albert Chan

Introduction

What’s the Story?

Supported by the shift from fragmented store-based distribution to online platforms, resale is set to continue gaining share of total fashion sales. Resale constitutes buying and selling previously owned goods, which may be new, but are more often gently used. In this report, we provide an overview of the US fashion resale market, including categories such as apparel, footwear, accessories, jewelry and watches.

We cover six resale models that represent the majority of resale businesses today: consignment-based resale, e-commerce native resale, non-consignment-based resale, resale programs launched by retailers and brands, social commerce-based resale and offline-based thrift stores.

Why It Matters

Resale is becoming increasingly mainstream as consumers seek out value options, both in terms of price and sustainability. According to Coresight Research’s survey from August 2020, US consumers have become more focused on sustainability following the Covid-19 crisis. Some 29.0% of respondents said that the pandemic had made environmental sustainability more of a factor in their shopping choices, which indicates demand opportunities for the resale market in the near future. A number of digitally native resale companies have emerged to make the process easier for buyers and sellers, and we are seeing more brands and retailers jump onto the bandwagon to launch resale services.

The US Fashion Resale Market: Coresight Research Analysis

Market Size

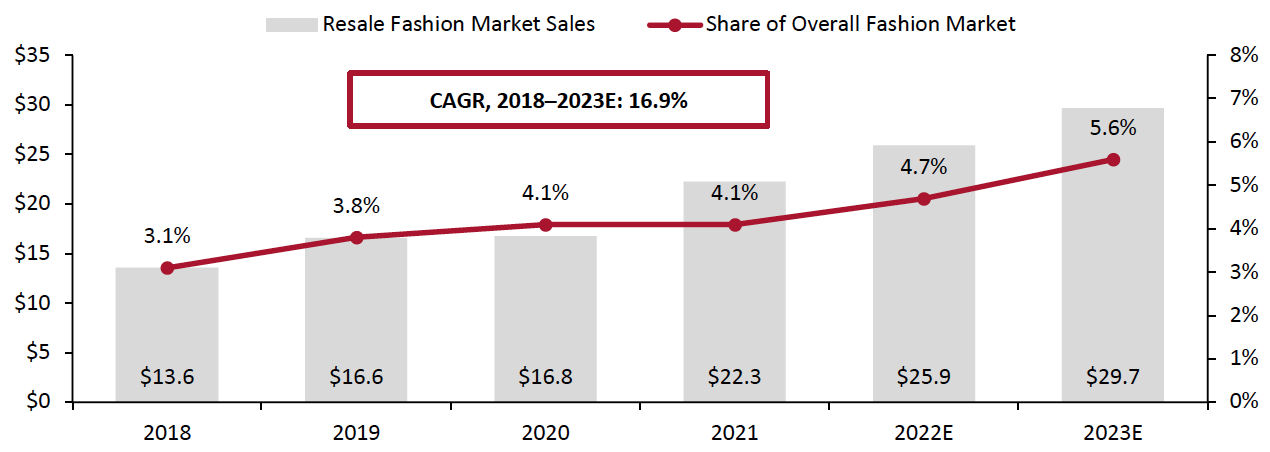

US fashion resale has evolved from a single-billion-dollar market in 2008 to a $22.3 billion market in 2021, Coresight Research estimates. We expect the market to grow to $25.9 billion in 2022, capturing a 4.7% share of the total US fashion market, as shown in Figure 1.

Figure 1. The US Fashion Resale Market (Left Axis; USD Bil.) and Share of Total Fashion Market (Right Axis; %)

[caption id="attachment_142248" align="aligncenter" width="700"] Excluding sales taxes

Excluding sales taxesSource: US Census Bureau/Coresight Research[/caption]

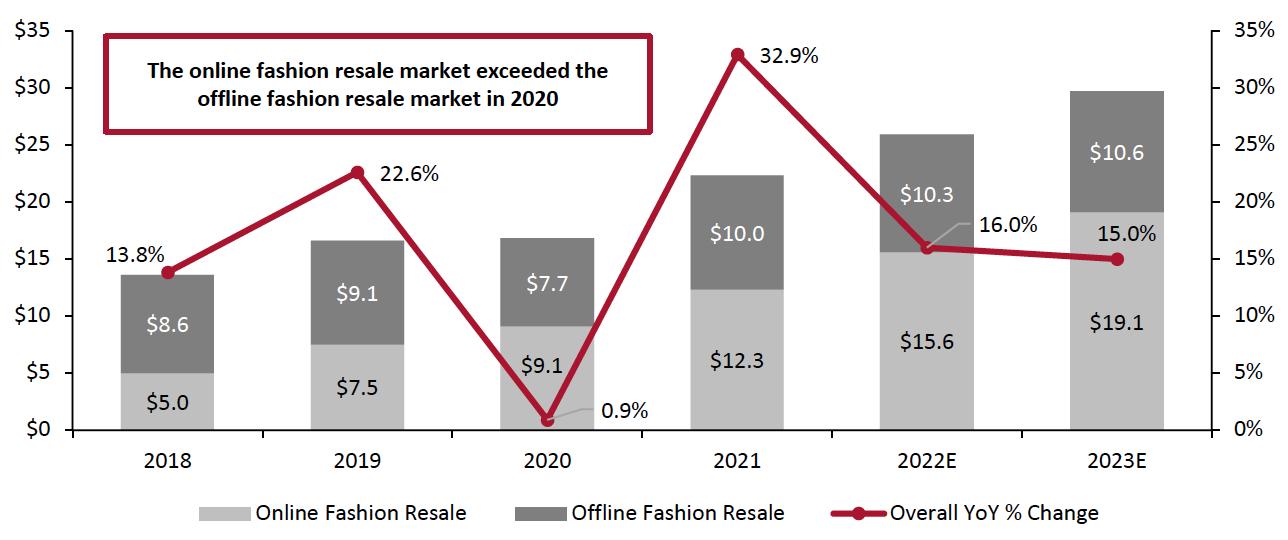

The fashion resale model showed its resilience in 2020 amid the severe impacts of the Covid-19 crisis. We calculate that while the overall fashion market declined by 7.4% in 2020, the fashion resale market grew 0.9%. By distribution channel, the online fashion resale market exceeded the offline fashion resale market in 2020, reflecting consumers’ pandemic-driven online shopping habits. Retailers such as Depop reported 100% growth in GMV; StockX reported a record $1.8 billion in GMV; Poshmark reported 29% growth in GMV; and The RealReal reported 0.7% growth in GMV.

