DIpil Das

Introduction

As consumers migrated to sportswear and athleisure starting in 2013, the US denim market endured several tough years. However, it saw a revival beginning in 2018, largely driven by new sustainable offerings, a wider range of denim fits, and fashion trends in streetwear and vintage, as well as the rise of casual workplace dress codes. Although the Covid-19 pandemic interrupted the category’s trajectory in 2020, we saw a strong recovery in 2021. In this report, we look at the size, market factors, key players and trends of the US denim market. We examine what retailers and brands are doing to recover denim sales and leverage the opportunities the market presents. Brands and retailers are implementing more sustainable manufacturing practices as well as investing in collaborations to satisfy consumer demand. As denim continues to evolve, the market is expected to grow at a steady rate. Denim has been an important apparel category for decades due to its deep-rooted cultural relevance with most Americans. However, denim sales have fallen sharply amid the coronavirus pandemic, with brands such as Lucky Brand Jeans and True Religion filing for bankruptcy and Levi’s revenue declining. Meanwhile, athleisure retailers such as Lululemon are experiencing a sales lift. As consumers increasingly adopt comfortable apparel, existing denim brands are innovating their products and go-to-market strategies.US Denim: Performance and Outlook

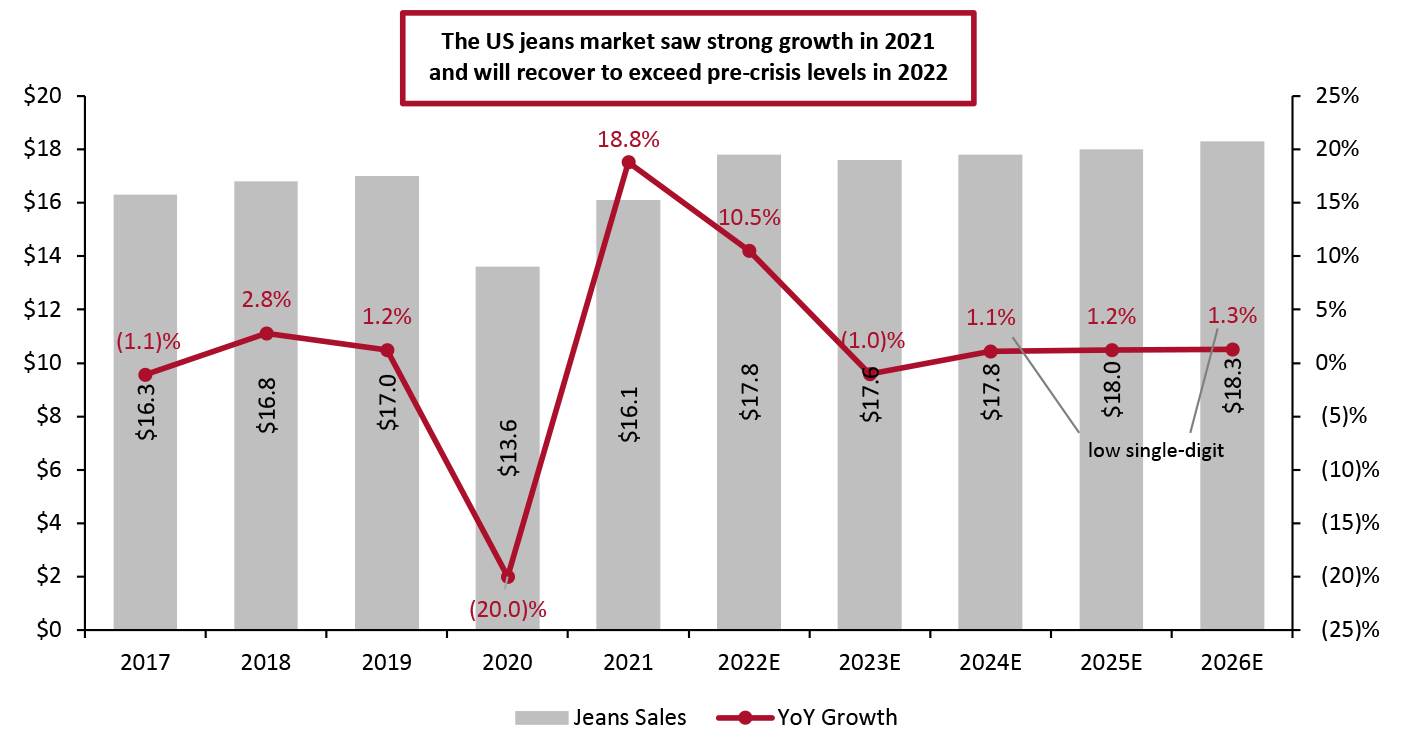

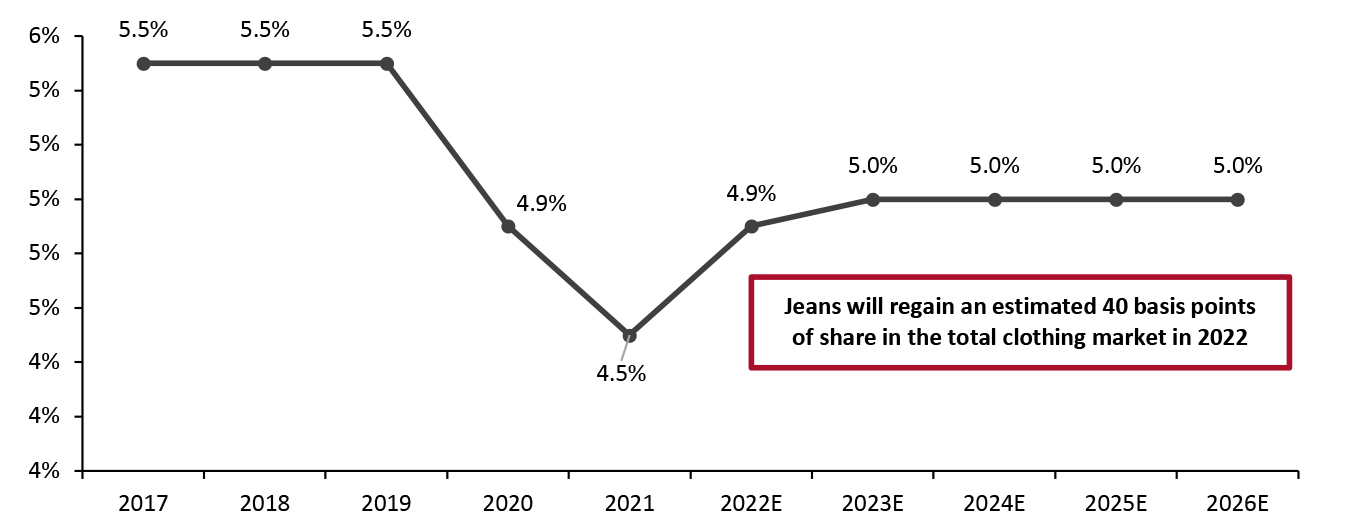

