Nitheesh NH

Introduction

As more shopping shifts online, US drugstore chains with large physical footprints have been forced to rethink the relevance of their stores and the experiences they provide to consumers. In this report, we explore how two traditional pharmacy chains—CVS and Walgreens—are revamping themselves in the face of competition from players such as Amazon, Walmart and e-pharmacy startups. We cover the following topics:- Healthcare

- Beauty

- Loyalty programs

- Partnerships—CVS with Target and Walgreens with Kroger

- Market disruption by major e-pharmacy startups

- The possible privatization of Walgreens

CVS and Walgreens on the Healthcare Path

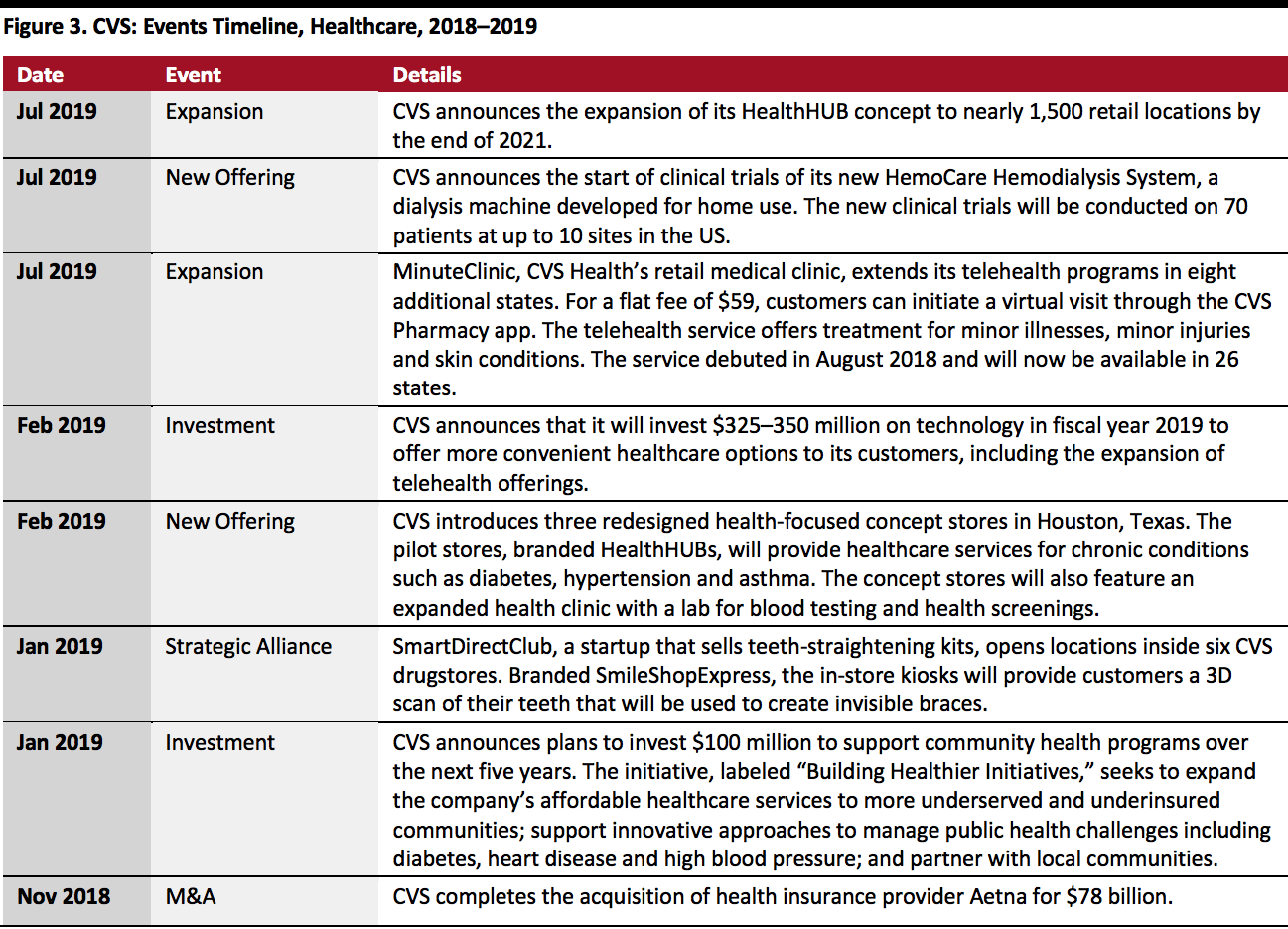

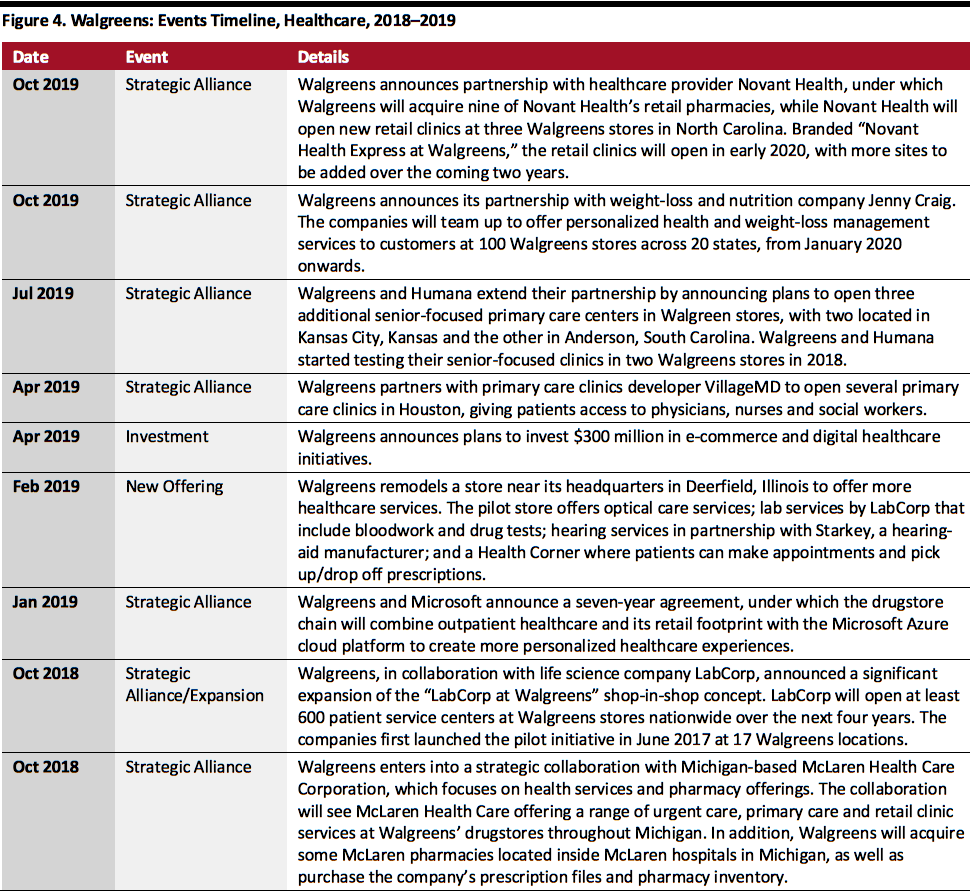

CVS and Walgreens are embracing retail healthcare as a critical part of their growth strategies. For the last two years, CVS and Walgreens have been redesigning their physical retail spaces to offer comprehensive primary care services to consumers at a lower cost. Walgreens has forged a series of partnerships with medical-care providers and health-insurance companies to provide in-store health services and primary care. On the other hand, CVS has relied on acquisitions—including the late-2018 takeover of health insurer Aetna—to make its push into the healthcare sector. CVS HealthHUBs Building on the positive customer response to its HealthHUB pilot program—which was introduced in February 2019 in three stores in Houston—CVS announced in June 2019 that it would expand the HealthHUB format to 1,500 retail locations by the end of 2021. In