albert Chan

Introduction

The digital payments landscape is evolving rapidly as consumers and merchants adopt more innovative modes of payments. Cash is declining worldwide, while credit and debit cards have gained popularity. Mobile payment and wallet services are also gaining traction, supported by growing smartphone use, faster data rates and greater Internet penetration.So, What Is a Digital Payment?

Simply put, a payment is digital when no cash or other paper-based instrument is used. Credit and debit cards count as digital, in addition to newer methods such as Internet or mobile banking, mobile wallets, bank prepaid cards, smartphone point of sale (POS), digital currencies, mobile payment apps and social media payment apps. Digital payments are proliferating, and can include consumer to business (C2B), business to consumer, business to business, consumer to government and peer to peer (P2P). In this report, we focus on consumer to business (C2B), i.e., customers paying merchants for products and services.The US Digital Payments Landscape

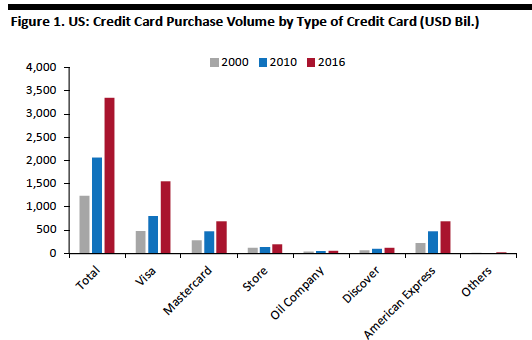

The U.S. digital payment industry has shown robust growth in the past decade as consumers have increasingly adopted non-cash payment methods such as credit and debit cards, mobile wallets, contactless cards, and cryptocurrencies. According to a survey conducted in 2017 by Datamonitor, about 29.5% of U.S. consumers said they prefer personal credit cards, while 14.8% prefer paying through PayPal, 9.2% prefer personal debit cards and 6.2% were comfortable with bank transfers. Only 8% preferred paying with cash or check. Popular Digital Payment Methods As technology advances, several types of payment methods have evolved, including frictionless payment. 1) Contact Credit and Debit Cards Credit and debit cards remain the most popular payment methods in the U.S. Credit Cards Growth in the number of purchases made by credit cards in the U.S. has outpaced the growth in the number of credit card accounts. Between 2010 and 2016, credit card purchase volume grew 62% (a CAGR of 8.4%), while the number of credit card accounts increased only 16%, according to estimates by the New York Federal Reserve Bank and Equifax. Traditional “contact” credit cards continue to dominate while “contactless” credit cards have not gained much traction. [caption id="attachment_65372" align="aligncenter" width="532"] Credit card purchases include online and in-store purchases.

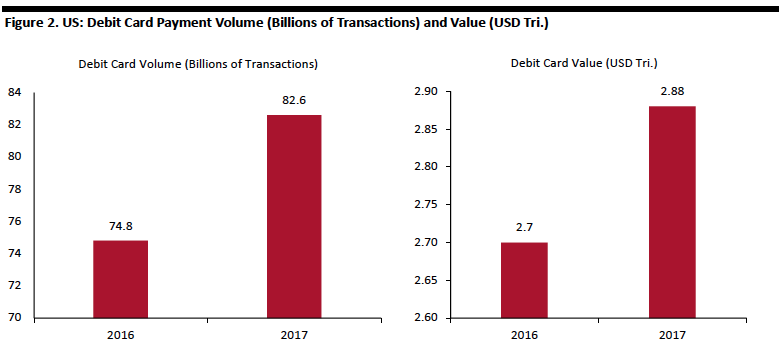

Credit card purchases include online and in-store purchases.Source: New York Fed/Equifax[/caption] Debit Cards Debit cards have grown almost as quickly as credit cards in recent years. A Federal Reserve payment study shows that between 2012 and 2015, debit card payments grew at a CAGR of 7.5% by volume and at a CAGR of 6.8% by value. Year-over-year growth by volume accelerated to 10.4% in 2017. [caption id="attachment_65375" align="aligncenter" width="784"]

Debit card purchases include online in-store purchases.

