DIpil Das

US Department Store Insights

Kohl’s, Macy’s and Nordstrom are the leading US department store companies, by revenue. As the department store sector has become smaller, the revenue gap between the companies is narrowing, with Kohl’s catching up to Macy’s. The companies are navigating a migration to, and integration of, digital channels, and they are each approaching this differently. Their strategies offer lessons to other retailers, as growing online sales while maintaining physical sales is an industry-wide goal. The categories that are selling at department stores today also provide a barometer of consumer trends. Coresight Research’s new US Department Store Insights quarterly series covers the recent performance of Kohl’s, Macy’s and Nordstrom, highlighting trends in comparable sales, revenue, digital sales, product categories and areas of note by management. In this report, we look at the performance of the three retailers in 4Q20 (ended January 30, 2021) and discuss relevant fiscal 2020 highlights.4Q20: In Detail

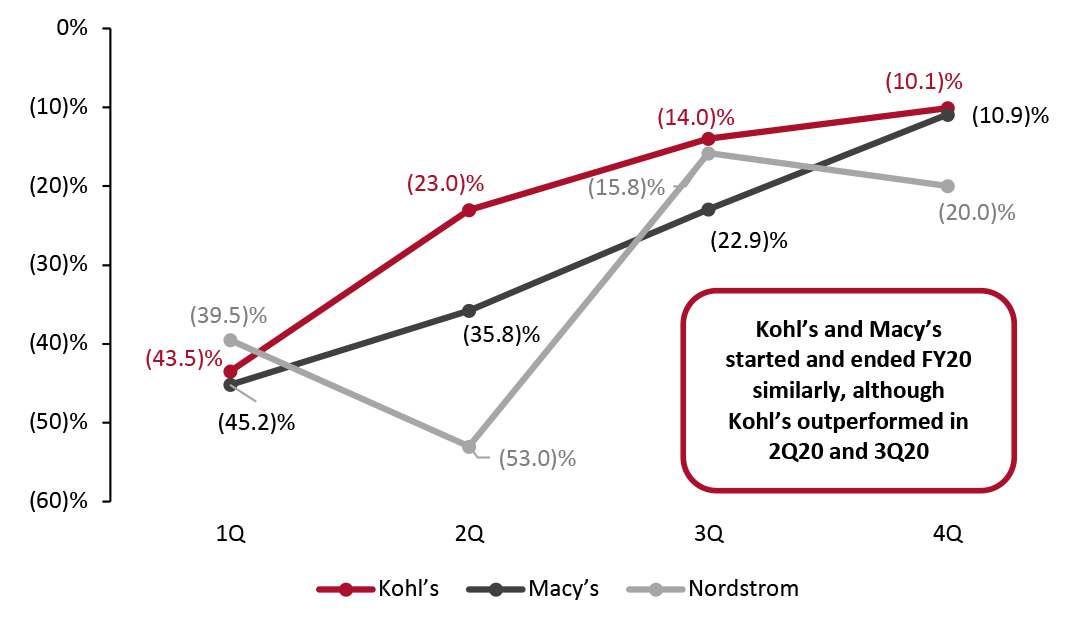

The department store sector was severely impacted by the Covid-19 pandemic due to the sector’s reliance on sales via expansive physical store fleets, and three department stores have so far filed for bankruptcy: JCPenney, Neiman Marcus and Stage Stores. The combined revenue of Kohl’s, Macy’s and Nordstrom declined by 27.2% in fiscal 2020 due to the pandemic, to $44.8 billion from $61.2 billion in fiscal 2019. Comparable Sales: Improvements at Kohl’s and Macy’s, Quarter over Quarter, Versus a Deepening Decline at Nordstrom For 4Q20, comparable sales growth rates improved at Kohl’s and Macy’s, versus the prior quarter, and beat consensus estimates—although comp sales remain down (see Figure 1). However, Nordstrom saw its net sales (which the company approximates to comparable sales) decline deepen in the quarter: Growth was (20.0)% in 4Q20 versus (16.0)% in 3Q20. Due to the pandemic, Kohl’s and Macy’s did not report comparable sales in the first half of the fiscal year, and Macy’s only reported 2Q20 comparable sales, of (34.7)%. We therefore present the relevant details for only the second half of the fiscal year in Figure 1.Figure 1. Kohl’s, Macy’s and Nordstrom: Comparable Sales [wpdatatable id=827 table_view=regular]

