albert Chan

Introduction: The Department Store

Starting with Hudson’s Bay in 1670, the department store is the oldest store format. However, in today’s world of niche, specialized products and services, the “something for everybody” department store approach is suffering. Furthermore, supporting a merchandise assortment that understands the changing wants and needs of multiple consumers is costly and challenging. Previously, it may have been easier to dress a family with department store fashion, but today, the range of specialized retailers means that each family member is likely to seek out items from a mix of stores and online retailers to suit their preferences and fulfill their fashion needs. The “one-stop shop” appears over-simplified for today’s world.

As part of our Post-Crisis Outlook series, in this report we provide an update on the sector, forward-looking trends and its prospects for the remainder of 2020 and into 2021.

The Impacts of Covid-19 on the Department Store Sector

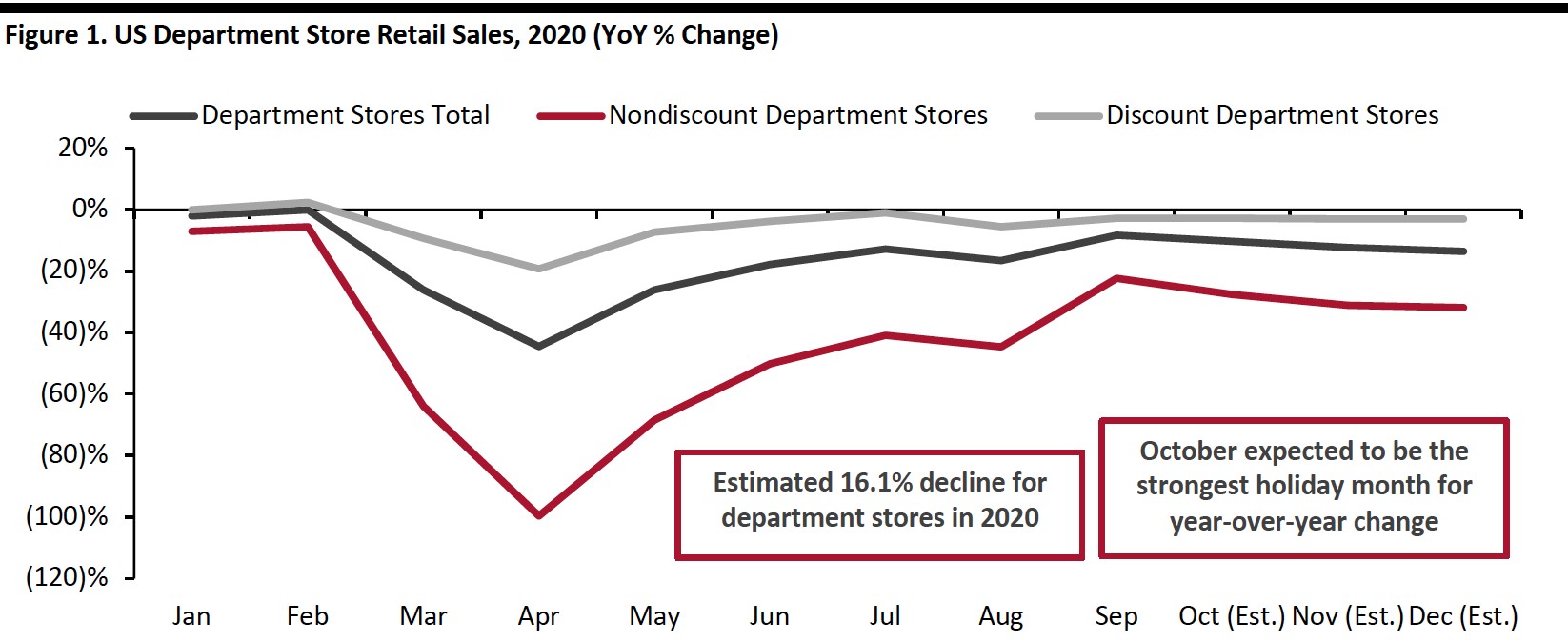

For 2020, we estimate that the overall department store sector will see sales fall by 16.1%, driven by a 41.4% decline in the nondiscount department store sub-sector, as charted in Figure 1 below. We estimate that the discount sub-sector will decline by 4.6% in 2020. The discount segment is much bigger and includes some nontraditional mixed-goods formats, including retailers that stayed open as essential retailers during lockdown (see also the notes below about classifications by the Census Bureau).

The department store sector has exhibited a sequential, month over month improvement from its greatest decline of 44.5% in April 2020. In September, the decline in sector sales eased dramatically. However, given trends in recent months, we are skeptical that this substantially improved performance will continue in the near term, until we see further supporting data points. In terms of year-over-year declines, we expect October to be the strongest month of the holiday season, as many consumers start their holiday shopping earlier than usual. Kohl’s, Macy’s, and Nordstrom highlighted that they will seek to pull some holiday sales forward to October.

Nevertheless, we estimate a still-deep circa-10% decline in October, weakening to a low-teens-percent decline in both November and December, due to shifts in holiday demand. Overall, we anticipate holiday gifting demand to be better than the underlying sector demand—sector sales have been impacted by reduced demand for apparel for work or social events, but such immediate or practical needs are less important for those buying apparel as gifts for others.

Outlook for 2021:

- We estimate that total department store sector sales will be up by around 4–7% overall in 2021. However, such an improvement will not fully restore sales lost in 2020. This estimated increase would see the total department store sector down by between 10% and 13% versus 2019 levels. At the 5.5% midpoint increase, 2021 sales would still be 11.5% below those of 2019.

- Nondiscount department stores have taken the biggest hit in 2020 and will see the biggest bounce in 2021—we estimate that this sub-sector could see sales up by 30–40% in 2021; however, even such a bounce does not return it to close to 2019 levels. The larger discount sub-sector has proved more resilient in 2020 and is likely to see broadly flat sales in 2021.

- We believe that 2021 will see a tough start to the year, as the estimated substantial declines from late 2020 will likely flow through into January and February and with potential impacts from store closures.

Our outlook for sector sales, as shown below in Figure 1, is based on Census Bureau sector data and definitions. The sector was seeing substantial declines even before the crisis—in 2019, total sector sales fell by around 5%, with nondiscount store sales declining by 9% and discount stores declining by 3%. Total 2019 department store revenue amounted to nearly $135 billion, with $93 billion in discount department store revenue and $41.9 billion in nondiscount department store revenue.

