albert Chan

What’s the Story?

We provide a preview of Easter 2021 in US retail, based on Coresight Research survey data and insights into directional trends in retail sales. We also review recent Easter activities from the biggest US retailers. This year, Easter Sunday falls on April 4, versus April 12 last year.

Why It Matters

Easter is a multibillion-dollar event for retailers and service providers. The holiday drives spending on food and discretionary goods in particular and can be an opportunity to drive sales of spring-themed goods more generally.

Easter 2021 Retail Preview: In Detail

Survey Findings Imply $23.6 Billion Total Spend

We discuss our survey findings on spending expectations for Easter, including a breakdown by age group and activities that consumers expect to do to celebrate the holiday.

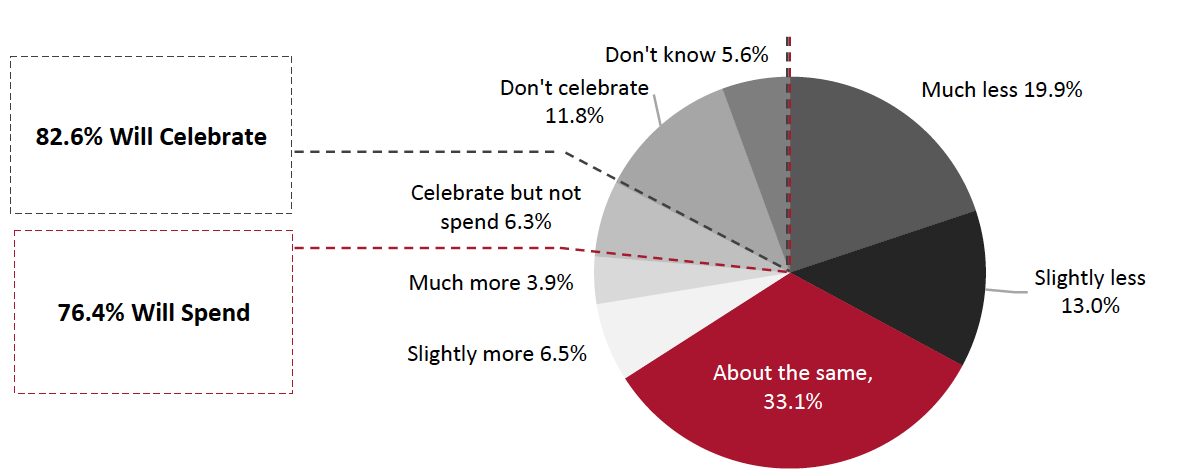

Some 82.6% of respondents in our survey indicated that they will celebrate Easter, with 76.4% planning to spend on the event.

- Out of respondents that expect to spend on the holiday, the average estimated spend came in at $121, across products (i.e., retail) and services.

- Extrapolating from Census Bureau population data, we calculate total Easter 2021 spending of around $23.6 billion by US adult consumers across products and services.

- Those in the 18–29 age group recorded the lowest average spend of $90, while those aged 45–60 expected to spend the most—an average of $138.

- We discuss the potential year-over-year trajectory in retail sales later in this report.

As charted in Figure 1, in addition to the expectations above, some 5.6% of respondents didn’t know how their spending would shape up, suggesting opportunities for retailers and service companies to expand participation and spending a little further.

A greater proportion of consumers expect to spend less than they did last year compared to those that expect to spend more. Last year, Easter fell on April 12—well after lockdowns began in the US and as retail sales fell. Given the very solid retail sales growth we have seen recently (see Figure 4), we think that these expectations versus last year may prove overly pessimistic.

