Nitheesh NH

What’s the Story?

We explore the revival in US consumer demand for dress wear as the country gradually emerges from the pandemic and consumers return to more normal ways of living and working. Our coverage of dress wear comprises formal accessories, clothing and footwear. This covers dress categories such as blazers, blouses, dresses, skirts, shoes, shirts and suits that consumers wear for special occasions such as weddings, social occasions such as parties, and work. In this report, we discuss the US dress wear market size, including our outlook for 2021. We also present our proprietary data on US consumer demand for dress wear and reports from brands and retailers, as well as three strategies for brands and retailers to capitalize on renewed dress wear spending.Why It Matters

Increased time spent indoors and working from home amid the pandemic in 2020 accelerated the longstanding casualization trend in US consumer clothing preferences and dress codes—with a significant negative impact on the dress wear market. With the vaccination rollout and easing of lockdowns in 2021 in the US, we are seeing signs of dress wear sales recovery and a revival of consumer demand in the market. Our report informs brands and retailers on how to best respond to the swing in demand.Consumer Demand Revival in Dress Wear: A Deep Dive

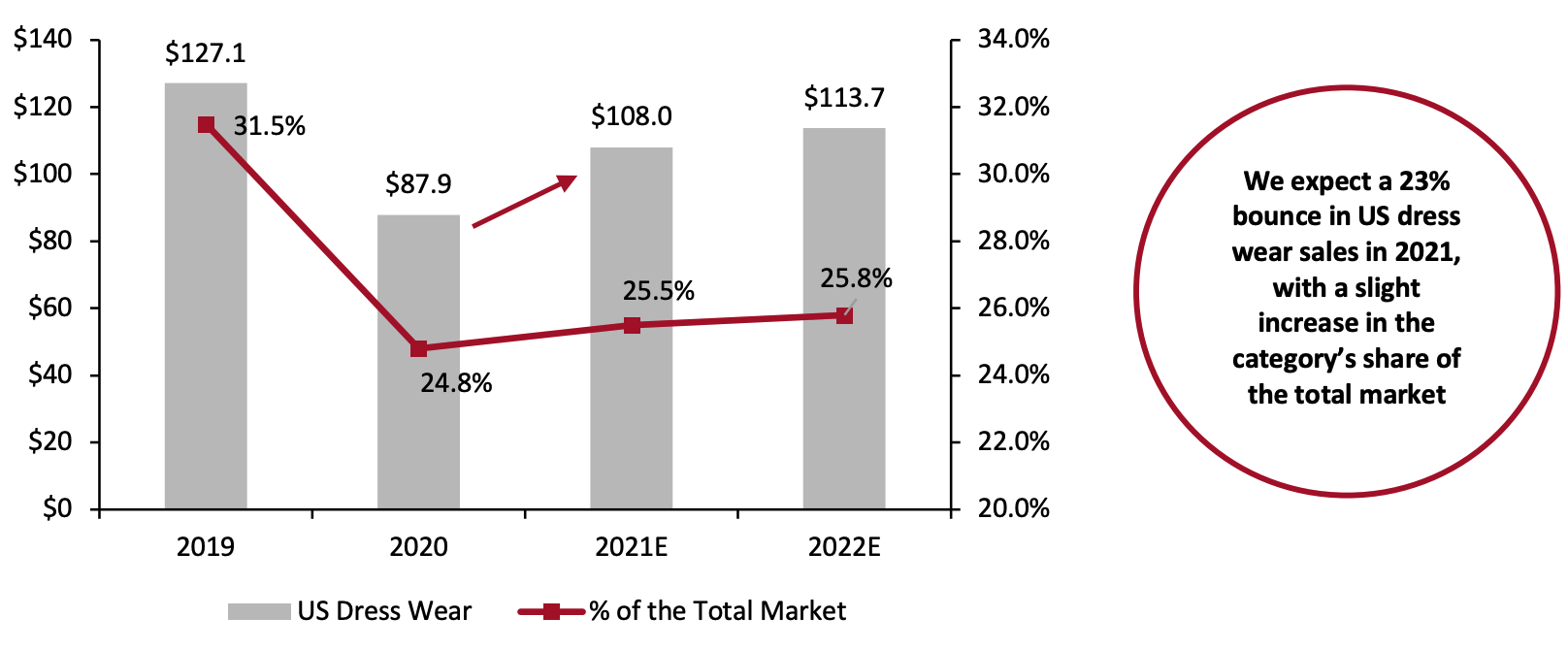

