albert Chan

With this report, we launch the Coresight Research and IRI monthly US CPG Sales Tracker. Each month, these reports will provide our data-driven insights into online sales trends in the US CPG industry—covering the product categories of food & beverage; health & beauty; and general merchandise & homecare. In this report, we present five key insights from June 2020.

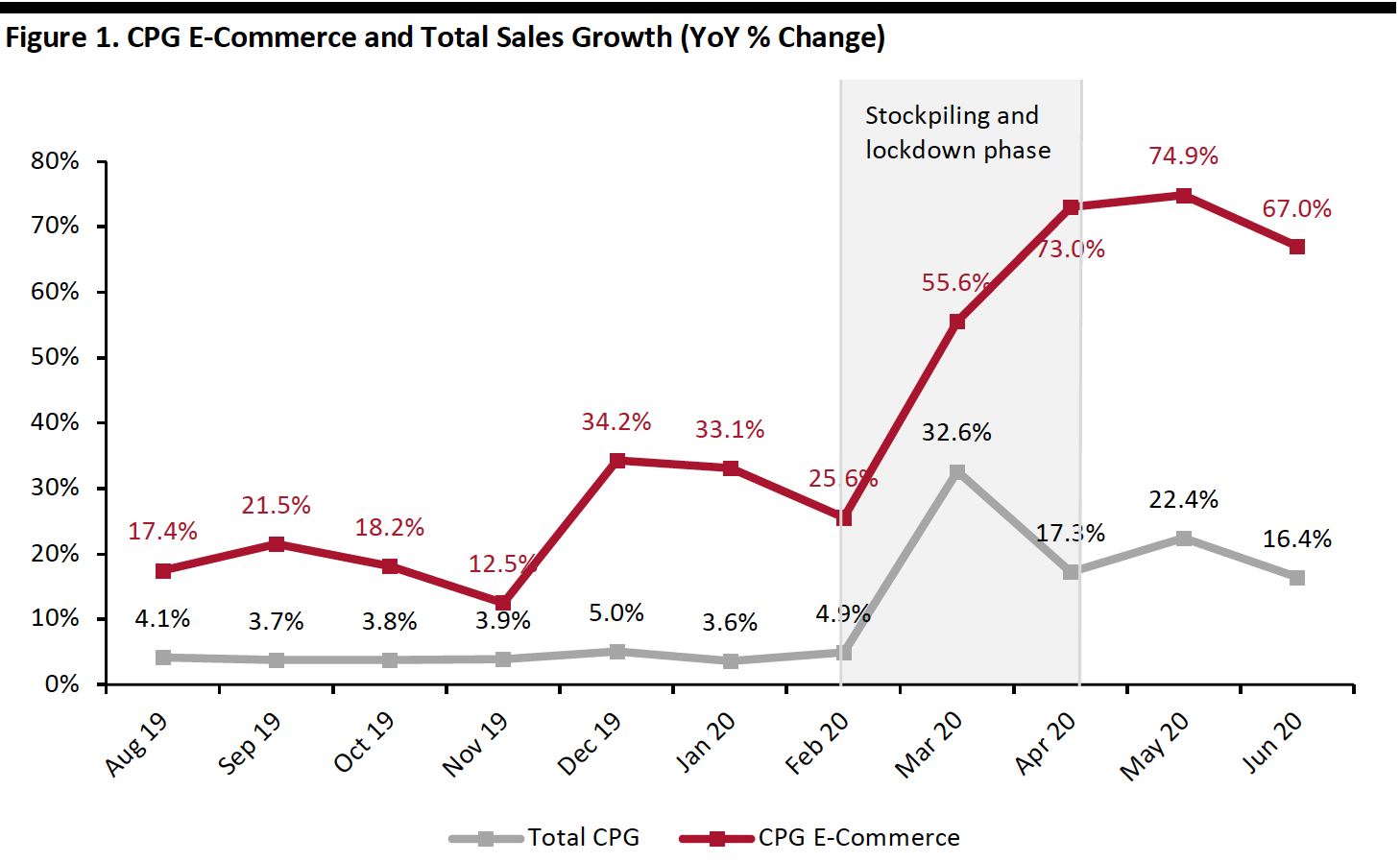

1. Online CPG Growth Remains at Elevated Levels Post LockdownThe online CPG channel has been on a rapid and steady rise prior to Covid-19. With the onset of the pandemic, the industry saw a boom in online spending boosted by stockpiling and subsequent lockdown announcements by state and local governments, which mandated the temporary closure of nonessential physical stores. The new necessity of social distancing and self-isolation spurred homebound consumers to turn to online CPG shopping in greater numbers and with higher frequency. In March, the stockpiling trend raised e-commerce CPG sales by 55.6%, which climbed to 73% in April, fueled by substantial demand during lockdown.

As lockdowns were lifted and brick-and-mortar stores were allowed to reopen, online CPG shopping still retained its appeal with consumers, posting 67% growth in June. E-commerce took a 7.8% share of CPG sales in edibles in June, up 2.0 percentage points from February; for non-edibles, the e-commerce share increased by 4.8 percentage points over the same period, to 28.2% in June. We believe that the growth will moderate in the second half of the year but will remain at elevated levels versus last year due to the looming threat of the virus still being present.

This shift to online shopping amid the pandemic will have potential long-term implications. Around 20% of shoppers who tried curbside pickup during the past few months plan to continue in the future; 15% of shoppers who tried home delivery in the past few months expect to do so in the future, according to the IRI Consumer Network™ panel survey which represents total US primary grocery shoppers.

According to Martin Sarano, Senior Vice President of Corporate Strategy at IRI, “many shoppers gave online shopping a try as a way to avoid exposure to Covid-19 and even to get products that were out of stock at their preferred retailer. Among those shoppers, many were satisfied with the online experience, and they will stick with it long after the pandemic recedes.”

[caption id="attachment_114050" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research[/caption]

