DIpil Das

What’s the Story?

The coronavirus pandemic has significantly accelerated the growth of e-commerce. This report provides an overview of e-commerce development in the US in the second quarter of 2020—based on Census Bureau sector data and definitions—and post-crisis trends. We also discuss the performance of e-commerce platforms such as Amazon and eBay, as well as retailers that sell online.Why It Matters

The coronavirus pandemic has made the online channel the preferred option for consumers to shop, as people choose to avoid public places in fear of contracting the virus. Changes in consumer shopping behavior during the crisis could be sustained in the long term. The rise of e-commerce is likely to continue, and companies need to get ready to take on this tailwind. Retailers should reassess the role of physical stores in the context of rising e-commerce business. Coresight Research estimates that there will be 20,000–25,000 total US store closures in 2020. Brands and retailers need to increase investment into growing experiential e-commerce, enhancing omnichannel capabilities and ensuring efficient fulfillment, which is increasingly something that consumers value and therefore represents a key differentiator for retailers.US E-Commerce Post-Crisis Outlook: A Deep Dive

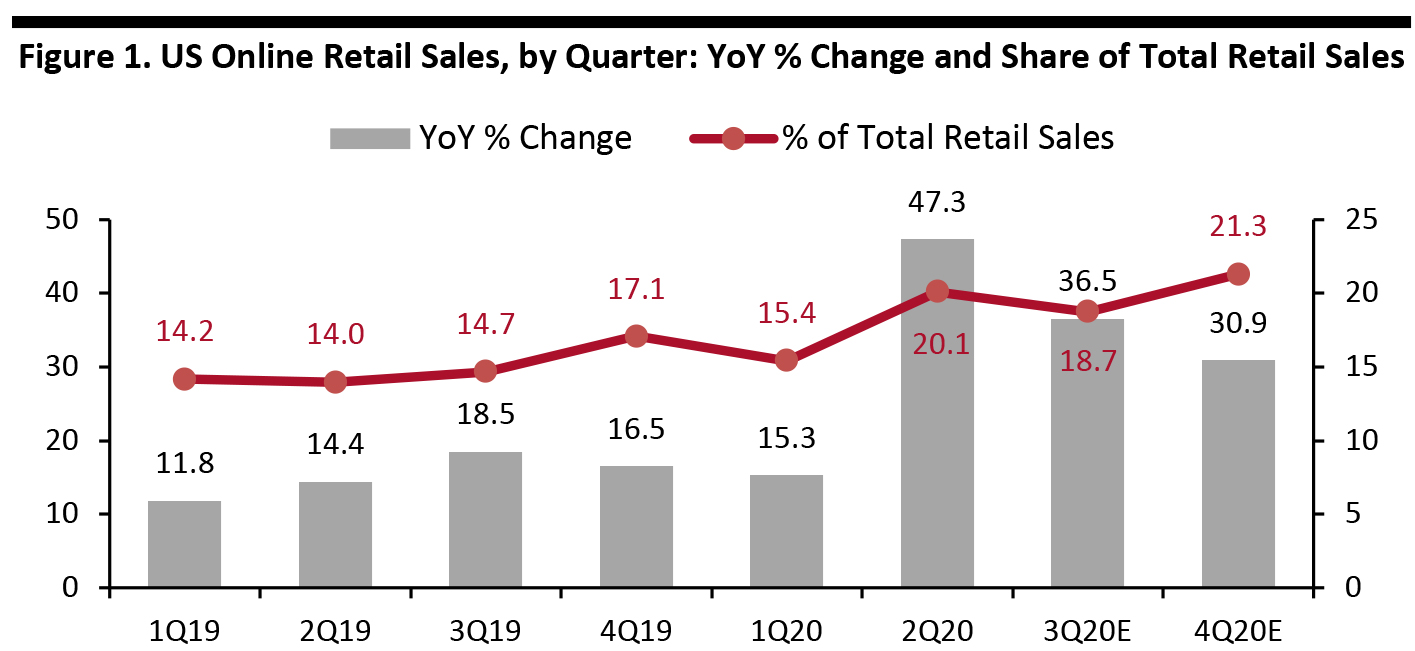

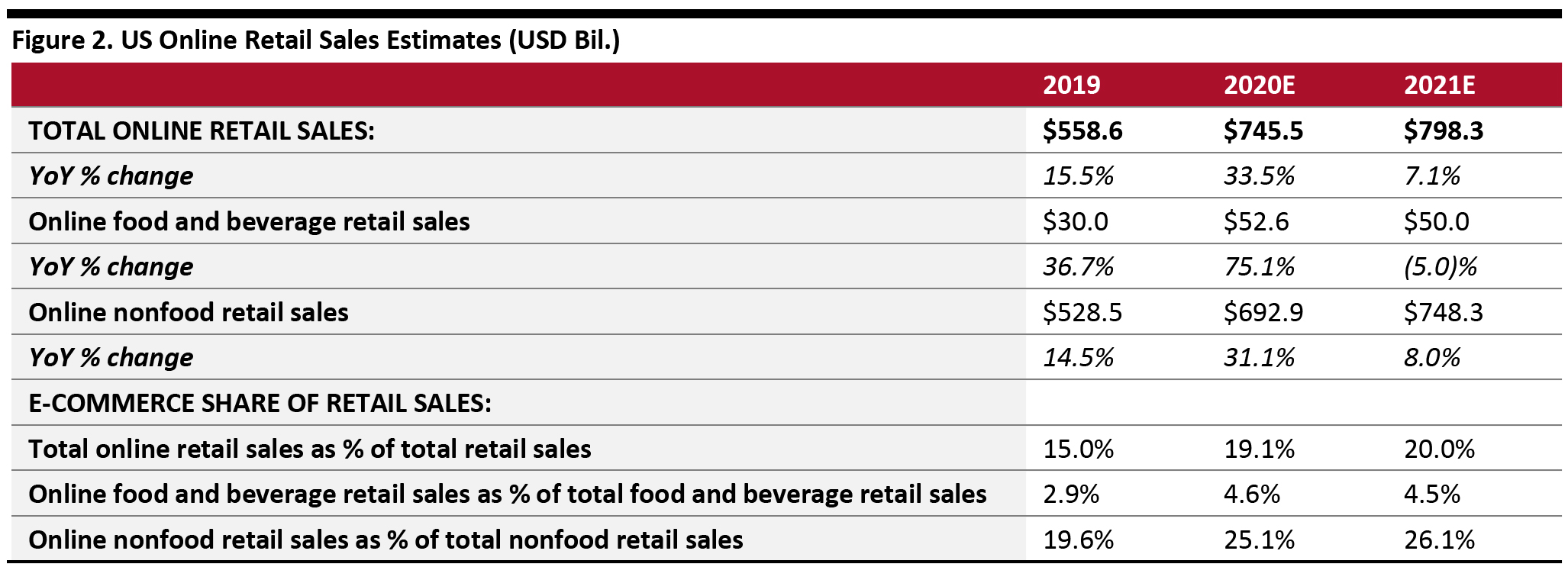

Online Sales Set To Grow by Over 30% in 2020 We estimate that US e-commerce sales will surge by around one-third to $746 billion in 2020—equivalent to around 19% of 2020’s total retail sales. In the second quarter, total US online retail sales grew by 47.3%, according to our analysis of Census Bureau data. That quarter saw Covid-19 lockdowns in April, so our forward estimates assume a reduced year-over-year increase in the third and fourth quarters, as consumers return to stores for some purchases. We calculate that e-commerce accounted for 20% of all retail sales in the second quarter. We expect this to moderate to 18.5% in the third quarter and rise to around 21% in the final quarter—when e-commerce penetration is traditionally at its highest. [caption id="attachment_116636" align="aligncenter" width="700"] Data exclude online sales by automobile dealers and are represented as a percentage of total retail sales ex automobile dealers and gasoline stations

