albert Chan

Introduction

In the US, e-commerce has established a major share in the biggest nonfood categories, such as electronics and apparel. Furniture and home furnishings lag in e-commerce penetration, but we see that changing.

The brick-and-mortar format continues to be the predominantly preferred format for most furniture shoppers, although they also conduct significant research online. Traditional retailers are stepping up to this competition and scaling up the own e-commerce capabilities.

Digital brands continue to vie for a larger share of market. On the one hand, they are innovating with digital solutions, such as investing in AR and VR to make shoppers more comfortable in purchasing online. On the other hand, they are also opening stores and establishing a physical presence. Both digital natives and traditional retailers are realizing that an omni-channel presence is imperative.

Specialist furniture retailers such as Wayfair are among the key players. But, Amazon’s growing interest and investment in the sector means that existing digital players need to step up and optimize their operational strategies to stay relevant.

In this report, we track what digitally native furniture and home-furnishings retailers are doing to capture a greater share of the US furniture market. This report focuses on business-to-consumer (B2C) sales and excludes business-to-business (B2B) sales.

One-Sixth of US Furniture Sales Are Online

E-commerce has gained significant market share in furniture, and this share continues to grow.

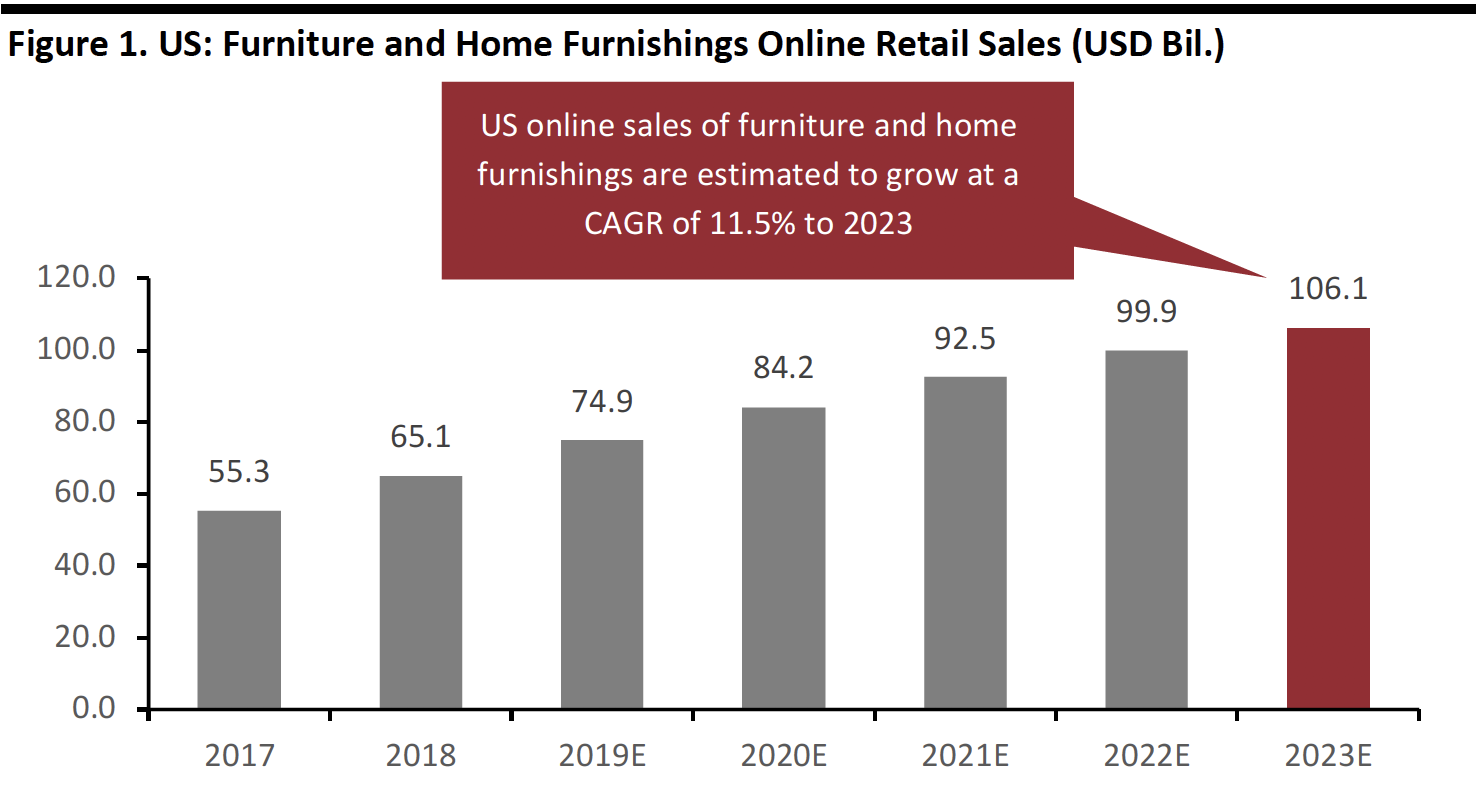

According to Statista, online furniture and home-furnishing sales totaled $65.1 billion in 2018. That compares to total consumer spending on furniture and furnishings of $211.3 billion in the same year, according to the US Bureau of Economic Analysis (although category definitions may differ between these two sources).

