Nitheesh NH

The Coresight Research and IRI monthly US CPG Sales Tracker provides our data-driven insights into online sales trends in the US CPG industry—covering the product categories of food & beverage; health & beauty; and general merchandise & homecare. In this report, we present five key insights into the four weeks ending November 1, 2020.

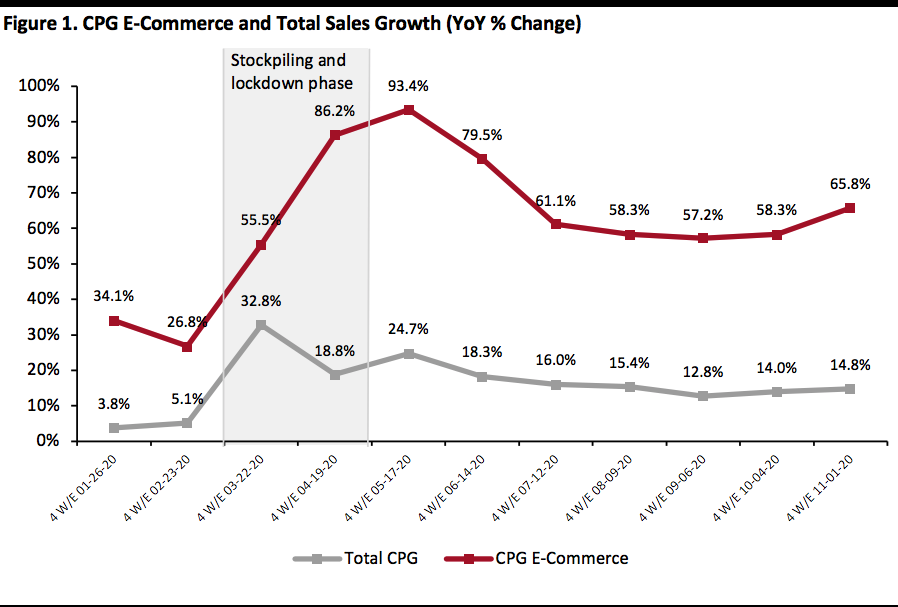

1. Online CPG Growth Re-Accelerates

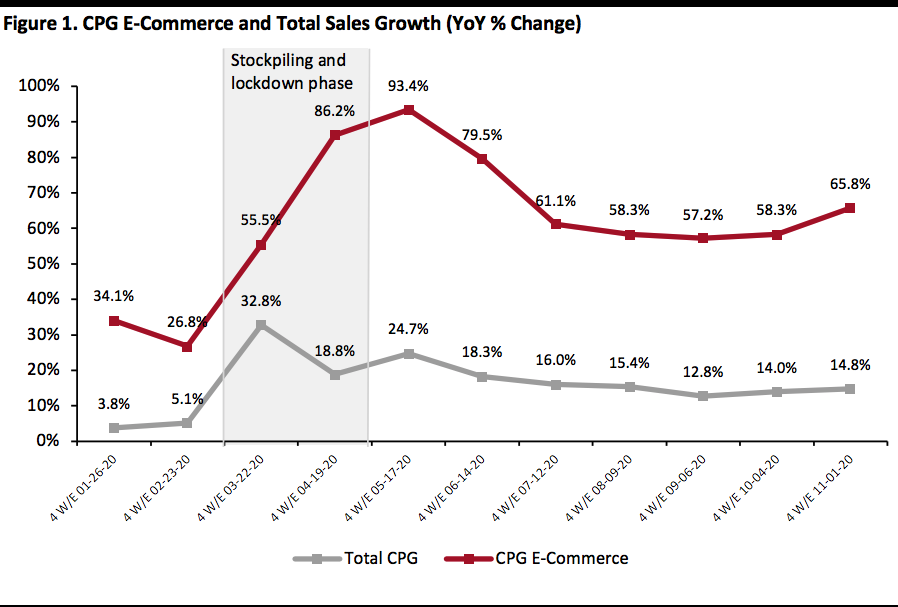

CPG e-commerce growth stayed widely above the pre-pandemic growth figures as consumers continue to gravitate towards the online channel for CPG shopping. Online sales climbed 65.8% for the four weeks ended November 1, after hovering around the 58% mark for three consecutive periods. The growth for the latest period was partly supported by consumers shopping early for the holiday season, coupled with the recent resurgence of Covid-19 cases in various US states that prompted many consumers to turn to digital channels to avoid virus exposure.