Data exclude online sales by automobile dealers and are represented as a percentage of total retail sales ex automobile dealers and gasoline stations Source: US Census Bureau/Coresight Research [/caption] As we head toward the holidays, we see capacity, rather than consumer demand, being a restraint on e-commerce growth, as retailers and fulfillment firms struggle with a higher-than-anticipated rate of peak demand. E-Commerce To Account for One-Quarter of Nonfood Sales Looking at 2020 and ahead to 2021, we segment online sales by food and nonfood products:

- Online food and beverage retail sales will grow by around three-quarters this year, we estimate from IRI data (shown later). However, food will make up a still-small proportion of all e-commerce sales, and e-commerce’s share of total food retail spend will remain in the low, single digits.

- Nonfood retail sales will grow by around 31% year over year, taking the e-commerce penetration rate to around one-quarter.

Total data exclude online sales by automobile dealers and are represented as a percentage of total retail sales ex automobile dealers and gasoline stations

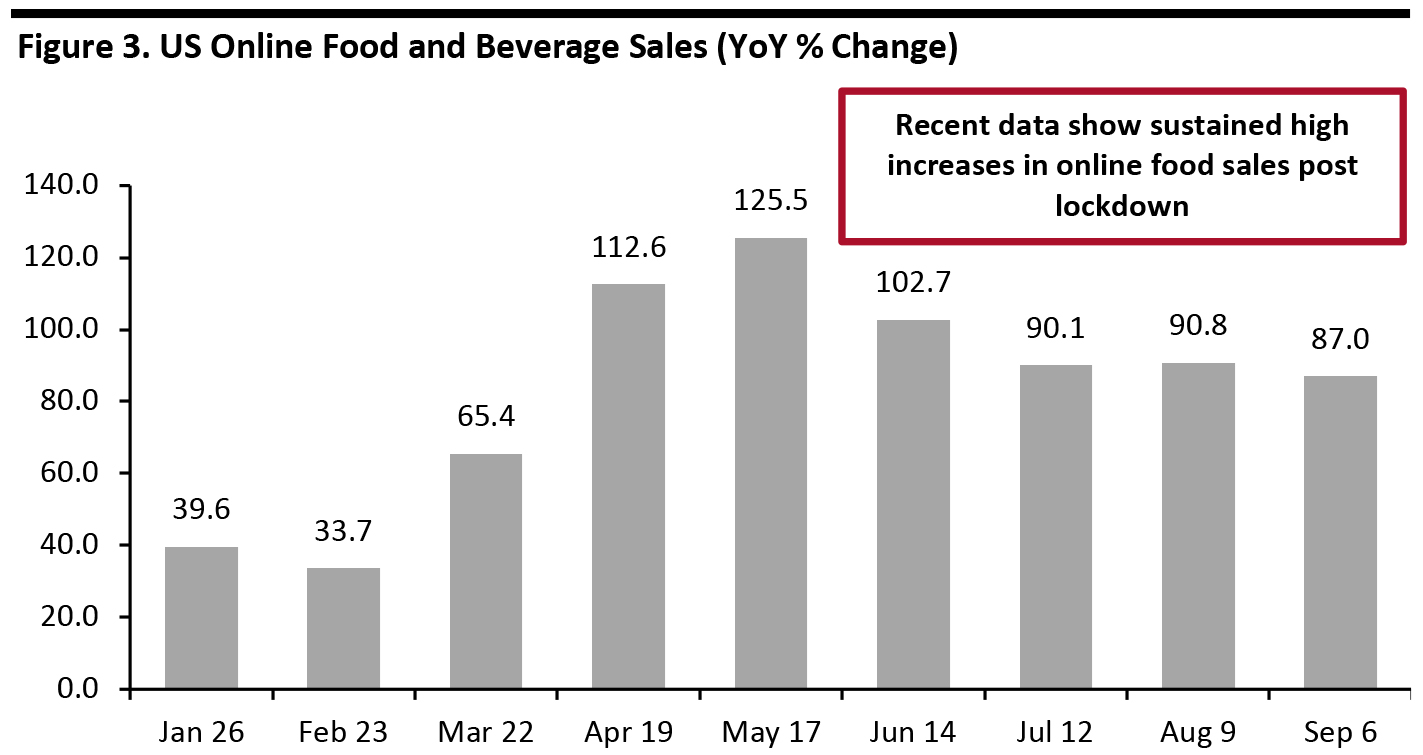

Total data exclude online sales by automobile dealers and are represented as a percentage of total retail sales ex automobile dealers and gasoline stations Source: US Census Bureau/IRI E-Market Insights™/US Bureau of Economic Analysis/Coresight Research [/caption] Grocery Surge Supports E-Commerce Demand According to IRI data, year-over-year growth in online food sales has decelerated from its 125% peak in May. However, the deceleration has been relatively modest in the context of a post-lockdown reopening of the economy. Based on recent trends and assuming some further easing of growth, we estimate that full-year online food sales will grow by around three-quarters. This represents an upgrade to our previously published estimates. This very strong growth nudges up the total for online retail sales growth in 2020—but only slightly: Our analysis of IRI data suggests that food and beverage sales will account for only around 7% of US online retail sales this year. [caption id="attachment_116622" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research [/caption]

