Executive Summary

This is our fourth monthly report based on Prosper Insights and Analytics’ Amazon Shopper Intelligence service. This month, we focus on the menswear category.

Key Findings

- Brick-and-mortar stores—which include discount stores, specialty stores and department stores—remain the main channel at which surveyed men most often purchase menswear, for a total share of 78.3% as of June 2016.

- The majority of surveyed men have purchased menswear online, with 67.0% having done so in June However, those who do over half of their menswear shopping online remained a small minority, representing only 14.8% of surveyed men, whereas those buying most often online was a niche segment, at 2.6%.

- The number of Amazon menswear customers has doubled over the past five years―23.4% of those surveyed bought menswear at the online retailer in the three months prior to June 2016, up from 4% in June 2011. However, those buying menswear most often at Amazon remained a niche segment, with a share of 2.1% in June 2016.

- Amazon, Kohl’s and Walmart appeal to price-sensitive customers― over 85% of their customers cite price as the reason they shop Macy’s positioning differs slightly, in that it has an edge on selection and style compared to the other top retailers.

About Amazon Shopper Intelligence Service

The Amazon Shopper Intelligence service provides members with monthly data on consumer shopping patterns and preferences, drawing on more than 10 years of data on Amazon shoppers as well as on shoppers at other leading retailers. The data are instructive in helping users make informed business decisions.

Source: Shutterstock

US Menswear Market Overview

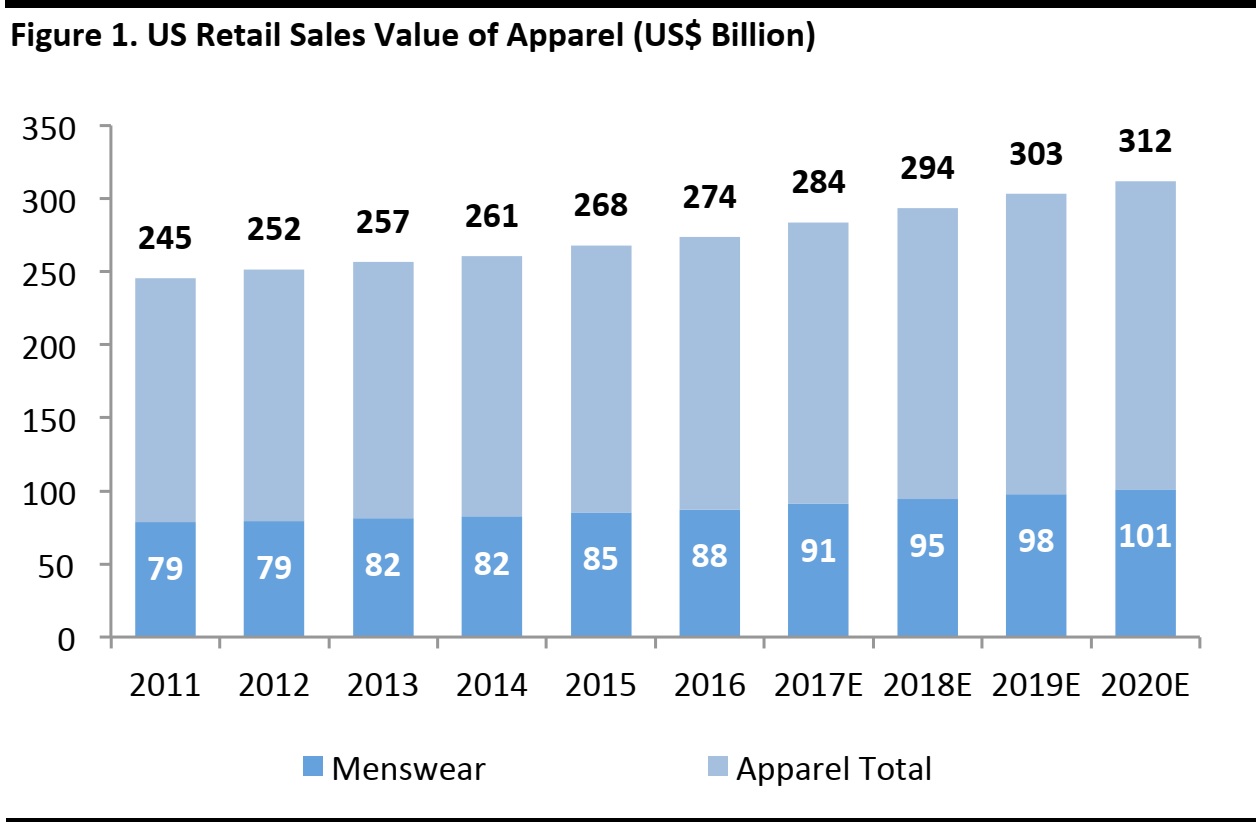

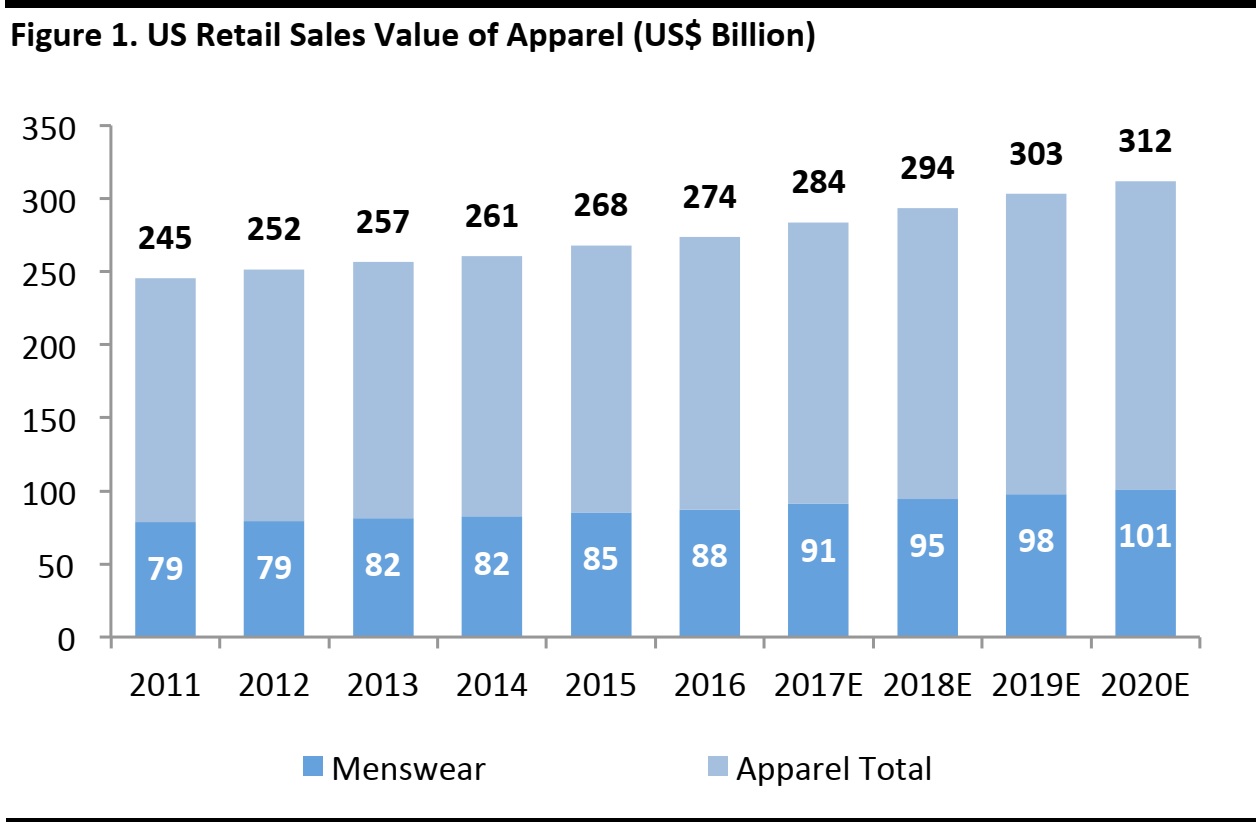

The US apparel market grew at a modest compounded annual growth rate (CAGR) of 2.2% from 2011 to 2016, and was valued at US$274 billion in 2016. The share of menswear relative to the total market size has remained stable over the past five years, staying at 32% and valued at US$88 billion in 2016. This category is expected to grow at a CAGR of 3.7% on average through 2020 to reach US$101 billion, according to Euromonitor.

