DIpil Das

The Coresight Research and IRI monthly US CPG Sales Tracker provides our data-driven insights into online sales trends in the US CPG industry—covering the product categories of food & beverage; health & beauty; and general merchandise & homecare. In this report, we present five key insights into the four weeks ended September 6, 2020.

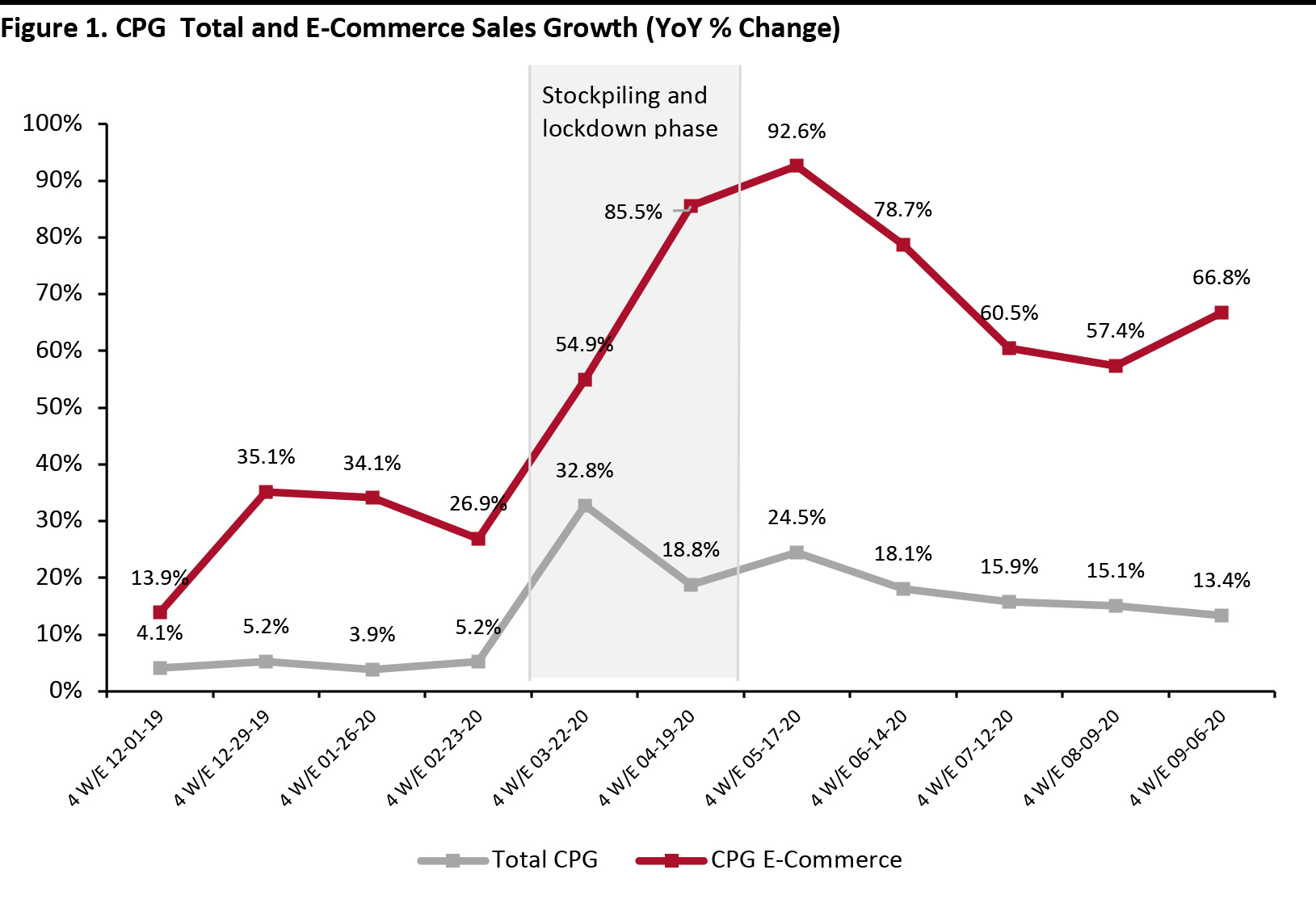

1. Online CPG Growth Picks Up Again

As the pandemic wears on, consumers have continued to gravitate towards e-commerce for CPG shopping. Online channel growth is up again after decelerating for three consecutive months. The channel expanded by 66.8% for the four weeks ended September 6, compared to 57.4% for the four weeks ended August 9. We believe that online growth will remain higher than pre-Covid levels for the remainder of the year due to uncertainties surrounding the pandemic still being present.

