DIpil Das

Executive Summary

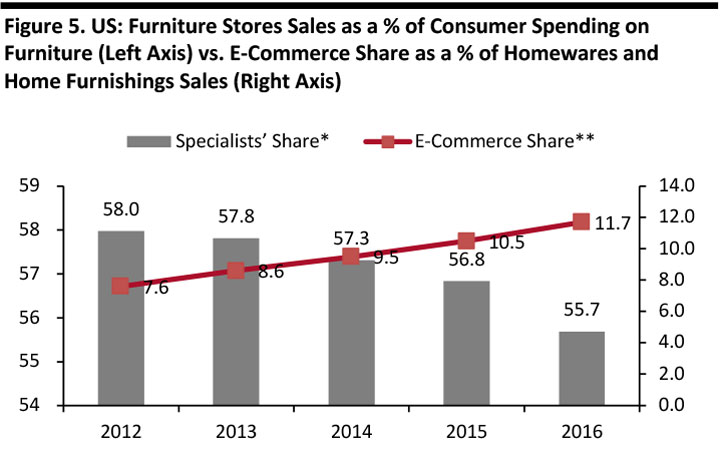

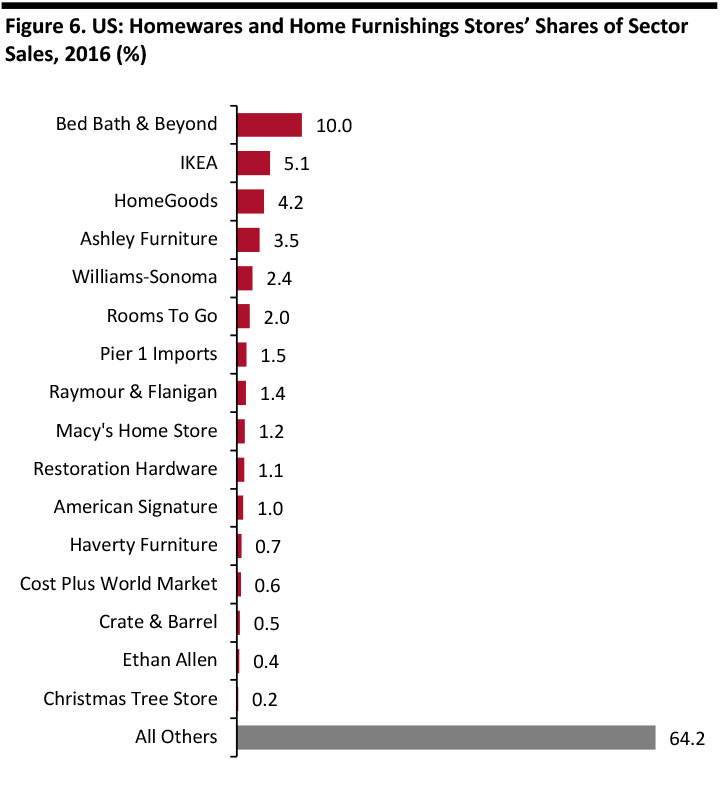

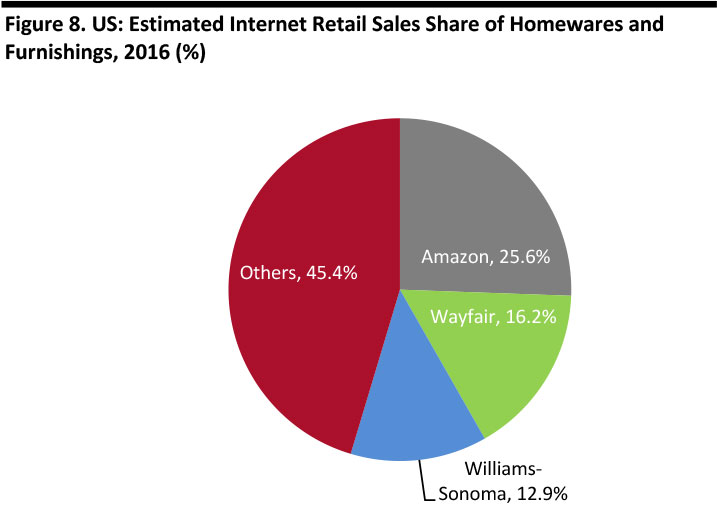

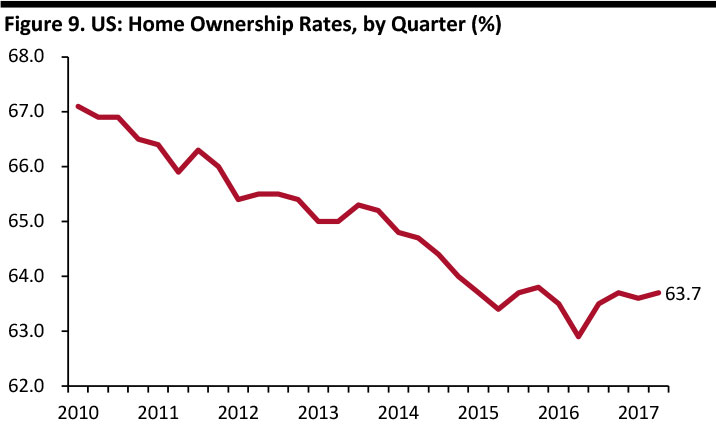

The US furniture market was worth $114 billion in 2016, when sales climbed by a solid 4.5%. Growth in consumer spending on furniture has softened considerably in 2017, averaging 2.5% year over year in the first six months of the year, according to the US Bureau of Economic Analysis (BEA). Growth was even weaker in May and June, the most recent months for which we have data. The performance of the residential property market has a major impact on furniture sales, and existing home sales growth has been tepid so far this year, according to the National Association of Realtors. Consumers’ ability to spend is crucial, too, and average real weekly earnings growth deteriorated in 2016, and turned negative in early 2017, although there has been a modest recovery since then. Furniture specialists’ sector sales are growing more slowly than spending on furniture overall, as Internet-only retailers continue to build share. E-commerce accounted for close to 12% of the broader homewares and home furnishings category last year, according to Euromonitor International, and is expected to climb to just over 13% in 2017. On the basis that around 5% of total Amazon sales are in the homewares and furnishings categories, we estimate Amazon would capture around one-quarter of online category sales. Wayfair and Williams-Sonoma each capture sizeable shares of the online market, too. Established furniture players need to look past short-term fluctuations and prepare for fundamental shifts in US consumers’ lifestyles:- Lower home-ownership levels, more people renting: More Americans are renting homes nowadays than in previous decades. Renters looking to furnish their homes are likely to find lower-cost furniture more appealing than higher-value investment pieces. Moreover, many landlords of furnished rental properties will opt for cheaper furniture.

