Nitheesh NH

Introduction

Although it is not mainstream, fashion rental is an essential part of the apparel and footwear market, as many consumers seek out value options, both in terms of price and sustainability, while wanting to try different things without committing to purchases. In 2022, we are seeing the return of occasion wear and we expect to see strong growth in the fashion rental market. In this report, we provide an overview of the US fashion rental market, including categories such as apparel, footwear and accessories (including handbags). We cover five rental models that represent most fashion rental businesses today: traditional offline-based fashion rental, membership/subscription-based rental, non-membership/subscription-based rental, brands’/retailers’ own rental programs and consumer-to-consumer rental.US Fashion Rental Market: Performance and Outlook

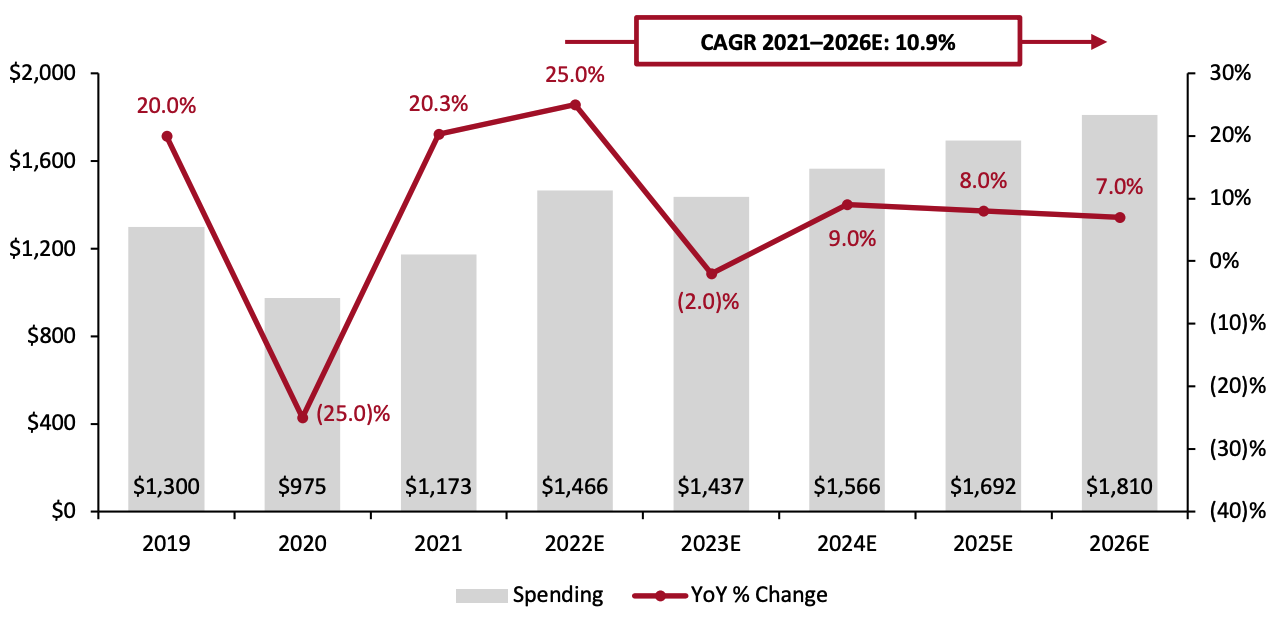

Market Size We expect the US fashion rental market to grow 25% in 2022, reaching $1.47 billion but representing less than 1% of the total US fashion market. We expect the market to see a low-single-digit percentage decline in 2023 as the pent-up demand for occasion wear will have faded away. We estimate that the market will fully normalize in 2024 and grow with high-single-digit percentage annual growth rates. The market will grow with a CAGR of 10.9% from 2021 to 2026. The market declined by 25% in 2020, impacted by the pandemic, but recovered strongly in 2021 as consumers returned to in-person events amid easing Covid-19 restrictions.Figure 1. The US Fashion Rental Market Size (Left Axis; USD Mil.) and YoY % Change (Right Axis; %) [caption id="attachment_152687" align="aligncenter" width="700"]

Source: Statista/US Census Bureau/Coresight Research[/caption]