January 2020, the company said 600 of these conversions would be undertaken this year. HealthHUBs are remodeled CVS drugstores that have 20% of their retail space dedicated to healthcare services, including wellness products and personalized care. HealthHUB stores stock a higher number of new health products and medical equipment and feature an expanded health clinic, where nurse practitioners provide services such as diabetic screening, blood tests and sleep apnea assessments. The HealthHUB format also hosts in-store dieticians to provide one-on-one guidance to customers about nutritional health and weight management programs. In addition, the stores feature wellness rooms for group events such as health seminars and yoga classes. [caption id="attachment_102819" align="aligncenter" width="700"] Source: CVS Health[/caption]

The launch and expansion of the HealthHUB format signal the shift of CVS from a traditional pharmacy chain to what the company calls an “elevated healthcare destination.” CVS already operates a network of approximately 1,100 MinuteClinic medical clinics inside its stores, which offer diagnosis services and the treatment of minor illnesses and injuries. However, its HealthHUB stores are better equipped to deal with chronic conditions such as respiratory illnesses and diabetes. Furthermore, by devoting more retail space to healthcare services, the company is looking to reduce its reliance on nonpharmacy retail sales (including greetings cards, chocolates and seasonal merchandise), as shoppers are increasingly buying nondrug products online or from convenience stores.