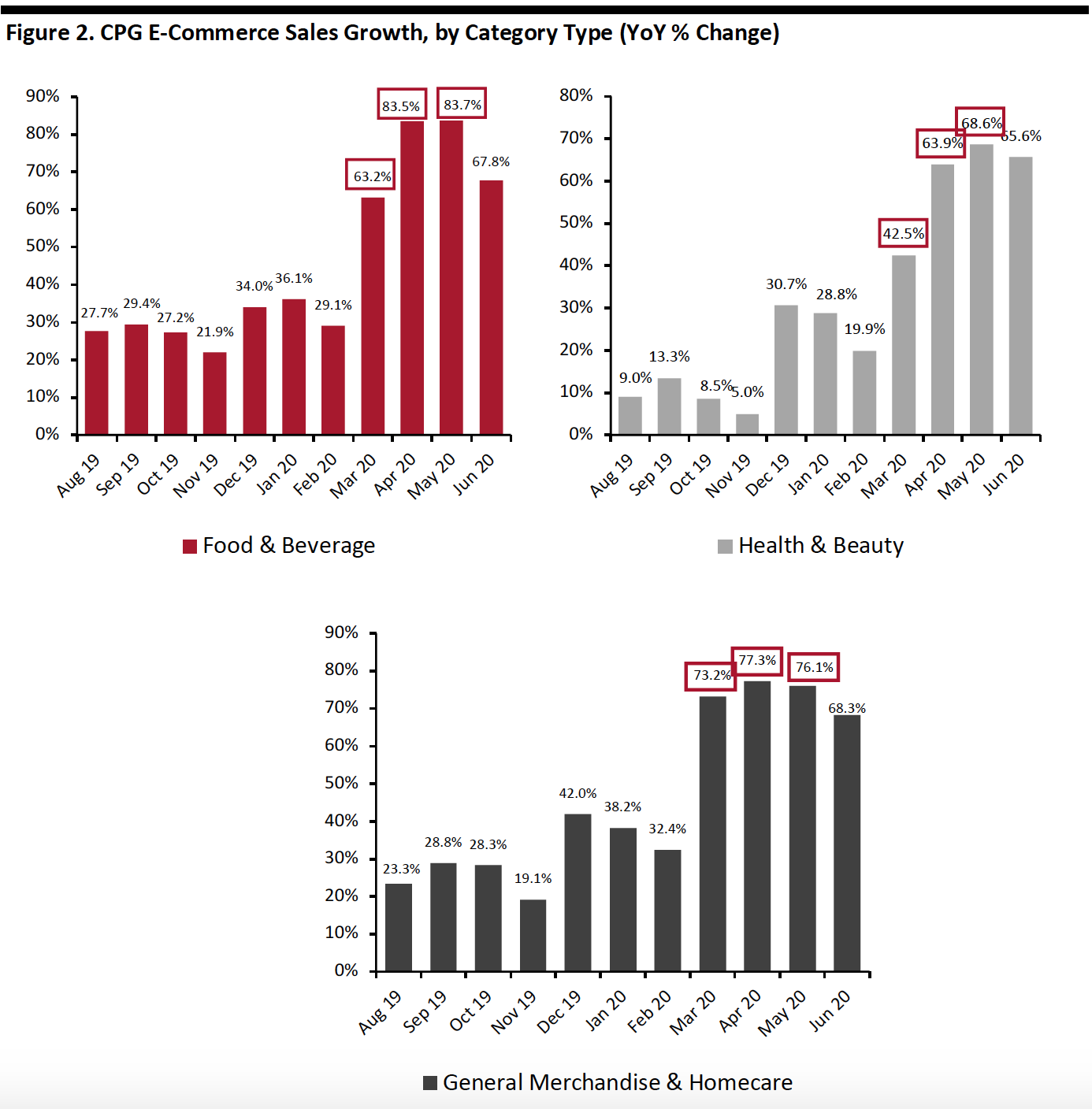

2. Food & Beverage Category Sees E-Commerce Sales Growth Soften after Highest Spike During Lockdown

Source: IRI E-Market Insights™/Coresight Research[/caption]

2. Food & Beverage Category Sees E-Commerce Sales Growth Soften after Highest Spike During Lockdown

The Covid-19 pandemic caused an unprecedented surge in demand for online grocery in the US. Several food retailers reported exceptional growth in online grocery sales during this period. Kroger, for example, saw its online sales surge by 92% in its first fiscal quarter ended May 23, 2020.

In the online channel, food and beverage sales surged 63.2% in March, while health & beauty sales rose 42.5% and general merchandise & homecare category sales grew 73.2%. In the lockdown phase, the online growth of food and beverage was higher compared to the health & beauty and general merchandise and homecare categories, hovering around the 83.5% mark.

However, online food growth saw a greater erosion, relative to health & beauty and general merchandise & homecare, slowing from 83.7% in May to 67.8% in June (down by 15.8 percentage points).

[caption id="attachment_114051" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research[/caption]

