DIpil Das

We discuss select findings from our US consumer survey and compare them to findings from previous weekly surveys.

1. High and Middle-Income Consumers Boost Service Spending

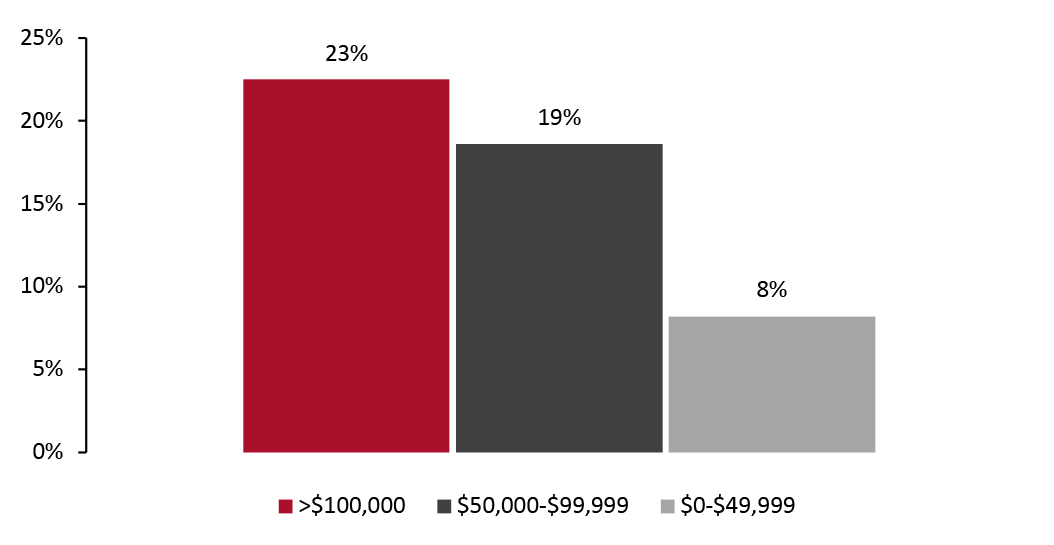

Over the past three months, consumers have slowly become more comfortable venturing into public places and partaking in activities that involve interacting with others. The rates at which high and middle-income consumers, in particular, have report visiting restaurants increased disproportionately compared to low-income consumers over the past three months, as illustrated in Figure 1 below.

Figure 1. Proportion of Respondents Who Reported Going to a Restaurant in the Past Two Weeks, Percentage Point Change from December 1, 2020 to March 8, 2021 [caption id="attachment_124507" align="aligncenter" width="725"] Base: US respondents aged 18+

Base: US respondents aged 18+

Source: Coresight Research [/caption] The proportion of consumers with incomes between $50,000 and $99,999 and greater than $100,000 that reported visiting a restaurant in the two weeks prior to the survey each rose by around 20 percentage points. By contrast, the proportion of consumers with incomes below $50,000 that carried out the same activity in the same timeframe rose by around eight percentage points. 2. Consumers Reduce Avoidance of Shops and Service Locations This week, the avoidance rate of any type of public area came in at about 78%, continuing a downward trend in avoidance. Looking at trends over a longer term, we have seen a decline in avoidance of every public place we ask respondents about since December.