[caption id="attachment_116811" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research [/caption]

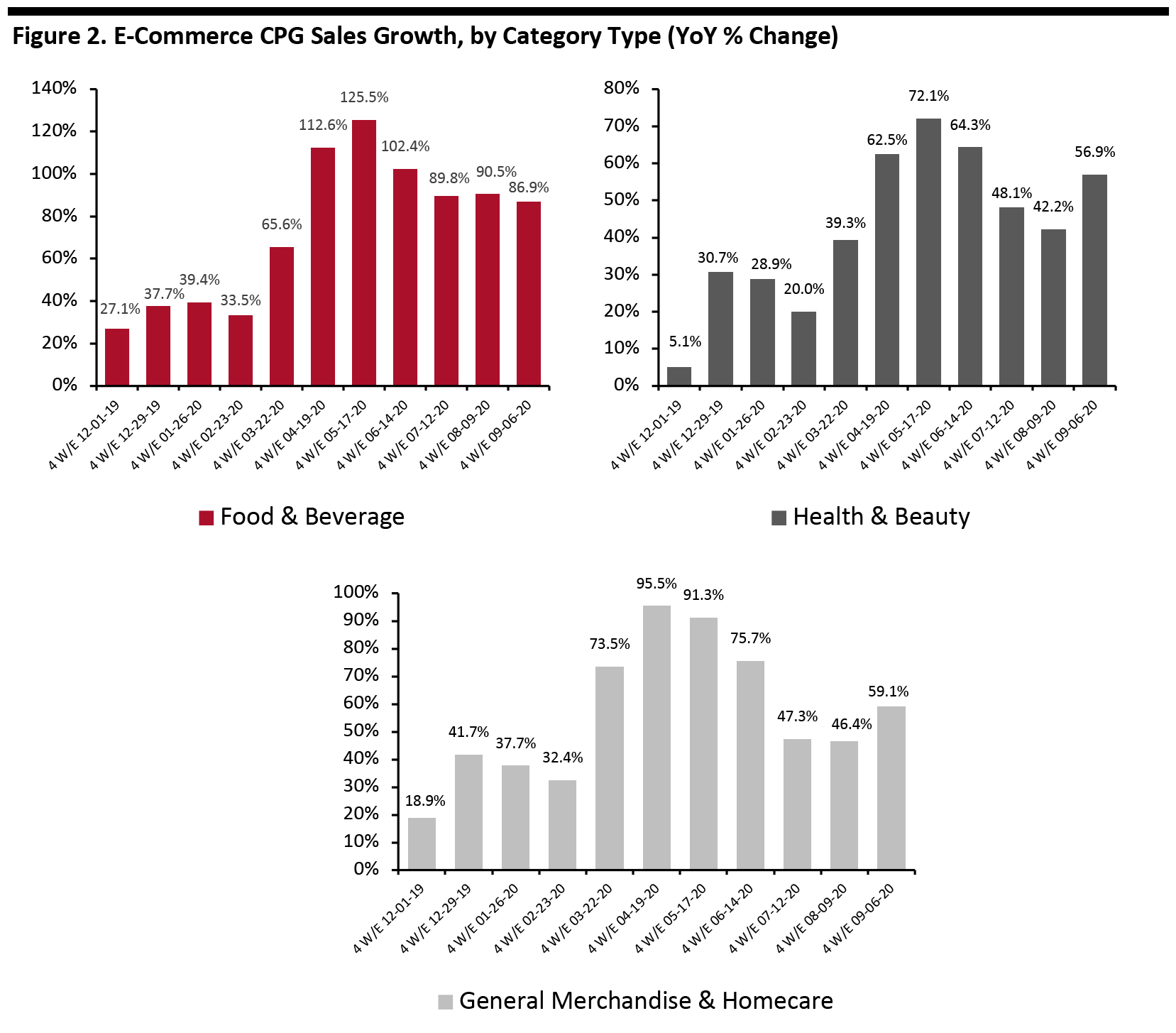

2. Online Growth of Food & Beverage Remains Strong

The pandemic has accelerated online grocery adoption, and the channel remains popular with shoppers six months into the crisis in the US. The food & beverage category continues to see high online growth, relative to other categories, soaring 86.9% for the four weeks ended September 6. Several grocery retailers are benefiting from the strong grocery e-commerce trend. Kroger, for example, saw its online sales surge by 127% in its second fiscal quarter, ended August 15. The company expects its grocery sales to continue to see an e-commerce boost even after the pandemic subsides.

Growth in the health & beauty and general merchandise & homecare categories is up again, after slowing for three months in a row. Health & beauty saw a significant increase, jumping from 42.2% for the four weeks ended August 9 to 56.9% for the four weeks ended September 6 (up by 14.7 percentage points).

[caption id="attachment_116812" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research [/caption]

2. Online Growth of Food & Beverage Remains Strong

The pandemic has accelerated online grocery adoption, and the channel remains popular with shoppers six months into the crisis in the US. The food & beverage category continues to see high online growth, relative to other categories, soaring 86.9% for the four weeks ended September 6. Several grocery retailers are benefiting from the strong grocery e-commerce trend. Kroger, for example, saw its online sales surge by 127% in its second fiscal quarter, ended August 15. The company expects its grocery sales to continue to see an e-commerce boost even after the pandemic subsides.

Growth in the health & beauty and general merchandise & homecare categories is up again, after slowing for three months in a row. Health & beauty saw a significant increase, jumping from 42.2% for the four weeks ended August 9 to 56.9% for the four weeks ended September 6 (up by 14.7 percentage points).

[caption id="attachment_116812" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research [/caption]