We believe that CPG e-commerce sales will continue to post higher growth figures for the remainder of the year. Typical celebratory on-premise consumption, which tends to spike in the last quarter of every year, will likely suffer due to socializing restrictions. As more people organize small get-togethers at home rather than dining out or attending social events this holiday season, CPG firms and grocery retailers will be the major beneficiaries of holiday spending.

[caption id="attachment_120188" align="aligncenter" width="700"] Historical data have been revised for the latest period

Historical data have been revised for the latest period

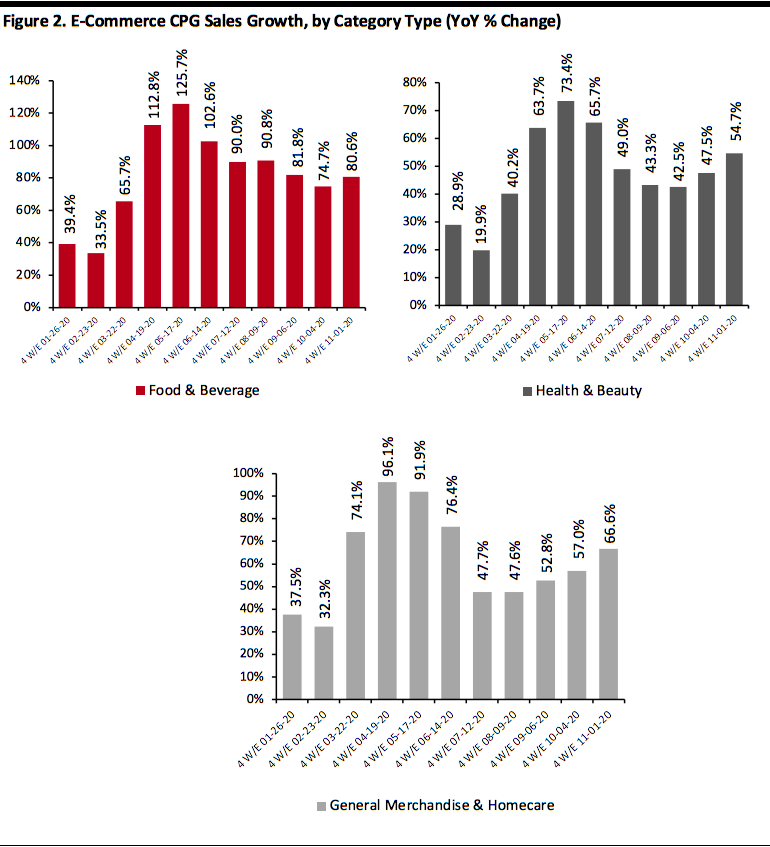

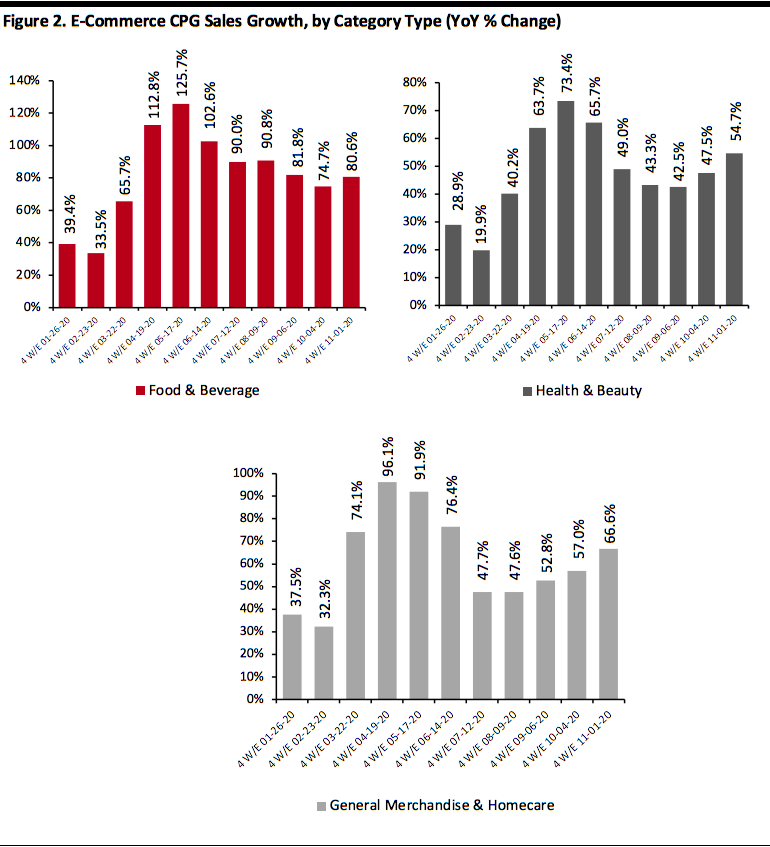

Source: IRI E-Market Insights™/Coresight Research[/caption] 2. Food & Beverage Continues To Experience High Online Demand Food & beverage continues to experience high online growth relative to other categories, soaring 80.6% for the four weeks ended November 1. The surge in demand for online food, coupled with increased at-home consumption trends, continue to benefit a number of major retailers that sell groceries. For example, digital sales at wholesaler BJ’s surged 200% in the third fiscal quarter, ended October 31, 2020. Total grocery sales had accounted for 77% of the company’s total revenues in the third quarter. Similarly, Walmart saw online sales in its US business rise by 79% for the third quarter, ended October 31. The retailer said that it is significantly ramping up its e-commerce capabilities and has turned on almost 2,500 stores to fulfill online orders. [caption id="attachment_120190" align="aligncenter" width="700"] Historical data have been revised in the latest period

