being home with a limited supply of groceries or access to gig workers has prompted millennials to do many chores themselves. As a generation that has traditionally sought convenience through the gig economy, we think that millennials will continue to focus on convenience when completing tasks themselves, such as preparing home-cooked meals. They could do this by subscribing to ready-to-prepare meal-kit services or services that dispense advice on demand—such as cookware brand Equal Parts, which lets users receive recipes, cooking tips and grocery shopping help via text.

Millennials Comprise the Largest Earning Demographic Group of the Total US Population

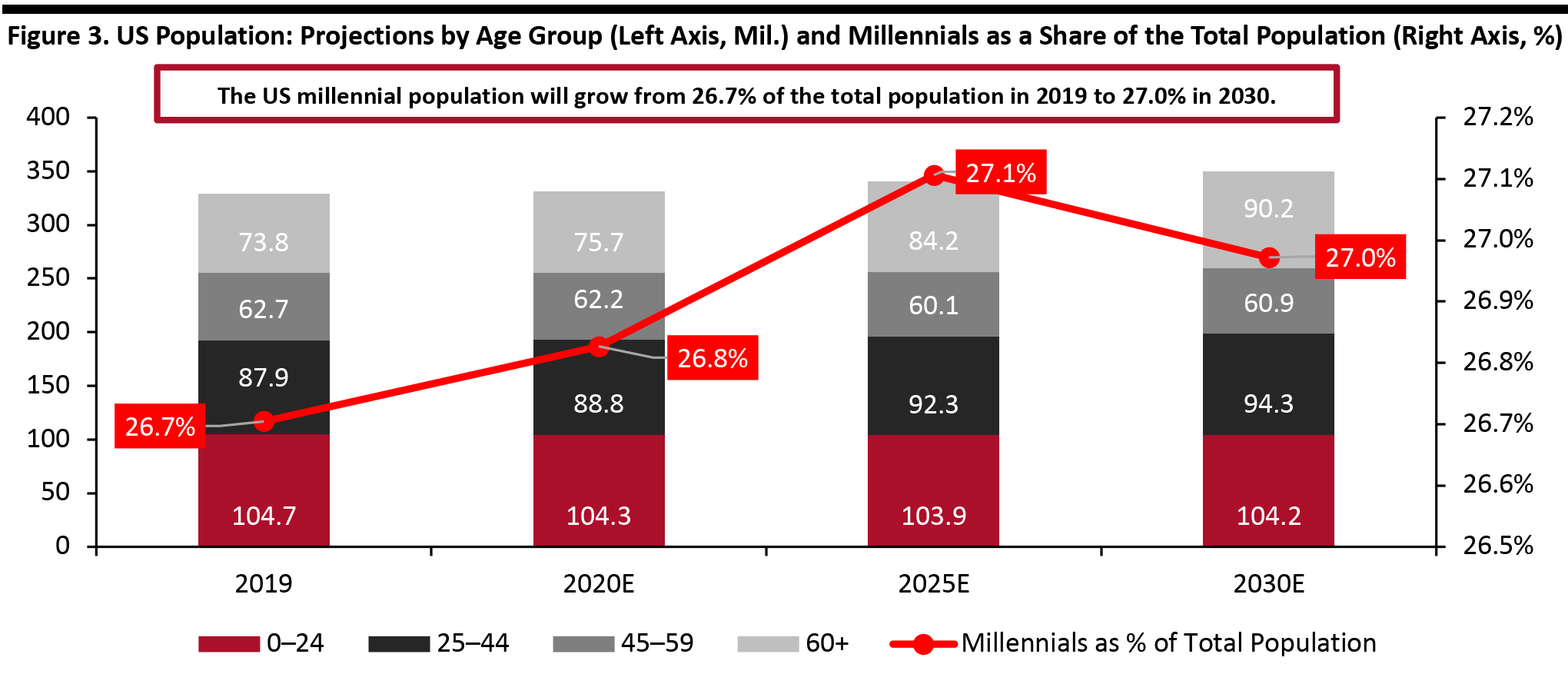

In the US, consumers aged 25–44 (the millennial population) form the second-largest demographic group after consumers aged 0–24. According to the United Nations (UN):- The US millennial population stood at 87.9 million in 2019 and will reach 94.3 million by 2030.

