albert Chan

Introduction

The line between beauty, wellness and fitness have been blurring for years in the US, accelerated by millennial and Gen Z look-good feel-good momentum. While numerous health food bars and cafés, and athleisure stores continue to dot the living well and looking good landscape, drugstores have been rolling out initiatives of their own, too. In this report, we explore what two major US drugstore retailers, CVS Health (CVS) and Walgreens Boots Alliance (Walgreens), have done and examine the opportunities for them in the beauty and wellness space. Under beauty, we look at the companies’ initiatives and review spending on cosmetics, skincare, haircare and other beauty products and services. The term “wellness” is rather broad, so for the purposes of this report, we look at initiatives and programs drugstores have launched to help the general wellbeing of customers, as well as reviewing spending on healthcare and on non-prescription drugs.What US Drugstores Have Done in the Beauty and Wellness Space

CVS and Walgreens have not only refreshed and redesigned beauty spaces in their stores but have also partnered with other retailers to provide new and exciting experiences to customers. [caption id="attachment_85595" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

CVS Beauty Initiative: Shops-in-Shops Called BeautyIRL

In October 2018, CVS launched shops-in-shops called BeautyIRL at four of its pharmacies. IRL, which stands for “in real life,” is aptly aligned with millennial social media speak. The spaces feature expanded and redesigned beauty departments and offer mini beauty (quick services, not the full-fledged ones offered at salons) through CVS’s partnership with a tech-driven beauty services company Glamsquad.

[caption id="attachment_85596" align="aligncenter" width="522"]

Source: Company reports/Coresight Research[/caption]

CVS Beauty Initiative: Shops-in-Shops Called BeautyIRL

In October 2018, CVS launched shops-in-shops called BeautyIRL at four of its pharmacies. IRL, which stands for “in real life,” is aptly aligned with millennial social media speak. The spaces feature expanded and redesigned beauty departments and offer mini beauty (quick services, not the full-fledged ones offered at salons) through CVS’s partnership with a tech-driven beauty services company Glamsquad.

[caption id="attachment_85596" align="aligncenter" width="522"] BeautyIRL spaces in CVS

BeautyIRL spaces in CVSSource: CVS Health[/caption] Key features of CVS’s expanded offer at BeautyIRL spaces are:

- A Korean Beauty or “K-Beauty” Shop: CVS stocks over 500 K-beauty products and is one of the biggest retailers of the products in the US, according to news outlet Refinery29, and we expect this section to be a popular feature of BeautyIRL spaces. Innovations in skincare products and quirky makeup have propelled K-beauty to be a dominant market trend over recent years in the US and international markets. Millennials often seek out novelty in experiences and look for natural and eco-friendly characteristics when shopping. These have been some of Korean beauty retailers’ key success drivers: Brands such as Choc Choc sell sheet masks with cute animal faces, and Innisfree makes cosmetics from natural ingredients.

- Brand Boutiques: These areas highlight brands popular with CVS customers so they can easily find popular products.

- “Now Trending” Wall: The “Now Trending” wall puts the spotlight on socially driven brands and trending independent brands, such as e.l.f., Peripera and NYX.

- Mini Beauty Services: Glamsquad professionals are available to provide dry hairstyling services, 30-minute makeup refreshes and manicures. CVS said it will also include a hair color mixing station by hair color company eSalon that will let users create custom hair colors to use at home.

- Project Health: This annual program offers no-cost health assessments, including blood pressure, body mass index measurements, and glucose and cholesterol screenings. Since launch, CVS has provided over $127 million in free health care services to nearly 1.7 million Americans through its Project Health program.

- Attain Apple Watch App: CVS and Aetna worked with Apple to launch an Apple Watch app called “Attain” to provide new a “health experience” to Aetna members. The app:

o Give Aetna members personalized daily and weekly activity goals based on age, gender and weight.

o Log members’ daily activities and recommend weekly challenges to improve overall health and well-being.

o Send health notifications such as reminders for vaccinations and prescription refills.

o Allow members to earn rewards for meeting health goals and taking recommended actions – including getting the Apple Watch free for participating in the program.

[caption id="attachment_85597" align="aligncenter" width="344"] Attain Apple Watch App

Attain Apple Watch AppSource: Attain by Aetna[/caption]

- HealthHUB: In February this year, CVS launched three pilot HealthHUB stores in Houston which offer a broader range of healthcare services compared to regular CVS pharmacies. The HealthHUBs offer digital tools, health kiosks and personalized care for patients managing chronic conditions as well as those looking for holistic wellness products and therapies. They include community spaces, called Wellness Rooms, for health classes, nutritional seminars and benefits education.