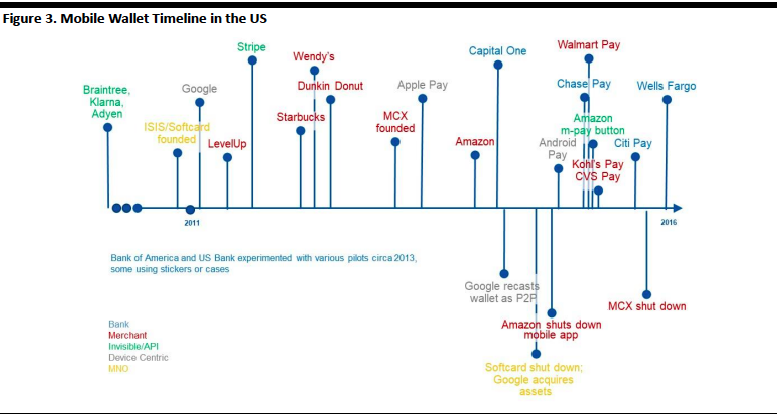

Debit card purchases include online in-store purchases.Source: Federal Reserve Payment Study Report[/caption] 2) Mobile Payment App and E-Wallet Services Consumers can use mobile payment apps and e-wallet services for instore payments using smartphones at near-field communication (NFC)-enabled POS terminals; these in-store/face-to-face payments are often referred to as proximity mobile payments. NFC is a short-range technology that allows phones and POS-terminals to communicate wirelessly when they are close to one another. Mobile wallets use NFC to access bank accounts, payment cards, coupons, loyalty and discount cards, and other relevant information stored on a smartphone. Another way smartphones can be used to make instore payments is by scanning QR codes using the company app, which is what the Walmart Pay and Starbucks’ payment apps use. Mobile payments initially gained traction when, in early 2011, Google introduced an NFC wallet in partnership with a number of merchants, including Macy’s and Walgreens. Google Wallet was one of the first to support a contactless payment system, but soon others joined in such as Starbucks and Dunkin’ Donuts. In 2014, Apple introduced the much-awaited Apple Pay, so iPhone users can add credit and debit card information to the app and use it to shop any place Apple Pay is accepted. In 2015, Google launched Android Pay, and at the same time restricted the existing Google Wallet for peer-to-peer payments. In January 2018, Google launched the Google Pay app, integrating Android Pay and Google wallet into one platform. Seeking to get in on the growing popularity of mobile payments, a number of banks launched e-wallets, including Chase, Capital One and Wells Fargo. [caption id="attachment_65376" align="aligncenter" width="780"]

Source: US Payments Forum[/caption]

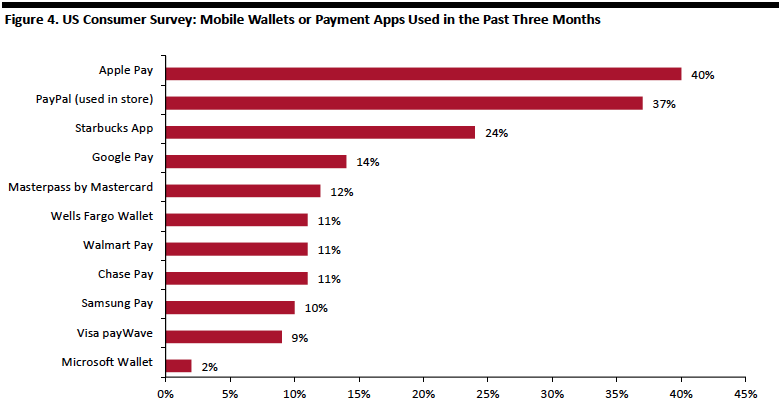

Despite aggressive marketing campaigns by some of these new entrants, Apple Pay remains the most popular mobile wallet U.S. consumers use in-store, According to a survey from Worldpay, followed by PayPal, Starbucks and Google Pay.

[caption id="attachment_65377" align="aligncenter" width="780"]

Source: US Payments Forum[/caption]

Despite aggressive marketing campaigns by some of these new entrants, Apple Pay remains the most popular mobile wallet U.S. consumers use in-store, According to a survey from Worldpay, followed by PayPal, Starbucks and Google Pay.