US Dress Wear Market A pandemic-driven year-over-year decline of 31% took US dress wear sales to $87.9 billion in 2020, according to Coresight Research and Euromonitor. We expect US dress wear sales to total $108.0 billion in 2021 and $113.7 billion in 2022, representing year-over-year growth of 23% and 5%, respectively. Dress wear’s share of the total apparel market dropped by 6.7 percentage points, from 31.5% in 2019 to 24.8% in 2020. The share is set to increase slightly over the remainder of the year as consumers return to working and socializing outside of their homes. The increasing vaccination rollout and easing of lockdown restrictions will drive the US dress wear market in 2021, prompting spending on dressy and formal clothes. Moreover, we expect demand to increase as consumers refresh their work wardrobes ahead of returning to the office, with companies such as Google and Amazon taking steps to allow employees to go back to their workplaces. In 2021 and into 2022, we expect the casual wear market to continue to dominate total US apparel spending but cede a small portion of demand to the dress wear market. We estimate that the dress wear market will grow at a CAGR of 13.8% between 2020 and 2022, outpacing the estimated 10.7% CAGR for the casual wear market over the same period. Our casual wear market estimate excludes baby clothing and accessories. Figure 1. US Dress Wear Market (Left Axis; USD Bil.) and Share of Total US Apparel Sales (Right Axis; %) [caption id="attachment_129306" align="aligncenter" width="700"] Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

