DIpil Das

Introduction: The Department Store

Starting with Hudson’s Bay in 1670, the department store is the oldest store format. However, in today’s world of niche, specialized products and services, the “something for everybody” approach of the department store is suffering. Furthermore, supporting a merchandise assortment that understands the changing wants and needs of multiple consumers is costly and challenging. In simpler days, it may have been easier to dress a family with department-store fashion; today, the preferences and demographic trends of each family member may be so unique and varied that they may seek out specialty retailers, athletic retailers, boutiques, online retailers or a mix of all of the above to fulfill their fashion needs. The “one-stop shop” is over-simplified in today’s world.How Has the Department-Store Sector Been Impacted by Covid-19?

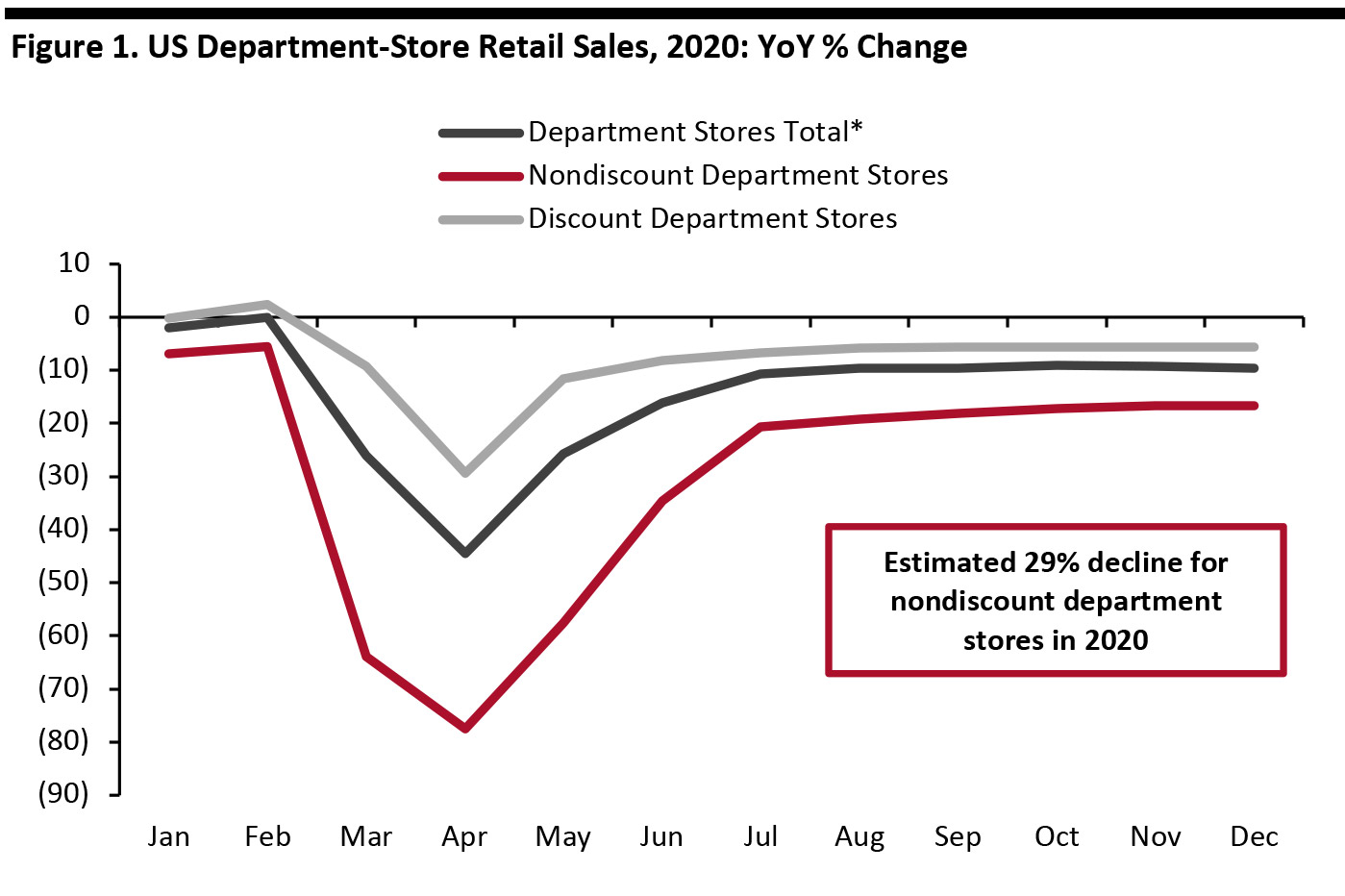

Our outlook for sector sales, shown below, is based on Census Bureau sector data and definitions. During coronavirus-led lockdowns, the department-store sector was severely hit, according to the Census Bureau—but not as badly as may have been expected, given the closure of all nonessential retailers, including the major department-store chains.- In April, the only full month of enforced closures, total department-store sector sales fell by 44.5%, according to the Census Bureau. Based on prior months’ trends, we estimate that this limited decline—“limited” given the context—was supported by the discount department-store subsector. In May, total sector sales fell by 25.8%.

- The department-store sector will be one of the worst hit of all sectors, impacted by an estimated double-digit decline in spending on clothing, store closures (although closing-down sales may prompt isolated improvements) and the structural weakness of the sector in terms of consumer demand.

- Total department-store sales will fall by around 14% in 2020, driven by an estimated 29% fall at nondiscount stores and an 8% fall at discount department stores (as defined by the Census Bureau).

- See our separate report US Apparel Retail: Post-Crisis Outlook for our estimates for consumer spending on clothing—a key category for department stores—for 2020.

*As defined by the US Census Bureau. Given the strength of the discount department-store subsector during lockdown, when nonessential stores were closed, we believe the sector includes a number of retailers that may not traditionally be considered department stores. According to the US Census Bureau, discount department stores have central customer checkout areas, generally in the front of the store, and may have additional checkouts located in one or more individual departments.