Historical data have been revised in the latest period

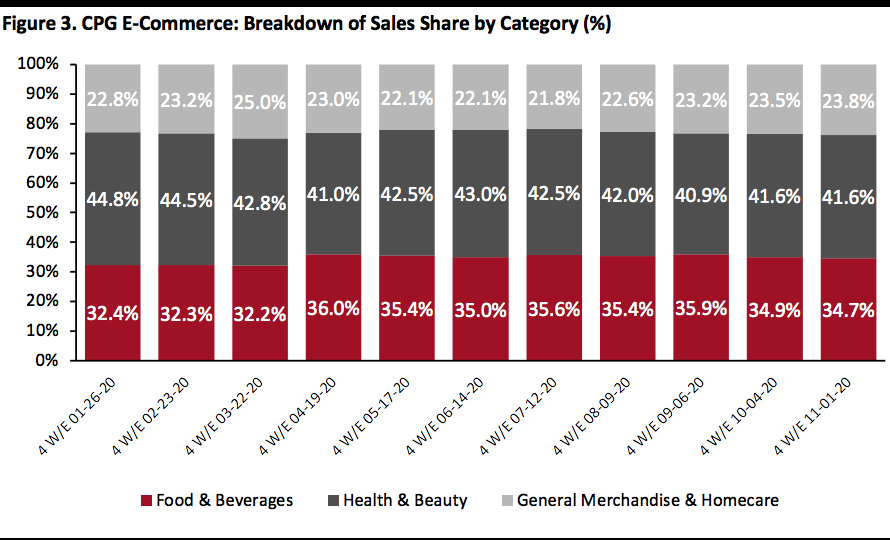

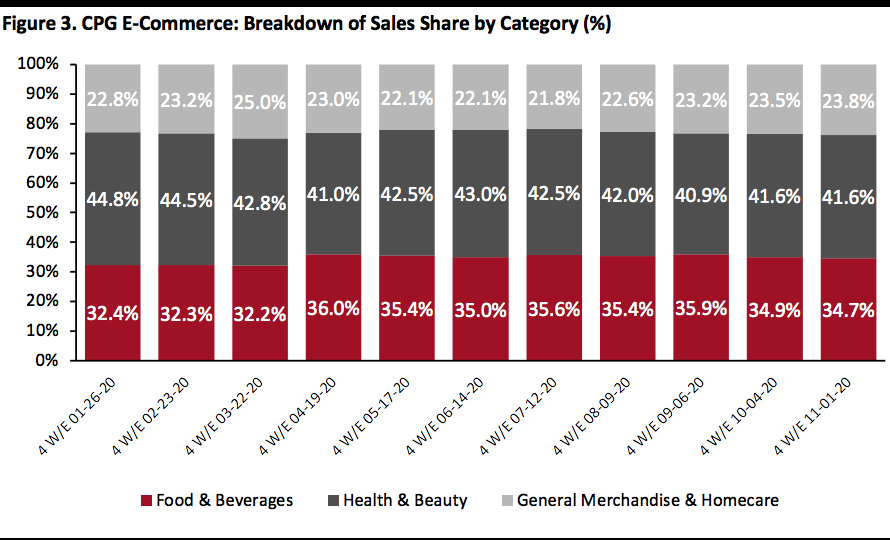

Source: IRI E-Market Insights™/Coresight Research[/caption] 3. Breakdown of Online CPG Sales: General Merchandise & Homecare Trending Up The chart below shows the breakdown of online sales by type of CPG category. The general merchandise & homecare share is on an upward trend, reaching 23.8% for the four weeks ended November 1. Meanwhile, health & beauty’s online share stayed flat relative to last period, at 41.6% for the four weeks ended November 1. [caption id="attachment_120191" align="aligncenter" width="700"] Historical data have been revised in the latest period

Historical data have been revised in the latest period

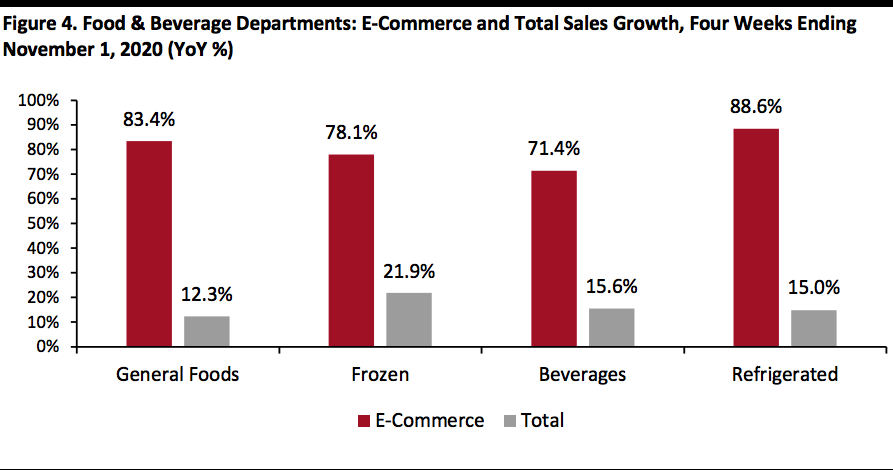

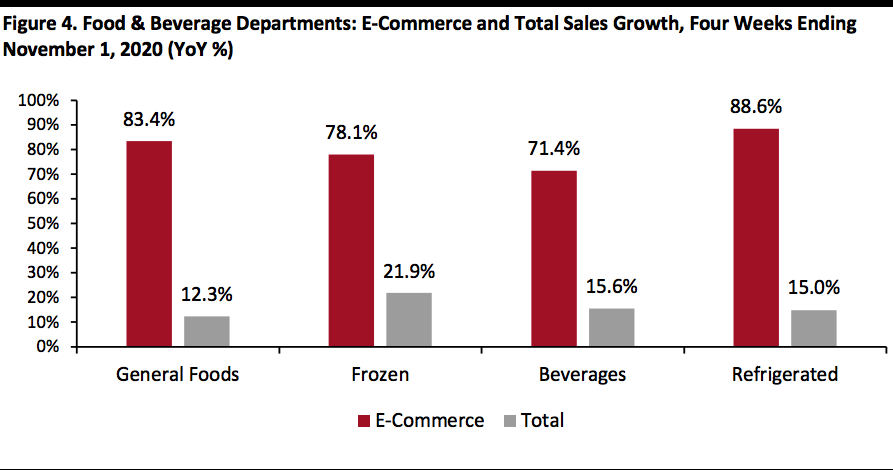

Source: IRI E-Market Insights™/Coresight Research[/caption] 4. Refrigerated Foods Outpaces Other Food Departments in Online Sales Total food & beverage sales stayed strong, growing 14.8% for the latest period compared to a 14.5% increase in the prior period. However, this tends to negate any signs of a rumored second wave of grocery stockpiling, which would have reflected a marked acceleration of growth in food & beverage sales in the latest period. Nevertheless, retailers such as Albertsons said that they are holding more inventory than normal this holiday season to counter any potential hoarding. Among the major groupings charted below, refrigerated foods saw the biggest online gains in the four weeks ended November 1, with growth of 88.6% versus last year, driven by juices (up 142%), sour cream (up 127%) and milk (109%). Frozen foods’ popularity swelled early in the pandemic and is still not showing any signs of abatement. Frozen food sales continue to outpace other food departments in total sales, posting total sales growth of 21.9% for the latest period, driven by seafood (up 42%), meat (up 38%) and processed poultry (up 29%). [caption id="attachment_120192" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research[/caption]