Source: Euromonitor International

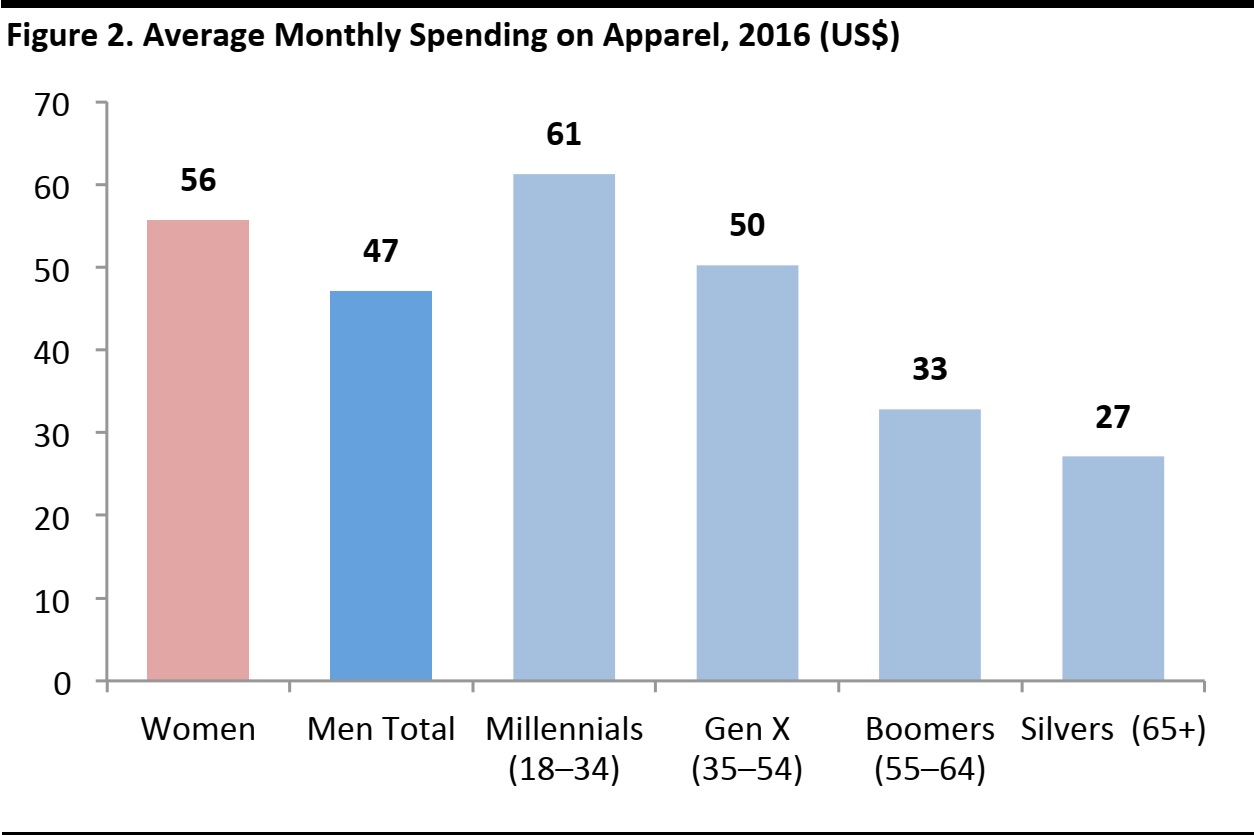

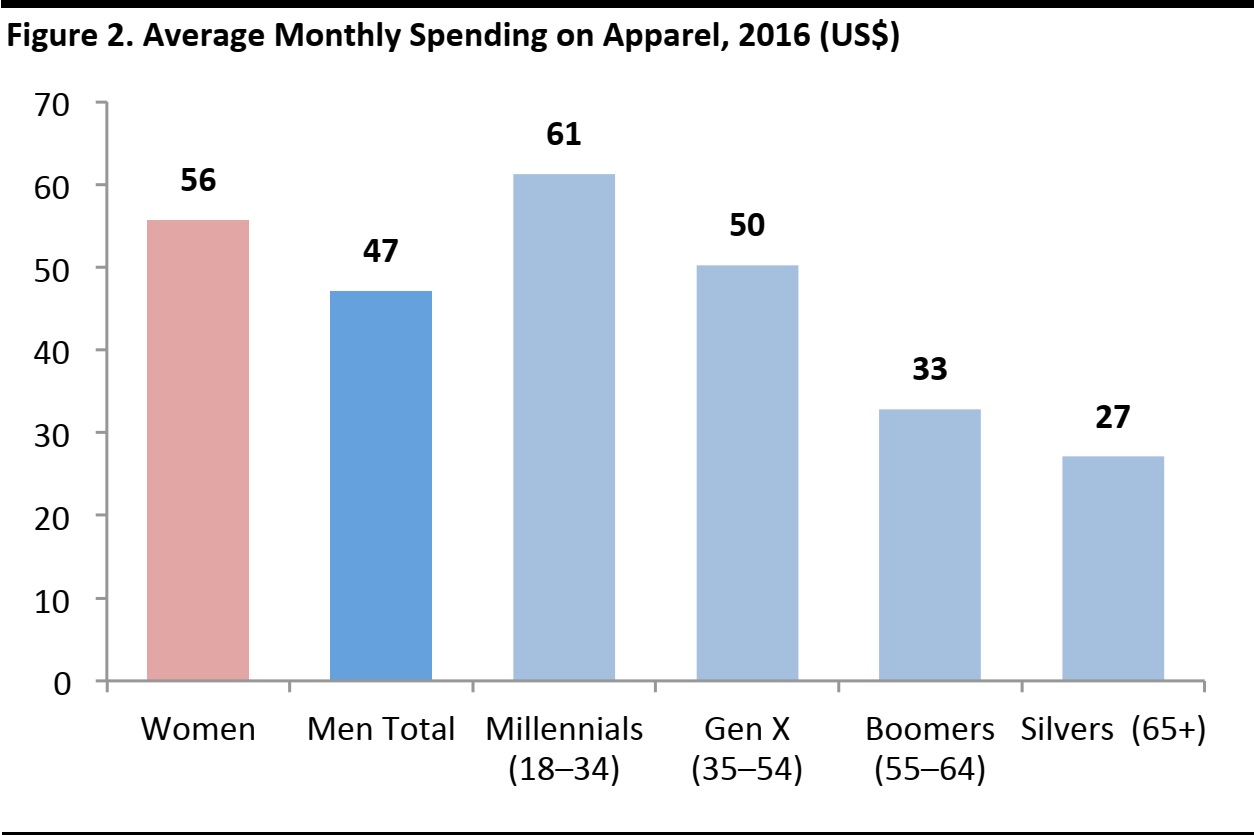

On average, men spend US$47 on apparel each month; less than women’s monthly spending of US$55. Younger men tend to spend more on apparel― millennials and Generation X spend an average of US$61 and US$50, respectively, each month. Boomers and Silvers spend less, at an average of US$33 and US$27 each month, respectively.

Sample Size: Men: N=3,373 (June, 2016); Women: N=3,651 (April, 2016)