*As defined by the US Census Bureau. Given the strength of the discount department-store subsector during lockdown, when nonessential stores were closed, we believe the sector includes a number of retailers that may not traditionally be considered department stores. According to the US Census Bureau, discount department stores have central customer checkout areas, generally in the front of the store, and may have additional checkouts located in one or more individual departments. Nondiscount department stores have separate departments for different merchandise lines, such as apparel, jewelry and home furnishings, each with separate checkouts and sales associates.

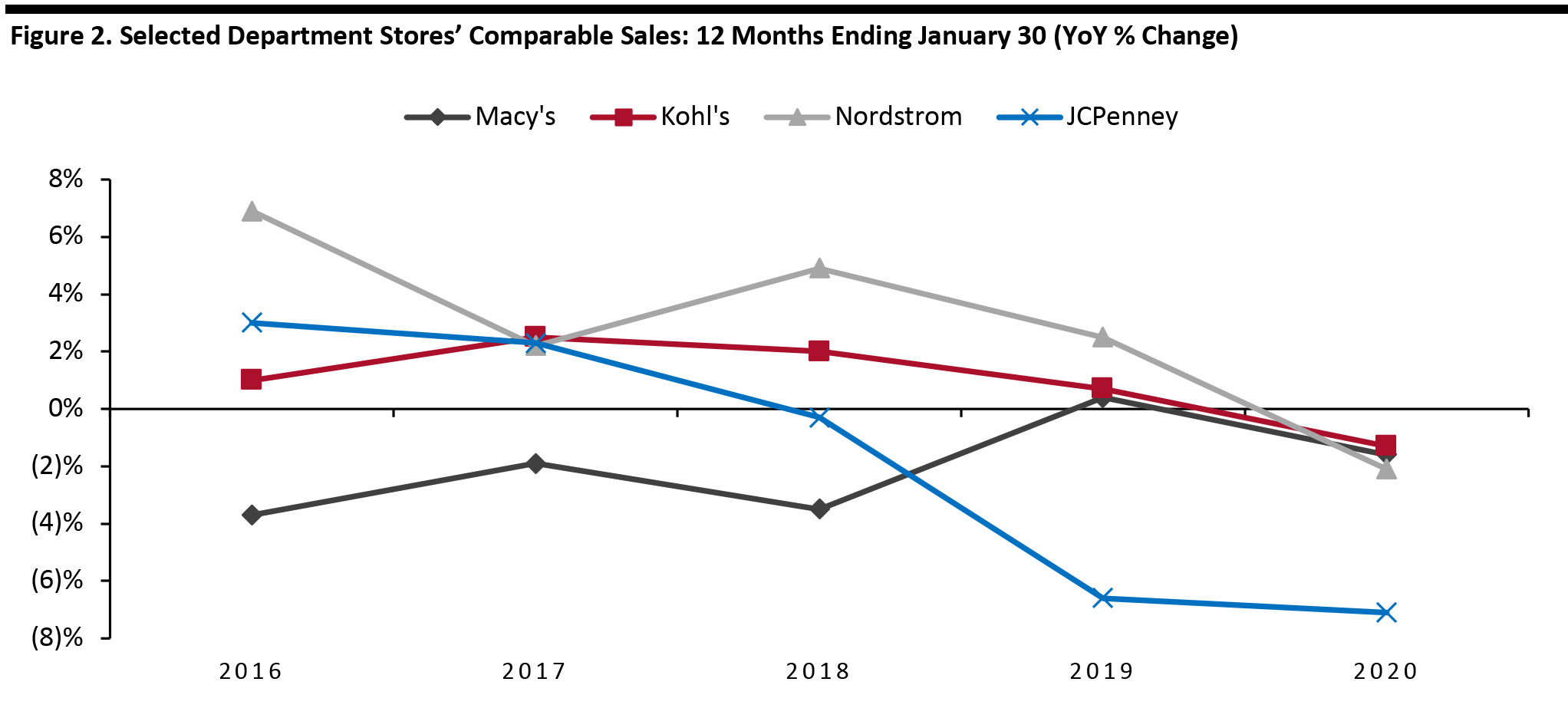

Source: US Census Bureau/Coresight Research[/caption] Department-Store Comparable Sales, Store Closures and Bankruptcies The department-store sector has been struggling over the past few years. As shown in Figure 2, comparable sales across the four biggest department stores moved into negative territory in the latest fiscal year. [caption id="attachment_112598" align="aligncenter" width="700"]

Nordstrom includes Nordstrom Rack; Macy’s includes Macy's, Bloomingdale's, Bloomingdale’s The Outlet, Macy’s Backstage and Bluemercury

