albert Chan

Executive Summary

This report outlines the current landscape of the US furniture and home furnishing industry and analyses the influence of the changing behavior of the US consumer on the industry with a focus on millennials. It also identifies and profiles some retailers that have innovated with new business models, technology and operational strategies. The US economy continues to be strong, with relatively high consumer confidence, strong consumer spending on discretionary goods and low unemployment levels. However, a decline in housing permits and starts, along with a fall in pending new home sales, reflect uncertainty in the housing sector that could impact the furniture industry. Although early indications were that interest rates would continue to rise in 2019, a March 2019 Federal Reserve meeting has alleviated concerns to an extent, which bodes well for the housing sector and, so, the furniture industry. The US consumer furniture market has been growing steadily over the years and reached $114.2 billion in 2018, according to the Bureau of Economic Analysis (BEA). Millennials represent the largest age cohort in the market, and their attitudes are very different. They look for value for money and products that suit their lifestyles, but are establishing homes later in life. In response, traditional companies are adjusting operational models while startups are developing innovative models to keep pace with trends in consumer behavior. E-commerce is growing in prominence and eating into the market share of brick-and-mortar furniture sales, e-commerce’s progression has been slower in furniture. Since the most common furniture purchasing journey is research online, buy in store, more furniture companies are investing in omni-channel abilities. The final section of the report highlights some of the current and emerging trends in the industry such as augmented reality (AR) and robotics.Introduction

Like much of US brick-and-mortar retail, the furniture sector is undergoing change. E-commerce has disrupted the sector, making serious inroads at the expense of brick-and-mortar retailers and this trend is expected to continue. Forward-thinking physical stores are upping their game through innovative use of technology such as AR and robotics, enhancing omnichannel offerings and inventive operational strategies. At the cusp of all this is the millennial, whose behavioral trends as a consumer group are having a growing influence on the sector as a whole. New trends are emerging with technology at the center of it. While some companies prosper in this changing environment, others have not. The sections below delve into more detail regarding the sector’s landscape and various key factors influencing it.The Market

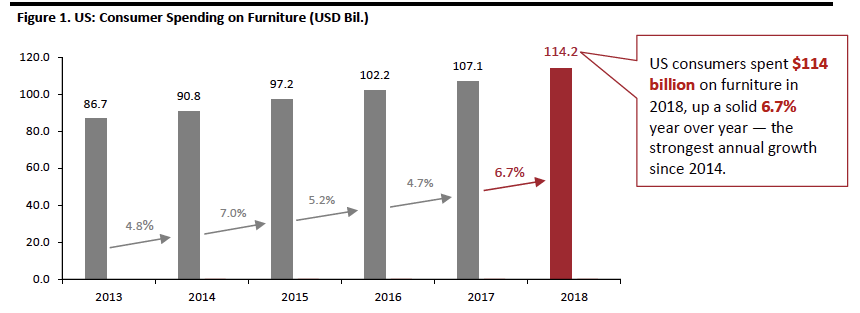

The furniture retailing industry in the US has been on a steady path of expansion. US consumers spent $114 billion on furniture in 2018, up a solid 6.7% year over year and following 4.7% growth in 2017, according to the BEA. Each of the five most recent years has seen solid growth in furniture spending, as shown in the chart below. [caption id="attachment_87028" align="aligncenter" width="700"] Source: BEA/Coresight Research[/caption]

Among the key growth drivers in the fragmented furniture industry are interest rates and residential construction (as new homes fuel demand for furniture). Overall, these drivers are giving mixed signals. Interest rates are expected to remain stable for the rest of 2019 after the US Federal Reserve announced in March that further hikes are unlikely this year amid slower economic growth. Residential construction spending was down 1.8% month over month, and declined 8.4% year over year in March 2019, per the US Census Bureau.

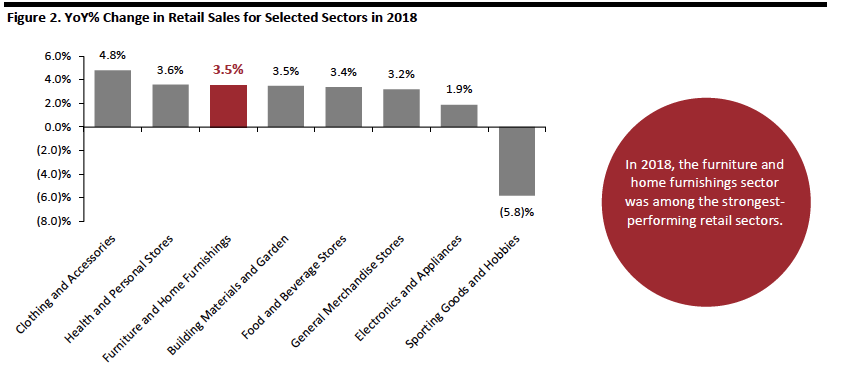

In 2018, furniture and home furnishing stores grew 3.5%, among the better performing retail sectors, according to data from the US Census Bureau.