HealthHub stores

HealthHub storesSource: CVS Health[/caption] Walgreens Beauty Initiatives: Birchbox Collaboration and Store Revamp In 2018, Walgreens announced a partnership with online beauty subscription retailer Birchbox, which included revamped retail spaces at select Walgreens locations that look like mini Birchbox stores. Walgreens has also redesigned stores to feature beauty sections at the front of the stores.

- Birchbox Collaboration: The 400- to 1,000-square-foot Birchbox spaces feature full-size makeup, skincare and other beauty products from over 40 brands specially curated by Birchbox. At interactive Build Your Own Box (BYOB) counters in stores, consumers can test new products by picking and choosing five samples and take them home in an exclusively-designed box while they consider a subscription.Birchbox offers the following personalized subscription boxes for women and men, priced at $10 per month:

o Birchbox Beauty for women, featuring a mix of makeup, hair, skincare and perfume samples.

o Birchbox Grooming for men, which includes a mix of hair styling, beard care, skin care and other samples.

[caption id="attachment_85599" align="aligncenter" width="528"] Birchbox at Walgreens

Birchbox at WalgreensSource: Walgreen[/caption]

- Redesigned Stores with Beauty Focus: Walgreens has revamped some of its stores by moving the beauty section to the front, relegating candy and snack shelves — which usually command the space — to the back. Customers are greeted with attractive displays and counters showcasing bath bombs, lip balm and other products. The retailer has been working on a Walgreens Beauty Differentiation concept since 2017, which saw it rollout revamped beauty sections with an expanded beauty product, a new brand mix and specially trained beauty consultants on hand to help customers with products. On the retailer’s most recent earnings call in April, EVP and CFO James Kehoe remarked that Walgreens will continue to “refocus resources on health, wellness and beauty.”

- Balance Rewards for Healthy Choices: Walgreens introduced this program to help participants “modify behavior risk factors associated with the nation’s most urgent public health issues.” This program encourages members to form healthy habits by making healthy choices such as exercising regularly or quitting smoking. Members who meet goals are rewarded with Walgreens Balance Rewards loyalty program points, which they can use to shop, or get special deals in-store and online. The program includes three key elements:

o Get Fit: Program participants earn points for activities such as biking, walking and running, which are tracked by connecting their Balance Rewards account with fitness devices, such as a Fitbit or Withings, and apps such as RunKeeper, MapMyFitness and MyFitnessPal.

o Manage Health: Members who monitor blood pressure and blood glucose levels through iHealth and other such devices can connect their Balance Rewards account to a smart device to track their progress. Walgreens’ smoking cessation program participants can also earn Balance Reward points. Members also receive points when they fill prescriptions or are get an immunization at a Walgreens clinic.

o Eat Right: Members earn points each time their weight is checked through a wireless Wi-Fi or Bluetooth scale that connects to the program site or app, or by logging their weight manually.

- Feel More Like You: With this program, Walgreens has combined pharmacy, health and beauty services to help cancer patients and their caregivers manage the medical and physical changes that accompany cancer treatment. Walgreens has trained over 12,000 pharmacists to recommend OTC products to help manage treatment side effects, such as fatigue and skin rashes. The retailer has also trained over 3,000 beauty consultants to manage the physical changes linked to treatment, such as loss of eyebrows and eyelashes, dry hair and skin and changes to nails. This program began as a pilot at 100 stores in 2018 and is now available at 3,000 Walgreens stores across the US.

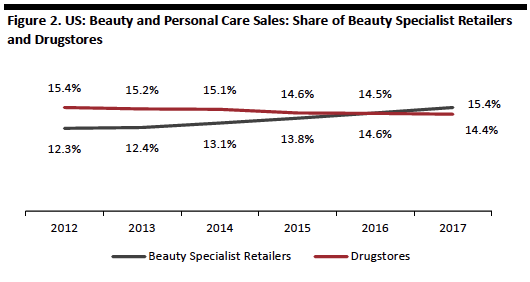

Beauty Specialist Retailers Are Overtaking Drugstores in Beauty and Personal Care

As more shopping shifts online, US retailers with a large physical presence have been forced to rethink the relevance of stores and the experiences they provide to shoppers. US drugstore retailers’ share of beauty and personal care sales has been declining, from 15.4% in 2012 to 14.4% in 2017, while that of beauty specialist retailers has been growing, from 12.3% in 2012 to 15.4% in 2017, according to data from Euromonitor International. [caption id="attachment_85600" align="aligncenter" width="530"] Data represent in-store sales only.