According to the Census Bureau, nondiscount department stores have separate departments and checkouts for different merchandise lines while discount department stores have central checkout areas. Some retailers that are categorized as discount department stores were able to remain open as essential retailers during lockdown. Where e-commerce operations are considered to be a different business to a retailer’s store-based operations, the Census Bureau separates e-commerce sales into the nonstore retail sector—so the Bureau’s total figures for department stores are likely to exclude an unspecified amount of online sales.

[caption id="attachment_117847" align="aligncenter" width="700"] Sectors as defined by the US Census Bureau. The Census Bureau separates some online sales off into the nonstore retailers sector—as evidenced by the very deep decline for nondiscount department store retailers in April 2020, when major retailers were still selling online. Given the strength of the discount department store subsector during lockdown, when nonessential stores were closed, we believe the sector includes a number of retailers that may not traditionally be considered department stores.

Sectors as defined by the US Census Bureau. The Census Bureau separates some online sales off into the nonstore retailers sector—as evidenced by the very deep decline for nondiscount department store retailers in April 2020, when major retailers were still selling online. Given the strength of the discount department store subsector during lockdown, when nonessential stores were closed, we believe the sector includes a number of retailers that may not traditionally be considered department stores.According to the US Census Bureau, discount department stores have central customer checkout areas, generally in the front of the store, and may have additional checkouts located in one or more individual departments.

Nondiscount department stores have separate departments for different merchandise lines, such as apparel, jewelry and home furnishings, each with separate checkouts and sales associates.

Source: US Census Bureau/Coresight Research[/caption]

Our separate US Apparel Retail: Post-Crisis Outlook—Fall Update provides further context to our department store estimates, including the following Coresight Research estimations:

- We expect US consumer spending on clothing to fall by 13.2% in 2020.

- We expect the clothing, footwear and accessories specialty retail sector sales to see a drop of 29.3% in 2020.

Department Store Revenue Growth and Category Shifts Due to Covid-19

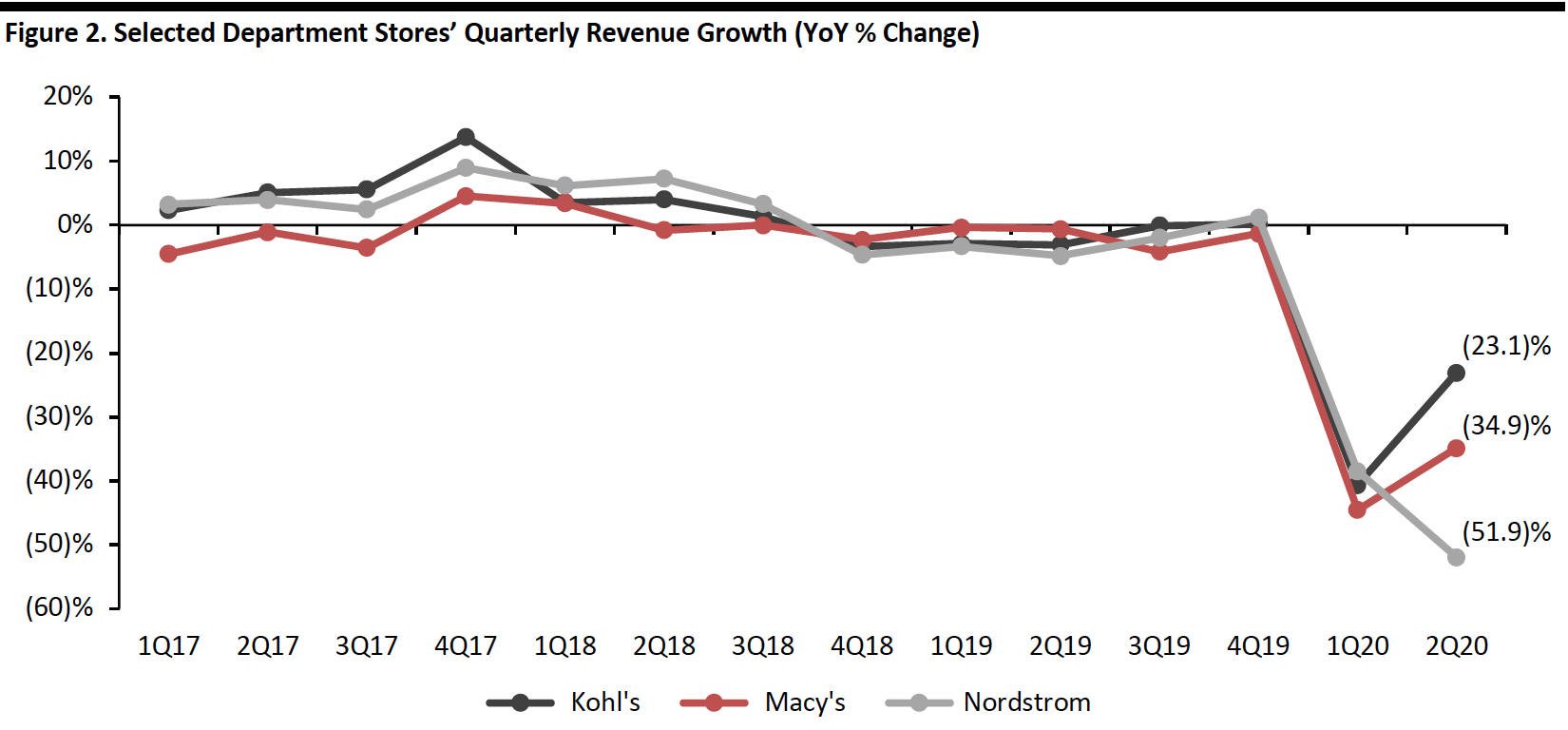

The department store sector has been struggling over the past few years. As shown in Figure 2, revenue growth across the three major US department stores has moved into negative territory for the last seven quarters following the end of 4Q18 on January 31, 2019. The onset of Covid-19 has exacerbated revenue declines as physical stores were forced to close temporarily. The department stores were most affected in 1Q20 and are beginning to see recovery in 2Q20.