Walgreens’ Partnership with VillageMD

In April 2019, Walgreens partnered with Chicago-based primary healthcare provider VillageMD to open primary care clinics next to five of its stores in Houston. Branded “Village Medical at Walgreens,” the 2,500-square-foot primary care clinics will offer services including chronic care management, annual preventive care, women’s health services, smoking cessation, vaccinations, diagnostic testing and some specialty care. The clinics will be staffed with pharmacists, primary care physicians, nurses and social workers. Walgreens and VillageMD opened the first Village Medical at Walgreens in November 2019.

In recent years, to diversify its business beyond traditional pharmacy sales, Walgreens has inked a number of agreements to provide retail clinic services at its stores. The company has partnered with UnitedHealth Group to place MedExpress urgent care centers at 15 Walgreens locations in six states. It also runs senior health clinics at five locations in collaboration with health insurer Humana.

CVS and Walgreens Go Head to Head in Beauty

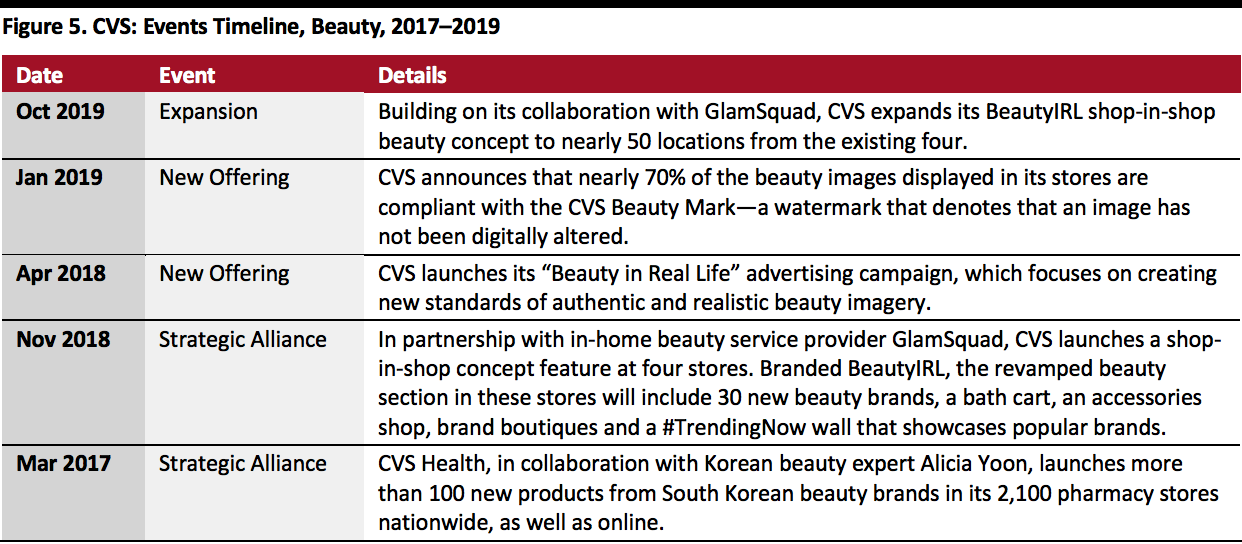

CVS and Walgreens have refreshed and upgraded beauty spaces in their stores to offer shop-in-shop experiences in partnership with beauty companies that are focused on millennial and Gen-Z consumers. The companies are also revamping their private-label beauty assortments and adding premium brands into their portfolios, both in store and online.