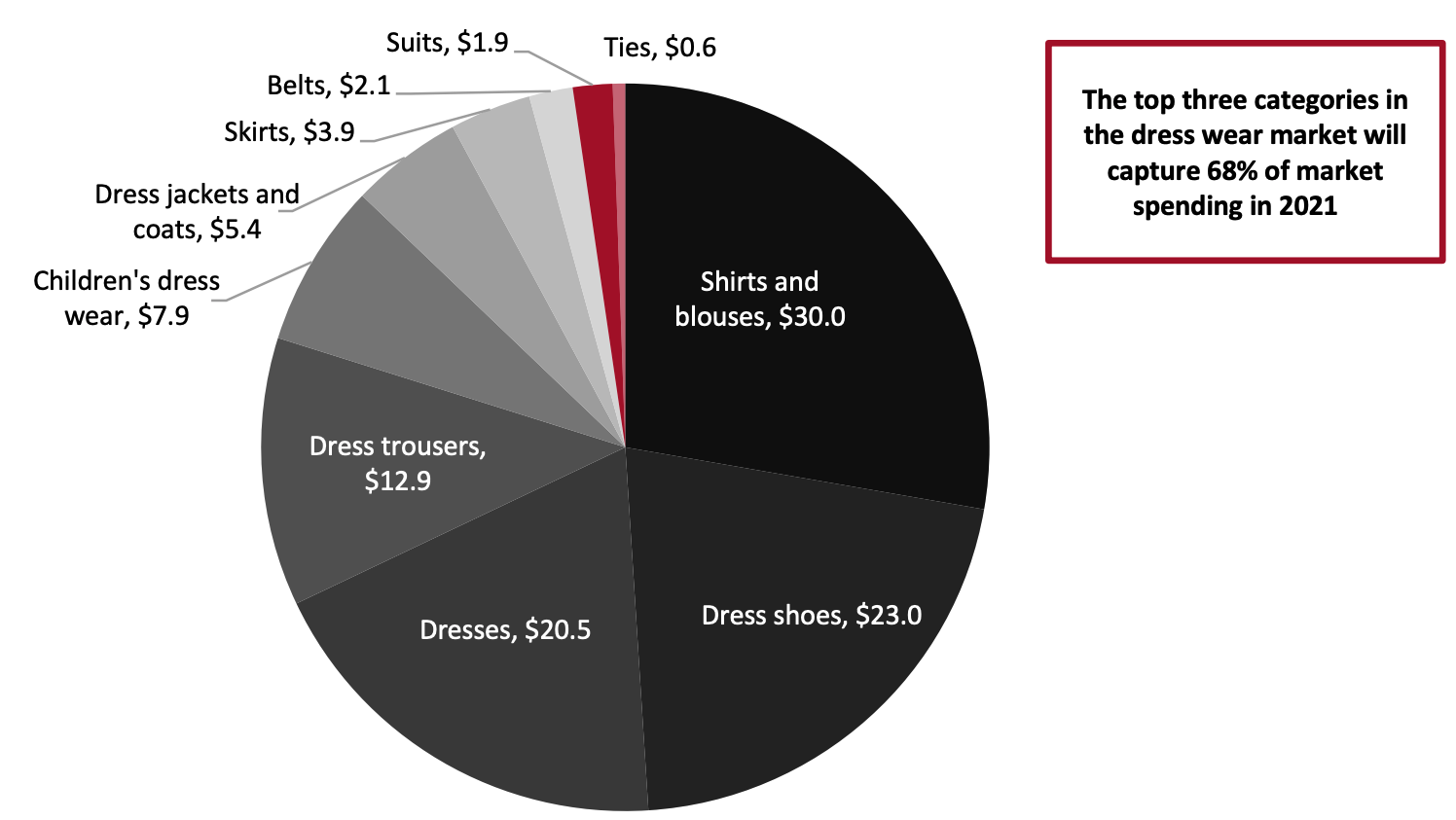

We expect dress wear spending to vary significantly across product categories. Shirts and blouses, dress shoes, and dresses will set to dominate the market, with a combined spending share of 68% of the total market. Figure 2 provides a breakdown of the market share outlook across categories for 2021.

Figure 2. 2021 US Dress Wear Market, by Category (USD Bil.)

[caption id="attachment_129393" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

We expect dress wear spending to vary significantly across product categories. Shirts and blouses, dress shoes, and dresses will set to dominate the market, with a combined spending share of 68% of the total market. Figure 2 provides a breakdown of the market share outlook across categories for 2021.

Figure 2. 2021 US Dress Wear Market, by Category (USD Bil.)

[caption id="attachment_129393" align="aligncenter" width="700"] Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Consumer Demand Revival

Coresight Research Data

We are seeing signs of restored consumer demand for dress wear. In 2020, many consumers would have completely cut their spending on categories for parties and events, effectively deferring any renewal in dress wear until the pandemic eases. With the gradual return to normal socializing going forward in 2021, this trend may also be amplified by consumer fatigue with casual wear and a “revenge spending”-style return to dress wear clothing.