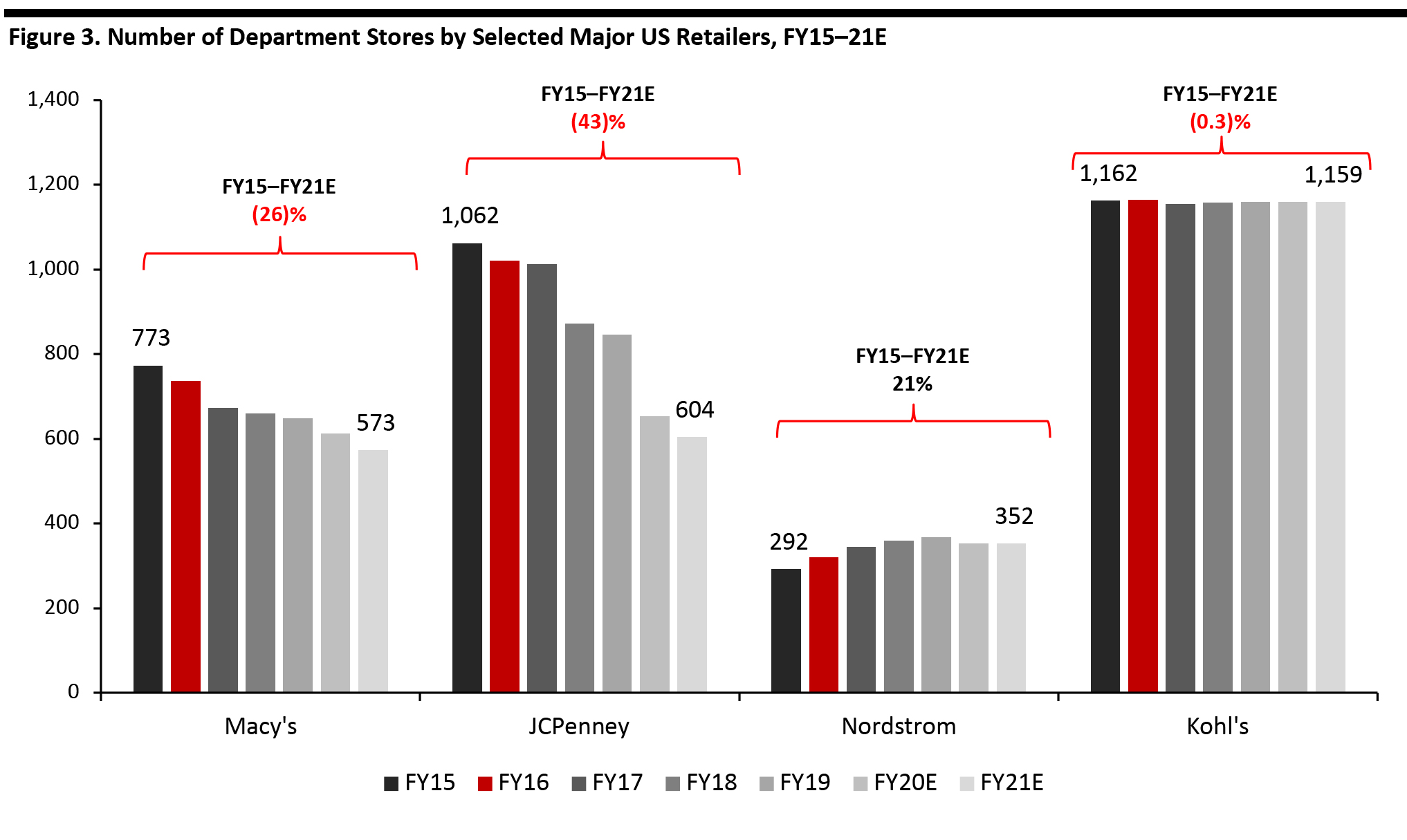

Nordstrom includes Nordstrom Rack; Macy’s includes Macy's, Bloomingdale's, Bloomingdale’s The Outlet, Macy’s Backstage and Bluemercury Source: Company reports [/caption] Department stores have had a difficult time keeping up with trends, most notably in women’s apparel. The fast-moving fashion cycle has exacerbated an already challenging environment. Department-Store Closures Are Accelerating: Just Three Chains Set To Close 303 Stores over the Next Two Years Coresight Research analyzed the four major department-store chains noted above. Over the past five years, the number of stores operated by these chains has declined by 18%, from 3,289 in fiscal year 2015 (FY15) to 2,688 department stores in FY21E, as shown in Figure 3. It is important to note that the number of department-store closures is understated because it does not take into account the closures of Sears, which filed for bankruptcy on October 15, 2018. The retailer had 700 total stores; as of February 2020, Sears operated 182 stores under its banner, totaling an estimated 518 closures. Stage Stores filed for bankruptcy on May 11, 2020; the company operates 769 stores that could be impacted by store closures. The pace at which departments stores are closing is accelerating.

- Three major chains—Macy’s, JCPenney and Nordstrom—have confirmed a combined total of 598 department-store closures over the period of FY15 to FY21, with 298 of these (55.7%) set to occur in this year and next. Kohl’s store fleet has remained steady, hovering at around 1,160 stores without major closures.

- JCPenney announced on May 19, 2020 that it will not reopen 246 stores (22.6% of its fleet) between FY20 and FY21, with expectations to close 192 stores in FY20 and 50 more in FY21—taking its store count down from 846 to 604.

- Macy’s announced at its Analyst Day February 5, 2020 that it would close 125 of its 613 stores (20.4% of its department-store fleet) over the next three years. Management reported that the announced plan optimizes the company’s portfolio of stores that are mostly in A and A+ malls, “because these malls are going to be vital destinations for generations to come.”

- Nordstrom announced on April 30, 2020 that it would close 13.7% of its full-line stores, closing 16 of its 116 full-line department stores in 2020. These stores are primarily located in A malls.

Fiscal years end January, so FY20E, for example, ends in January 2021. Macy’s FY20 and FY21 estimates based on a company announcement that 125 stores will close over the next three years.