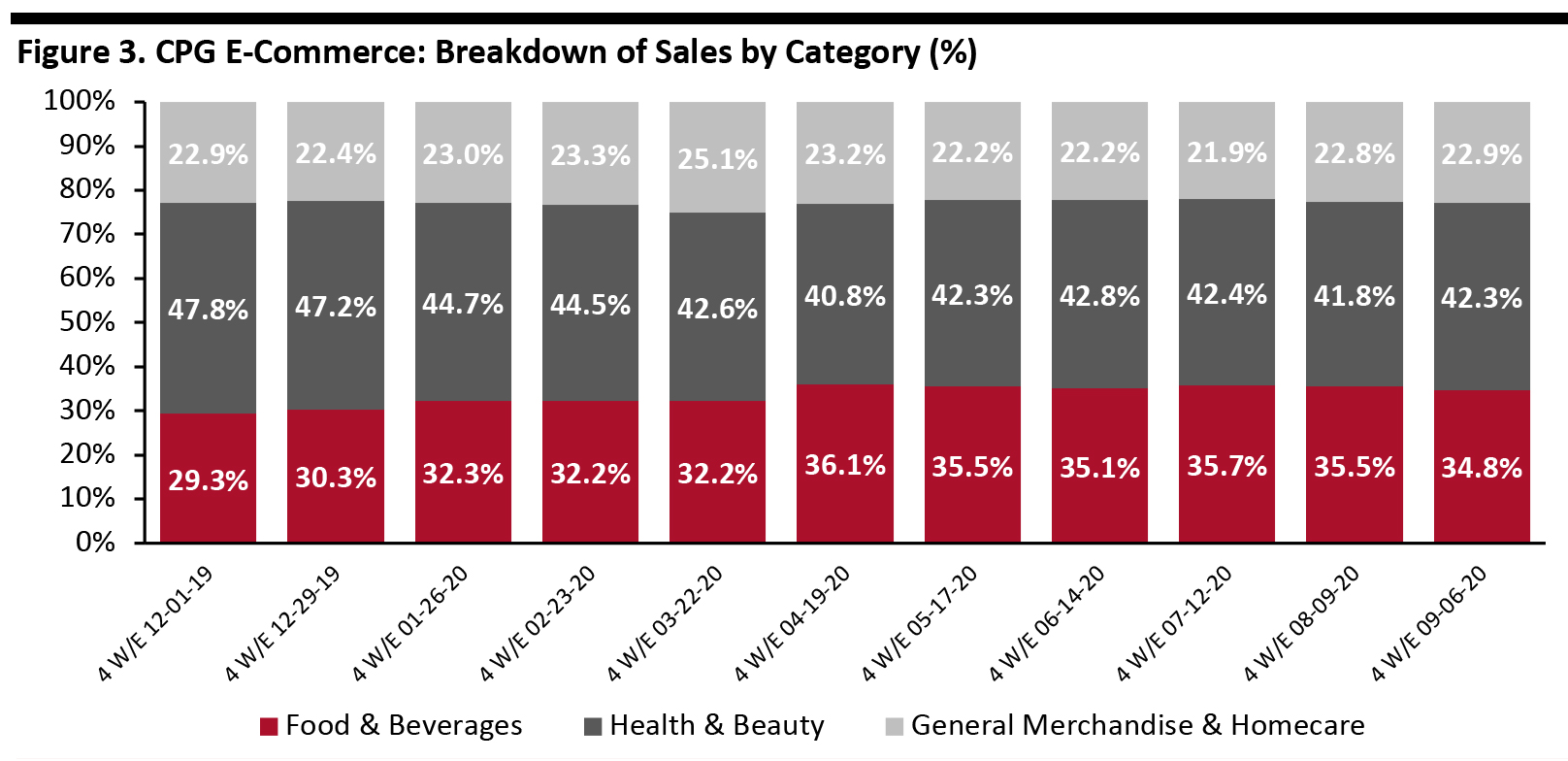

3. Breakdown of Online CPG Sales: General Merchandise & Homecare Picks Up; Food & Beverage Trends Down

The chart below shows the breakdown of online sales by type of CPG category. Health & beauty, which contributes nearly half of online CPG dollar sales, picked up again to reach 42.3% for the four weeks ended September 6. Food & beverage fell below the 35% mark for the first time since April, reaching 34.8%. Meanwhile, general merchandise & homecare’s online share has grown for two consecutive periods, reaching 22.9% for the four weeks ended September 6.

[caption id="attachment_116813" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research [/caption]

3. Breakdown of Online CPG Sales: General Merchandise & Homecare Picks Up; Food & Beverage Trends Down

The chart below shows the breakdown of online sales by type of CPG category. Health & beauty, which contributes nearly half of online CPG dollar sales, picked up again to reach 42.3% for the four weeks ended September 6. Food & beverage fell below the 35% mark for the first time since April, reaching 34.8%. Meanwhile, general merchandise & homecare’s online share has grown for two consecutive periods, reaching 22.9% for the four weeks ended September 6.

[caption id="attachment_116813" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research [/caption]