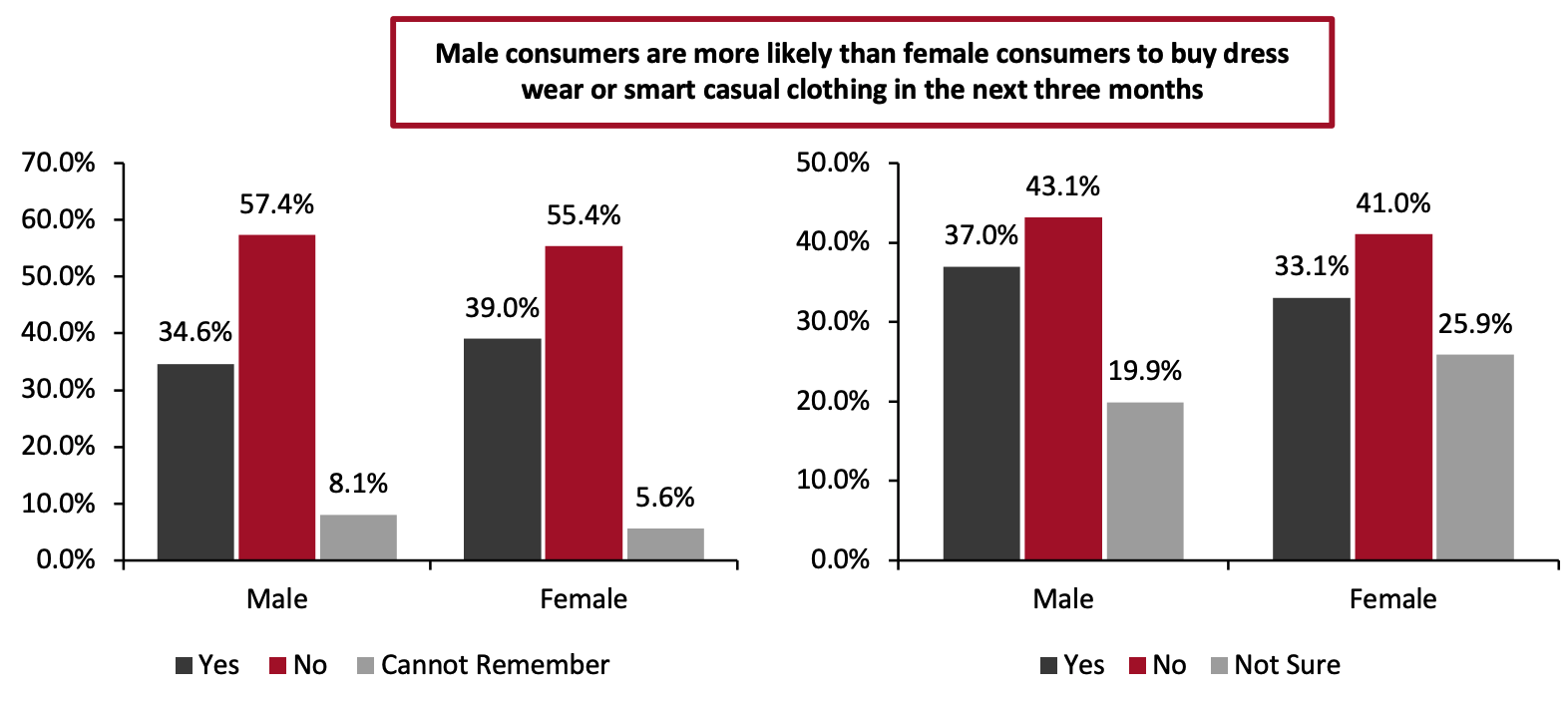

According to Coresight Research’s US consumer survey of April 12, 2021, 34.85% of consumers overall plan to purchase dress wear in the next three months. Within this, some 37.0% of male consumers surveyed will purchase dress wear or smart casual clothing in the next three months, compared to the 34.6% of male consumers who reported purchasing dress wear or smart casual clothing in the past three months.

This demand pattern is different among female consumers, with 33.1% of female respondents expecting to purchase dress wear or smart casual clothing in the next three months, compared to 39.0% of female consumers who reported purchasing dress wear or smart casual clothing in the past three months. Despite this apparent decline, a significant proportion of female consumers reported considering whether to purchase in the category, which provides an indication of reviving demand for dress wear.