Figure 1. All Respondents: Expectations To Spend on Easter 2021 (% of Respondents)

[caption id="attachment_125105" align="aligncenter" width="700"] Base: 432 US respondents aged 18+, surveyed on March 22

Base: 432 US respondents aged 18+, surveyed on March 22 Source: Coresight Research[/caption]

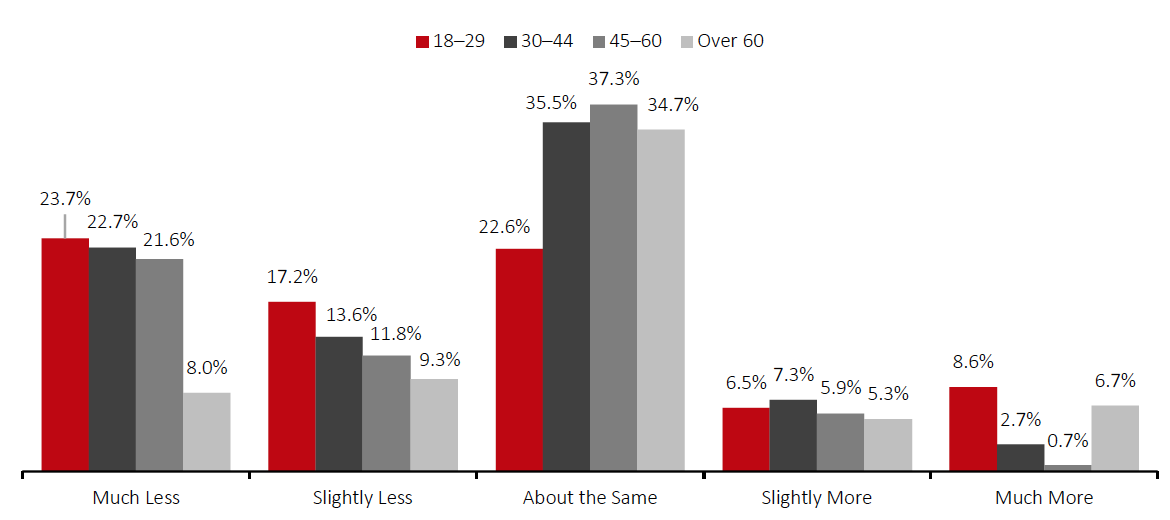

By age, younger consumers— the group that tends to be hardest hit by job losses—are the most likely to expect to cut spending versus last year.

Figure 2. All Respondents: Expectations To Spend on Easter 2021, by Age Group (% of Respondents)

[caption id="attachment_125106" align="aligncenter" width="700"] Base: 432 US respondents aged 18+, surveyed on March 22

Base: 432 US respondents aged 18+, surveyed on March 22Source: Coresight Research[/caption]

