albert Chan

We discuss select findings from our US consumer survey and compare them to findings from previous weekly surveys.

1. How Consumers Spent or Plan To Spend Their Third Stimulus ChecksIn this week’s survey, we asked consumers that had received a third stimulus check—around six in 10 survey respondents—how they used or plan to use their money and compared. We compare this with our survey findings from the same question following the first and second rounds of stimulus payments.

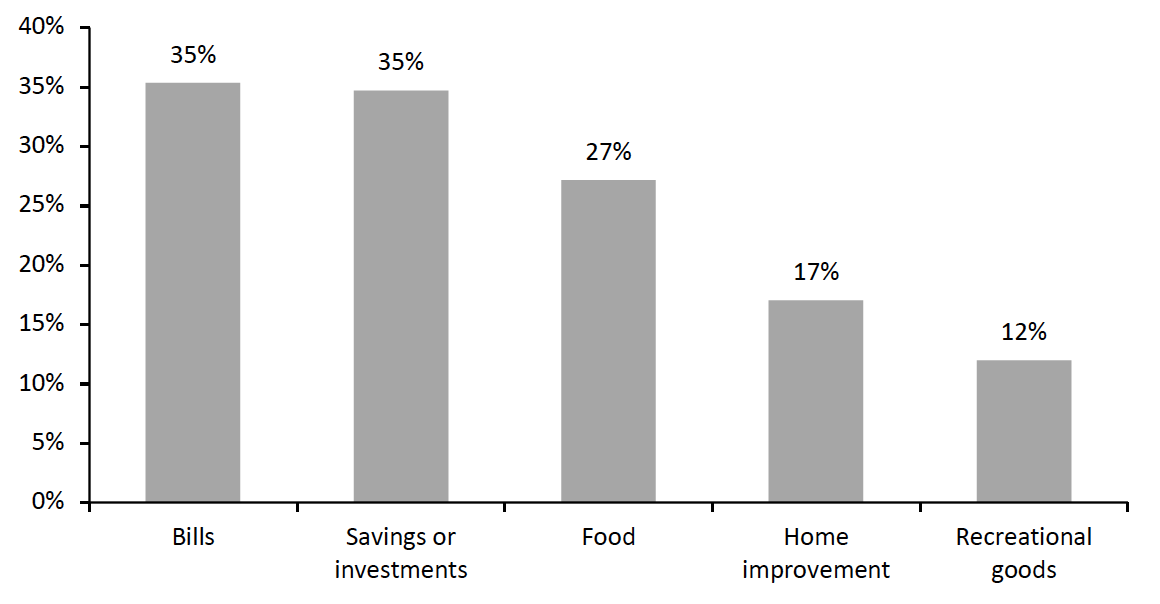

Essential payments including bills, savings, debt, mortgages and rent again topped consumers’ use of a stimulus check. Some 35% of consumers that received a third stimulus check reported that they used it to pay bills—eight percentage points lower than those that used their first and second payment on bills.

Despite a declining trend in consumers that spent or expect to spend their stimulus check on groceries, food remains the top retail spending option for stimulus dollars in our survey.

Among discretionary retail purchases, home-improvement products saw the strongest demand—some 17% of consumers reported that they spent or plan to spend their third check on such items, up 12 percentage points from our survey findings on consumers’ use of the second check. The recreational goods and clothing and footwear categories also saw a spike in the proportion of consumers that spent or plan to spend their third stimulus check to purchase such items.

Overall, we expect the latest stimulus check to boost US retail recovery. The $1,400 check is larger than the previous two rounds of payments, likely reflected in more consumers reporting that they used or plan to use a third check on discretionary retail categories than our results for the two prior stimulus checks.

Figure 1. Respondents Who Had Received A Third Stimulus Check: How They Spent or Expect To Spend the Money (Selected Options; % of Respondents)

[caption id="attachment_125520" align="aligncenter" width="700"] Base: 317 US respondents aged 18+ who had received a third stimulus check

Base: 317 US respondents aged 18+ who had received a third stimulus checkSource: Coresight Research[/caption] 2. Fewer Than Half Expect To Retain Changed Behaviors in the Long Term

We asked respondents whether they anticipate keeping some of the behaviors they have adopted during the coronavirus crisis in the long term. This week, some 48% of respondents reported that they expect to retain some changed behaviors, the second-lowest level we have recorded in our survey.