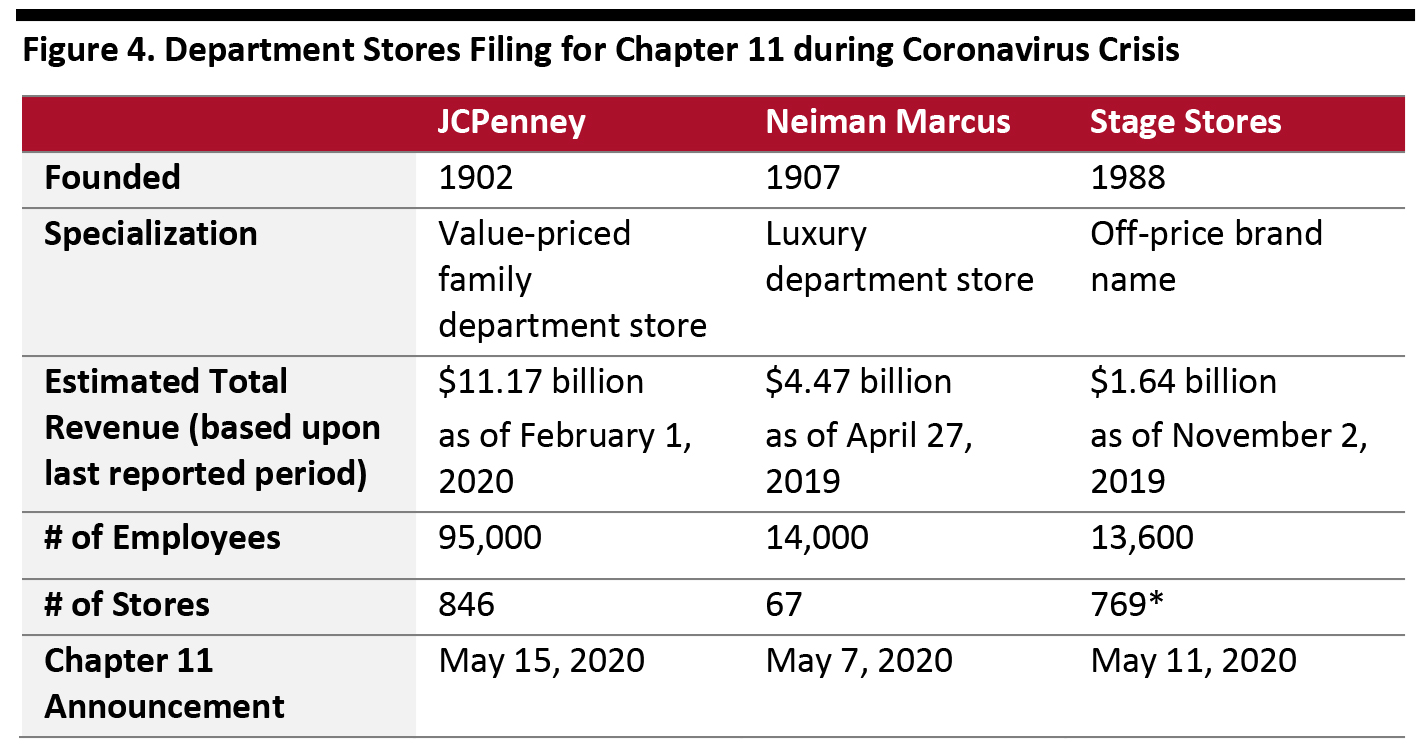

Fiscal years end January, so FY20E, for example, ends in January 2021. Macy’s FY20 and FY21 estimates based on a company announcement that 125 stores will close over the next three years. Source: Company reports/Coresight Research [/caption] Department-store closures impact on malls because of their sheer size: The average department store ranges from approximately 100,000 square feet to upwards of 160,000 square feet for a mall-based anchor store, so there there is a lot of space to fill when a department store closes. There may be ripple effects to surrounding retail stores, particularly as many retailers may have co-tenancy clauses in their leases, which provides protection to a mall tenant if a key tenant leaves the retail space, such as by having rent reduced to compensate for the loss of traffic. Effects can therefore further trickle down to the mall owner. A projected 25,000 store closures could be announced by retailers this year, according to Coresight Research’s Store Tracker, with 55–60% of these in malls. This is a significantly higher figure that the previous record of 9,800 closures in 2019. Three Department Stores File for Chapter 11 Bankruptcy amid Covid-19 Within a two-week period in May 2020—during the pandemic—three major US department-store retailers filed for Chapter 11 bankruptcy: Neiman Marcus on May 5, Stage Stores on May 11 and JCPenney on May 15. Combined, the three chains hold 1,862 stores and $17.3 billion in revenue as of the last reporting period—totaling 12.8% of total FY20 sector revenue from selected major retailers. [caption id="attachment_112625" align="aligncenter" width="700"]

*Includes 158 Gordman Stores

*Includes 158 Gordman Stores Source: Company reports/Coresight Research [/caption] The three department stores that filed for Chapter 11 during the coronavirus pandemic span the value to luxury markets, each specializing in their unique customer base, highlighting today’s precarious retail environment.

- JCPenney offers value prices on products the entire family can shop. The store was founded in 1902, so it is a household department store name.

- Neiman Marcus is associated with luxury. The company is known for producing a holiday catalog that includes outrageous and extraordinary gifts; for example, the 2019 catalog included a $700,000 2019 Aston Martin car that Daniel Craig (current James Bond actor) helped to design.

- Stage Stores’ department-store portfolio was in the midst of transitioning to the Gordmans off-price brand when it filed for bankruptcy. Management reported on January 13, 2020 that it projected to have 700 of its department stores converted to off-price by the end of the year. More than 86% of its stores are located in markets that have a population of fewer than 150,000 people.

