DIpil Das

US Economic Update, 2Q22

In this report, we look at newly released US economic data for the second quarter of 2022.

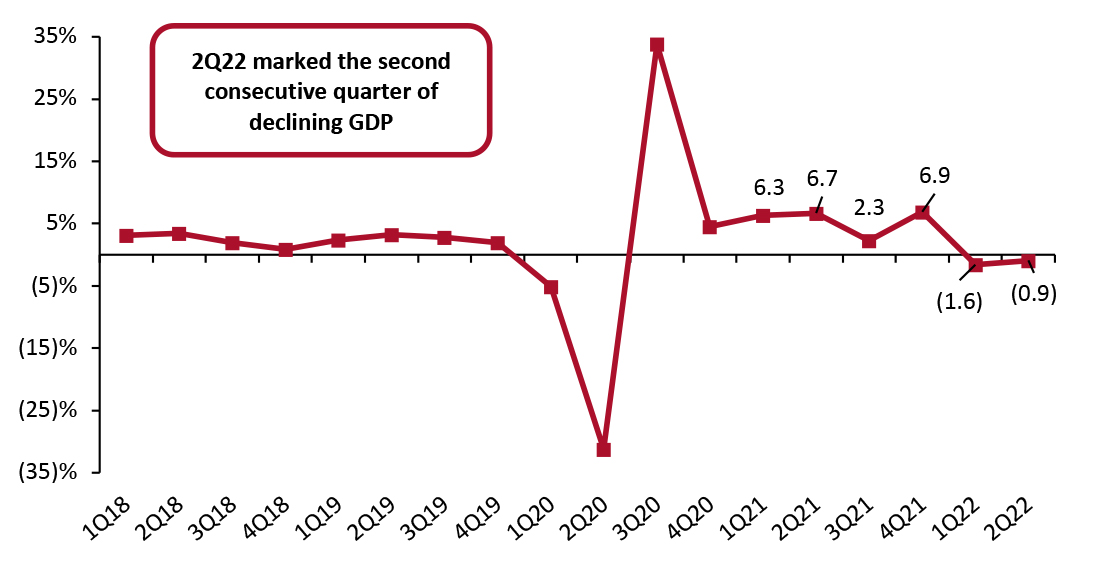

Second Quarter of GDP Contraction

The US economy shrank at an annualized rate of 0.9% in the second quarter of 2022, following a contraction of 1.6% in the first quarter (revised estimate). Two quarters of economic contraction are widely taken as an indicator of a recession.

- According to the Bureau of Economic Analysis (BEA), in the second quarter, contractions were recorded in private inventory investment, residential fixed investment, federal government spending, state and local government spending, and nonresidential fixed investment.

- These were partly offset by increases in exports and personal consumption expenditures. Imports, a subtraction in the calculation of GDP, increased.

- The fall in private inventory investment was led by a decrease in retail trade, which the BEA said was mainly general merchandise stores as well as motor vehicle dealers.

- In current prices, disposable personal income increased by 6.6% in the second quarter, versus a 1.3% decline in the first quarter.

- Real disposable personal income decreased by 0.5% in the second quarter, versus with a fall of 7.8% in the first quarter.

Figure 1. US GDP: Change from Preceding Quarter (Annualized; %) [caption id="attachment_152506" align="aligncenter" width="700"]

Source: US BEA[/caption]

Source: US BEA[/caption]

The BEA reported that the slower decrease in the second quarter reflected a sequential strengthening in exports and a smaller decrease in federal government spending; these were partly offset by larger declines in private inventory investment and state and local government spending, a slowdown in personal consumption expenditures, and downturns in nonresidential fixed investment and residential fixed investment. Imports decelerated in the second quarter.