In 2021, the brick-and-mortar channel saw sales grow 29.9% to $10.0 billion, Coresight Research estimates from US Census Bureau data, as consumers returned to stores amid easing Covid-19 restrictions.

In total, we estimate that the US fashion resale market saw a huge, 32.9% year-over-year increase in 2021, with many consumers refreshing their wardrobes as they returned to more normalized ways of living. We expect the market to continue its momentum in 2022 and 2023, with year-over-year growth of 16% and 15%, respectively (see Figure 2).

Figure 2. The US Fashion Resale Market: Sales by Distribution Channel (Left Axis; USD Bil.) and YoY Growth (Right Axis; %)

[caption id="attachment_142249" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

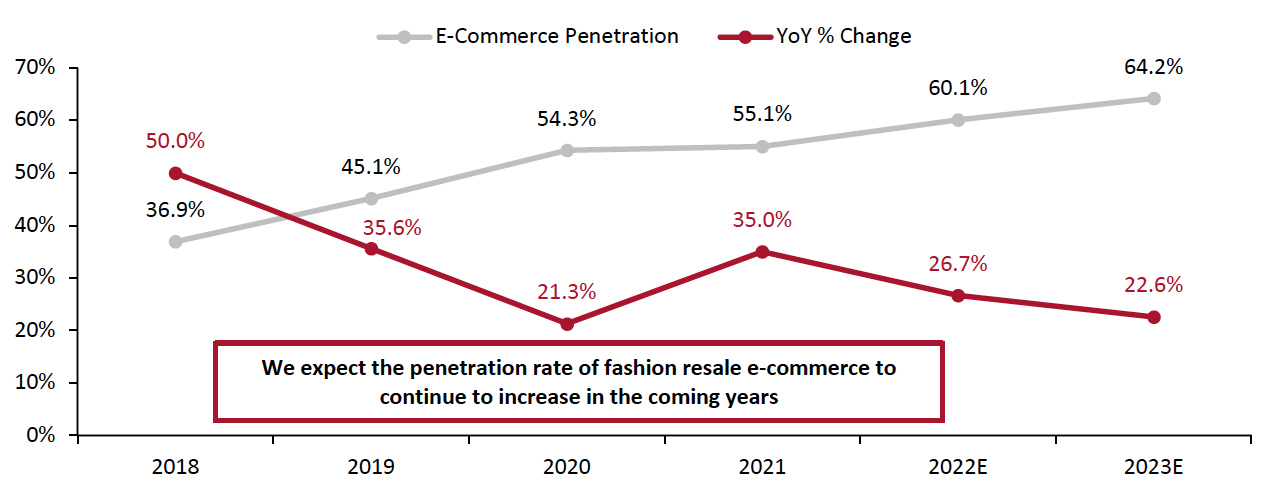

Focusing on e-commerce, Coresight Research estimates that the US online fashion resale market grew 35.0% to $12.3 billion in 2021—representing a CAGR of 36.2% between 2017 and 2021—and will continue to grow in 2022 and 2023, with platforms such as The RealReal, Poshmark, StockX and ThredUP all showing organic sales growth and user number growth momentum.

Coresight Research estimates that the US online fashion resale market grew to account for 55.1% of overall fashion resale sales in 2021, up from 36.9% in 2018. We expect the penetration rate of fashion resale e-commerce to continue to increase in the coming years (see Figure 3).

Figure 3. US Fashion Resale: E-Commerce Penetration (Online Sales as a % of Total Sales) and Online Sales YoY Growth (%)

[caption id="attachment_142250" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Market Factors

Consumer Demand for Fashion Resale

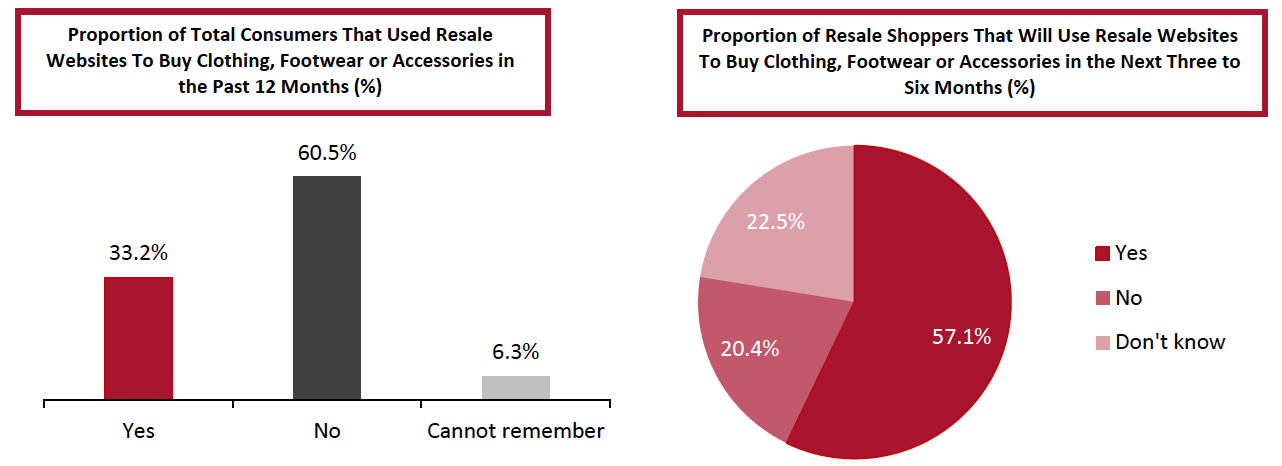

We are seeing signs of growing consumer demand for fashion resale. According to a Coresight Research survey of US consumers conducted in November 2021, one-third (33.2%) of consumers said they used resale websites to buy clothing, footwear or accessories in the past 12 months. Among those consumers that had done so, 57.1% said they planned to use resale websites to buy clothing, footwear or accessories in the next three to six months; however, one-fifth expect to drop out of resale purchasing in that period. In the long term, we believe that the resale trend will grow alongside consumers’ increasing awareness of sustainability and demand for pre-owned luxury.