CVS’s Partnership with GlamSquad

Building on the success of four pilot locations that were launched in November 2018, CVS announced in October 2019 that it would expand its “BeautyIRL” (meaning “in real life”) concept to nearly 50 stores by the end of 2019. Locations include key markets such as Boston, Los Angeles, Miami and New York City. The BeautyIRL concept was created in collaboration with in-home beauty service provider GlamSquad and provide an expanded assortment of on-trend beauty products as well as offering mini beauty services. Each BeautyIRL section is more than double the size of CVS’s typical beauty department and includes a Test-and-Play Hygiene Bar, brand boutiques, an accessories shop, bath boutiques and a “Now Trending” wall that showcases popular brands. CVS BeautyIRL stores feature more than 30 indie brands such as Crème Shop, Karity, Storybook Cosmetics and Zoella. The stores also offer hairstyling, makeup services, face and eye masks and manicures.

In addition to offering GlamSquad services within the revamped beauty sections, CVS is exclusively launching GSQ by GlamSquad, a line of beauty products targeted towards millennial and Gen-Z shoppers.

[caption id="attachment_102820" align="aligncenter" width="700"]

Source: CVS Health[/caption]

The launch and expansion of the HealthHUB format signal the shift of CVS from a traditional pharmacy chain to what the company calls an “elevated healthcare destination.” CVS already operates a network of approximately 1,100 MinuteClinic medical clinics inside its stores, which offer diagnosis services and the treatment of minor illnesses and injuries. However, its HealthHUB stores are better equipped to deal with chronic conditions such as respiratory illnesses and diabetes. Furthermore, by devoting more retail space to healthcare services, the company is looking to reduce its reliance on nonpharmacy retail sales (including greetings cards, chocolates and seasonal merchandise), as shoppers are increasingly buying nondrug products online or from convenience stores.

Walgreens’ Partnership with VillageMD

In April 2019, Walgreens partnered with Chicago-based primary healthcare provider VillageMD to open primary care clinics next to five of its stores in Houston. Branded “Village Medical at Walgreens,” the 2,500-square-foot primary care clinics will offer services including chronic care management, annual preventive care, women’s health services, smoking cessation, vaccinations, diagnostic testing and some specialty care. The clinics will be staffed with pharmacists, primary care physicians, nurses and social workers. Walgreens and VillageMD opened the first Village Medical at Walgreens in November 2019.

In recent years, to diversify its business beyond traditional pharmacy sales, Walgreens has inked a number of agreements to provide retail clinic services at its stores. The company has partnered with UnitedHealth Group to place MedExpress urgent care centers at 15 Walgreens locations in six states. It also runs senior health clinics at five locations in collaboration with health insurer Humana.

