albert Chan

1. Rising Number of Whole Foods Shoppers Suggests Consumers Are Feeling More Financially Secure

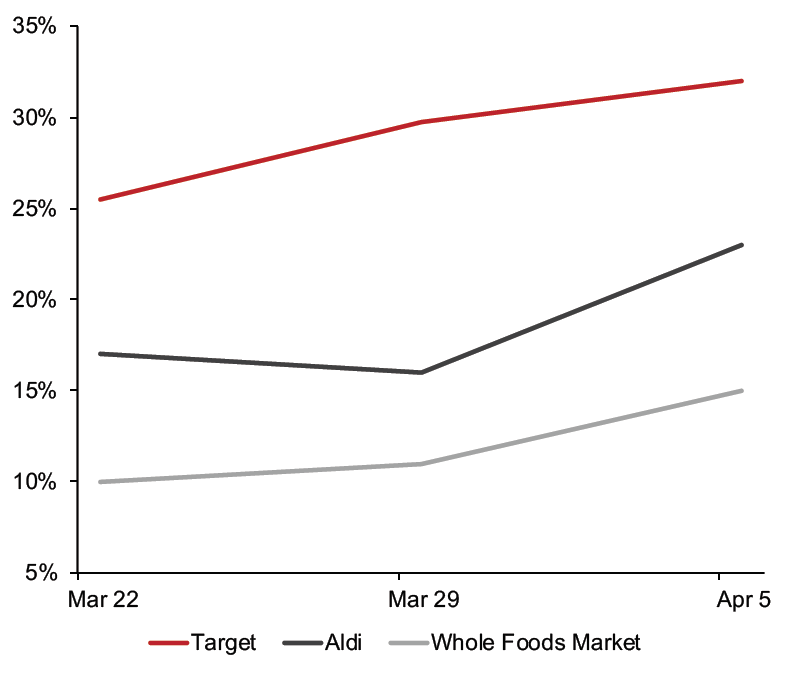

Both Target and Whole Foods saw increased proportions of shoppers indicate they had shopped with them for food products in the past two weeks—potentially the result of increasingly financially secure consumers trading up to slightly higher-price-point retailers.

However, Aldi saw a rise in its share of shoppers by more than six percentage points this week.

Figure 1. All Respondents: Which Retailers They Have Bought Food Products From in the Past Two Weeks (% of Respondents) [caption id="attachment_125772" align="aligncenter" width="550"]

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]

2. Avoidance of Gyms and Community Centers Fall for the Second Consecutive Week, Indicating Diminishing Virus Concerns

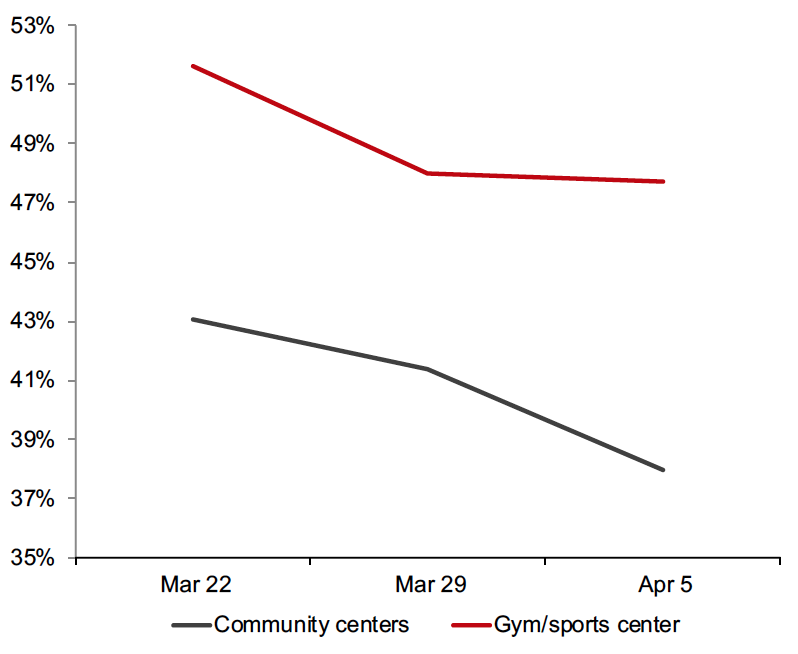

Avoidance increased in seven of the 12 categories we surveyed, but all of these changes were within the margin of error.