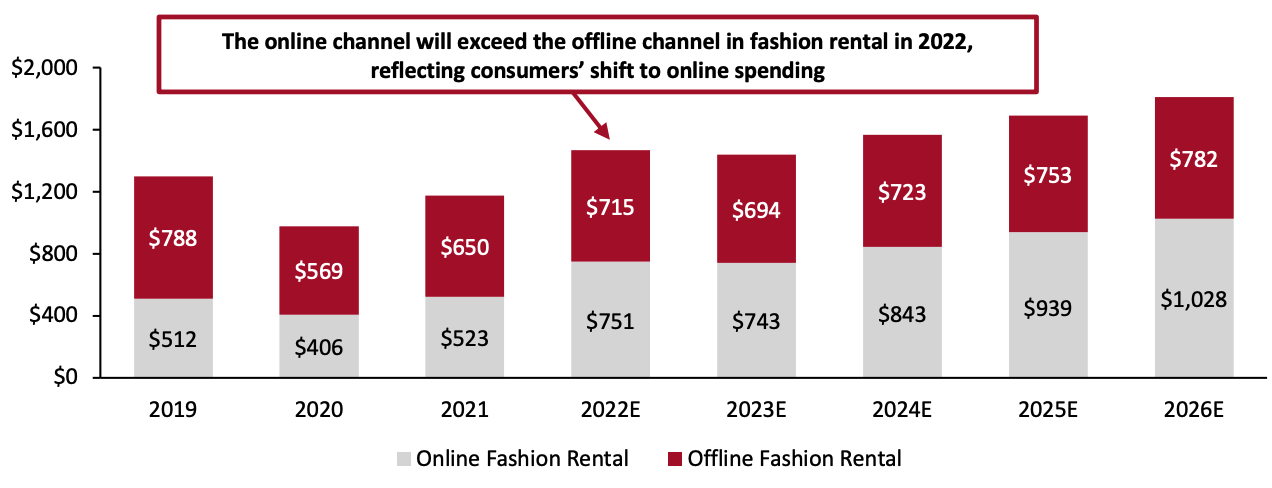

Coresight Research estimates that the US online fashion rental market grew 28.8% to $523 million in 2021 and will continue to grow in 2022, with platforms such as Rent the Runway and Nuuly showing organic sales growth and user number growth momentum. For fiscal 2022, Rent the Runway expects revenue to grow between the range of 45% and 50%, according to the company’s latest guidance.

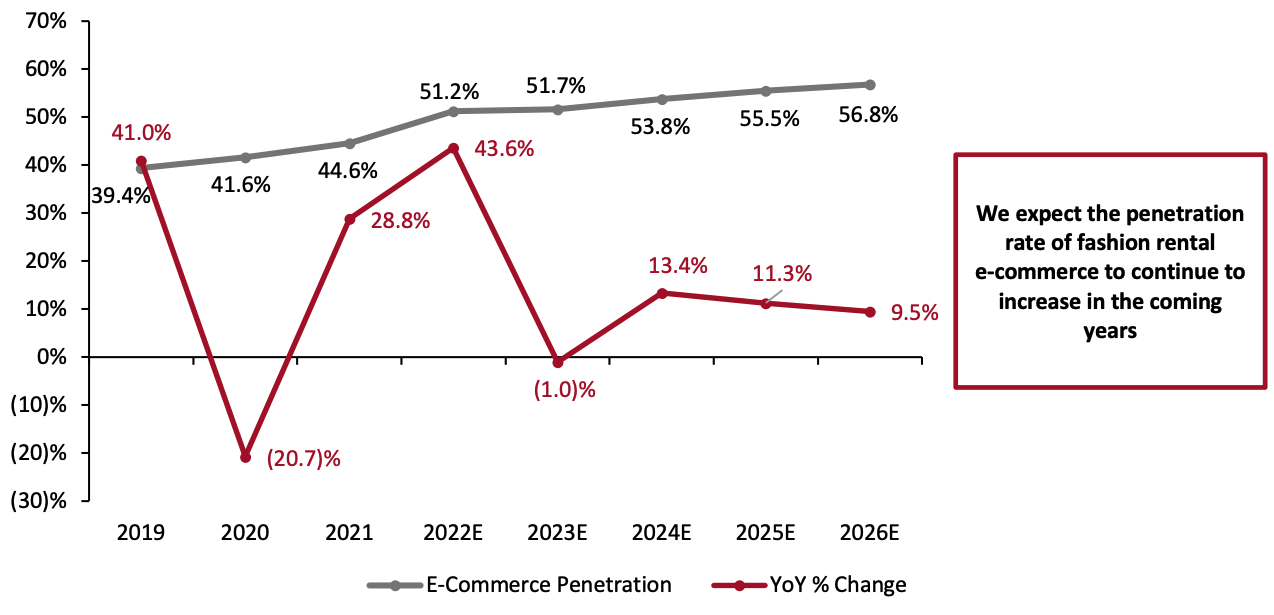

We expect the penetration rate of fashion rental e-commerce to continue to increase in the coming years (see Figure 3).

Source: Statista/US Census Bureau/Coresight Research[/caption]

Coresight Research estimates that the US online fashion rental market grew 28.8% to $523 million in 2021 and will continue to grow in 2022, with platforms such as Rent the Runway and Nuuly showing organic sales growth and user number growth momentum. For fiscal 2022, Rent the Runway expects revenue to grow between the range of 45% and 50%, according to the company’s latest guidance.