Figure 3. All Respondents: Proportion That Purchased Dress Wear or Smart Casual Clothing in The Past Three Months (Left, %) and Proportion That Will Purchase Dress Wear or Smart Casual Clothing in the Next Three Months (Right, %) April 2021

[caption id="attachment_129308" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Consumer Demand Revival

Coresight Research Data

We are seeing signs of restored consumer demand for dress wear. In 2020, many consumers would have completely cut their spending on categories for parties and events, effectively deferring any renewal in dress wear until the pandemic eases. With the gradual return to normal socializing going forward in 2021, this trend may also be amplified by consumer fatigue with casual wear and a “revenge spending”-style return to dress wear clothing.

According to Coresight Research’s US consumer survey of April 12, 2021, 34.85% of consumers overall plan to purchase dress wear in the next three months. Within this, some 37.0% of male consumers surveyed will purchase dress wear or smart casual clothing in the next three months, compared to the 34.6% of male consumers who reported purchasing dress wear or smart casual clothing in the past three months.

This demand pattern is different among female consumers, with 33.1% of female respondents expecting to purchase dress wear or smart casual clothing in the next three months, compared to 39.0% of female consumers who reported purchasing dress wear or smart casual clothing in the past three months. Despite this apparent decline, a significant proportion of female consumers reported considering whether to purchase in the category, which provides an indication of reviving demand for dress wear.

Figure 3. All Respondents: Proportion That Purchased Dress Wear or Smart Casual Clothing in The Past Three Months (Left, %) and Proportion That Will Purchase Dress Wear or Smart Casual Clothing in the Next Three Months (Right, %) April 2021

[caption id="attachment_129308" align="aligncenter" width="700"] Base: 462 US Internet users aged 18+