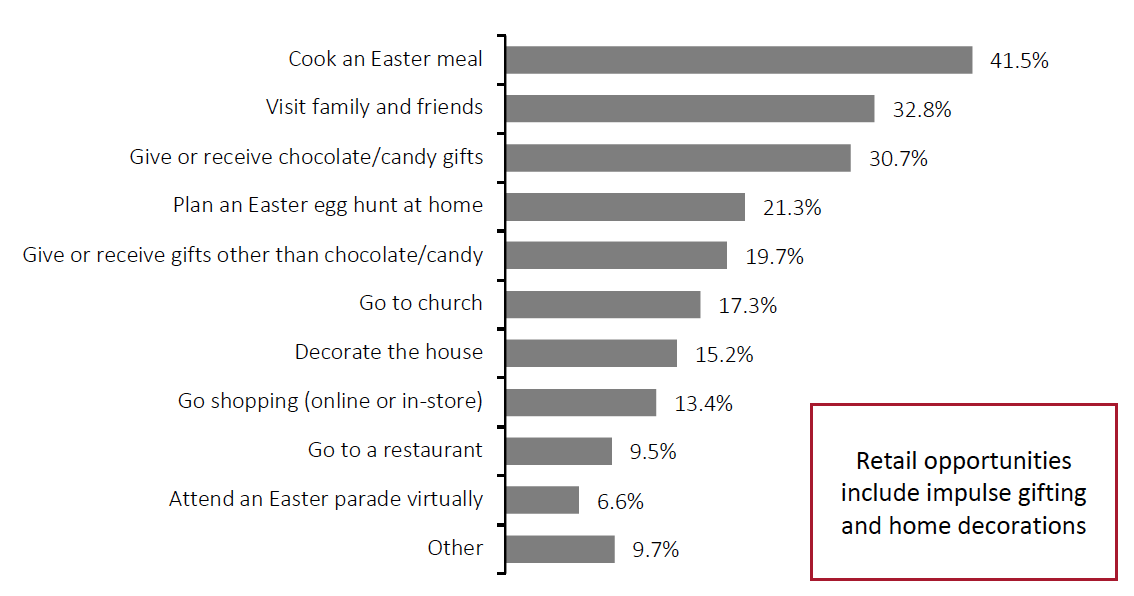

While buying for Easter generates a substantial market size, shopping as an activity during Easter is limited: Only 13.4% of respondents said that they expect to mark the holiday by shopping. Family activities remain highly popular, as shown in Figure 3.

We anticipate opportunities for retailers to drive incremental purchases, suggested by 19.7% of respondents stating that they plan to give or receive non-chocolate or non-candy gifts and 15.2% reporting that they plan to decorate their houses.

- Given difficulties with reunions this year, retailers can encourage consumers to send greeting cards and gift cards to family and friends living in different cities, as well as last-minute gifting.

- In 2020 and so far in 2021, we have seen a nesting trend whereby consumers are spending more freely on their homes. Retailers can drive spend by promoting seasonal home products such as Easter wreaths and Easter trees.

Figure 3. Respondents That Expect To Celebrate Easter: How They Will Celebrate Easter 2021 (% of Respondents)

[caption id="attachment_125107" align="aligncenter" width="700"] Base: 381 US respondents aged 18+ that expect to celebrate Easter 2021, surveyed on March 22

Base: 381 US respondents aged 18+ that expect to celebrate Easter 2021, surveyed on March 22Source: Coresight Research[/caption]

In other findings from our survey:

- Some 10.0% said that they expect to switch some or all of their Easter spending from stores to e-commerce.

- While 17.9% of respondents said that they have less money to spend on Easter purchases this year due to the pandemic, some 8.1% said the opposite and have more to spend on the holiday.

- Some 7.1% expect to spend part of a third-round stimulus check on Easter. Read our separate survey report for overall consumer expectations for third-round spending.

April Retail Sales Could Jump 20% Year Over Year

In this section, we discuss US retail sales growth and Easter-themed trends at major US retailers.