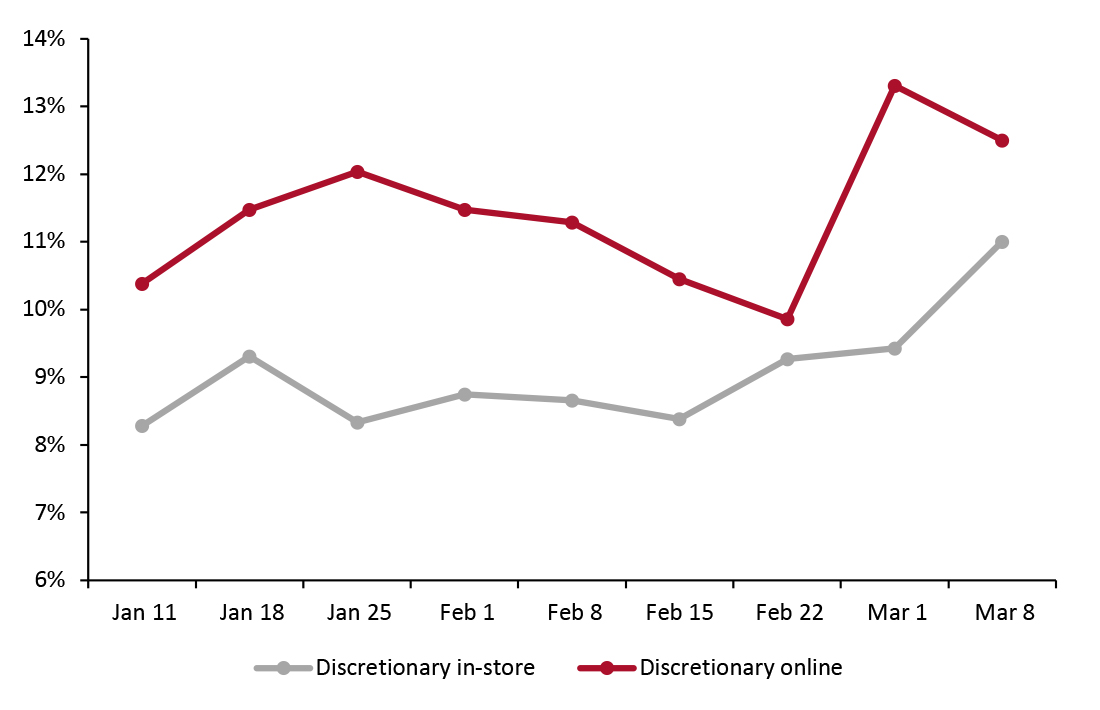

Figure 2. All Respondents: What They Have Bought Online and In-Store [caption id="attachment_124508" align="aligncenter" width="725"] Respondents could select multiple options

Respondents could select multiple options

Base: US respondents aged 18+

Source: Coresight Research [/caption]

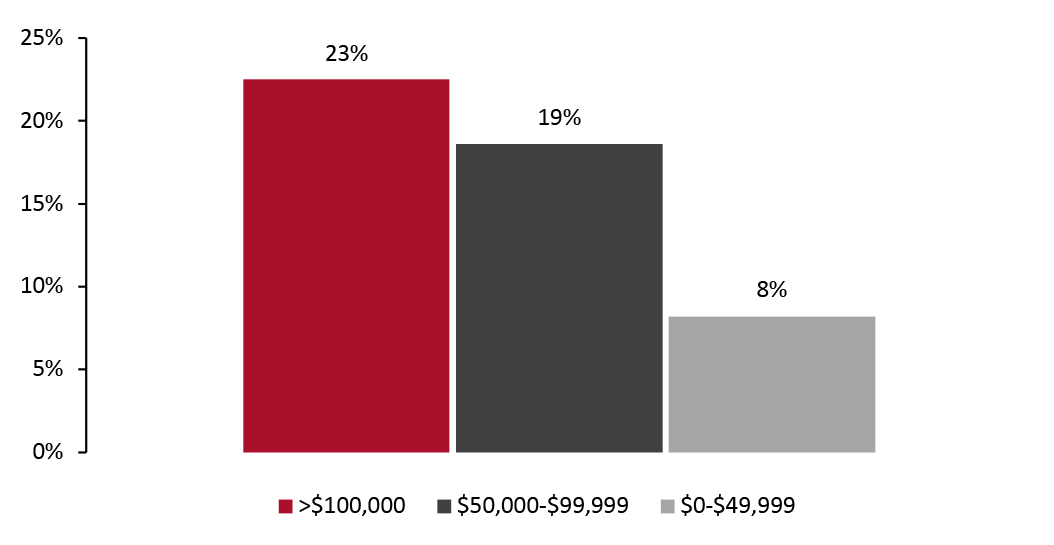

Figure 1. Proportion of Respondents Who Reported Going to a Restaurant in the Past Two Weeks, Percentage Point Change from December 1, 2020 to March 8, 2021 [caption id="attachment_124507" align="aligncenter" width="725"]

