albert Chan

We discuss select findings from our US consumer survey and compare them to findings from previous weekly surveys.

1. Online Jump for Apparel and GroceriesThis week, we recorded an increase in online shopper numbers for apparel and grocery categories in the past two weeks.

- The proportion of respondents that had bought clothing or footwear online in the past two weeks spiked more than five percentage points to 29.6%. This followed a decline in online apparel shopper numbers last week.

- The proportion of respondents buying food and beverages online rebounded closer to holiday levels this week after declining last week. This week, we saw a rise of 5.5 percentage points to 29.4% of respondents.

- We saw more modest week-over-week increases in online purchases of other grocery-store categories such as household products and personal care products.

- In-store purchases of clothing and footwear, and cosmetics, fragrance and skincare products fell sharply this week, dropping by more than six percentage points each.

Each week, we ask respondents which retailers they bought food and nonfood products from over the two weeks preceding the survey date.

Our survey unsurprisingly indicates that food demand remains below its holiday levels. This week, Walmart saw the largest decline in food shoppers: the proportion of shoppers reporting they had shopped for food at Walmart in the last two weeks declined roughly seven percentage points, but the retailer retained a commanding lead in shoppers over competitors. Clear trends in shoppers’ changing preferences for other food retailers are yet to emerge in the wake of the holiday season: of the twelve retailers we ask respondents about, only two have seen the proportion of consumers shopping there move in a consistent direction each of the past two weeks.

For nonfood purchases, Amazon and Walmart saw shopper numbers drop slightly this week and sit at about ten percentage points lower than holiday values. Department stores continued to see a decline in shoppers, as the proportion of respondents reporting that they had shopped at Kohl’s dropped for a fourth straight week.

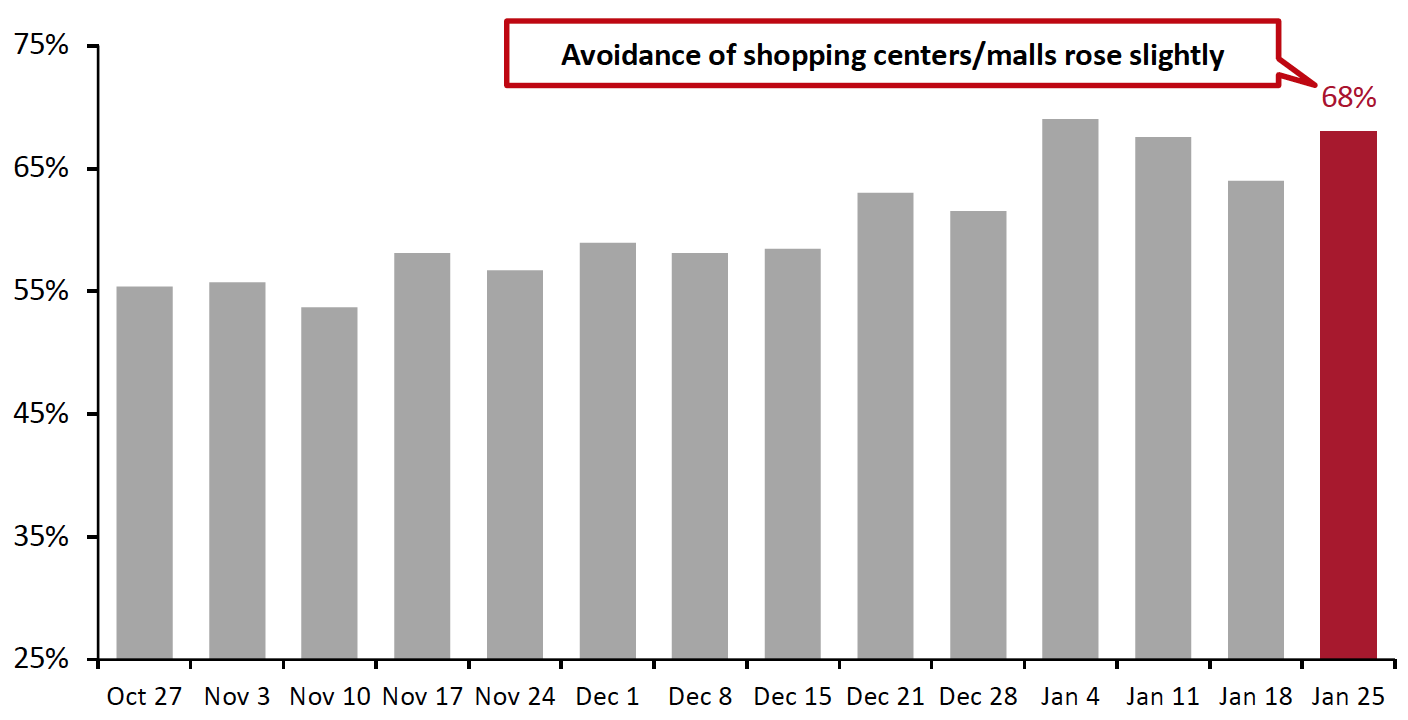

3. Slight Increases in Avoidance Rates of Shopping Centers and Sharp Rises in Avoidance of Communal PlacesIn this week’s survey, the avoidance rate of any type of public area stood at 82%, versus 81% last week and 83% two weeks ago.

- Consumers appear increasingly eager to avoid non-essential communal places: the proportion of consumers avoiding sporting events, entertainment and leisure venues, gyms, and community centers all rose by more than 7% this week.

- The proportion of consumers avoiding shopping centers bounced back up to 68%, while avoidance of shops in general stood at 50%, roughly even with last week’s number.

- Consumers also reported avoiding public transportation and international travel at increasing rates.

Figure 1. All Respondents: Proportion That Are Currently Avoiding Shopping Centers/Malls (% of Respondents)

[caption id="attachment_122539" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]