[caption id="attachment_117848" align="aligncenter" width="700"] Nordstrom includes Nordstrom Rack; Macy’s includes Macy's, Bloomingdale's, Bloomingdale’s The Outlet, Macy’s Backstage and Bluemercury

Nordstrom includes Nordstrom Rack; Macy’s includes Macy's, Bloomingdale's, Bloomingdale’s The Outlet, Macy’s Backstage and BluemercurySource: Company reports[/caption]

Kohl’s is seeing the fastest recovery out of the three department stores, with revenue down by 23% in 2Q20, compared to Macy’s at 35% and Nordstrom at 52%. This may be attributed to Kohl’s off-mall locations, as over 95% of its stores are located off-mall and consumers may feel safer picking shopping away from busy shopping mall locations. Additionally, Kohl’s stores may have benefitted from reopening earlier than some of its competitor’s stores as many mall-based stores stayed closed for longer.

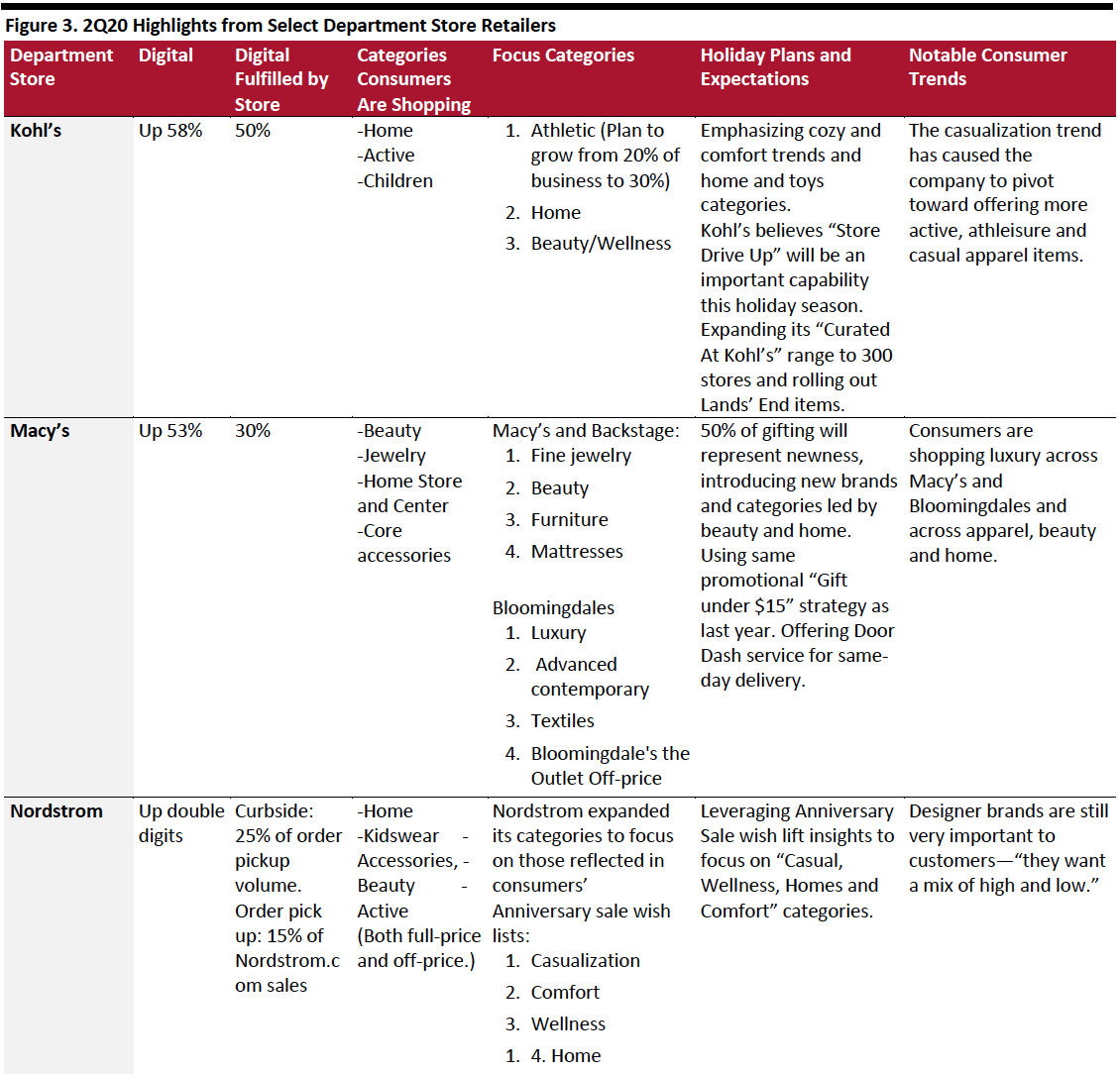

Prior to Covid-19, department stores had a difficult time keeping up with trends—most notably in women’s apparel. The department stores have all highlighted that there has been an acceleration of consumer preferences away from dress apparel categories into casual, comfort and athletic categories—as well as into other major product categories including accessories, beauty, home and wellness. Kohl’s highlighted that they are now focusing on active, home and wellness for the whole family, with the intention of growing its active, athleisure, and outdoor category from 20% to 30% of its business. The company plans to launch its own private-label athleisure brand this spring.

Macy’s reported that its dresses and men’s tailored business was down by 70% during 2Q20 and that consumers were focusing shopping on accessories, beauty, home store and center, and jewelry categories. The company also highlighted that its luxury category was booming across all product types sold at Macy’s and Bloomingdale’s banners, such as cashmere items, fine jewelry (including diamonds), high-end mattresses, luxury watches and top-end beauty products (including skin care and makeup). The company is focusing on this area of the business. Jeff Gennette, Macy’s CEO reported at the Goldman Sachs Annual Retailing Conference that luxury accounted for 30% of Bloomingdales’ overall business in 2Q20, compared to 20% of its business in 2Q19.

Nordstrom’s consumer is still very interested in designer brands and is interested in mixing “high and low” brands. They are shopping active, beauty, home and kidswear categories. In its Anniversary Sale, consumers selected items that reflected casualwear, comfort and wellness trends, as well as home products, and the company is focusing on these categories. Highlights from select department stores from 2Q20 are presented in Figure 3.

