DIpil Das

US Department Store Insights

Kohl’s, Macy’s and Nordstrom are the leading US department store companies, by revenue. As the department store sector has become smaller, the revenue gap between the companies is narrowing, with Kohl’s catching up to Macy’s. The companies are navigating a migration to, and integration of, digital channels, and they are each approaching this differently. Their strategies offer lessons to other retailers, as growing online sales while maintaining physical sales is an industry-wide goal. The categories that are selling at department stores today also provide a barometer of consumer trends, particularly as consumers begin to resume pre-pandemic activities amid vaccination rollouts. Coresight Research’s US Department Store Insights quarterly series covers the recent performance of Kohl’s, Macy’s and Nordstrom, highlighting trends in comparable sales, revenue, digital sales, product categories and areas of note by management. Ahead of these retailers reporting 2Q21 results in the coming weeks, we review metrics on their recoveries from the crisis conditions of 2020, up to the end of 1Q21 (ended May 1, 2021), and their outlook for the full fiscal year.US Department Store Insights: In Detail

Comparable Sales: Positive Growth as Store Traffic Trends Improve Comparable sales at all three department stores improved from 4Q20 to 1Q21, with each management team reporting that US stimulus payments and vaccinations are helping to drive consumers back to brick-and-mortar stores. Both Kohl’s and Macy’s reported an acceleration in comparable sales growth of approximately 80 percentage points in 1Q21 compared to 4Q20, while comparable sales growth strengthened by 64 percentage points at Nordstrom. It is notable that comparable store sales moved into positive territory for all three department stores in the first quarter of fiscal year 2021.Figure 1. Kohl’s, Macy’s and Nordstrom: Comparable Sales [wpdatatable id=1181 table_view=regular]

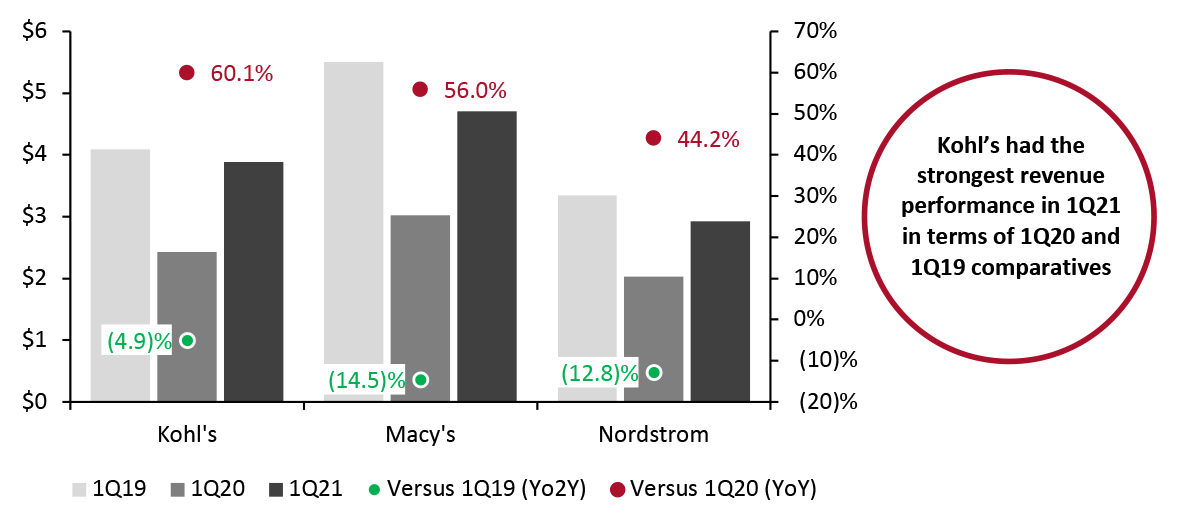

Nordstrom reports only changes in net sales, which are represented in the table as approximate to comparable sales Source: Company reports/S&P Capital IQ Store Traffic Trends Kohl’s reported that sales strengthened as it moved through 1Q21, with March and April seeing positive combined sales growth compared to the same period in 2019. Store sales more than doubled year over year as the company lapped the pandemic-led temporary store closures of 2020. Management reported an acceleration in customer store visits as the quarter progressed. Macy’s reported that stores outperformed across all metrics in the first quarter and continue to show signs of recovery earlier than expected, with sequential improvement of nearly 890 basis points in comparable sales from 4Q20. In US states with stronger vaccine rollouts and in areas where restrictions have loosened, Macy’s stores saw a corresponding increase in foot traffic. At its flagship stores, traffic is slowly improving. As travel restrictions lift, the company expects tourism levels to pick up gradually. However, Macy’s does not expect international tourism to improve until 2022, which historically comprises 3%–4% of annual business for Macy’s and Bloomingdale’s. Nordstrom reported that stores in markets that opened earlier outperformed other markets by 7–10 percentage points, giving the company optimism about the pace of recovery through the remainder of the year. Revenue: Positive Year-over-Year Growth but Down Versus 1Q19; Fast Recovery by Kohl’s Compared to 1Q19, revenue across the three major department stores was down by 4.9% (Kohl’s) to 14.5% (Macy’s), averaging an 11.0% decline.