Key Players in the Department-Store Sector: Covid-19 Response and Outlook

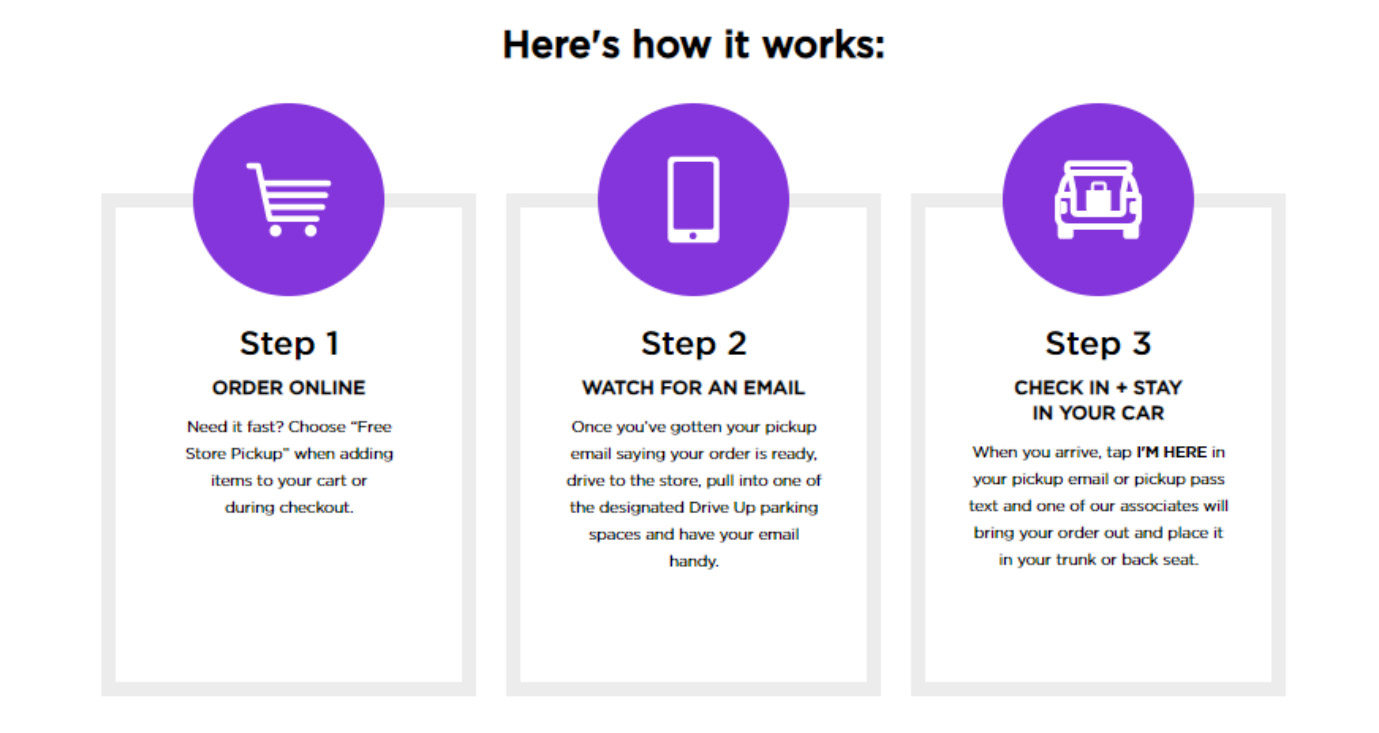

The department-store sector was deemed to be “nonessential” during the coronavirus pandemic, meaning that nearly all brick-and-mortar stores were temporarily closed. JCPenney Store Optimization as Part of Chapter 11: The company filed for Chapter 11 bankruptcy on May 15, 2020. It plans to close 242 stores (29% of its 846-store fleet) to focus on its most productive stores. Of these, 192 stores are projected to close in 2020, with the remaining 50 stores are slated to close in 2021. As part of the plan, the company identified 154 stores that will begin closing with liquidation sales. JCPenney announced on June 23, 2020 that 13 stores were slated for closure and would begin liquidation sales on July 3, 2020. The expectation is that the closing sales will take 10–16 weeks to complete. Contact-Free Curbside Pickup: As of May 28, 2020, JCPenney had reopened 304 stores post lockdown and planned to have 500 stores reopened by June 3, offering contact-free, curbside pickup at selected stores. Outlook: In the company’s Chapter 11 restructuring agreement, it is focusing on its “Plan for Renewal,” which intends to drive sustainable, profitable growth, reduce store footprint and focus resources on its strongest stores and its online store, jcp.com. Kohl’s Store Productivity at 75% for Reopened Stores: The company began reopening stores on May 4, 2020, and as of June 8, 2020, Kohl’s reported at the Cowen Conference that 1,047 stores (90% of its fleet of 1,159) had reopened. The company said on its earnings call on May 19, 2020 that it was seeing sequential improvement in store productivity, reporting 50–60% of regular levels; aggregate productivity for the quarter to date was at 75% of usual levels for reopened stores. Digital Up 90% in May: In April, when all stores were closed, digital sales were up 60%, and for the month of May, digital sales were up 90%. Kohl’s digital business continues to perform at high levels even as stores are reopening. The company attributes this to two factors: It has adapted its website to market the categories that consumers are shopping—including active, home and kids products; and Kohl’s is continuing to innovate and implement curbside-pickup service, “Store Drive Up,” to take advantage of how customers are shopping. Over 40% of Digital Orders Fulfilled from Stores: The company reported that it is leveraging its store inventory to fulfill 40% of its digital orders. This has been particularly useful for categories that are trending up, such as home. “Store Drive Up” Exceeds BOPIS Pre-Coronavirus: Management reported on its first-quarter 2021 earnings call that the company had successfully launched its curbside-pickup service and seen customer uptake: In over 900 stores where Store Drive Up is offered, the percentage of digital demand fulfilled by the service was 15%, exceeding that of BOPIS (buy online, pick up in store) before the crisis began. [caption id="attachment_112601" align="aligncenter" width="700"] Store Drive Up