We expect the penetration rate of fashion rental e-commerce to continue to increase in the coming years (see Figure 3).

Figure 2. The US Fashion Rental Market: Spending by Distribution Channel (USD Mil.) [caption id="attachment_152688" align="aligncenter" width="700"]

Source: Statista/US Census Bureau/Coresight Research[/caption]

Source: Statista/US Census Bureau/Coresight Research[/caption]

Figure 3. US Fashion Rental: E-Commerce Penetration (Online Spending as a % of Total Spending) and Online Spending YoY Growth (%) [caption id="attachment_152689" align="aligncenter" width="700"]

Source: Statista/US Census Bureau/Coresight Research[/caption]

Source: Statista/US Census Bureau/Coresight Research[/caption]

Market Factors

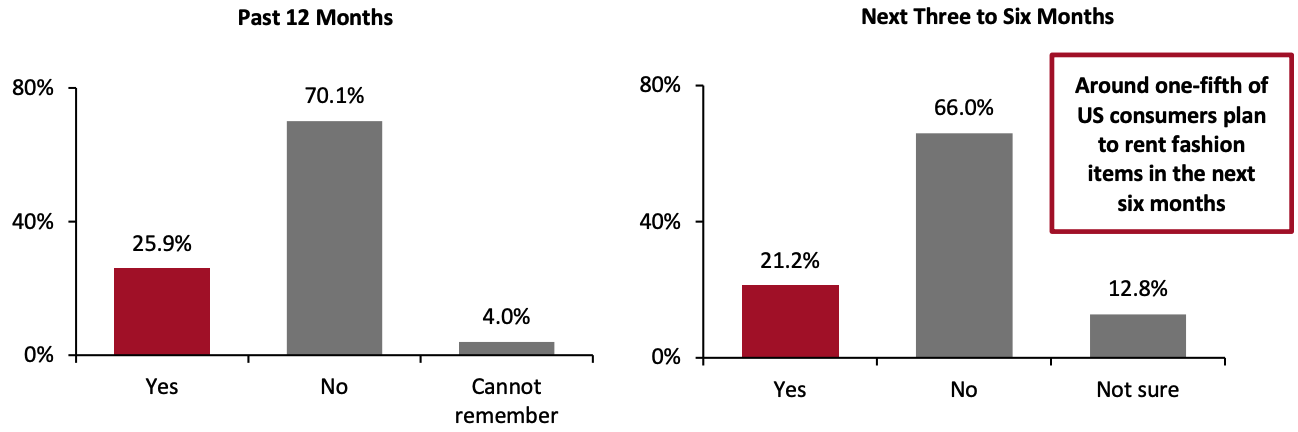

Consumer Demand for Fashion Rental We are seeing significant consumer demand for fashion rental. According to a Coresight Research survey of US consumers conducted in July 2022, over one-quarter (25.9%) of consumers said they used apparel rental stores or online websites to rent clothing, footwear or accessories in the past 12 months—and over one-fifth (21.2%) said they planned to rent clothing, footwear or accessories in the next three to six months (see Figure 4). We expect consumer demand for fashion rental will weaken in 2023 and the following years compared to 2022, as the pent-up demand for occasion wear will have faded away.Figure 4. US Consumers’ Use of Apparel Rental Stores or Online Websites To Rent Clothing, Footwear or Accessories in the Past 12 Months (Left) and Planned Usage in the Next Three to Six Months (Right) (% of Respondents) [caption id="attachment_152690" align="aligncenter" width="700"]

Base: 472 US respondents aged 18+ (left) and 467 respondents aged 18+ (right), surveyed in July 2022

Base: 472 US respondents aged 18+ (left) and 467 respondents aged 18+ (right), surveyed in July 2022Source: Coresight Research[/caption] A Return of Demand for Occasion Wear Also driving the US fashion rental market in 2022 is a return to in-person events such as dinner out, parties and formal business events, and, therefore, the demand for occasion and more formal, dresswear categories, such as suits, tuxedos, dresses, blouses and evening gowns. Rent the Runway is seeing customers gravitate toward more formal looks with cocktail dresses and gowns having the highest utilization of any category in the company’s first quarter of fiscal 2022 and reaching all-time highs, according to the company’s earnings call on June 9, 2022. In addition, the company mentioned that women are renting very bold clothing (for example, a sexy red knockout dress) from the platform. Events such as weddings will specifically drive wedding dress and tuxedos rentals. An estimated 2.5 million weddings are taking place in 2022, which is the most the US has seen since 1984, according to The Wedding Report, a market research firm. Most people postponed their celebrations during the pandemic and are planning to book venues and celebrate the weddings in 2022, which will drive the fashion rental market. Consumers’ Growing Sustainability Awareness About three in 10 US consumers report that the Covid-19 crisis has made environmental sustainability more of a factor for them when shopping, more than double the proportion of respondents that said sustainability is now less of a factor for them, according to Coresight Research’s July 26, 2021, survey from our US Consumer Tracker series. Consumer emphasis on the importance of sustainability will help the fashion rental market; more and more consumers will consider renting clothes, bags and accessories to avoid the overall resource waste in the fashion market and extend the lifecycles of fashion products.