[caption id="attachment_65377" align="aligncenter" width="780"] Base: 111 US consumers surveyed in December 2017

Base: 111 US consumers surveyed in December 2017Source: Worldpay/Socratic Technologies[/caption] Some of the most popular and preferred e-wallets in the U.S. are: Apple Pay Apple Pay is the most popular mobile payment service in the U.S.: iPhone 6 or later users can use their phones to pay at over four million locations in the U.S. Apple Pay also supports payment and receipt of money through iMessages. With Apple Pay Cash, users can send money to each other free using their Apple Pay cash balance, debit and prepaid cards. PayPal PayPal is the second-most-used in-store mobile payment method. PayPal has been in business since 1990 and has over 250 million active users. The company processed 2.5 billion transactions worth $143 billion in the last quarter of 2018, according to Statista. Venmo was launched by PayPal mainly as a P2P money transferring app. With Venmo, people can send or receive money using their Venmo balance, a debit card or prepaid cards, free of charge. Venmo is growing in popularity among millennials mainly because of its social networking features such as adding memos and sharing emojis. Starbucks Starbucks is the third-most-preferred mobile app used in-store by U.S. consumers, according to the survey. It is also the most popular loyalty reward app among the major restaurant chains. With the app’s geo-location feature, customers can locate nearby Starbucks stores, see menus and place an order. Google Pay Google integrated its Android Pay and Google Wallet services when it launched the Google Pay app in January 2018, through which users can make P2P transfers and purchases. What is unique about Google Pay is its ability to work across platforms: It’s available on both Android and iOS. The app is secured with features such as:

- Tokenization: A process which replaces an account number with substitute values.

- Biometrics: Scanning the user’s finger prints or face to authenticate payments.

- Host card emulation (HCE) technology: HCE allows the smartphone to emulate a payment card and carry out transactions in a similar manner.

- PIN: A personal identification number.

Mobile Payments or Contactless Cards, Which Payment Method the Consumers will Choose?

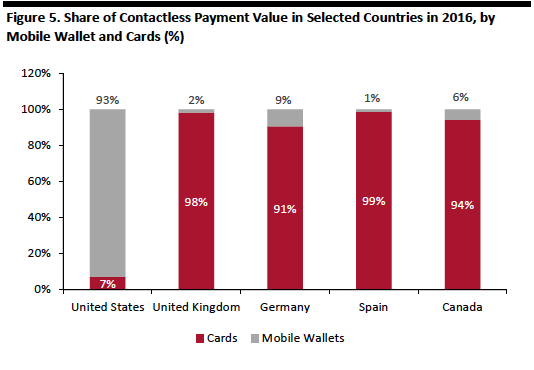

Mobile payments such as Apple Pay, Google Pay and Samsung Pay were already prevalent when contactless card payments were introduced, so mobile payments gained traction in the U.S. that contactless cards are now finding difficult to overcome. Mobile wallets were more popular as a means of contactless payments in the U.S. than contactless card payments in 2016, according to Juniper Research. [caption id="attachment_65379" align="aligncenter" width="534"] Mobile wallets represent payments made for online purchases using mobile wallets as well as proximity mobile payments, and exclude P2P transfers.

Mobile wallets represent payments made for online purchases using mobile wallets as well as proximity mobile payments, and exclude P2P transfers.Source: Juniper Research[/caption] In the U.S., contactless cards and mobile payments are competing for consumer use in the frictionless proximity payments space. Relative to some other countries, contactless cards are playing catch up. The threat to mobile payment providers is the prospect of contactless cards achieving as high a penetration rates in the U.S. as they have in countries such as the U.K. and Canada.

Factors Driving Digital Transactions: Young Consumers and Online Shopping

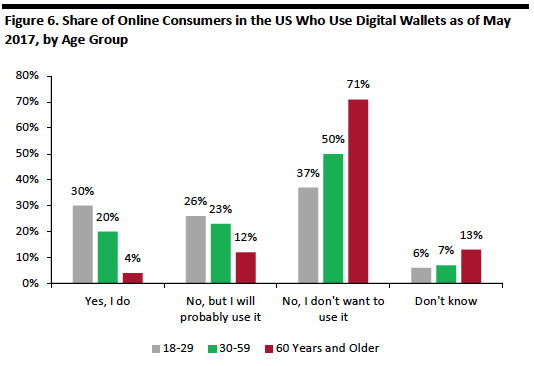

The momentum in digital payments is supported by several factors. Demographics Play A Vital Role in Digital Payments Millennials (born between 1980 and 2000), and Gen Zers (born after 2000) are playing a leading role in the ongoing digital transformation, which spans commerce to payments to communications. According to the Statista survey, 30% of respondents between 18-29 said they use digital wallets for online purchases; 26% reported they would probably use one in the future. Over 70% of respondents 60 and older said they were not interested in a digital wallet. As millennials enter peak spending years and Gen Zers enter the workforce, they are likely to bring their digital familiarity and preference for digital payments with them. [caption id="attachment_65381" align="aligncenter" width="534"] Survey question: Do you personally use a digital wallet?