Store Drive Up Source: Kohls.com [/caption] 95% of Stores Are Off-Mall—an Advantage Post Crisis: Stores will be a big part of the future of Kohl’s, with 95% of its stores located in off-mall locations and within 25 kilometers of 80% of the population. Management said in its first-quarter earnings report that the company’s off-mall stores provide a unique advantage to facilitate social distancing as consumers begin to journey away from home. Our recent proprietary survey of US consumers found that shoppers are likely to favor off-mall locations in the wake of the crisis, with 43.3% of respondents reporting that they expect to avoid shopping centers/malls after lockdowns end. According to Kohl’s, it is very much an omnichannel retailer, with over 40% of digital orders fulfilled by stores. With 99% of stores being cashflow positive and 50 to 75 leases coming to an end within the next year, the company will need to make some decisions but claims that it has a lot of flexibility. Management reported that Kohl’s has looked at smaller store formats, but said that over 75,000 square feet of selling will be an advantage post coronavirus, as it will provide more space for social distancing and helps with cleanliness—which it will monitor going forward. Outlook: Management said that it sees the beauty category as a “tremendous opportunity” for the company and that is the “number-one category priority” for Kohl’s, with over 70% of the company’s 65 million customers being women. Michelle Gass, CEO and Director of Kohl’s, said that the customer is responding to elevated products, particularly in fragrances. Kohl’s has 12 new experience test stores that will offer a beauty “shop-in-shop” with an engaging consumer experience and new, sizable beauty departments. Gass also added that in the last recession, customers gravitated to value brands, so she believes that consumers will seek out Kohl’s again following Covid-19. Macy’s Store Productivity Better than Expected: At the Cowen Conference Presentation on June 9, 2020, Jeffrey Gennette, Chairman and CEO of Macy’s, Inc., said that the company expected its stores to be down between 80% and 85% after post-lockdown reopening, based on other countries’ experiences. However, Macy’s started opening its stores on May 4, 2020 with incremental store openings each week, and as of June 9, the company reported that average sales productivity is down about 50% at its 400 reopened stores. Digital Up 80% in May: Gennette reported that digital was up strongly in May, and although the company does not expect it to remain that high for the remainder of the year, it does expect digital to continue strong. Macy’s Backstage Outperforming Reopened Full-Price Stores: Management said that in reopened Macy’s stores, Backstage is performing better than the balance of the full-price store by “about 10 points.” In its fourth-quarter 2019 earnings report in February 2020, the company stated that Backstage locations open for more than 12 months achieve mid-single-digit comparable sales growth and are helping Macy’s to improve its gross margin and inventory turn. Mixed Apparel Demand Post Crisis: As Macy’s stores begin to reopen, the company said that most apparel categories are returning to pre-Covid levels—with the active and casual categories doing particularly well. However, women’s sportswear, dresses and the “dress-up” category have remained depressed. Store Closures and Store Formats: Going into the coronavirus pandemic, Macy’s announced at its Investor Day on February 5, 2020 that it planned to close 16% of its fleet (125 of its 775 stores) over the next three years, exiting lower-quality malls. Furthermore, the company plans to open smaller-format “Market by Macy’s” stores in off-mall locations. Beauty Category Rebounding Quickly: As Macy’s stores reopened for curbside pickup, the company reported in an article to WWD that it was seeing a faster rebound than anticipated. Nata Dvir, General Business Manager at Macy’s, said that beauty was the first category to rebound and is also the strongest. Nordstrom Majority of Store Fleet Has Reopened: At the Evercore ISI Conference on June 16, 2020, Nordstrom reported that 75% of its stores had reopened, with its Rack business producing “a bit stronger store results” than full-price stores. Over 50% of Digital Orders Fulfilled by Stores: Also at the conference, the company reported that its full-price busines normally fulfills approximately 20% of its orders from stores, but with stores closed during the pandemic, Nordstrom has fulfilled over 50% of orders from stores over the past two months. Some of the Nordstrom Rack stores can fulfill orders for rack.com, which has also provided increased flexibility. Less than 40% of Nordstrom Business Is in Malls: According to the company, mall-based or corporate stores comprised less than 40% of its business last year, with Nordstrom Rack and e-commerce accounting for the remainder, despite Nordstrom being characterized as a mall-based retailer. The company’s mall-based business is going to be further reduced in 2020 with the closing of 16 full-line stores and three Jeffrey Boutiques. New Customers Increased by 50% Online: The company reported on its first-quarter 2021 earnings call that while its stores were temporarily closed, its ecommerce business saw more than 50% growth in new customers. Outlook: At the Cowen Conference Presentation on June 9, 2020, management reported that the Nordstrom Rack business represents an opportunity. Its online business totals over $1 billion in annual revenues and is growing; it is the company’s number-one source of new customers for full-price Nordstrom stores, with approximately 30% of Rack customers becoming full-price customers within the first year. Erik Nordstrom, CEO, Principal Executive Officer and Director at Nordstrom, believes that there is also store growth opportunities in its Rack business, located outside of regional malls. [caption id="attachment_112626" align="aligncenter" width="700"]