- Read more Coresight Research insights into sustainability in retail.

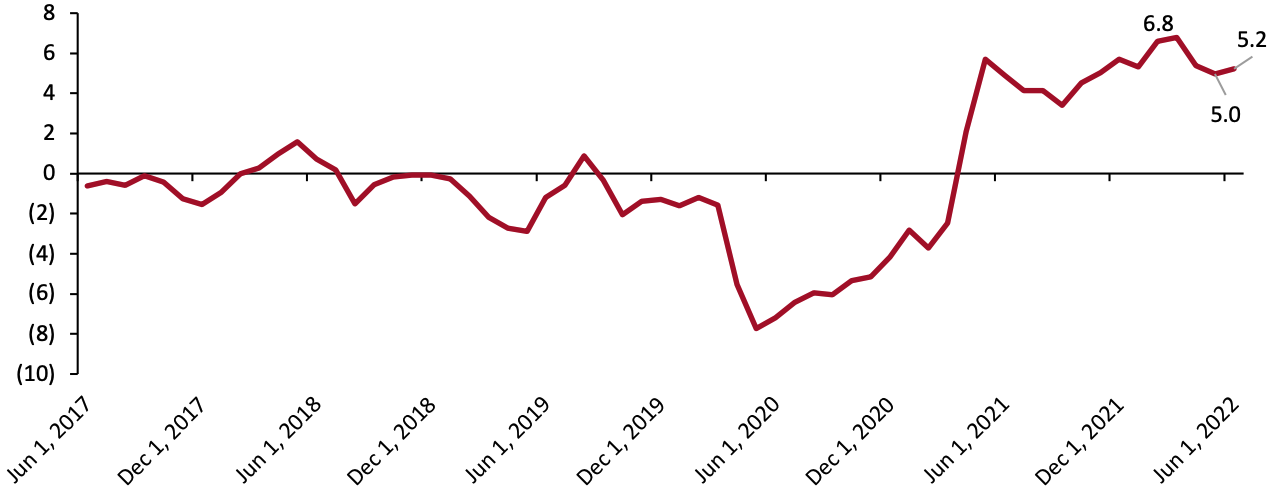

Figure 5. YoY Changes of Consumer Price Index in Apparel and Footwear for All Urban Consumers (%, Seasonally Adjusted) [caption id="attachment_152692" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

