DIpil Das

Coronavirus-led lockdowns, enforced closures of nonessential businesses, increased working at home and consumer reluctance to dine out mean that many US food-service outlets have been struggling to stay in business. As a result, many chains are closing locations permanently.

As we have discussed previously, Coresight Research estimates that there will be between 20,000 and 25,000 retail store closures this year. Our estimates do not include food-service outlets, meaning that the broader picture for landlords, mall owners and REITs could be worse than our estimates.

In this report, we supplement our previous coverage of retail store closures by noting recent developments in food-service closures, which further point to meaningful occupancy challenges in commercial real estate.

Declining Traffic Drives Closures

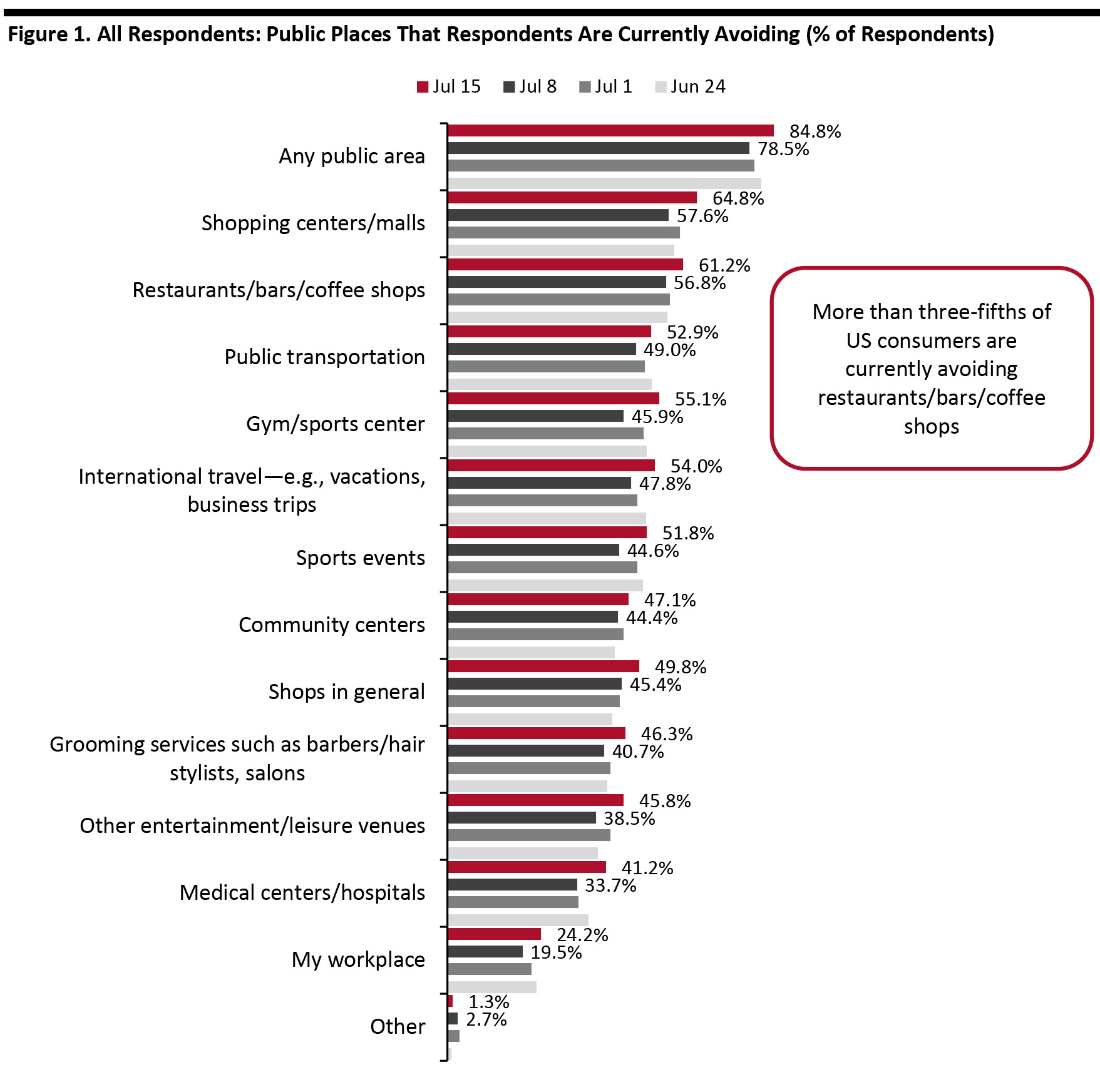

Our latest weekly US consumer survey, undertaken on July 15, includes insights into current consumer avoidance behavior for different types of public places. The proportion of respondents who said they are avoiding food-service locations such as restaurants, bars and coffee shops came in at 61.2%, versus 56.8% the prior week. This option was second only to shopping centers and malls in terms of specific public places (see Figure 1).

The data indicates that traffic in food-service locations, many of which are located in shopping centers and malls, continues to be low. With revenues therefore still being impacted by the pandemic, we could see more closures in the weeks to come—in addition to those we outline later in this report—as businesses struggle to be profitable.

[caption id="attachment_113157" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

Source: Coresight Research [/caption]

Food-Service Closures: Some Key Chains That Have Announced Closures

Various restaurants and food-service chains have announced closures in recent months. Unlike our retail store-closure data sets, this is not a comprehensive list of closures.Figure 2. Food Service: Selected Chains That Have Announced Closures since April 2020 [wpdatatable id=329 table_view=regular]

Source: Company reports/Coresight Research Feast American Diners, a franchisee operator of popular full-service restaurant chain Denny’s, announced in May that it will permanently shut down 15 outlets in New York and lay off 524 staff. The company attributed the closures to “unforeseeable business circumstances prompted by Covid-19.” FoodFirst Global Restaurants, the Orlando-based parent company of Brio Tuscan Grille and Bravo Cucine, announced in April that it has filed for Chapter 11 bankruptcy protection and that it will close around 71 of its 92 locations. Most of the locations that are earmarked for closure had already been closed since March 20. Rubio’s Coastal Grill, a Mexican fast-casual restaurant chain, announced in June that it will close 12 outlets, six each in Colorado and Florida, out of its total fleet of 170 locations. Starbucks announced in June that it plans to shutter up to 400 company-operated stores in Canada and the US over 18 months, while simultaneously pivoting to carryout and pickup-only locations: The company plans to open around 300 new stores in North America that will focus on carryout and pickup options. This shift in strategy exemplifies the change in consumer behavior during the pandemic. TGI Fridays announced in late May that it plans to close 10–20% of its total fleet of 380 outlets, which would imply anywhere between 38 and 76 outlets. However, by early June, the company had reopened 311 outlets. Other food-service chains that have closed locations include IHOP, Specialty’s Café & Bakery and Steak ’n Shake. Aside from closures, a number of restaurants, food-service chains and franchisees have recently filed for Chapter 11 bankruptcy, including BarFly Ventures (parent of HopCat brewpub chain), CEC Entertainment (parent company of Chuck E. Cheese and Peter Piper Pizza), Fig & Olive, Le Pain Quotidien, NPC International (largest US franchisee of Yum Brands’ Pizza Hut), Sustainable Restaurant Holdings (parent of seafood chains Bamboo Sushi and QuickFish), TooJay’s and Vapiano. Buffet-centric restaurant chain Garden Fresh Corp filed for Chapter 7 bankruptcy in May.

Figure 3. Food Service: Selected Chains That Have Filed for Bankruptcy since April 2020 [wpdatatable id=330 table_view=regular]

Source: Company reports/Coresight Research