Retained Habits

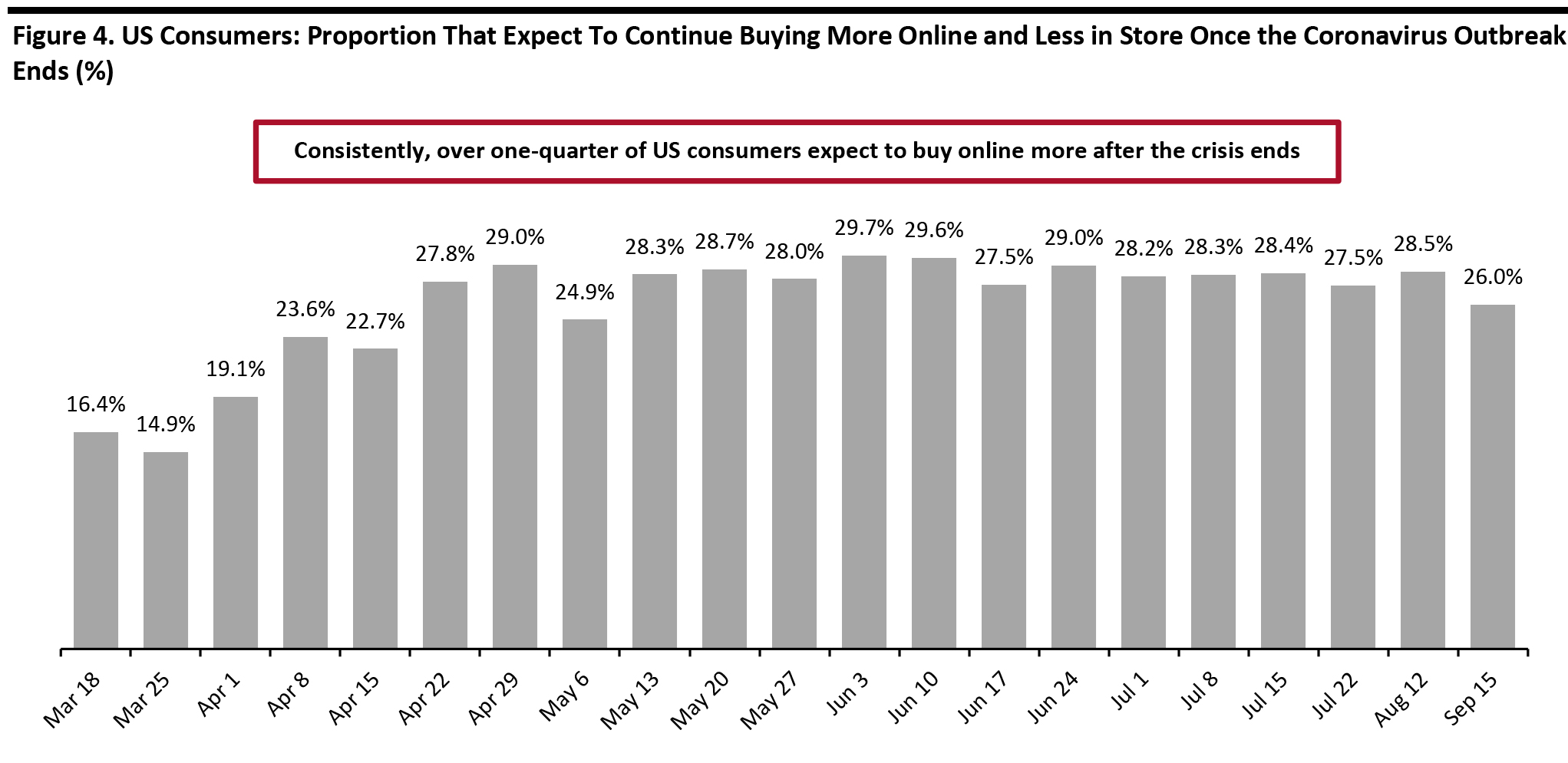

Coresight Research survey data suggest that many US consumers will retain the habit of purchasing more online even when the crisis ends. In our weekly surveys, consistently over one-third say they expect to buy more online and less in stores once the crisis ends. However, given that stores have reopened and many retailers have reported solid levels of in-store sales productivity, consumers are clearly switching some of their retail spending back to the brick-and-mortar channel. We expect to see a partial retention of sales within e-commerce over the medium-to-long term.

See our weekly surveys for more data.

[caption id="attachment_116623" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research [/caption]

Retained Habits

Coresight Research survey data suggest that many US consumers will retain the habit of purchasing more online even when the crisis ends. In our weekly surveys, consistently over one-third say they expect to buy more online and less in stores once the crisis ends. However, given that stores have reopened and many retailers have reported solid levels of in-store sales productivity, consumers are clearly switching some of their retail spending back to the brick-and-mortar channel. We expect to see a partial retention of sales within e-commerce over the medium-to-long term.

See our weekly surveys for more data.

[caption id="attachment_116623" align="aligncenter" width="700"] Base: US Internet users aged 18+