- Millennials accounted for 26.7% of the US population in 2019 and are expected to grow about 7.3%, or 6.4 million, through 2030.

- Millennials will continue to account for over one-quarter (around 27.0%) of the total US population in 2030.

Source: United Nations, Department of Economic and Social Affairs, Population Division (2019)[/caption]

Millennials form the largest consumer spending segment in the US. While the categories they spend on may change in the near term as a result of buying behaviors through the lockdown, millennials are likely to continue being the biggest consumer spending segment.

Source: United Nations, Department of Economic and Social Affairs, Population Division (2019)[/caption]

Millennials form the largest consumer spending segment in the US. While the categories they spend on may change in the near term as a result of buying behaviors through the lockdown, millennials are likely to continue being the biggest consumer spending segment.

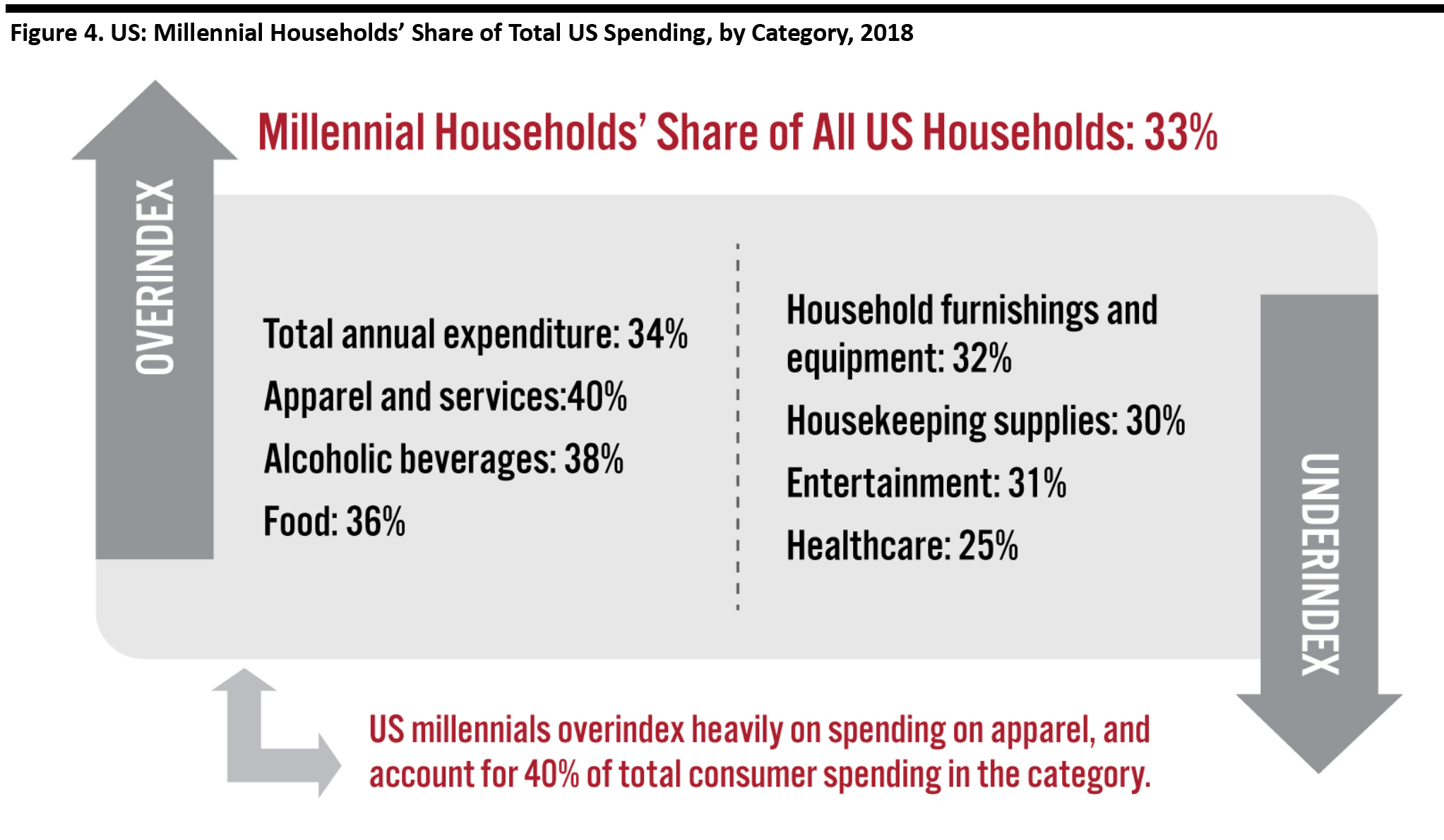

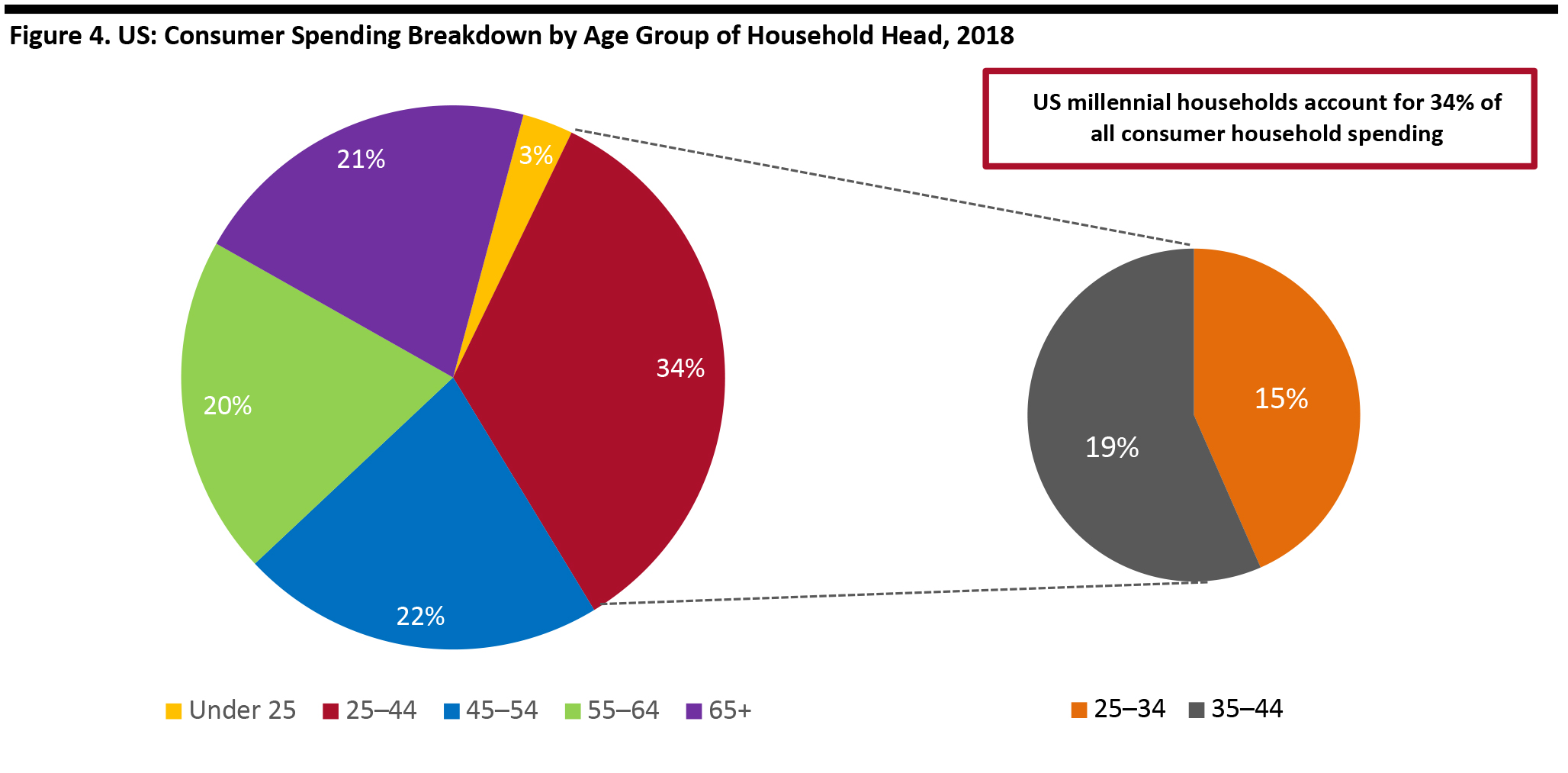

Millennials Are a $2.8 Trillion Consumer Segment

In 2018, total consumer household spending was $8.1 trillion. We take the weighted average of spending data for households headed by those in the 25–34 and 35–44 age groups to denote millennial spending in this report. Millennial households alone spent $2.8 trillion, representing 34.4% of the total