CVS and Walgreens Go Head to Head in Beauty

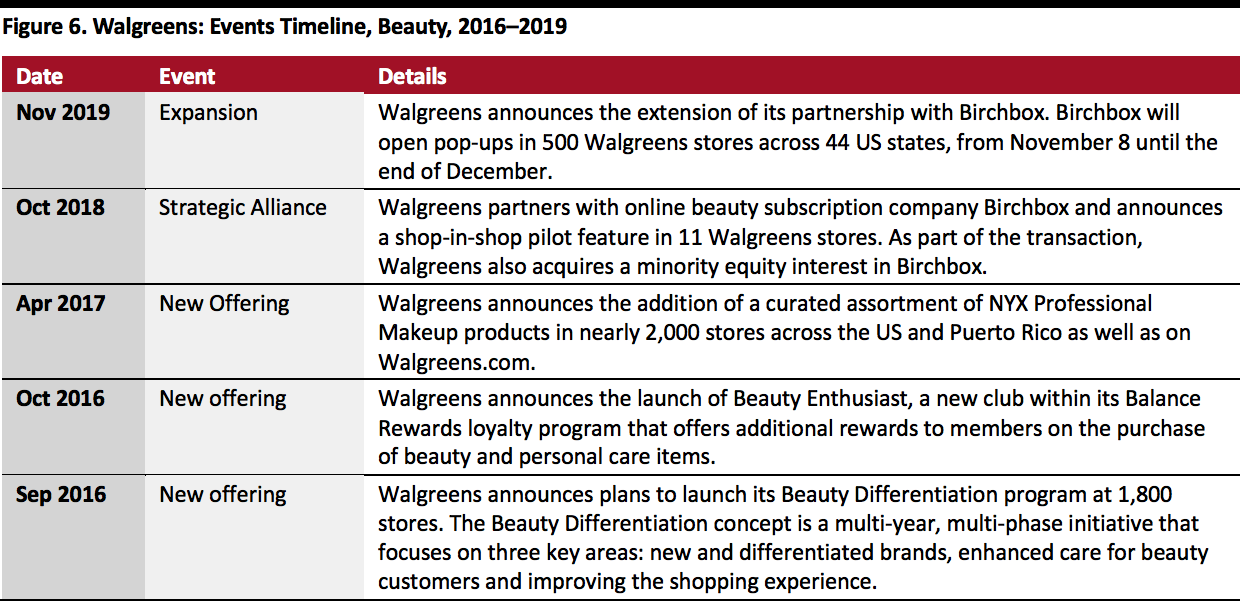

CVS and Walgreens have refreshed and upgraded beauty spaces in their stores to offer shop-in-shop experiences in partnership with beauty companies that are focused on millennial and Gen-Z consumers. The companies are also revamping their private-label beauty assortments and adding premium brands into their portfolios, both in store and online.

CVS’s Partnership with GlamSquad

Building on the success of four pilot locations that were launched in November 2018, CVS announced in October 2019 that it would expand its “BeautyIRL” (meaning “in real life”) concept to nearly 50 stores by the end of 2019. Locations include key markets such as Boston, Los Angeles, Miami and New York City. The BeautyIRL concept was created in collaboration with in-home beauty service provider GlamSquad and provide an expanded assortment of on-trend beauty products as well as offering mini beauty services. Each BeautyIRL section is more than double the size of CVS’s typical beauty department and includes a Test-and-Play Hygiene Bar, brand boutiques, an accessories shop, bath boutiques and a “Now Trending” wall that showcases popular brands. CVS BeautyIRL stores feature more than 30 indie brands such as Crème Shop, Karity, Storybook Cosmetics and Zoella. The stores also offer hairstyling, makeup services, face and eye masks and manicures.

In addition to offering GlamSquad services within the revamped beauty sections, CVS is exclusively launching GSQ by GlamSquad, a line of beauty products targeted towards millennial and Gen-Z shoppers.

[caption id="attachment_102820" align="aligncenter" width="700"] BeautyIRL spaces at CVS