According to Statista estimates, online furniture and home-furnishing sales will grow at an 11.5% CAGR to reach $106.1 billion in 2023.

[caption id="attachment_98906" align="aligncenter" width="700"] Source: Statista[/caption]

Source: Statista[/caption]

E-commerce will account for 17% of US furniture and homeware sales in 2019, according to Statista estimates (note that this e-commerce penetration rate is based on a slightly different category definition that includes homewares). For comparison, and as shown in the chart below, Coresight Research expects e-commerce to account for just over 20% of all US nonfood retail sales in 2019.

The furniture and homeware category lags a number of other major nonfood categories in terms of e-commerce penetration. As we show below, this includes consumer electronics (in which 42% of sales are estimated to be online in 2019) and apparel, footwear and accessories (at an estimated 20%).

Reflecting the relative immaturity of the online furniture market, we think this category’s e-commerce penetration rate implies a long runway for growth in online furniture sales. We see the potential for close to one-quarter of US furniture and homeware sales to be online in five years (i.e., in 2024).

[caption id="attachment_98907" align="aligncenter" width="702"] *Homeware includes home accessories, home textiles, kitchen accessories, glass, ceramics, porcelain, lamps, lights and bulbs.

*Homeware includes home accessories, home textiles, kitchen accessories, glass, ceramics, porcelain, lamps, lights and bulbs.Source: Statista/Coresight Research[/caption]

Despite the rapid rise of online retail, brick-and-mortar remains the preferred format for purchasing furniture.

A September 2019 survey by Prosper Insights & Analytics found just 6.4% of US respondents said the Internet is their most-used channel for furniture purchases – making online the third-most popular channel. Some 40.9% of respondents shop most often at specialty home retailers for furniture and home furnishings and 11.7% at discount stores.

In this context, we are seeing a mix of channel trends:

- Digital-first retailers such as Wayfair are opening physical stores.

- Major e-commerce focused companies such as Amazon are expanding furniture offerings significantly.

- Traditional retailers are enhancing e-commerce capabilities.

According to Prosper’s September 2019 survey, Amazon was the fourth-most-popular option when US respondents were asked where they shop most often for furniture – at just 3.4% (albeit in a fragmented market). That put Amazon behind IKEA, Ashley Furniture and Walmart.

Digital Retailers Establish a Brick-And-Mortar Presence

Online retailers such as Wayfair and Casper are opening physical stores to augment their online business, .

In February 2019, Wayfair opened its first brick-and-mortar store in Florence, Kentucky, close to its distribution center in Erlanger, Kentucky. The store sells pieces returned in good condition, along with other discounted goods. Prior to this, the company opened two holiday pop-up shops.

In August 2019, Wayfair opened its first full-service retail store in the Natick Mall in Natick, Massachusetts. The store includes a Wayfair Home Bar, which lets shoppers digitally design a room and view it in virtual reality.

The same month, Wayfair opened four pop-up shops in the Woodfield Mall in Schaumburg, Illinois; Streets at Southpoint in Durham, North Carolina; the King of Prussia Mall in King of Prussia, Pennsylvania; and, Tysons Corner Center in Fairfax, Virginia. These pop-up stores are expected to be open for three months.

The pop up stores feature over 250 economical and eclectic décor items, according to Courtney Lawrie, Director of Brand Marketing of Wayfair. Among the merchandise on offer are wall art for living rooms, throw pillows and candles, lounge goods, seasonal kitchen goods and bed and bath essentials. The stores also allow customers to browse Wayfair’s online offerings and order items for delivery.

[caption id="attachment_98908" align="aligncenter" width="700"] Wayfair’s Natick Mall retail outlet

Wayfair’s Natick Mall retail outlet Source: Wayfair[/caption]

Direct-to-consumer mattress brand Casper is now opening stores following a positive response to its pop-up stores.

Casper opened its first brick-and-mortar store in New York in February 2018, letting customers sample the retailer’s range of products in six aesthetically designed miniature homes. The home designs change every few months and customers can buy products including mattresses, pillows and bedsheets to take home immediately or to be delivered. The company hopes the store will provide a unique ambience different from the traditional in-store mattress purchase experience.