and up 5% year over year, based on data from the BLS. Millennial households’ share of overall spending is close to their share of all US households, which stood at 33% in 2018. Below, we illustrate millennial households’ share of estimated total household spending by category in 2018. [caption id="attachment_110261" align="aligncenter" width="700"] Source: BLS/Coresight Research[/caption]

Millennial households overindex heavily on spending on apparel (accounting for 40% of total consumer spending on the category, while they make up 33% of total consumer households), alcoholic beverages (at 38% of the US total) and food (36%). Our survey, which we discussed earlier, indicated a greater proportion of millennials continuing to buy more products in the clothing, footwear or fashion accessories category than older age groups through the lockdown.

US millennials’ spending on healthcare (at 25% of the US total) is significantly lower than their 33% share of US households, and the group underindexes on spending on entertainment, household furnishings and equipment, and housekeeping supplies.

Younger millennials contribute slightly less than half of the millennials’ share of consumer spending, as they are still early in their careers with comparatively lower incomes than older consumers in the group: People aged 25–34 accounted for $1.2 trillion, while those aged 35–44 accounted for $1.8 trillion of the total $2.8 trillion.

[caption id="attachment_110262" align="aligncenter" width="700"]

Source: BLS/Coresight Research[/caption]

Millennial households overindex heavily on spending on apparel (accounting for 40% of total consumer spending on the category, while they make up 33% of total consumer households), alcoholic beverages (at 38% of the US total) and food (36%). Our survey, which we discussed earlier, indicated a greater proportion of millennials continuing to buy more products in the clothing, footwear or fashion accessories category than older age groups through the lockdown.

US millennials’ spending on healthcare (at 25% of the US total) is significantly lower than their 33% share of US households, and the group underindexes on spending on entertainment, household furnishings and equipment, and housekeeping supplies.

Younger millennials contribute slightly less than half of the millennials’ share of consumer spending, as they are still early in their careers with comparatively lower incomes than older consumers in the group: People aged 25–34 accounted for $1.2 trillion, while those aged 35–44 accounted for $1.8 trillion of the total $2.8 trillion.

[caption id="attachment_110262" align="aligncenter" width="700"] Source: BLS/Coresight Research[/caption]

Source: BLS/Coresight Research[/caption]

How Much Does the Average Millennial Household Spend and on What Categories?