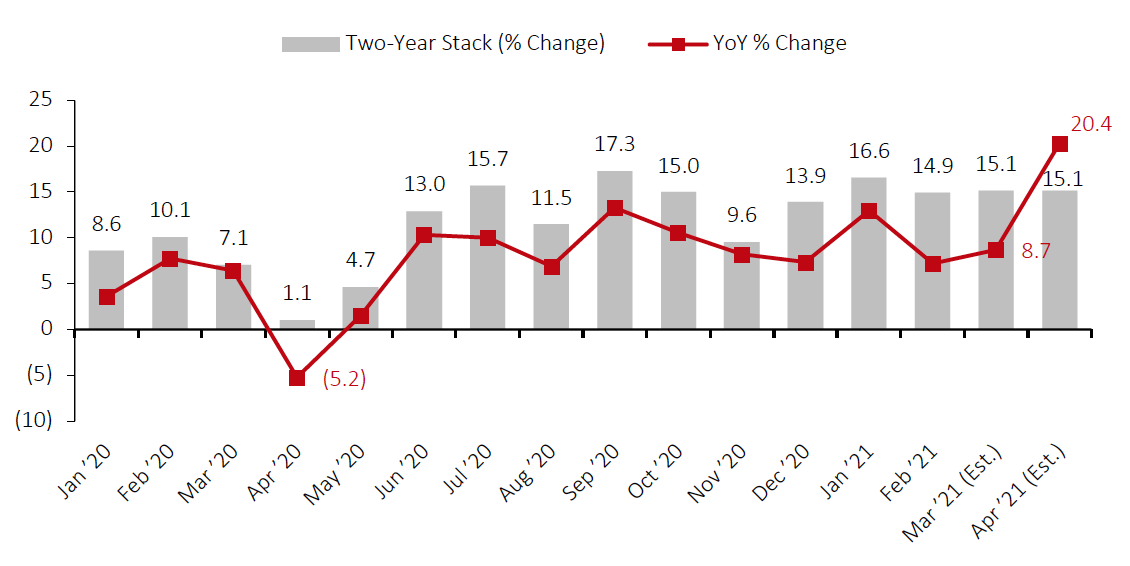

Supported by tax refunds and stimulus measures, US retail sales have recently proved very strong, boding well for a bounce in Easter spending. Total sales (excluding automobiles and gasoline) were up 7.2% in February, maintaining a two-year stack of mid-teens percentage increases. This two-year stack averaged 15.1% across December 2020 and January and February 2021.

April 2020 was the weakest month of the year as lockdowns hit retail. Should the recent two-year pace be sustained, we will be on track for a circa-20% year-over-year increase in total sales in April 2021 as we lap the 5.2% decline seen in April 2020 (as shown in Figure 4 below).

This year, Easter falls on April 4, so some retail spending for the holiday will be drawn forward into March.

- We expect the year-over-year improvement in total sales to be supported by solidly performing nonfood sectors, such as furniture retailers, health and personal care stores, and recreational and leisure goods retailers.

- Clothing specialty retailers and department stores will be annualizing the deep declines from April 2020, when sales recorded by the Census Bureau were down 86.4% and 44.5%, respectively. Year-over-year growth should spike in these hard-hit sectors in April 2021, but total sales at clothing retailers and department stores are still likely to be down versus precrisis 2019.

- Food retailers are likely to see negative year-over-year trends in April 2021: The sector will be lapping a 13.5% increase one year earlier when consumers were still stockpiling groceries. For the full year, we estimate a low-single-digit decline in food retail sales. A number of major grocery retailers, such as Kroger, have guided for negative underlying growth across the year.

Figure 4. US Total Retail Sales (ex. Automobiles and Gasoline): Two-Year % Change Stack and YoY % Change [caption id="attachment_125108" align="aligncenter" width="700"]

March and April 2021 estimates assume that the 15.1% two-year stack average for December 2020, January 2021 and February 2021 is maintained

March and April 2021 estimates assume that the 15.1% two-year stack average for December 2020, January 2021 and February 2021 is maintainedSource: US Census Bureau/Coresight Research[/caption]

Treating and Nesting Trends from America’s Biggest Retailers

At Kohl’s, Target and Walmart the trends of treating and nesting are prominent. We discuss Easter-themed product offerings from the three retailers.

