albert Chan

What’s the Story?

We present select findings from our latest weekly survey of US consumers, undertaken on April 12, 2021. This free report includes analysis of the impacts of the Covid-19 pandemic on shopper behaviors. We explore the trends we are seeing from week to week.

Click here to read the full report.

Click here to read our previous US Consumer Tracker reports.

1. Discretionary Purchases Improve

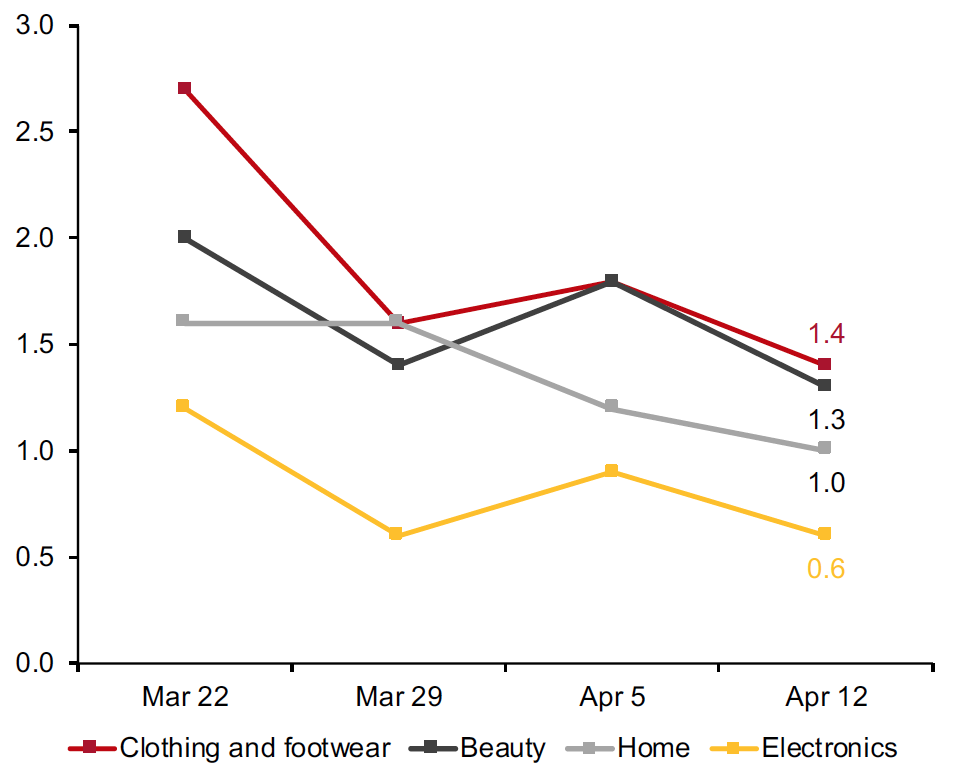

Each week, we ask respondents which categories (if any) they are buying less of or more of than before the pandemic hit. The ratio of consumers buying less to those buying more fell week over week in some discretionary categories:

- The ratio of buying less to more for clothing and footwear went down to a historic low of 1.4, compared to 2.7 three weeks ago.

- The ratio for beauty products stood at 1.3 this week, down from 2.0 three weeks before.

- We saw a downward trend in the ratio for home products, to a new low of 1.0 this week, from 1.6 three weeks ago.

- The ratio for electronics have been below 1.0 for three consecutive weeks now. This week, the ratio came in at 0.6.

Figure 1. All Respondents: Ratios of Those Currently Buying Less to Those Currently Buying More Than Before the Coronavirus Outbreak (Selected Options; % of Respondents)

[caption id="attachment_126019" align="aligncenter" width="550"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]