*Nordstrom reports only changes in net sales, which are represented in the table as approximate to comparable sales Source: Company reports/S&P Capital IQ Optimism for a Consumer Return to Physical Stores During the retailers’ 4Q20 earnings calls, management expressed optimism about the second half of 2021. They believe that customers will be eager to return to stores after being housebound for a year and cited vaccination distribution as a key element to customers feeling safe. Executives are also optimistic about consumers’ desire to shop for fashion-related apparel. Below, we summarize highlights from each of the department store chains. Macy’s anticipates that customers will be increasingly more comfortable in public spaces as vaccine distribution reaches scale, meaning that they revert to pre-pandemic shopping behaviors. However, management stated that malls in general “will continue to face headwinds that will lead to low- to mid-single-digit comparable store sales declines after recovering from the pandemic in 2021 and 2022.” Kohl’s highlighted that stores will still be under pressure in the first half of 2021. As vaccines are distributed, the company believes that consumers will be eager to shop in stores and purchase apparel, footwear and beauty as they return to normal life—including going to work and traveling—after spending so much time at home. Nordstrom reported that it saw customer demand improve from November 2020 through January 2021, but the company did not provide specifics on customer trends. The company reported that it is currently seeing early improvements in apparel categories such as dresses. While management said it is still too early to make any assessments, Nordstrom is optimistic as it is seeing consumers begin to shop categories that used to, pre-pandemic. Management sees the opportunity to be flexible in 2021 as consumers return to shopping, and stated that the company has the ability to quickly adjust its product and fashion assortment based on what consumers are seeking. According to Nordstrom, this capability is integrated into its strategic model with the ability to experiment and allocate space across its Nordstrom Rack and Nordstrom full-line businesses. Revenue: Year-over-Year Declines Across the Three Department Stores Kohl’s and Macy’s both beat revenue consensus estimates in 4Q20: Kohl’s beat the consensus estimate of $5.85 billion, with 4Q20 revenue of $5.88 billion; and the $6.8 billion reported revenue of Macy’s far exceeded the consensus estimate of $5.85 billion. Kohl’s and Macy’s both experienced a similar upward trajectory in year-over-year revenue changes throughout fiscal 2020—albeit from steep revenue declines of 43.5% and 45.2%, respectively, in 1Q20. In 4Q20, revenue at Kohl’s was down by 10.1%, year over year, and Macy’s recorded a 10.9% decline. The main difference between the two department stores in terms of revenue progression is that during 2Q20 and 3Q20, Kohl’s performed comparatively better than Macy’s. On the other hand, Nordstrom’s 2020 revenue trajectory has been spikier and less of an upward curve. For 4Q20, the company saw a year-over-year decline of 20.0%—worsening from 3Q20, when the 16.0% decline represented a stark improvement from 2Q20 (see Figure 2). In its 4Q20 report, Nordstrom reported inventory challenges, which may have been a contributing factor to its fourth-quarter revenue decline: The company increased its inventory plan for the fourth quarter in anticipation of the holiday, and inventory arrived later than expected, leaving Nordstrom unable to fully cater to holiday demand.

Figure 2. Kohl’s, Macy’s and Nordstrom: Revenue by Quarter, 2020 (YoY % Change) [caption id="attachment_125090" align="aligncenter" width="725"]

Source: Company reports[/caption]