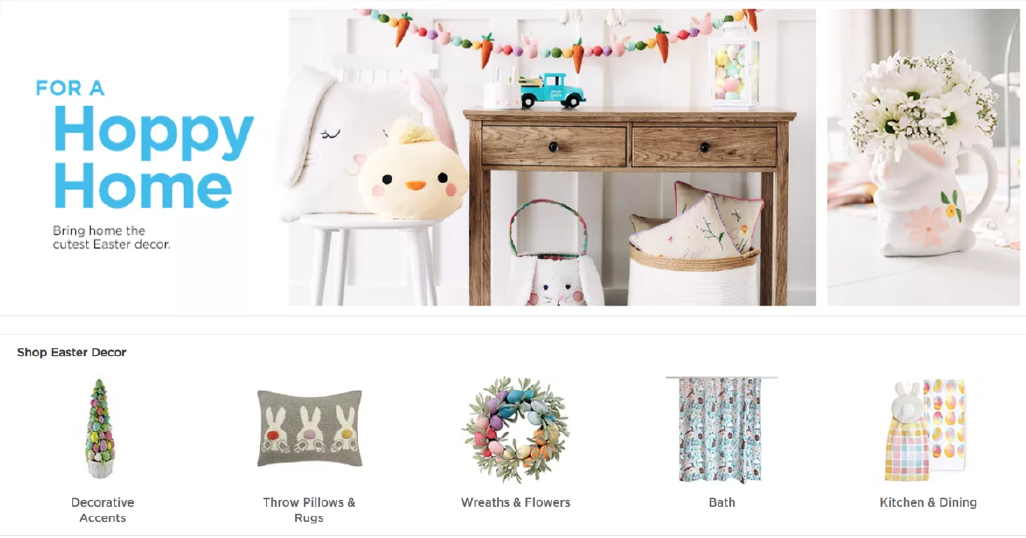

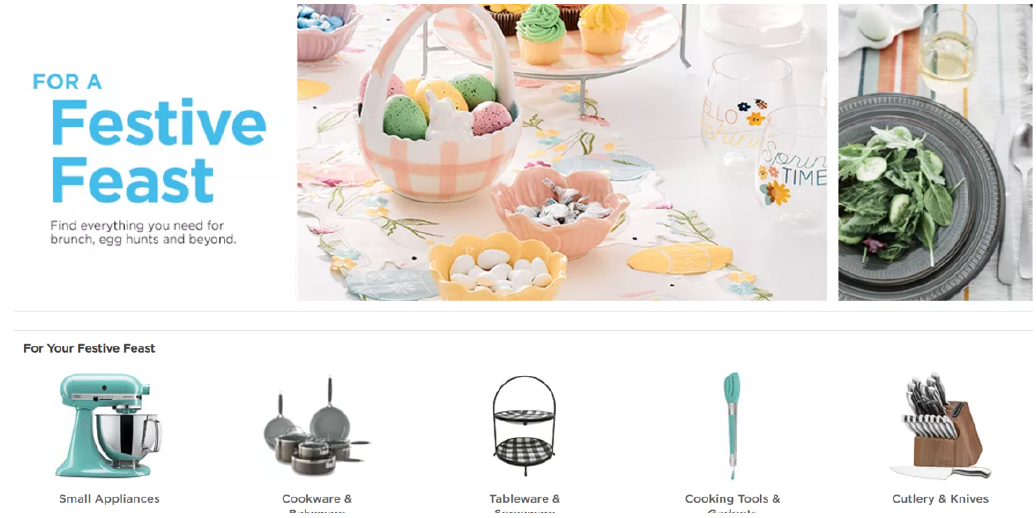

- Kohl’s is targeting nesting consumers, with ideas for “hoppy home” décor. Its second Easter focus is on kitchen and houseware products for festive feasts. Beyond the holiday theme, Kohl’s is promoting non-Easter-specific spring purchases, such as outdoor living—specifically in the categories of outdoor grilling and dining, and patio and outdoor décor.

The Kohl’s “Hoppy Home” website landing page

The Kohl’s “Hoppy Home” website landing pageSource: Kohls.com[/caption] [caption id="attachment_125087" align="aligncenter" width="550"]

The Kohl’s “Festive Feast” website landing page

The Kohl’s “Festive Feast” website landing pageSource: Kohls.com[/caption]