Figure 4. US Consumers’ Use of, and Plans To Use, Resale Websites To Buy Clothing, Footwear or Accessories, November 2021 (% of Respondents)

[caption id="attachment_142251" align="aligncenter" width="700"] Base: 443 US respondents aged 18+ (left) and 147 respondents aged 18+ that purchased from resale websites in the past 12 months (right)

Base: 443 US respondents aged 18+ (left) and 147 respondents aged 18+ that purchased from resale websites in the past 12 months (right)Source: Coresight Research[/caption]

Consumers’ Growing Sustainability Awareness

About three in 10 US consumers report that the Covid-19 crisis has made environmental sustainability more of a factor for them when shopping, more than double the proportion of respondents that said sustainability is now less of a factor for them, according to Coresight Research’s July 26, 2021, survey from our US Consumer Tracker series. Consumer emphasis on the importance of sustainability will help the fashion resale market, because more and more consumers will consider buying secondhand clothes, bags and accessories to avoid the overall resource waste in the fashion market and extend the lifecycles of fashion products.

- Read more Coresight Research insights into sustainability in retail.

The Continuation of Hype in Sneaker Culture

The sports footwear market is being buoyed by “sneaker culture” across segments, from mass market to luxury. The sneaker trend is one of the most visible manifestations of fashion in footwear. We have seen a proliferation of sneakers sold at regular prices by brands such as Adidas, Louis Vuitton and Nike, which are then valued much higher on resale platforms such as StockX. According to StockX, an online apparel and footwear reseller, the top three most popular footwear brands in 2021 were Jordan (an average of 60% price premium), NIKE (57%) and Adidas (44%). We expect sneaker mania to continue, making the price premiums likely to stay high and driving the fashion resale market.

Consumers’ Accelerated Demand for Pre-Owned LuxuryConsumers have more discretionary spending power, fueled by the stimulus payment issued by the US government and the accumulation of savings during the pandemic. We are seeing more aspirational consumers who are interesting in buying luxury goods. Among them, many consumers choose to buy pre-owned luxury goods, because secondhand luxury is more affordable than purchasing new goods.

Consumer’s accelerated demand for pre-owned luxury goods will power the total fashion resale market. A Vogue Business survey of US luxury consumers conducted from July to August 202 showed that 69% of luxury shoppers bought pre-owned luxury and 56% of luxury shoppers sold pre-owned luxury in the last 12 months ending July 2021. The survey also revealed that 55% of luxury shoppers will shop more for pre-owned luxury as Covid-19 subsides.

Proliferation and Expansion of Resale Platforms

We are seeing a growing number of resale platforms in the US, which drives the total fashion resale market from the supply side. The proliferation and expansion of resale platforms is making it much easier and more appealing for consumers to shop for secondhand fashion items, in part by raising the standards and perceptions of resale.

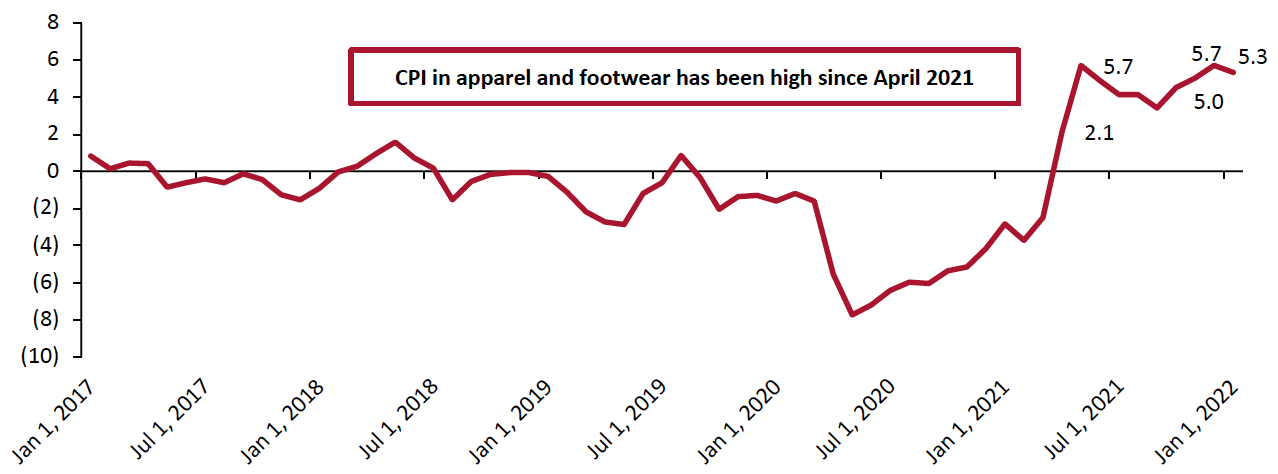

Inflation

We see inflation as an important factor in the US fashion resale market. US inflation rate in the apparel and footwear sector rose 5.3% in January 2022 compared to the same month in 2020, according to the Bureau of Labor Statistics. Raised prices will support the size of the US fashion resale market.