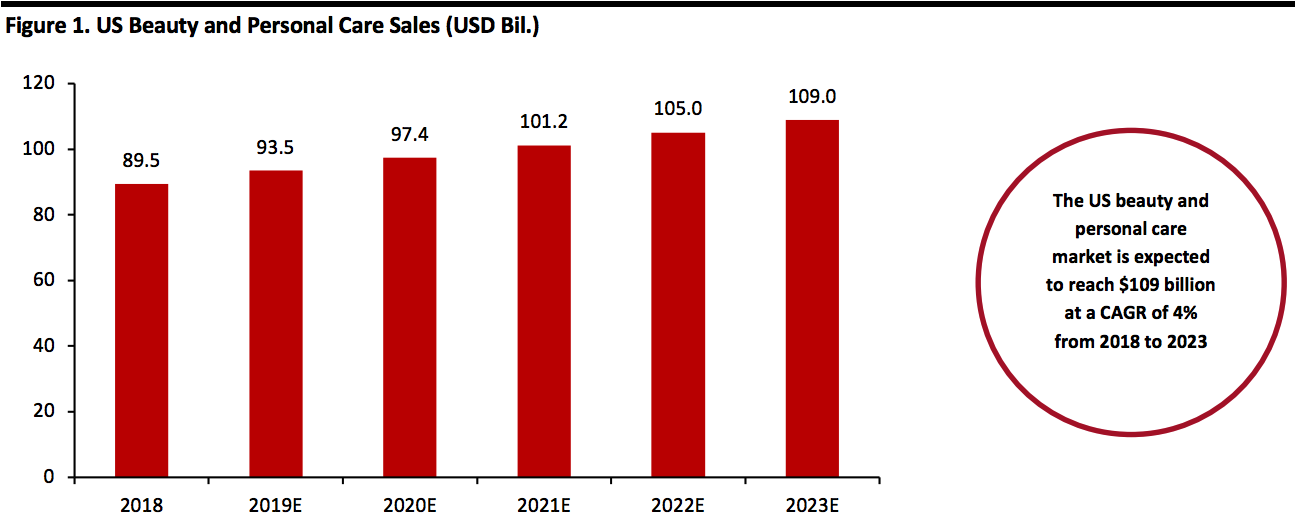

BeautyIRL spaces at CVSSource: CVS Health[/caption] Walgreens’ Partnership with Birchbox and the Beauty Differentiation Initiative Walgreens has strengthened its offering in the beauty category and enhanced its reach to younger consumers through its partnership with beauty subscription company Birchbox. The partnership began with a pilot program in 2018, which saw the drugstore chain dedicate 400–1,000-square-foot spaces to Birchbox in 11 of its stores. The program was extended online too, with Walgreens adding a Birchbox section to its website. The Walgreens-Birchbox stores offer a curated product assortment of more than 40 prestige hair and makeup brands, including Beachwaver, COOLA, Sand & Sky and Wander Beauty. The stores also feature product tutorials, sanitation stations and dedicated areas to allow customers to test the products. As part of the deal, Walgreens took a minority stake in Birchbox for an undisclosed sum. Birchbox expanded its brick-and-mortar partnership with Walgreens for the 2019 holiday season, by installing pop-ups in 500 Walgreens stores across 44 US states from November 8 until the end of December. Walgreens has made significant strides in the beauty category in recent years by offering upscale beauty assortments in over 3,000 stores and adding 3,500 beauty consultants to help shoppers. It has also introduced a Beauty Enthusiast Club within its Balance Rewards loyalty program. Since the rollout of its multi-year, multi-phase “Beauty Differentiation” initiative in 2016, Walgreens has added its private-label brands—such as Soap & Glory and No7—in 1,800 stores and on Walgreens.com. As part of the initiative, the company has also added luxurious beauty brands in more than 2,000 stores across the US and Puerto Rico as well as online, including La Roche-Posay skincare products, NYX makeup and OPI nail polish. Responding to the Rise of Beauty Retailers The rise of beauty specialist retailers such as Sephora and Ulta Beauty pose a threat to the beauty departments of drugstore chains, thanks to the unique experiences they provide. For example, Ulta Beauty’s store and online portfolio comprises more than 25,000 products, with every store featuring a full-service salon that offers hair, skin and eyebrow services. CVS and Walgreens, in response, have intensified their presence in the beauty category by revamping beauty sections with an expanded product line, a new brand mix and specially trained beauty consultants and makeup testers. Although these drugstore chains have quite a hill to climb to establish themselves as beauty destinations for younger consumers, such initiatives offset some pressures on their pharmacy businesses and enable the companies to vie for a bigger slice of the $93.5 billion US beauty and personal care market, which is estimated by Euromonitor International to reach $109 billion in 2023. [caption id="attachment_102821" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

Strong Loyalty Programs

CVS and Walgreens have both launched fee-based subscription programs that offer discounts on eligible prescriptions and expedited delivery to members. CVS CarePass Building on the positive customer response to its paid pilot membership program—known as CarePass—CVS Health announced plans in August 2019 to introduce the program at CVS pharmacies nationwide. The pilot program was launched in October 2018 at 350 CVS pharmacies in the Greater Boston area. Results showed that the average CarePass member spent three to four times more than an average CVS customer. Through this program, the company was also able to expand its reach, with 30% of CarePass members being new or previously unengaged customers. Offering two membership options— $5/month or $48/year—CarePass provides in-store and online benefits that are exclusive to members. Benefits include free one- to two-day delivery on qualifying prescription drug orders, access to a 24/7 CVS pharmacist hotline, 20% discounts on eligible CVS brand products (over-the-counter medicines, vitamins and supplements and other personal care items) in store and online and a $10 Carepass promotional reward that can be used on many items in store and online. CarePass is an extension of CVS Health’s ExtraCare Rewards program, so to become a member of CarePass, customers must possess an active ExtraCare Rewards card. Walgreens Plus In April 2018, Walgreens launched a paid pilot subscription program known as Walgreens Plus at 17 stores in Gainsville, Florida. Consumers pay a $25 annual fee (increased in January 2020 from $20) to receive 20% discounts on eligible products and 60% discounts on various generic and brand-name medications. Members also have access to free, same-day prescription delivery through Walgreens.com.CVS’s Partnership with Target and Walgreens’ Partnership with Kroger