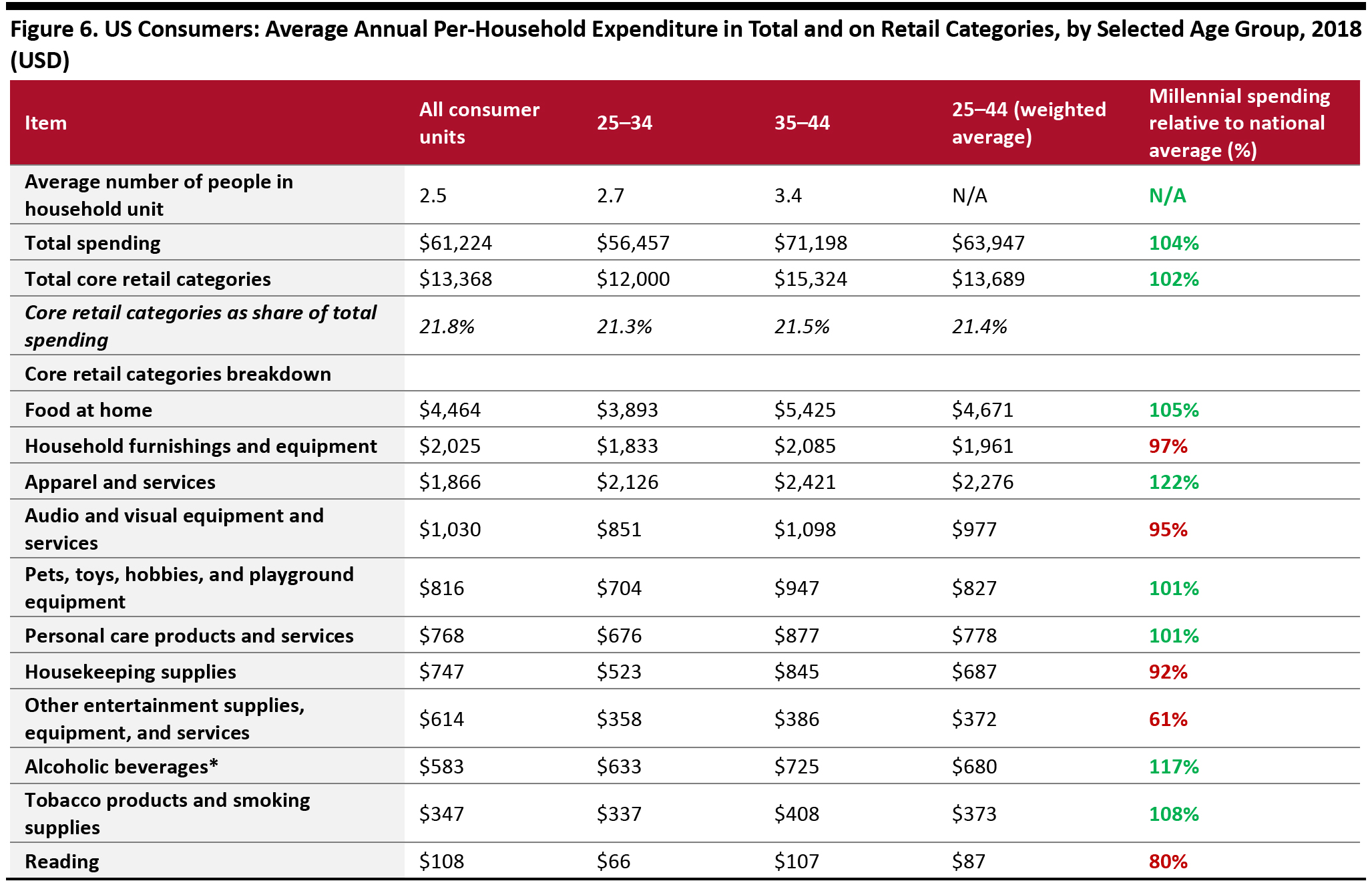

Millennial households spend more in total and more on retail categories, in absolute numbers, partly due to their larger average household sizes. In 2018, households headed by those in the 35–44 age group comprised 3.4 people, the largest consumer unit compared to households headed by people in other age groups. According to BLS data, millennials spent 104% of the average national amount on all categories and 102% on core retail categories in 2018. The US retail spending data behind our analysis in Figure 6 below show that millennial households allocate a larger share than average households to discretionary spending. The ratio of absolute spending by millennial households versus the average household is shown in the last column of the table. Millennial households in the US overindexed the most on apparel spending in 2018, spending fully 122% of the national average in this category. Other categories where they overindex include spending on alcoholic beverages (which includes an element of spending on services) at 117%, tobacco products and smoking supplies at 108% and food at home at 105%. They underindex most severely, at 61%, on spending on other entertainment supplies, which includes equipment for indoor exercise, camping, hunting and fishing, and boats—possibly because millennials enjoy social fitness experiences and possibly because they are less likely to be able to afford big-ticket items such as boats. Through the Covid-19 lockdown, however, a greater proportion of millennials reported buying more products in the sports or workout equipment categories than older consumers did. We expect some millennial consumers to continue to do this in the near term and engage less in in-person group fitness classes or going to gyms, where there are high chances of being in contact with others. [caption id="attachment_110263" align="aligncenter" width="700"] By age of “household reference person,” i.e., the head of the household. *Includes an element of spending on services