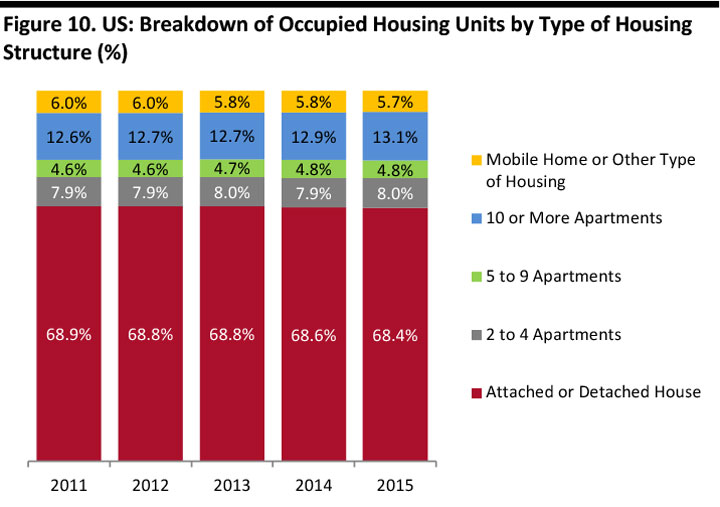

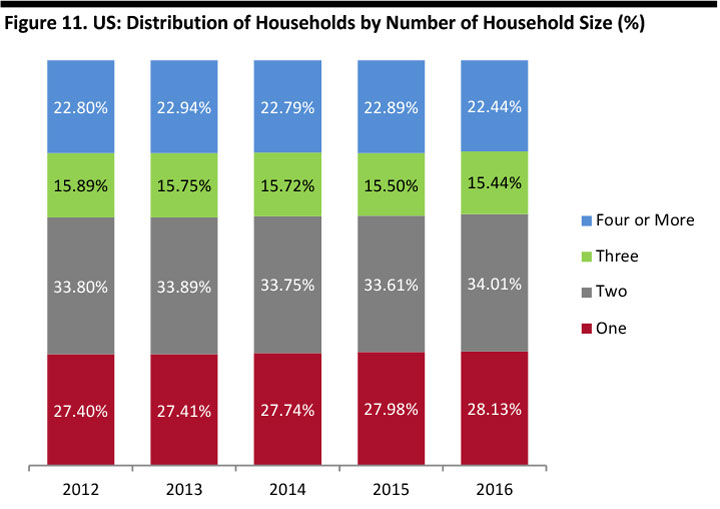

- More apartment living, more single-person households: The proportion of the US population that is living in apartments is growing, as is the number of single-person households. Smaller homes and smaller households suggest greater demand for more compact and multifunctional furniture, as well as products offering storage solutions.

- Older consumers want to age in place: More seniors want to live independently in their own home—in other words to “age in place”— rather than in institutions devoted to care. Seniors may look for furniture that offers them assistance in day-to-day living, including opting for simple changes such as replacing soft sofas with firmer, higher seating and arm rests that enable easier movement.

- Cash-strapped millennials are forming households: Millennials are becoming more important as purchasers of furniture. These consumers are likely to look to retailers with strong value credentials and Internet-only retailers whose brands or offerings resonate with them.

Introduction

The US furniture market has seen growth moderate significantly in 2017. In this report, we provide updated data on the market, including data on e-commerce penetration, and discuss key macroeconomic impacts on furniture sales. We then turn to the longer term to note four demographic shifts that we expect to have an impact on the American furniture market in the coming years. This report updates our October 2016 overview Deep Dive: US Furniture Market 2016: Preference and Trends.Market Overview: Growth Weakens in 2017

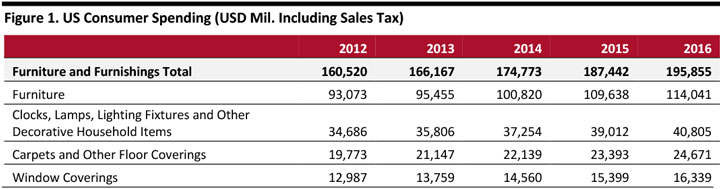

How Big is the Market and How Fast Is It Growing? American consumers spent $114 billion on furniture in 2016, according to the BEA. In addition, they spent a further $82 billion on adjacent categories such as lighting, carpets and window coverings [caption id="attachment_84945" align="aligncenter" width="720"] Source: BEA[/caption]

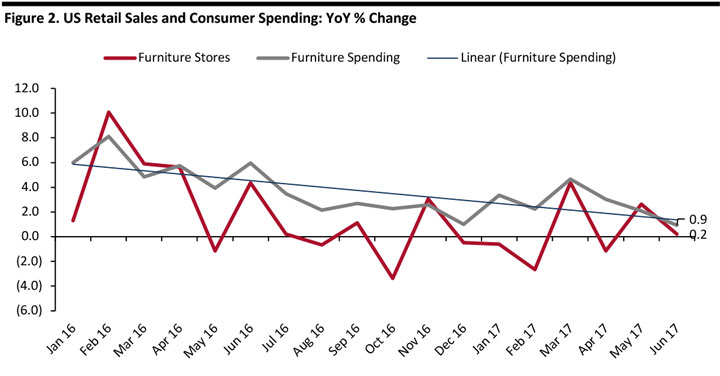

Growth in furniture sales has weakened considerably so far this year

Source: BEA[/caption]

Growth in furniture sales has weakened considerably so far this year

- Year-over-year growth in spending on furniture averaged 2.5% in the first six months of 2017, according to the BEA.