CVS’s Partnership with Target CVS acquired Target’s pharmacy and clinic business for $1.9 billion in December 2015. CVS rebranded Target’s 1,672 in-store pharmacies as CVS Pharmacy and 79 Target clinics under the CVS MinuteClinic moniker. This acquisition allowed CVS to expand its number of pharmacies by almost 20%. Building on their relationship, CVS Pharmacy announced in April 2019 that it is working with delivery service provider Shipt, a Target company, to offer same-day prescription delivery from about 6,000 pharmacy locations nationwide for a $7.99 fee. Customers can place orders via the CVS Pharmacy app, through SMS or by calling their local stores. They can also add non-pharmacy products to a same-day prescription order at no extra charge. Walgreens’ Partnership with Kroger In December 2019, Kroger and Walgreens announced the establishment of a joint-venture group-purchasing organization aimed at driving supply chain efficiencies and lowering costs. Through the Retail Procurement Alliance venture, Kroger and Walgreens plan to cut costs by exerting greater purchasing power and to increase efficiency by combining some sourcing operations. Kroger and Walgreens first entered into a strategic collaboration in October 2018, when they announced the testing of a pilot program called “Kroger Express”. The program saw Kroger’s private-label food brands—such as Simple Truth—sold at 13 Walgreens stores in Northern Kentucky and allowed Kroger customers to pick up their online orders at some Walgreens locations. In August 2019, the two companies committed to broadening this pilot test to 35 Walgreens locations in Knoxville, Tennessee. Selected stores will offer a Kroger Express assortment of up to 2,700 products and other stores will feature 2,300 products on average. In addition, a curated selection of Walgreens’ health and beauty merchandise—including beauty care, personal care, over-the-counter medicines and Walgreens’ private-label products No7 and Soap & Glory—are being featured in 17 Kroger stores as a trial.Major Startups Are Disrupting the Pharmacy Retail Market

The pharmacy retail market is facing significant disruption from e-pharmacy startups, which often dispense prescription medicines to patients at substantial discounts, with the added benefit of direct-to-home delivery at no extra charge. [caption id="attachment_102822" align="aligncenter" width="700"] Major US e-pharmacy startups

Major US e-pharmacy startupsSource: Company websites[/caption]

- Pillpack, which was founded in 2013, is a full-service e-pharmacy that delivers medications in pre-sorted dose packaging; schedules refills and renewals; and offers emergency overnight deliveries, for no delivery charge. In 2018, Amazon acquired Pillpack for a reported $1 billion, enabling the e-commerce leader to enter the prescription drug industry for the first time. By leveraging Amazon’s logistics network, Pillpack can expand its reach even further and provide same- and next-day delivery services nationwide.

- Capsule is an online pharmacy startup that was founded in 2015 in New York City (NYC). It offers a free, same-day, hand-delivery service. Capsule promises to provide medication, hand-delivered by couriers, in NYC within two hours of interaction. Pharmacists are reachable 24/7 through text, e-mail or video chat. The online platform also allows patients to transfer their prescription refills from their old pharmacies to Capsule. The company has contracts with major insurance agencies and is licensed by the New York Board of Pharmacy with approval from the Drug Enforcement Administration. In September 2019, Capsule raised $200 million in a funding round led by venture firms Glade Brook Capital Partners, TCV and Thrive Capital, which the company will use to expand its operations beyond NYC.

- NowRx is an online pharmacy that was founded in 2015 and specializes in the speedy delivery of prescription medication. The company is able to fulfill same-day and within-one-hour delivery orders through its micro-fulfillment centers, which employ fully automated dispensing processes driven by robotics and artificial intelligence.

- Blink Health, which was founded in 2014, promises customers the lowest prices on generic drugs through its ‘Price Match Guarantee’ policy. If its user buys certain medication and finds that another pharmacy or online site offers a lower price for the same product, Blink Health will refund the difference. The company offers free home delivery and free local pickup at Albertsons, Kroger Safeway and Walmart, pharmacies. In August 2019, Blink Health opened a new headquarters in NYC to accommodate its plans for rapid expansion.