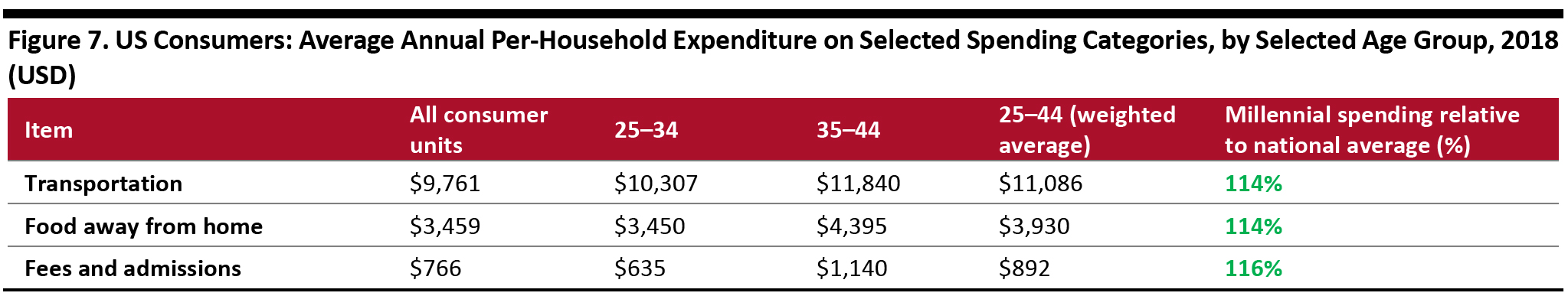

By age of “household reference person,” i.e., the head of the household. *Includes an element of spending on services Source: BLS/Coresight Research [/caption] Outside the core retail categories, millennial households outspend the average household on immersive experiences, such as eating out, travel, participating in sports and attending events. In 2018, millennial households spent 114% of the national average on transportation, which includes using public transport as well as vehicle ownership and rentals, and on food away from home, which includes eating at restaurants, cafes, specially catered events and meals on trips. Millennial households spent fully 116% of the national average on admissions to sports events, movies, concerts and plays; fees for sports and country club memberships; fees for other social, recreational and fraternal organizations; fees for lessons; and recreation expenses on trips. [caption id="attachment_110264" align="aligncenter" width="700"]

By age of “household reference person,” i.e., the head of the household.

By age of “household reference person,” i.e., the head of the household. Source: BLS/Coresight Research [/caption]

Younger and Older Millennials Are Growing Increasingly Distinct

As the millennial cohort’s age group spans nearly two decades, the differences between younger and older millennials is growing increasingly stark. Younger millennials have smaller household sizes and are therefore likely responsible for fewer people. However, they are also in the early stages of their careers and so have less propensity to spend on big-ticket items or house ownership. Older millennials have the largest household sizes and may have dependent children to care for, and therefore the size of their spending is higher than that of younger millennials. Older consumers in the millennial cohort are in the later stages of their careers compared to younger consumers, and would possibly have different spending goals compared to younger consumers, such as investing in home ownership and buying products or services that come with settling down. Making this distinction between consumers in the millennial cohort while being aware of some of their collective characteristics can help retailers to refine their offer and make their marketing efforts more targeted toward specific age groups.Key Insights

Millennials form the largest earning consumer segment and is the only other group expected to grow significantly in size through 2030, after the 60+ population. Their needs and spending behaviors reflect that millennial consumers are young and at the start of their careers and in terms of building their households. Through the coronavirus lockdowns, millennials have been looking at ways they can feel a sense of community with their friends, family and colleagues. While some of their spending is likely being focused on staple items, these young consumers have made purchases with the intention of making their time spent at home more meaningful, enjoyable or productive. As these unique times are shaping future consumer buying behavior, retailers will need to adapt their assortment as well as their approach to selling.- Retailers could look to offer toys and games that help families spend quality time together, or those that help young families keep children occupied as parents continue to work from home.

- Apparel retailers could look to provide a broader mix, or perhaps “smart” versions, of loungewear, as people are increasingly engaging in video calls from home as part of their working day.

- Retailers of home décor and appliances can appeal to millennials by providing space-saving, economical products for day-to-day activities at home, as well as offering ideas and tips for using them.

- Brands and retailers could increase their consumer engagement and digital presence through livestreaming and other video content—such as by hosting online fitness classes centered around home workout equipment, so that users can feel a sense a community while maintaining a safe social distance.

- Through the lockdown and beyond, retailers should continue to market to millennials online by posting engaging content, as they are digital-first consumers, and by offering various home delivery or pickup options, as many shoppers may be reluctant to shop in physical stores.