Base: US respondents aged 18+

Base: US respondents aged 18+ Source: Coresight Research [/caption] The proportion of consumers with incomes between $50,000 and $99,999 and greater than $100,000 that reported visiting a restaurant in the two weeks prior to the survey each rose by around 20 percentage points. By contrast, the proportion of consumers with incomes below $50,000 that carried out the same activity in the same timeframe rose by around eight percentage points. 2. Consumers Reduce Avoidance of Shops and Service Locations This week, the avoidance rate of any type of public area came in at about 78%, continuing a downward trend in avoidance. Looking at trends over a longer term, we have seen a decline in avoidance of every public place we ask respondents about since December.

- Avoidance of restaurants, shops in general and shopping centers have seen the most significant declines over the past few months—the proportion of consumers that have reported avoiding each location has decreased by more than 14 percentage points since the peak in January.

- Avoidance of certain public areas, typically those that consumers have less discretion in deciding to visit, has been more stagnant. The proportion of consumers that have reported avoiding their workplace dropped by less than two percentage points between December 8 and March 8.

- Despite this week’s rise in consumers planning vacations, many still appear cautious about traveling in the short term. The proportion of consumers that reported avoiding international travel remained over 50% this week, and is down less than one percentage point from its value on December 8.

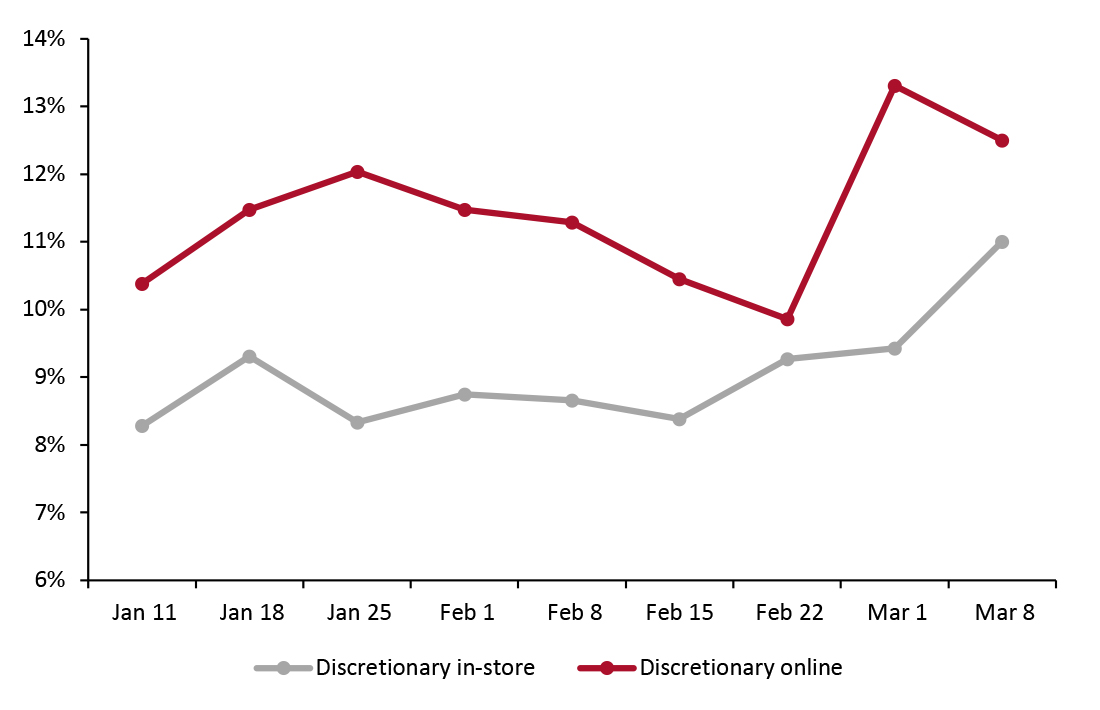

Figure 2. All Respondents: What They Have Bought Online and In-Store [caption id="attachment_124508" align="aligncenter" width="725"]

Respondents could select multiple options

Respondents could select multiple options Base: US respondents aged 18+

Source: Coresight Research [/caption]