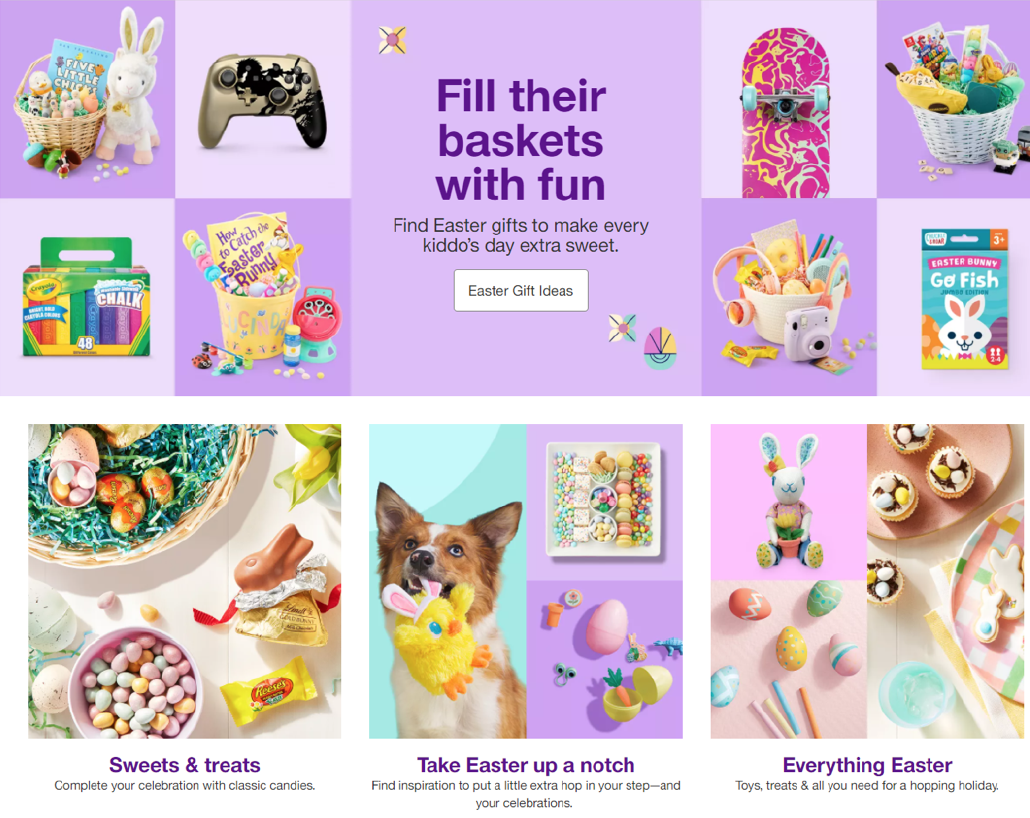

- Target features Easter front and center on its website, urging shoppers to “fill their baskets with fun.” The retailer is promoting gifting in categories from backpacks and skateboards to sweatshirts to gaming—higher-value categories than those most prominently featured at Walmart. Target’s website has gift selections by children’s age group and by price range. Target.com is promoting immediacy in its omnichannel services—the retailer is offering same-day delivery via Shipt and its free drive-up service.

Target’s homepage, featuring an Easter theme

Target’s homepage, featuring an Easter themeSource: Target.com[/caption] [caption id="attachment_125089" align="aligncenter" width="550"]

Target’s Easter landing page

Target’s Easter landing pageSource: Target.com[/caption]