Market Size As a category, denim includes jeans, skirts, jackets and other apparel made out of denim materials. We use jeans as the largest and most representative product in the category as our market size. We anticipate that the US jeans market will grow 10.5% in 2022, shown in Figure 1. This is faster than our estimated low-single-digit growth of the total clothing market, with denim demand supported by meaningful shifts in style preferences driving wardrobe renewal, which we discuss later. We expect the jeans market to decline slightly but still outperform the total clothing market in 2023. These trajectories follow a 20.0% decline amid the Covid-19 crisis in 2020 and an estimated 18.8% bounce in 2021. In Figure 2, we chart the share of US jeans market versus the total clothing market. From 2017 to 2021, the US jeans market lost 100 basis points of share of the total clothing market, which was picked up by athleisure and sportswear. We expect the jeans market to recapture 40 basis points of total clothing share in 2022 and stabilize at 5% in 2023 and beyond. We expect the US jeans market to grow with a stabilized low single-digit rate in 2024 and beyond, reaching $18.3 billion by 2026. The market will grow at a CAGR of 5.1% from 2020 to 2026, according to our estimates.Figure 1. US Jeans Sales (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_141517" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Figure 2. Jeans’ Share of the Total US Clothing Market (%) [caption id="attachment_141518" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Bureau of Economic Analysis/Coresight Research[/caption]