Competitive Landscape

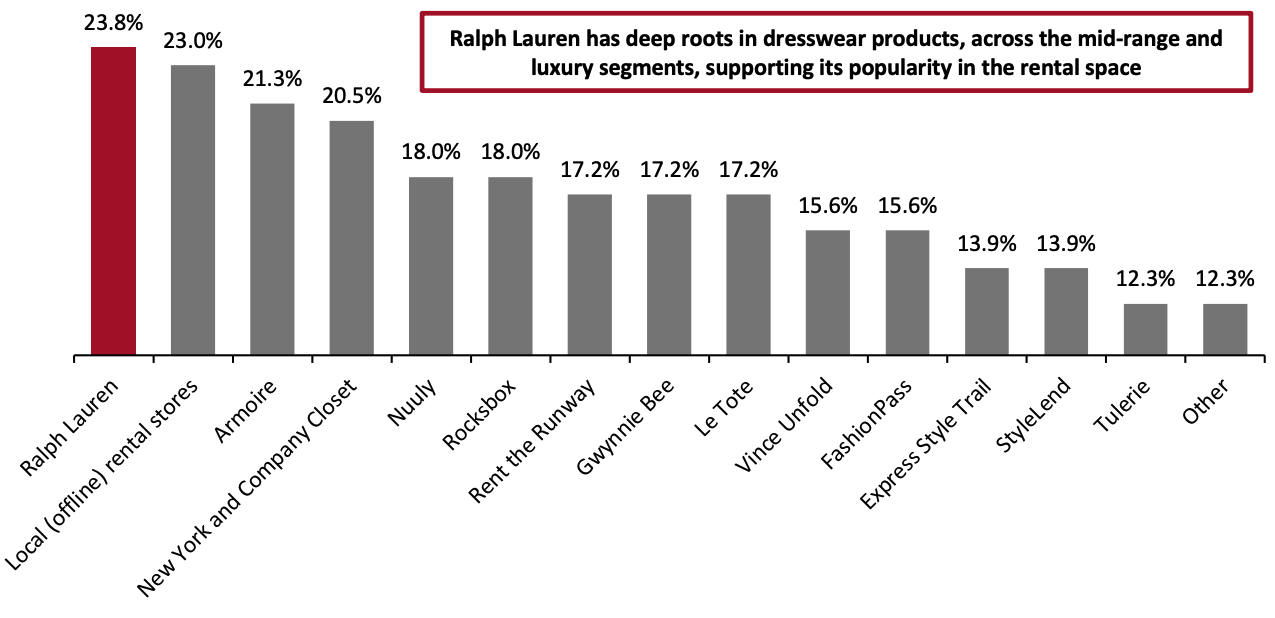

The US fashion rental market is fragmented. The market comprises a range of players, from traditional offline-based companies such as Mr. Formal, to relatively new membership- or subscription-based companies such as Rent the Runway, to retailers’ own programs such as Urban Outfitters’ Nuuly. In addition, there are a few companies that are operating based on the consumer-to-consumer model, such as Tulerie. According to Coresight Research’s July 2022 survey, Ralph Lauren, local (offline) rental stores and Armoire were the top three rental platforms consumers shopped from in the past 12 months.Figure 6. Online Fashion Rental Shoppers: Rental Platforms Used in the Past 12 Months (% of Respondents) [caption id="attachment_152693" align="aligncenter" width="700"]

Base: 122 US respondents aged 18+ that used fashion rental services in the past 12 months, surveyed in July 2022

Base: 122 US respondents aged 18+ that used fashion rental services in the past 12 months, surveyed in July 2022Source: Coresight Research[/caption] We present the major players in the US fashion rental market in Figure 7 and discuss each in detail in the following sections.