[caption id="attachment_87029" align="aligncenter" width="700"]

Source: BEA/Coresight Research[/caption]

Among the key growth drivers in the fragmented furniture industry are interest rates and residential construction (as new homes fuel demand for furniture). Overall, these drivers are giving mixed signals. Interest rates are expected to remain stable for the rest of 2019 after the US Federal Reserve announced in March that further hikes are unlikely this year amid slower economic growth. Residential construction spending was down 1.8% month over month, and declined 8.4% year over year in March 2019, per the US Census Bureau.

In 2018, furniture and home furnishing stores grew 3.5%, among the better performing retail sectors, according to data from the US Census Bureau.

[caption id="attachment_87029" align="aligncenter" width="700"] Source: US Census Bureau[/caption]

Impact of E-Commerce on the Furniture Sector

As in most nonfood categories, e-commerce has gained a meaningful share of sales in furniture, and online sales continue to grow.

According to a survey by research firm Goodmind for global logistics services provider XPO Logistics, an estimated 37% of US consumers expect to purchase large items (including furniture) online in 2019.

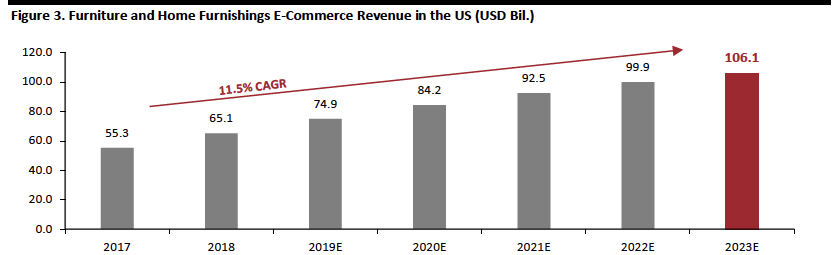

Online furniture sales were $65.1 billion in 2018 according to Statista and accounted for 12.9% of total e-commerce sales in the US. The category is expected to contribute 14.4% of total retail e-commerce sales by 2023, according to Statista, which would make it among the biggest e-commerce sales categories.

The graph below depicts online furniture and home furnishings revenue in the US from 2017 to 2023. According to Statista estimates, revenue from this category will grow at an 11.5% CAGR to reach $106.1 billion by 2023.

[caption id="attachment_87030" align="aligncenter" width="700"]

Source: US Census Bureau[/caption]

Impact of E-Commerce on the Furniture Sector

As in most nonfood categories, e-commerce has gained a meaningful share of sales in furniture, and online sales continue to grow.

According to a survey by research firm Goodmind for global logistics services provider XPO Logistics, an estimated 37% of US consumers expect to purchase large items (including furniture) online in 2019.

Online furniture sales were $65.1 billion in 2018 according to Statista and accounted for 12.9% of total e-commerce sales in the US. The category is expected to contribute 14.4% of total retail e-commerce sales by 2023, according to Statista, which would make it among the biggest e-commerce sales categories.

The graph below depicts online furniture and home furnishings revenue in the US from 2017 to 2023. According to Statista estimates, revenue from this category will grow at an 11.5% CAGR to reach $106.1 billion by 2023.

[caption id="attachment_87030" align="aligncenter" width="700"] Source: Statista[/caption]

Much like other sectors, major e-commerce-only players such as Amazon are aggressively increasing furniture offerings, while brick-and-mortar retailers with a significant online presence are scaling up online furniture offerings as well.

Williams-Sonoma and its brands (such as West Elm and Pottery Barn) generated over half (54.3%) of total revenue of $5.7 billion via e-commerce in 2018. Digital-only Wayfair, which generated total revenue of $6.8 billion in 2018, ranked 10th in US retail e-commerce sales in 2018, according to eMarketer estimates.

However, brick-and-mortar continues to be the format of choice for furniture purchase. According to a 2018 survey by market research firm Morning Consult, some 80% of US internet users prefer to shop for furniture in-store. The prevailing environment has prompted many retailers to expand omni-channel abilities, with traditional furniture retailers that once focused on their physical presence enhancing their online abilities while online pure plays such as Wayfair are opening shops.