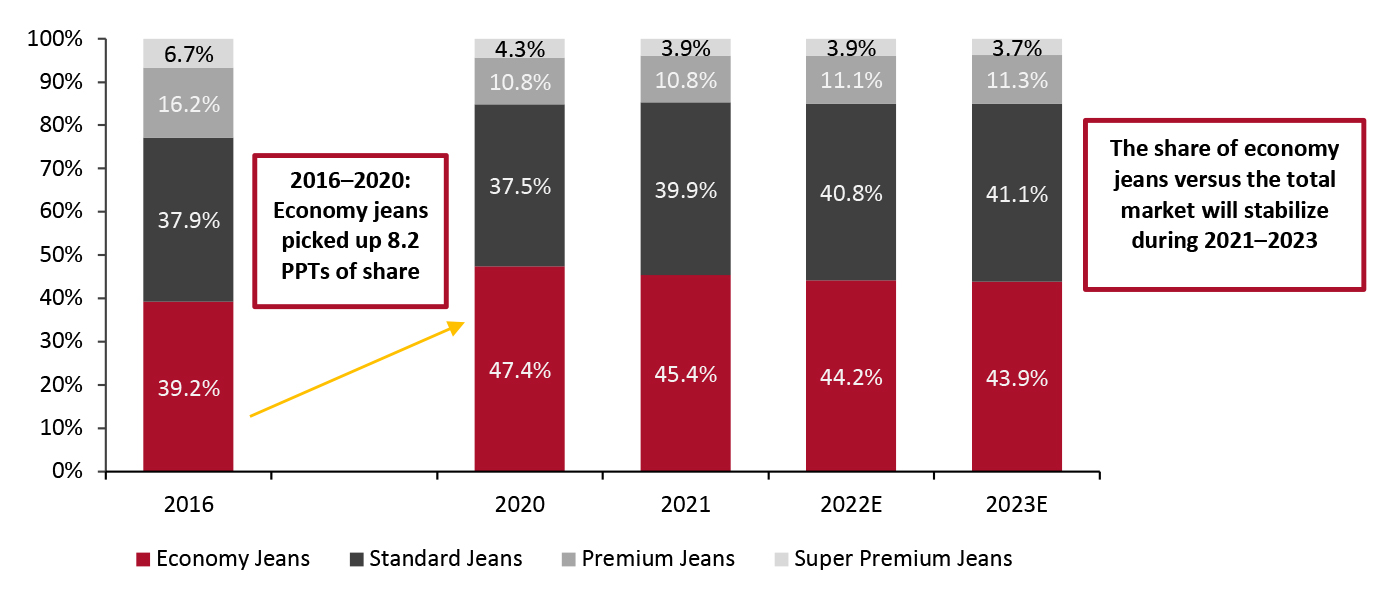

As measured by value (rather than volume), economy jeans picked up share from premium and super-premium jeans from 2016 to 2020, especially from 2019 to 2020 when the share increased by 6.3 percentage points, according to Euromonitor International. Economy jeans accounted for almost half of the jeans market by value in 2020.

The share of economy jeans versus the total market will stabilize during 2021 to 2023 to a level of around 43% to 45%, according to Euromonitor International.

Source: Euromonitor International Limited 2022 © All rights reserved/Bureau of Economic Analysis/Coresight Research[/caption]

As measured by value (rather than volume), economy jeans picked up share from premium and super-premium jeans from 2016 to 2020, especially from 2019 to 2020 when the share increased by 6.3 percentage points, according to Euromonitor International. Economy jeans accounted for almost half of the jeans market by value in 2020.

The share of economy jeans versus the total market will stabilize during 2021 to 2023 to a level of around 43% to 45%, according to Euromonitor International.

Figure 3. US Jeans Sales by Tier (%) [caption id="attachment_141530" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

In Figure 4, we present denim brands and retailers by their position and affordability, ranging from economy to super-premium.

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

In Figure 4, we present denim brands and retailers by their position and affordability, ranging from economy to super-premium.

Figure 4. Selected US Denim Brands and Retailers by Market Position [wpdatatable id=1714 table_view=regular]

<em>Source: Coresight Research

Market Factors

We identify five main factors driving growth in the US denim market. 1. The “Death of Skinny” and a New Denim Cycle In an inflection point for the denim market, consumers have exhibited a newfound appetite for looser jeans styles that marks a new style cycle after an extended period during which skinny jeans were the go-to style (for female consumers, at least). The trend toward high-rise and looser denim will continue to drive denim growth in 2022 and beyond. Management commentary at brands and activity from retailers point to changed trends providing ongoing support to category sales. Levi’s CEO Chip Bergh, for example, noted in January 2022 that the market is “in the early innings of the new denim cycle.” At Coresight Research, we continue to see major retailers promote alternative fits such as bootcut, flare and wide leg, and encourage female consumers to break away from the hitherto-dominant skinny style. [caption id="attachment_141532" align="aligncenter" width="320"] “Give your skinny jeans a break” email campaign from Nordstrom, February 2022

