DIpil Das

We discuss select findings from our US consumer survey and compare them to findings from previous weekly surveys.

1. In-Store Apparel Purchases Pick Up

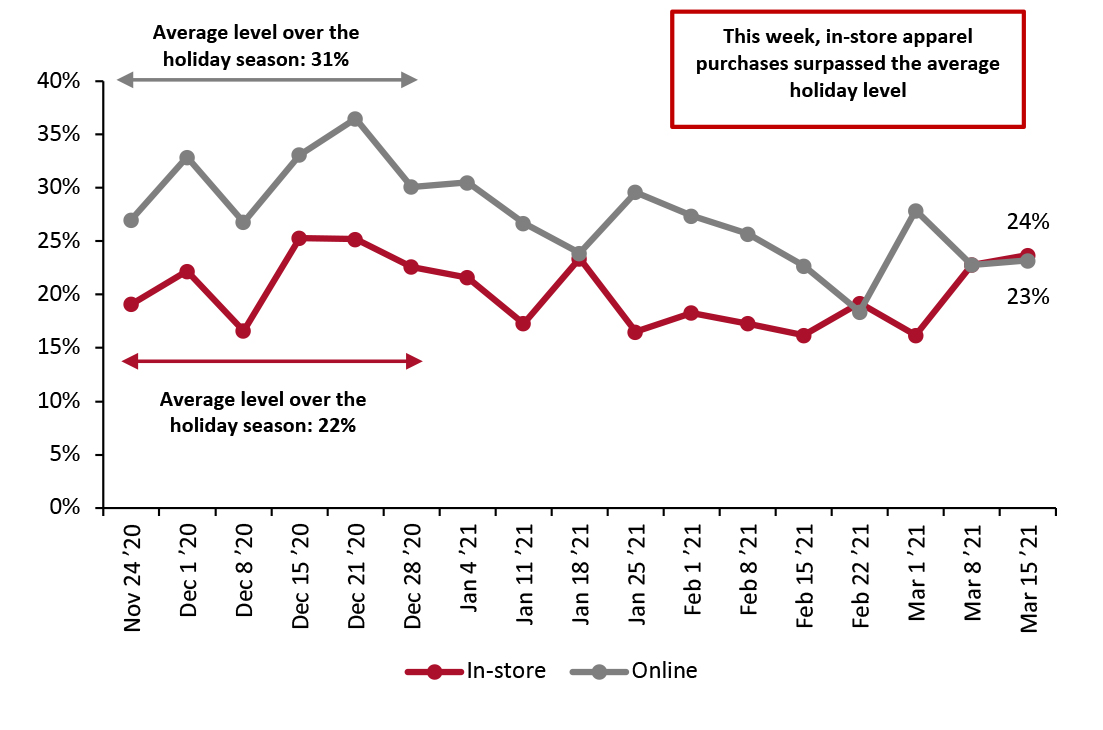

This week, we saw renewed consumer interest in in-store shopping for clothing and footwear, with a slightly higher proportion reporting that they bought apparel in-store than online. This week, in-store purchase levels exceeded the average level we saw during the 2020 holiday season from our November 24 to December 28 surveys.

While online purchases for clothing and footwear outperformed in-store purchases during the holiday season, we have seen a declining trend in online apparel purchases this year following the holiday season. Contrastingly, in-store apparel purchases have gradually picked up—indicating that more consumers are returning to stores for apparel shopping.

For the second time this year, our survey registered a higher proportion of consumers buying clothing and footwear in a store, at 24%, compared to online purchases at 23%—although the margin is very narrow. Moreover, the in-store metrics in this week’s survey exceeded the average in-store apparel purchase level of 22% over the holiday season last year. On the contrary, the proportion of consumers that have bought apparel online in this week’s survey declined by eight percentage points compared to the holiday season average of 31%.

Figure 1. Proportion of Respondents That Have Bought Clothing and Footwear In-Store and Online in the Past Two Weeks [caption id="attachment_124800" align="aligncenter" width="725"] Base: US respondents aged 18+