[caption id="attachment_117849" align="aligncenter" width="700"] Macy’s includes Macy's, Bloomingdale's, Bloomingdale’s The Outlet, Macy’s Backstage and Bluemercury; Nordstrom includes Nordstrom Rack

Macy’s includes Macy's, Bloomingdale's, Bloomingdale’s The Outlet, Macy’s Backstage and Bluemercury; Nordstrom includes Nordstrom RackSource: Company reports[/caption]

Accelerations in Department Store Closures

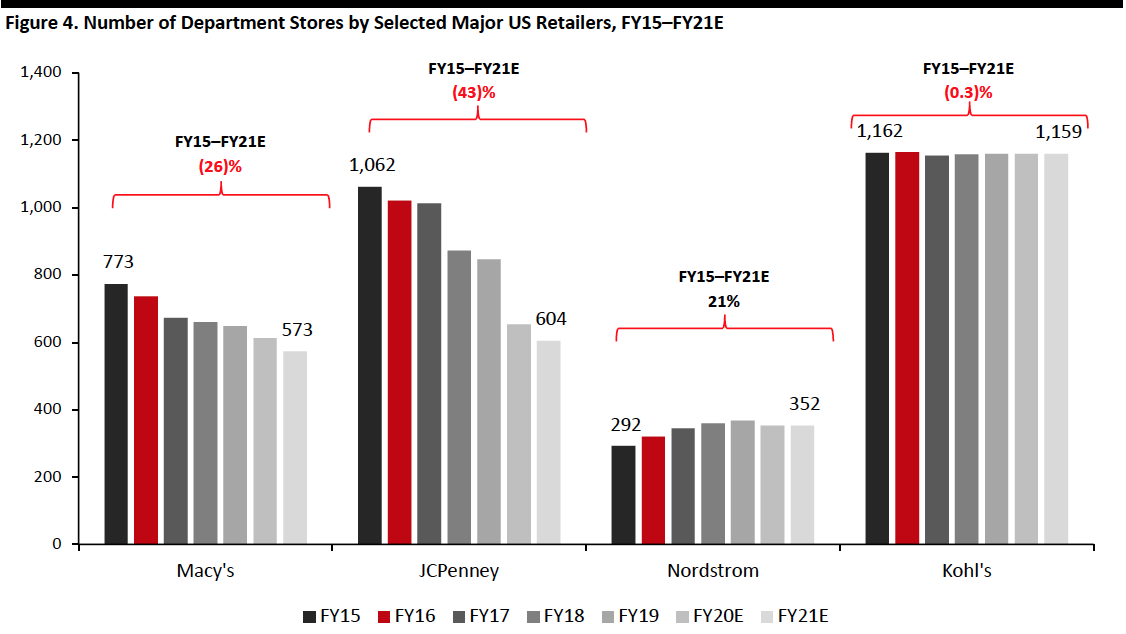

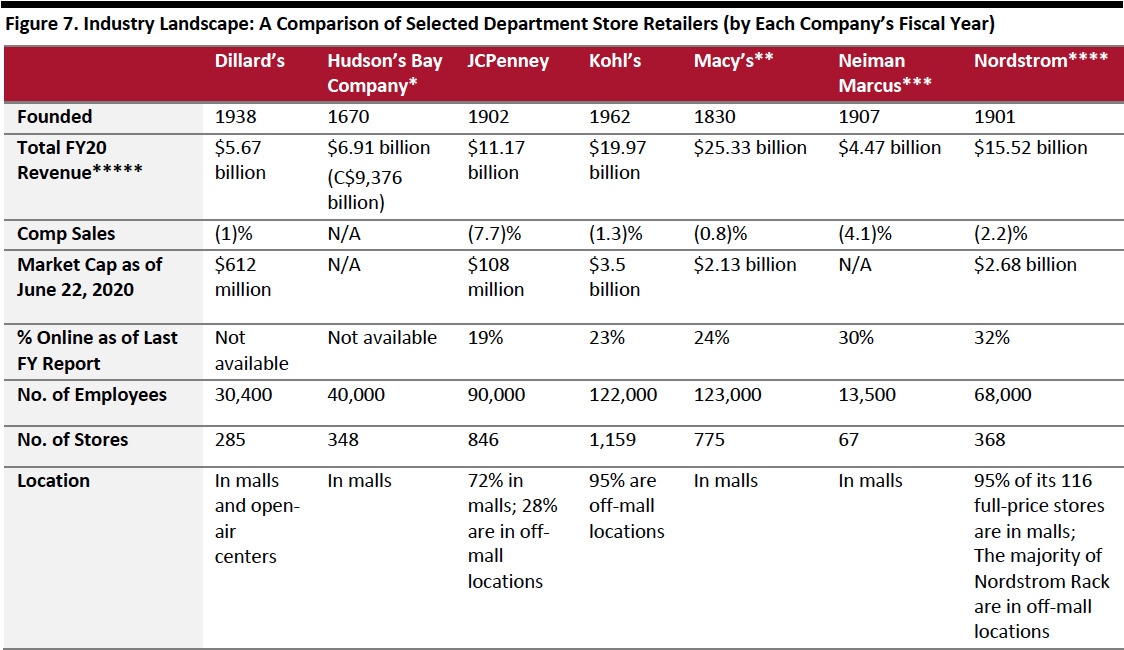

Coresight Research analyzed the three major department store chains—Kohl’s, Macy’s and Nordstrom. Over the past five years, the number of stores operated by these chains has declined by 18%, from 3,289 in fiscal year 2015 to 2,688 department stores at the end of fiscal year 202, as shown in Figure 4.

It is important to note that the number of department store closures is understated because it does not take into all department stores:

- When Sears retailer filed for bankruptcy on October 15, 2018 it operated a total of 700 total stores; as of February 2020, Sears operated 182 stores under its banner—totaling an estimated 518 closures.

- Stage Stores filed for bankruptcy on May 11, 2020. The company operates 769 stores that are impacted by store closures. As it was unable to find a buyer during bankruptcy, Stage Stores has begun the liquidation and closing process of its stores.

The pace at which departments stores are closing is accelerating:

- Three major chains—JCPenney, Macy’s and Nordstrom—have confirmed a combined total of 598 department store closures over the period of FY15 to FY21, with 298 of these (55.7%) set to occur in this year and next. Kohl’s store fleet has remained steady, hovering at around 1,160 stores without major closures.

We summarize selected store-closure announcements of these three major department store chains below:

- JCPenney announced on May 19, 2020 that it will not reopen 246 stores (22.6% of its fleet) between FY20 and FY21, with expectations to close 192 stores in FY20 and 50 more in FY21—taking its store count down from 846 to 604.