- This is significantly lower than the 4.5% for 2016 as a whole.

- In May and June—the latest two months for which we have data—growth was weaker still, below the 2.5% year-to-date average, as we chart below.

Source: US Census Bureau/BEA/Coresight Research[/caption]

Macroeconomic Drivers Deteriorate in 2017

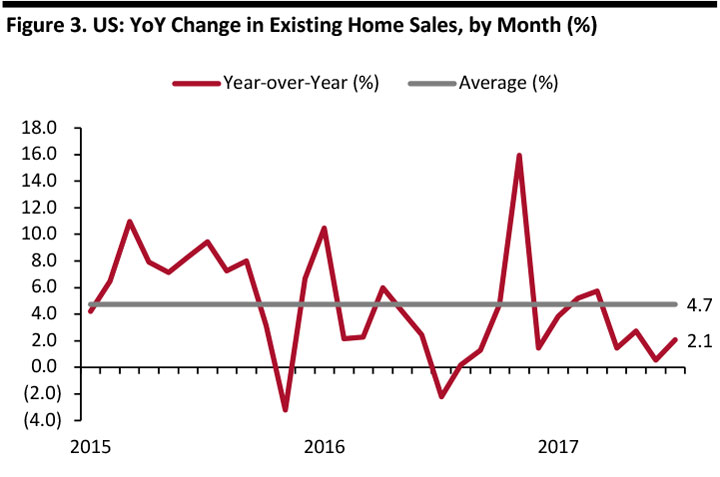

The explanation for the weakening furniture market may lie in the softening of key economic metrics, such as home sales and real earnings growth, in 2017.

A substantial share of furniture sales is tied to the residential property market. Consumers tend to buy furniture when moving into their first home, and many take the opportunity to buy replacement furniture when moving on. Moreover, rising property prices tend to make home owners more willing to splash out on big-ticket purchases.

2017 has so far seen tepid growth in existing home sales, according to the National Association of Realtors. Aside from a robust performance in February and March this year, year-over-year increases in home sales have underpaced the 2015–2017 rolling average.

US home sales data is split between existing homes and new builds. Existing home sales account for around 90% of residential property sales in the US, making it the most important metric to watch.

[caption id="attachment_84947" align="aligncenter" width="720"]

Source: US Census Bureau/BEA/Coresight Research[/caption]

Macroeconomic Drivers Deteriorate in 2017

The explanation for the weakening furniture market may lie in the softening of key economic metrics, such as home sales and real earnings growth, in 2017.

A substantial share of furniture sales is tied to the residential property market. Consumers tend to buy furniture when moving into their first home, and many take the opportunity to buy replacement furniture when moving on. Moreover, rising property prices tend to make home owners more willing to splash out on big-ticket purchases.

2017 has so far seen tepid growth in existing home sales, according to the National Association of Realtors. Aside from a robust performance in February and March this year, year-over-year increases in home sales have underpaced the 2015–2017 rolling average.

US home sales data is split between existing homes and new builds. Existing home sales account for around 90% of residential property sales in the US, making it the most important metric to watch.

[caption id="attachment_84947" align="aligncenter" width="720"] Note: Through to July 2017.