Digital Sales: High E-Commerce Penetration in 4Q20 but Not a Standout Quarter

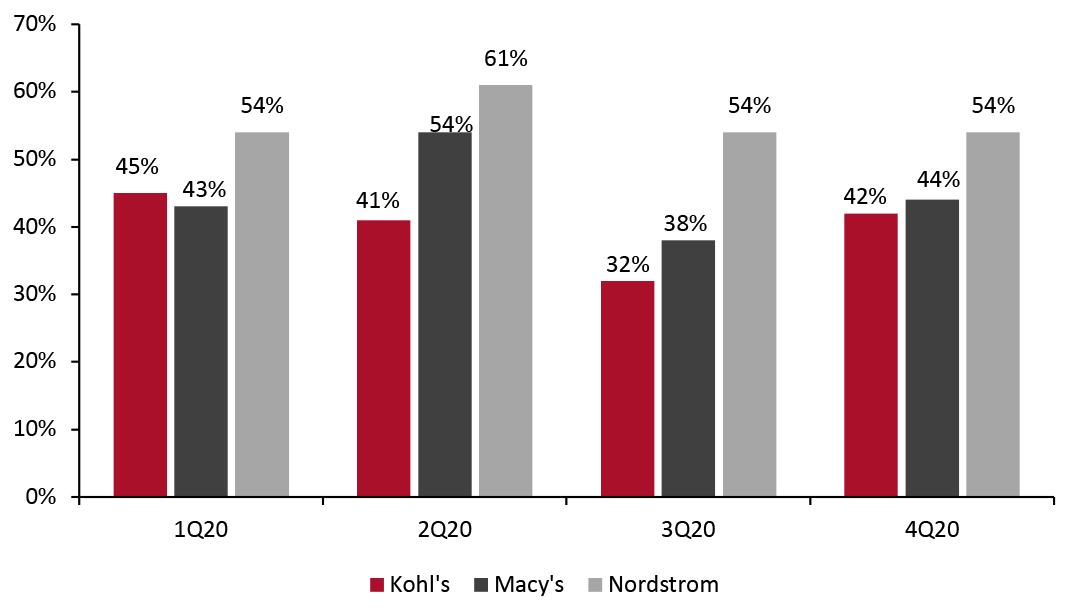

Kohl’s, Macy’s and Nordstrom ended 4Q20 with digital sales representing between 42% and 54% of total sales—matching or exceeding e-commerce penetration in 3Q20 for all three companies. However, the fourth quarter was not the peak of digital sales for any of the department stores in fiscal 2020:

Source: Company reports[/caption]

Digital Sales: High E-Commerce Penetration in 4Q20 but Not a Standout Quarter

Kohl’s, Macy’s and Nordstrom ended 4Q20 with digital sales representing between 42% and 54% of total sales—matching or exceeding e-commerce penetration in 3Q20 for all three companies. However, the fourth quarter was not the peak of digital sales for any of the department stores in fiscal 2020:

- Kohl’s saw e-commerce penetration of 45% in 1Q20—with $1.0 billion in digital sales.

- Macy’s achieved $1.9 billion in digital sales in 2Q20—representing 54% of total sales in 2Q20.

- Nordstrom reported a record-breaking 2Q20, with 61% of all sales coming from the digital channel—$1.1 billion in total.

Figure 3. Kohl’s, Macy’s and Nordstrom: Digital Sales by Quarter, 2020 (% of Total Sales) [caption id="attachment_125092" align="aligncenter" width="725"]