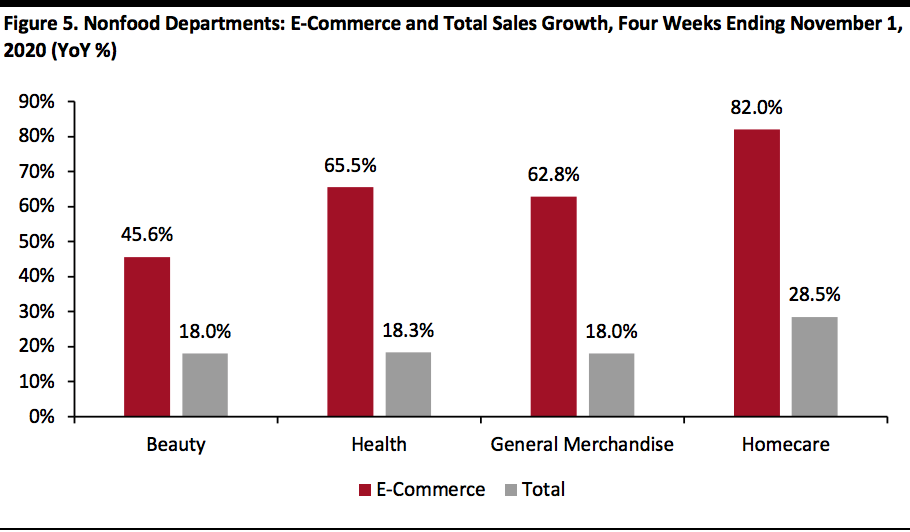

5. Homecare Posted the Strongest Online and Total Growth Among Nonfood Departments

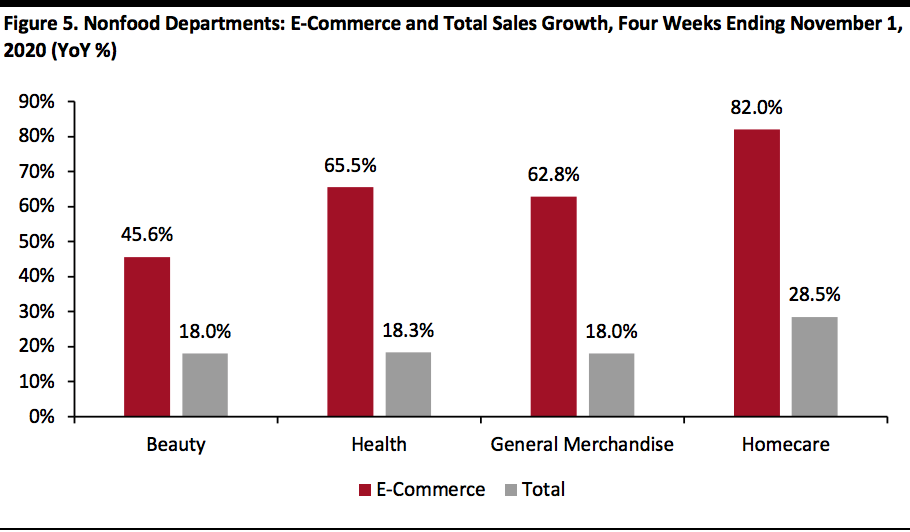

Homecare products maintained their growth momentum in the latest period, driven by household cleaning essentials, as consumers have become more attuned to the pandemic-induced social importance of hygiene. The online channel saw the highest growth relative to other nonfood departments, at 82%, while total sales increased by 28.5%. Homecare e-commerce sales were driven by home cleaning tools (up 143%), household cleaners (up 120%) and household cleaner cloths (up 70%).

Homecare product sales have remained exceptionally high over the past eight months. In its first fiscal quarter ended September 30, 2020, Clorox reported that its Cleaning business saw double-digit growth on the back of continued strong demand for disinfecting products. It added that despite making significant progress expanding supply, Clorox is still not at a point where it can fully meet the ongoing elevated demand for disinfectants and other cleaning products.

This trend is also supported by a recent Coresight Research survey, conducted on November 24, which found that a substantial 39% of US consumers are currently buying more household items, such as cleaning or laundry products, than pre-crisis.