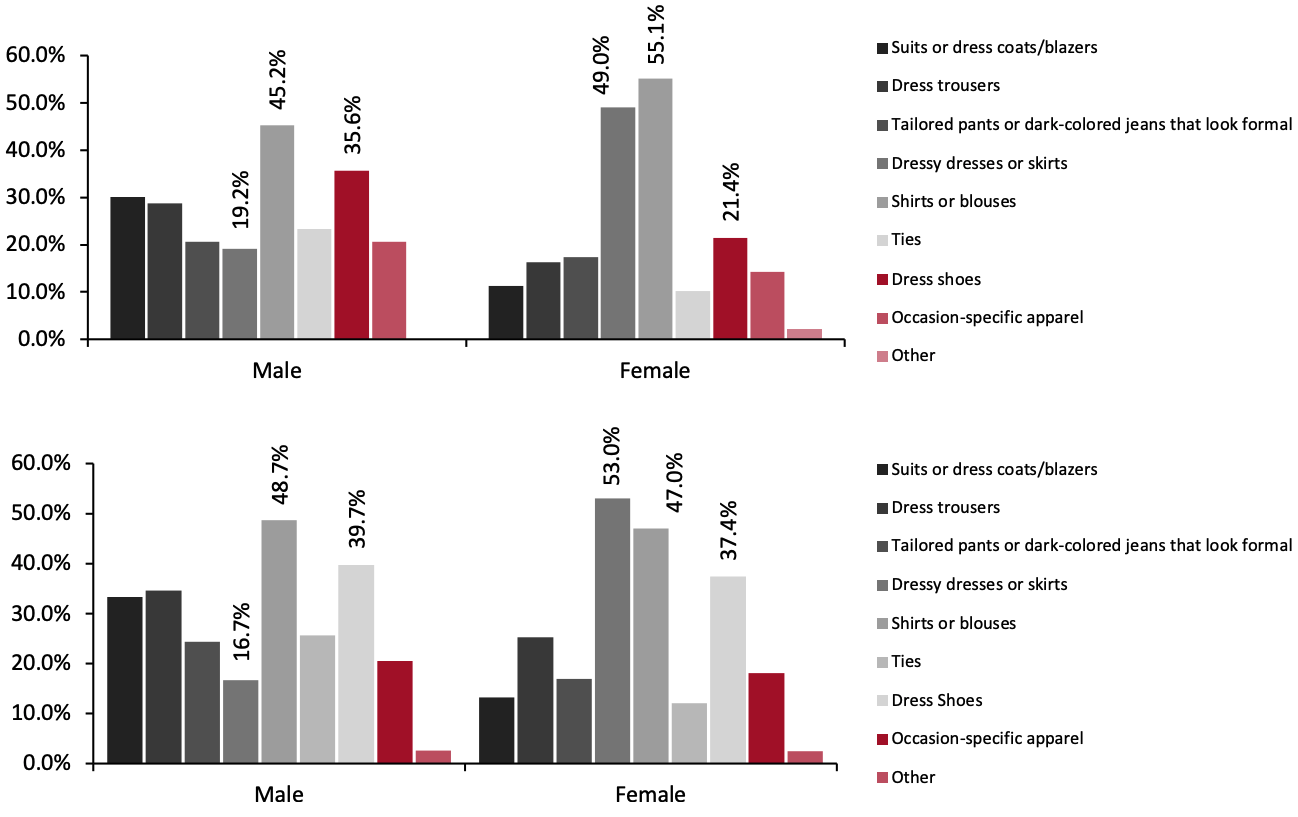

Base: 462 US Internet users aged 18+Source: Coresight Research[/caption] Shirts or blouses, dressy dresses or skirts, and dress shoes are the top three categories that female consumers purchased in the last three months and will purchase in the next three months, as shown in Figure 4. For male consumers, shirts or blouses, dress shoes, and dress trousers are the most popular categories. Apparel brands and retailers should respond to consumer demand in these categories with expanded product assortments. Figure 4. Respondents Who Purchased or Will Purchase Dress Wear or Smart Casual Clothing: Categories That Consumers Purchased in the Past Three Months (Top, %) and Categories That Consumers Will Purchase in the Next Three Months (Bottom, %) April 2021 [caption id="attachment_129309" align="aligncenter" width="700"]

Base: 171 US Internet users aged 18+ that purchased dress wear or smart casual clothing in the past three months; 161 US Internet users aged 18+ that plan to purchase dress wear or smart casual clothing in the next three months