Key Players

These are some of the key players in the fragmented furniture industry:

[caption id="attachment_87031" align="aligncenter" width="574"]

Source: Statista[/caption]

Much like other sectors, major e-commerce-only players such as Amazon are aggressively increasing furniture offerings, while brick-and-mortar retailers with a significant online presence are scaling up online furniture offerings as well.

Williams-Sonoma and its brands (such as West Elm and Pottery Barn) generated over half (54.3%) of total revenue of $5.7 billion via e-commerce in 2018. Digital-only Wayfair, which generated total revenue of $6.8 billion in 2018, ranked 10th in US retail e-commerce sales in 2018, according to eMarketer estimates.

However, brick-and-mortar continues to be the format of choice for furniture purchase. According to a 2018 survey by market research firm Morning Consult, some 80% of US internet users prefer to shop for furniture in-store. The prevailing environment has prompted many retailers to expand omni-channel abilities, with traditional furniture retailers that once focused on their physical presence enhancing their online abilities while online pure plays such as Wayfair are opening shops.

Key Players

These are some of the key players in the fragmented furniture industry:

[caption id="attachment_87031" align="aligncenter" width="574"] Source: Furniture Today/Coresight Research[/caption]

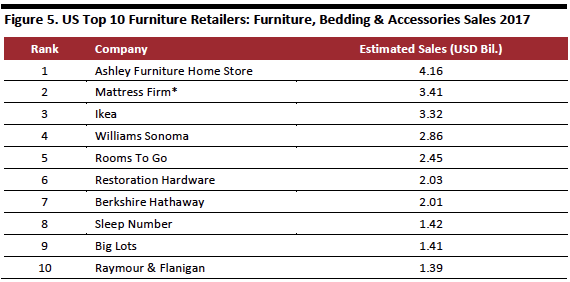

The table below shows the top 10 furniture stores in the US ranked by estimated sales of furniture, bedding and accessories in 2017.

[caption id="attachment_87032" align="aligncenter" width="570"]

Source: Furniture Today/Coresight Research[/caption]

The table below shows the top 10 furniture stores in the US ranked by estimated sales of furniture, bedding and accessories in 2017.

[caption id="attachment_87032" align="aligncenter" width="570"] *Mattress Firm filed for Chapter 11 bankruptcy in October 2018 but emerged out of it by November 2018. The retailer closed over 600 stores in 2018.

*Mattress Firm filed for Chapter 11 bankruptcy in October 2018 but emerged out of it by November 2018. The retailer closed over 600 stores in 2018.Source: Furniture Today/Statista[/caption]

Innovators and Disruptors

Amazon Amazon announced its first two private label furniture brands (Rivet and Stone & Beam) in November 2017, each catering to different markets. Rivet specializes in affordable mid-century modern living room furniture and décor, while Stone & Beam is slightly more upscale and offers sturdy products at relatively higher price points. At the time of launch, the company said furniture was one of its fastest-growing retail categories. Amazon offers 369 products under its Rivet brand and 340 products under its Stone & Beam brand, according to our 2018 research on Amazon’s private labels. The wide range of products the company offers under its furniture and home furnishings brands differs from the segmented strategy the company follows for its private label apparel brands, wherein each brand offers fewer than 100 products. A Coresight Research survey in February 2019 found that “furniture, furnishings or decorative items for the home” was the 10th-most-shopped category on Amazon by number of shoppers, with 22.6% of respondents purchasing the category on Amazon.com in the prior 12 months. This put furniture, furnishings or decorative items ahead of categories such as music (including CDs, downloads and streaming) and watches and jewelry, but it was marginally less shopped than food or drink items, home-improvement and automotive products. Amazon is testing a shopping site called Scout that recommends products in various categories, including furniture, targeting customers who do not have a clear idea of what they want but are open to being aided by automated recommendations. Wayfair In February 2019, Wayfair launched its first brick-and-mortar store in Florence, Kentucky, close to its distribution center in Erlanger, Kentucky. The store sells pieces returned in good condition, along with other discounted goods. The company previously opened two holiday pop-up shops, and plans to open its first full-service retail store in the Natick Mall in Natick, Massachusetts this year. Wayfair has been a dominant player in the US online furniture retail space, one of the ways that it was able to disrupt the market was through paid search. Its share of furniture and home related paid search terms on Google shot up to 13% in 2017, up from 6% in 2016. The retailer has also invested significantly in television advertising and direct mail to improve customer engagement. Macy’s Macy’s entered into a partnership with AR and virtual reality (VR) specialist Marxent in October 2018 to rollout over 70 VR installations across the country. The technology helps customers discover products and make informed purchase decisions. Through VR technology, customers can immerse themselves in virtual rooms they can design using a VR headset. MoDRN Walmart introduced MoDRN in February 2019, an exclusive online furniture brand that caters to customers who “embrace a modern aesthetic.” The company aims to offer high-quality products at affordable prices with free two-day shipping, an appealing proposition as customer expectations around delivery rise. Houzz Houzz, having raised $614 million in funding, is one of the highest funded furniture tech startups in the US. The platform makes it convenient for customers to explore and discover interior ideas and connects them to local professionals for help. Its website also facilitates a direct purchase from a curated list. The company’s app has a feature called “View in My Room 3D” that allows customers to visualize over 300,000 products in their house in 3D.The Consumer