Survey question: Do you personally use a digital wallet?Survey conducted in May 2017 on 1,027 internet users aged 18+

Source: Statista[/caption] Booming Digital Commerce to Drive the Digital Payments The growth of e-commerce is driving the expansion in digital payments. According to data published by the U.S. Census Bureau, e-commerce retail sales grew 14.5% year over year in the third quarter of 2018, compared to 5.3% growth for total retail sales. E-commerce accounted for 9.8% of total U.S. retail sales in the third quarter. Digitalized Stores Omnichannel efforts are digitalizing physical stores. As omnichannel commerce evolves, new payment use-cases will emerge to speed payment processing. For example, in January 2018, Amazon launched its first convenience store, called Amazon Go. To use the store, shoppers install an app on their mobile phones, check in when they arrive at the store, pick up products and walk out without having to checkout. The account linked to the app is charged and shoppers receive a receipt on their phones. Innovation from Fintech firms The payment industry was once dominated by banks and large financial institutions. Now, fintech companies are disrupting the payment landscape by providing niche services. While regulations are more relaxed in Europe with the introduction of open application program interface (API), the U.S. has yet to embrace such changes. Only a few banks, such as Capital One, Citi, BBVA Compass and Silicon Valley Bank, offer open APIs to third parties. Here are a few fintech startups that have created niche services:

- Square Inc is one of the largest payment processing companies in the U.S. Square launched a P2P payment service in 2013 called Square Cash. The major difference between Square Cash and its competitors is that Square Cash moves money into and out of customer’s debit card account directly, rather than keeping cash in a digital wallet. The app had 33.5 million downloads as of August, 2018.

- Forter, based in New York, develops fraud prevention technology using machine learning to understand buyer behaviour and will decline purchases when fraud is detected by unusual buying behaviour. The company processes over 1 billion transactions every year.

- Stripe, based in San Francisco, provides payment processing and allows businesses to receive payments from all major credit and debit cards from countries across the globe in their respective currencies.

- Plaid, based in San Francisco, supports other fintech firms, connecting to customers’ bank accounts, enabling fund transfers and detecting fraud.

- Remitly, a Seattle-based company, provides P2P money transfer services for residents of the U.S., the UK, Canada and Australia. Users can pick up cash from certain locations if they do not have bank accounts.