Base: US respondents aged 18+

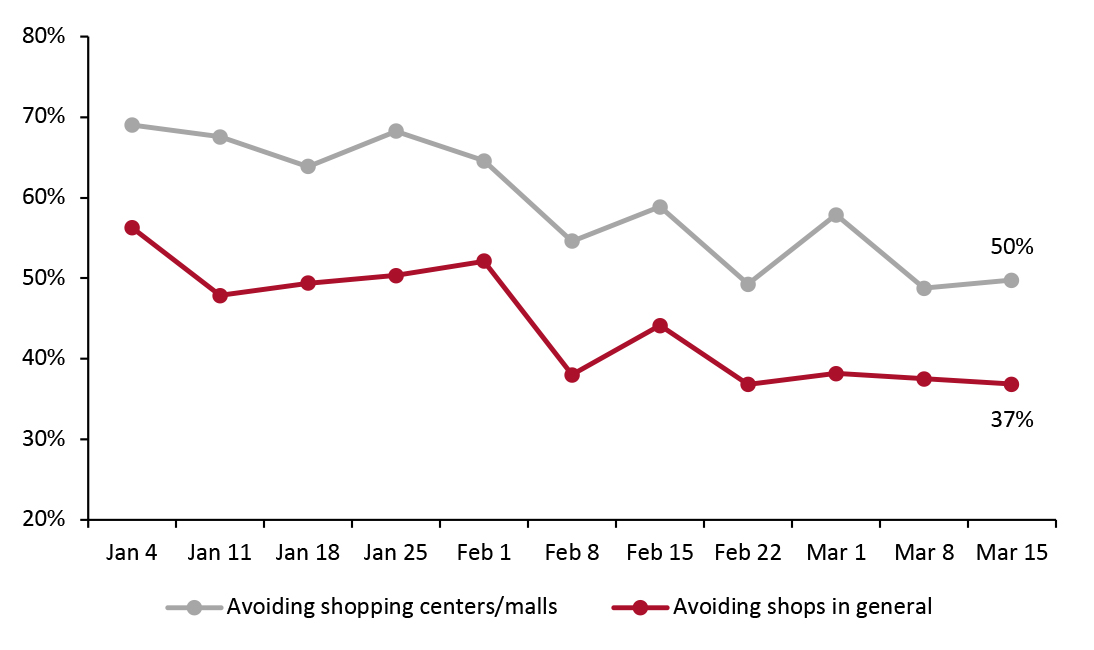

Source: Coresight Research [/caption] 2. Increased Travel Optimism Among Consumers Each week, we ask consumers what activities they have done in the past two weeks. Consumers appear to be increasingly comfortable about traveling in the coming weeks and months. The proportion of consumers that reported arranging a trip increased for the fifth straight week, from 7% in the first week of February to 18% this week, representing a jump of 11 percentage points. This level is also the highest we have seen since we started asking this question in June 2020. For other activities, visits to food-service locations remained at a relatively high level compared to last month. The proportion of consumers that reported dining in a restaurant stood at one-third. The proportion that had gone to a coffee shop broadly leveled off, at one-fifth. Compared to the average level of 15% in February, this week’s result represents an increase of five percentage points. Both metrics reflect a gradual return to food-service locations among consumers. We expect this trend to continue, driven by ongoing vaccination rollouts and warmer weather. 3. Declining Trend in Avoidance of Any Public Place This week, the avoidance rate of any type of public area came in at around 77%, continuing a downward trend. Compared to the peak of 86.3% one month ago, the avoidance rate for any public area declined by almost 10 percentage points in our survey this week.

Figure 2. Proportions of Respondents That Are Currently Avoiding Shopping Centers/Malls and Shops in General (% of Respondents) [caption id="attachment_124801" align="aligncenter" width="725"] Base: US respondents aged 18+

Base: US respondents aged 18+

Source: Coresight Research [/caption]

Figure 1. Proportion of Respondents That Have Bought Clothing and Footwear In-Store and Online in the Past Two Weeks [caption id="attachment_124800" align="aligncenter" width="725"]

Source: Coresight Research [/caption] 2. Increased Travel Optimism Among Consumers Each week, we ask consumers what activities they have done in the past two weeks. Consumers appear to be increasingly comfortable about traveling in the coming weeks and months. The proportion of consumers that reported arranging a trip increased for the fifth straight week, from 7% in the first week of February to 18% this week, representing a jump of 11 percentage points. This level is also the highest we have seen since we started asking this question in June 2020. For other activities, visits to food-service locations remained at a relatively high level compared to last month. The proportion of consumers that reported dining in a restaurant stood at one-third. The proportion that had gone to a coffee shop broadly leveled off, at one-fifth. Compared to the average level of 15% in February, this week’s result represents an increase of five percentage points. Both metrics reflect a gradual return to food-service locations among consumers. We expect this trend to continue, driven by ongoing vaccination rollouts and warmer weather. 3. Declining Trend in Avoidance of Any Public Place This week, the avoidance rate of any type of public area came in at around 77%, continuing a downward trend. Compared to the peak of 86.3% one month ago, the avoidance rate for any public area declined by almost 10 percentage points in our survey this week.

- While half of consumers are currently avoiding food-service locations, this rate is significantly lower rate than the average level of 57% in February and two-thirds in January earlier this year.

- Around half of consumers are avoiding shopping centers/malls, down by seven percentage points from the average level in February and 17 percentage points from January’s average. The proportion of consumers that are avoiding shops in general returned to the historical low we saw in February 22, at 37%. Both metrics are encouraging signs for retailers.

Figure 2. Proportions of Respondents That Are Currently Avoiding Shopping Centers/Malls and Shops in General (% of Respondents) [caption id="attachment_124801" align="aligncenter" width="725"]

Source: Coresight Research [/caption]