“Give your skinny jeans a break” email campaign from Nordstrom, February 2022 Source: Email [/caption] The shift away from skinny has been reflected on, and supported by, social media. In 2021, a well-documented trend on TikTok saw young, Gen Z consumers attack the style credentials of the skinny fit in videos tagged “no skinny jeans.” Looser fits increased penetration in Levi’s sales in 2021, representing roughly half of its women's and men's bottoms assortments, according to the company. Levi’s also said on its earnings call in January 2022 that it will iterate on this trend in future seasons, showing that the looser fit fashion silhouettes will likely drive the denim market from a supplier’s perspective.

- We discuss these changing silhouettes further in the Themes We Are Watching section, later in this report.

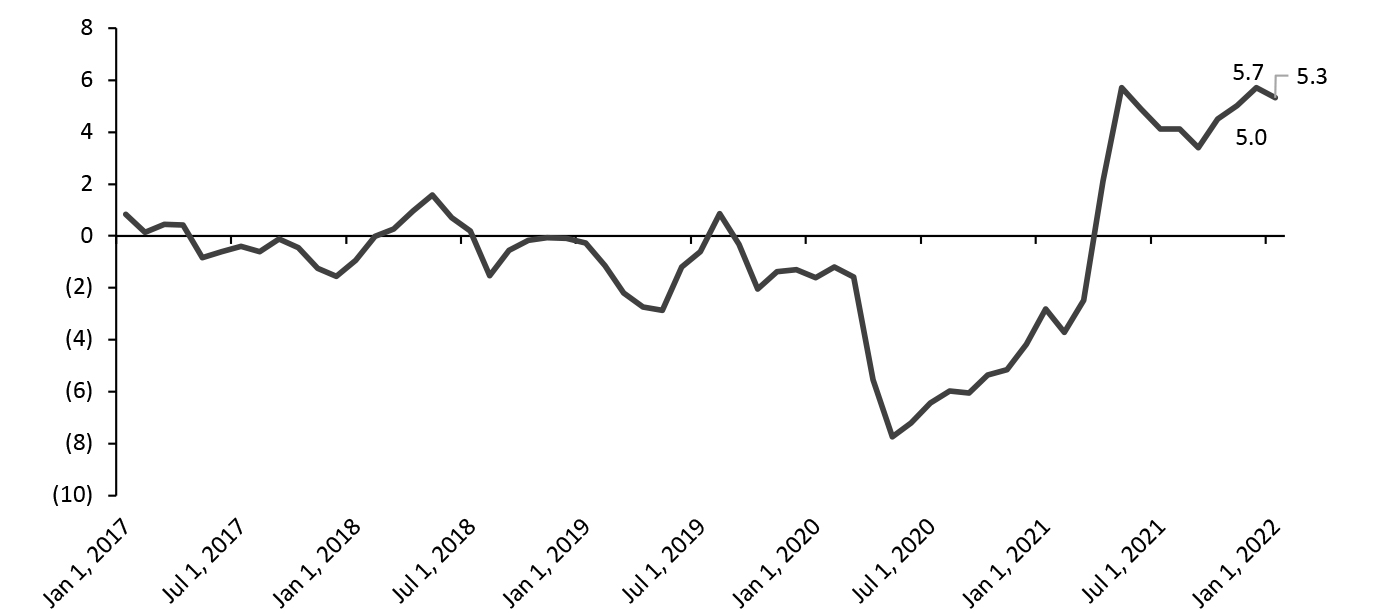

Figure 4. YoY Changes of Consumer Price Index in Apparel and Footwear for All Urban Consumers (%, Seasonally Adjusted) [caption id="attachment_141521" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