- Macy’s announced at its Analyst Day on February 5, 2020 that it would close 125 of its 613 stores (20.4% of its department store fleet) over the next three years. Management reported that the announced plan optimizes the company’s portfolio of stores that are mostly in A and A+ malls, “because these malls are going to be vital destinations for generations to come.”

- Nordstrom announced on April 30, 2020 that it would close 13.7% of its full-line stores and has closed 16 of its 116 full-line department stores in 2020. These stores are primarily located in category A malls. The company reported at the Goldman Sachs Retailing Conference on September 10, 2020 that it did not open the 16 stores set for closure after the pandemic.

Fiscal years end January, so FY20E, for example, ends in January 2021.

Fiscal years end January, so FY20E, for example, ends in January 2021.Macy’s FY20 and FY21 estimates are based on a company announcement that 125 stores will close over the next three years.

Source: Company reports/Coresight Research[/caption]

Department store closures have a significant impact on malls because of their sheer size—the average department store ranges from approximately 100,000 square feet to upwards of 160,000 square feet for a mall-based anchor store, so department store closures leave behind a lot of space to fill. There may also be ripple effects for surrounding retail stores, mall owners and the overall mall ecosystem, particularly as many retailers have co-tenancy clauses in their leases to provide protection if a key tenant leaves the retail space—such as rent reductions or compensation for reduced traffic.

Department Stores Lean into Digital in the Wake of Covid-19

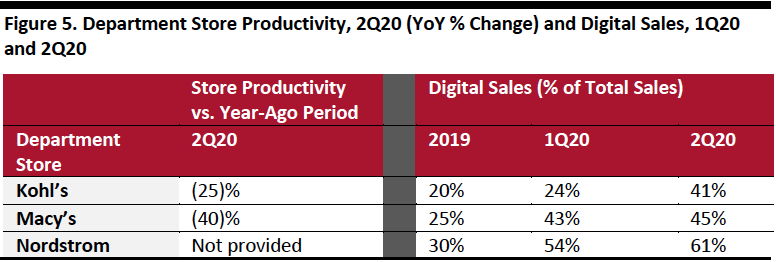

Physical store sales productivity has not yet returned to near-normal levels, with Kohl’s and Macy’s reporting that in-store sales were down from 25% to 40% in the second quarter. Nordstrom did not report its in-store productivity.

However, the pandemic has helped retailers to accelerate their digital channels, as store productivity was reduced. With feet to the fire, department stores had to innovate digital channels quickly in order to attract customers and maintain sales. As shown in Figure 5, Kohl’s digital sales as a percentage of its total sales grew from 20% in 2019 to 41% in 2Q20. Macy’s has grown its online sales from 25% to 45% and Nordstrom increased e-commerce sales from 30% to 61%, as shown in Figure 4. Macy’s reported that it expects to see continued growth of its digital channels and for online sales penetration to remain high.

In 2Q20, 4 million new customers visited macys.com. In a conversation with the President and CEO of the National Retail Federation Matthew Shay, Macy’s CEO Jeff Gennette said that the increased digital demand has helped Macy’s to learn more about its customers—revealing that they are younger, more diverse than its core customer, and wanted services that Macy’s did not offer—such as different ways to pay, installment payment options and same day delivery. Macy’s moved quickly to implement Klarna’s flexible payment solution and partnered with DoorDash to offer a same day delivery service nationwide. Macy’s is data analysis from its digital channels to keep up with consumer demands and help the company to adapt quickly.

[caption id="attachment_117851" align="aligncenter" width="550"] Macy’s includes Macy's, Bloomingdale's, Bloomingdale’s The Outlet, Macy’s Backstage and Bluemercury; Nordstrom includes Nordstrom Rack;

Macy’s includes Macy's, Bloomingdale's, Bloomingdale’s The Outlet, Macy’s Backstage and Bluemercury; Nordstrom includes Nordstrom Rack;Source: Company reports[/caption]

Each of the CEOs of the three department store retailers referenced in Figure 5 have emphasized the relationship between the physical and digital channels—and how they see these channels strengthening each other:

- Macy’s CEO, Jeff Gennette said that the Macy’s brand is constantly looking at ways to make its products more profitable. He explained in his conversation with CEO of the National Retail Federation Matthew Shay that while digital is profitable, as a channel it is not as profitable as stores. The company is therefore looking at ways to leverage its stores, such as using store-based fulfillment strategies and using inventory from stores with Buy Online, Pick Up in Store (BOPIS) services to reduce shipping. Macy’s is leveraging the relationship between stores and e-commerce to optimize inventory management and maximize profitability.

- Nordstrom emphasized that it is investing in its Nordstrom Rack digital presence as consumers are seeking more online merchandise from Nordstrom Rack and BOPIS options. The company is one of the largest off-price, digital retailers and it aims to be the leader in the off-price digital world. This has traditionally been a tough nut to crack, as the off-price digital world has to manage many different stock keeping units (SKUs) across different brands, categories, descriptions, as well as many individual SKUs, which presents a challenge for website administrators. Nordstrom Rack reported that its customers are increasingly requesting more online shopping options and want the convenience of collecting products from physical stores, so the company is investing in this capability.

- Kohl’s CEO Michelle Gass said that the company sees its omnichannel opportunity as more important than ever. Gass explained that one positive impact of coronavirus-related closures is the shift by its customers toward omnichannel shopping. Kohl’s omni-channel shopper is six times more productive than a digital-only customer and four times more productive than a store-only customer, presenting a significant opportunity for the holiday season and beyond.

