albert Chan

We discuss select findings from our US consumer survey and compare them to findings from previous weekly surveys.

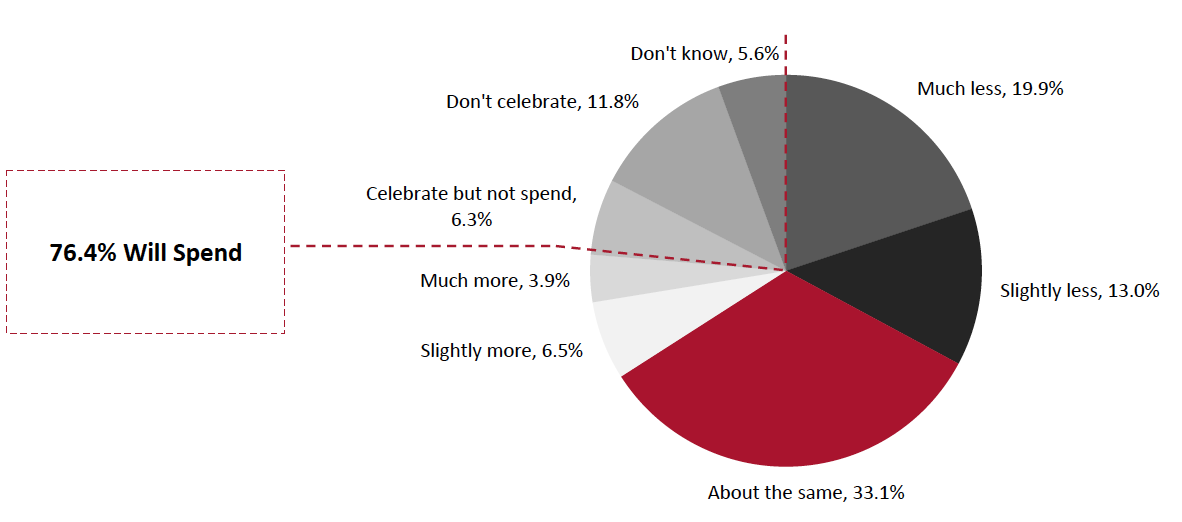

1. Consumers Expect To Spend Less on EasterIn this week’s survey, we asked consumers about their spending plans for Easter 2021. Compared to last year, a greater proportion of consumers expect to spend less in total on Easter than those that expect to spend more. Last year, Easter took place on April 12, amid lockdowns. Given recent strong growth in retail sales, we think these consumer expectations may be overly pessimistic.

Figure 1. All Respondents: Expectations To Spend on Easter 2021 vs. 2020 (% of Respondents)

[caption id="attachment_125023" align="aligncenter" width="700"] Base: 432 US respondents aged 18+, surveyed on March 22

Base: 432 US respondents aged 18+, surveyed on March 22Source: Coresight Research[/caption]

Consumers aged over 60 were the least likely to spend less on Easter this year, with just 8% planning to spend much less on Easter. Contrastingly, more than 20% of consumers in each of the three younger age groups we surveyed reported plans to spend much less on Easter this year.

Among all consumers who reported planning to spend on Easter this year, one in ten reported plans to switch some or all of their spending from stores to e-commerce, while less than 10% expect to spend part of their third stimulus check on Easter. For more coverage of Easter spending, see our upcoming US Easter Spending Preview report.