Figure 5. Consumer Price Index in Apparel and Footwear for All Urban Consumers, YoY Changes (%, Seasonally Adjusted) [caption id="attachment_142252" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

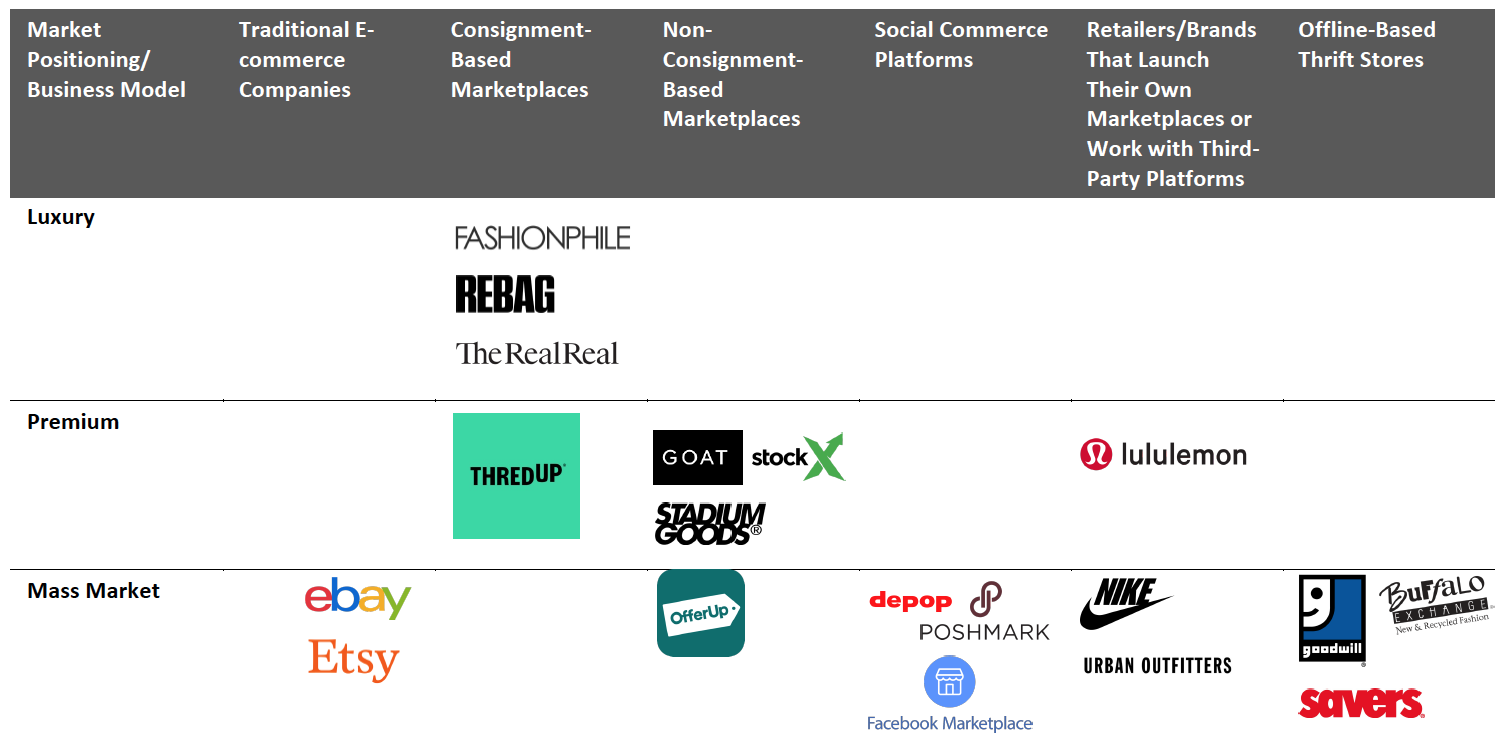

Competitive Landscape

The US fashion resale market is fragmented. The market comprises a range of players, from traditional e-commerce companies such as eBay, to relatively new consignment-based marketplaces such as ThredUP and The RealReal, to social commerce platforms such as Facebook Marketplace and Poshmark, and retailers such as NIKE. In addition, offline-based fashion resale players, mostly thrift stores such as Buffalo Exchange, continue to operate in the market.

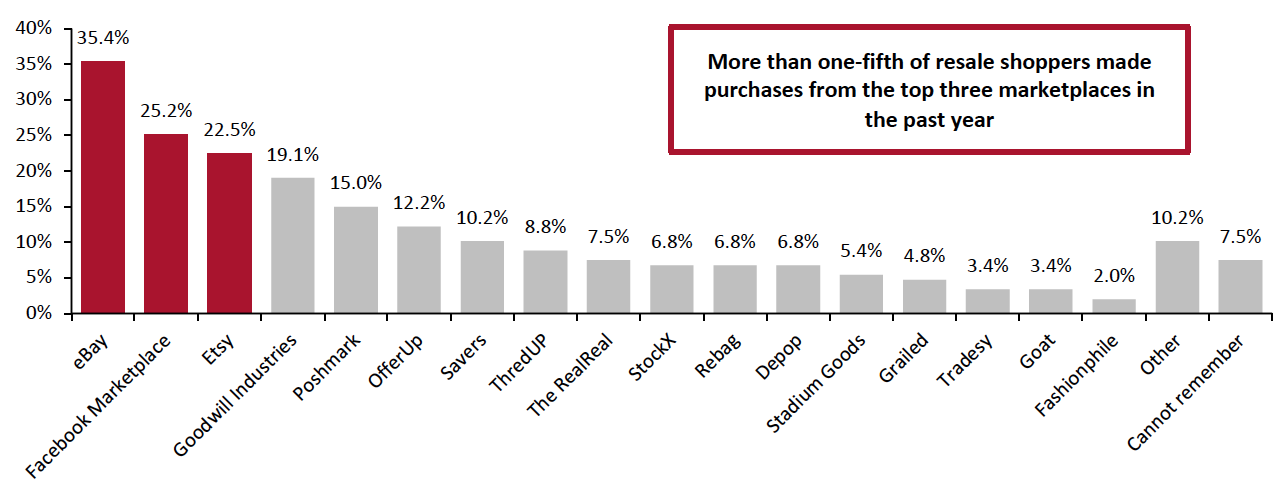

According to Coresight Research’s November 2021 survey, eBay, Facebook Marketplace and Etsy were the top three resale marketplaces consumers shopped from in the past 12 months.

Figure 6. Online Resale Shoppers: Resale Platforms Used in the Past 12 Months, November 2021 (% of Respondents)

[caption id="attachment_142253" align="aligncenter" width="700"] Base: 147 US respondents aged 18+ that purchased from resale websites in the past 12 months

Base: 147 US respondents aged 18+ that purchased from resale websites in the past 12 monthsSource: Coresight Research[/caption]

We present the major players in the US fashion resale market in Figure 7 and discuss each in detail in the following sections.