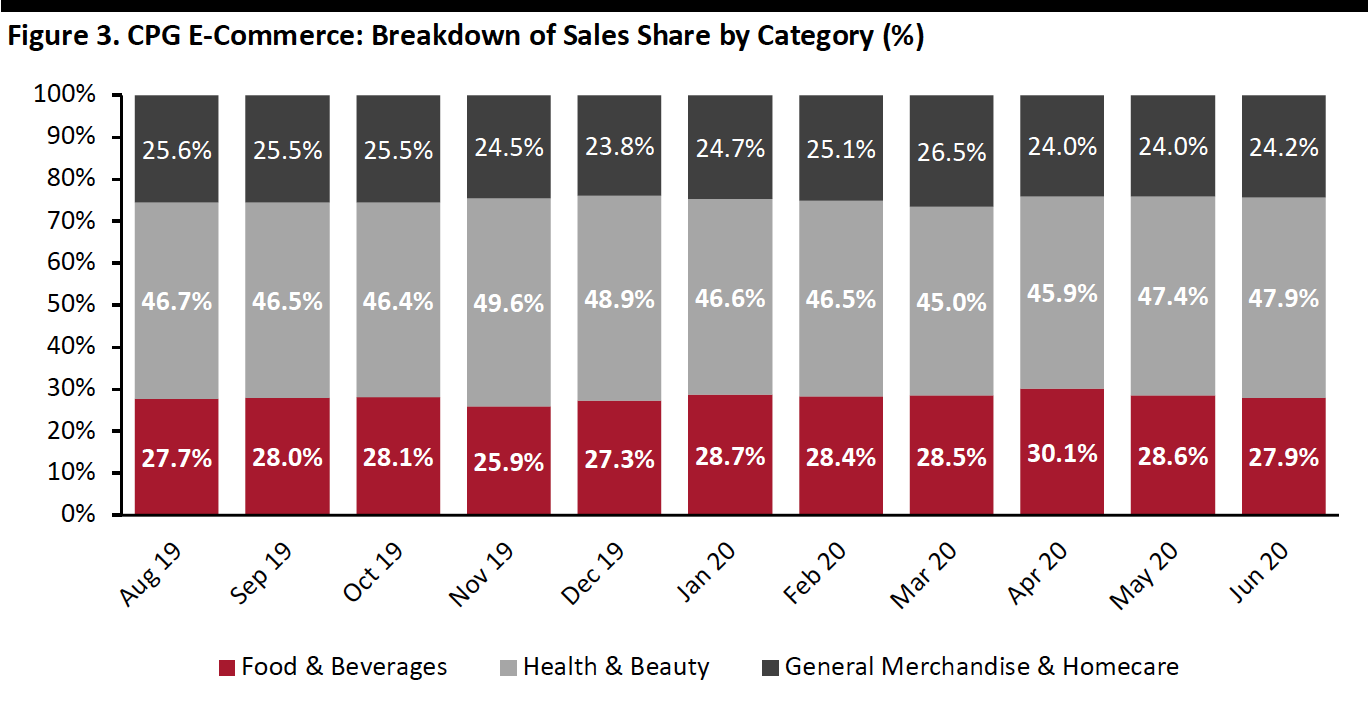

3. Breakdown of Online CPG Sales: Health & Beauty Gains Share, while Food & Beverage Trends Down

Source: IRI E-Market Insights™/Coresight Research[/caption]

3. Breakdown of Online CPG Sales: Health & Beauty Gains Share, while Food & Beverage Trends Down

The chart below shows the breakdown of online sales by type of CPG category. Health & beauty contributes almost half of online CPG dollar sales. The category is gaining share after witnessing a decline in March, reaching 47.9% in June. Meanwhile, the share of the online food category, which saw a boom in recent months, has been trending down since its April peak, at 27.9% in June.

[caption id="attachment_114052" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research[/caption]