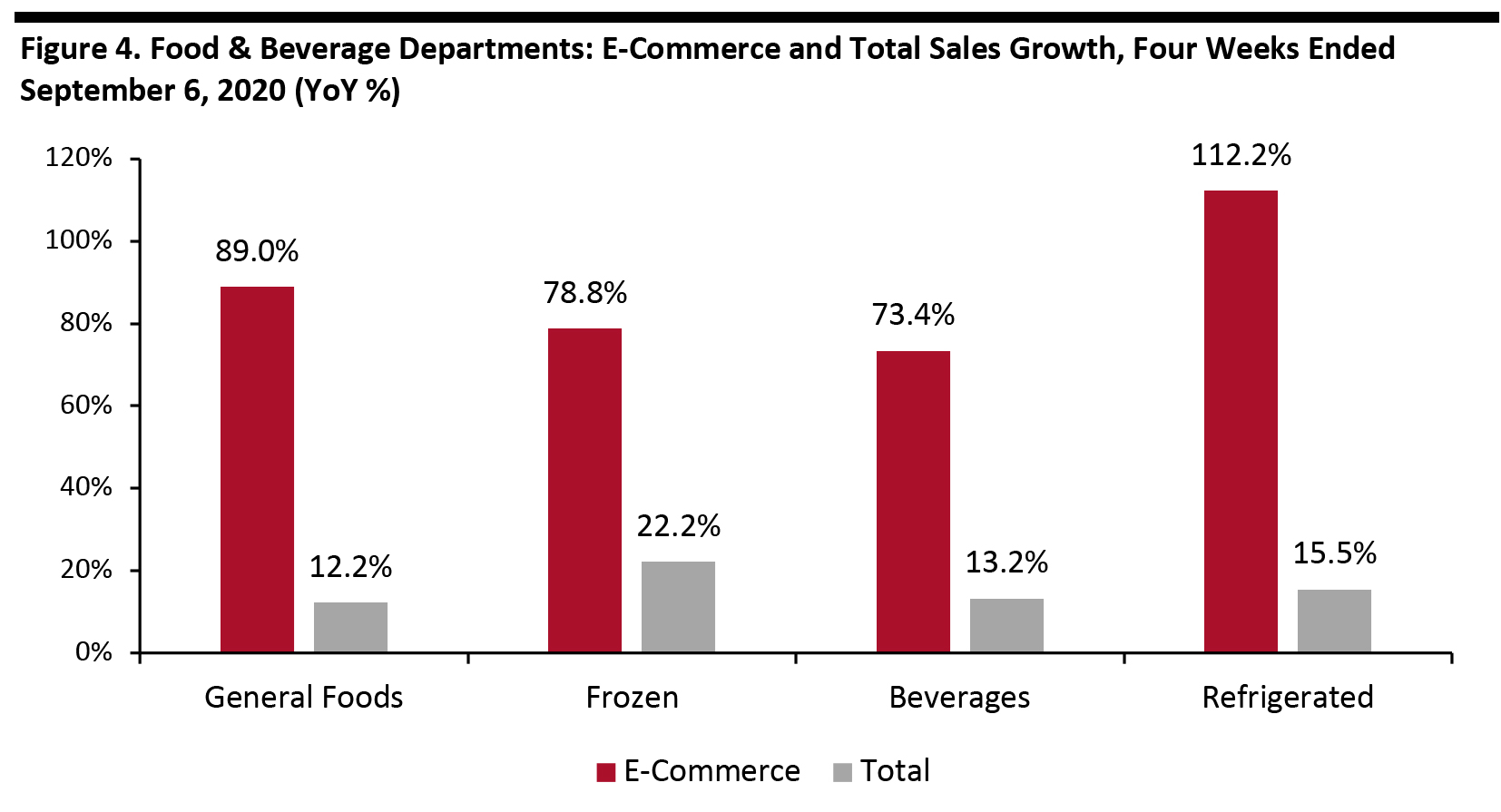

4. Frozen Foods Continue To Outpace Other Food Departments in Total Sales

Several supermarkets and grocery stores reported a surge in demand for frozen food as the pandemic unfolded in March, and it continues to be a hot seller. For the four weeks ended September 6, frozen food posted total sales growth of 22.2%, driven by seafood (42% growth), fruit (35%) and meat (33.7%).

According to survey results released by food company Caulipower on September 17, around 67% of US consumers said that they had increased purchases of frozen food since the beginning of the lockdown, with the majority of respondents saying that they will continue to purchase more frozen food post pandemic. Almost 63% stated that they stepped up their purchasing of frozen food because it is easier to prepare, while 52% said they are “going frozen” because of its long shelf life.

Costco, which posted a 15% increase in net sales for the four weeks ended August 30, attributed some of the growth to strong frozen food sales.

Refrigerated foods saw the biggest online gains in four weeks ended September 6, with the growth of 112.2% versus last year driven by entrees (up 161.8%), pasta (up 157.4%) and fresh eggs (up 148.1%).

[caption id="attachment_116814" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research [/caption]

4. Frozen Foods Continue To Outpace Other Food Departments in Total Sales

Several supermarkets and grocery stores reported a surge in demand for frozen food as the pandemic unfolded in March, and it continues to be a hot seller. For the four weeks ended September 6, frozen food posted total sales growth of 22.2%, driven by seafood (42% growth), fruit (35%) and meat (33.7%).