Figure 7. Selected Players in the US Fashion Resale Market

[caption id="attachment_142254" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Traditional E-Commerce Companies

Etsy and eBay are the two largest players among traditional e-commerce companies in the fashion resale market. (Amazon does not offer secondhand fashion products.)

Figure 8. Selected Traditional E-Commerce Companies in the Fashion Resale Market

[wpdatatable id=1759]Source: Company reports

Consignment-Based Marketplaces

The consignment model is an arrangement in which secondhand goods are left in the possession of an authorized third party to price and sell.

Figure 9. Selected Consignment-Based Marketplaces in the Fashion Resale Market

[wpdatatable id=1760]Source: Company reports

Non-Consignment-Based Marketplaces

The non-consignment model is an arrangement in which secondhand goods are priced and sold directly by sellers.

Figure 10. Selected Consignment-Based Marketplaces in the Fashion Resale Market

[wpdatatable id=1762]Source: Company reports

Social Commerce Platforms

Social commerce resale mainly relates to secondhand product purchases through social media.

Figure 11. Selected Social Commerce Platforms in the Fashion Resale Market

[wpdatatable id=1763]Source: Company reports

Brands/Retailers

Brands and retailers are entering the fashion resale market in recent years, either working with third-party marketplaces such as ThredUP or launching their own resale programs or marketplaces.

Figure 12. Selected Retailers and Brands that Launched Their Own Resale Programs in the Fashion Resale Market

[wpdatatable id=1764]Source: Company reports

Offline-Based Thrift Stores

Offline-based thrift stores typically sell offline and often have charitable purposes or offer other community services. Offline-based thrift stores are also expanding their online presence to increase sales.

Figure 13. Selected Offline-Based Thrift Stores in the Fashion Resale Market

[wpdatatable id=1765]Source: Company reports

Themes We Are Watching

Digital Business Innovation To Drive Customer Engagement

Retailers or platforms in the fashion resale space are innovating digital businesses to stand out in the increasingly competitive landscape. We describe two key aspects of innovation, with examples, below.

- Offering Customers Style Inspirations Increases Engagement and Improves Sales

ThredUP launched Thrift the Look in 2021, which leverages algorithms and the data science capabilities the company has built through its Goody Box offering (curated style boxes discontinued in October 2021). Thrift the Look makes it easy for customers to create favorite outfits with secondhand styles across ThredUP’s vast assortment. Goody Boxes were proving difficult to scale efficiently as they consumed outsized labor in the company’s distribution centers, according to ThredUP, but the company found Goody Box's one-to-one styling service highly useful and valuable to consumers. The company launched Thrift the Look to deepen engagement with customers and improve sales.

- Launching Collaborations Increases Consumer Excitement

The RealReal unveiled a partnership with Gucci in November 2020. It rolled out an e-commerce store showcasing pre-owned Gucci products to foster circularity for high-end fashion. In April 2021, The RealReal launched a new collection ReCollection in partnership with a group of luxury brands such as Balenciaga, Dries Van Noten, Jacquemus, Simone Rocha, Stella McCartney, Ulla Johnson and Zero + Maria Cornejo.

Cross-brand collaborations are still growing as a way to propel consumer engagement and increase brand awareness in the overall apparel and footwear market. In the increasingly digital resale world, we see a promising future in online collaboration between brands and between brands and celebrities.