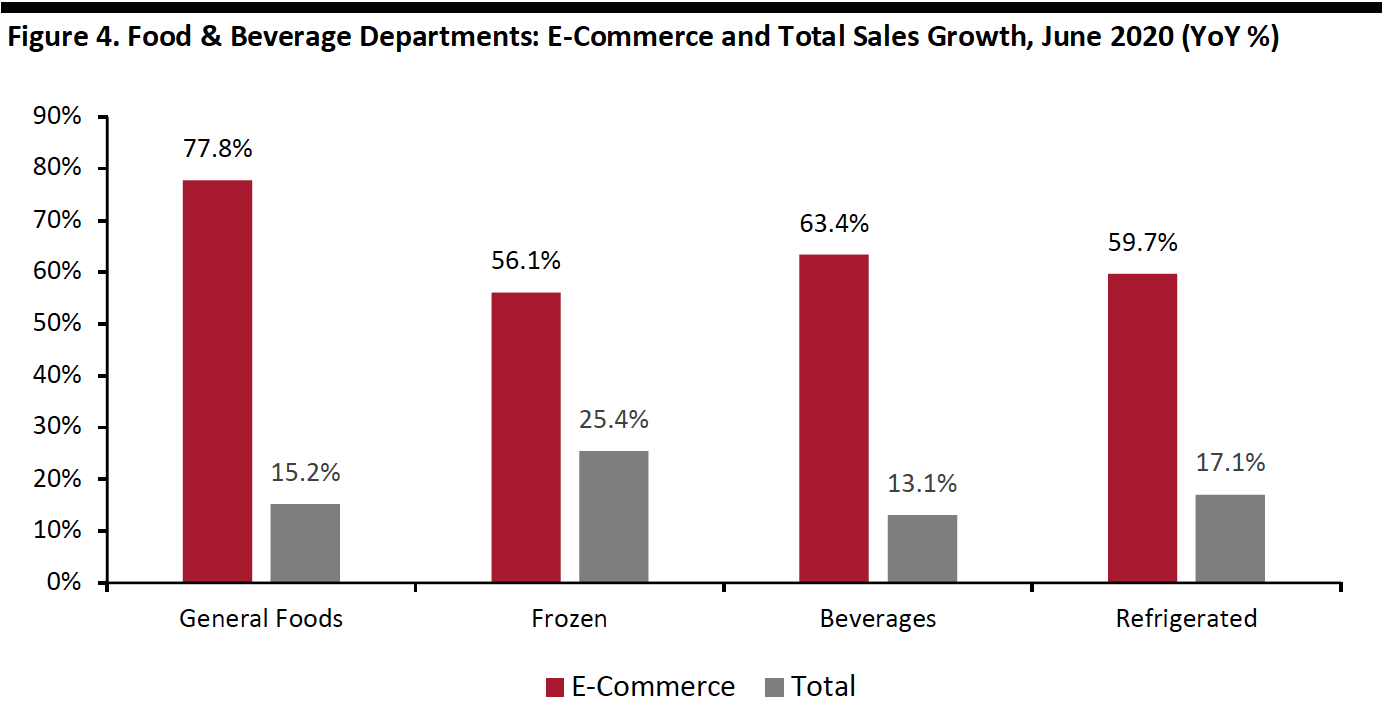

4. Strong Sales Gains for Frozen Foods Persist

Source: IRI E-Market Insights™/Coresight Research[/caption]

4. Strong Sales Gains for Frozen Foods Persist

With restaurants reopening in June, the competition for the share of the food dollar is heating up again, but thus far, grocery sales remain strong—far above pre-coronavirus levels. Three months into the pandemic, frozen foods continue to outperform other food departments, with total sales holding at almost one-quarter in June from last year, driven by seafood (53.8%), baby food (58.4%) and fruit (40.8%). The online growth of frozen food posted more than double that of total sales, at 56.1%.

In addition, the high demand for frozen food is expected to continue in the near future. According to a survey conducted by the American Frozen Food Institute in April, almost 50% of respondents who had bought frozen foods since early March said that they expect to purchase “a lot” or “somewhat” more frozen food in the next few months.

General foods—which consists of shelf-stable foods such as canned goods, cookies, snacks, rice and flour—saw the biggest online gains in June, with year-over-year growth of 77.8%.

[caption id="attachment_114053" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research[/caption]