Digital sales reported by the companies to zero decimal places

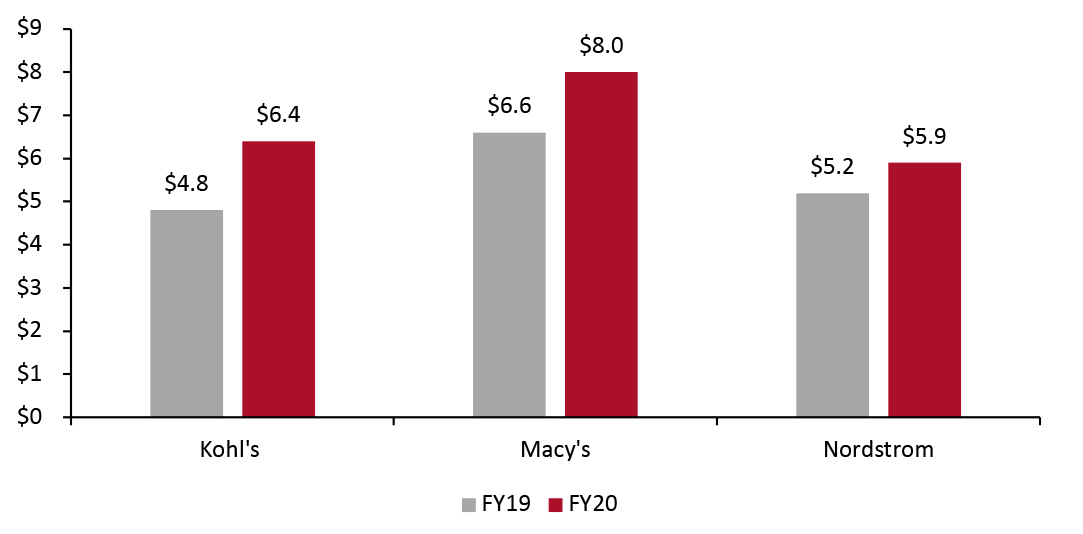

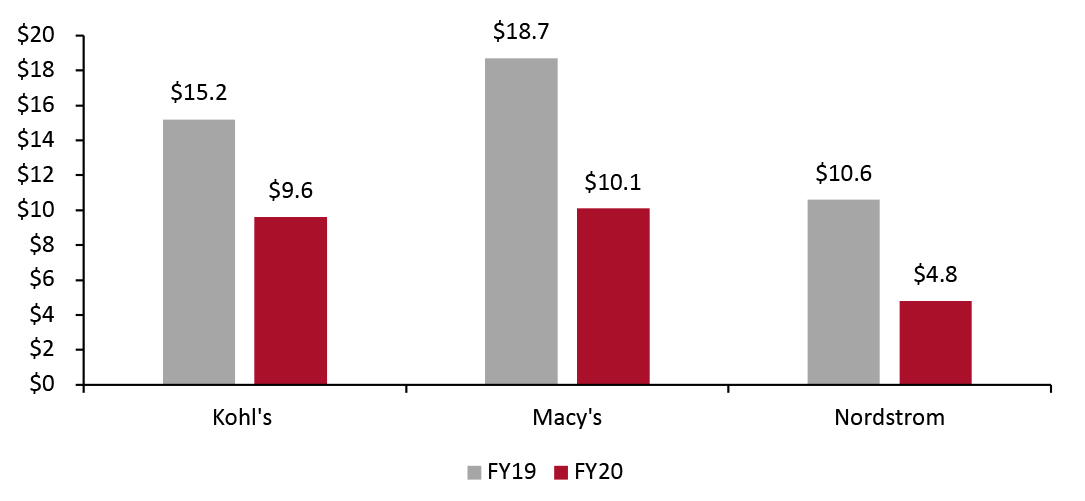

Digital sales reported by the companies to zero decimal places Source: Company reports/Coresight Research [/caption] In terms of the full fiscal year, e-commerce penetration was high for all three companies:

- Kohl’s saw e-commerce account for 40% of all sales—totaling $6.0 billion. This compared to just 24% penetration in fiscal 2019 ($4.8 billion).

- Macy’s achieved $8.0 billion in digital sales—representing 44% of total sales, up from 24% in fiscal 2019 ($6.6 billion).

- Nordstrom reported that 55% of all sales came from the digital channel—$5.9 billion in total. For fiscal 2019, Nordstrom reported $5.2 billion in digital sales (33% of total sales).

Figure 4. Kohl’s, Macy’s and Nordstrom: Digital Sales (USD Bil.) [caption id="attachment_125095" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Figure 5. Kohl’s, Macy’s and Nordstrom: Estimated Physical Store Sales (USD Bil.) [caption id="attachment_125096" align="aligncenter" width="725"]

Source: Company reports/Coresight Research [/caption]