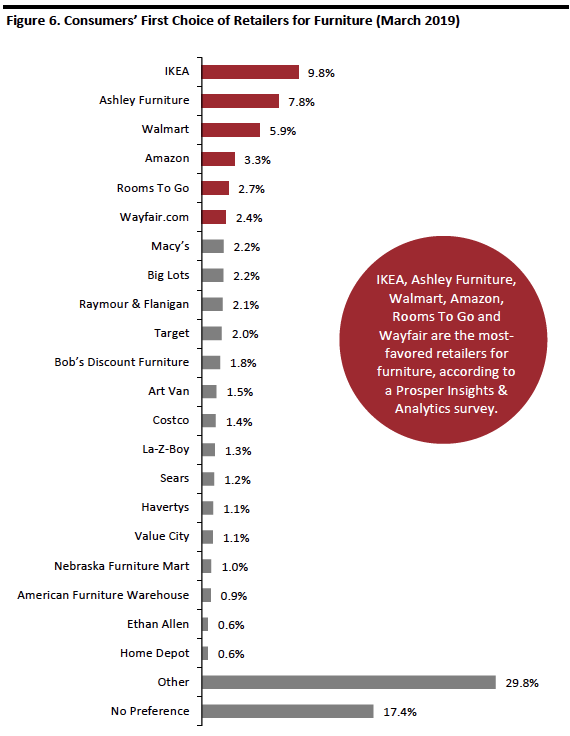

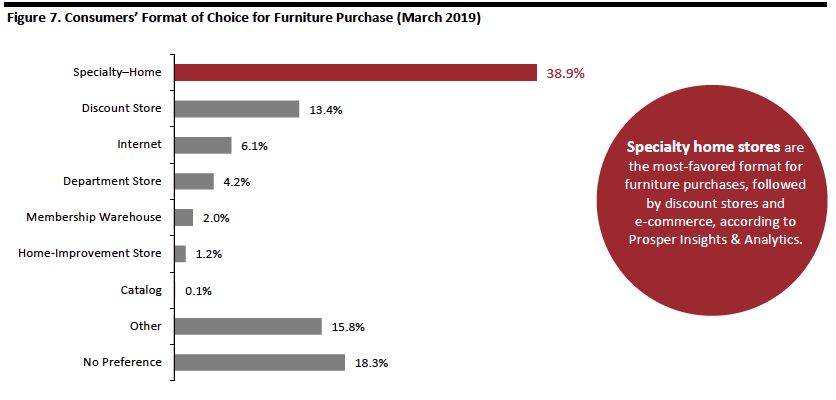

Millennials are Becoming Key Growth Drivers Millennials, the largest demographic in the US labor force, have become a key target group for furniture retailers and a focal point for growth strategies. Brick-and-mortar furniture stores continue to be the predominant format even for digitally focused millennials, representing about 63% of indoor home furnishings purchases, per an HFN Millennial Total Home survey. At the same time, however, millennials have the highest proportion of consumers (47%) who research furniture online but buy in store, compared to Generation X (40%) and Baby Boomers (36%) according to 2016 data from Furniture Today. Online product reviews have a significant influence on purchase decisions and social media plays a key role in product discovery. Sustainable and eco-friendly products find more favor among millennial consumers. They also look for compact, multifunctional and cost-effective products that are more in tune with their lifestyles. Free shipping is an important purchase consideration factor for the millennial consumer. According to a recent report from the National Retail Federation, around 61% of US millennials expect free shipping when buying online. Millennials and the Housing Market According to data from Realtor.com, Millennials have overtaken Generation X as the consumer group that accounts for the maximum number of new mortgages in the US, and this share has continued to grow. Millennials accounted for 45% of all new mortgages in 2018, in contrast to Gen Xers (36%) and Baby Boomers (17%). Millennials have also overtaken older generations in mortgage dollar value: As of November 2018, millennials accounted for 42% of the dollar value of new loans, compared to 40% for Generation X and 17% for Baby Boomers. However, Millennials are not buying houses at the rate previous generations did. They are buying later in life, largely due to lower disposable income and higher debt levels. Gen Xers and older generations, on the other hand, tend to have higher disposable incomes and head more households than millennials, despite being outnumbered in terms of population size. Shopper Preferences IKEA, Ashley Furniture, Walmart, Amazon, Rooms To Go and Wayfair are the most-popular furniture retailers in the US, according to a consumer survey carried Prosper Insights & Analytics that asked consumers where they would shop first for furniture. [caption id="attachment_87033" align="aligncenter" width="570"] Base: 7,388 US consumers ages 18+, surveyed in March 2019