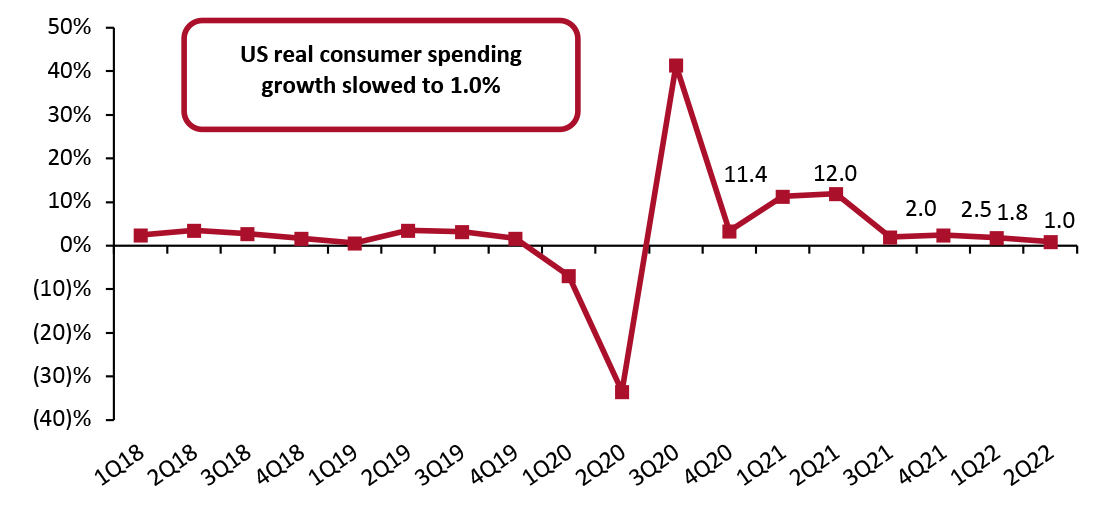

Real-Terms Consumer Spending Growth Slows; Spend on Goods Declines

In the second quarter of 2022, real personal consumption expenditures, also known as consumer spending, rose at an annual rate of 1.0%, while the first quarter’s growth estimate was revised down from an initial 2.7% to 1.8%.

A 4.4% real-terms decline in spending on goods (versus a decline of 0.3% in the first quarter) was outweighed by a 4.1% increase in spending on services (versus 3.0% in the first quarter). Durable goods spend fell 2.6% and nondurable goods spend fell 5.5% in the second quarter, in real terms.

Coresight Research has been pointing to real-terms year-over-year declines in total US retail sales in recent months, as our estimated retail-only inflation metric has outpaced the nominal increase in US retail sales reported by the US Census Bureau.

Figure 2. US Real-Terms Personal Consumption Expenditures: Change from Preceding Quarter (Annualized; %) [caption id="attachment_152496" align="aligncenter" width="701"]

Source: US BEA[/caption]

Source: US BEA[/caption]

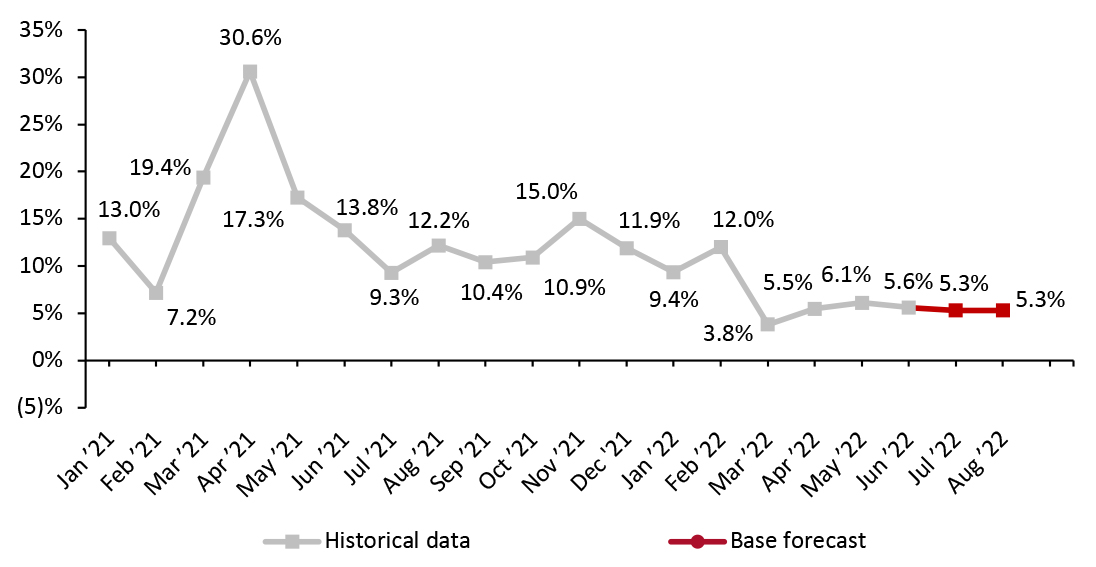

Projected Moderate Retail Sales Growth Likely To Represent Further Real-Terms Declines

Coresight Research’s model analyzes correlations between retail sales and macroeconomic indicators. Our latest update predicts retail sales growth to remain in the mid-single digits for the remaining two months of summer, with sales growing 5.3% from a year earlier. This growth is in nominal terms and continued raised inflation is likely to mean these translate into negative real-terms growth in total retail sales.