[caption id="attachment_120193" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research[/caption]

5. Homecare Posted the Strongest Online and Total Growth Among Nonfood Departments

Homecare products maintained their growth momentum in the latest period, driven by household cleaning essentials, as consumers have become more attuned to the pandemic-induced social importance of hygiene. The online channel saw the highest growth relative to other nonfood departments, at 82%, while total sales increased by 28.5%. Homecare e-commerce sales were driven by home cleaning tools (up 143%), household cleaners (up 120%) and household cleaner cloths (up 70%).

Homecare product sales have remained exceptionally high over the past eight months. In its first fiscal quarter ended September 30, 2020, Clorox reported that its Cleaning business saw double-digit growth on the back of continued strong demand for disinfecting products. It added that despite making significant progress expanding supply, Clorox is still not at a point where it can fully meet the ongoing elevated demand for disinfectants and other cleaning products.

This trend is also supported by a recent Coresight Research survey, conducted on November 24, which found that a substantial 39% of US consumers are currently buying more household items, such as cleaning or laundry products, than pre-crisis.

[caption id="attachment_120193" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research[/caption]

What We Think

In light of upward e-commerce trends, CPG firms must be proactive with their e-commerce strategies and capitalize on the boom by diversifying to online channels, including partnering with online retailers and selling directly to consumers.

Demand for food & beverage stayed healthy in the latest period, but we are yet to see any drastic increase that could be attributed to a further wave of stockpiling in food. That being said, grocery retailers must stand ready for a possible further acceleration in online growth during the holiday season, in light of a recent rise in Covid-19 cases across the country. They must be agile enough to ramp up capacity in a short period, such as turning to additional physical stores to fulfill online orders—thus helping to relieve strain on e-commerce fulfillment centers—and extending physical capacity for collection services such as curbside pickup.

Source: IRI E-Market Insights™/Coresight Research[/caption]

What We Think

In light of upward e-commerce trends, CPG firms must be proactive with their e-commerce strategies and capitalize on the boom by diversifying to online channels, including partnering with online retailers and selling directly to consumers.

Demand for food & beverage stayed healthy in the latest period, but we are yet to see any drastic increase that could be attributed to a further wave of stockpiling in food. That being said, grocery retailers must stand ready for a possible further acceleration in online growth during the holiday season, in light of a recent rise in Covid-19 cases across the country. They must be agile enough to ramp up capacity in a short period, such as turning to additional physical stores to fulfill online orders—thus helping to relieve strain on e-commerce fulfillment centers—and extending physical capacity for collection services such as curbside pickup.

Historical data have been revised for the latest period

Historical data have been revised for the latest periodSource: IRI E-Market Insights™/Coresight Research[/caption] 2. Food & Beverage Continues To Experience High Online Demand Food & beverage continues to experience high online growth relative to other categories, soaring 80.6% for the four weeks ended November 1. The surge in demand for online food, coupled with increased at-home consumption trends, continue to benefit a number of major retailers that sell groceries. For example, digital sales at wholesaler BJ’s surged 200% in the third fiscal quarter, ended October 31, 2020. Total grocery sales had accounted for 77% of the company’s total revenues in the third quarter. Similarly, Walmart saw online sales in its US business rise by 79% for the third quarter, ended October 31. The retailer said that it is significantly ramping up its e-commerce capabilities and has turned on almost 2,500 stores to fulfill online orders. [caption id="attachment_120190" align="aligncenter" width="700"]

Historical data have been revised in the latest period

Historical data have been revised in the latest periodSource: IRI E-Market Insights™/Coresight Research[/caption] 3. Breakdown of Online CPG Sales: General Merchandise & Homecare Trending Up The chart below shows the breakdown of online sales by type of CPG category. The general merchandise & homecare share is on an upward trend, reaching 23.8% for the four weeks ended November 1. Meanwhile, health & beauty’s online share stayed flat relative to last period, at 41.6% for the four weeks ended November 1. [caption id="attachment_120191" align="aligncenter" width="700"]