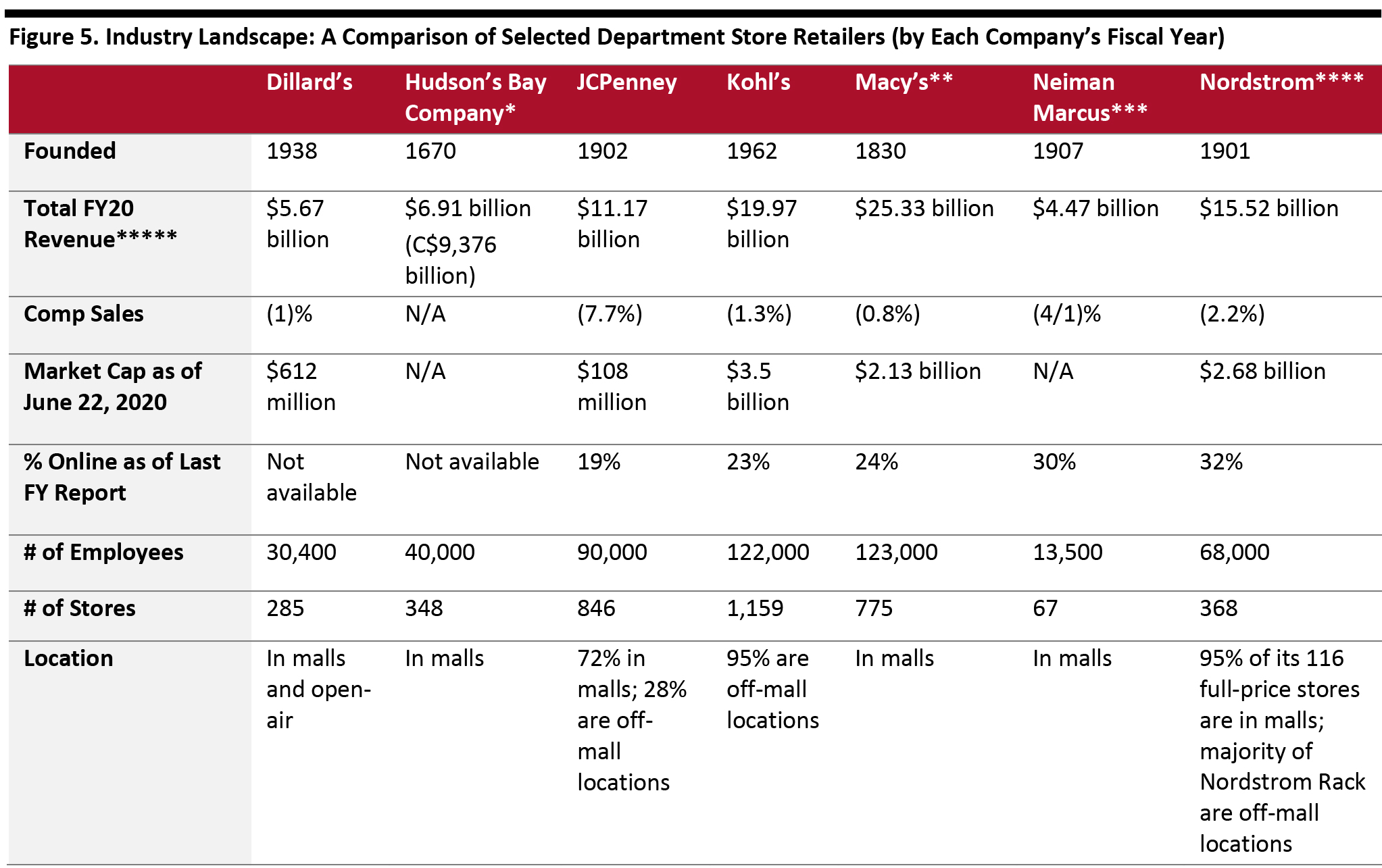

*Hudson’s Bay Company includes Saks Fifth Avenue/Saks OFF 5TH and, formerly, Lord & Taylor)

*Hudson’s Bay Company includes Saks Fifth Avenue/Saks OFF 5TH and, formerly, Lord & Taylor) **Macy’s includes Macy's, Bloomingdale's, Bloomingdale’s The Outlet, Macy’s Backstage, and Bluemercury

***Includes Last Call and Bergdorf Goodman; note, there are 43 Neiman Marcus stores.

****Includes Nordstrom Rack; There are 116 full-price Nordstrom and 248 Rack stores as of May 29, 2020. The company announced it will close 16 full-price stores and three Jeffrey Boutiques on May 20, 2020.

*****Dillard’s last reporting period on May 5, 2020; Neiman Marcus last reporting period ended on April 27, 2019; all others on February 1, 2020

Source: Company reports [/caption]

Trend Analysis and Insights

Department Stores Offering Contactless Pickup Services Will Benefit Post Coronavirus Pandemic Consumers are seeking contactless product-delivery options in the wake of the crisis—for both convenience and safety. Retailers offering store “drive-up” and other pickup options are reporting positive consumer feedback, such as Kohl’s. Stores in off-mall locations may be better positioned for this solution, because the retailers can create lanes or designated areas within store parking lots for this purpose, whereas malls have limited space and thus fewer opportunities. Leveraging Store Inventory To Fulfill Orders Will Become a Best Practice Department stores are shipping digital orders from stores, helping to reduce inventory. As outlined previously in this report, Kohl’s reported that more than 40% of its digital orders were fulfilled by ship-from-store and customer pickup during the first quarter, and Nordstrom reported that 50% of its digital orders were fulfilled from store, up from 20%. We expect that this trend will continue beyond the coronavirus crisis, as retailers further identify business process efficiencies to best meet customer demand. Early Indications Suggest that Consumers Are Shopping Value Post Covid-19 Kohl’s reported in its last earnings transcript that as a value retailer, it is well positioned for the post-Covid environment—given that after the 2018 recession, consumers sought out its merchandise. Early indicators are pointing to the potential of the value department-store sector to perform well in the near term, with Nordstrom Rack and Macy’s Backstage both reporting sales above their full-price counterparts. “Beauty” Is an Opportunity for All Department Stores Kohl’s, Macy’s and Nordstrom each highlighted the beauty category as a high-growth opportunity to pursue.Department Stores To Leverage Technology Innovators