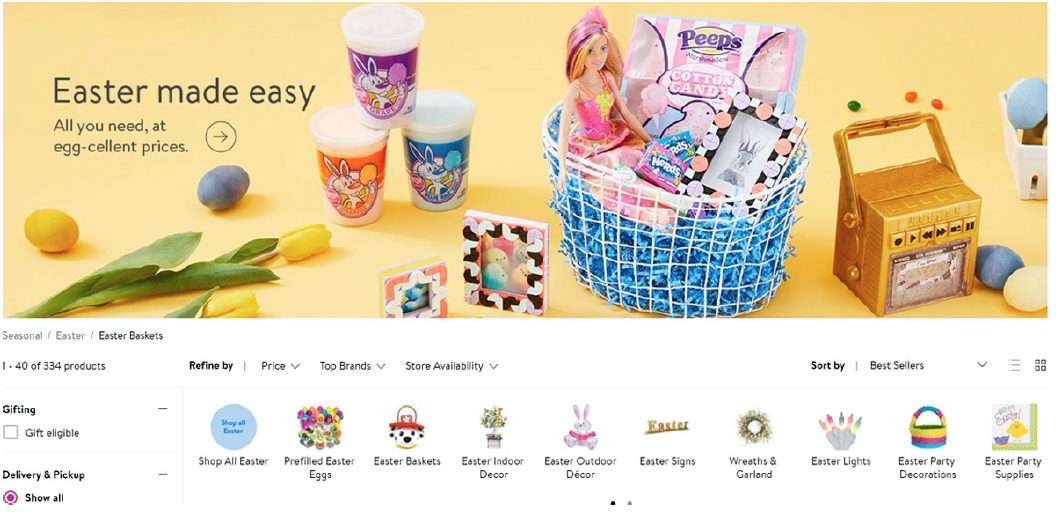

- Walmart is encouraging customers to “build beautiful baskets” with eggs and treats. The retailer is promoting Easter wreaths, décor products and crafting goods for egg painting and making chocolate bunnies. In light of long-distance gifting, it is also offering buy-two-get-one-free on select greeting cards in its stores. Many Easter products on Walmart’s website are sold and shipped by third-party sellers, reflecting the scale of Walmart.com’s marketplace offering—with all purchases on the site qualifying for free shipping. Moreover, the Capital One Walmart Rewards credit card is offering 5% cashback at Walmart.com over Easter.

Walmart’s Easter landing page

Walmart’s Easter landing pageSource: Walmart.com[/caption] [caption id="attachment_125093" align="aligncenter" width="550"]

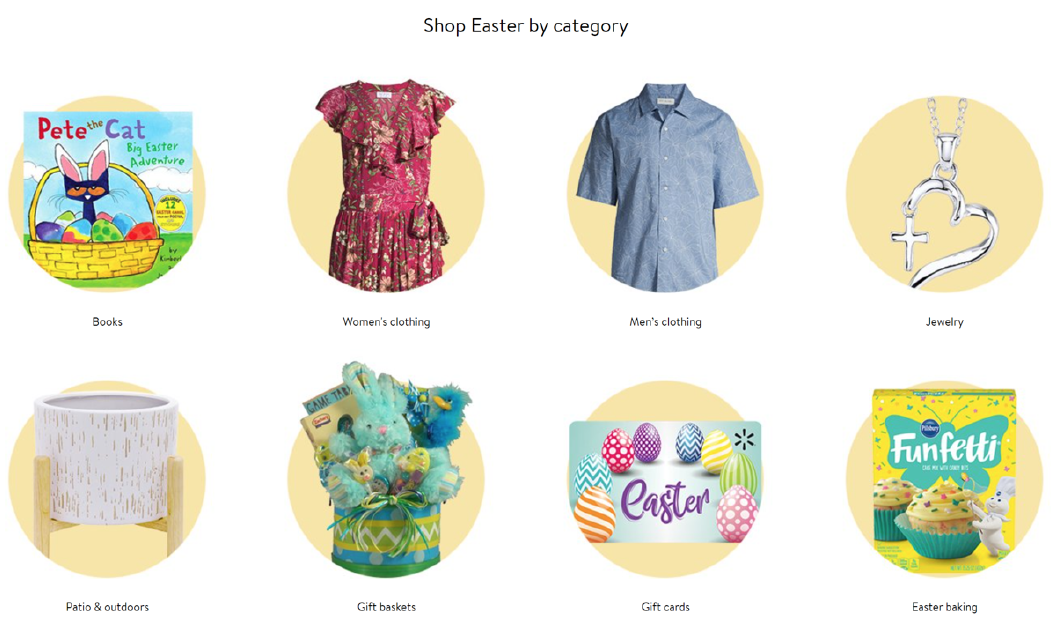

Walmart’s Easter by Category selection

Walmart’s Easter by Category selectionSource: Walmart.com[/caption]

At other retailers:

- Easter has a lower profile on Amazon.com (at the time of writing), with a small homepage link to its Easter shop. That shop features Amazon Launchpad, the retailer’s department for small brands.

- BJ’s Wholesale Club is pledging “unbeatable value” on fresh food, candy, toys and other categories for this Easter.

- Costco.com’s Easter banner at the time of writing focuses on food treats, promising “Your Easter dinners and baskets delivered.”

What We Think

In total, 2021 looks set to provide bumper Easter sales for US retail. Consumers are likely to remain focused on spending time at home—supporting sales of Easter food, outdoor living and leisure goods. These trends will be against the weak period of April 2020 (for nonfood retail), providing a jump in year-over-year terms.

However, across 2021 and into 2022, retail in total is likely to be impacted by the redirection of some spending back to services such as dining out, travel and leisure services. Retailers must make every effort to capitalize on the favorable trends while they can.