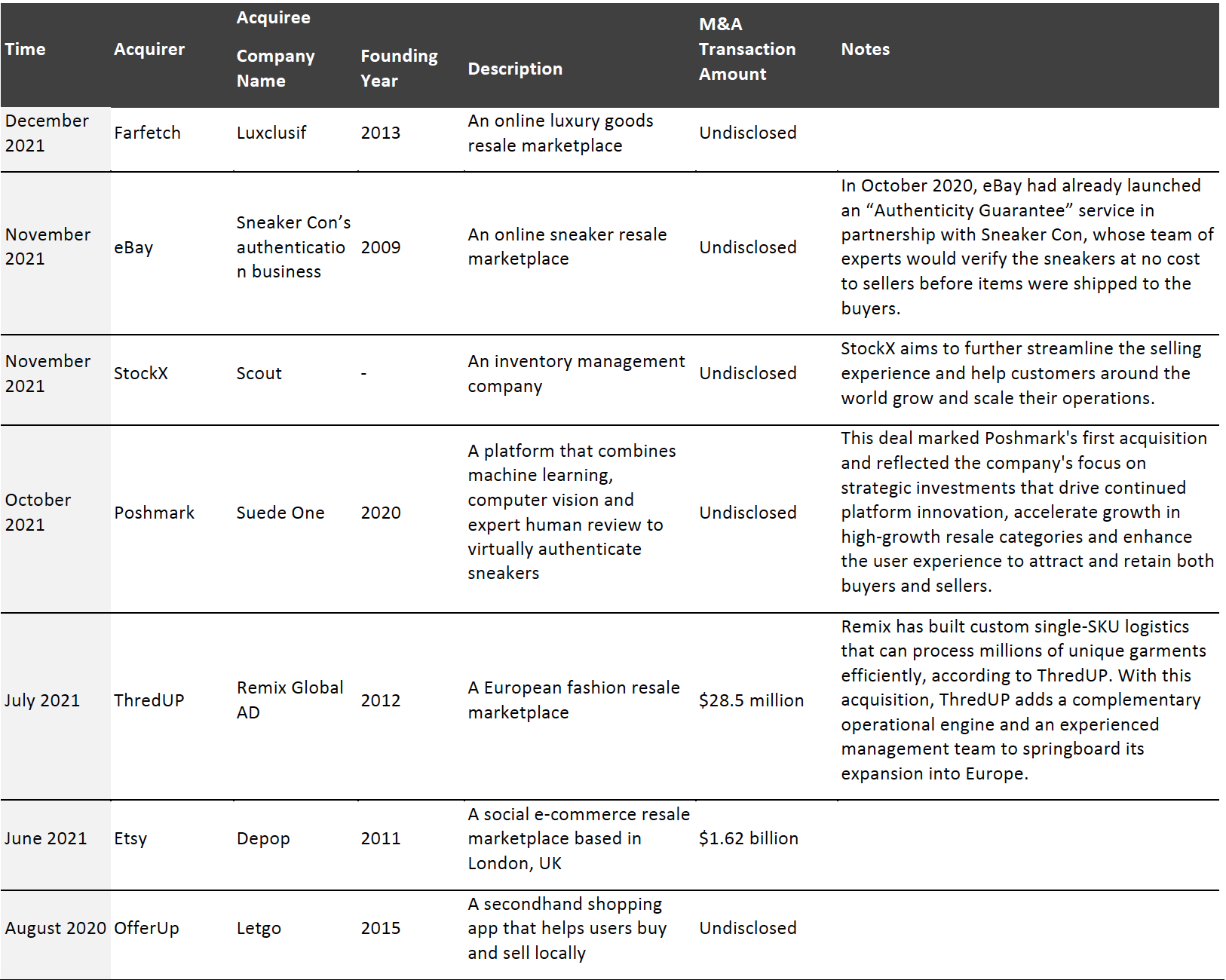

M&A

The increased consumer interest in the fashion resale market, along with retailers’ visions to expand business reach and operational efficiency, has prompted many retailers in the resale space to reevaluate their capabilities and overall portfolio in the long-term. This has led to a wave of M&A activity.

We summarize M&A activity in the fashion resale space over the past 24 months in Figure 14.

Figure 14. Selected M&A Activity in the Fashion Resale Market for the Past 24 Months

[caption id="attachment_142270" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Some platforms choose to invest in resale platforms instead of buying them. For instance, in October 2021, ThredUP announced a strategic investment in Vopero, a resale marketplace serving Latin America. Vopero has focused on creating a resale engine that can inspect, tag, photograph and distribute thousands of high-quality unique SKUs with high efficiency, providing a differentiated buyer and seller experience. Vopero has onboarded more than 3,000 independent sellers and retail stores on the platform and achieved a 70% repeat customer rate, while processing more than 80,000 secondhand products since it was established.

Physical Store Innovation

We are seeing online fashion resale retailers and brands leveraging the benefit of omnichannel and open physical stores or pop-up stores to attract customers.

For example, Mercari, an online marketplace for buying and selling secondhand items, launched its first experiential pop-up shop in San Francisco on December 29, 2021. The shop allowed customers to buy and sell products ranging from apparel to household goods. Customers selling items can receive up to $100 per day.

In September 2021, ThredUP and Madewell launch a Brooklyn pop-up shop that is stocked with secondhand clothes. In addition to shopping, visitors can bring their own clothes to be expertly repaired on-site. The store also offers clothes purchased to be tailored onsite for the perfect fit.

Brick-and-mortar has been an important business driver for The RealReal, according to the company’s presentation at the 2nd Annual New Retail Ecosystem CEO Summit: Innovation and Digitalization in May 2021. Management mentioned that the company’s 10 physical stores have been one of the main engines of discovery, with more than 30% of new consignors in the second quarter of fiscal year 2021 being introduced to The RealReal through a physical location. Management also mentioned that the next focus will be letting the existing stores mature as well as expanding the number of new stores.

Although the pandemic has had a severe impact on physical retail, we expect online fashion resale businesses to continue to value physical stores and to adjust their strategies to better combine online and in-store retail.

[caption id="attachment_142265" align="aligncenter" width="450"] Source: Madewell[/caption]

Source: Madewell[/caption]

The Impact of Added Resale Business on Company Profit Margins

Most fashion brands, marketplaces and retailers launch resale businesses with aims to stay relevant with the growing sustainability trend and attract new customers. Over 60% of brands and retailers partner with third-party resale marketplaces such as ThredUP to enter the fashion resale market, while over 20% of brands and retailers choose to build their own marketplaces from scratch, Coresight Research estimates. Fewer than 10% of brands and retailers choose to acquire another resale business as the starting point of entering the market.

Overall, the majority of brands and retailers are still experimenting with the resale model to see its impact on company’s overall profit margin, operational costs and customer loyalty. Macy’s management told Forbes that when it worked with ThredUP in 2019 to convert a 500-square-foot shop in one of its stores into a resale shop that the shop has had no discernable impact on Macy’s backstage discount sales in that location. Rather, the shops were attracting new customers, especially younger consumers. Macy’s is currently extending its pilot to more stores, which may indicate that the resale model is benefiting Macy’s business. However, we expect the impact of resale business on profit margin is still minimal. We continue to monitor brand and retailer reporting on the impact of resale business on their profit margins.

We believe that those that bring the resale business in house will likely achieve better profit margins than brands and retailers that work with third-party marketplaces because of lower operational costs and more branding effect. NIKE Refurbished, for example, extends the life of eligible products by taking like-new, gently worn and slightly imperfect shoes for resale and typically prices those shoes 50%–70% of their original prices (without giving customers any incentives or money returns). NIKE is able to bring those shoes back into the market with lower costs. Reselling luxury goods could lift a brand’s profit margin by 40% in 2030, according to Bain & Company.

Retail Innovators

Trove

Founded in 2012 and headquartered in San Francisco Bay Area, US, Trove is a technology company that enables end-to-end operations to power resale selling for premium and luxury brands. Trove has assisted a number of brands such as Arc’teryx, Cotopaxi, Eileen Fisher, Levi’s, Lululemon, NEMO and Patagonia launch their resale programs by helping brands manage items (including item identification, cleaning, repairs, photography), identify product conditions (including item authentication and condition grading), price products and ship items. Trove is at its Series D stage and the total funding amount as of November 2021 is $122.5 million.