Data represent in-store sales only.Source: Euromonitor International[/caption] The rise of beauty specialist retailers such as Sephora and Ulta Beauty pose a threat to the beauty departments of multicategory retailers, thanks to the unique experiences they provide. Apart from well-laid-out stores and a plethora of products and brands, Sephora, for instance, provides a host of digital tools to personalize the in-store shopping experience. By connecting customers’ digital experience to stores, Sephora sales associates can make recommendations based on shopping history, while the retailer’s mobile app can function as an in-store recommendation tool, providing store-specific product information and suggestions based on past shopping history. While CVS and Walgreens may not have incorporated digital tools to the extent that Sephora has, redesigned beauty and wellness spaces are a step in the right direction.

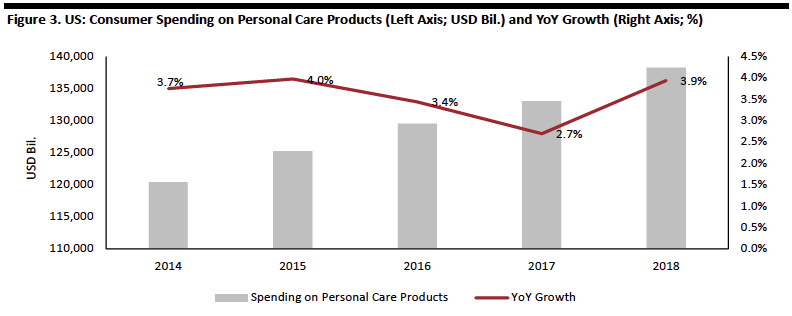

US Consumers Spent $138 Billion on Personal Care Products in 2018

In 2018, US consumers spent $138 billion on personal care products, which includes hair, dental, shaving, bath and other beauty products and electrical appliances for personal care. This represented growth of 3.9% year over year and a CAGR of 3.5% over five years. If consumer spending on personal care grows at a similar CAGR this year, it will reach $143 billion. [caption id="attachment_85601" align="aligncenter" width="700"] Source: Bureau of Economic Analysis[/caption]

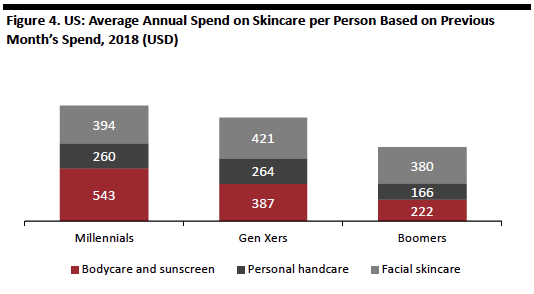

Millennials tend to spend the most on skincare products (which includes body care and sunscreen, personal hand care and facial skincare), according to a February 2018 survey by L.E.K. Consulting. On average, millennials tend to spend $1,197, gen Xers spend $1,097 and boomers spend $768 annually on skincare products.

[caption id="attachment_85602" align="aligncenter" width="534"]

Source: Bureau of Economic Analysis[/caption]

Millennials tend to spend the most on skincare products (which includes body care and sunscreen, personal hand care and facial skincare), according to a February 2018 survey by L.E.K. Consulting. On average, millennials tend to spend $1,197, gen Xers spend $1,097 and boomers spend $768 annually on skincare products.

[caption id="attachment_85602" align="aligncenter" width="534"] Base: 1,600 US millennials, Gen Xers and baby boomers.