We estimate that retail-only inflation stood at around 7.3% in May and 7.6% in June (latest), implying real-terms declines versus one year earlier.

Figure 3. US Retail Sales ex. Auto and Gas (YoY % Change) [caption id="attachment_152497" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

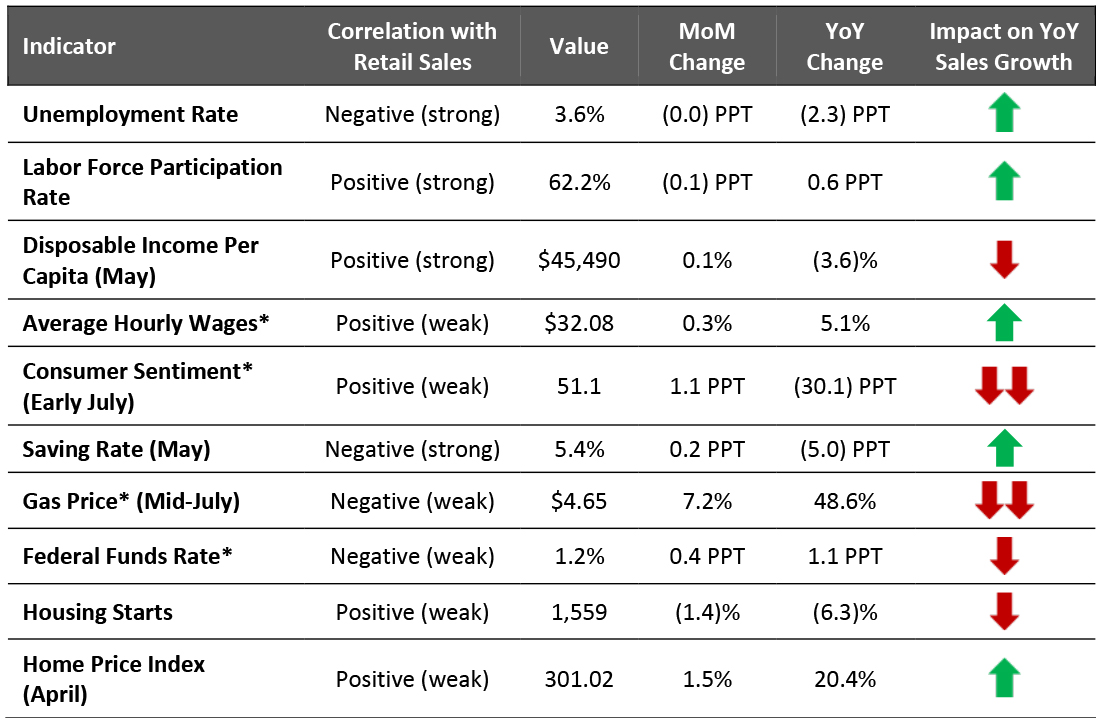

Five of the 10 indicators we examine each month in our Leading Indicators of Retail Sales report are likely to positively impact retail sales in the coming months. In June, the unemployment rate remained near a half-century low. Average hourly wage growth remains historically high at around 5%, although it is not keeping pace with inflation. As of early July, consumer sentiment has marginally improved from a record-low June reading due to gas prices climbing down. Gas prices moving downwards may also signal that June’s Consumer Price Index (CPI) increase could have been the peak of consumer price increases, meaning we may now be on the path to getting inflation under control.

Figure 4. US: Leading Indicators of Retail Sales as of July 20, 2022 [caption id="attachment_152498" align="aligncenter" width="700"]

Latest available data from June unless otherwise indicated

Latest available data from June unless otherwise indicated *Not included in predictive model

Source: BEA/BLS/Federal Reserve Board of Governors/S&P/University of Michigan/US Energy Information Administration/Coresight Research [/caption]