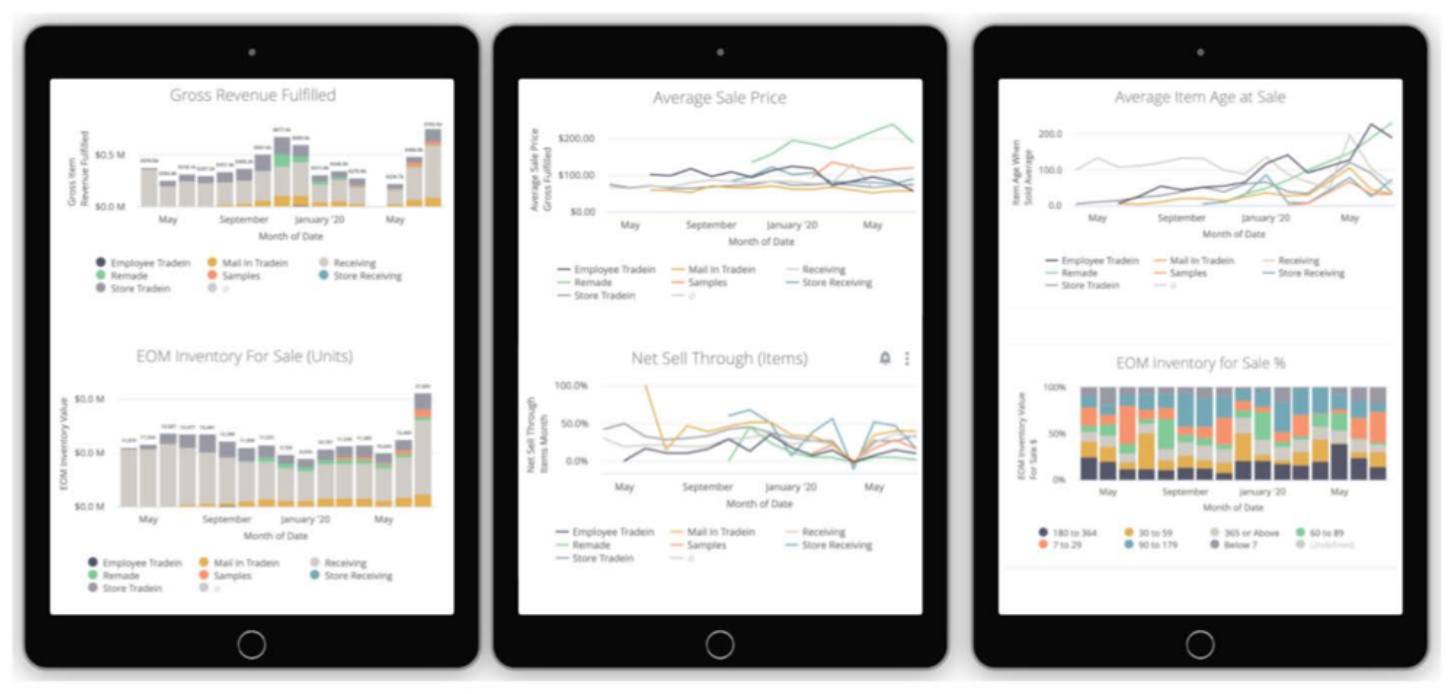

Three factors make Trove innovative. First, the company features an omni-channel supply generating technology, which allows brands to offer consumers the choices of trading in products in stores or online. Second, the company allows end-to-end, scalable single-SKU operations, meaning that the company acts as a third-party partner and helps brands take all necessary procedures to complete resale, including visual inspection, condition grading, authentication, cleaning, repair, order fulfillment, branded packaging, customer service and returns. Third, Trove features comprehensive analytics and business insights, which can help brands understand consumer trends and sales performance. As more and more fashion brands jump onto the bandwagon and launch resale programs, we expect Trove to play a vital role in helping brands realize better operational efficiency in the next few years.

[caption id="attachment_142266" align="aligncenter" width="700"] Trove’s real-time business analytics dashboards that allow brands to understand their sales performance and consumer preferences

Trove’s real-time business analytics dashboards that allow brands to understand their sales performance and consumer preferencesSource: Trove[/caption]

Whatnot

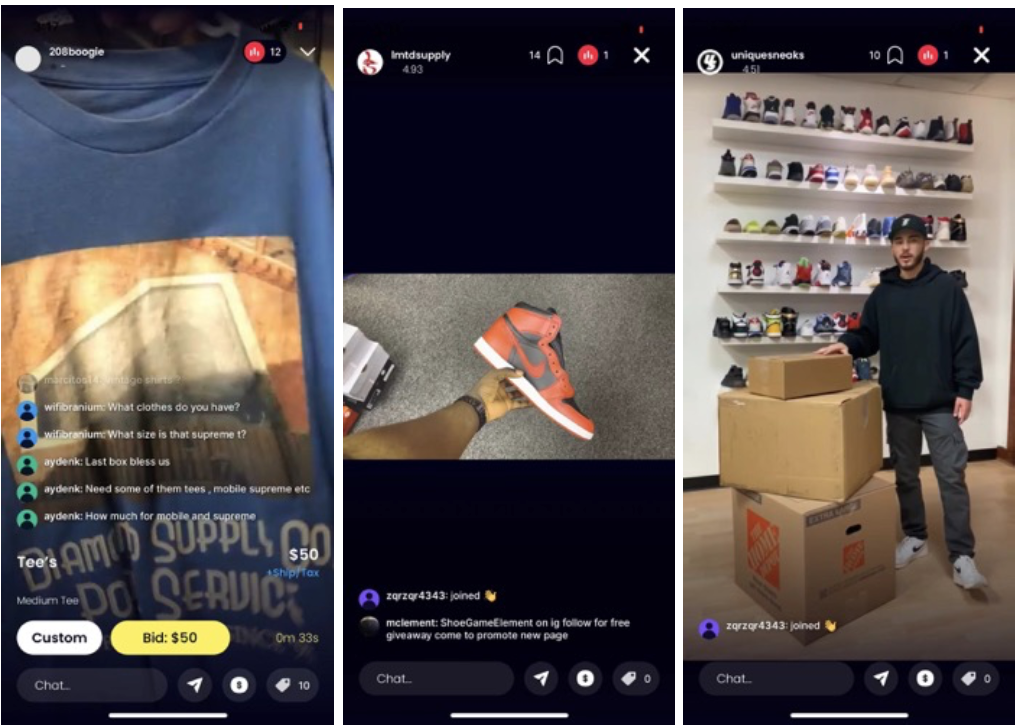

Founded in 2019 and based in Los Angeles, US, Whatnot is a livestream platform and marketplace that enables consumers to connect, buy and sell products with a focus on sneakers, streetwear, toys and games. Sellers typically hold livestreams to introduce their products, which have been verified by the platform, and attract buyers. The company is at its Series C stage and the total funding amount as of November 2021 is $224.7 million.