Outlook for Digital Payments

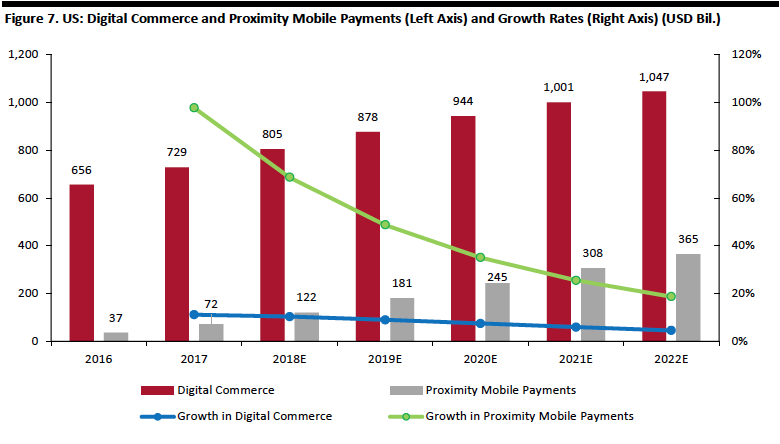

Even though contact credit and debit cards have grown significantly, U.S. consumers have been slow to adopt contactless card payments and mobile payments. This is what we think will happen. US Consumers Will Increasingly Adopt Digital Payments Growth in digital transactions in the U.S. will be mainly driven by proximity mobile payments. More consumers are expected to use e-wallets, such as Apple Pay, Android Pay and Samsung Pay, as merchants offer integrated loyalty programs, driving mobile proximity payments. Statista estimates suggest that in 2018, payments related to digital commerce are projected to be $805 billion and proximity mobile payments will be $122 billion. Digital commerce includes all consumer transactions made on the Internet related to online shopping for products and services using payment methods such as credit cards, direct debit, invoice, or online payment providers, such as PayPal and Alipay. Digital commerce payments are expected to grow at CAGR of 14.8% through 2022 to be worth over $1 trillion, and proximity mobile payments by 31.6% to $365.5 billion. [caption id="attachment_65383" align="aligncenter" width="780"] Digital commerce covers all consumer transactions made on the Internet related to online shopping for products and services using payment methods such as credit cards, direct debit, invoice, or online payment providers, such as PayPal and Alipay.

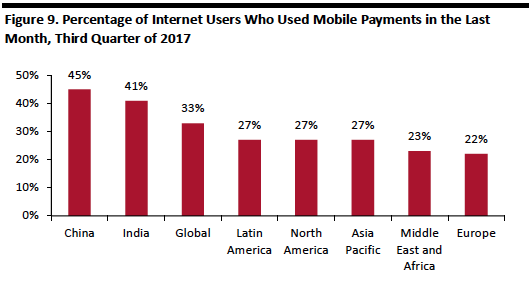

Digital commerce covers all consumer transactions made on the Internet related to online shopping for products and services using payment methods such as credit cards, direct debit, invoice, or online payment providers, such as PayPal and Alipay.Source: Statista[/caption] Huge Growth Potential for Mobile Payment Providers in the US The U.S. has the third-highest number of Internet users, just behind China and India, but the percentage of U.S. Internet users who use mobile payment services is far lower. Only 27% of U.S. Internet users used mobile payment services in 2017, compared to 45% and 41% in China and India, respectively, according to Global WebIndex. Mobile payments include payments for online purchases using mobile wallets as well as proximity mobile payments, they exclude P2P transfers. [caption id="attachment_65385" align="aligncenter" width="532"]

Mobile payments include payments for online purchases using mobile wallets as well as proximity mobile payments, and exclude P2P transfers.

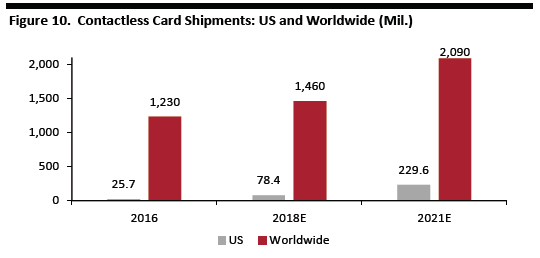

Mobile payments include payments for online purchases using mobile wallets as well as proximity mobile payments, and exclude P2P transfers.Source: GlobalWebIndex/Statista[/caption] Contactless Card Payments to Thrive Security has been a major reason users choose cash and contact cards over mobile payments. A 2016 Federal Reserve study found 67% of respondents stated security as a major reason for not using mobile payments. A lack of necessary infrastructure has also led to slower adoption of contactless card payments in the U.S. compared to other nations, such as China and Canada, countries in which they built the basic infrastructure first, then launched the contactless payment cards. Except for a few big players, not many U.S. merchants have upgraded to NFC-enabled POS terminals. However, as merchants upgrade POS terminals to support chip and contactless cards, contactless card payments will grow at a faster pace, replacing traditional contact cards. ABI research estimates that contactless card shipments stood at 25.7 million in 2016, and are projected to reach 229.6 million in 2021, growing at CAGR of 55%. As more contactless cards land in the wallets of U.S. consumers and more terminals are installed to accept them, we expect a rapid rise in use. [caption id="attachment_65387" align="aligncenter" width="540"]

Source: ABI Research[/caption]

Juniper Research estimates that in 2016, 92.8% of contactless payments in the U.S. were made from mobile wallets while only 7.2% of payments were made through contactless cards, pointing to growth opportunity for contactless cards.

Source: ABI Research[/caption]

Juniper Research estimates that in 2016, 92.8% of contactless payments in the U.S. were made from mobile wallets while only 7.2% of payments were made through contactless cards, pointing to growth opportunity for contactless cards.