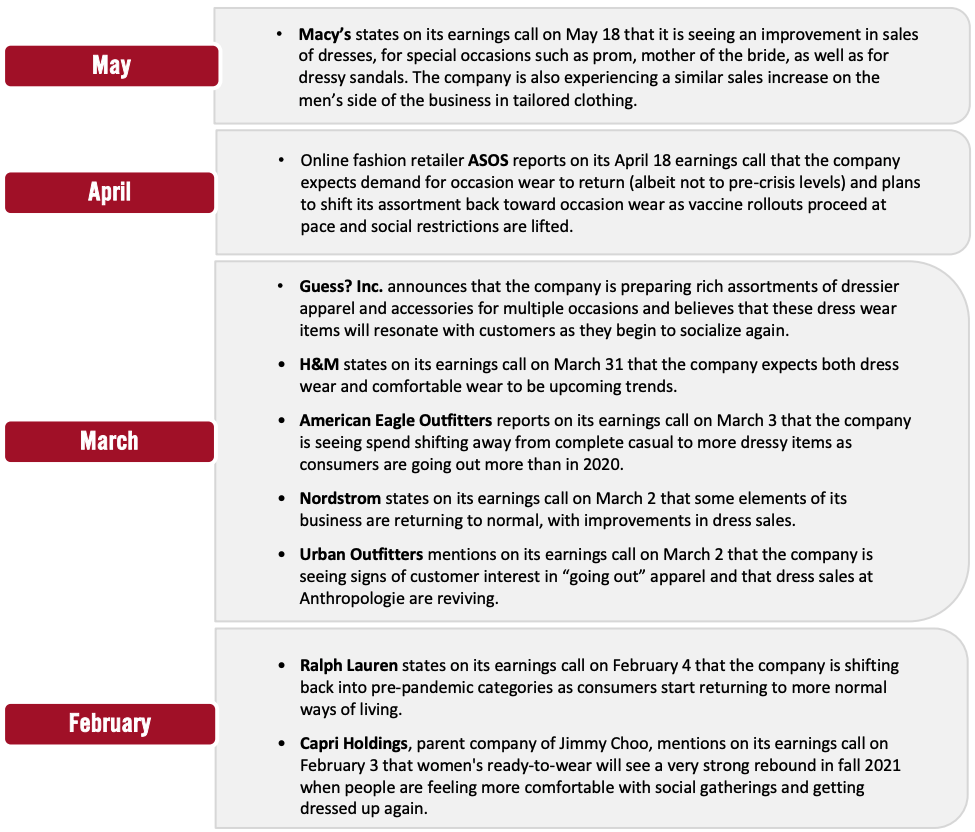

Base: 171 US Internet users aged 18+ that purchased dress wear or smart casual clothing in the past three months; 161 US Internet users aged 18+ that plan to purchase dress wear or smart casual clothing in the next three monthsSource: Coresight Research[/caption] Insights from Apparel Brands and Retailers Apparel retailers and brands from Macy’s to Nordstrom are reporting a revival in dress wear sales or indicators of a forthcoming revival in the market. Figure 5 presents a timeline of insights from brands and retailers compiled by Coresight Research. Figure 5. A Timeline of Apparel Retailers and Brands Who Reported Dress Wear Sales Revival in 2021 [caption id="attachment_129310" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Strategies for Brands and Retailers To Respond to Consumer Demand

As the US dress wear market is picking up, the following three strategies will help apparel brands and retailers to respond to growing consumer demand for dress wear.

1. Expand Product Assortments: Dual Offerings

Although we are seeing a revival of dress wear sales with its share of the total apparel market set to increase by 1% in 2022 from its 2020 drop, the casual wear category still dominates US apparel spending. We recommend that apparel retailers and brands that carry dress wear categories expand their product assortment to incorporate casual wear collections. It is particularly important for brands and retailers previously focused on business wear, occasion-specific clothing and formal wear to broaden their assortments to find new growth opportunities.

We are already seeing examples of product assortment expansion into dual offerings among dress wear brands and retailers:

Source: Company reports/Coresight Research[/caption]

Strategies for Brands and Retailers To Respond to Consumer Demand

As the US dress wear market is picking up, the following three strategies will help apparel brands and retailers to respond to growing consumer demand for dress wear.

1. Expand Product Assortments: Dual Offerings

Although we are seeing a revival of dress wear sales with its share of the total apparel market set to increase by 1% in 2022 from its 2020 drop, the casual wear category still dominates US apparel spending. We recommend that apparel retailers and brands that carry dress wear categories expand their product assortment to incorporate casual wear collections. It is particularly important for brands and retailers previously focused on business wear, occasion-specific clothing and formal wear to broaden their assortments to find new growth opportunities.

We are already seeing examples of product assortment expansion into dual offerings among dress wear brands and retailers:

- Brooks Brothers launched sportswear and casual wear in its collection from late 2020, a significant distinction from its traditional offering.

- Michael Kors (a subsidiary of Capri Holdings) has been pushing hard on its active and casual apparel so far in 2021 compared to its usual dress wear offering. The company reported on its May 26, 2021, earnings call that it is seeing traction in these categories.

- Everlane has leaned into casual wear amid the pandemic, expanding its offerings with the launch of a sportswear collection in March 2021—following on from its first swimwear collection in April 2020.