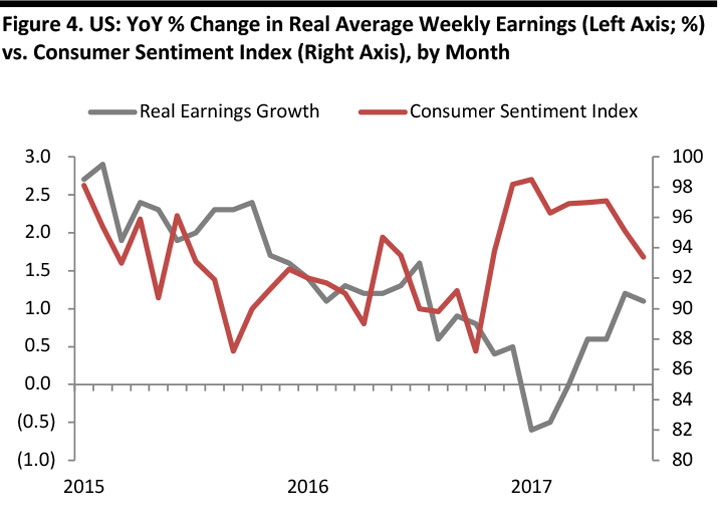

Note: Through to July 2017. Source: National Association of Realtors/Coresight Research [/caption] Big-ticket categories such as furniture are dependent on consumers’ willingness and ability to spend, and solid real earnings growth is one spur for that. Adjusted for inflation, average weekly earnings growth deteriorated in 2016 and turned negative in early 2017. There has been some recovery this year—although to lower-than-previous levels. As with the softening of home sales, this deterioration in real income growth has been bad news for the furniture market. Counterintuitively, consumer sentiment has recently tended to show a negative correlation with real earnings growth: as income growth softened, confidence rose. [caption id="attachment_84948" align="aligncenter" width="720"]

Through July 2017.

Through July 2017. Source: Bureau of Labor Statistics/University of Michigan[/caption] We note that there are some inflationary clouds over US discretionary spending for the remainder of 2017:

- Gasoline prices: Gasoline prices started to creep back up, year over year, in July and August (latest), according to data from the US Energy Administration.

- Food prices: At the same time, US food prices have emerged from deflation to be mildly inflationary. Any further upward trend in food-price inflation would squeeze consumers’ wallets.

- E-commerce in total—whether through Internet-only retailers or multichannel players—accounted for almost 12% of homewares and home furnishings sales in 2016, according to Euromonitor International. (Note that the definition for this e-commerce data is broader than just furniture.)

- The share of e-commerce is expected to climb to 13.1% for 2017, according to Euromonitor.

- In absolute terms, Euromonitor forecasts that US shoppers will spend $22 billion on homewares and home furnishings online in 2017 (excluding sales taxes).

Retail sales for furniture specialists include any non-furniture sales, so the percentages are indicative only. Consumer spending is adjusted to strip out sales tax at average annual rates.

Retail sales for furniture specialists include any non-furniture sales, so the percentages are indicative only. Consumer spending is adjusted to strip out sales tax at average annual rates. ** Includes homewares such as cookware and kitchenware as well as household textiles, lighting and furniture.

Source: BEA/US Census Bureau/Thomson Reuters/Euromonitor International/Coresight Research [/caption] Market Shares Reflect a Fragmented Specialists Sector The home furnishings and homewares specialists sector is highly fragmented. Even major names such as Williams-Sonoma and Restoration Hardware enjoy only a single-digit share of sector sales, while almost two-thirds of the sector is accounted for by retailers that individually have only very small market shares. [caption id="attachment_84950" align="aligncenter" width="720"]

Source: Euromonitor International[/caption]

An alternative view of the top retailers comes from Furniture Today’s Top 100 list of retailers. That list excludes generalists such as department stores and mass merchandisers. And it splits retailers into two categories:

Source: Euromonitor International[/caption]

An alternative view of the top retailers comes from Furniture Today’s Top 100 list of retailers. That list excludes generalists such as department stores and mass merchandisers. And it splits retailers into two categories:

- Conventional furniture stores: This includes furniture stores with a traditional merchandise mix of furniture, bedding and decorative accessories.

- Specialty stores: These are furniture stores with a specialized product mix. The data shown below are estimated sales of furniture, bedding and accessories.

Source: Furniture Today [/caption]

E-Commerce Market Leaders

The market-share breakdowns shown above exclude Internet-only retailers. In the US market, Wayfair is the leading specialized Internet-only retailer. Wayfair generated US revenues of $3.1 billion in 2016, up fully 46% year over year.

Euromonitor estimates that US Internet sales of the broader homewares and furnishings market totaled $19.2 billion in 2016. Wayfair’s revenues equate to 16% of this online market size.

Amazon is the major unknown in online furniture retailing, given the retailer provides no breakdown of revenues by product split, and because analysts’ estimates of the total sales made through Amazon, including third-party sales, differ.