Competitive Landscape

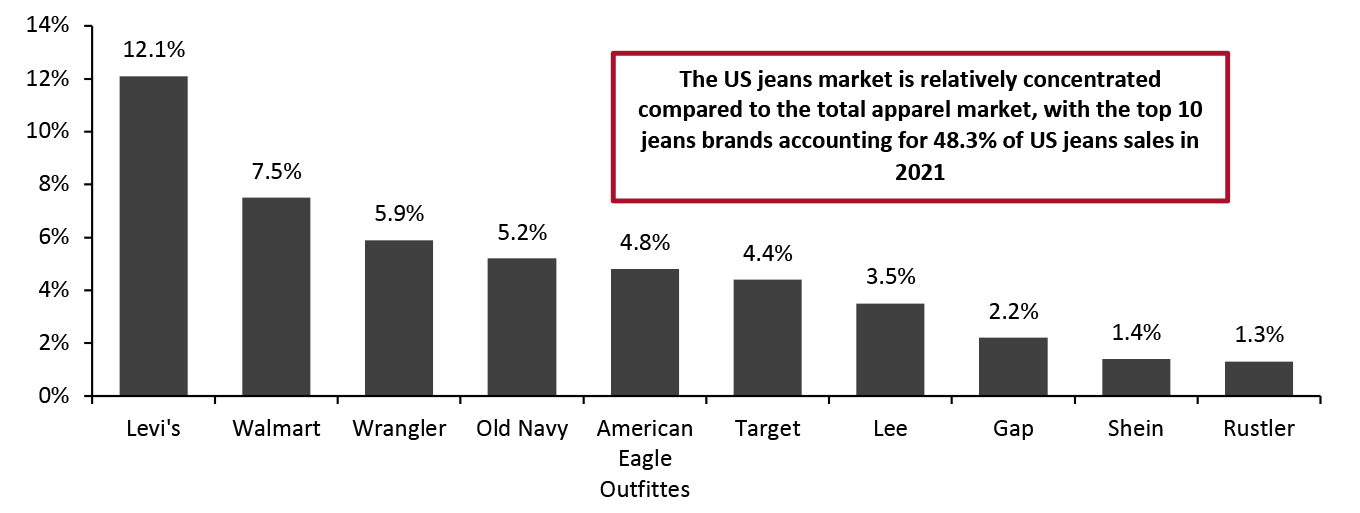

The US denim market is relatively concentrated compared to the total apparel market (where the top 10 apparel brands account for less than 20% of US apparel sales), with the top 10 jeans brands accounting for 48.3% of US jeans sales in 2021, according to data from Euromonitor International. We expect the market to become more concentrated in the next three to five years, with major retailers such as Levi’s and mass retailers such as Walmart continuing to capture shares from smaller brands. The market leader Levi’s saw strong sales recovery in 2021 and reported net revenues of $5.8 billion for the full fiscal year 2021 ended November 28, 2021, up by 29% versus 2020. Management mentioned on its earnings call in January 2022 that they believe the total addressable market for denim is large and growing, and they are seeing consumer preferences continue to shift towards casualization. The company is well positioned to take advantage of and drive growth in the market. Kontoor Brands, with a portfolio led by Wrangler and Lee, also reported strong sales recovery in 2021. In the nine months ended September 2021, Kontoor Brands achieved 25% sales growth compared to the same period in 2020. Gap, Inc. reported on its earnings call in November 2021 that the company has a $2 billion denim business, almost equal to Banana Republic’s total US sales. Management believes that denim is coming back and plans to take the great opportunity to capture more market shares. American Eagle Outfitters reported in November 2021 that the company’s women's business posted strong sales in the quarter ended October 30, 2021, supported by the denim category. Management mentioned on the earnings call in November 2021 that the denim trend will continue for a long time.Figure 5. Top 10 US Jeans Brands: Market Share, 2021 (%) [caption id="attachment_141522" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Themes We Are Watching