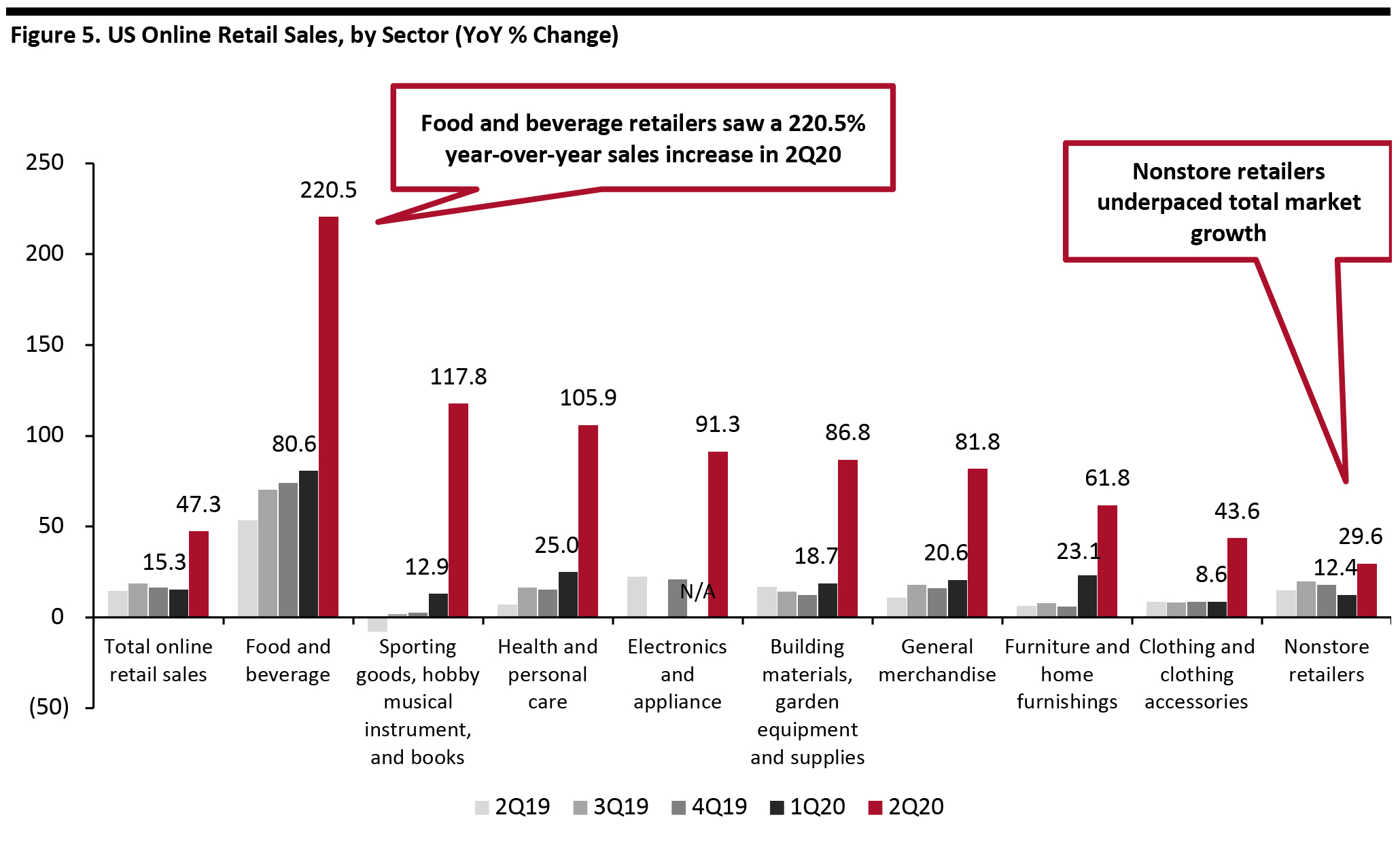

Base: US Internet users aged 18+ Source: Coresight Research [/caption] What Recent Data Tell Us: Sector and Category Data Store-based retailers were the winners in the lockdown quarter, according to data from the US Census Bureau. Online-only retailers (as represented by nonstore), in aggregate, underpaced total e-commerce growth, reporting an overall year-over-year increase of around 30% to the market’s 47%. We saw very high increases in sales through sectors such as electronics and appliances stores, food and beverage retailers, and health and personal care retailers, as well as sporting goods, hobby musical instrument and books retailers. Consumers have shifted purchasing toward items to help them work at home, entertain themselves and make their homes more comfortable—such trends are likely to persist for as long as large numbers of consumers remain at home. The data are by type of retailer, and the 220% increase for food retailers does not include online grocery sales through other channels, such as mass merchandisers, warehouse clubs and online-only retailers; see the IRI data, cited earlier, for growth figures for online food sales in total. [caption id="attachment_116624" align="aligncenter" width="700"]

No data available for Electronics and Appliance Retailers for 3Q19 or 1Q20

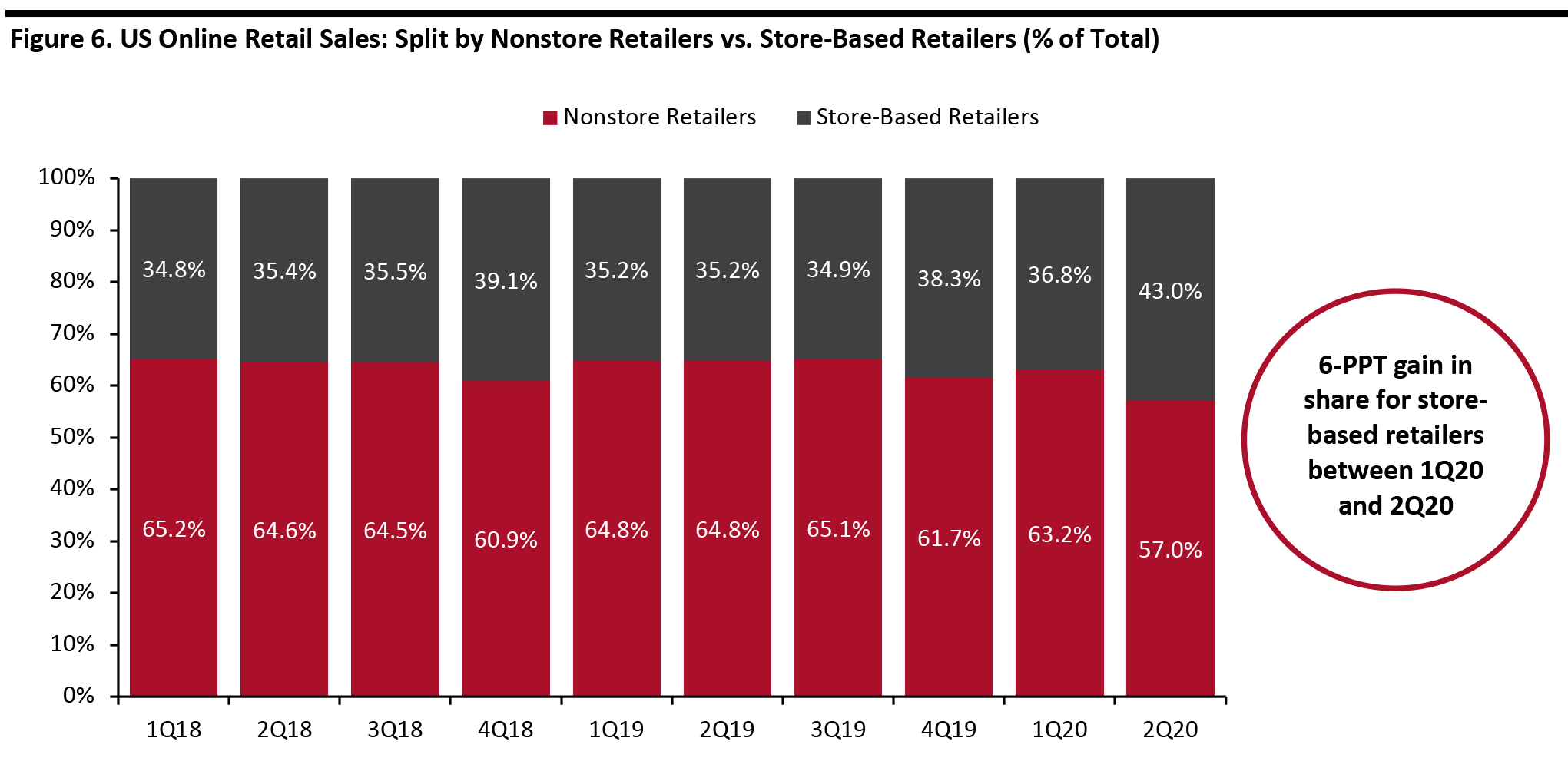

No data available for Electronics and Appliance Retailers for 3Q19 or 1Q20 Source: US Census Bureau/Coresight Research [/caption] Store-Based Retailers Gain Share Online In total, nonstore retailers lost six percentage points of online channel share between the first and second quarters of 2020, we calculate from Census Bureau data. In part, this was a function of the surging demand for online grocery—store-based retailers tend to be better positioned, in terms of range, fulfillment capabilities and website functionality, to serve full-basket online grocery shops than companies such as Amazon. Moreover, as we show later in this report, Coresight Research survey data confirm that at-store collection is far more common when buying groceries online than when making nongrocery purchases online—supporting those retailers that have stores. [caption id="attachment_116625" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research [/caption]