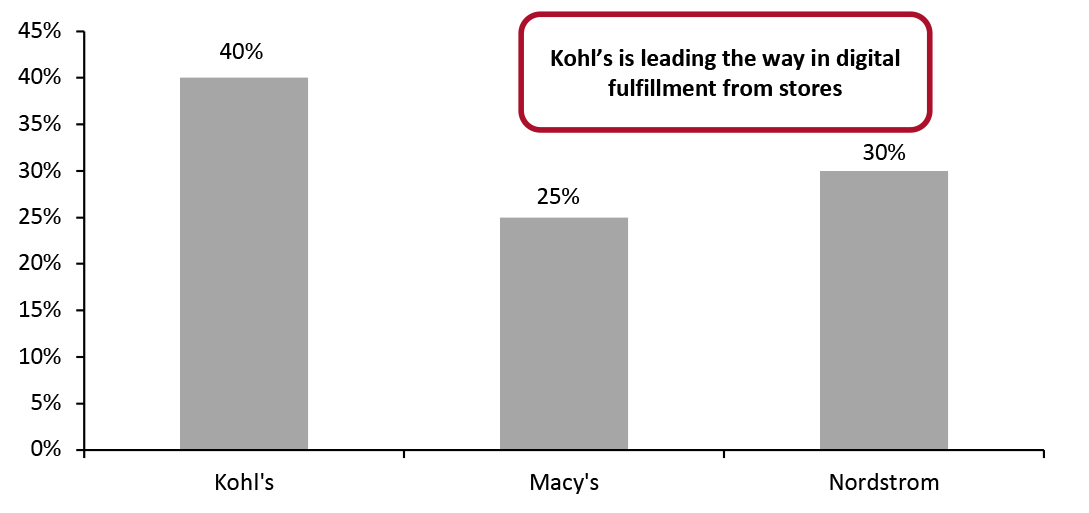

Digital Fulfillment from Stores: Kohl’s Leads the Way

Kohl’s is leading the three department stores in terms of digital fulfillment from stores: The company reported that 40% of its digital sales were fulfilled by stores in 4Q20.

At Macy’s, approximately 25% of digital orders were fulfilled by stores 4Q20.

In October 2020, Nordstrom expanded fulfillment capabilities at its Nordstrom Rack stores. The company reported that 30% of its digital orders were fulfilled by stores in 4Q20 and approximately 10% of online orders were picked up at stores.

Source: Company reports/Coresight Research [/caption]

Digital Fulfillment from Stores: Kohl’s Leads the Way

Kohl’s is leading the three department stores in terms of digital fulfillment from stores: The company reported that 40% of its digital sales were fulfilled by stores in 4Q20.

At Macy’s, approximately 25% of digital orders were fulfilled by stores 4Q20.

In October 2020, Nordstrom expanded fulfillment capabilities at its Nordstrom Rack stores. The company reported that 30% of its digital orders were fulfilled by stores in 4Q20 and approximately 10% of online orders were picked up at stores.

Figure 6. Kohl’s, Macy’s and Nordstrom: Digital Orders Fulfilled by Stores, 4Q20 (%) [caption id="attachment_125097" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Fulfilling orders from store provides a competitive advantage for retailers. During its 4Q20 earnings call on March 2, 2021, Target reported that fulfilling orders from stores is more cost-effective than shipping from a warehouse. Target’s stores fulfilled 75% of digital sales, saving the retailer 40% of the cost of shipping from a warehouse. Management added that the absolute cost of providing store-based fulfillment—which includes order pickup, Drive Up (curbside pickup), same-day delivery and ship-from-store—are all less expensive than they were two years ago when the company started providing these services for customers.

Digital fulfillment from stores will be particularly important moving forward. In 4Q20, Macy’s reported that delivery costs were a significant cost driver, having increased materially over the previous year. The retailer reported that due to high digital sales, delivery expenses impacted gross margin in the fourth quarter by a 310-basis-point decline. Management is working on a new strategy to improve inventory allocation, processes such as reducing split shipments, and personalization in targeting consumers to encourage customers to use its BOPIS (buy online, pick up in-store) service.

Product Categories: Home, Active and Beauty Categories Remain Strong; Apparel Is Struggling

In 4Q20, the home, active and beauty categories were positively highlighted by all three retailers, while apparel remains challenged.

Source: Company reports/Coresight Research[/caption]

Fulfilling orders from store provides a competitive advantage for retailers. During its 4Q20 earnings call on March 2, 2021, Target reported that fulfilling orders from stores is more cost-effective than shipping from a warehouse. Target’s stores fulfilled 75% of digital sales, saving the retailer 40% of the cost of shipping from a warehouse. Management added that the absolute cost of providing store-based fulfillment—which includes order pickup, Drive Up (curbside pickup), same-day delivery and ship-from-store—are all less expensive than they were two years ago when the company started providing these services for customers.

Digital fulfillment from stores will be particularly important moving forward. In 4Q20, Macy’s reported that delivery costs were a significant cost driver, having increased materially over the previous year. The retailer reported that due to high digital sales, delivery expenses impacted gross margin in the fourth quarter by a 310-basis-point decline. Management is working on a new strategy to improve inventory allocation, processes such as reducing split shipments, and personalization in targeting consumers to encourage customers to use its BOPIS (buy online, pick up in-store) service.

Product Categories: Home, Active and Beauty Categories Remain Strong; Apparel Is Struggling

In 4Q20, the home, active and beauty categories were positively highlighted by all three retailers, while apparel remains challenged.