- Kohl’s showed the most resilience among the three department stores, with the smallest decline compared to 1Q19 levels. The company reported that many areas of its business have returned to pre-pandemic levels or exceeded those levels.

Figure 2. Kohl’s, Macy’s and Nordstrom: Total Revenue (USD Bil.; Left Axis) and Revenue Growth (%; Right Axis) [caption id="attachment_131019" align="aligncenter" width="726"]

Source: Company reports[/caption]

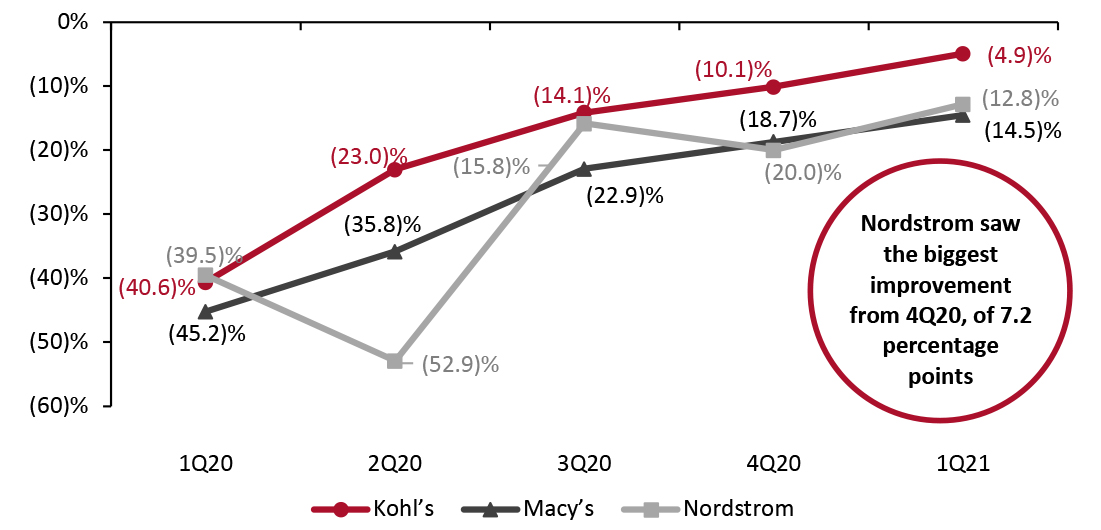

As shown in Figure 3, progressing from 4Q20 to 1Q21, Nordstrom showed the biggest improvement in its revenue growth, from (20.0)% to (12.8)%—an increase of 7.2 percentage points.

Source: Company reports[/caption]

As shown in Figure 3, progressing from 4Q20 to 1Q21, Nordstrom showed the biggest improvement in its revenue growth, from (20.0)% to (12.8)%—an increase of 7.2 percentage points.

Figure 3. Kohl’s, Macy’s and Nordstrom: Revenue by Quarter (YoY % Change) [caption id="attachment_131020" align="aligncenter" width="725"]

Source: Company reports[/caption]