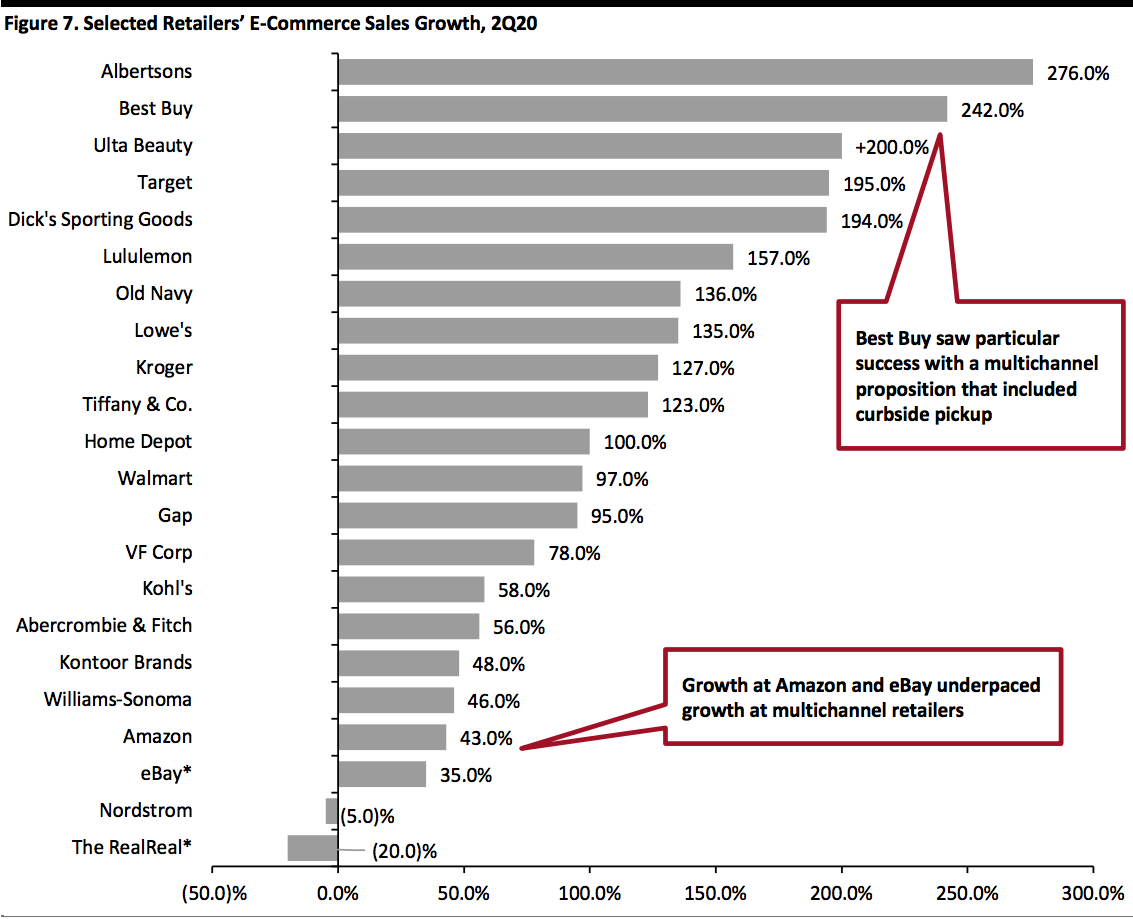

The gains made by retailers with stores are reflected in company-specific data on their e-commerce expansion. Many such retailers in the US reported their biggest online sales growth ever, benefitting from the rapid shift to e-commerce during the pandemic.

Source: US Census Bureau/Coresight Research [/caption]

The gains made by retailers with stores are reflected in company-specific data on their e-commerce expansion. Many such retailers in the US reported their biggest online sales growth ever, benefitting from the rapid shift to e-commerce during the pandemic.

- Best Buy reported that its digital revenue in the US grew by 242%, owing to greater demand for electronic products, such as in the computing, appliances and tablets categories.

- Dick’s Sporting Goods, Home Depot, Kroger, L Brands, Lowe’s, Target and Tiffany & Co. reported triple-digit online growth.

- Ulta Beauty did not disclose an exact growth figure but reported that its sales from e-commerce increased by more than 200%.

- For the quarter ended June 30, Amazon reported that North America revenues were up 43% year over year, although this included its high-growth Amazon Web Services segment; Amazon grew global product sales by 40% year over year.

- eBay reported growth of around 35%—like Amazon, that was overshadowed by the figures reported by many multichannel retailers.

*GMV (US-only GMV for eBay)

*GMV (US-only GMV for eBay)Source: Company reports/Coresight Research[/caption] However, some companies underperformed.

- Nordstrom’s online sales declined by 5% in the second quarter of 2020. The department store chain said that this was largely due to the company moving its popular Anniversary Sale event, which is usually held in July, into the third quarter.

- The RealReal saw GMV decline by 20%. The company noted that the closure of its consignment offices weakened its ability to receive new consignments and authenticate them.

- For the third quarter, Amazon expects net sales to be $87.0–93.0 billion, representing year-over-year growth of 24–32%. Management said that the company is focused on making more room in its fulfillment centers as it prepares to head into the peak holiday shopping season in November.

- In the second half, Lululemon expects its digital sales growth to remain above its pre-Covid growth of 30–40% but moderate as compared to the second quarter’s 155% year-over-year growth in digital revenue.

- Macy’s forecasts slightly stronger digital growth for the third and fourth quarters than the previous year.

- For its fiscal year ended March 2021, VF Corporation expects more than 40% growth in its digital business and its digital penetration to be over 25% of total revenues.

Source: Company reports/Coresight Research[/caption]