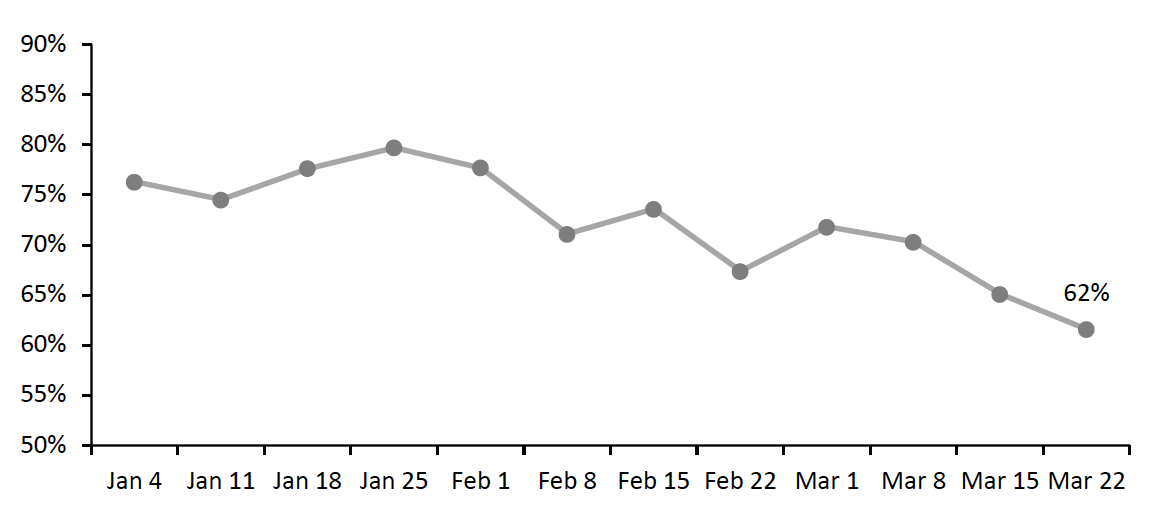

2. Consumers Deprioritize In-Store Grocery SpendingEach week, we ask consumers what products they have bought in-store and online in the past two weeks. In-store purchases for food and beverage dropped for the second straight week in our survey, with the proportion sitting at 62% this week—some 18 percentage points lower than its peak on January 25.

Figure 2. Proportions of Respondents That Bought Food or Beverages In-Store in the Past Two Weeks (% of Respondents)

[caption id="attachment_125024" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]

While the proportion of consumers purchasing food and beverage online did increase slightly this week, most of the decline in spending in stores does not appear to have been redirected toward digital sales: Since January 25, the proportion of consumers purchasing food and beverage products online has decreased by nearly three percentage points.

At the same time, discretionary categories have ticked up—roughly one in five consumers reported purchasing home-improvement products in a store this week, the fourth straight week of strong performance in this category. Similarly, for the third straight week, more than one in five consumers reported purchasing clothing, footwear or fashion accessories in-store in two weeks prior to our survey. The last time we recorded such a streak in our survey was between December 21 and January 4, amid the holiday season.

3. Consumers’ Return to Public Places StallsThis week, the avoidance rate of any type of public area came in at 80%, ticking up slightly after a period of sustained decline in avoidance. Despite this week’s slight rise, avoidance of public places remains nearly seven percentage points below the peak of 86% in February. For 11 of the 13 location options provided, rates of avoidance increased this week, although some changes were within the margin of error. Despite these recent upticks, avoidance of most public places remains down from the levels we saw earlier in the year.

- Avoidance of gyms and sports centers bounced back up this week by nearly seven percentage points after declining in both of our two prior surveys. This indicates that, while consumers are slowly returning to regular activities, many remain reluctant to go back to these often crowded, enclosed locations.

- Boding well for retailers, the proportion of consumers that reported avoiding shops declined for the third straight week—the only category to see this consistent decline over the past month.

- More than half of consumers reported avoiding international travel this week, up nearly five percentage points after two weeks of steep decline. Travel restrictions on international destinations likely play a role in consumers’ continued avoidance of planning trips outside of the US.

- Overall, we expect that consumers will continue to return to normal activities, but this week’s survey provides an important reality check on the rate and mode of recovery. Even as more than one in four Americans has now received at least one shot of a Covid-19 vaccine, many of those who have not been vaccinated remain cautious of returning to more normal ways of living and spending, with daily cases still coming in at more than 70,000.