Source: Euromonitor International

1. Male Consumers Purchase Menswear Most Often at Brick- and-Mortar Locations

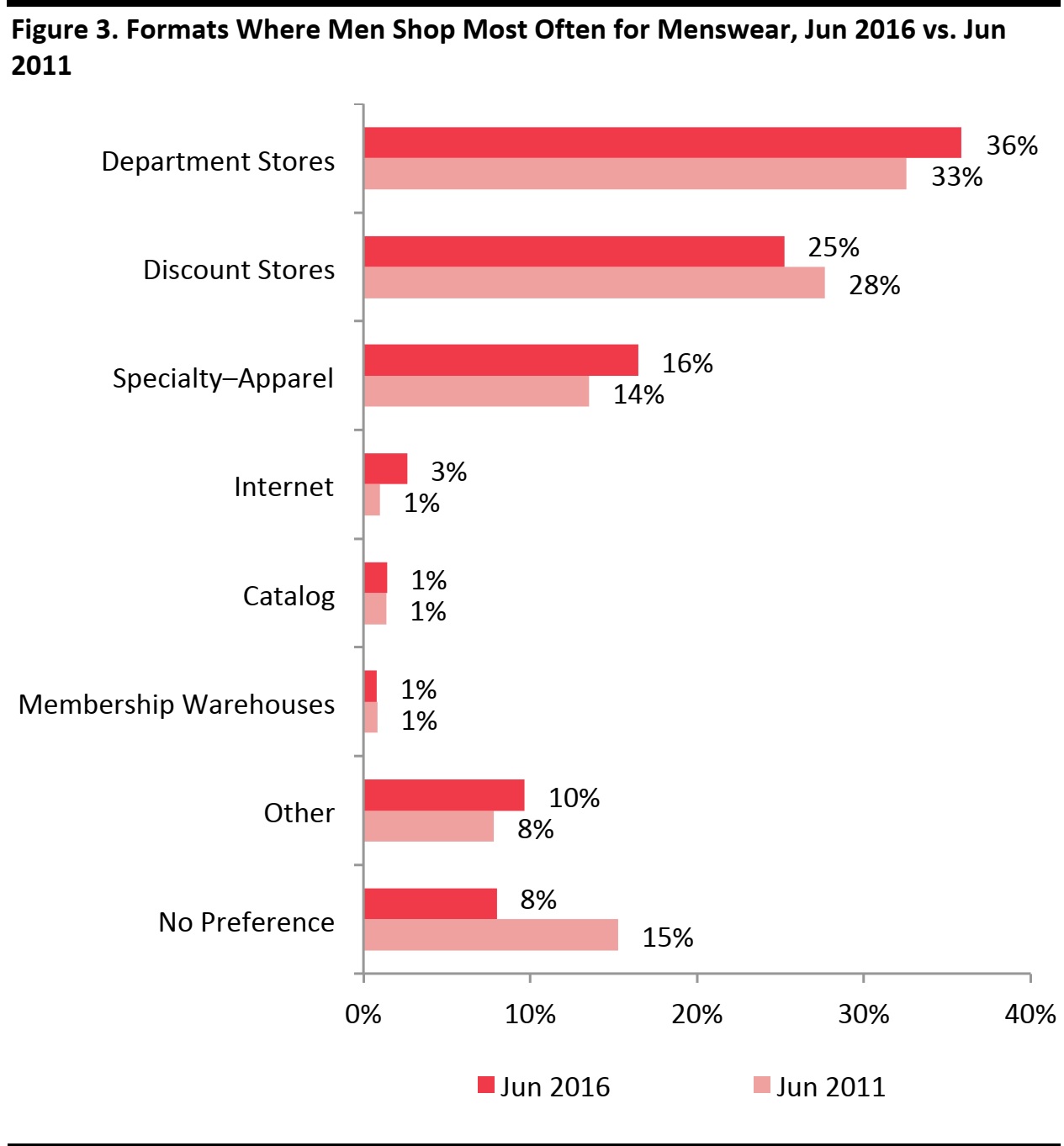

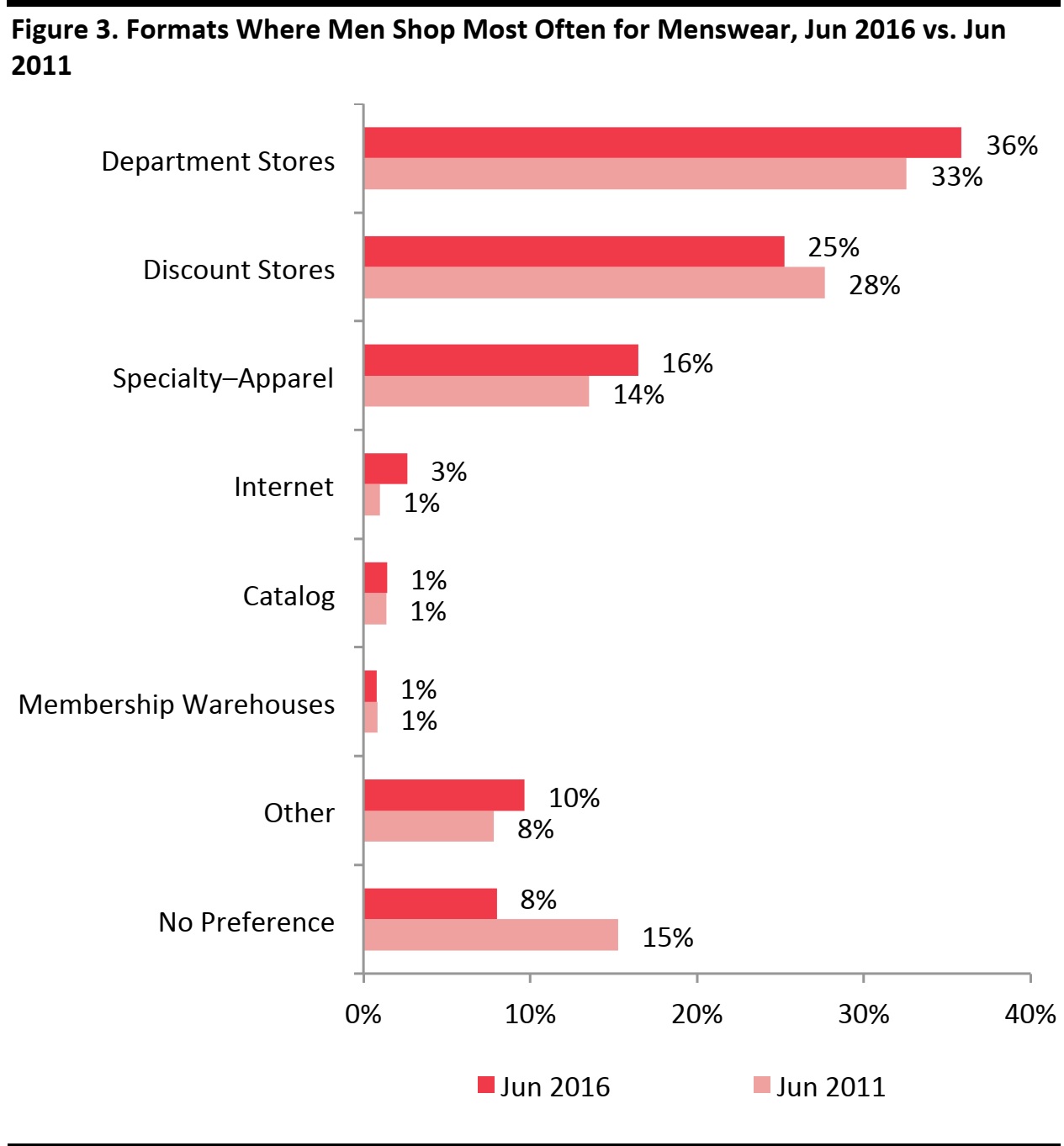

According to the Prosper monthly consumer survey conducted in June 2016, brick-and-mortar is the main channel for menswear purchases―78.3% of surveyed men buy menswear most often at physical stores, up 3.8 percentage points compared to five years ago. However, it is worth noting that those who have no preference dropped from 15.3% in June 2011, to 8.0% in June 2016.

Department stores, discount stores and specialty stores remain the top- three store formats where men buy menswear most often. However, the share of the respective store formats varies. Department stores remained the top store format, with its mind share increasing from 32.6% in June 2011, to 35.9% in June 2016. Specialty stores also saw an increase in mind share from 13.5% to 16.5% in the same period. In contrast, discount stores saw their mind share drop from 27.7% in June 2011, to 25.2% in June 2016.

Those who purchased menswear online most often remain a niche segment, up from 1.0% in June 2011, to 2.6% in June 2016.

Note: Target universe = Men aged 18+

Sample size: N=3,811 (Jun 2011); N=3,373 (Jun 2016)

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

2. The Majority of Male Consumers Have Purchased Some of Their Menswear Online

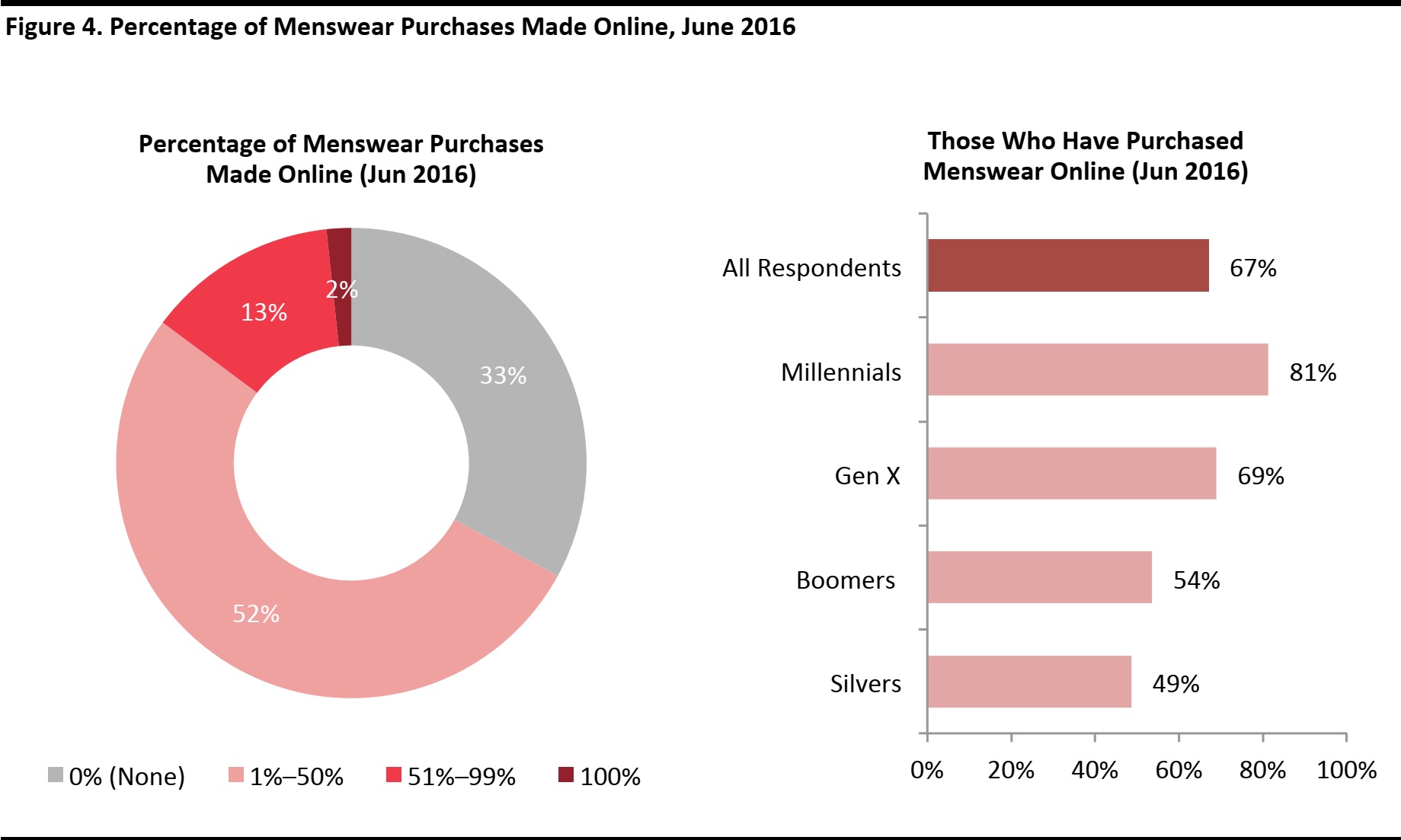

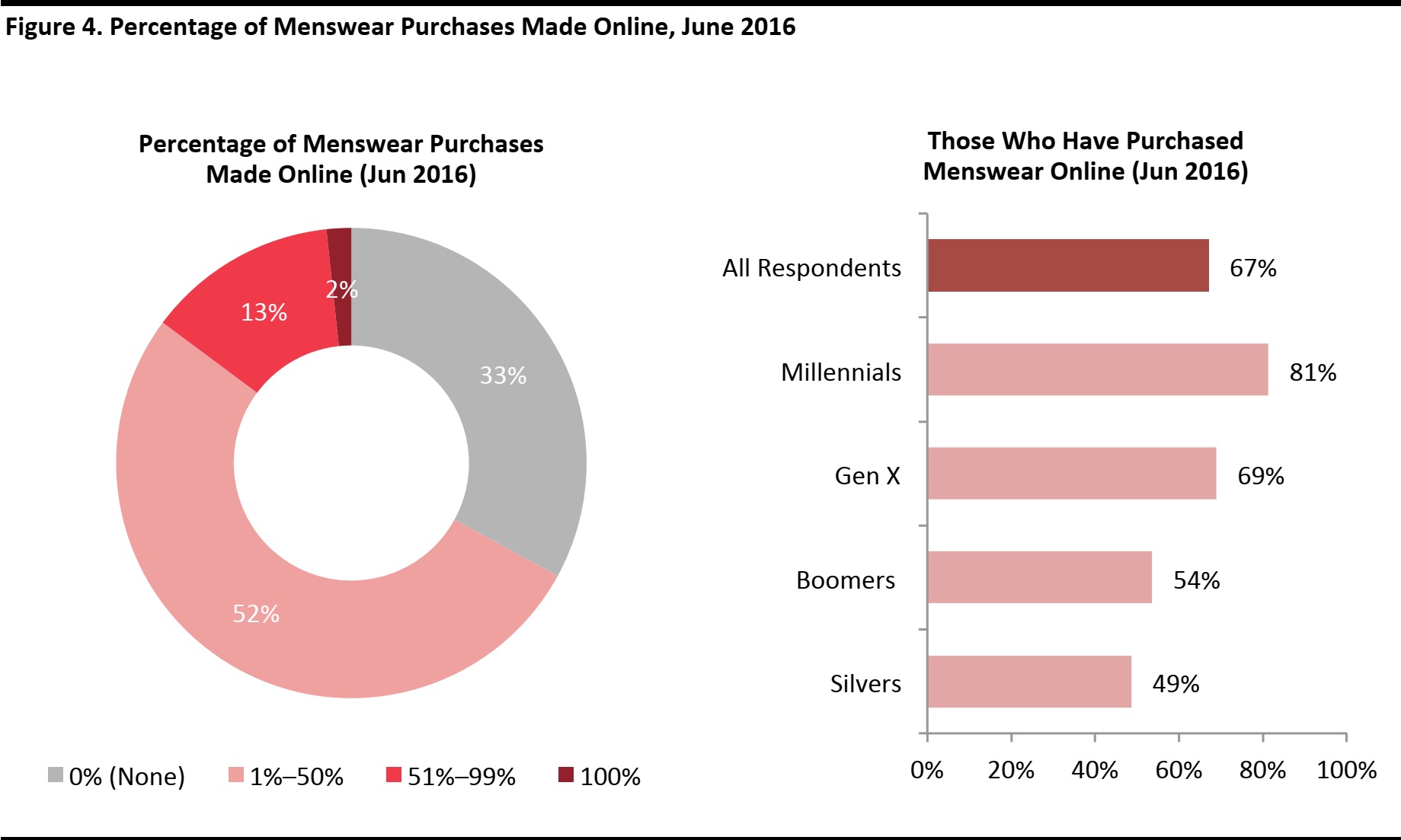

The majority of surveyed men have purchased menswear online, with 67.0% having done so in June 2016. Among all men, 14.8% have purchased more than half of their menswear online, and 1.7% purchased all of their clothing online. Those who buy no more than half of their menswear online form the majority of male consumers, at 52.2%.