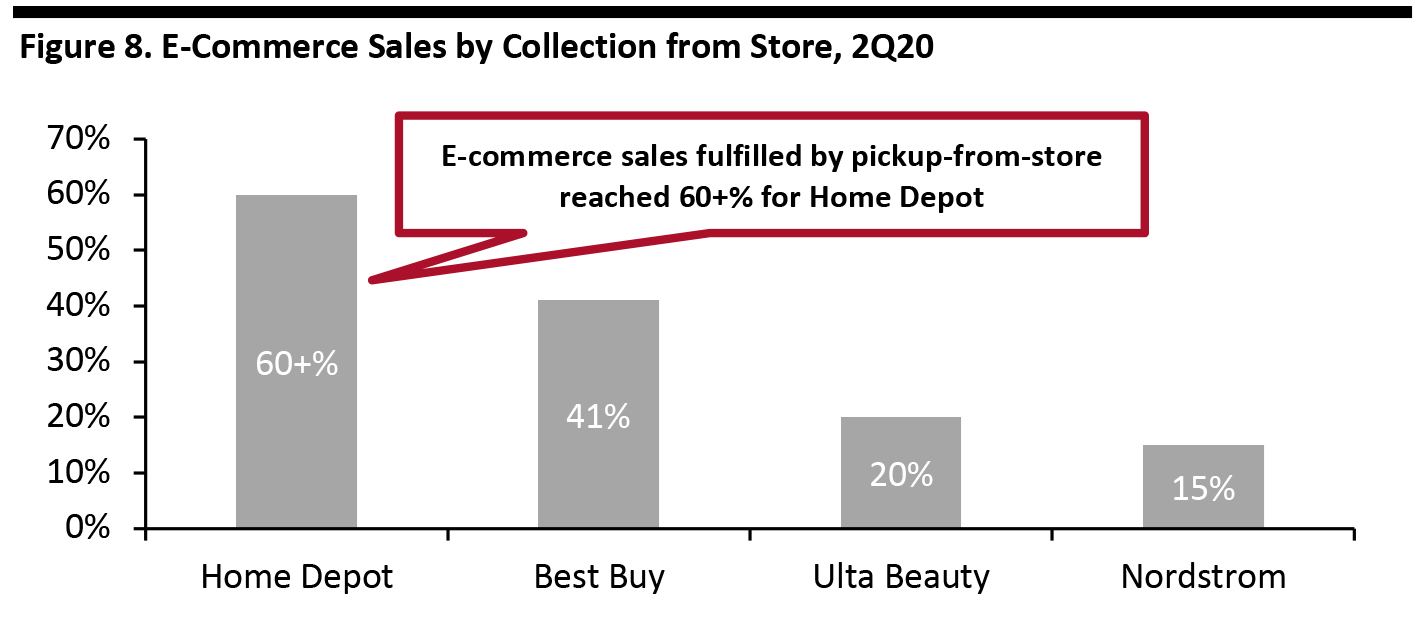

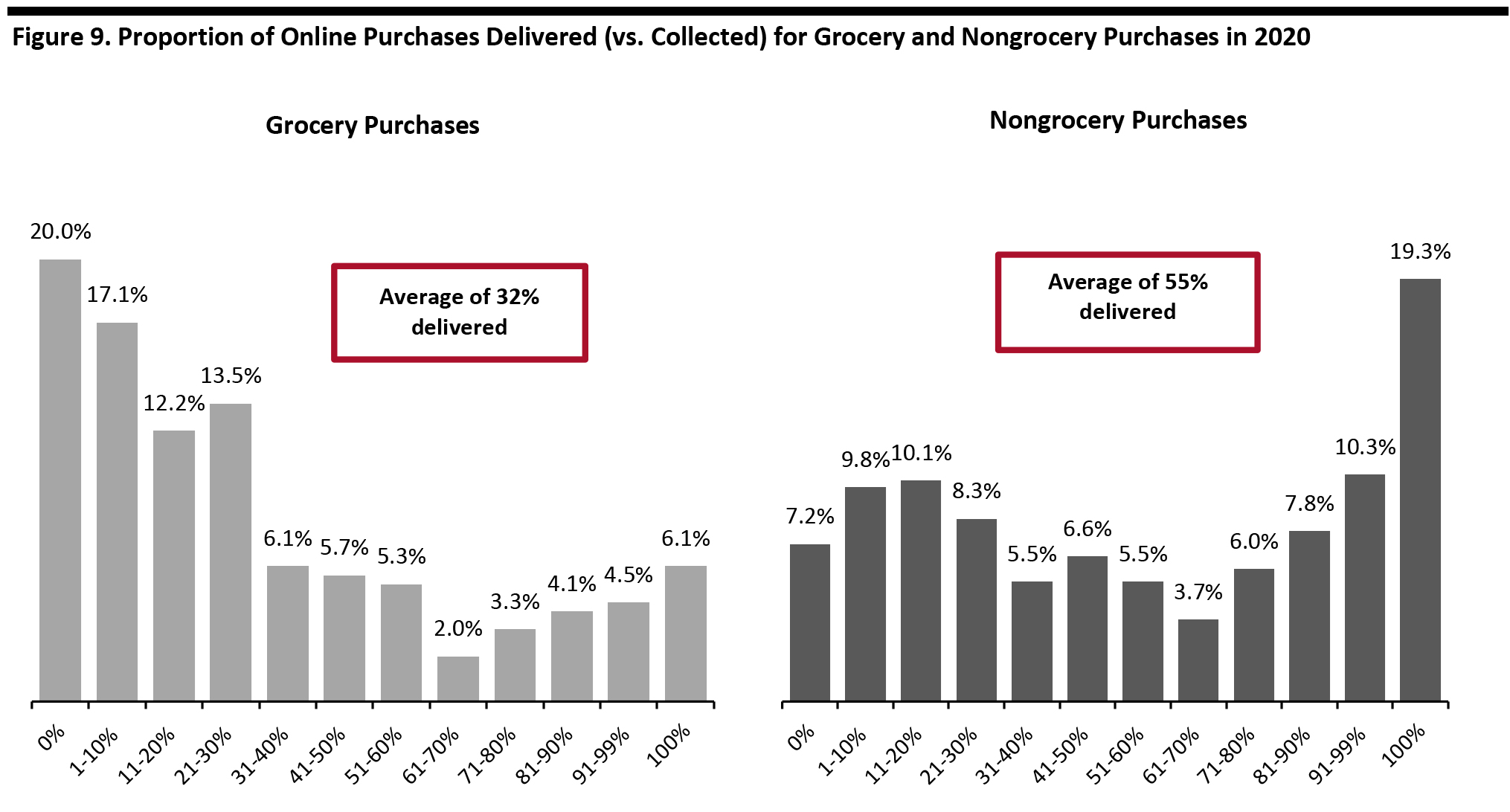

To gauge the balance of consumer demand for collection and delivery, we surveyed online grocery and nongrocery shoppers about their use of fulfillment services so far this year. As charted below, pickup was much more common for grocery purchases than for nongrocery purchases, among our respondents.

Source: Company reports/Coresight Research[/caption]

To gauge the balance of consumer demand for collection and delivery, we surveyed online grocery and nongrocery shoppers about their use of fulfillment services so far this year. As charted below, pickup was much more common for grocery purchases than for nongrocery purchases, among our respondents.

- On average, survey respondents had had a little under one-third (32%) of online grocery orders delivered this year, collecting the majority from stores.

- On average, respondents had had just over half (55%) of online nongrocery orders delivered so far this year—with the remainder collected, such as via BOPIS services.

Base: 406 US Internet users aged 18+ who had bought grocery/nongrocery products online in 2020, surveyed in September 2020