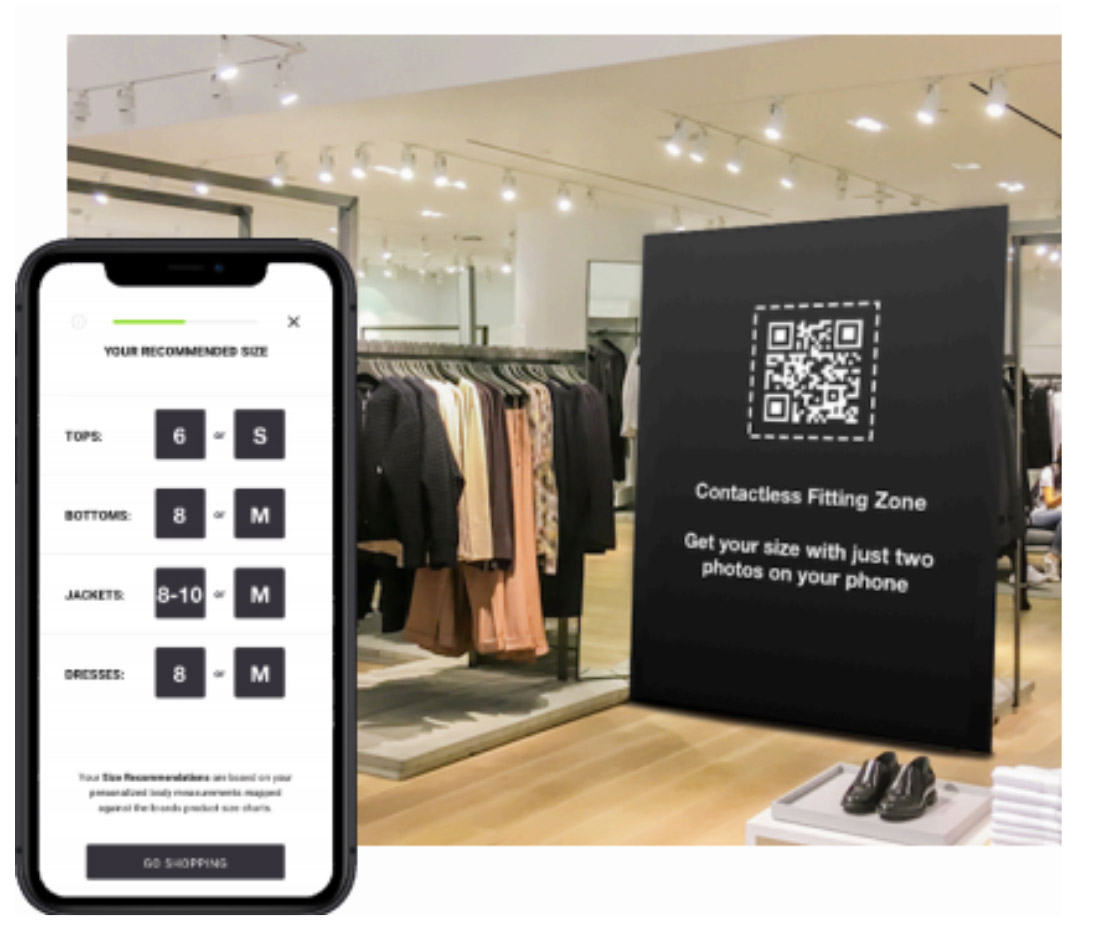

We expect technology innovators to continue to provide key solutions for department-store retailers across three areas: 3D Visualization: Marxent has been working with Macy’s furniture department store since October 2018. Marxent’s 3D and VR (virtual reality) tools allow consumers to visualize how furniture will look and fit inside their home. Beck Besecker, Co-Founder of Marxent, reported in an interview on June 17, 2020, that the technology enables the consumer to easily shop across brands too, which is beneficial in a department-store environment. He explained that shoppers want the ability to manage their own home design and configure their own space. Besecker stated that since the launch of Marxent’s technology at Macy’s, VR-influenced furniture sales have increased by more than 44% versus non-VR furniture sales, and returns have decreased to less than 25%. In addition to providing shoppers with a cross-brand experience and “mental ownership,” the technology allows Macy’s to promote its furniture category in all of its stores without needing a physically large furniture footprint; for example, the retailer is implementing virtual furniture showrooms in Macy’s stores that currently do not have furniture on display. Marxent’s clients include Ashley Furniture, Bob’s Furniture, John Lewis, La-Z-Boy and Lowe’s. The tech company has reported a recent explosion in the use of both its augmented-reality apps and its 3D Room Planner for Web, with 3D technology proving instrumental in helping retailers to transition to virtual and contactless selling during the pandemic. One of Marxent’s clients attributed $2 million in sales to its 3D Room Planner while stores were closed during the coronavirus lockdowns, because the tool helped the retailer to sell full rooms. Marxent has seen over $70 million in sales through a virtual experience. Contactless Sizing: In the post-coronavirus environment, consumers are seeking out contactless alternatives for a number of stages in the shopping journey, including trying on apparel. 3DLOOK is a data platform that helps consumers find their clothing size based on only two photos: The customer scans a QR code on their smartphone and is prompted to enter a side-view photo and a front-facing photo of themselves. The technology then provides sizing recommendations, specific to different brands, for each product category. The customer only has to photograph themselves once; upon entering a store, they can simply scan their QR code and 3DLOOK will retrieve the relevant data. Company Co-Founder Whitney Cathcart said that retailers are actively seeking safe consumer solutions as stores reopen due to changing demand post pandemic. In addition to helping customers to feel safe in stores, contactless sizing technology offers two advantages to retailers by using actual measurements: better control of inventory challenges, as returns are likely to be reduced; and an understanding of their customers’ body shapes and sizes through increased data. [caption id="attachment_112603" align="aligncenter" width="700"] Source: 3DLook[/caption]

Returns Solution: Happy Returns is a technology innovator that helps retailers to address challenges around returns, which have impacts throughout the supply chain and pressure margins. Reportedly, in 2019, up to 40% of products were returned; retailers are now bracing for an increase in returns due to the coronavirus pandemic, with consumers having shopped more online during store closures and therefore buying products without physically experiencing them.

Happy Returns’ “Return Bars” allow consumers to return other retailers’ items to the store without boxes or labels, and the company claims that Return Bars provide a refund to the customer within 60 seconds. Happy Returns operates over 700 Return Bars, with over 200 reopening in the week of June 17, 2020 following the crisis. The company has reported that returns volume increased by 23% during the week of June 7, 2020 compared to the same week in May. It has also seen more new customers in the second quarter of 2020 than any other quarter to date.

There are three major benefits of the Return Bar concept for the retailer:

Source: 3DLook[/caption]

Returns Solution: Happy Returns is a technology innovator that helps retailers to address challenges around returns, which have impacts throughout the supply chain and pressure margins. Reportedly, in 2019, up to 40% of products were returned; retailers are now bracing for an increase in returns due to the coronavirus pandemic, with consumers having shopped more online during store closures and therefore buying products without physically experiencing them.

Happy Returns’ “Return Bars” allow consumers to return other retailers’ items to the store without boxes or labels, and the company claims that Return Bars provide a refund to the customer within 60 seconds. Happy Returns operates over 700 Return Bars, with over 200 reopening in the week of June 17, 2020 following the crisis. The company has reported that returns volume increased by 23% during the week of June 7, 2020 compared to the same week in May. It has also seen more new customers in the second quarter of 2020 than any other quarter to date.

There are three major benefits of the Return Bar concept for the retailer:

- An increase in overall store revenue due to higher customer traffic. According to Paper Source, a Happy Returns client, the retailer lifted store sales by 6.3% and store transactions by 8.0% across Paper Source’s fleet. Online Paper Source revenue from customers within eight kilometers of its stores also increased by 16.8% after stores introduced the service.

- Return Bars help to expand a retailer’s customer base, with new consumers entering the store that may have never visited before and then spending more after using the Return Bar. Paper source reported that its new customers, sourced through the Return Bar, spend 20.5% more than existing patrons on average, and existing customers spend 3.2% more after using a Return Bar.

- The solution also helps to promote sustainability and provide convenience for customers. The Return Bars offer a box-free, label-free and contactless service. The company aggregates its shipping by placing up to 15 orders in one package instead of mailing one item per box. Happy Returns is also aiming to cut back on waste by offering a cardboard-free shipping solution.