Figure 7. Category Highlights [wpdatatable id=828 table_view=regular]

Source: Company reports Kohl’s and Nordstrom To Further Invest in Active; Macy’s Expects Digital To Grow to $10 Billion by 2023 During their 4Q20 earnings calls, each of the department store chains highlighted future areas and categories of focus, which we summarize below. Kohl’s reiterated that it is focusing on positioning itself as “an active destination for the family,” with a strategic goal to grow sales penetration of the active category from 20% of its portfolio to 30%. This includes dedicating 20% more floor space to active, launching a private-label athleisure brand, FLX, and adding new outdoor, active and athleisure brands. Kohl’s is also doubling down on growing its beauty category with its Sephora partnership, with plans to add 850 shop-in-shops in total by 2023. The Sephora at Kohl’s locations will introduce 100 prestige brands, some of which are exclusive to Sephora. Management believes that the Sephora partnership is a game changer, because it will drive significant beauty sales growth at an accretive margin and will have a halo effect across the entire store, driving sales in other categories with positive impacts for its women's business. Kohl’s is reinventing its women’s category: It exited 10 down-trending brands and is simplifying its women’s portfolio. Management said it is working closely with its national brand partners— Adidas, NIKE and Under Armour—and is launching a broad assortment in the Champion brand for women. Management also sees opportunity in its women’s denim category, with plans to amplify its offering with national brand Levi’s and value offering Sonoma in the next year. Macy’s emphasis during its 4Q20 call was on channel versus category: The company reported that it is accelerating its focus on digital shopping. Macy’s expects that $10 billion in sales will come from digital sales by 2023, up 25% from $8 billion in fiscal 2020. The company refreshed its homepage and product pages online, which has attracted a younger, more diverse customer base: 7 million new customers transacted with Macy’s in 4Q20, 4 million of which joined through digital channels. Commenting on product categories, management said that it is expecting consumers to return to physical stores and pre-pandemic shopping habits. Within each category, Macy’s is building a new and relevant assortment across its private and national brands as well as emerging brands. The company reported that it has a plan in place to shift to career and special occasion apparel and accessories when customers are ready to return to the office, community functions, outside events and entertaining. The company aims to balance this with its casual assortment. Of note, NIKE announced on March 26, 2021 that it will no longer sell its apparel products through Macy’s as it is shifting further into selling through its direct-to-consumer business—a trend that we are increasingly seeing throughout the retail industry. Nordstrom announced its partnership with Tonal, a smart home gym and personal trainer brand. The company will launch Tonal in 40 Nordstrom stores in the women’s department, with a 50-square-foot space where customers can try the fitness equipment—the partnership marks the first time Nordstrom is bringing fitness equipment into its stores. Nordstrom management also said that the company is deepening its partnership with ASOS to broaden distribution and drive growth in the fashion space. Nordstrom outlined at its Investor Day in February 2021 that it is seeking new vendor relationships to operate fewer wholesale models and hold less inventory; the retailer is moving toward partnership models that include revenue sharing and dropshipping. Nordstrom sees opportunities with ASOS in developing a new vendor relationship. Area of Note by Management: New, Younger Customers Kohl’s attributes the addition of 2 million new, unique customers in fiscal 2020—one-third of which were millennials—to the Amazon Returns program. Kohl’s reported a base of 65 million customers in February 2021, so these new customers represent approximately 3% of the retailer’s customer base. Macy’s reported that 7 million new customers transacted with the retailer in 4Q20, 4 million of which joined through digital channels. According to the company, these customers are younger than Macy’s typical consumer, with 38% of them under the age of 40. Macy’s also highlighted that its partnership with Klarna, a flexible payment service offering, has helped to bring in new, younger customers. The retailer reported that two-thirds of the customers that came through Klarna were new to Macy’s, and 45% were under the age of 40. Nordstrom gained 1.8 million new customers online in 4Q20—a 40% increase over the year-ago period. Nordstrom reported on a call in February 2021 that the company had 35 million customers that shopped both its Nordstrom and Nordstrom Rack brands and more than 13 million Nordy Club loyalty members. The 1.8 million new digital customers represent approximately 4% of the total customers shopping at Nordstrom and Nordstrom Rack today.