DIpil Das

We discuss select findings from our US consumer survey and compare them to findings from previous weekly surveys.

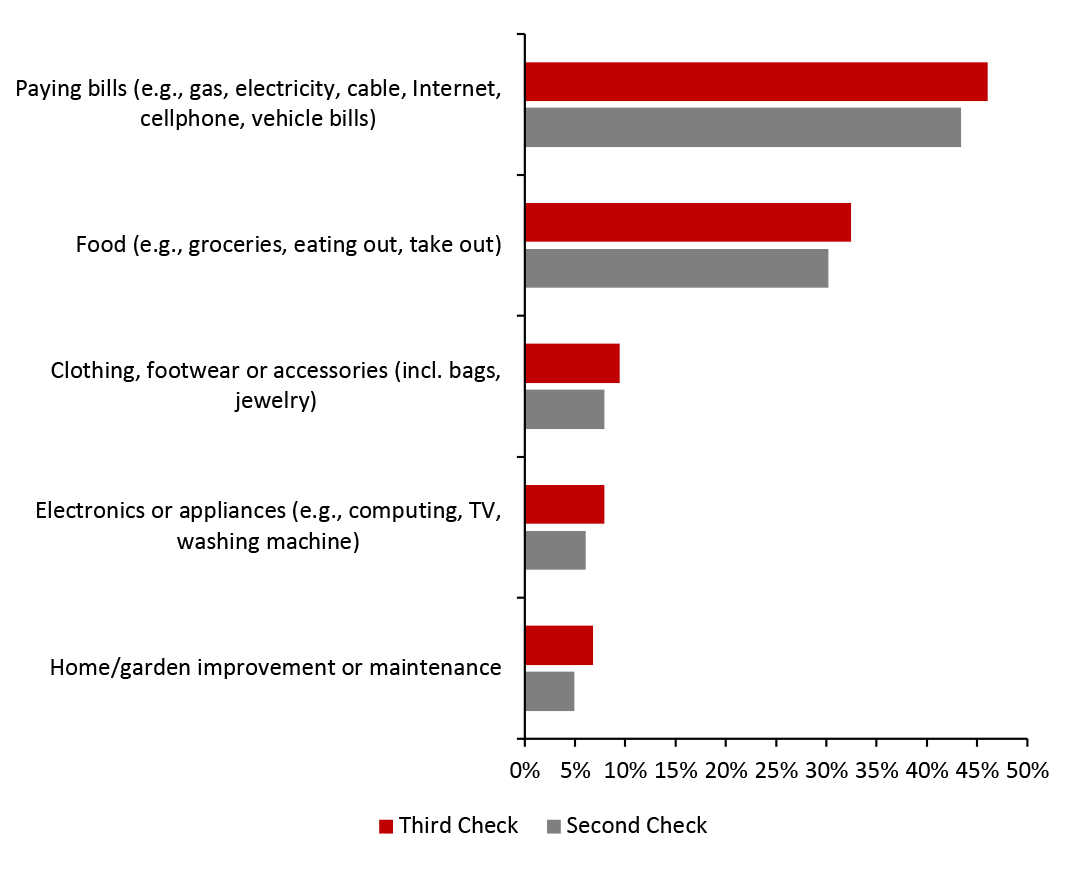

1. Consumers Use Stimulus Checks on Essentials

By far the most common uses of stimulus checks were essential payments, as well as purchases of food. Around 43% of consumers who received a stimulus check reported that they used it to pay bills, more than 13 percentage points higher than the next highest category: spending on food. Of discretionary purchases, the clothing, footwear, and accessories category was the most common response, with just under 10% of consumers reporting plans to use a third stimulus check on those items. Some 8% reported that they used the most recent stimulus check for purchases in this category.

Consumers do not appear to be prioritizing retail spending with their stimulus checks. Only one retail category, food spending, saw more than 10% of consumers reporting spending stimulus check money on purchases in the category.

Figure 1. Respondents That Had Received a Second Stimulus Check: How They Spent or Expect To Spend Their Second-Round Stimulus Checks, and How They Expect to Spend Any Third Round Stimulus Checks—Selected Options (% of Respondents) [caption id="attachment_123282" align="aligncenter" width="725"] Respondents could select multiple options

Respondents could select multiple options

Base: US respondents aged 18+ who received a second-round stimulus check

Source: Coresight Research [/caption] 2. Consumers Remain Cautious, but Reduce Avoidance of Certain Public Places Complementing our questions about purchases in the past two weeks, each week, we ask consumers what activities they have done in the past two weeks. This week, the proportion of respondents shrunk for nine of the twelve activities we asked about.

Figure 1. Respondents That Had Received a Second Stimulus Check: How They Spent or Expect To Spend Their Second-Round Stimulus Checks, and How They Expect to Spend Any Third Round Stimulus Checks—Selected Options (% of Respondents) [caption id="attachment_123282" align="aligncenter" width="725"]

Base: US respondents aged 18+ who received a second-round stimulus check

Source: Coresight Research [/caption] 2. Consumers Remain Cautious, but Reduce Avoidance of Certain Public Places Complementing our questions about purchases in the past two weeks, each week, we ask consumers what activities they have done in the past two weeks. This week, the proportion of respondents shrunk for nine of the twelve activities we asked about.

- After recovering for three straight weeks, the proportion of consumers visiting restaurants fell by more than six percentage points this week, signaling that a sustained recovery in food service is yet to come close to fruition.

- The proportion of consumers reporting going to an enclosed shopping center shrunk by nearly ten percentage points, but surprisingly even with this decline, the proportion that visited an enclosed shopping center rose for the third straight week.

- Avoidance of shops in general dropped drastically, falling below the 40% mark for the first time since October, even as avoidance of public places in general rose for the third straight week.

- After rising to a new high two weeks ago, avoidance of entertainment and leisure venues dropped sharply to just 41%, the lowest value recorded in approximately one month.

- Target and Amazon overtook Kroger to become the second and third most shopped at retailers for food products, respectively. It is just the second time that our survey has recorded Amazon climbing above Kroger, and the first time that Target has had more shoppers for food products than Kroger.

- Walmart extended its lead over other retailers: the proportion of consumers reporting having shopped at Walmart in the past two weeks rose by more than five percentage points.

- While Amazon and Target both saw increases in food purchases, they both also saw the proportion of non-food shoppers decrease week over week.

- Kohl’s saw shopper numbers decline for the sixth straight week, even as Macy’s saw a slight bounce back in its proportion of shoppers.

- Dollar stores saw strong shopper numbers over the past two weeks: both Dollar Tree/Family Dollar and Dollar General saw increases in shoppers this week, with the proportion of shoppers at each rising to the highest values since January 4, 2021.