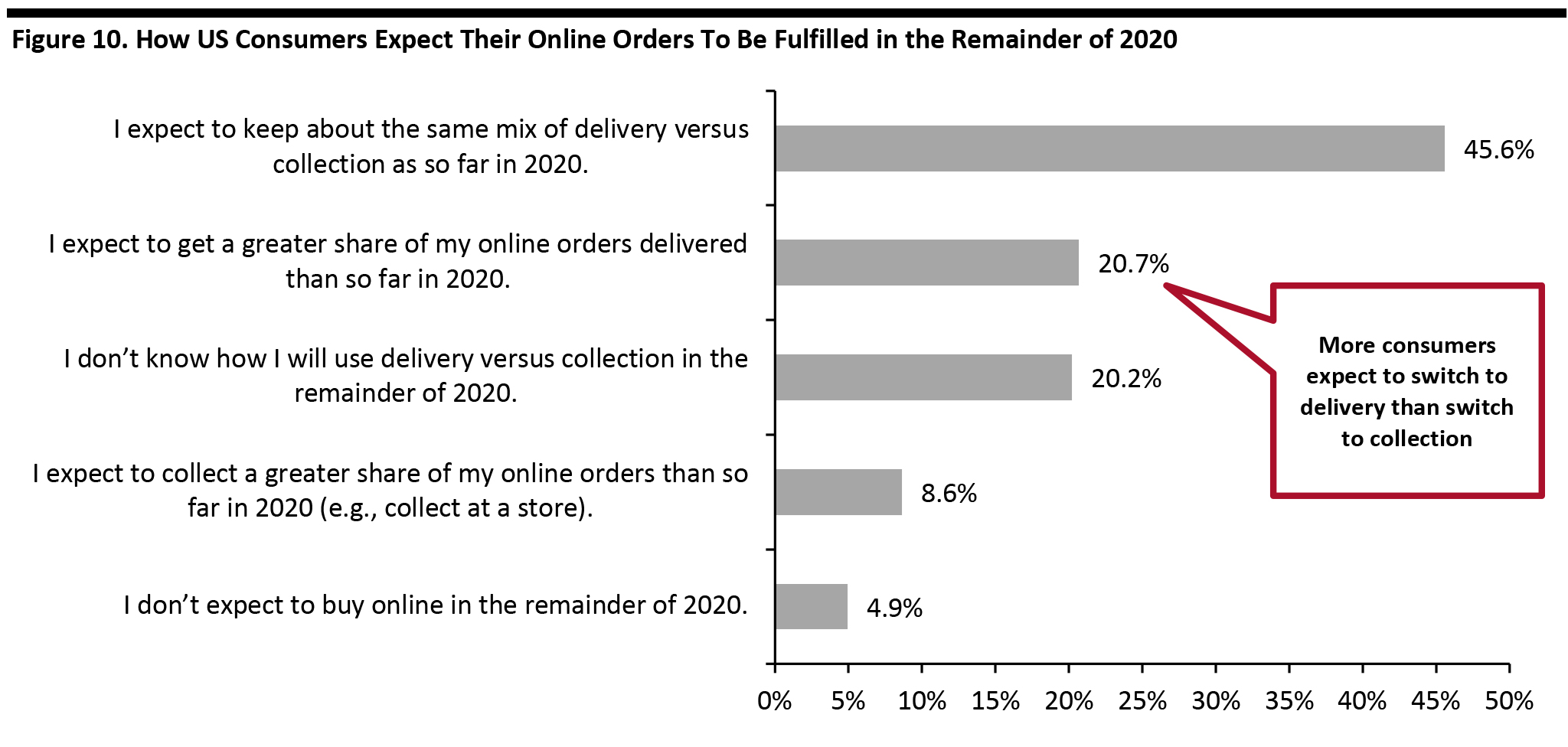

Base: 406 US Internet users aged 18+ who had bought grocery/nongrocery products online in 2020, surveyed in September 2020 Source: Coresight Research [/caption] Consumers’ choice to collect online orders also reflects delivery companies’ capacity constraints in shipping/fulfillment. Parcel providers, including delivery giants FedEx, United States Postal Service (USPS) and United Parcel Service, found it difficult to deliver packages on time. According to ShipMatrix, a shipping data provider, USPS delivered 91.6% of first-class and priority mail parcels on time in July, the lowest percentage since April (91.1%). We see shipping capacity constraints carrying through to the holiday peak, providing a potential cap on e-commerce growth during the final quarter. Around 45.6% of Respondents Will Keep the Same Delivery Mix in the Remainder of 2020 In our survey, we asked consumers whether they expect their mix of fulfillment (delivery versus collection) to change in the remainder of 2020. Some 45.6% reported that they will keep about the same mix of delivery versus collection as so far in 2020. Some 20.7% said they will get a greater share of their online orders delivered, which is significantly greater than the 8.6% that said they will collect a greater share of online orders than so far in 2020. This could sound alarm bells at retailers and delivery firms that may foresee the kind of capacity constraints we outlined above. As we head toward the holidays, it could be in retailers’ best interests to continue to promote collection methods such as BOPIS and curbside options. [caption id="attachment_116629" align="aligncenter" width="700"]