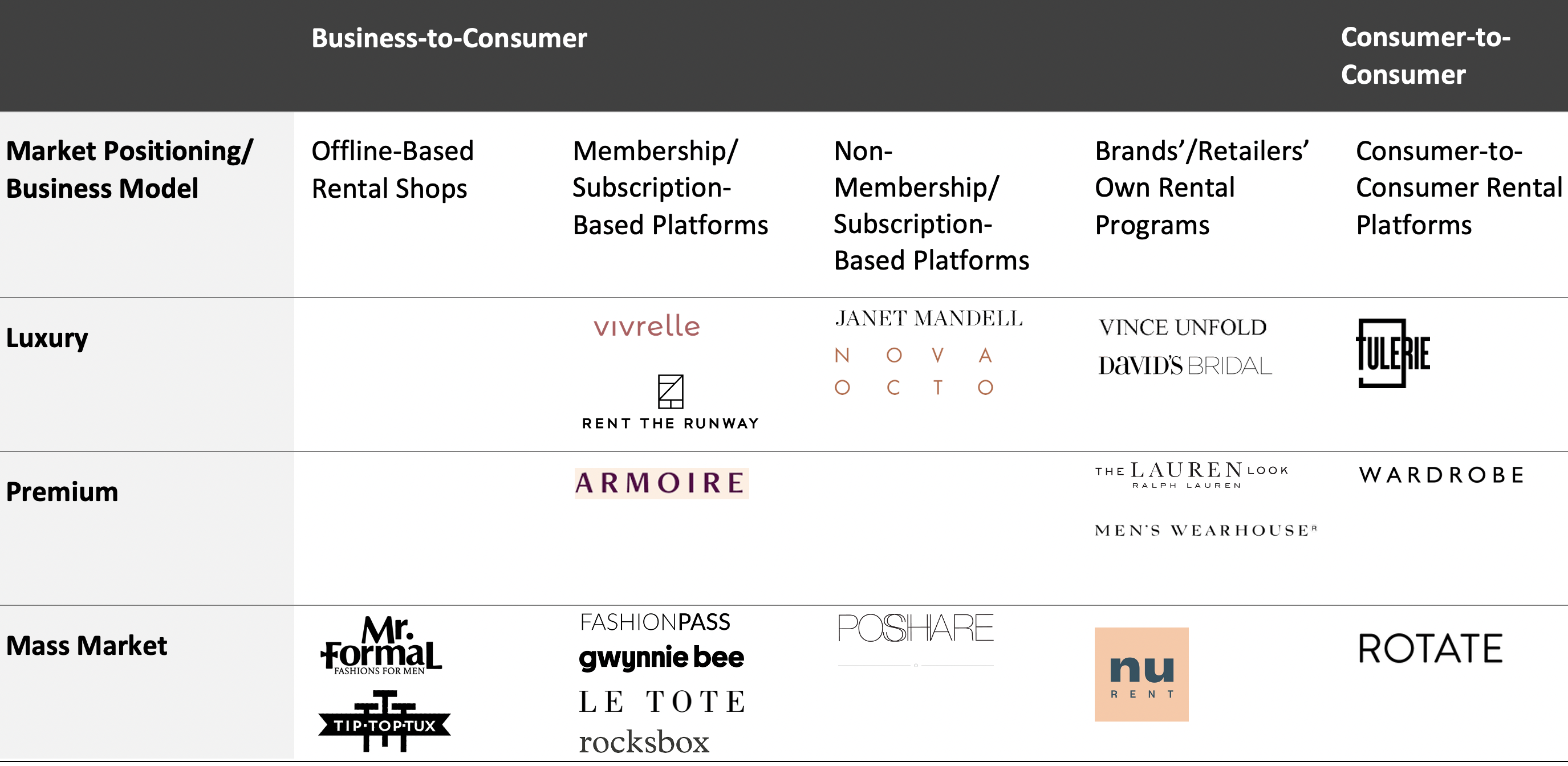

Figure 7. Selected Players in the US Fashion Rental Market [caption id="attachment_152823" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Traditional Offline-Based Fashion Rental Companies

There were 843 formal wear and costume rental businesses (offline-based establishments) in the US as of 2019, according to Census Bureau’s most recent data, with most of them serving local consumers.

Source: Coresight Research[/caption]

Traditional Offline-Based Fashion Rental Companies

There were 843 formal wear and costume rental businesses (offline-based establishments) in the US as of 2019, according to Census Bureau’s most recent data, with most of them serving local consumers.

Figure 8. Selected Traditional Offline-Based Fashion Rental Companies

| Company Name | Year of Entry to the Rental Space | Differentiators in the Fashion Rental Market | Social Media Performance (as of July 19, 2022) |

| Mr. Formal | 1961 |

|

Instagram: 460 followers, 101 posts Facebook: N/A |

| Tip Top Tux | 2008 |

|

Instagram: 1,811 followers, 1,639 posts Facebook: 3,424 followers |

Source: Company reports

Membership/Subscription-Based Platforms The membership/subscription-based model is an arrangement in which consumers need to pay a monthly fee to rent fashion items.Figure 9. Selected Membership/Subscription-Based Fashion Rental Companies

| Company Name | Year of Entry to the Rental Space | Differentiators in the Fashion Rental Market | Social Media Performance (as of July 19, 2022) |

| Armoire | 2016 |

|

Instagram: 21K followers, 2,427 posts Facebook: 6,518 followers |

| FashionPass | 2016 |

|

Instagram: 78.9K followers, 1,925 posts Facebook: 3,242 followers |

| Gwynnie Bee | 2012 |

|

Instagram: 44.8K followers, 3,520 posts Facebook: 431.1K followers |

| Le Tote | 2012 |

|

Instagram: 78.7K followers, 2,175 posts Facebook: 262.9K followers |

| Rent the Runway | 2009 |

|

Instagram: 437K followers, 5,823 posts Facebook: 762.9K followers |

| rocksbox | 2012 |

|

Instagram: 234K followers, 4,293 posts Facebook: 268.9K followers |

| Vivrelle | 2018 |

|

Instagram: 119K followers, 1,281 posts Facebook: 2,638 followers |

Source: Company reports

Non-Membership/Subscription-Based Platforms The non-membership/subscription-based model is an arrangement in which consumers can directly rent fashion items without paying monthly membership fees or subscription fees.Figure 10. Selected Non-Membership-Based Fashion Rental Companies

| Company Name | Year of Entry to the Rental Space | Differentiators in the Fashion Rental Market | Social Media Performance (as of July 19, 2022) |

| Janet Mandell | 2013 |

|

Instagram: 135K followers, 909 posts Facebook: N/A |

| Nova Octo | 2018 |

|

Instagram: 36K followers, 908 posts Facebook: 590 followers |

| Poshare | 2016 |

|

Instagram: 11K followers, 656 posts Facebook: 3,865 followers |

Source: Company reports

Brands/Retailers’ Own Rental Programs Brands and retailers are entering the fashion rental market in recent years, with some launching their own rental programs or marketplaces.Figure 11. Selected Brands/Retailers’ Own Fashion Rental Programs

| Company Name | Year of Entry to the Rental Space | Differentiators in the Fashion Rental Market | Social Media Performance (as of July 19, 2022) |

| Nuuly Rent (parent company: Urban Outfitters) | 2019 |

|

Instagram: 118K followers, 914 posts Facebook: 10.7K followers |

| The Lauren Look (parent company: Ralph Lauren) | 2021 |

|

(Ralph Lauren) Instagram: 13.9M followers, 6,965 posts Facebook: 9.2M followers |