Across the four demographic groups, 81.0% of surveyed millennials have purchased menswear online, followed by Gen X at 68.9% and Boomers at 54%. As mentioned in our report “

The Silver Wave—Understanding The Aging Consumer,” more Silver customers are shopping online. This is reflected in the Prosper Consumer survey, where close to half of the Silvers have bought menswear online.

Note: Target universe for Percentage Purchased Online = Men aged 18+

Sample size: N=3,373 (Jun 2016)

Source: Prosper Insights & Analytics

3. The Number of Amazon Menswear Customers has Doubled Over Five Years, But Only a Few Shop There Most Often

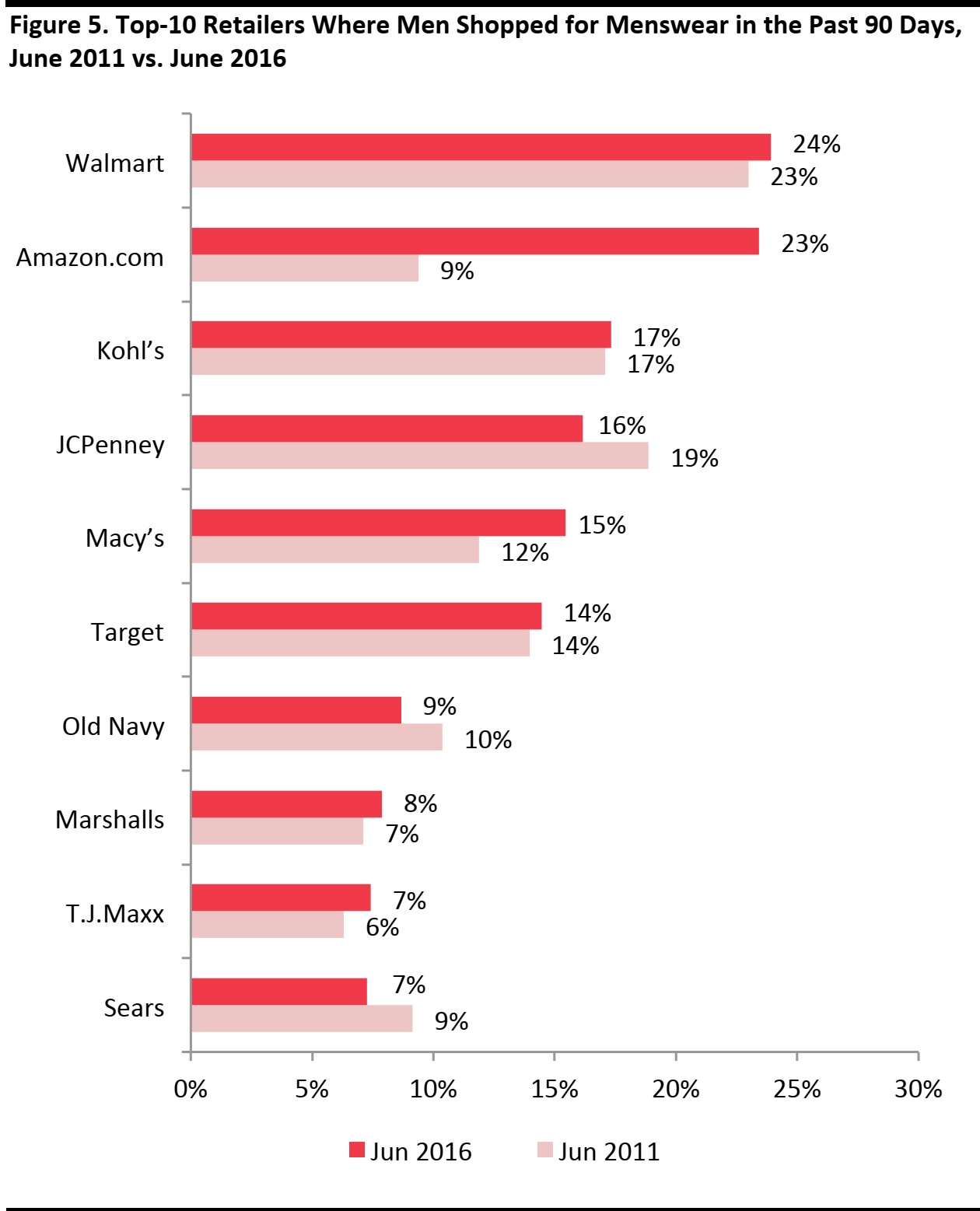

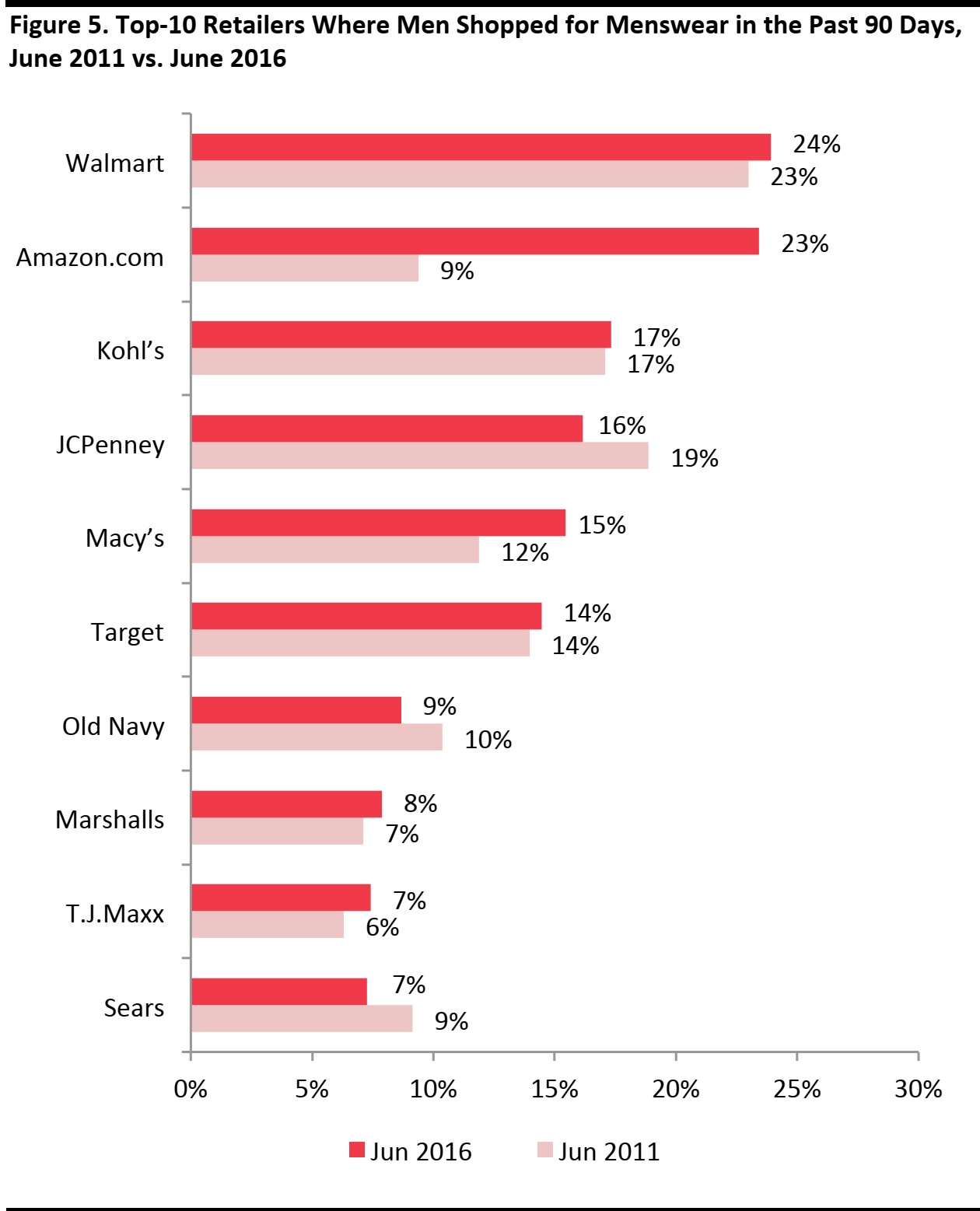

Among the top-10 retailers where men have shopped for menswear in the 90 days prior to June 2016, Walmart ranked first at 23.9%, followed by Amazon (23.4%), Kohl’s (17.3%), JCPenney (16.2%) and Macy’s (15.5%).

Amazon and Macy’s both saw an increase in the number of male menswear customers in June 2016 compared with June 2011―Amazon had the highest growth of 14.0 percentage points to reach 23.4% in June 2016. Macy’s saw modest growth of 3.6 percentage points, reaching 15.5% in June 2016.

Walmart remains the top retailer in this category, where 23.9% of surveyed men visited the store to purchase menswear in the three months prior to June 2016, up from 23.0% in June 2011, however, such an increase is not statistically significant.