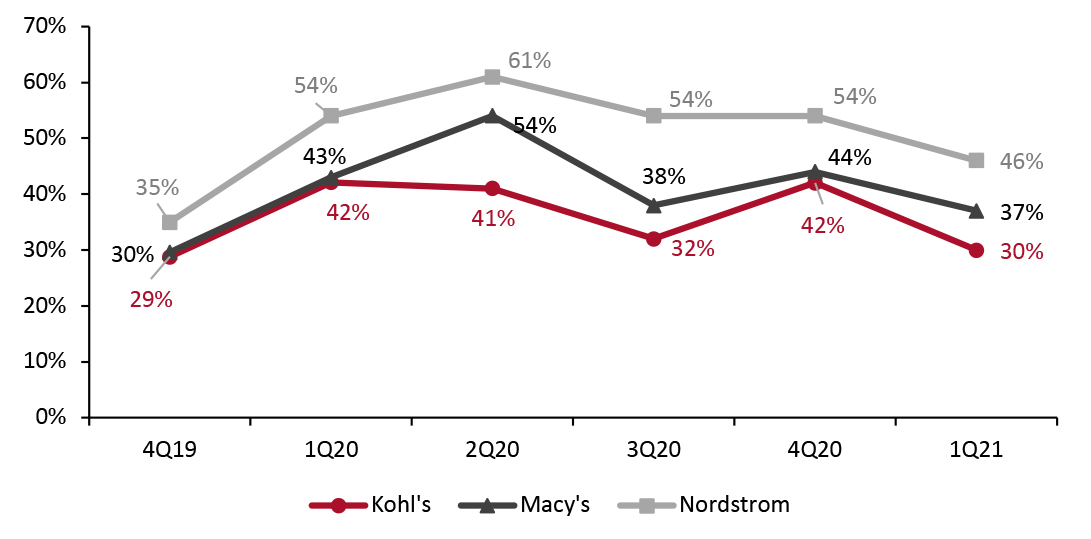

Digital Sales: E-Commerce Penetration Drops Below Fiscal 2020 Levels

In 1Q21, each of the major department stores reported e-commerce penetration below 2020 levels, although it remains elevated compared to pre-pandemic 2019 levels and online sales were up year over year in absolute terms.

Source: Company reports[/caption]

Digital Sales: E-Commerce Penetration Drops Below Fiscal 2020 Levels

In 1Q21, each of the major department stores reported e-commerce penetration below 2020 levels, although it remains elevated compared to pre-pandemic 2019 levels and online sales were up year over year in absolute terms.

- Kohl’s saw e-commerce penetration of 30% 1Q21—with $1.2 billion in digital sales. This compares to 42% penetration in the year-ago period, when digital sales totaled $1.0 billion.

- Macy’s achieved $1.7 billion in digital sales in 1Q21—representing 37% of total sales. This was down from 43% penetration in the year-ago period, when digital sales totaled $1.3 billion.

- Nordstrom reported that 46% of all sales came from the digital channel in 1Q21—$1.2 billion in total. This compares to 54% penetration in the year-ago period, when e-commerce sales totaled $1.1 billion.

Figure 4. Kohl’s, Macy’s and Nordstrom: Digital Sales by Quarter (% of Total Sales) [caption id="attachment_131021" align="aligncenter" width="725"]

Source: Company Reports[/caption]

The three retailers expect more moderate e-commerce penetration for the full fiscal year as compared to fiscal 2020 due to consumers returning to in-store shopping.

Source: Company Reports[/caption]

The three retailers expect more moderate e-commerce penetration for the full fiscal year as compared to fiscal 2020 due to consumers returning to in-store shopping.

- Kohl’s expects digital sales in fiscal 2021 to be below the 40% e-commerce penetration rate it saw in fiscal 2020.

- Macy’s projects e-commerce sales to be $8 billion for the full fiscal year, equating to 36.0%–36.9% e-commerce penetration compared to 44.5% in fiscal 2020.

- Nordstrom expects that e-commerce will comprise 50% of total fiscal 2021 sales compared to 55% in fiscal 2020.

- The retailer continued to enhance the digital experience and improve the overall site experience while embedding personalization.

- During the first quarter, the Kohl’s app accounted for one-third of digital sales, driven by strong double-digit user growth and improved conversion rates.

- During the first quarter, stores provided support for digital sales growth, fulfilling nearly 40% of sales—up slightly compared to last year as customer pickup increased with stores open for the full period.

- Macy’s added4.6 million new customers in the quarter, 47% of which made their initial transaction through the digital channel.

- The retailer upgraded its site search functionality and redesigned its product pages for a clearer, more curated experience, which helped to increase conversion by nearly 9% in the first quarter compared to 2019.

- Macy’s is upgrading its curbside-pickup service to provide specific delivery dates and is launching an improved returns experience within the app.

- In the first quarter, approximately 22% of Macy’s digital sales were fulfilled in stores. The company is focusing on improving inventory allocation while using data and analytics to better place inventory at stores and distribution centers as well as across its markets.

- Nordstrom expanded order pickup and ship to store to all Nordstrom Rack stores, with order pickup more than doubling compared to 1Q19. Since the launch of the service, nearly one-third of next-day order-pickup volume for Nordstrom.com in the top 20 markets have been picked up at Rack stores.