| Vince Unfold (parent company: Vince) | 2018 |

|

(Vince) Instagram: 393K followers, 2,914 posts Facebook: 247.0K followers |

| David’s Bridal | 1972 |

|

Instagram: 471K followers, 6,971 posts Facebook: 1.7M followers |

| Men’s Wearhouse | Undisclosed |

|

Instagram: 109K followers, 1,820 posts Facebook: 748.4K followers |

Source: Company reports

Consumer-To-Consumer Rental Platforms The consumer-to-consumer rental model is an arrangement in which consumers rent apparel products (from consumers) on peer-to-peer closet sharing websites or apps.Figure 12. Selected Consumer-to-Consumer Fashion Rental Companies

| Company Name | Year of Entry to the Rental Space | Differentiators in the Fashion Rental Market | Social Media Performance (as of July 19, 2022) |

| Rotate | Undisclosed |

|

Instagram: 615 followers, 220 posts Facebook: 19 followers |

| Tulerie | 2017 |

|

Instagram: 10.2K followers, 988 posts Facebook: 321 followers |

| Wardrobe | 2018 |

|

Instagram: 16.4K followers, Facebook: N/A |

Source: Company reports

Themes We Are Watching

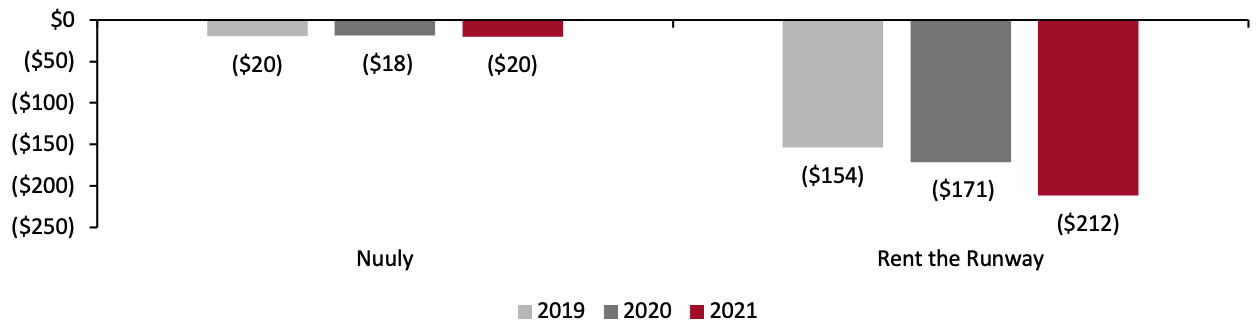

Profitability Although we expect the fashion rental market to grow in 2022, with key players’ revenues increasing, the profitability of fashion rental companies remains uncertain given that the sector still requires significant investment, especially for online apparel rental. Nuuly (including Nuuly Rent, launched in July 2019, and Nuuly Thrift, just launched in October 2021) has seen sequential losses in its past three fiscal years, according to Urban Outfitters, though Nuuly’s customer acquisition and operations are functioning smoothly. As of March 1, 2022 (the fourth quarter of fiscal 2022 earnings call date of Urban Outfitters), Nuuly has over 57,000 active paying subscribers, surpassing its fiscal 2022 goal of 50,000. Management believes that Nuuly is still at an early stage and that they have much to learn about this business model but are excited for its future based on demand so far. Rent the Runway disclosed that the company had 159,544 total subscribers as of January 31, 2022. But the company expects to incur increased operating costs and admitted its potential net losses in the near term, according to its most recent annual report. The company details its uses operating costs including acquiring products, increasing customer engagement, driving customer acquisition, enhancing website and mobile offerings and logistics fulfillment.Figure 13. Nuuly and Rent the Runway: Loss from Operations (USD Mil.) [caption id="attachment_152731" align="aligncenter" width="700"]

Source: Company reports[/caption]

Personalization in Fashion Rental Subscription

We are seeing online fashion rental platforms investing in personalization to drive more customer engagement and grow sales.

We expect to see more data-based, personalized styling recommendation services. Rent the Runway stated on its earnings call in April 2022 that it will continue to make important investments in customer experiences so it is faster and easier for customers to find clothing they love by improving search and product discovery. The company believes that it can make annual progress to increase customer discovery, acquisition and retention through these efforts.

In addition to style recommendations, personalized sizing recommendations will also fuel the success of rental businesses. Rent the Runway is investing in sizing recommendations. The company plans to enhance tools to improve fit confidence and success, which in turn can drive conversion. Rent the Runway introduced a proprietary fit algorithm in 2021 that recommends sizes that are most likely to fit customers. This has already resulted in a 40% reduction in fit issues, higher customer satisfaction and fewer customer service calls among customers who take the recommendations, according to the company’s April 2022 earnings call. We view personalization as a critical part of the apparel rental business and expect to see more investment into product discovery and fit solutions.