Left to right: Brooks Brothers’ new casual wear fleece bomber jacket; Everlane’s sports collection; and new sportswear offerings from Michael Kors

Left to right: Brooks Brothers’ new casual wear fleece bomber jacket; Everlane’s sports collection; and new sportswear offerings from Michael KorsSource: Brooks Brothers/Everlane/Michael Kors[/caption] 2. Strengthen Digital Capabilities and Consumer Experiences We recommend that dress wear apparel retailers and brands elevate their digital capabilities. Specific strategies include:

- Improving websites or mobile apps to increase operational efficiency

- Innovating in marketing campaign development, such as through social media platforms

- Engage consumers in virtual reality-enhanced shopping experiences, including virtual store experiences, digital community-building events or promotional activities and games

- Facilitate virtual interaction with consumers through livestreaming sessions

SMCP clothing worn by a virtual avatar

SMCP clothing worn by a virtual avatarSource: SMCP[/caption] Ralph Lauren has been focusing on digital strategies for engaging with customers amid the pandemic. The company has focused on strategies to immerse the consumer in the “World of Ralph Lauren” and facilitate brand interaction. These include:

- Virtual flagship store experiences (Beverly Hills, New York and Paris), enable consumers around the world to experience Ralph Lauren’s assortment in a way previously only possible by visiting one of the stores. Launched in late 2020, the experience amplifies the reach of Ralph Lauren’s flagship stores to a global audience—digital traffic to these virtual stores was eight times higher than the foot traffic to the three physical stores in the company’s third quarter of fiscal 2021.

- Social media platforms provide a platform for innovative marketing opportunities. Ralph Lauren launched a logo scan feature on Snapchat in December 2020, which triggers an augmented reality experience with built-in e-commerce links when consumers scan the brand’s famous Pony logo from any surface, including advertisements, shopping bags and clothing items.

- Livestreaming is a key sales innovation for Ralph Lauren in Asia, with its livestream selling event for Singles' Day 2020 recording more than 120 million views on November 11.

- Virtual events took on new relevance amid the pandemic in terms of consumer engagement opportunities. In March 2021, Ralph Lauren hosted a virtual fashion experience with a vintage Hollywood theme, featuring a musical performance by Janelle Monáe.

From left to right: Ralph Lauren’s virtual store experience; an advert for Ralph Lauren’s Snapchat's logo scan initiative; and a poster for the retailer’s virtual fashion event in March 2021

From left to right: Ralph Lauren’s virtual store experience; an advert for Ralph Lauren’s Snapchat's logo scan initiative; and a poster for the retailer’s virtual fashion event in March 2021Source: Ralph Lauren[/caption] 3. Leverage Technology in Demand Forecasting Increased accuracy in demand forecasting will help apparel brands and retailers to minimize inventory costs, optimize distribution and merchandising, and streamline their selling processes. Fluctuations in demand in dress wear make it especially important for dress wear brands and retailers to identify future demand accurately in order to create a clear manufacturing plan and avoid excess inventory issues. We are seeing numerous dress wear businesses exploring demand-forecasting techniques. For instance, in April 2021, UK men’s suit retailer Moss Bros implemented Retalon AI, an analytics software powered by artificial intelligence (AI), to get better visibility into future demand and make better decisions in its merchandising and inventory management. Faced with store closures, partial openings and accelerated digital transformation, Moss Bros has stated that better visibility of future demand down to the store and product level will help the businesses to recover. We expect more apparel retailers and brands to focus on AI and machine learning as the core technologies driving demand forecasting solutions. These solutions can function with a high degree of automation, applying algorithms with minimum intervention from data scientists.

What We Think

Implications for Brands/Retailers- While we expect dress wear to increase its share of total clothing and footwear sales in 2021, casual wear still dominates overall apparel sales in the US. We therefore recommend that apparel retailers and brands that carry dress wear categories expand their product assortment to include both dress wear and casual wear collections to expand their growth opportunities.

- Dress wear apparel retailers and brands must elevate their digital capabilities, including expanding their online footprint, innovating in their marketing initiatives and leveraging livestreaming sales models to gain more traffic.

- Technology providers in the field will have more opportunities to support apparel brands and retailers to improve forecasting abilities as they seek a clearer picture of future demand and solutions to excess inventory as we emerge from the pandemic.