Note: Target universe: Men aged 18+

Sample size: N=3,811 (Jun 2011); N=3,373 (Jun 2016)

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

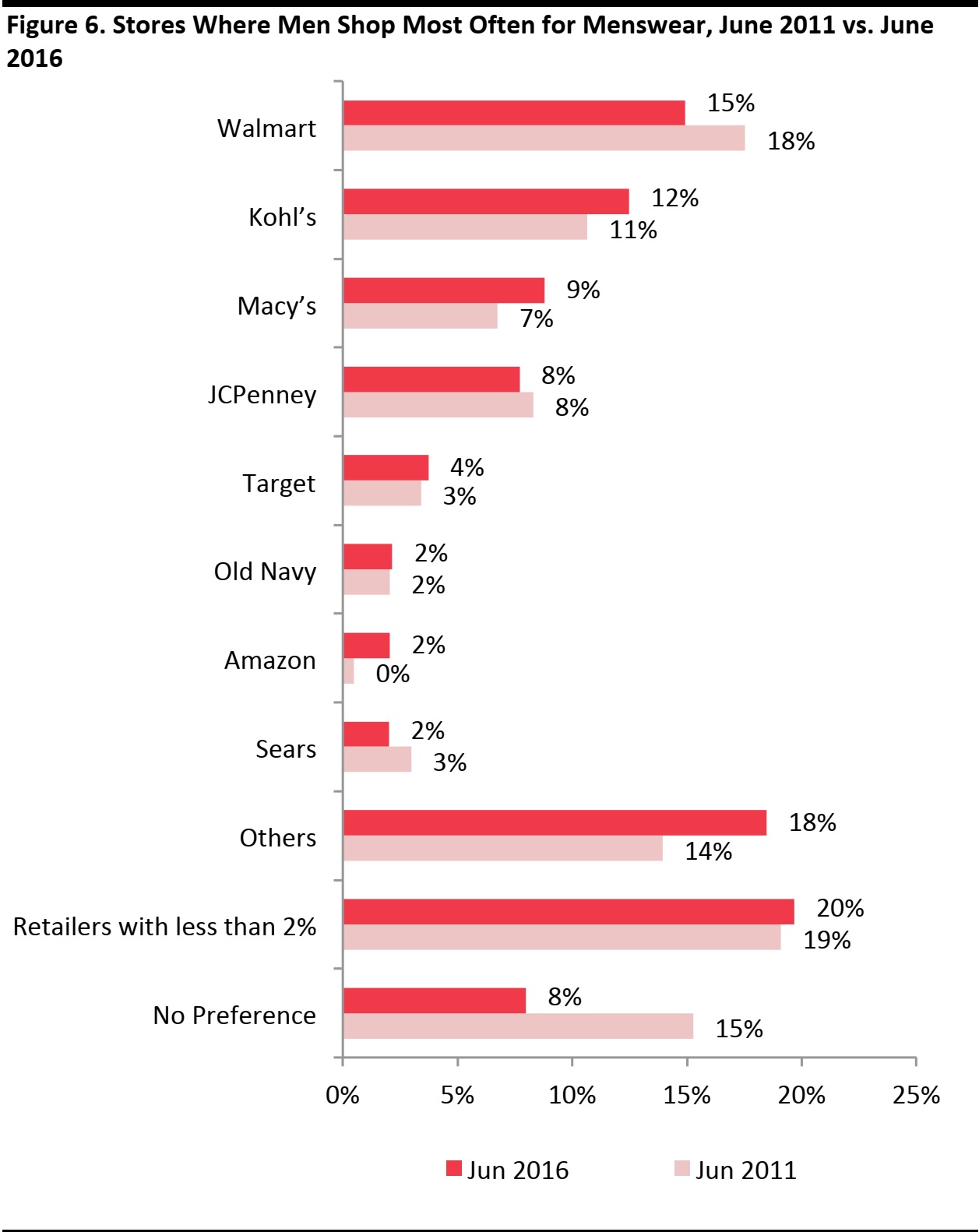

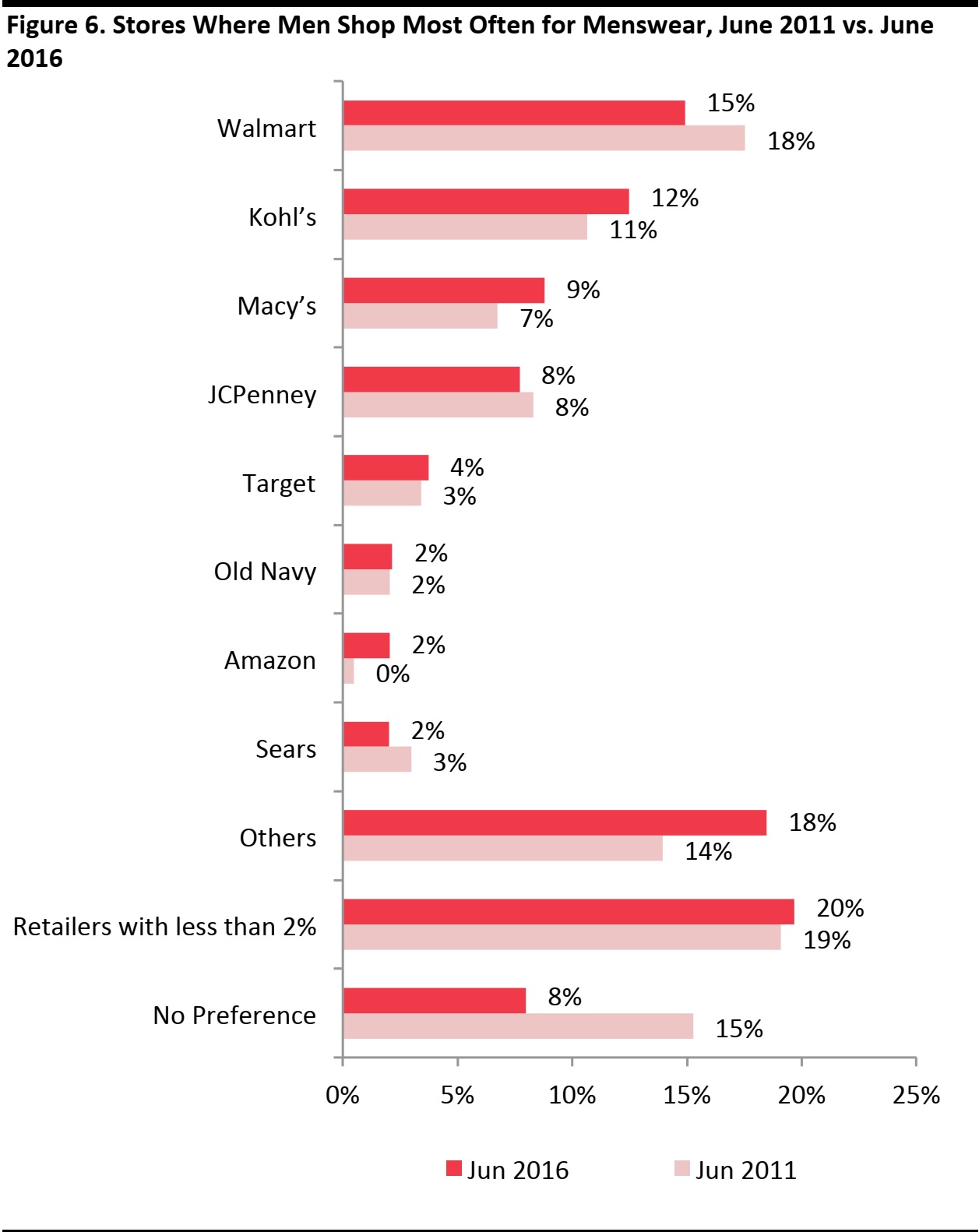

The top-five retailers where surveyed men shopped most often for menswear were either discount stores or department stores, including Walmart (14.9%), Kohl’s (12.5%), Macy’s (8.8%) and JCPenney (7.7%) and Target (3.7%). The combined share of the top-five retailer brands was 43.9%, indicating a rather fragmented market.

Walmart remained the top retailer by this measurement, but its share has decreased from 18% in June 2011, to 14.9% in June 2016. While those who shopped at Walmart for menswear in the past 90 days has seen little change compared with five years ago, this may indicate the retailer is losing some of its loyal customers in this category.

Close to a quarter of surveyed male consumers have purchased menswear at Amazon, but only a few shopped at Amazon most often, with 2.1% naming Amazon as the go-to place for menswear in June 2016, up from 0.5% in June 2011.

Note: Target universe = Men aged 18+

Sample size: N=3,811 (Jun 2011); N=3,373 (Jun 2016)