Base: 1,600 US millennials, Gen Xers and baby boomers.Source: L.E.K. Consulting[/caption]

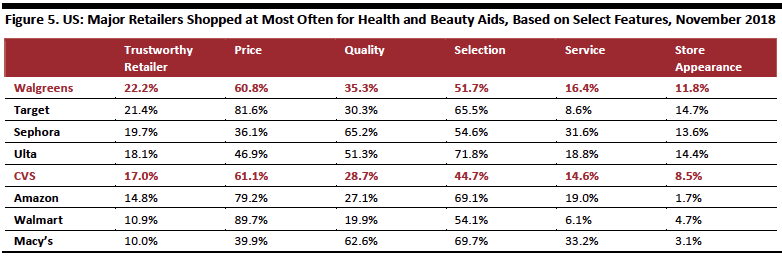

There’s an Opportunity for Drugstores to Fill a Niche in the Beauty Market

Sephora and Ulta Beauty may be positioned to cater to the premium consumer segment, but drugstores are preferred over other retailers as consumers find them more accessible in terms of price and trust them more than other retailers. Walgreens is the most-preferred retailer to shop at for health and beauty aids, in terms of trust, according to a survey of over 7,000 US adults in November 2018 by Prosper Insights and Analytics. The same survey found that over 60% of shoppers prefer to buy health and beauty aids at Walgreens and CVS because of pricing. Sephora and department store retailer Macy’s rank highly in terms of quality of products sold as well as for customer service. Walgreens and CVS rank lowest in terms of selection of products but fare better than mass merchandiser Walmart and Macy’s for store appearance. [caption id="attachment_85604" align="aligncenter" width="700"] Base: 7,000+ US adults surveyed in November 2018

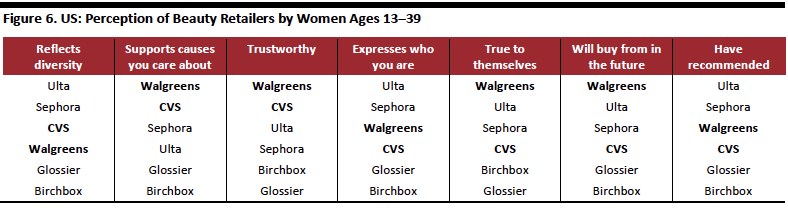

Base: 7,000+ US adults surveyed in November 2018Source: Prosper Insights and Analytics[/caption] Many millennials and Gen Zers care deeply about themes such as authenticity and social causes and Walgreens appears to resonate with them in this regard. A survey of US female consumers ages 13-39 by youth marketing company Ypulse ranked Walgreens above the top beauty specialists and CVS on four factors: supporting causes they care about, for being trustworthy, for being true to themselves and for being the retailer they will buy from in the future. CVS ranked just below Walgreens on two factors: supporting causes the respondents care about and for being trustworthy. [caption id="attachment_85606" align="aligncenter" width="700"]

Base: 1,000 US female consumers ages 13–39 surveyed in 2018.

Base: 1,000 US female consumers ages 13–39 surveyed in 2018.Source: Ypulse[/caption] Consumer perceptions of CVS and Walgreens are that they can be trusted and offer better prices than premium retailers. With drugstores taking steps in terms of store experience and design as well as customer service, they are bridging the gap between mass and premium product segments. In the wellness space, drugstores can contribute to reducing healthcare costs through preventive care services, screenings and fitness activities they encourage through wellness programs.

How Drugstores Can Contribute to Saving Healthcare Costs

In a note on preventive healthcare, the Centers for Disease Control and Prevention (CDC) suggests that taking preventive measures, undergoing regular screenings, eating healthy food and exercising regularly can go a long way in warding off or even mitigating chronic conditions. Some of those are heart disease, cancer and diabetes – which together account for 75% of national healthcare spending in the US, according to the CDC. These problems also affect productivity and result in an average of 69 million workers reporting days missed due to illness per year, cutting national economic output some $260 billion annually. In 2017, National Health Expenditure (NHE) grew 3.9% to $3.5 trillion, or $10,739 per person, accounting for 17.9% of Gross Domestic Product (GDP), according to the Centers for Medicare and Medicaid Services (CMS). In the years between 2018 and 2027, the CMS expect NHE to grow at an average rate of 5.5% per year, reaching some $6.0 trillion by 2027. Wellness programs from Walgreens and CVS have seen some successful results. Latest data from the Walgreens Balance Rewards for Healthy Choices program indicates that it has benefited its participants to a significant extent:- 100% of participants who tracked activities and logged weight lost an average of 3.3 pounds, indicating a positive correlation between tracking physical activity and making healthy choices.

- The proportion of participants that took their prescriptions as directed was 5.4 percentage points higher if they regularly monitored and logged serum glucose than those who did not.

- The proportion of participants that took their blood pressure medication as directed was 2.4 percentage points higher for people who regularly monitored and logged blood pressure than those that did not.