Source: Furniture Today [/caption]

E-Commerce Market Leaders

The market-share breakdowns shown above exclude Internet-only retailers. In the US market, Wayfair is the leading specialized Internet-only retailer. Wayfair generated US revenues of $3.1 billion in 2016, up fully 46% year over year.

Euromonitor estimates that US Internet sales of the broader homewares and furnishings market totaled $19.2 billion in 2016. Wayfair’s revenues equate to 16% of this online market size.

Amazon is the major unknown in online furniture retailing, given the retailer provides no breakdown of revenues by product split, and because analysts’ estimates of the total sales made through Amazon, including third-party sales, differ.

- Amazon’s gross merchandise volume (GMV), which includes sales made by third-party sellers on its site, was around $98 billion in 2016, according to Euromonitor.

- If we estimate that 5% of Amazon’s GMV was in the home furnishings category in 2016, this would equate to just under $5 billion of US category sales and, in turn, a 2.7% share of BEA-recorded furniture and furnishings spending after we adjust that data for sales tax.

- At 10% of Amazon GMV, home furnishings would equate to a 5% share of the total market in 2016. However, we think homewares and furniture are unlikely to account for 10% of Amazon’s total sales, given the retailers’ strength in a number of other categories.

Source: Euromonitor International/S&P Capital IQ/Coresight Research[/caption]

Source: Euromonitor International/S&P Capital IQ/Coresight Research[/caption]

- Williams-Sonoma reported e-commerce revenues of $2,634 million in the year ended January 2017. These revenues spanned its various banners, including Pottery Barn, West Elm and Williams-Sonoma. Approximately 6% of group revenues are from outside the US, and we have adjusted for this in our market-share estimate above.

- Bed Bath & Beyond noted e-commerce growth of more than 20% on its earnings call for fiscal year 2016. However, the company does not split out online revenues.

- See also our September 2016 report Deep Dive: Global Furniture and Homewares E-Commerce.

Looking to the Long Term: Four Demographic Trends Set to Impact the US Furniture Market

In this section, we look to the long term and identify four demographic shifts that we think could change what consumers look for when buying furniture. A number of these changes are incremental, and we expect their impacts to be felt over a period of years. 1. Lower Home-Ownership Levels, More Renting More Americans are renting their homes nowadays than in previous decades. Home ownership rates are now at under two-thirds of the US population, as we chart below. [caption id="attachment_84953" align="aligncenter" width="716"] Through the second quarter of 2017.

Through the second quarter of 2017. Source: National Association of Realtors/Coresight Research [/caption] Implications: Renters looking to furnish their homes are likely to find lower-cost furniture more appealing than higher-value investment pieces. Renters are likely to move homes more often than home owners, may face uncertainty over when they will need to move and, in some cases, may find themselves moving between furnished and unfurnished properties. As a result, renters may find that flat-pack furniture or other cheap, “semi-disposable” furniture offers them the flexibility they need. Moreover, in furnished rental properties, many landlords will opt for cheaper furniture, instead of seeking out quality furniture as an investment. In an owner-occupied home, the person who buys the furniture benefits from the enjoyment of a quality product; in a furnished rented home, the benefit to the person who buys the furniture is largely in minimizing cost. 2. More Apartment Living, More Single-Person Households Likely related to the trend toward renting a home is the growth in the proportion of the population living in apartments rather than houses. As we chart below, the share of total households living in larger apartment buildings, of 10 or more apartments, in particular, has grown in recent years. The proportion of the US population living in a standalone house is declining slowly. This trend dovetails with a steady increase in single-person households in the US. Although the increase in the proportion of households occupied by just one person is very gradual, it is consistent, according to the US Census Bureau. [caption id="attachment_84954" align="aligncenter" width="720"]

Source: US Census Bureau[/caption]

[caption id="attachment_84955" align="aligncenter" width="720"]

Source: US Census Bureau[/caption]

[caption id="attachment_84955" align="aligncenter" width="720"] Source: US Census Bureau[/caption]

Implications: Smaller homes and smaller households suggest greater demand for more compact and multifunctional furniture, as well as products offering storage solutions.