Source: Prosper Insights & Analytics, Monthly Consumer Survey

4. Amazon, Kohl’s and Walmart Appeal to Price-Sensitive Customers, while Macy’s has the Edge on Quality and Style

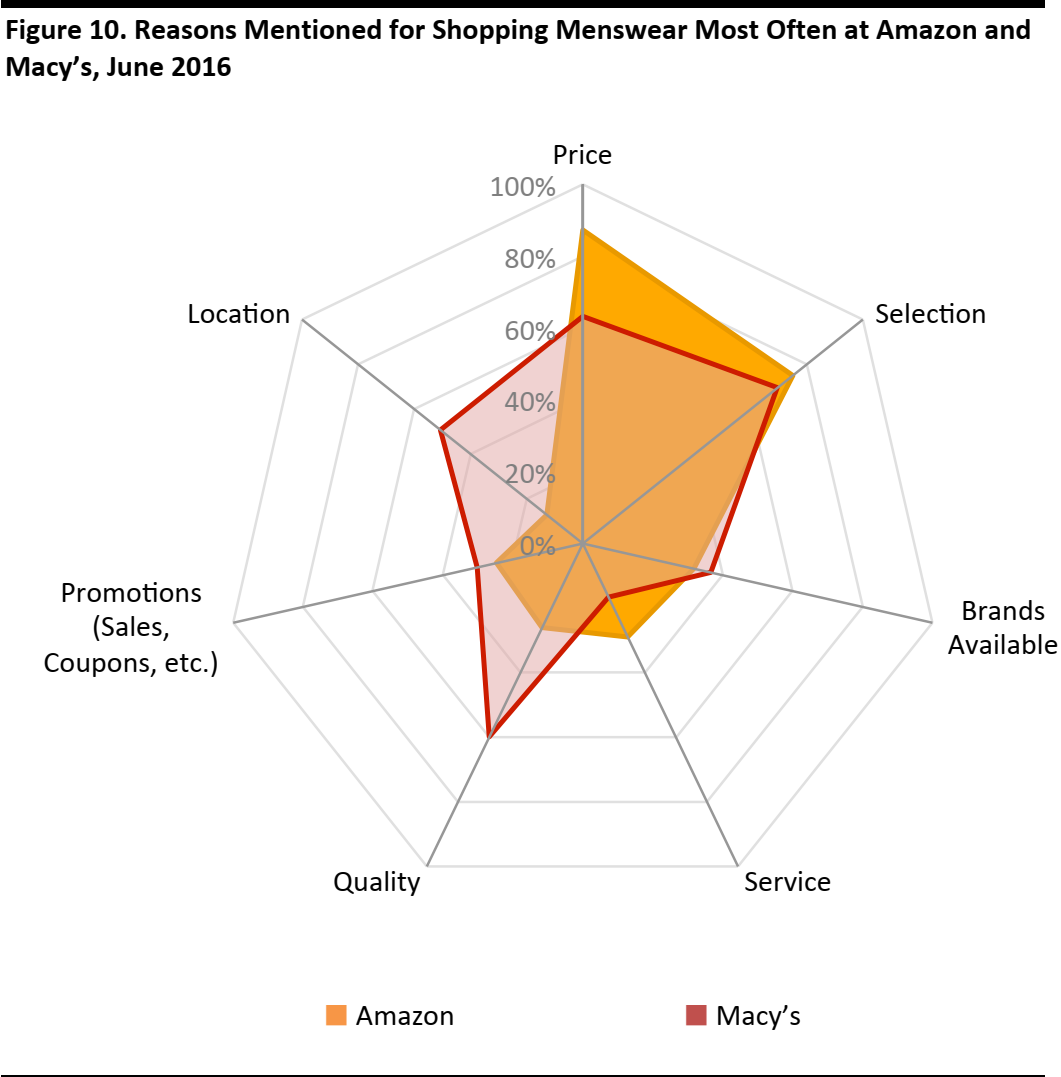

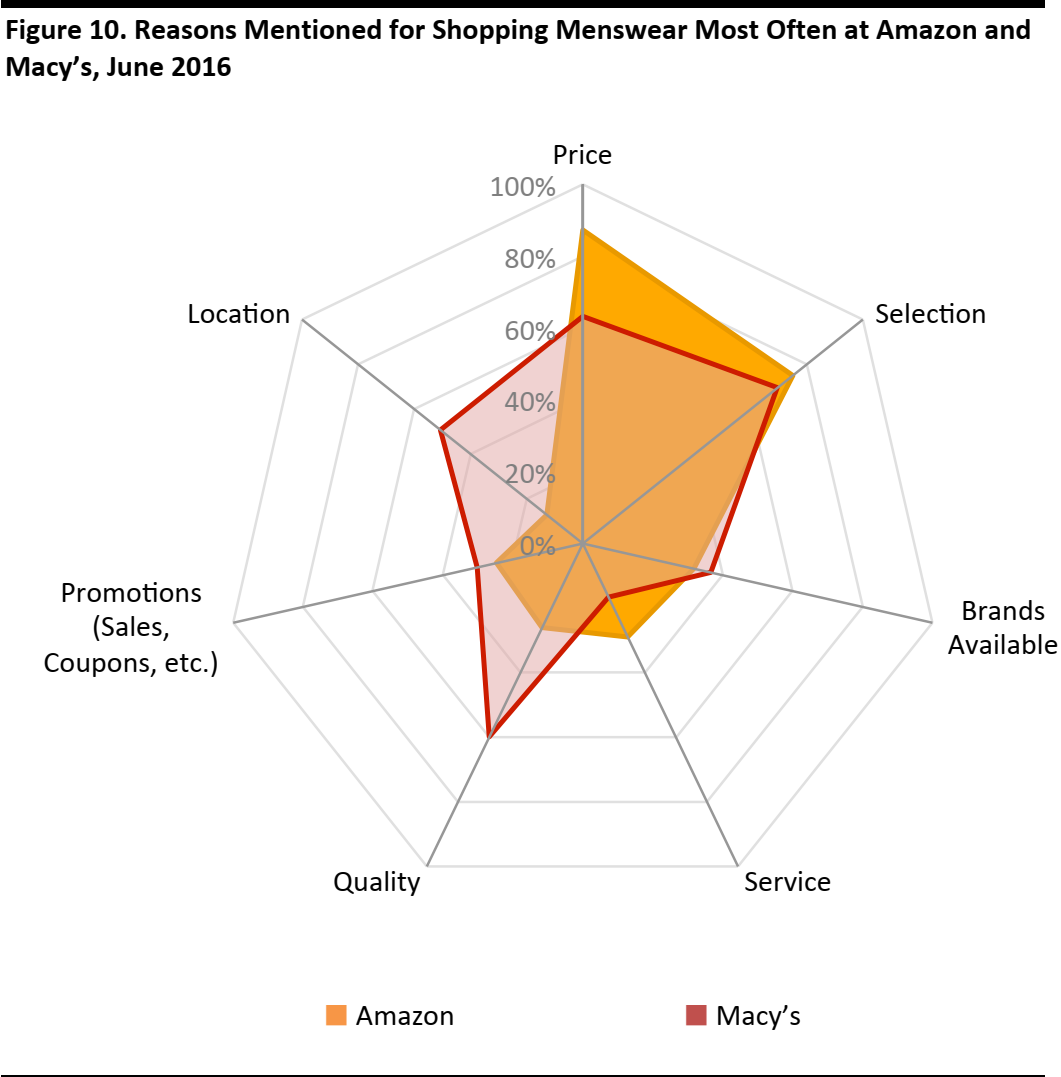

We looked at the reasons for shopping menswear most often at the respective retailers, as mentioned by their customers. In particular, we compared Amazon with the three other leading retailers, Walmart, Kohl’s and Macy’s.