According to survey results released by food company Caulipower on September 17, around 67% of US consumers said that they had increased purchases of frozen food since the beginning of the lockdown, with the majority of respondents saying that they will continue to purchase more frozen food post pandemic. Almost 63% stated that they stepped up their purchasing of frozen food because it is easier to prepare, while 52% said they are “going frozen” because of its long shelf life.

Costco, which posted a 15% increase in net sales for the four weeks ended August 30, attributed some of the growth to strong frozen food sales.

Refrigerated foods saw the biggest online gains in four weeks ended September 6, with the growth of 112.2% versus last year driven by entrees (up 161.8%), pasta (up 157.4%) and fresh eggs (up 148.1%).

[caption id="attachment_116814" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research [/caption]

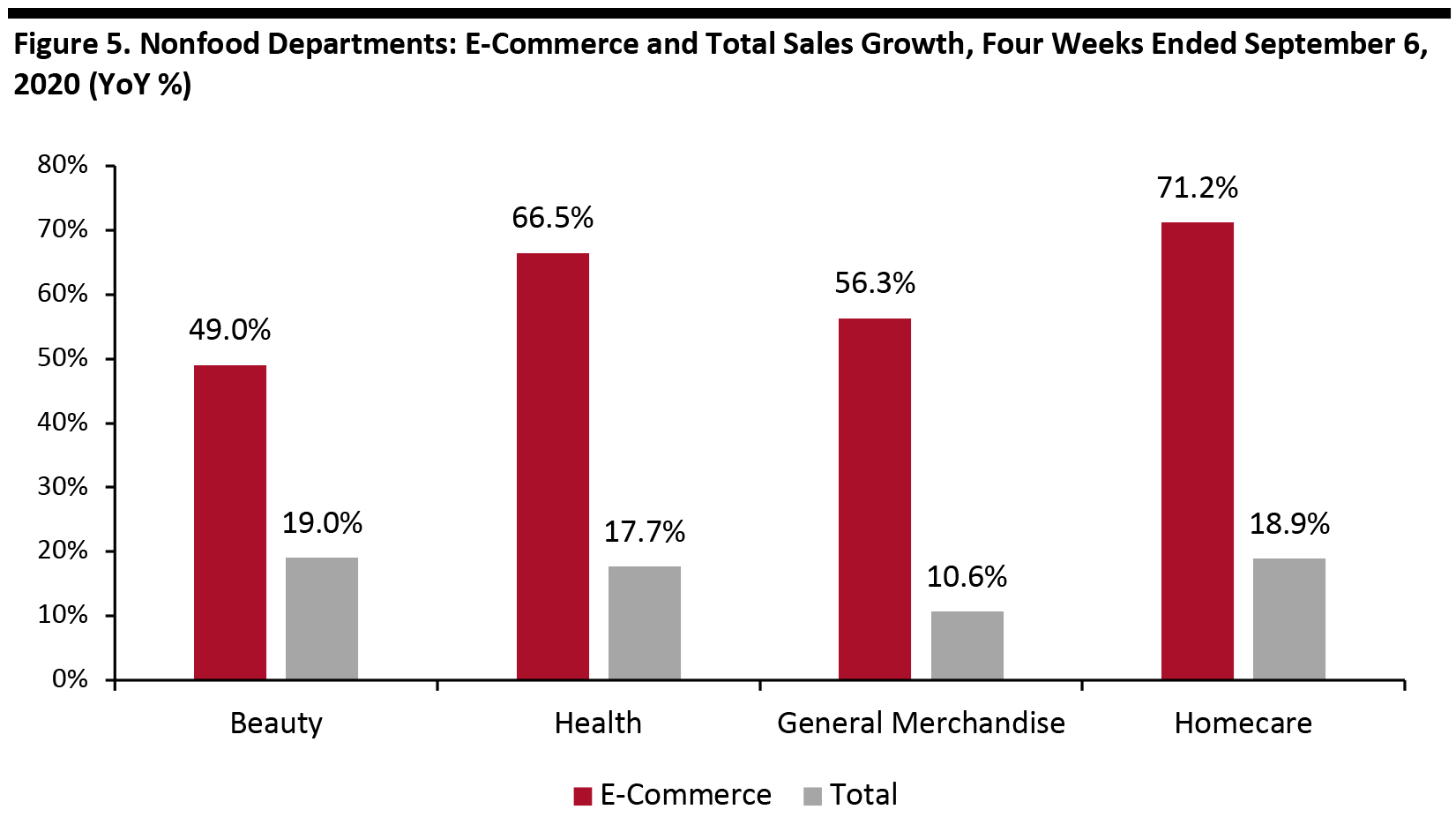

5. Homecare Sees the Strongest Online Growth Among Nonfood Departments

Homecare products continue to see high demand, driven by household cleaning supplies, as consumers take stringent precautions to maintain home hygiene. The online channel saw the highest year-over-year growth of the nonfood departments, at 71.2%, while total sales increased by 18.9%. Overall homecare sales were driven by household cleaners (up 39%), household cleaner cloths (up 35.1%) and cleaning tools (up 34.8%).

Household cleaning-product sales have remained exceptionally high over the past six months. Clorox, for example, highlighted in its earnings call for the fiscal year ended June 30, that it continues to experience tremendous growth for cleaning and disinfectant products, with demand still far exceeding supply. The company plans to aggressively ramp up its production capacity to meet the ongoing elevated demand, and it expects demand to stay high through the first half of its fiscal year 2021. This trend is also supported by a Coresight Research survey conducted on September 2, which found that a substantial 39% of US consumers are currently buying more household items, such as cleaning or laundry products.

[caption id="attachment_116815" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research [/caption]

5. Homecare Sees the Strongest Online Growth Among Nonfood Departments

Homecare products continue to see high demand, driven by household cleaning supplies, as consumers take stringent precautions to maintain home hygiene. The online channel saw the highest year-over-year growth of the nonfood departments, at 71.2%, while total sales increased by 18.9%. Overall homecare sales were driven by household cleaners (up 39%), household cleaner cloths (up 35.1%) and cleaning tools (up 34.8%).

