albert Chan

We discuss select findings from our US consumer survey and compare them to findings from previous weekly surveys.

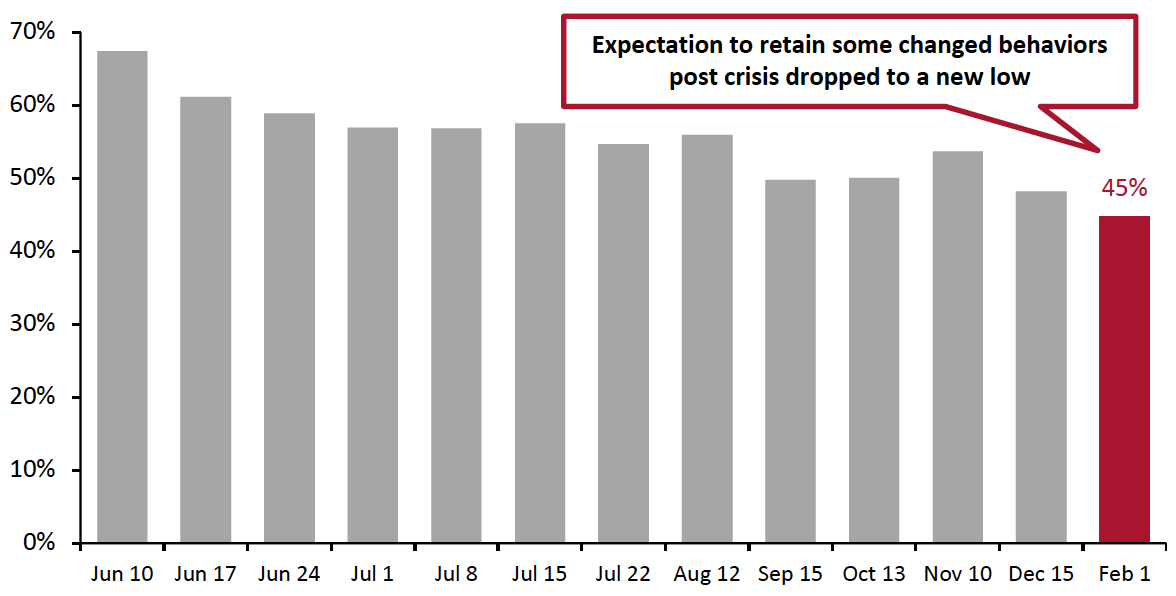

1. Fewer than Half Expect To Retain Changed Behaviors in the Long TermThis week, we asked respondents whether they think they will keep some of the behaviors they have adopted during the coronavirus crisis in the long term. Some 45% of respondents expect to retain some changed behaviors this week, the lowest level since we started asking this question in late March 2020. This implies that consumers may be more willing to return to their regular activities than previously expected.

For 10 of the 11 behavior options provided, the proportions of respondents declined this week in comparison to last time we asked the question on December 15, 2020.

- Some 23% expect to shop more online, less in stores in the long term. This behavior has trended downward since peaking at 30% in early June 2020, although there have been some fluctuations. Among all the behaviors, “shop more online, less in stores” has the smallest difference between its peak and this week’s level, making it the behavior most likely to be retained in the long term.

- One-fifth said that they expect to visit public places less often in the long term, the lowest level since April last year. Compared to the peak of 34.3%, this behavior has plunged by 13 percentage points from the peak in mid-June.

- A positive sign for the retail industry—more consumers may return to their pre-pandemic consumption level after the crisis ends. The proportion of consumers expecting to retain the behavior of shopping less overall decreased to 15%, versus the peak of one-quarter in mid-June.

Figure 1. All Respondents: Expectation To Behave Differently/Retain Changed Way of Living in the Long Term (% of Respondents)

[caption id="attachment_122943" align="aligncenter" width="700"] Questions not asked every week

Questions not asked every weekBase: US respondents aged 18+

Source: Coresight Research[/caption] 2. More Consumers Are Comfortable Resuming Some Regular Activities

Each week, we ask respondents what activities they have done over the two weeks preceding the survey date.

- We continue to see consumers’ visits to food-service locations recover from the level in December and the first half of January this year. Some 32% had dined in a restaurant—the highest since October, and 14% had gone to a coffee shop in the past two weeks. Moreover, one in 10 had gone to a bar—the highest level since we started asking this question in June last year.

- The proportion that reported getting haircuts has increased for the third straight week, to 24% this week.

- The proportion of consumers that had gone to a gym or fitness class reached a record high of 10.2%. This aligns with the decline in avoidance of gyms or sports centers in a separate survey question.

- Visits to an open-air shopping center remained stable at 22% week over week, up almost six percentage points from three weeks ago.

In-store shopping declined week over week for some essential categories, while most discretionary purchases still took place online.

- Despite the elevated level of respondents that had bought food and beverages in-store, consumers that had bought those online remained at a consistent proportion of 29% week over week, after declining to 24% two weeks ago.

- Other essentials, including health, household and personal care products all saw slight week-over-week decreases of in-store shoppers. Personal care products dropped most significantly, by almost seven percentage points week over week.

- Most discretionary purchases were online, except for in beauty and home improvement. This week, some 27% had bought clothing and footwear online in the latest two-week period, 10 percentage points higher than those that had done so in a store.