IKEA has recognized this trend for a number of years and has successfully launched multiple collections and marketing campaigns. IKEA’s latest initiative, in June 2017, was to collaborate with NASA: a team from the retailer spent three days at a spacecraft training center in Utah to understand how innovations can make living in confined spaces easier and more enjoyable.

3. Older Consumers Want to Age in Place

Not only is the US population aging, but more seniors want to “age in place”—in other words, to live independently in their own home, rather than in institutions devoted to care. The US Centers for Disease Control and Prevention (CDC) define aging in place as “the ability to live in one’s own home and community safely, independently and comfortably, regardless of age, income or ability level.” Over 90% of seniors aged 65 and above prefer to stay in their homes as they age, according to the advocacy group AARP.

Implications: A booming senior population does not translate into booming furniture sales: furniture retailers are more reliant on young families setting up home or refurbishing their houses than on older consumers who may be living on more restricted incomes and may have little reason to overhaul their home interiors.

However, the aging-in-place trend suggests a niche for furniture that can cater to older consumers’ demands for independent living. Perhaps the most obvious examples are adjustable beds and motorized reclining chairs for less-mobile people. But more able seniors may want to make minor adjustments without making their house feel like a nursing home. These seniors may opt for simple changes such as replacing soft sofas with firmer, higher seating and arm rests that enable easier movement, or replacing low coffee tables with substitutes that are more easily reached. We expect to see more mainstream retailers offer ranges that are subtly adjusted to, and marketed at, the demands of seniors.

4. Cash-Strapped Millennials Are Forming Households

Millennials are set to shrink as a proportion of the US population—from 28.7% in 2015 to 27.2% in 2020, according to our analysis of US Census Bureau data. However, their importance lies in the growth in their earnings and spending power.

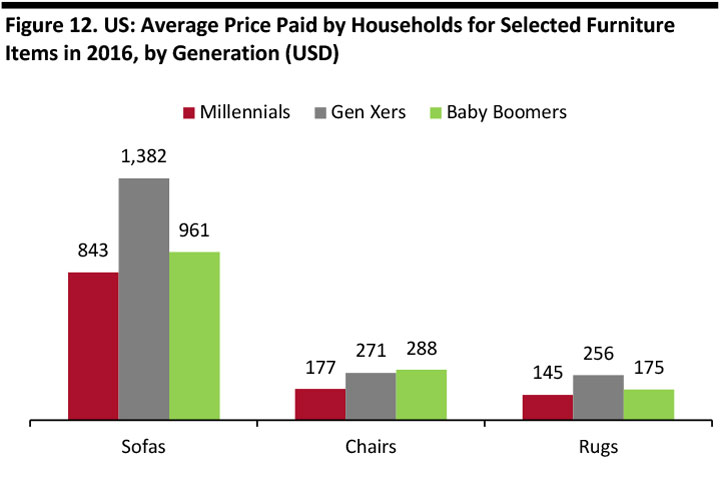

We define millennials as those born between 1980 and 2000. This means the youngest are starting to enter the workforce and the oldest are climbing career ladders, building families and establishing households. Their spending—and demand for furniture—is, therefore, increasing. We note two characteristics of millennials: 1) they tend to spend less on furniture; and 2) they have a tendency to shop online.

Millennials currently tend to spend less than older generations on furniture: Indeed, as our previous reports have discussed, millennials tend to be more frugal when shopping for groceries and beauty products, too. In part, this demand for value is because these consumers have not yet reached their peak earnings potential. However, we think this frugality is partly a cohort effect, too: less favorable work compensation, higher student debt and an apparent preference to spend on experiences will likely continue to impact millennials’ retail spending.

[caption id="attachment_84956" align="aligncenter" width="720"]

Source: US Census Bureau[/caption]

Implications: Smaller homes and smaller households suggest greater demand for more compact and multifunctional furniture, as well as products offering storage solutions.

IKEA has recognized this trend for a number of years and has successfully launched multiple collections and marketing campaigns. IKEA’s latest initiative, in June 2017, was to collaborate with NASA: a team from the retailer spent three days at a spacecraft training center in Utah to understand how innovations can make living in confined spaces easier and more enjoyable.

