DIpil Das

We discuss select findings from our US consumer survey and compare them to findings from previous weekly surveys.

1. High-Income Consumers Most Likely To Cut Spending

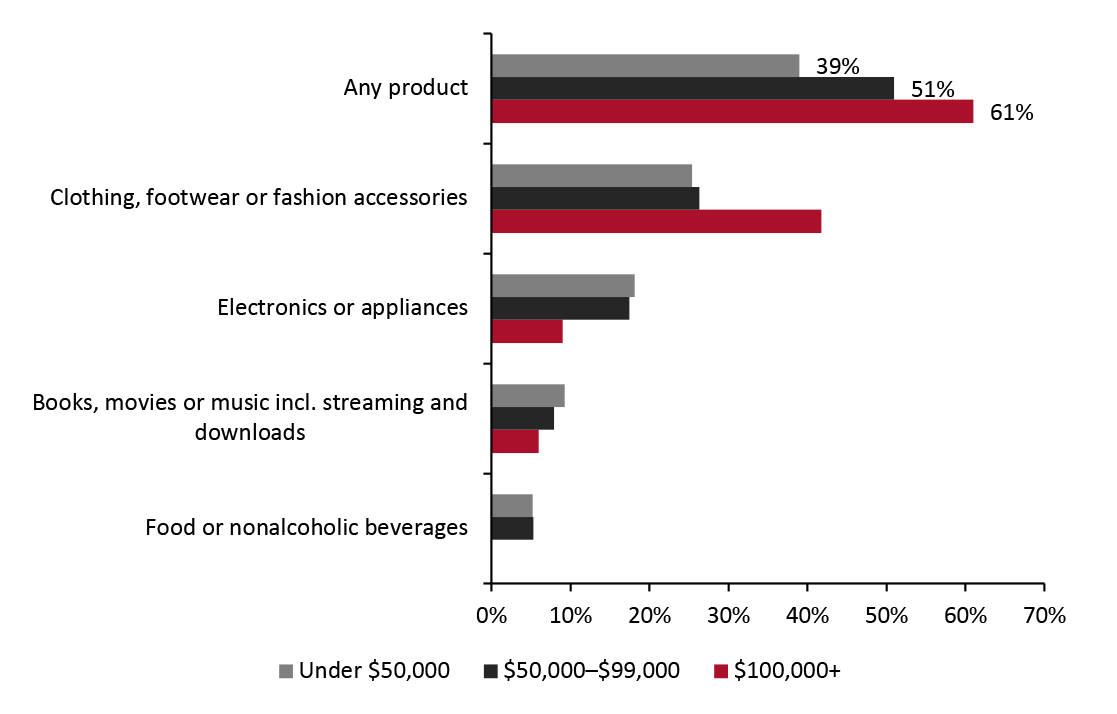

High-income consumers were the most likely to report cutting spending on any product: 61% of consumers with incomes over $100,000 reported purchasing less of any product, while just 51% of consumers with incomes between $50,000 and $99,999 and 39% of consumers with incomes under $50,000, reported purchasing less. This is likely to reflect more affluent consumers making more discretionary purchases that can easily be cut back.

Figure 1. All Respondents: What They Are Currently Buying Less Of Due to the Coronavirus Outbreak, Selected Categories, by Household Income (% of Respondents) [caption id="attachment_123553" align="aligncenter" width="725"] Base: US respondents aged 18+

Base: US respondents aged 18+

Source: Coresight Research[/caption] 2. Nearly Nine in 10 Avoid Public Places In this week’s survey, the avoidance rate of any type of public area stood at more than 86%, as consumers remain wary of virus risks associated with public places.

- None of the consumers we surveyed with incomes over $100,000 reported spending less on food or nonalcoholic beverages, while around 5% of consumers with incomes under $100,000 reported spending less.

- High-income consumers were far more likely to report purchasing less clothing, footwear or fashion accessories, reflecting that the decline in apparel spending is mostly due to consumers’ reduced need for clothing to wear outside the house rather than an inability to spend.

- Consumers with incomes under $50,000 were twice as likely as those with incomes above $100,000 to be purchasing fewer electronics or appliances.

Figure 1. All Respondents: What They Are Currently Buying Less Of Due to the Coronavirus Outbreak, Selected Categories, by Household Income (% of Respondents) [caption id="attachment_123553" align="aligncenter" width="725"]

Source: Coresight Research[/caption] 2. Nearly Nine in 10 Avoid Public Places In this week’s survey, the avoidance rate of any type of public area stood at more than 86%, as consumers remain wary of virus risks associated with public places.

- After falling substantially over the past two weeks, avoidance of restaurants, bars and coffee shops rose by nearly seven percentage points this week.

- The proportion of consumers avoiding entertainment and leisure venues fell again this week and now sits more than 17 percentage points lower than its value just two weeks ago.

- Avoidance of the workplace fell to just 15% this week, the lowest value we have ever recorded for this location.

- Consumers remain reluctant to visit malls and shops: nearly six out of 10 consumers continue to avoid shopping centers and malls. Over 40% of consumers are avoiding shops in general.

- More than half of consumers reported buying from Walmart, giving the retailer an advantage of more than 20 percentage points over Kroger, the next most-visited retailer recorded by our survey.

- This week, more consumers reported buying food from Publix and Sam’s Club than Costco.

- More consumers reported buying nonfood products from Walmart than from Amazon, reversing their previous rankings.

- More than one-quarter of consumers reported buying from Dollar Tree this week, while 22% reported buying from Dollar General. Both of these dollar-store retailers overtook Target in our survey.

- After declining for six straight weeks, the proportion of consumers buying from Kohl’s finally stopped sliding in our survey this week, although its increase was well within the margin of error.