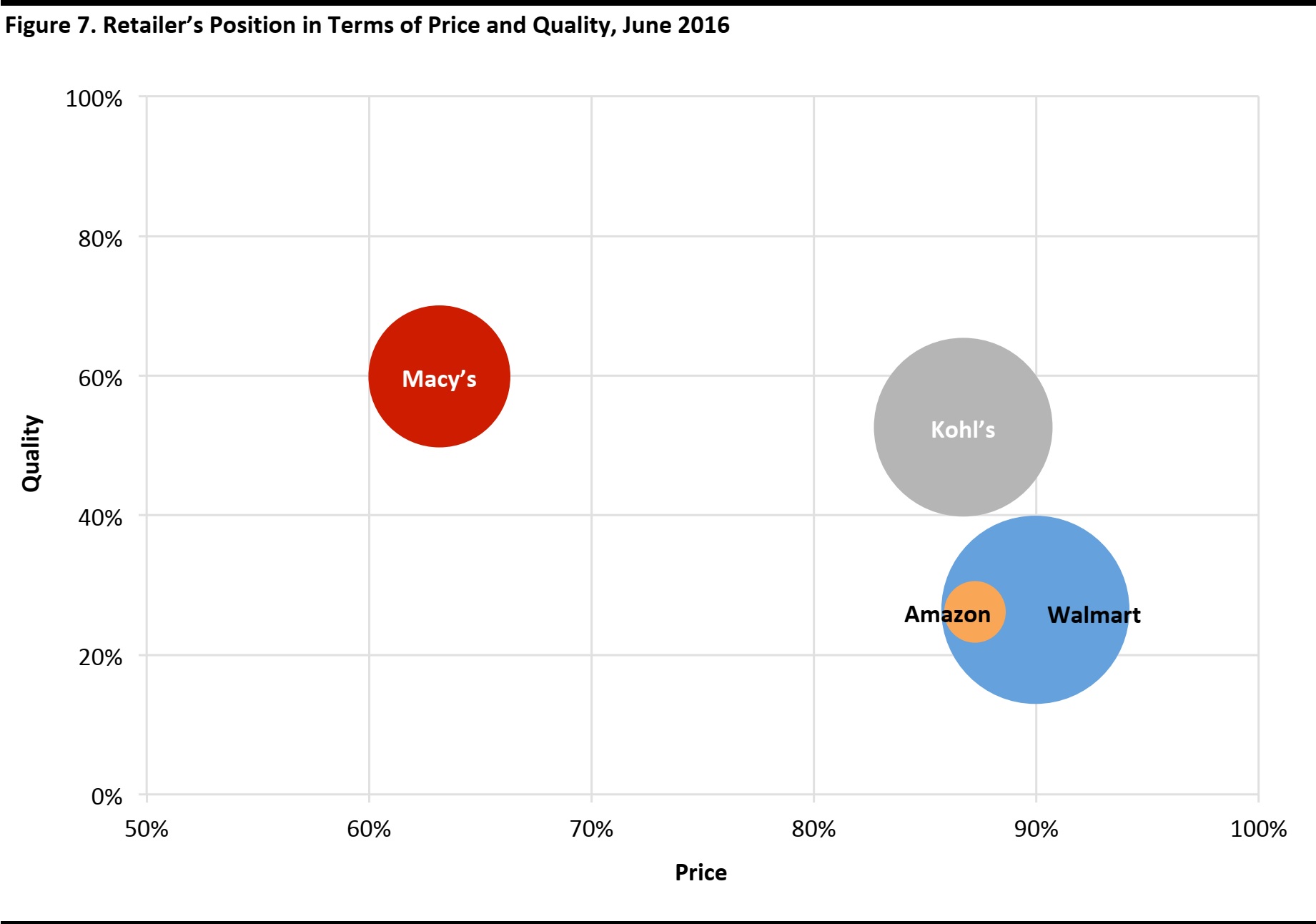

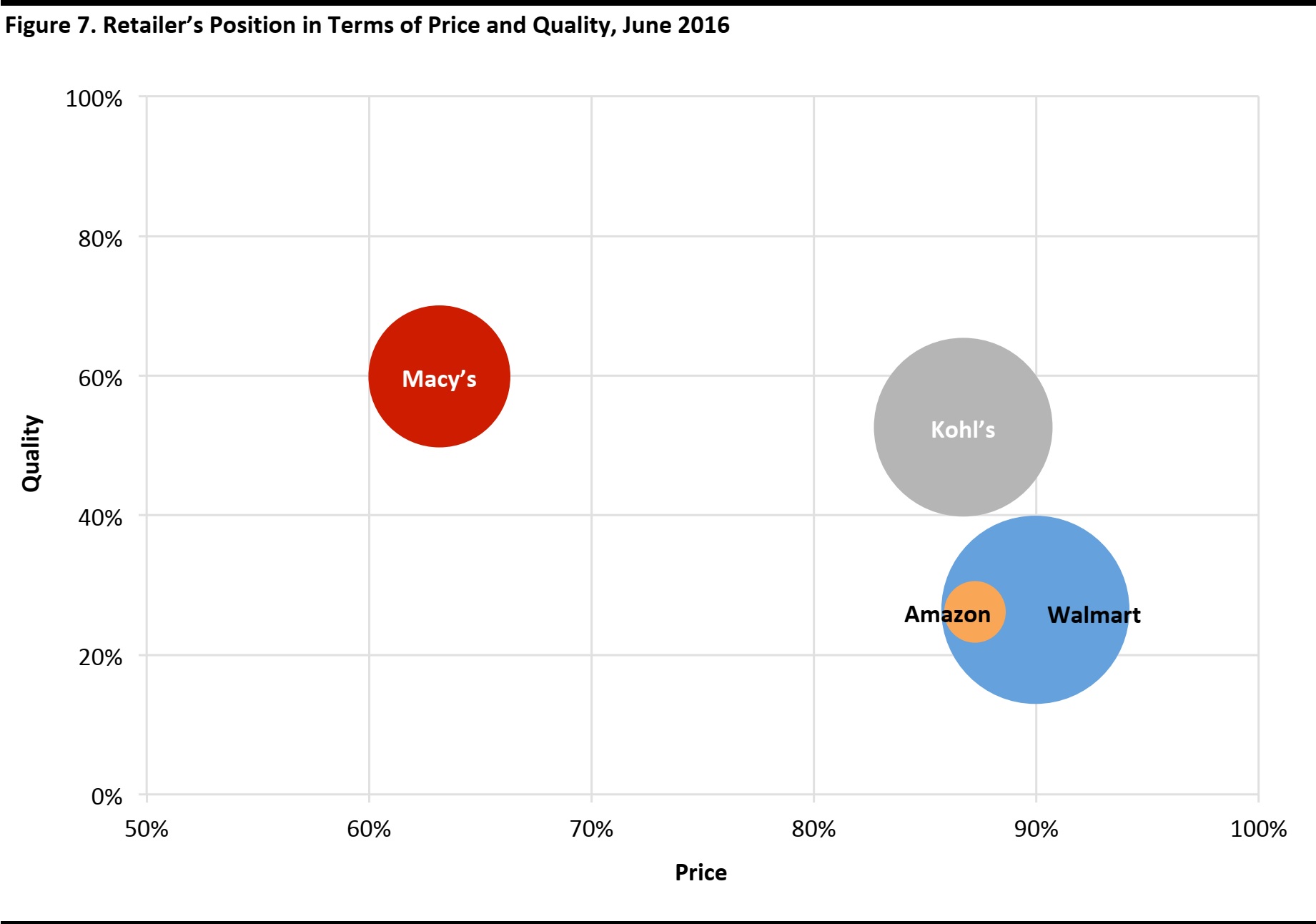

Price, selection and quality are the top-three most-mentioned reasons across all retailers’ customers. We took a closer look into price and quality by using the following matrix, where Amazon is similarly positioned as Kohl’s and Walmart. As for Macy’s, relatively fewer customers mentioned price as a reason to shop for menswear there, instead, most mentioned quality.

Apart from price and quality, we compared Amazon with each of the top- three retailers, and identified the relative strength and positioning of the respective retailers compared with Amazon.

* Size of bubble indicates retailer’s share as most often shop for menswear

Note: Target universe = Men aged 18+

Sample size: N=3,373 (Jun 2016)

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

Walmart: Captures Price-Sensitive Customers

Walmart: Captures Price-Sensitive Customers

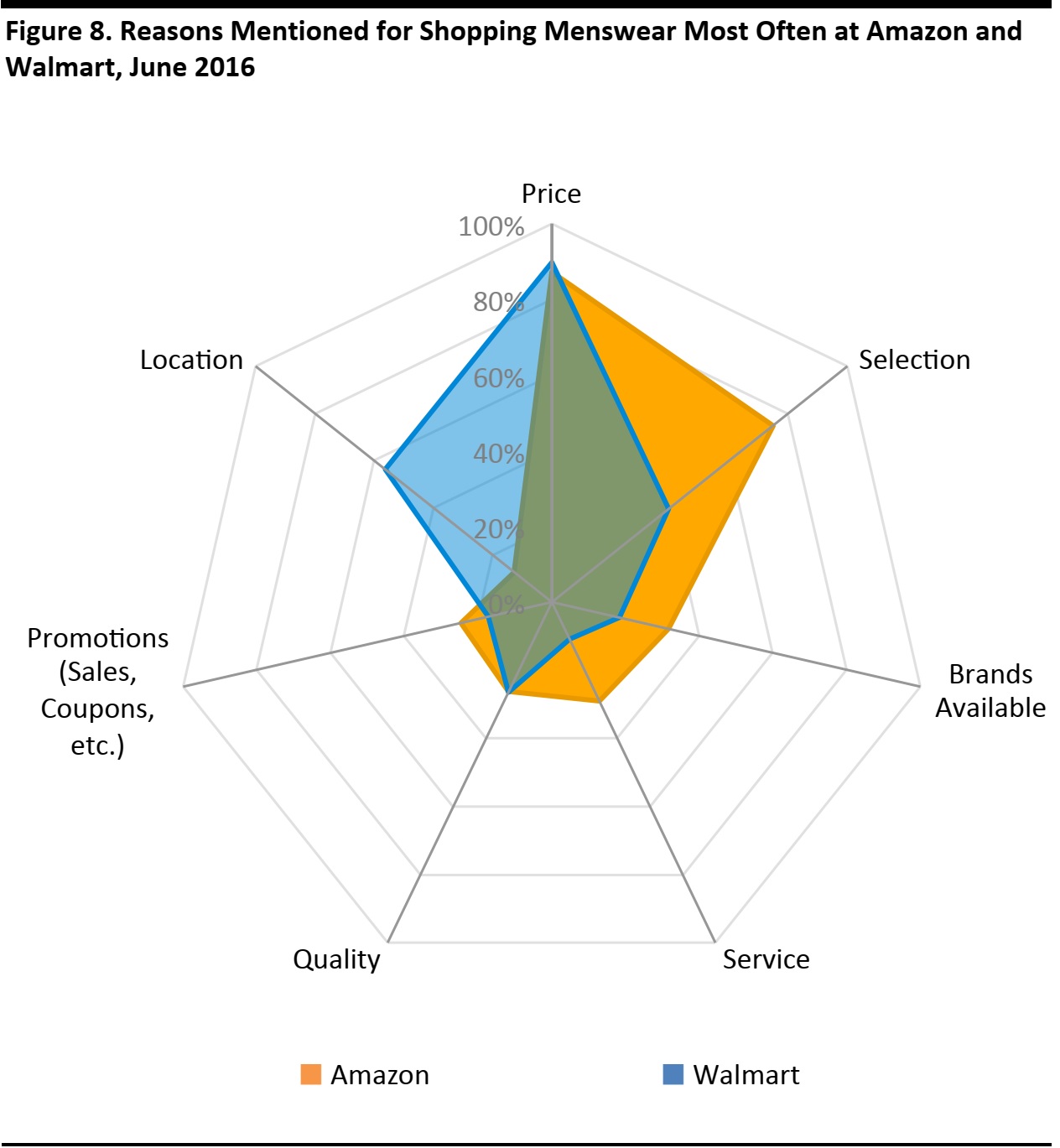

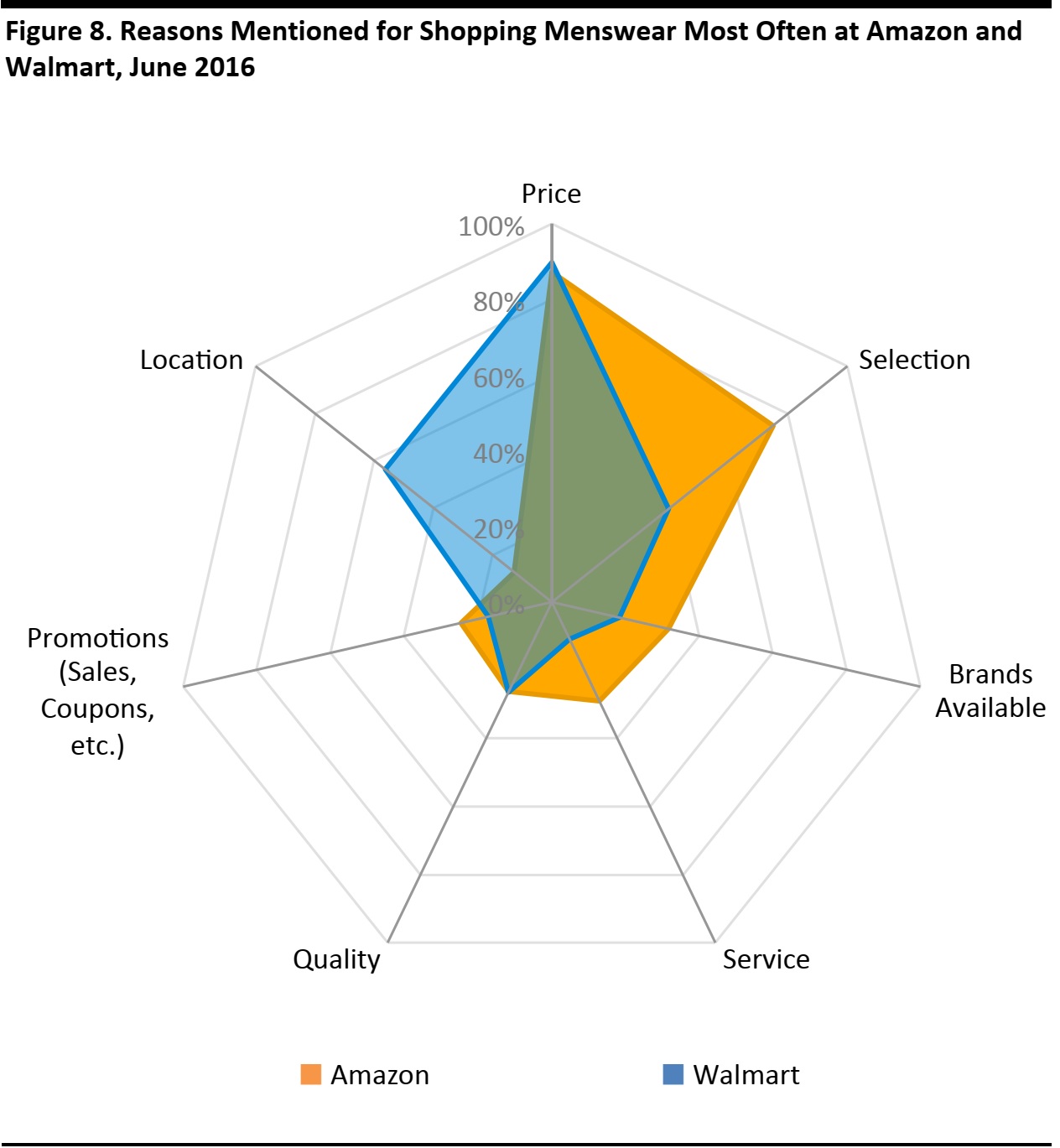

Amazon and Walmart both capture price-sensitive consumers, with price the most-mentioned reason for the two retailers’ loyal customers, at 87.2% and 90.0%, respectively. Both retail giants have been offering the most competitive pricing among US retailers, and the menswear category is no exception.