Move Into the Resale Space

We are seeing a few apparel rental businesses expanding into the resale space. Rent the Runway launched a resale business in June 2021 and disclosed that it will continue to grow subscribers by leveraging resale as strong funnel, according to its earnings call in December 2021. Urban Outfitter’s Nuuly launched Nuuly Thrift, a resale marketplace, in August 2021. Apparel rental platform Hurr also announced its plan to expand into resale in February 2022.

We believe it is beneficial from the revenue perspective to broaden the business range and acquire more consumers by offering services such as resale. Once consumers have the experience of buying secondhand products and seeing the quality, they will be more likely to end up converting into rental. Thrifting for apparel and footwear is becoming a compelling value proposition coming out of the pandemic. We expect the fashion resale market to reach $25.9 billion and $29.7 billion in 2022 and 2023, implying 16.0% and 15.0% growth, respectively. To capitalize on the $26 billion US fashion resale market, which is growing faster than the apparel rental market, we see opportunities for fashion rental businesses to launch resale services. However, we expect the impact of resale business on gross margin to be minimal in a short-term.

Source: Company reports[/caption]

Personalization in Fashion Rental Subscription

We are seeing online fashion rental platforms investing in personalization to drive more customer engagement and grow sales.

We expect to see more data-based, personalized styling recommendation services. Rent the Runway stated on its earnings call in April 2022 that it will continue to make important investments in customer experiences so it is faster and easier for customers to find clothing they love by improving search and product discovery. The company believes that it can make annual progress to increase customer discovery, acquisition and retention through these efforts.

In addition to style recommendations, personalized sizing recommendations will also fuel the success of rental businesses. Rent the Runway is investing in sizing recommendations. The company plans to enhance tools to improve fit confidence and success, which in turn can drive conversion. Rent the Runway introduced a proprietary fit algorithm in 2021 that recommends sizes that are most likely to fit customers. This has already resulted in a 40% reduction in fit issues, higher customer satisfaction and fewer customer service calls among customers who take the recommendations, according to the company’s April 2022 earnings call. We view personalization as a critical part of the apparel rental business and expect to see more investment into product discovery and fit solutions.

Move Into the Resale Space

We are seeing a few apparel rental businesses expanding into the resale space. Rent the Runway launched a resale business in June 2021 and disclosed that it will continue to grow subscribers by leveraging resale as strong funnel, according to its earnings call in December 2021. Urban Outfitter’s Nuuly launched Nuuly Thrift, a resale marketplace, in August 2021. Apparel rental platform Hurr also announced its plan to expand into resale in February 2022.

We believe it is beneficial from the revenue perspective to broaden the business range and acquire more consumers by offering services such as resale. Once consumers have the experience of buying secondhand products and seeing the quality, they will be more likely to end up converting into rental. Thrifting for apparel and footwear is becoming a compelling value proposition coming out of the pandemic. We expect the fashion resale market to reach $25.9 billion and $29.7 billion in 2022 and 2023, implying 16.0% and 15.0% growth, respectively. To capitalize on the $26 billion US fashion resale market, which is growing faster than the apparel rental market, we see opportunities for fashion rental businesses to launch resale services. However, we expect the impact of resale business on gross margin to be minimal in a short-term.

What We Think

We expect the US fashion rental market to see strong growth in 2022, driven by consumer’s pent-up demand for occasion wear to attend events, parties, or just dine-outs. Rising prices in apparel and footwear, and squeezed discretionary spending from higher overall inflation, could drive more consumers toward rental options in place of purchases. Although the market is growing, we think fashion rental market is niche and capturing only a tiny slice of the total US fashion market. Implications for Brands/Retailers- We expect the US fashion rental e-commerce market to continue to gain share from the offline rental market in the coming years, presenting opportunities for brands and retailers, especially dresswear brands positioned in the middle- and luxury-market. We saw the success of Ralph Lauren, which topped the list of rental platforms used by consumers in the past 12 months, according to our survey in July 2022.

- We expect offline rental platforms to capture a significant portion of the fashion rental market and remain as an important channel in the next five years.

- We are seeing rental platforms investing in personalization, such as Rent the Runway’s investment in product discovery and sizing recommendations. We believe personalization can help rental platforms retain more consumers by offering fit-to-purpose apparel choices.

- We believe it is beneficial from the revenue perspective for fashion rental businesses to broaden their business range and acquire more consumers by offering services such as resale. However, the profitability of fashion rental companies remains uncertain given that the sector still requires significant investment, especially for online apparel rental.

- We recommend that technology vendors focus on enabling fashion rental platforms to offer more personalized recommendations.

Methodology: Coresight Research surveys US consumers aged 18+ online each week. Informing the data in this report is our survey of US consumers online on July 4 (472 respondents). The results have a margin of error of +/- 5%, with a 95% confidence interval.