In August 2018, the company announced plans to open 200 stores in North America, including 18 pop-up shops over a period of three years.

[caption id="attachment_98909" align="aligncenter" width="700"] One of Casper’s miniature homes in its New york store.

One of Casper’s miniature homes in its New york store. Source: Casper[/caption]

Digital-native furniture retailer Burrow has three showrooms in New York. One of these, called Burrow House, encourages guests to visit and have a coffee in the showroom or watch a movie while checking out its furniture. The retailer has also teamed up with retail stores, coffee shops and co-working spaces around the country with an endeavor to provide a “try before you buy” opportunity to prospective customers.

[caption id="attachment_98910" align="aligncenter" width="700"] Burrow House, New York

Burrow House, New York Source: Burrow[/caption]

The above examples indicate that once digital native retailers reach a certain size, expanding into physical retail becomes the next logical step to sustain growth.

Leveraging AR and VR to Enhance the Online Shopping Experience

In a product category for which customers have traditionally placed a high premium on the “touch and feel” aspect, online channels face real challenges. The advent of AR and VR is helping address this challenge by allowing customers to get a better perspective through a variety of virtual tools. Digital-first retailers are investing heavily in this area.

Wayfair’s mobile shopping app, for example, includes an AR-powered feature called “View in Room,” which lets customers place and move 3D holograms of Wayfair products in their houses to get a better idea of what the item would look like in the home.

This “try-before-you-buy” experience lends more confidence to customers and helps convert browsers to buyers.

Wayfair first invested in AR in 2016 and started offering the View in Room service on Apple’s ARKit AR platform in 2017. The retailer extended the service to Android devices in 2018.

In October 2018, Wayfair, in partnership with wearable technology start-up Magic Leap, introduced another AR-powered interior design app called Wayfair Spaces, which offers a more immersive experience. The app leverages the concept of spatial computing and blends augmented reality with virtual reality to offer an intimate home design experience. Using a VR headset, users can see a range of 3D digital rooms curated by Wayfair stylists, can furnish and decorate a computer-generated home environment with Wayfair furnishings. But the high-tech glasses needed to use the app are expensive, which may make them useful to interior decorators and other professionals but probably not the average consumer. Nevertheless, the app demonstrates the extent to which Wayfair is incorporating AR and VR into its technological repertoire.

[caption id="attachment_98911" align="aligncenter" width="700"] Wayfair Spaces: Innovation in Mixed Reality

Wayfair Spaces: Innovation in Mixed RealitySource: Wayfair tech blog[/caption]

In September 2017, Overstock announced AR in its iOS shopping app, letting shoppers see how its products would look like in their homes – and if the item will fit. Shoppers can share design images on social media or messaging apps, add items to the cart and pay with Apple Pay – all without leaving the AR screen.

In 2018, Overstock introduced the same AR functionality in its Android app, using Google’s ARCore technology, letting shoppers see high resolution holograms of products. (Although the feature works only on certain Android phones that could handle some of the complex processes).

In 2017, Amazon invested in AR and launched the “AR View” feature, which allows users to place holograms of furniture and other items the home through the Amazon app. This feature was launched on iPhone and later expanded to include certain Android phones.

In early 2019, Amazon introduced a feature called “Showroom” on its website and app that lets users place items into a virtual room.

Scaling Up Diversification in Furniture and Home: Amazon

In recent years, Amazon has scaled up its furniture and home business significantly and furnishings have become a key product category.

Findings from a Coresight Research US consumer survey undertaken January-February 2019, furniture, furnishings or decorative items for the home was the 10th-most-shopped category on Amazon, with 22.6% of respondents purchasing the category on Amazon.com in the prior 12 months. Furniture, furnishings or decorative items ranked ahead of categories such as music (including CDs, downloads and streaming) and watches and jewelry, but marginally lower than food or drink items, home-improvement and automotive products.

Private labels are supporting Amazon’s expansion into the category. In November 2017, Amazon launched its first two private label furniture brands: Rivet and Stone & Beam. These brands cater to different market segments: Rivet focuses on affordable mid-century modern living room furniture and décor targeting city-dwelling millennials, while Stone & Beam offers sturdy products that are more upscale and at comparatively higher price points. In a statement made at launch, Amazon said furniture was one of its fastest-growing retail categories.

According to 2018 Coresight Research analysis, Amazon offers around 369 items under its Rivet brand, while the Stone & Beam brand lists around 340 products. Amazon offers a wide range of products under its private-label furniture category, unlike other private label categories in which it follows a segmented strategy and offers fewer than 100 products under each brand.