Privatization of Walgreens

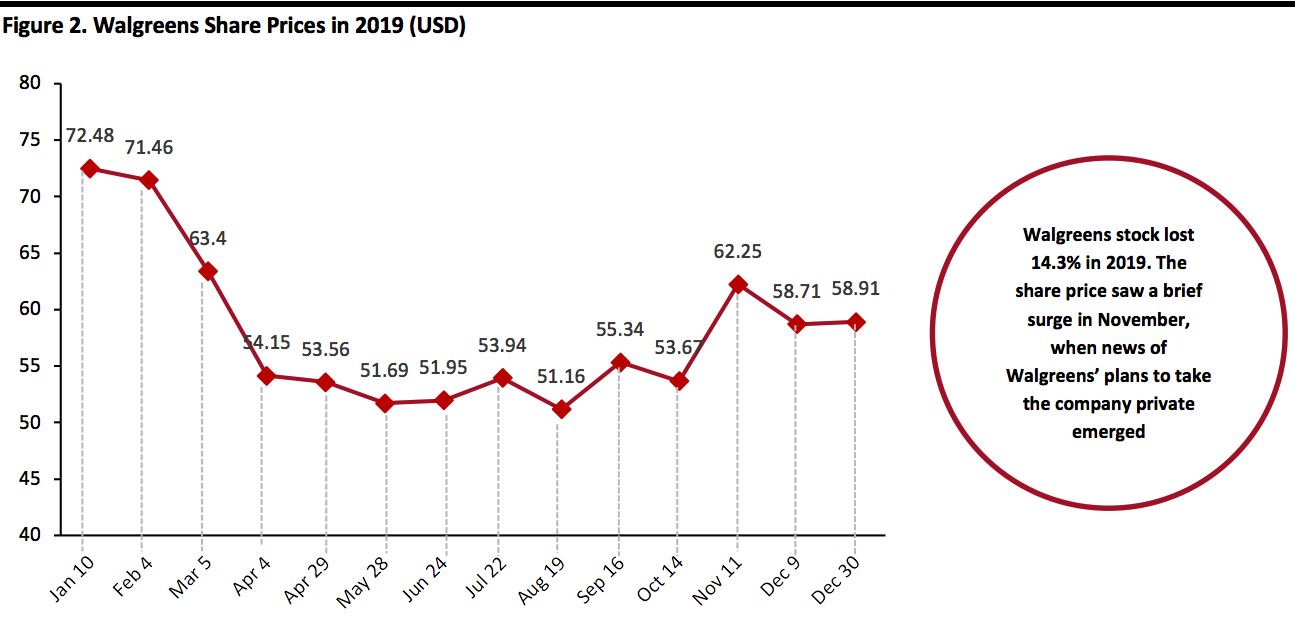

In November 2019, Bloomberg and Reuters reported that Walgreens was considering a deal to take the company private. Reuters reported that Walgreens had hired investment bank Evercore Partners to explore the potential of the deal. According to Bloomberg, private equity firm KKR & Co. had formally approached the drugstore chain to potentially buy out its shareholders. Such a move would represent the largest buyout in history, since Walgreens has a market capitalization of $48 billion (as of January 10, 2020) with an approximate debt of $17 billion, according to the company’s annual report released in October 2019. Walgreens has been striking partnerships with beauty companies, grocery stores and health systems, with the hope of finding new ways to make use of its drugstores. However, these new partnerships appear to be drawing skepticism from some investors and analysts, who argue that these joint ventures will not generate revenues fast enough to compete with rivals and offset falling traffic to its retail stores. Walgreens stock fell 14.3% in 2019, making it the worst performer in the Dow Jones Industrial Average for the year. A leveraged buyout would give the company time and flexibility to restructure and transform its stores, potentially relieving some of the quarterly pressures Walgreens faces as a public company. [caption id="attachment_102823" align="aligncenter" width="700"] Source: NASDAQ[/caption]

Source: NASDAQ[/caption]

Key Insights

As e-pharmacy startups continue to gain ground in the drugstore retail sector and the pressure of ongoing reimbursement rates negatively affects pharmacy businesses, CVS and Walgreens are looking to expand their service offerings outside their traditional domains. The drugstore chains are seeking to become the first port of call for patients by providing value-based primary care services. In the beauty category, the companies have refreshed their product assortment and redesigned the layouts of their stores in order to accommodate new services such as hairstyling, makeup and skin care. The drugstore chains are also forming partnerships to expand their offerings and extend their reach. Notably, Walgreens has teamed with Kroger to offer private-label brands at each other’s stores and enhance their supply chain efficiency. CVS and Walgreens are seeing increasing competition from online startups, which are making inroads into the pharmacy sector by offering better pricing than offline stores, as well as free doorstep delivery within a short time, convenience and greater anonymity for consumers.Appendix

Healthcare1. CVS

[caption id="attachment_102824" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2. Walgreens

[caption id="attachment_102825" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Beauty

Source: Company reports/Coresight Research[/caption]

Beauty

3. CVS

[caption id="attachment_102826" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

4. Walgreens

[caption id="attachment_102827" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source for all Euromonitor data: Euromonitor International Limited 2020 © All rights reserved

Source: Company reports/Coresight Research[/caption]

Source for all Euromonitor data: Euromonitor International Limited 2020 © All rights reserved