Nitheesh NH

Easter is just around the corner, but the mood and environment surrounding the holiday in 2020 are in stark contrast to typical years due to the coronavirus pandemic. As a result, US consumers are set to slash their spending on Easter this year. However, in this report, we note the pockets of opportunity that are available to retailers—not simply to drive sales but to build stronger bonds with consumers.

Discretionary consumer spending looks on course to take a big hit in an environment where many in the workforce are losing jobs, being furloughed or being forced to take a pay cut—and where most nonessential stores are shut. Service industries are likely to see the biggest impact, as many US state lockdowns are currently banning residents from dining out or taking part in leisure activities.

According to data from the University of Michigan, the consumer sentiment index in the US dropped to 89.1 in March from 101.0 in February, in what was the fourth-largest decline in almost 50 years.

We estimate that US retail will see Easter-related spending of about $12.5–13.7 billion this year, versus the $18.1 billion that the NRF estimated for last year—representing a 25–31% decline and driven by expected very deep declines in nonfood categories such as apparel, flowers and decorations.

Most Consumers Expect To Spend Less this Easter

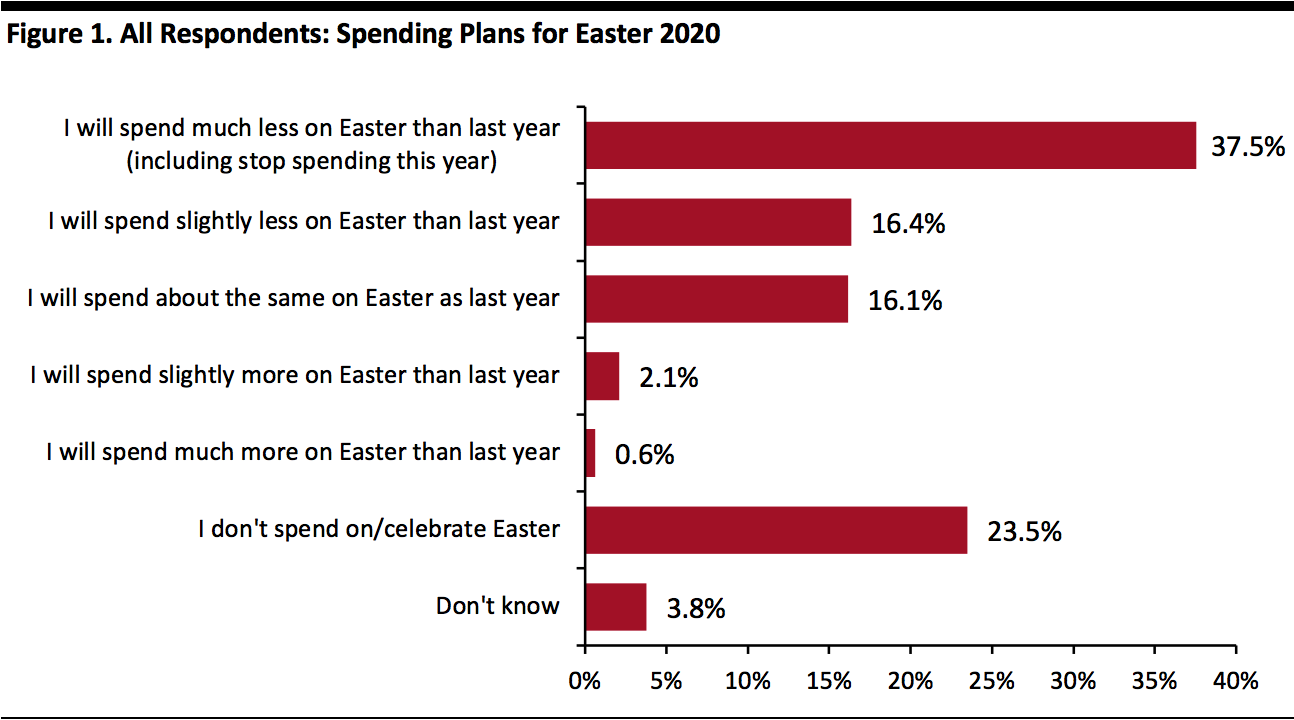

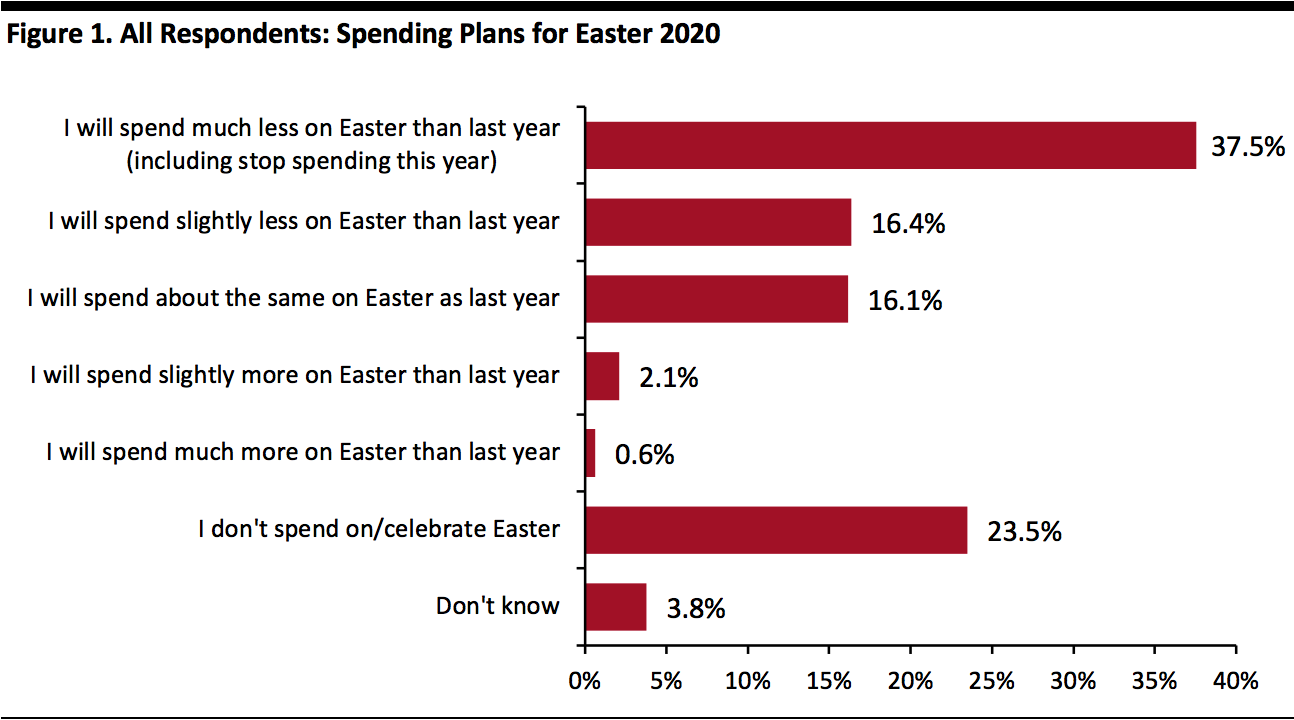

According to a recent Coresight Research survey of US consumers, conducted on April 1, some 54% of respondents said that they are likely to spend less on Easter this year in comparison to last year’s holiday, and 37.5% stated that they will spend “much less” or stop spending entirely. Less than 3% of respondents said that they plan to spend more this year.

[caption id="attachment_107339" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

Source: Coresight Research[/caption] Trends Leading Up to Easter Project a Bleak Outlook for Spending Our US consumer survey on the subject of the coronavirus outbreak last week brought out the following trends in the run up to Easter:

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption] Trends Leading Up to Easter Project a Bleak Outlook for Spending Our US consumer survey on the subject of the coronavirus outbreak last week brought out the following trends in the run up to Easter:

- Most consumers are very worried about the coronavirus.

- One in 10 respondents have lost their jobs.

- Half of consumers are now buying less.

- Shoppers are scaling back their apparel purchases.

- Half of consumers are spending more online than they used to.