Base: 406 US Internet users aged 18+, surveyed in September 2020

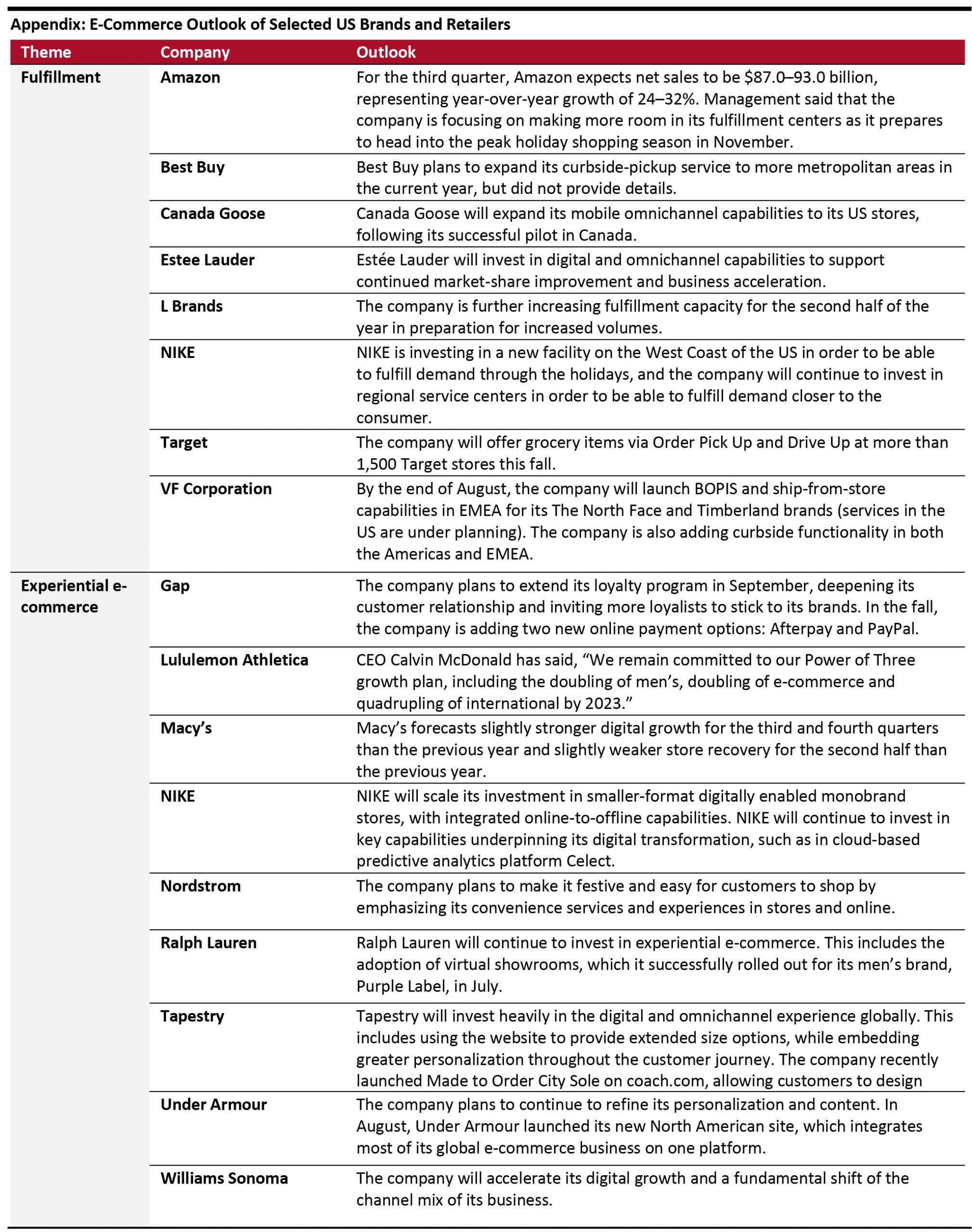

Base: 406 US Internet users aged 18+, surveyed in September 2020 Source: Coresight Research [/caption] An Early Holiday Shopping Season and Postponed Amazon Prime Day Prompt Greater Online Shopping The holiday shopping season is likely to start as early as October, providing for an extended shopping period. A number of retailers have indicated that they expect, or will encourage, an extended holiday shopping season, and Coresight Research data suggest that more consumers expect to start their shopping earlier than usual than expect to start it later than usual. As noted earlier, we expect the e-commerce channel to drive a significantly greater share of sales than last year. In the latest Coresight Research weekly consumer survey, more than 55% of US consumers reported that they are avoiding shopping centers and malls, although this percentage has declined over the past several weeks. More than 40% of respondents said they are avoiding shops in general, but this trend is also slowly receding. Amazon appears to be targeting a shopping surge in October as well. Although the company has not officially announced dates for Amazon Prime Day this year, the event is reportedly planned for early October. Last year’s US Prime Day ran for two days, reflecting the trend of ever-longer shopping events. Furthermore, Amazon’s Black Friday sales are expected to begin on October 26 and run for three weeks, marking an early start to the season. US E-Commerce Trends Post Crisis We studied 50 major US brands and retailers’ outlook on e-commerce, within which 16 companies provided guidance/plans on e-commerce development. We categorized three themes: continuous investment in digital business, further development of omnichannel fulfillment and the adoption of technology in delivery. We discuss these themes below and provide more details by major retailer in the appendix of this report. 1. Continuous Investment in Digital Business The online channel provided sales opportunities during periods of temporary store closures, so many brands and retailers turned to e-commerce amid the Covid-19 crisis. We expect retailers to further experiment with, and invest in, their e-commerce sites in order to remain competitive and drive sales in the uncertain post-coronavirus environment. Whereas recent years have seen an emphasis on in-store experiences, we expect experiential e-commerce to emerge from the crisis. We expect experiential e-commerce techniques such as livestreaming to continue to help brands and retailers offset the decline in offline business and connect with consumers from afar. Livestreaming has begun to be globally recognized as an effective marketing tool. In the US, it is just taking off—we estimate a potential market size for US livestreaming e-commerce of around $25 billion by 2023. This is based on the assumption that livestreaming can capture 2.5% of online retail sales by 2023—half of the proportion that it captures in China. Estée Lauder said on August 20 that the company will continually invest in livestreaming capabilities to support continued market-share improvement and business acceleration. The company already made more investments in deploying shoppable livestreaming globally. For example, Clinique’s livestreaming series led consumers to return more frequently, spend four times longer on the site and convert at higher levels. 2. Further Enhance Omnichannel Capabilities Covid-19 will push brands and retailers to rethink their strategies on ecommerce fulfillment. We expect curbside pickup to be embraced by more retailers in the long term, as shoppers and retailers look for contact-light fulfillment options. Our August 2020 analysis found that 76% of the top 50 store-based retailers in the US now offer curbside pickup. We see that share creeping even higher post crisis. Retailers who rolled out curbside pickup during the pandemic also plan to extend the service to additional stores through the remainder of the year. We anticipate that more brick-and-mortar stores, especially those in densely populated areas, will serve as mini fulfillment centers, in response to consumer demand for faster delivery of online orders. Brands and retailers that start shipping from stores can realize the benefits of having a larger base of inventory closer to consumers, thus the ability to deliver products in shorter lead times. We are also likely to see retailers convert underperforming stores into fulfillment centers, including, in some cases, “dark stores”—stores open only to staff for picking online orders. According to commercial real estate firm JLL, US retailers will need an additional 1 billion square feet of industrial real estate by 2025 as fulfillment space for e-commerce distribution. 3. Drones and Autonomous Vehicles/Robots Drone deliveries are likely to become more commonplace as their potential applications expand. The rollout of 5G technology will also enable a more seamless and fully automated delivery process. Drones can move items quickly as they are able to bypass traffic or complex terrain. We have seen multiple tests of drone delivery services for food and other products in many countries, including in the US. Big companies such as Amazon have their own drone delivery service. Other brands and retailers can seek partnership with third-party tech companies.

- Walmart announced its partnership with delivery startup Zipline on September 14 to use drones to pilot deliver health and wellness products in Arkansas. It will potentially expand to delivery general merchandise later. This partnership came just after its announcement for its partnership with Flytrex to test drone deliveries on September 10.

- Amazon received approval from the Federal Aviation Administration to operate delivery drones for Prime Air in late August.

- CVS worked with UPS to begin delivering prescriptions by drone in Florida from May 2020.

- Grocery chain Rouses Markets announced on July 7 that it would test grocery drone delivery this fall, through its partnership with tech startup Deuce Drone.

- In July 2020, Amazon announced the expansion of its six-wheeled, self-driving delivery robot, Scout, to two more cities in Georgia and Tennessee.

- Starship Technologies, which mainly uses robots to deliver groceries and food on college campuses, has extended its reach to several new areas in Arizona, California and Washington, D.C. The company said it has more than tripled its robot delivery fleet in the last year.

What We Think

The coronavirus outbreak has significantly accelerated the growth of e-commerce. Coresight Research surveys regularly confirm that a substantial share of US consumers expect to retain the habit of shopping more online, less in stores after the crisis ends—although the incremental recovery of store-based sales indicates that we will ultimately see a partial retention of sales in the online channel. Implications for Brands/Retailers- We expect total online sales to rise by just over 30% in the holiday 2020 quarter, taking e-commerce’s share of all retail sales to approximately 21%. This will place significant logistical pressures on retailers and shipping firms. In fact, we expect capacity constraints to be one inhibitor of fourth-quarter e-commerce growth.

- Omnichannel retailers have tended to see the greatest e-commerce growth during and after lockdown, and this is reflected in surging demand for collection options. However, Coresight Research survey data indicates a significantly greater proportion of consumers expect to switch online purchases to delivery than to collection in the remainder of 2020. This could sound alarm bells at retailers and delivery firms that may foresee capacity constraints. As we head toward the holidays, it could be in retailers’ best interests to continue to promote collection methods such as BOPIS and curbside options

- Faced with pressures from surging demand online, retailers must encourage consumers to begin their online holiday shopping early, pulling shopping forward to October from the traditional Black Friday kickoff.

- The outlook for 2021 in terms of the growth trajectory is highly uncertain given the unprecedented context, including demanding comparatives. We currently estimate that total online sales will climb by single digits in 2021, although growth rates are likely to be mixed, by category and by time period, such as when we annualize the lockdown period. However, e-commerce penetration rates are likely to remain elevated across categories, compared to pre-crisis rates.

- Multichannel retailers must continue to invest in e-commerce capabilities in the medium term. This includes fulfillment from stores—whether BOPIS, curbside pickup, for rapid delivery or ship-from-store for regular delivery. Retailers faced with surging online sales and dwindling store traffic can consider converting some stores entirely or partially to fulfillment centers—akin to the “dark store” model used in the online grocery space.

- Companies can offer technologies that enable efficient curbside pickup—including AI-enabled inventory management, real-time product-location tracking, automation and robotics.

- They can focus on developing technologies in autonomous robots and drones, including AI, sensors, GPS and computer vision.

- Companies could provide technology support to optimize and streamline delivery, such as AI, machine learning, IoT (Internet of Things) sensors and analytics.

- Technology vendors can support brands and retailers to enable livestreaming platforms to identify products being promoted by livestream hosts and display associated embedded links that viewers can click to make purchases.

- Technology vendors should consider developing in-video checkout technologies for livestreaming that will enable frictionless purchasing and drive conversion.

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.