Department Store Chapter 11 Bankruptcies amid Covid-19: An Update

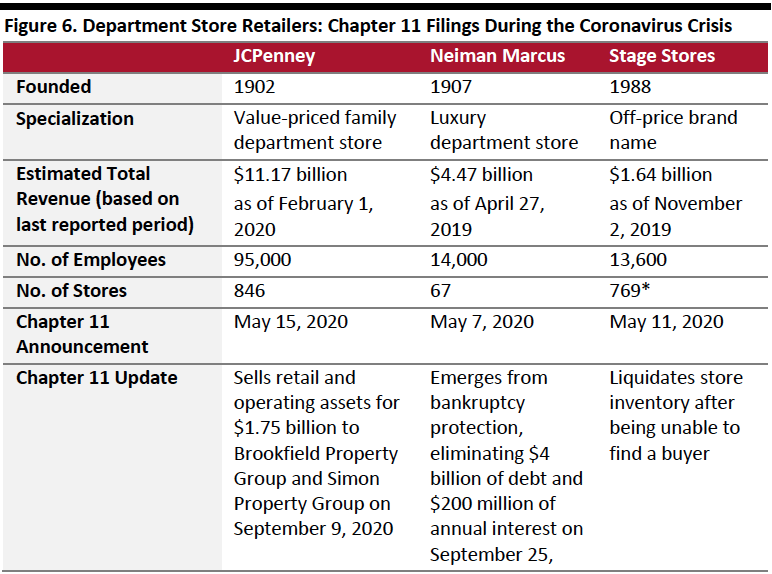

Within a two-week period in May 2020, three major US department store retailers filed for Chapter 11 bankruptcy. Amidst the pandemic, Neiman Marcus filed on May 5, Stage Stores on May 11 and JCPenney on May 15. Combined, the three chains hold 1,862 stores and $17.3 billion in revenue as of the last reporting period—totaling 12.8% of total FY20 sector revenue from selected major retailers.

On September 9, JCPenney sold its retail and operating assets for $1.75 billion to Brookfield Property Goup and Simon Property Group and the company’s stores remain open. Neiman Marcus reemerged from bankruptcy protection as of September 25. However, Stage Stores was unable to find a buyer and began the liquidation process. This affects 769 department stores, which are mainly located in the southwest and areas with small populations—86% of its stores are located in areas with less than 150,000 residents. The store closures may provide an opportunity for off-price retailers in these areas.

[caption id="attachment_117852" align="aligncenter" width="550"] *Includes 158 Gordman Stores

*Includes 158 Gordman StoresSource: Company reports/Coresight Research[/caption]

The three department stores that filed for Chapter 11 during the coronavirus pandemic span the value to luxury markets, each specializing in their unique customer base, highlighting today’s precarious retail environment.

- JCPenney offers value prices on products that the entire family can shop. The store was founded in 1902, so it is a household department store name.

• Update: On September 9, 2020, JCPenney entered into an agreement with Brookfield Property Group and Simon Property Group to sell its retail and operating assets for $1.75 billion, which includes a combination of cash and new term loan debt. The agreement contemplated the formation of a separate real-estate trust and a property holding company that will include 161 of the company’s real-estate assets and all of its owned distribution centers.

- Neiman Marcus is associated with luxury. The company is known for producing a holiday catalog that includes outrageous and extraordinary gifts.

• Update: On September 25, 2020 Neiman Marcus emerged from bankruptcy protection, eliminating $4 billion of debt and $200 million of annual interest. The company completed a restructuring process and identified new ownership, including Davidson Kempner Capital Management, PIMCO and Sixth Street. According to a report by Bloomberg, the company began reducing an undisclosed number of its employees in September as it reemerged from bankruptcy.

- Stage Stores’ department store portfolio was in the midst of transitioning to the Gordmans off-price brand when it filed for bankruptcy. Management reported on January 13, 2020 that it expected to have 700 of its department stores converted to off-price by the end of the year. More than 86% of its stores are located in markets that have a population of fewer than 150,000 people.

• Update: After filing for bankruptcy in May 2020, the retailer was unable to find a buyer. Therefore the company is proceeding with the liquidation process.

Key Players in the Department Store Sector: Covid-19 Impact and Outlook

The department store sector was deemed to be “nonessential” during the coronavirus pandemic, meaning that nearly all brick-and-mortar stores were temporarily closed.

Here we look at performance highlights from 2Q20, customer spending preferences, digital growth and fulfillment, notable trends, store announcements and holiday outlook for the sector.

Kohl’s

- Performance Highlights: As stores reopened over the first two weeks of May, Kohl’s reported its store productivity to be at 50% to 50%—in the remaining 2Q20 quarter, productivity increased to 75%. From a category perspective, the company saw strong demand for active, childrenswear and home but it experienced softness in apparel, including men’s and women's dress attire. On September 16, 2020, the company announced a 15% corporate headcount reduction as part of a restructuring related to Covid-19. The company expects to make annual savings of approximately $65 million through the reduction, according to a regulatory filing.

- Category Prioritization: Kohl’s CEO Michelle Gass said that the company sees a “tremendous opportunity” around “active, casual and wellness” categories. Gass said that consumers want to be comfortable while working from home and are wearing athleticwear to work, adding that there is an opportunity around wellness which extends to cooking and sleeping. Kohl’s active category, which also includes athleisure and outdoor, makes up 20% of its total business today and the company plans to increase this to 30%. The Kohl’s brand is repositioning to stand for all things for the family, which Gass said is white space for the company. She said that although lots of retailers do aspects of active, casual and wellness for the family, but the breadth of what Kohl’s accessible assortment will offer the entire family will put the company in a unique position. From a brand portfolio, Kohl’s is introducing its own athleisure brand in spring 2021.

- Digital: Kohl’s reported that its digital sales increased 58% in 2Q20, representing 41% of net sales in the quarter—up from 20% last year. Its home category business remained very strong during the second quarter, with sales up double digits overall and up over 90% digitally. Its active offering also outperformed in the quarter, with sales increasing more than 70% digitally. Previously, in April of 1Q20, when all stores were closed, digital sales were up by 60%, and for the month of May in 2Q20 digital sales were up by 90%.

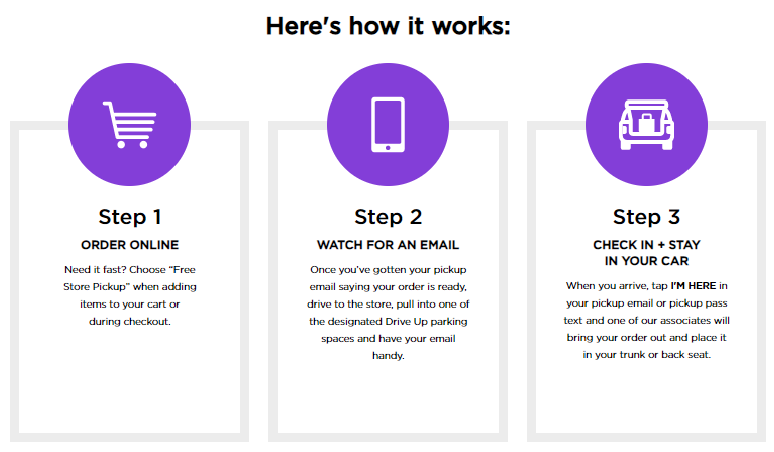

- Fulfillment from Stores: The company reported that it is leveraging its store inventory to fulfill 50% of its digital orders—an increase of 40% from 1Q20. This has been particularly useful for categories that are trending up, such as home. Additionally, customers picking up orders from stores accounted for 15% of digital demand, with Kohl’s Store Drive Up service accounting for around half of this.