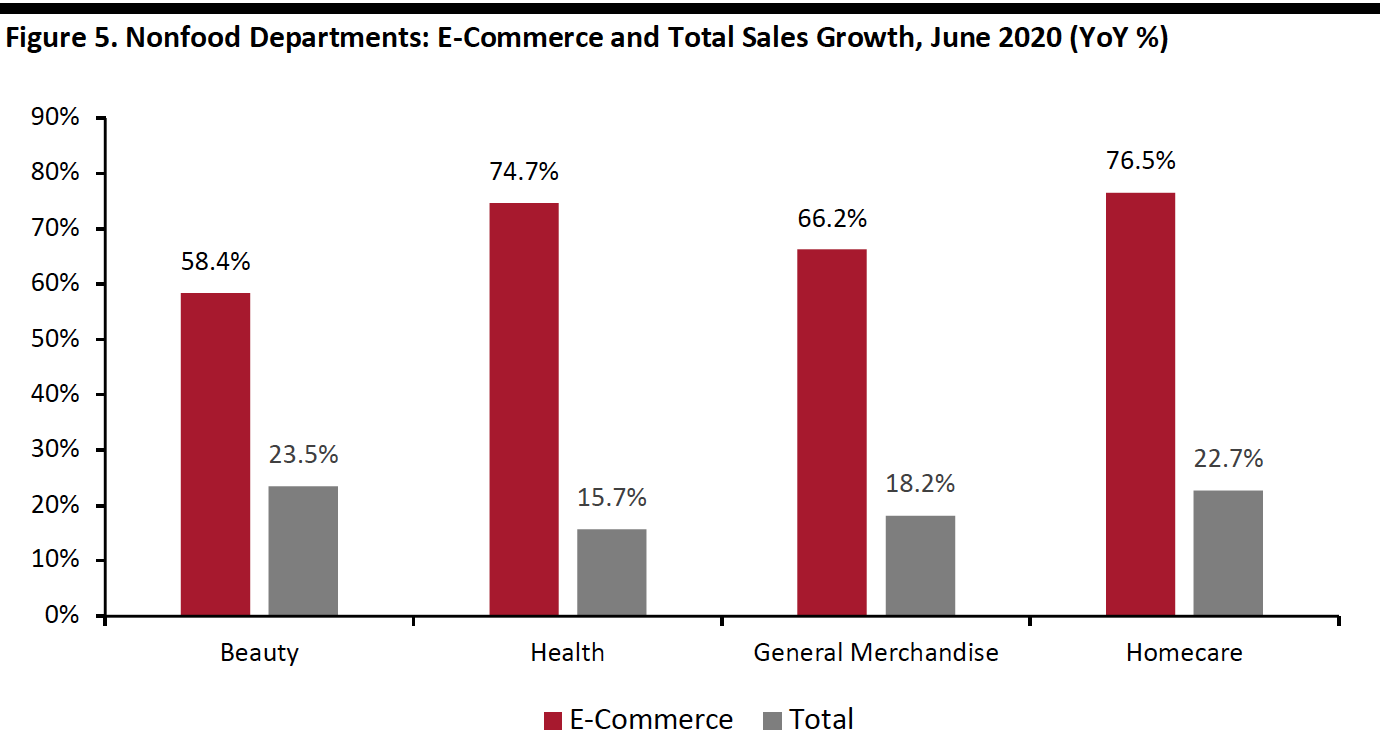

5. Homecare Shows the Strongest Online Growth among Nonfood Departments

Source: IRI E-Market Insights™/Coresight Research[/caption]

5. Homecare Shows the Strongest Online Growth among Nonfood Departments

Homecare products continue to see high demand in June, driven by household cleaning essentials, as consumers have become much more in tune with home hygiene than they were prior to the Covid-19 crisis. The online channel saw the highest year-over-year growth among the nonfood categories at 76.5%, while total sales increased by 22.7% from last year. Overall homecare sales were driven by household cleaning tools (88.5%), cleaners (83.2%) and dish detergents (79.2%).

Clorox reported that sales in its third quarter, ended March 31, 2020, surged 15%—driven by 32% growth in its cleaning segment, which consists of its namesake bleach, disinfectant wipes and Pine-Sol cleaners. The company added that it would continue to experience strong demand for such products through the rest of the fiscal year (which ended on June 30, 2020). This is supported by the recent Coresight Research survey conducted on June 15, which found that almost 40% of US consumers are currently buying more household items, such as cleaning or laundry products.

[caption id="attachment_114054" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research[/caption]

Source: IRI E-Market Insights™/Coresight Research[/caption]

What We Think

The CPG industry has been traditionally slow to embrace e-commerce compared to other sectors. However, the pandemic shook the status quo and rapidly accelerated the e-commerce pivot leading to unprecedented growth in online CPG shopping. The online channel was significantly up in June as the widespread virus kept many shoppers at home and away from physical stores.

In light of these upward e-commerce trends, we believe that the channel will hold some permanent gains as consumers’ habits of shopping CPG online are going to persist well beyond the pandemic, underscoring the fact that the online channel will expand at a more robust rate than before Covid-19. CPG manufacturers will have to fast-track their digital capabilities to capitalize on changing consumer trends to stay relevant and maintain long-term market positioning.

IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.