Historical data have been revised in the latest period

Historical data have been revised in the latest periodSource: IRI E-Market Insights™/Coresight Research[/caption] 4. Refrigerated Foods Outpaces Other Food Departments in Online Sales Total food & beverage sales stayed strong, growing 14.8% for the latest period compared to a 14.5% increase in the prior period. However, this tends to negate any signs of a rumored second wave of grocery stockpiling, which would have reflected a marked acceleration of growth in food & beverage sales in the latest period. Nevertheless, retailers such as Albertsons said that they are holding more inventory than normal this holiday season to counter any potential hoarding. Among the major groupings charted below, refrigerated foods saw the biggest online gains in the four weeks ended November 1, with growth of 88.6% versus last year, driven by juices (up 142%), sour cream (up 127%) and milk (109%). Frozen foods’ popularity swelled early in the pandemic and is still not showing any signs of abatement. Frozen food sales continue to outpace other food departments in total sales, posting total sales growth of 21.9% for the latest period, driven by seafood (up 42%), meat (up 38%) and processed poultry (up 29%). [caption id="attachment_120192" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research[/caption]

5. Homecare Posted the Strongest Online and Total Growth Among Nonfood Departments

Homecare products maintained their growth momentum in the latest period, driven by household cleaning essentials, as consumers have become more attuned to the pandemic-induced social importance of hygiene. The online channel saw the highest growth relative to other nonfood departments, at 82%, while total sales increased by 28.5%. Homecare e-commerce sales were driven by home cleaning tools (up 143%), household cleaners (up 120%) and household cleaner cloths (up 70%).

Homecare product sales have remained exceptionally high over the past eight months. In its first fiscal quarter ended September 30, 2020, Clorox reported that its Cleaning business saw double-digit growth on the back of continued strong demand for disinfecting products. It added that despite making significant progress expanding supply, Clorox is still not at a point where it can fully meet the ongoing elevated demand for disinfectants and other cleaning products.

This trend is also supported by a recent Coresight Research survey, conducted on November 24, which found that a substantial 39% of US consumers are currently buying more household items, such as cleaning or laundry products, than pre-crisis.

[caption id="attachment_120193" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research[/caption]

5. Homecare Posted the Strongest Online and Total Growth Among Nonfood Departments

Homecare products maintained their growth momentum in the latest period, driven by household cleaning essentials, as consumers have become more attuned to the pandemic-induced social importance of hygiene. The online channel saw the highest growth relative to other nonfood departments, at 82%, while total sales increased by 28.5%. Homecare e-commerce sales were driven by home cleaning tools (up 143%), household cleaners (up 120%) and household cleaner cloths (up 70%).

Homecare product sales have remained exceptionally high over the past eight months. In its first fiscal quarter ended September 30, 2020, Clorox reported that its Cleaning business saw double-digit growth on the back of continued strong demand for disinfecting products. It added that despite making significant progress expanding supply, Clorox is still not at a point where it can fully meet the ongoing elevated demand for disinfectants and other cleaning products.

This trend is also supported by a recent Coresight Research survey, conducted on November 24, which found that a substantial 39% of US consumers are currently buying more household items, such as cleaning or laundry products, than pre-crisis.

[caption id="attachment_120193" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research[/caption]

What We Think

In light of upward e-commerce trends, CPG firms must be proactive with their e-commerce strategies and capitalize on the boom by diversifying to online channels, including partnering with online retailers and selling directly to consumers.

Demand for food & beverage stayed healthy in the latest period, but we are yet to see any drastic increase that could be attributed to a further wave of stockpiling in food. That being said, grocery retailers must stand ready for a possible further acceleration in online growth during the holiday season, in light of a recent rise in Covid-19 cases across the country. They must be agile enough to ramp up capacity in a short period, such as turning to additional physical stores to fulfill online orders—thus helping to relieve strain on e-commerce fulfillment centers—and extending physical capacity for collection services such as curbside pickup.

Source: IRI E-Market Insights™/Coresight Research[/caption]

What We Think

In light of upward e-commerce trends, CPG firms must be proactive with their e-commerce strategies and capitalize on the boom by diversifying to online channels, including partnering with online retailers and selling directly to consumers.

Demand for food & beverage stayed healthy in the latest period, but we are yet to see any drastic increase that could be attributed to a further wave of stockpiling in food. That being said, grocery retailers must stand ready for a possible further acceleration in online growth during the holiday season, in light of a recent rise in Covid-19 cases across the country. They must be agile enough to ramp up capacity in a short period, such as turning to additional physical stores to fulfill online orders—thus helping to relieve strain on e-commerce fulfillment centers—and extending physical capacity for collection services such as curbside pickup.

IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.