Store Drive Up

Store Drive UpSource: Kohls.com[/caption]

- Off-Mall Stores: Around 95% of Kohl’s stores are located in off-mall locations in suburban communities and within 15 miles of 80% of people in the US. The company’s management said in its first-quarter earnings report that its off-mall stores provide a unique advantage to facilitate social distancing as consumers begin to journey away from home. Our recent proprietary survey of US consumers found that shoppers are likely to favor off-mall locations in the wake of the crisis, with 43.3% of respondents reporting that they expect to avoid shopping centers and malls after lockdowns end. Kohl’s is very much positioned as an omnichannel retailer, with over 40% of its digital orders fulfilled by stores. As 99% of its stores are cashflow positive but 50 to 75 leases come to an end within the next year, the company will need to make important location decisions, but claims that it has a lot of flexibility. The company’s management reported that Kohl’s has considered smaller store formats, but explained that large store spaces with over 75,000 square feet of space will be an advantage post coronavirus—providing more space for social distancing and cleaning facilities.

- Holiday Expectations: Due to the uncertainty of securing items and safety concerns, Kohl’s expects consumers to bring holiday shopping forward, starting in October. The company is focusing on customer’s current lifestyles and are emphasizing comfort, cozy, home and toys categories. The company’s launch of Store Drive Up service has been particularly successful and will be an important capability this holiday season.

Macy’s Banner Stores

- Performance Highlights: CEO Jeff Gennette reported at the Goldman Sachs Annual Global Retailing Conference on September 9, 2020 that Macy’s store productivity is down around 40% compared to last year. On June 9, the company reported that average sales productivity was down around 50% across its 400 reopened stores. Macy’s started opening its stores on May 4, 2020 with incremental store openings each week. Beauty, core accessories, home store and center, and jewelry are the top-performing businesses across its stores. Gennette said that its home business has been a standout and the company expects this to through the remainder of the year into 2021. Beauty has also been a highlight—particularly for fragrance, luxury and skincare products. In apparel, the consumer has shifted category preferences from dresses and men’s tailored clothing, which were formerly the company’s two “destination businesses,” towards active, athleisure and loungewear items. Dresses and men’s tailored clothing sales declined by nearly 70% in the spring season.

- Category Prioritization: The company is focusing on current consumer demand, with a strategy titled “Focus 4.” Macy’s and Backstage is focusing on beauty, fine jewelry, furniture and mattresses. At Bloomingdale's, the focus is on the advanced contemporary, luxury and textiles categories, as well as Bloomingdale's the Outlet (off-price).

- Digital: Macy’s reported that its digital sales grew by 53% in the second quarter. Macy’s reported that app and mobile device users accounted for 57% of sales and 77% of traffic. In 2Q20, the company recorded 4 million new digital customers. At the Goldman Sachs Global Retailing Conference in September, CEO Jeff Gennette reported that in 2019, digital sales accounted for 25% of the company’s business, while today it accounts for over 40%. The company expects digital penetration to remain high moving forward—traffic on Macy’s.com and bloomingdales.com is up significantly and conversion rates are healthy.

- Fulfillment from Stores: Macy’s reported that 30% of its digital demand is fulfilled through stores, through BOPIS, curbside pickup and ship to store services.

- Investments in Backstage banner: Macy’s is testing an online sales platform for Backstage during October 2020. The company’s management is going to test and iterate its online off-price basis on the basis of strong customer indications about Backstage. The company also announced in its 2Q20 earnings that it will be launching three free-standing Backstage stores in three markets over the next two years.

- Store Closures and New Store Formats: The company has put its “Store 150” growth strategy on pause. The previously announced number of store closures has not changed. Macy’s announced in its 2Q20 earnings call that it plans to open several small-format off-mall Macy's stores. The company plans to test a small format for Bloomingdales in 4Q21. The company plans to build its second Market @ Macy’s concept store in Dallas in 2021.

- Holiday Expectations: Macy’s expects the holiday shopping season to be extended this year and is focusing on newness for 50% of gifts. The company is promoting gifts under $15, as well as luxury categories and price points, given the strong position of luxury sales. Macy’s is partnering with DoorDash to offer same day delivery options nationwide. Macy’s expects the same promotional levels as the 2019 holiday season.

Nordstrom

- Performance Highlights: In its 2Q20 earnings call, Nordstrom reported that its Rack business continues to produce “stronger store results than full-price stores.” In full-price, net sales decreased by 58% whereas off-price net sales decreased by 43%. Top performing categories included accessories, active, beauty, home and kidswear—in both full-price and off-price.

- Category Prioritization: Nordstrom is expanding its categories to focus on casualization, comfort, home and wellness—reflecting its consumers’ Anniversary Sale wish lists. For the first time, customers could preview items ahead of the Anniversary Sale through a digital catalog and build wish lists to allow for faster checkout after the launch. Nordstrom reported that customers created nearly 20 million wish lists, providing the company with significant insight into trends. The company’s management said that the products customers were selecting highlighted the “casualization of America” trend that has accelerated during the pandemic and is expected to remain. While consumers will still attend events and weddings, Nordstrom still envisages a more casual consumer.

- Digital: The company reported that its digital business traffic grew by double digits year-over-year and sequentially improved from Q1, indicating signs of increasing customer demand. On its 1Q21 and 2Q21 earnings calls, Nordstrom reported that its e-commerce business continues to see growth of more than 50% in new customers. However, the company did see its digital sales decline by 5%, which included the shift of its Anniversary Sale from July to August. Excluding this shift, its digital sales increased by 20%.

- Fulfillment from Stores: Nordstrom increased customer use of contactless services such as curbside pickup and returns, which represent 25% of its order pickup volume. In total, order pickup is approaching 15% of nordstrom.com sales. On June 16, Nordstrom reported that its full-price business normally fulfills approximately 20% of its orders from stores, but when stores were closed during the pandemic, Nordstrom fulfilled over 50% of orders from stores.