Avoidance of indoor public-gathering locations, namely gyms and community centers, continued to see declines in avoidance, dropping to 48% and 38% respectively.

International travel was the only other category to see avoidance decline in both of the past two weeks.

Figure 2. All Respondents: Public Places That Respondents Are Currently Avoiding (% of Respondents)

[caption id="attachment_125773" align="aligncenter" width="550"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]

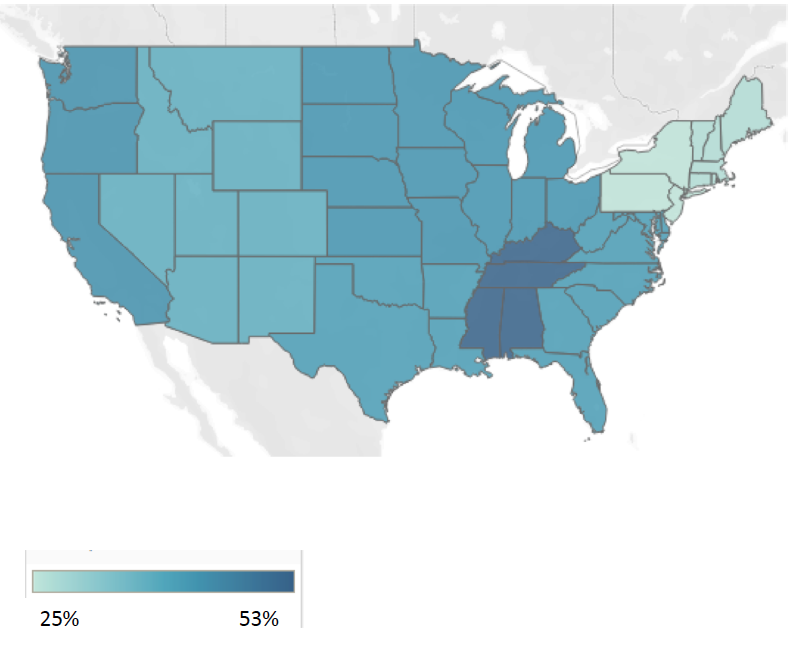

3. Proportion of Consumers Visiting Restaurants Shows a Geographic Divide in Return to Normalcy

While less than 30% of consumers in the Mid-Atlantic and New England regions of the US reported going to a restaurant in the past two weeks, more than 50% of consumers across Alabama, Kentucky, Mississippi and Tennessee reported the same.

Figure 3. All Respondents: Proportion Who Have Visited a Restaurant for Dine-In in the Past Two Weeks by Region (% of Respondents) [caption id="attachment_125774" align="aligncenter" width="550"]

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]

What We Think

The health landscape in the US is being pulled in opposite directions by two conflicting forces: Speedy vaccinations of about 3 million Americans per day is pressing down cases, while accelerated reopenings are giving rise to fears of a fourth Covid-19 wave.

While this stagnation in health recovery is likely temporary—at the current pace of vaccination, herd immunity should be reached early in the summer—for now, it appears to be slowing consumers’ return to a less virus-conscious existence.

Overall economic recovery led by a surging jobs market has helped keep the proportion of consumers buying more of product categories in our survey high, and this should effectively bridge the gap to a full and permanent vaccine-driven recovery in the late spring and summer.

Implications for Brands/Retailers- Consumers’ steady spending habits over the past few weeks reflect the duelling forces of reopenings versus vaccinations, but retailers can be optimistic about the medium-term outlook as consumers return to stores.

- With increasing financial security, more consumers appear to be trading up to slightly higher-price-point grocers, a trend that may carry over to other categories as the economy looks poised for strong growth in the months ahead.

- Retailers must carefully segment their customer base geographically, as different regions see starkly different paces of the resumption of pre-pandemic behaviors.