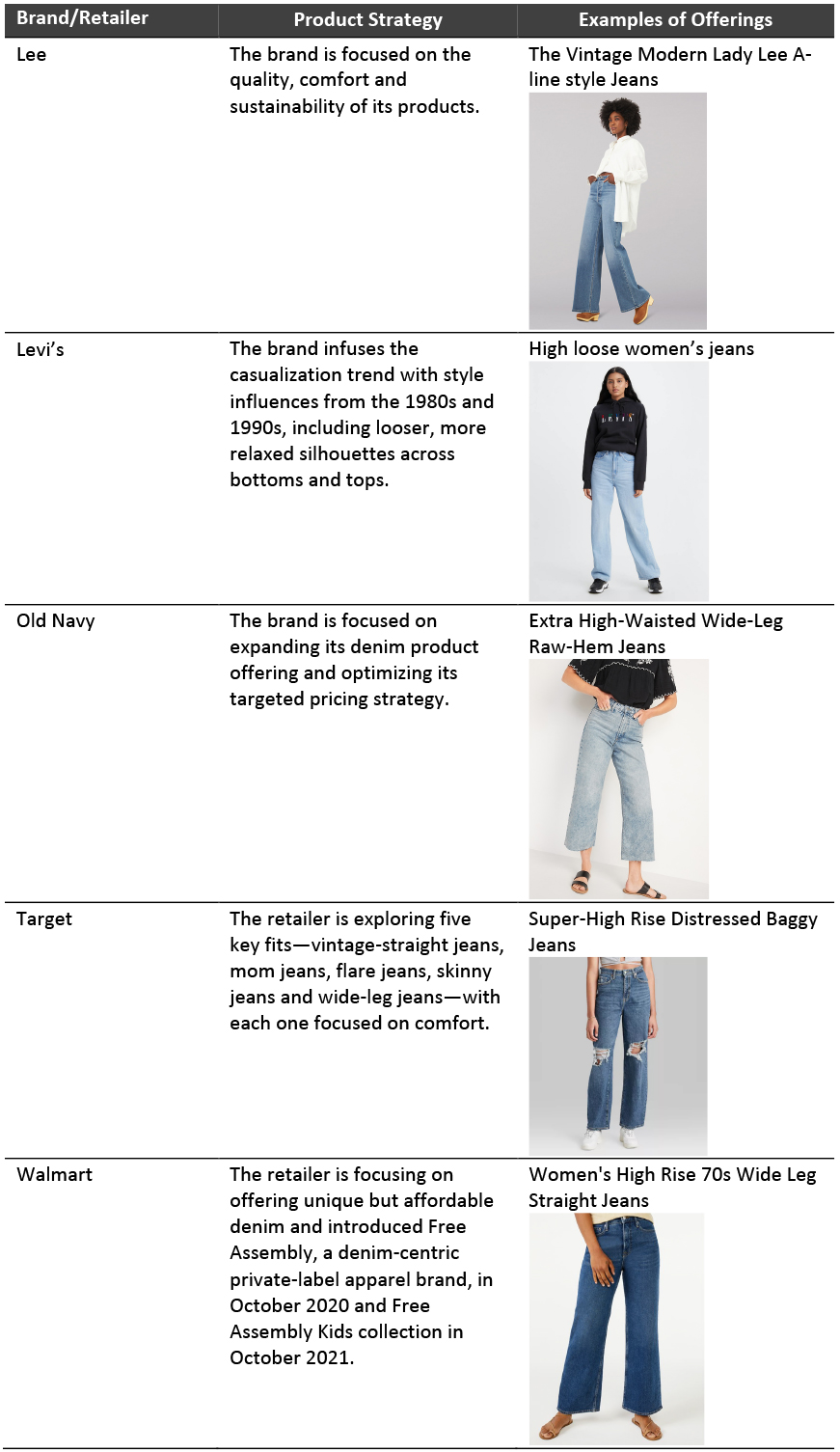

Straight and Loose Silhouettes Emerged as The New Go-To New silhouettes are driving a new denim cycle and we expect these silhouettes to last at least seven to ten years. Consumers are pivoting towards looser fits such as jeans with wide legs, high-rise cuts and ankle crop length. Supported by the casualization trend, we are also seeing denim brands and retailers respond to changing consumer needs by upgrading their denim designs. For instance, Levi’s started to launch more loose fits in 2020, especially on the women's side of the business, and found those styles were sold through very quickly, according to the company. Then, the company doubled down on this in 2021 and we continue to see the looser fit trend taking hold.Figure 6. Selected Denim Brands’ and Retailers’ Product Strategies and Recent Offerings [caption id="attachment_141531" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Conscious Consumption: Denim Leads the Sustainable Fashion Trend

We are seeing more denim brands implement eco-friendly manufacturing processes in response to growing consumer demand for sustainability. It is important to consumers that retailers and brands adopt sustainable practices that minimize the environmental impact of their products and operations.

As shown in Figure 7, more denim brands now focus on fabric innovation to reduce reliance on traditional fabrics, such as virgin cotton, as well as looking for more dyes that minimize harmful chemical use and reduce water consumption. Popular responsible fabric alternatives include Tencel. Brands are also disclosing more information about the manufacturing process of their products from fibers to finished goods. We expect to see sustainable fibers and product recyclability be key themes for the denim market over the next five years.