In October 2018, Amazon launched its third private label furniture brand called Ravenna Home. The brand offers traditional living room furniture, upholstered headboards, lighting and barstools in more transitional styles. At the time of launch, the brand offered 60 products and as with its other furniture brands, Amazon offers free shipping and free returns within 30 days of delivery on Ravenna Home items.

Amazon’s introduction of its AR View and Showroom features are likely to support its expansion in the category.

What Challenges Do Online Retailers Face?

In their quest to capture a larger share of market, online retailers face a range of challenges. A few of these are discussed below, along with how these retailers are trying to address them.

Handling Returns

One of the biggest challenges digital furniture retailers face is returns – an expensive business, often requiring two-person teams to collect bulky items.

An example of the challenges related to product returns is provided by the “mattress-in-a-box” sector. These companies typically offer trial periods, such as Casper’s 100-night trial; however, these trials, coupled with remote selling, ramp up returns rates, which can prove disproportionately costly for a mattress company. When mattresses are delivered, they are rolled up in a box, which makes for easy and efficient fulfilment. But when they are returned, they’ve been taken out of the box, unrolled and probably placed in a bed frame – which means the mattress must be collected as a bulky item. Returned mattresses cannot be resold and, according to trade sources, are often recycled as underlay for flooring or donated to charity.

In some furniture and furnishings categories (although probably less so in mattresses), AR and VR-powered apps and services can help reduce uncertainty around buying furniture online by giving customers a better understanding of what they are purchasing, how it will look in the room and if it will fit.

We expect retailers to continue to adopt digital tools and open physical stores to help online shoppers make better informed decisions and drive down return rates.

Managing Logistics and Last-Mile Delivery

In the era of Amazon, customers are used to speedy delivery and unwilling to put up with cumbersome delivery processes. With digital retailers venturing into physical retail, the logistics challenge has increased.

Wayfair announced it would open new last-mile delivery facilities every month in 2019 to handle more supply chain logistics in house to cut cost, improve efficiency and streamline the supplier experience.

At the end of its second quarter ended June 30, 2019, Wayfair operated 39 last-mile delivery facilities in North America.

Digital-native furniture and home décor retailer Article announced the launch of an in-house delivery service called Article Delivery Team in January 2019. According to company statements, the delivery service will launch in New York and Los Angeles before expanding to other major cities.

Developing a Winning Mobile Strategy

As mobile shopping continues to grow steadily, shoppers are demanding smooth and seamless shopping experiences. In an increasingly competitive market, retailers need to effectively strategize the extent to which they need to invest in mobile apps and mobile websites.

While mobile websites offer greater audience reach and better SEO rankings, mobile apps offer a more immersive experience to shoppers through features such as push notifications, alerts and personalization. However, smart phones users tend to use certain apps frequently and delete those they use rarely. Considering furniture is bought frequently, getting shoppers to download and keep a furniture-focused app could represent a challenge.

To counter this, digital retailers are investing in digital tools to enhance the appeal and user functionality of their apps and mobile websites.

More than 50% of Wayfair’s orders are made via mobile, including app, mobile web and tablet, while around 20% of its gross revenues are generated through the app. In its first quarter ended March 31, 2019, the retailer announced plans to increase the speed of its app this year, and in the second quarter it redesigned the app to offer a more native feel.

In May 2019, Overstock partnered with immersive AR e-commerce software developer Seek to enhance the retailer’s mobile shopping experience through AR and 3D technology. The retailer’s mobile website now lets shoppers view furnishings in 360-degree detail through their smartphones.

The Road Ahead

Unlike the initial years of furniture e-commerce during which digital retailers largely competed with traditional brick-and-mortar retailers, brick and mortar retailers are investing more in digital channels, while digital native open stores.

Technology will play a key deciding role and we expect retailers to continue experimenting with new AR and VR applications both in-store and online through apps to overcome many of the challenges of online furniture shopping – and to drive down returns.

Amazon has already become a major force in the furniture and home sector and continues to scale up. While it is still comparatively early days for Amazon within the private label furniture space with only three private label furniture brands so far, we could see more from Amazon’s stable in the years to come.

With Wayfair opening its first full-fledged store earlier this year, there could be more in the pipeline in future. Amazon is also reportedly (unconfirmed by the company) considering opening furniture stores, which would represent a significant development in the sector.

Our View

The penetration rate of e-commerce in other discretionary nonfood categories suggests a long runway for growth in furniture e-commerce. Online and offline channels are likely to continue to converge, reflecting that the shopper journey is complex for big-ticket categories. One major issue furniture e-commerce retailers face is costly returns – a particular challenge for retailers without stores that can serve as showrooms. We expect online retailers to continue to adopt digital tools and open physical stores to help shoppers make better informed decisions and drive down returns rates.