- The retailer increased its digital product count by approximately 20% versus 2019, primarily driven by an expanded dropship assortment in core categories and in categories such as Home, Active and Kids.

- Nordstrom introduced new livestream shopping events.

- The retailer expanded its personalized styling programs with new tools to allow sales associates to offer customers relevant recommendations, both in-store and digitally. More than 50% of sales associates are utilizing these remote styling tools, according to the company.

Figure 5. Category Highlights [wpdatatable id=1182 table_view=regular]

Source: Company reports Areas of Note by Management Kohl’s: Sephora Launch and Category Expansion The company is focusing on two main initiatives:

- Kohl’s confirmed in 1Q21 that it would launch Sephora at Kohl’s online on August 1, 2021, with a subsequent rollout in 200 stores this year. Sephora will offer more than 125 prestige beauty brands through the partnership, many which will be exclusive to Sephora and Sephora at Kohl’s.

- Kohl’s is aiming to be a destination in active and casual wear for the whole family, increasing its active sales from 20% to 30%. This includes increasing dedicated space for the category in store, expanding the company’s product assortment and aggressively addressing white-space opportunities in athleisure and inclusive sizing. The company’s active sales nearly doubled year over year in 1Q21, growing to 23% of sales, up 300 basis points from 1Q20.

- Immersive experiences—Macy’s will use immersive experiences including virtual try-on to elevate ways of engaging with customers. The retailer plans to double down on the beauty category using immersive experiences.

- Expanding shopping channels—Macy’s is using live video shopping as another avenue to reach consumers. It will continue to host live events with the goal of making online shopping as social and fun as in-person shopping. Macy’s is redesigning its website to modernize its brand presence and elevate its image as a source of style, guidance and inspiration, with the goal of attracting a younger customer.

- Redesigning the overall digital experience—Macy’s plans to launch refreshed shopping experiences on its site and app before the holiday season.

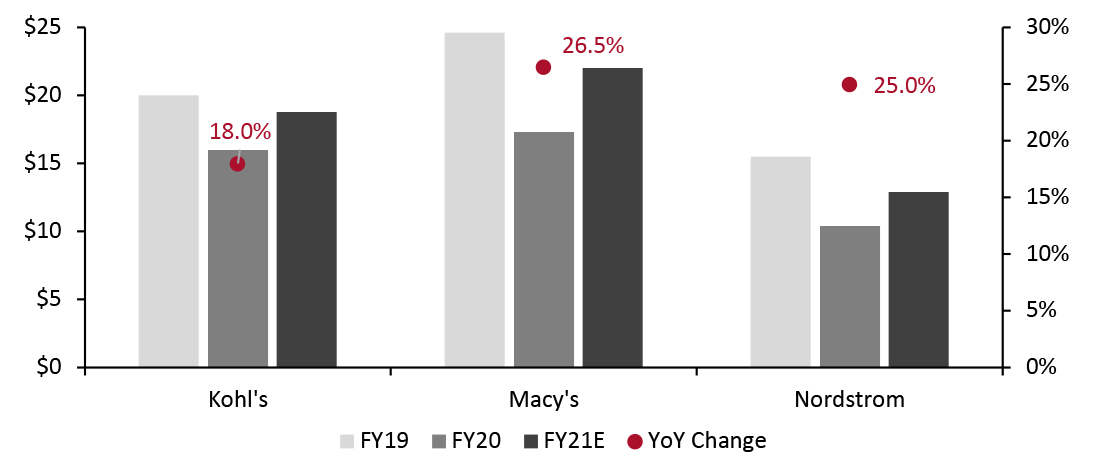

- Kohl’s raised its guidance and expects revenue growth to be in the mid-to-high-teens percentage range (from prior expectation of a mid-teens percentage range) versus fiscal 2020. Compared to fiscal 2019, the retailer expects a revenue decline of 5.9%.

- Macy’s projects total sales in fiscal 2021 to be between $21.7 billion and $22.2 billion—representing around 26.5% growth year over year but down 10.6% on a two-year basis.

- Nordstrom affirmed its revenue projection of 25% growth versus fiscal 2020, with sales set to total $12.9 billion; this estimate represents a 16.6% decline versus fiscal 2019 levels.

Figure 6. Kohl’s, Macy’s and Nordstrom: Total Revenue (USD Bil.; Left Axis) and Revenue Growth (YoY %; Right Axis) [caption id="attachment_131022" align="aligncenter" width="725"]

Source: Company reports[/caption]

Source: Company reports[/caption]