2. Avoidance of Public Places Drops Significantly

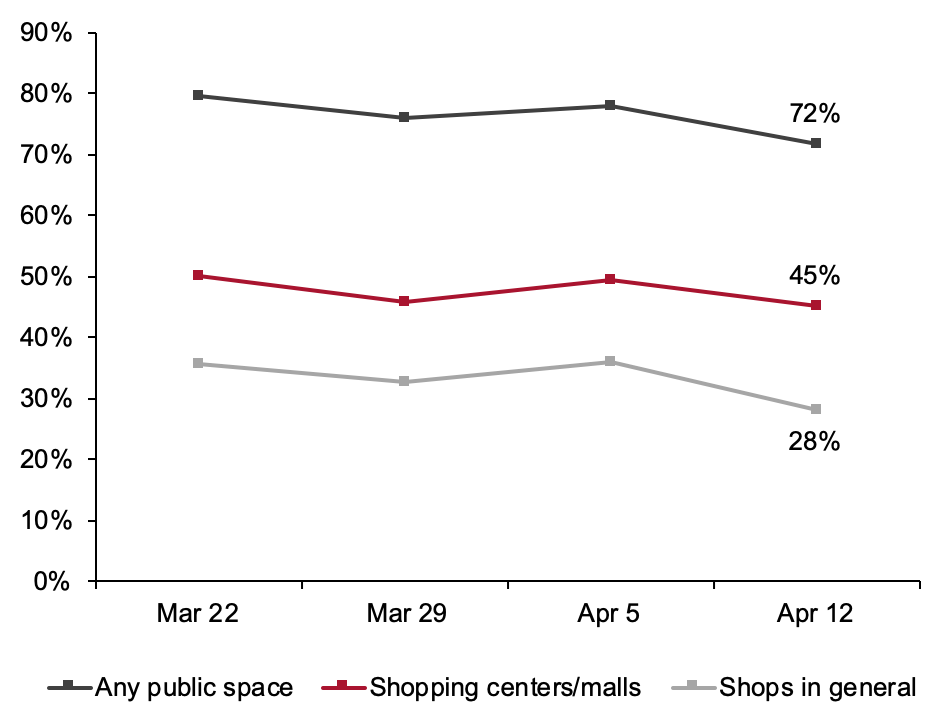

- Avoidance of any public places tumbled by six percentage points this week to 72%—the lowest we have seen in the past 10 months.

- International travel was the most-avoided option, with 46% of respondents reporting that they are currently avoiding it.

- Avoidance of shopping locations, including shopping centers/malls and shops in general both declined to historic lows this week. Shops in general saw the largest week-over-week decline of almost eight percentage points.

- Some 44% of respondents are avoiding foodservice locations—the lowest on record.

Figure 2. All Respondents: Public Places That Respondents Are Currently Avoiding (Selected Options; % of Respondents)

[caption id="attachment_126053" align="aligncenter" width="500"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]

3. More Consumers Resume Normal Activities

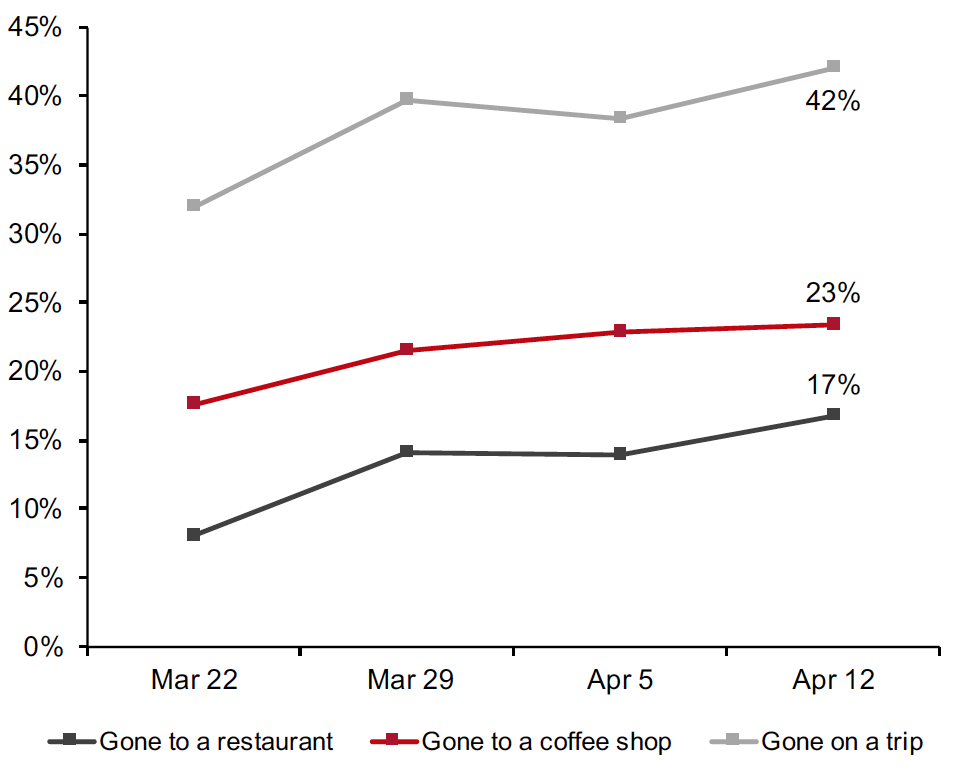

- The proportion of respondents undertaking activities increased for half of the 12 options we asked, although most changes were within the margin of error.

- In line with the decline of avoidance of foodservice locations noted in the previous slide, the proportions of consumers that had gone to restaurants and coffee shops increased slightly to new highs this week. Compared to a month ago (our March 15 survey), the proportion that had dined in a restaurant rose by 9.5 percentage points.

- Travel has rebounded significantly in the past month. The proportion of consumers that had gone on a trip more than doubled from 8% on March 22 to 17% this week.

Figure 3. All Respondents: What Activities They Have Done in the Past Two Weeks (Selected Options; % of Respondents)

[caption id="attachment_126021" align="aligncenter" width="550"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]