Livestreaming is taking off in the US and is a powerful way for sellers to engage with consumers. According to Coresight Research’s proprietary research, approximately two-thirds of US livestream consumers make their purchases after the livestream has finished. Coresight Research survey findings from March 2021 indicate that 31.5% of US consumers have watched a shoppable livestream, indicating a huge opportunity in the online live-shopping space. Therefore, we believe Whatnot will continue to grow in the next few years, fueled by its innovative business model and the overall growing livestreaming e-commerce space.

[caption id="attachment_142267" align="aligncenter" width="450"] Screenshots of livestreaming sessions on Whatnot

Screenshots of livestreaming sessions on WhatnotSource: Whatnot[/caption]

Grailed

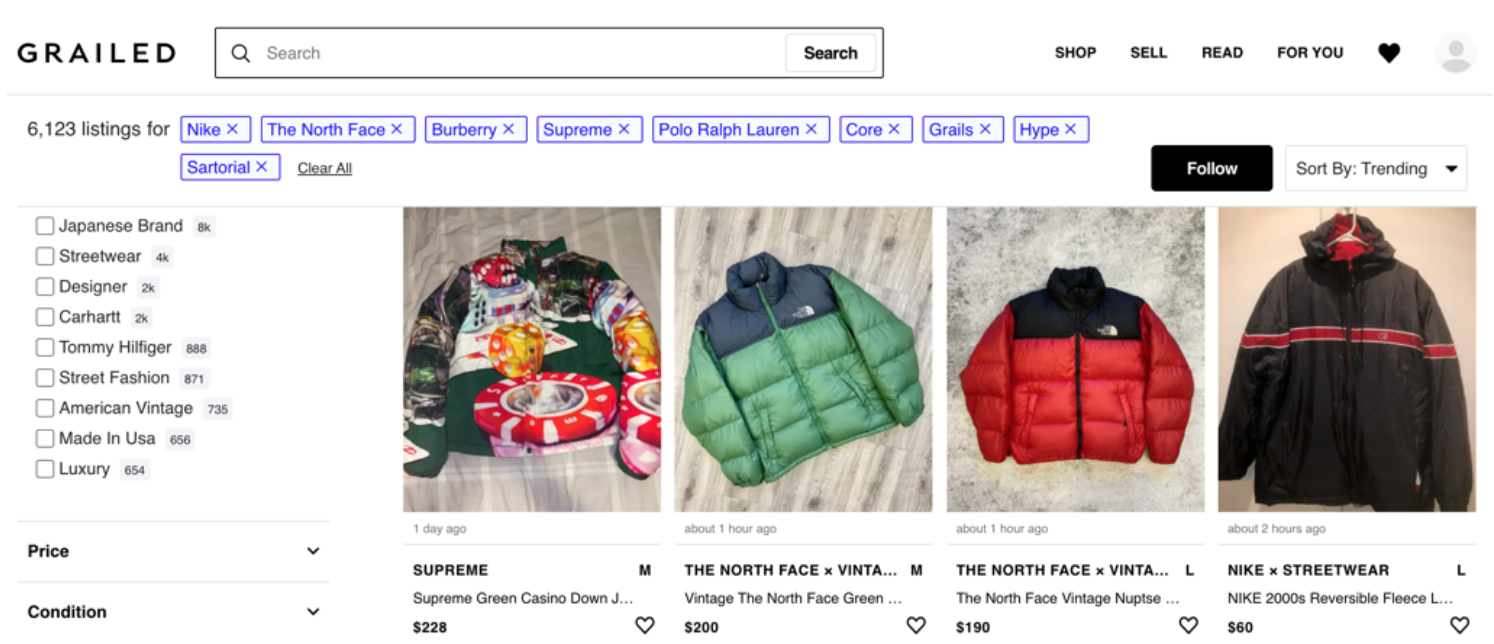

In contrast to most resale marketplaces that focus more on women’s clothing, Grailed is a non-consignment-based, curated resale marketplace for men’s clothing. The company was founded in 2013 and is headquartered in New York, US. As of November 2021, the total funding amount raised by the company is $76.5 million, and the company is at its Series B stage.

The US men's and boys' clothing market reached $125 billion in 2021, according to Bureau of Economic Analysis, and we expect it to grow by a flat-to-low-single-digit percentage rate in 2022, offering opportunities for resale sites such as Grailed.

[caption id="attachment_142268" align="aligncenter" width="700"] A screenshot of Grailed’s product page

A screenshot of Grailed’s product pageSource: Grailed[/caption]

What We Think

Implications for Brands/Retailers

· The US fashion resale market grew in 2021 and we expect it to see continued growth in 2022 and 2023, powered by consumers’ demand for sustainability and affordability. To capitalize on this growing trend, improve the utilization of materials and fabrics, and turnover outdated or extra inventories efficiently, we see opportunities for brands and retailers to launch resale services or work with resale platforms.

Implications for Technology Vendors

· We recommend that technology vendors focus on enabling resale platforms to run smoothly in operations, logistics and merchandising. For example, in terms of logistics, automation technology will allow authentication teams to process more products, while also improving overall quality control procedures.

· The opportunities for technology vendors to serve individual brands’ and retailers’ own resale marketplaces is currently somewhat limited, but can be increased: Coresight Research estimates that over 60% of brands and retailers partner with third-party resale marketplaces to enter the fashion resale market, while over 20% choose to build their own marketplaces from scratch. Technology firms can help brands and retailers migrate resale to their own sites.

Implications for Resale Retailers/Platforms

· It is important for resale platforms to consider innovations to improve buyer retention and stay competitive while some brands and retailers start to launch their own resale services or marketplaces. For example, resale platforms can offer customers style inspirations to spark engagement and improve sales or launch collaborations to increase buzz.