Source: Company reports/Coresight Research[/caption]

Conscious Consumption: Denim Leads the Sustainable Fashion Trend

We are seeing more denim brands implement eco-friendly manufacturing processes in response to growing consumer demand for sustainability. It is important to consumers that retailers and brands adopt sustainable practices that minimize the environmental impact of their products and operations.

As shown in Figure 7, more denim brands now focus on fabric innovation to reduce reliance on traditional fabrics, such as virgin cotton, as well as looking for more dyes that minimize harmful chemical use and reduce water consumption. Popular responsible fabric alternatives include Tencel. Brands are also disclosing more information about the manufacturing process of their products from fibers to finished goods. We expect to see sustainable fibers and product recyclability be key themes for the denim market over the next five years.

Figure 7. Selected Denim Sellers’ Actions on Sustainability [wpdatatable id=1717 table_view=regular]

Source: Coresight Research Ongoing Cross-Branding and Celebrity Collaborations We saw ongoing cross-branding and celebrity collaborations for denim in 2021 and expect the trend to continue to gain momentum in 2022. Collaborating with denim brands will help retailers expand into complementary markets and attract new customers. Lee, a subsidiary brand of Kontoor Brands, collaborated with streetwear brand The Hundreds to debut a collection of denim workwear in June 2021. Levi’s has been at the forefront of brand collaboration. In December 2021, the brand worked with bentgablenits, a Toronto-based design trio, to launch a collection focusing on Levi’s Authorized Vintage 501 Jeans and Trucker Jackets with a mix of textural decorations. In addition, the brand launched a collection focused on youthful optimism in partnership with celebrities Hailey Bieber and Jaden Smith. In early 2021, Levi’s launched products in collaboration with high-profile luxury brands such as Valentino, Mumu and Denim Tears, which yielded strong sell-throughs, according to Levi’s earnings call in July 2021. The brand also collaborated with New Balance on denim-clad sneakers, which sold out everywhere within seconds of the product’s launch on October 29, 2020, including on newbalance.com and Alibaba’s Tmall e-commerce platform. Also, in October 2020, Levi’s teamed up with Danish fashion brand Ganni on an exclusive rental-only capsule collection featuring three staple denim pieces, a button-down shirt, 501 jeans and a shirt dress—all of which have been made from upcycled vintage Levi’s products and repurposed denim. LEGO and Levi’s launched a new collaboration on limited-edition “wearable art” apparel in October 2020. J Brand’s collaboration with Halpern on a capsule collection launched on September 3, 2020. The collection merges colors, patterns and textures for a series of stand-out looks. J Brand has previously worked with emerging designers and fashion figures such as Bella Freud, Christopher Kane and Kozaburo Akasaka. Wrangler has looked to collaborations to reach a younger and more diverse consumer base. In November 2021, Wrangler launched a new collection in collaboration with TV series Yellowstone. The collection includes an assortment of denim and work shirts and jackets that feature the Dutton Ranch’s “Y” logo, as well as gender-neutral hoodies and T-shirts that feature graphics from the series. In July 2021, Wrangler collaborated with Billabong, an Australian company focused on outdoor wear, to launch apparel items made with eco-conscious materials. In May 2020, the brand collaborated with musical artist Diplo for the release of his highly anticipated country album. The brand also worked with the Marley family to launch a limited-edition collection and with reggae influencers to revive singer-songwriter Bob Marley’s favorite Wrangler styles.

What We Think

Implications for Apparel Brands/Retailers- We believe a recovery in 2021 will drive denim to grow significantly in 2022, although the US denim market saw an estimated 20.0% decline due to the Covid-19 crisis in 2020. The rising casualization trend is impacting the category, supporting the move away from tight, skinny styles to modern cuts with straight legs and high-rise designs. We recommend that denim brands and retailers diversify their offerings to include more casual styles such as jeggings, straight jeans and high-rise ankle crop jeans.

- As consumers are becoming more conscious of the importance of sustainability, it is important for denim brands to reduce environmental impacts with water-saving technologies and sustainable fibers.

- Cross-brand and celebrity collaborations in denim are still growing as a way to drive consumer engagement and increase brand awareness. We see a promising future in collaboration between brands and between brands and celebrities.

Source for all Euromonitor International data: Euromonitor International Limited 2022 © All rights reserved