- Growth Opportunities at Nordstrom Rack: At the Goldman Sachs Annual Global Retailing Conference in September 2020, Erik Nordstrom said that the company is focusing on opportunities at Nordstrom Rack opportunity across three areas. First, the company sees growth in lowering price points. Secondly, it aims to better connect its physical Nordstrom Rack stores with its digital stores, which relates to its third identified opportunity that focuses on increasing its digital assortment. The company’s management said that it has one of the biggest online off-price businesses of any brand, so it sees opportunity in driving its omnichannel presence by continuing to focus its personalization efforts, which will provide more opportunities for customers to buy online and pick up in store. Expanding its online assortment online will also provide even more choice for its customers.

- Physical Store Footprint: At the Goldman Sachs Conference, CEO Erik Nordstrom, said that he sees the company’s full-price store fleet reducing in 2021 compared to 2019, whereas the company plans to continue expanding its off-price fleet channel. Opening Nordstrom Rack stores does not require significant advance planning, presenting a clear opportunity to expand.

- Holiday Expectations: The company is expecting an early holiday shopping season this year and is decorating its stores before Thanksgiving, which it does not normally do. Nordstrom plans to leverage data from its Anniversary Sale to inform assortments and focus on categories that are resonating with customers along the themes of active, casualization and wellness. It is expanding its assortment of giftable products, with greater range at lower prices. It is focusing on making it easy for customers to shop by emphasizing convenience services and festive experiences in stores and online.

*Hudson’s Bay Company includes Saks Fifth Avenue/Saks OFF 5TH and, formerly, Lord & Taylor

*Hudson’s Bay Company includes Saks Fifth Avenue/Saks OFF 5TH and, formerly, Lord & Taylor**Macy’s includes Macy's, Bloomingdale's, Bloomingdale’s The Outlet, Macy’s Backstage, and Bluemercury

***Includes Last Call and Bergdorf Goodman; note, there are 43 Neiman Marcus stores.

****Includes Nordstrom Rack; There are 116 full-price Nordstrom and 248 Rack stores as of May 29, 2020. The company announced it will close 16 full-price stores and three Jeffrey Boutiques on May 20, 2020.

*****Dillard’s last reporting period on May 5, 2020; Neiman Marcus last reporting period ended on April 27, 2019; all others on February 1, 2020

Source: Company reports[/caption]

Trend Analysis and Insights

Department Stores Are Pivoting to Trending Categories

Covid-19 has forced department stores to pivot more quickly to trending categories including activewear, beauty, casualwear, comfortwear and home. Dramatic sales decreases include the dress apparel and businesswear categories. As department stores have seen slow declines over time, these trend shifts acted as a wakeup call and forced refocusing efforts, according to new preferences and new consumer priorities, such as working from home.

Contactless Pickup Services

Consumers are seeking contactless product-delivery options in the wake of the crisis—for both convenience and safety. Retailers offering store “drive-up” and other pickup options are reporting positive consumer feedback, such as Kohl’s. Stores in off-mall locations may be better positioned for this solution, because retailers can create lanes or designated areas within parking lots for this purpose, whereas malls have limited space and thus fewer opportunities.

Leveraging Store Inventory

Department stores are increasingly shipping digital orders from stores in order to reduce inventory. Kohl’s reported that more than 50% of its digital orders were fulfilled by ship-from-store and customer pickup services during the second quarter, up from 40% in the first quarter. Macy’s reported that it sees increasing opportunities to maximize the store for profitability. We expect this trend to continue beyond the coronavirus crisis, as retailers further identify business process efficiencies to best meet customer demand.

Value-Conscious Consumers

Indicators are pointing to potential strong performances in the value department store sector in the near term, with Nordstrom Rack and Macy’s Backstage both reporting sales above their full-price counterparts. Both retailers reported making investments in their online off-price channels—Nordstrom has one of the biggest online off-price businesses of any brand, so it sees opportunity to drive its omnichannel presence by continuing to focus its personalization efforts and providing larger online selections and BOPIS services for Nordstrom Rack. Nordstrom also reported that it sees future physical store growth for its Rack store. Similarly, Macy’s plans to open three free-standing Backstage stores over the next two years.

Growth Opportunities in Beauty

Kohl’s, Macy’s and Nordstrom each highlighted the beauty category as a high-growth opportunity to pursue. Kohl’s identified “wellness” as an area of focus in all areas, which includes beauty, and the retailer announced it will launch Lauren Conrad Beauty, a clean makeup and skincare brand that aligns with wellness priorities. Macy’s identified “beauty” as one of its four focus categories to prioritize in the future, based on insights into areas where consumers are spending.

Outlook

The Covid-19 pandemic exacerbated the existing challenges facing the department store sector, with three department store retailers filing for Chapter 11 bankruptcy in May 2020. Neiman Marcus emerged from bankruptcy protection in September while JCPenney sold its retail and operating assets to Brookfield Property Group and Simon Property Group for $1.75 billion, and Stage Stores was forced to begin liquidation of its 769 stores. While it is not the end of the road for Neiman Marcus and JCPenney, coming out of bankruptcy presents challenges as the consumer is sometimes unclear of the retailer’s status. Adding Covid-19 pandemic challenges on top of bankruptcy is an additional hurdle.

We expect overall department store sales to decline by around 16% in 2020. In 2021, we project that department store sector sales will be up 4–7% over 2020. This range is approximately 10–13% below pre-Covid total department store sector sales for 2019. We expect the department store sector to achieve better results going into 2021 by optimizing its assortments, focusing on digital, maximizing inventory store fulfillment options, and using data to determine what the customer is seeking.

We expect October to be the strongest of the 2020 holiday months, in terms of the year-over-year percentage change in sector sales, although we estimate a still-deep decline of around 10% for October. Given the context of this holiday season, we expect department stores’ spacious layout to be a benefit as consumers are seeking less-confined shopping experiences. Additionally, the everything-under-one-roof format may attract consumers who want to spend less time moving from store to store. Lastly, mall anchor department stores or those off-mall locations stand to benefit more from store pickup than interior mall stores.

Activewear, beauty, casualwear, home and wellness will all become more crowded categories as each of the department stores have highlighted that they are focusing on these areas as growth categories. Kohl’s is launching a private-label athleisure brand and plans to grow active from 20% to 30% of its business; Nordstrom is focusing on casual, comfort, home and wellness as a result of insights from customer’s Anniversary Sale wish lists; and Macy’s is focusing on accessories, beauty, home, jewelry and luxury.