Household cleaning-product sales have remained exceptionally high over the past six months. Clorox, for example, highlighted in its earnings call for the fiscal year ended June 30, that it continues to experience tremendous growth for cleaning and disinfectant products, with demand still far exceeding supply. The company plans to aggressively ramp up its production capacity to meet the ongoing elevated demand, and it expects demand to stay high through the first half of its fiscal year 2021. This trend is also supported by a Coresight Research survey conducted on September 2, which found that a substantial 39% of US consumers are currently buying more household items, such as cleaning or laundry products.

[caption id="attachment_116815" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research [/caption]

What We Think

The Covid-19 upheaval has further strengthened the prospects of e-commerce in the CPG industry. We believe that the online channel will continue to see rapid growth for at least the next six to 12 months as concerns about contracting coronavirus remain. This will create and reinforce online buying behaviors, and e-commerce will likely become more deeply embedded into the shopper’s buying habits well beyond the pandemic.

Although e-commerce still forms a small percentage of overall CPG sales, it is seeing significant growth. CPG manufacturers must realize that they need to ride this wave; otherwise, they may risk not growing along with the channel growth. CPG firms had also faced shoppers’ frustration due to frequent out-of-stock situations at retail stores during the stockpiling and lockdown phase. They must therefore place a bigger focus on diversifying their channels, including selling directly to consumers through standalone e-commerce websites and partnering with online retailers.

Source: IRI E-Market Insights™/Coresight Research [/caption]

What We Think

The Covid-19 upheaval has further strengthened the prospects of e-commerce in the CPG industry. We believe that the online channel will continue to see rapid growth for at least the next six to 12 months as concerns about contracting coronavirus remain. This will create and reinforce online buying behaviors, and e-commerce will likely become more deeply embedded into the shopper’s buying habits well beyond the pandemic.

Although e-commerce still forms a small percentage of overall CPG sales, it is seeing significant growth. CPG manufacturers must realize that they need to ride this wave; otherwise, they may risk not growing along with the channel growth. CPG firms had also faced shoppers’ frustration due to frequent out-of-stock situations at retail stores during the stockpiling and lockdown phase. They must therefore place a bigger focus on diversifying their channels, including selling directly to consumers through standalone e-commerce websites and partnering with online retailers.

IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.

IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.