Base: 7,388 US consumers ages 18+, surveyed in March 2019Source: Prosper Insights & Analytics[/caption] Specialty home stores are most popular in terms of format, with around four in ten shoppers naming a specialty home store as where they would shop first for furniture, followed by discount stores and e-commerce. [caption id="attachment_87034" align="aligncenter" width="700"]

Base: 7,388 US consumers ages 18+, surveyed in March 2019

Base: 7,388 US consumers ages 18+, surveyed in March 2019Source: Prosper Insights & Analytics[/caption]

Macro-Economic Perspective

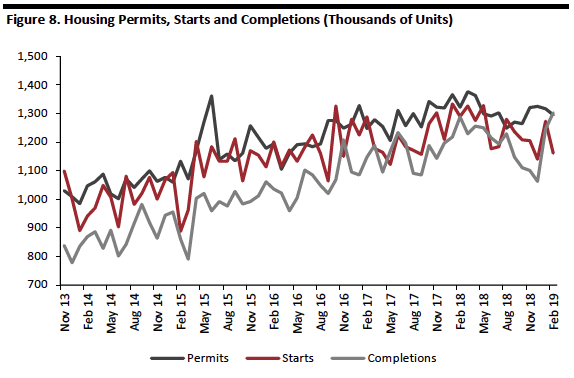

US Housing Market Buying a home in the US was expected to become more expensive in 2019 as mortgage rates were expected to continue rising. Home prices were also expected to grow 2.2%, according to Realtor.com estimates. Amidst this context, Realtor.com predicted a 2% decline in home sales in 2019. However, the Federal Reserve has said no more hikes are planned for 2019 and only one is planned for 2020, a reversal of previously announced plans for three rate hikes in 2019 that pushed down mortgage rates. Data on new housing permits, starts, and completions show mixed signals, with housing permits and starts down year over year and completions up year over year. Month over month growth in authorized housing permits declined by 1.6% in February this year, 2.0% year over year, according to US Census Bureau data. Housing starts also declined 8.7% from January and 9.9% year over year. On the other hand, housing completions grew 4.5% month to month and 1.1% year over year. [caption id="attachment_87035" align="aligncenter" width="574"] Source: US Census Bureau[/caption]

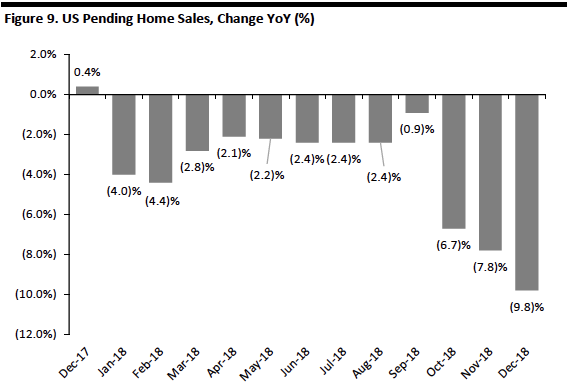

Following several months of decline, the fall in pending new home sales deepened further in the last months of 2018, attributed to high home prices and higher mortgage rates. This, in turn, could negatively impact furniture demand.

[caption id="attachment_87036" align="aligncenter" width="568"]

Source: US Census Bureau[/caption]

Following several months of decline, the fall in pending new home sales deepened further in the last months of 2018, attributed to high home prices and higher mortgage rates. This, in turn, could negatively impact furniture demand.

[caption id="attachment_87036" align="aligncenter" width="568"] Source: National Association of Realtors[/caption]

Source: National Association of Realtors[/caption]