The proportion of respondents that expect to retain behavior changes in the long term declined for seven of the 11 behavior options provided, in comparison to the last time we asked the question on February 1. Most changes were within the margin of error.

- The behavior option of having more hygienic practices witnessed the largest decline, dropping by six percentage points compared to when we asked this question.

- Some 22% of respondents expect to shop more online and less in stores in the long term, slightly down from 23% on February 1. Among all the behaviors, “shop more online, less in stores” has the smallest difference between its peak and this week’s level, making it the behavior that is most likely to be retained in the long term.

- Moreover, the proportion of consumers that expect to retain the behavior of shopping less overall decreased to 12%, from 15% on February 1. This level is the lowest we have recorded in the past 12 months, indicating that more consumers expect to return to their consumption levels from prior to the pandemic.

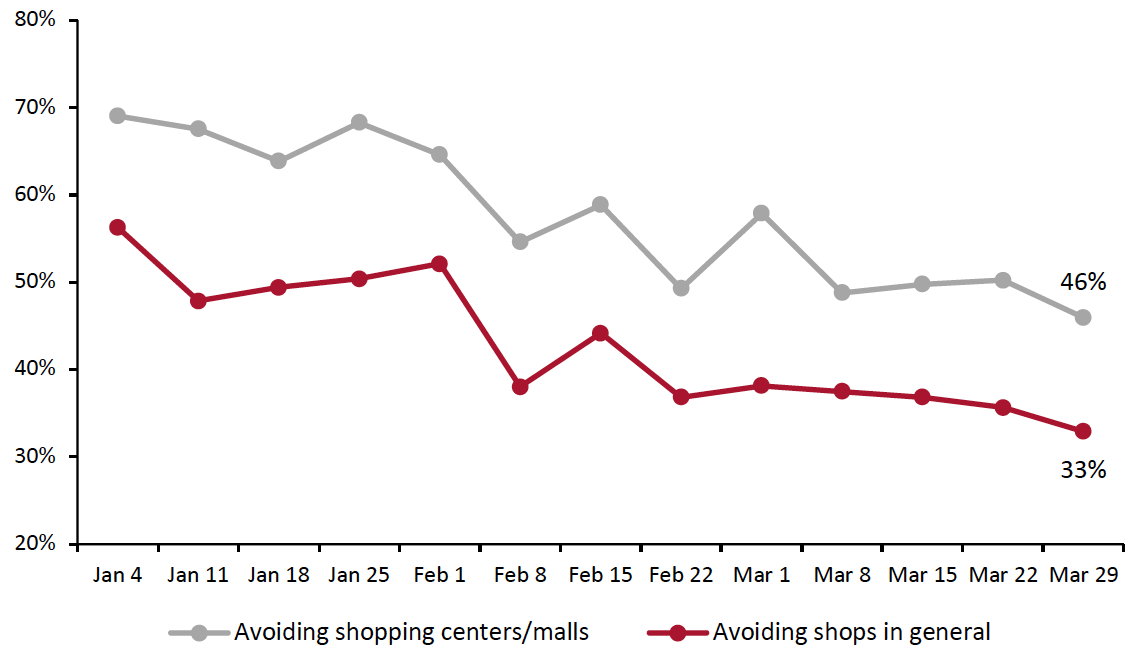

This week, the avoidance rate of any type of public area came in at 76%, the lowest level from the last six months. For all of the 13 location options provided, rates of avoidance decreased this week, although some changes were within the margin of error.

- Food-service locations saw the largest week-over-week decline, dropping by seven percentage points from 51% to 44% this week. The decrease takes the location out of its usual position among the top three most-avoided public places in our survey.

- Encouragingly for retailers, the proportion of consumers that reported avoiding shopping centers/malls and shops in general both dropped to a low this week. Some 46% are avoiding shopping centers/malls and roughly one-third are avoiding shops in general.

Figure 2. Proportion of Respondents That Are Currently Avoiding Shopping Centers/Malls and Shops in General (% of Respondents)

[caption id="attachment_125521" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]