3. Older Consumers Want to Age in Place

Not only is the US population aging, but more seniors want to “age in place”—in other words, to live independently in their own home, rather than in institutions devoted to care. The US Centers for Disease Control and Prevention (CDC) define aging in place as “the ability to live in one’s own home and community safely, independently and comfortably, regardless of age, income or ability level.” Over 90% of seniors aged 65 and above prefer to stay in their homes as they age, according to the advocacy group AARP.

Implications: A booming senior population does not translate into booming furniture sales: furniture retailers are more reliant on young families setting up home or refurbishing their houses than on older consumers who may be living on more restricted incomes and may have little reason to overhaul their home interiors.

However, the aging-in-place trend suggests a niche for furniture that can cater to older consumers’ demands for independent living. Perhaps the most obvious examples are adjustable beds and motorized reclining chairs for less-mobile people. But more able seniors may want to make minor adjustments without making their house feel like a nursing home. These seniors may opt for simple changes such as replacing soft sofas with firmer, higher seating and arm rests that enable easier movement, or replacing low coffee tables with substitutes that are more easily reached. We expect to see more mainstream retailers offer ranges that are subtly adjusted to, and marketed at, the demands of seniors.

4. Cash-Strapped Millennials Are Forming Households

Millennials are set to shrink as a proportion of the US population—from 28.7% in 2015 to 27.2% in 2020, according to our analysis of US Census Bureau data. However, their importance lies in the growth in their earnings and spending power.

We define millennials as those born between 1980 and 2000. This means the youngest are starting to enter the workforce and the oldest are climbing career ladders, building families and establishing households. Their spending—and demand for furniture—is, therefore, increasing. We note two characteristics of millennials: 1) they tend to spend less on furniture; and 2) they have a tendency to shop online.

Millennials currently tend to spend less than older generations on furniture: Indeed, as our previous reports have discussed, millennials tend to be more frugal when shopping for groceries and beauty products, too. In part, this demand for value is because these consumers have not yet reached their peak earnings potential. However, we think this frugality is partly a cohort effect, too: less favorable work compensation, higher student debt and an apparent preference to spend on experiences will likely continue to impact millennials’ retail spending.

[caption id="attachment_84956" align="aligncenter" width="720"] Source: Furniture Today[/caption]

Tendency to shop online: A second characteristic of millennials is their increased tendency to shop online, relative to older age groups.

Implications: The rise of millennials as furniture shoppers should boost retailers with strong value credentials, whether that is specialists such as IKEA, or nonspecialist retailers such as Target. Meanwhile, the familiarity with online shopping will provide tailwinds to Internet-only retailers whose brands or offerings resonate with this age group; Wayfair and Amazon are among the names that look well positioned to capture share. Brick-and-mortar retailers that are seeking to capture millennial market share will need to offer online and cross-channel services that match those of the best-positioned Internet pure plays.

Source: Furniture Today[/caption]

Tendency to shop online: A second characteristic of millennials is their increased tendency to shop online, relative to older age groups.

Implications: The rise of millennials as furniture shoppers should boost retailers with strong value credentials, whether that is specialists such as IKEA, or nonspecialist retailers such as Target. Meanwhile, the familiarity with online shopping will provide tailwinds to Internet-only retailers whose brands or offerings resonate with this age group; Wayfair and Amazon are among the names that look well positioned to capture share. Brick-and-mortar retailers that are seeking to capture millennial market share will need to offer online and cross-channel services that match those of the best-positioned Internet pure plays.

- See also our February 2017 report Deep Dive: Millennials and Furniture in the US and the UK—Ten Characteristics That Define the Market.

Key Takeaways

- Furniture demand has proved soft so far this year. Moreover, rises in gasoline and food prices could exert pressures on consumers in the second half of 2017. The performance of the residential property market will be crucial.

- The brick-and-mortar furniture specialists sector is, in aggregate, losing share of the furniture category, while e-commerce continues to grow.

- Longer term, established furniture players need to look past short-term fluctuations and prepare for fundamental shifts in how US consumers live their lives.