With over 5,200 retail outlets throughout the US, location is a natural advantage possessed by Walmart, which was mentioned by 56.4% of its customers, higher than Amazon at 12.7%. However, when compared with Amazon on other attributes, more Amazon customers mentioned selection and brands available as the reason to shop most often there, at 74.9% and 31.7%, respectively. This also reflected Amazon’s effort in these areas, especially in its selection, where it launched seven in-house clothing brands in February 2016.

Note: Target universe = Men aged 18+

Sample size: N=69 (Amazon); N=504 (Walmart)

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

Kohl’s: Promotions Plays an Important Role in Retaining its Customers

Kohl’s: Promotions Plays an Important Role in Retaining its Customers

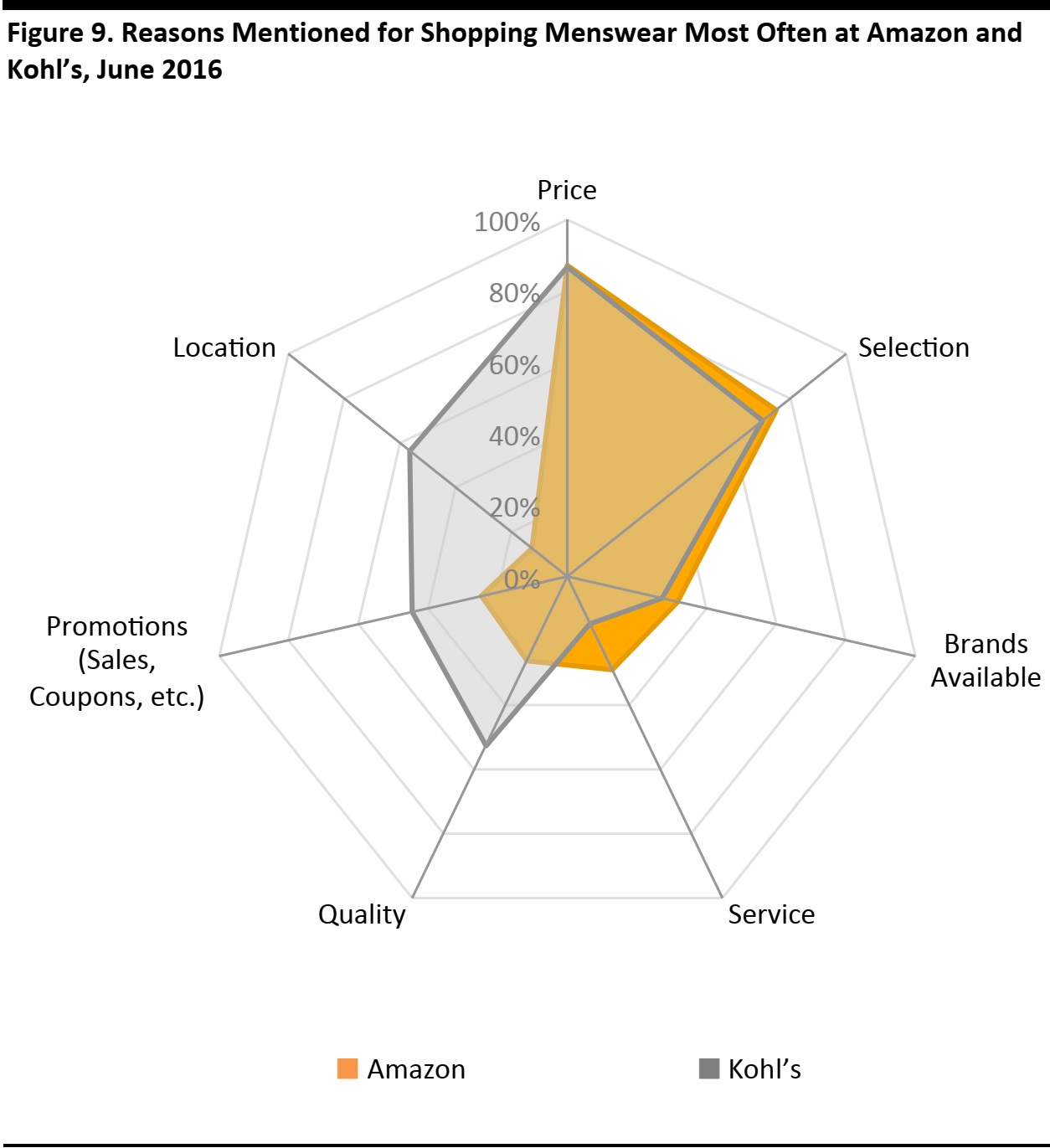

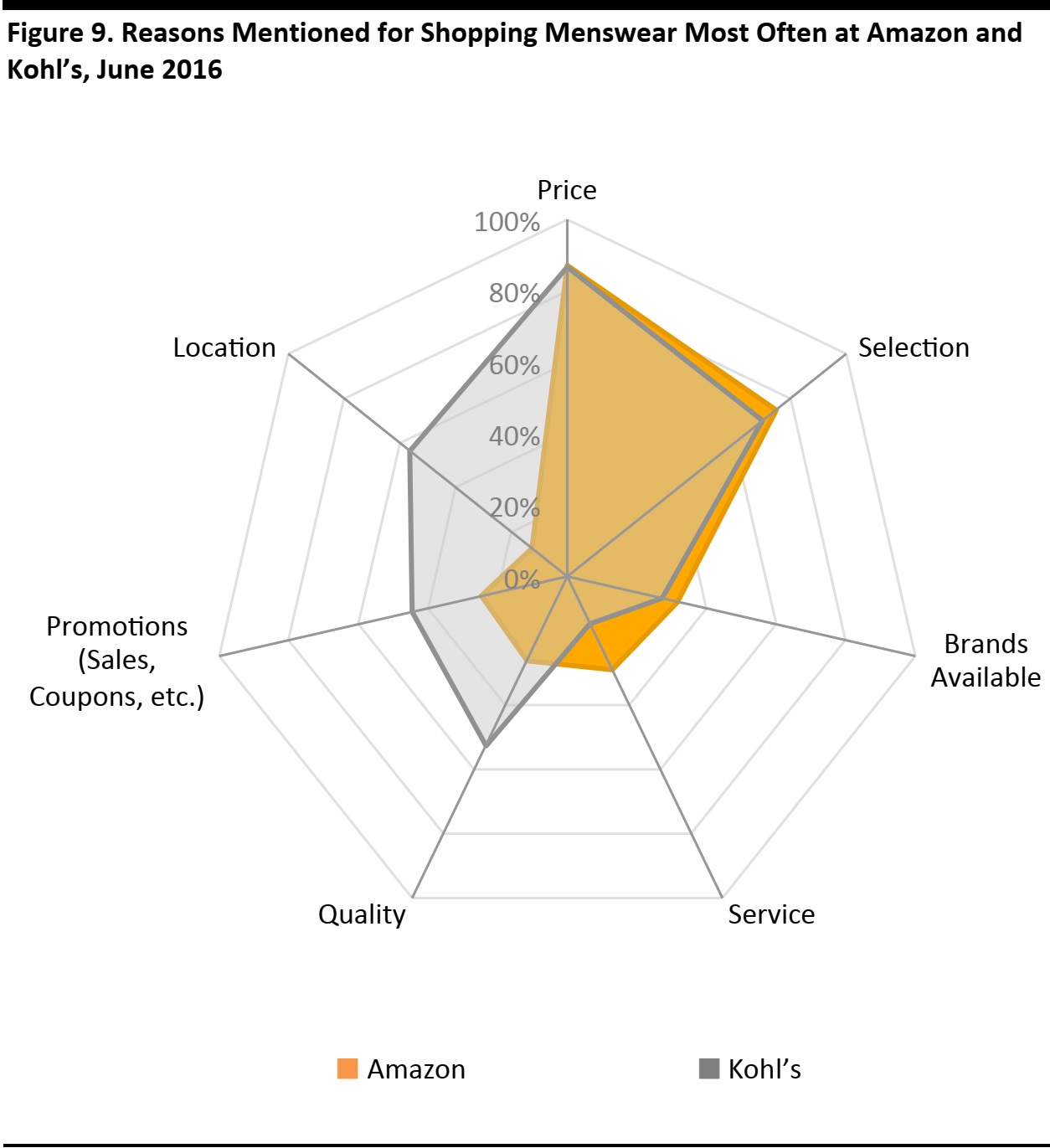

Price, mentioned by 86.7% of its customers, is also the top reason to shop menswear at Kohl’s, and this figure is close to that of Amazon and Walmart.

On a number of key metrics, Kohl’s is comparable with Amazon, and indeed menswear has been Kohl’s strongest category for three consecutive quarters, particularly active and tailored dress clothing, which was mentioned during Kohl’s 3Q 2017 earnings call. More Kohl’s customers mentioned reasons for shopping there such as location and quality, which were at 56.5% and 52.6%, respectively, than did Amazon’s customers at 12.7% and 26.1%, respectively.

Compared with other top menswear retailers, promotions such as sales and coupons play an important role in capturing Kohl’s loyal customers. Even though promotions was only the fifth-most-mentioned reason among Kohl’s customers, at 44.5%, this was the highest figure among all top retailers. This indicates that the conventional pricing strategy of using promotions and coupons remains an important and effective tool for the retailer.

Note: Target universe = Men aged 18+

Sample size: N=69 (Amazon); N=420 (Kohl’s)

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

Macy’s: An Edge on Quality and Style

Macy’s: An Edge on Quality and Style

Selection is the most popular reason to shop menswear at Macy’s, as mentioned by 69.4% of its customers. Unlike at the other three top retailers, price is not the most mentioned reason to shop at Macy’s, which was at 63.2%.

More Macy’s customers mentioned reasons such as brands available and quality, at 36.7% and 59.9%, respectively, than did Amazon’s customers, at 31.7% and 26.1%, respectively. This indicates how different Macy’s customer base is, where selection and quality is as important as price for them.

Note: Target universe = Men aged 18+

Sample size: N=69 (Amazon); N=297 (Macy’s)

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

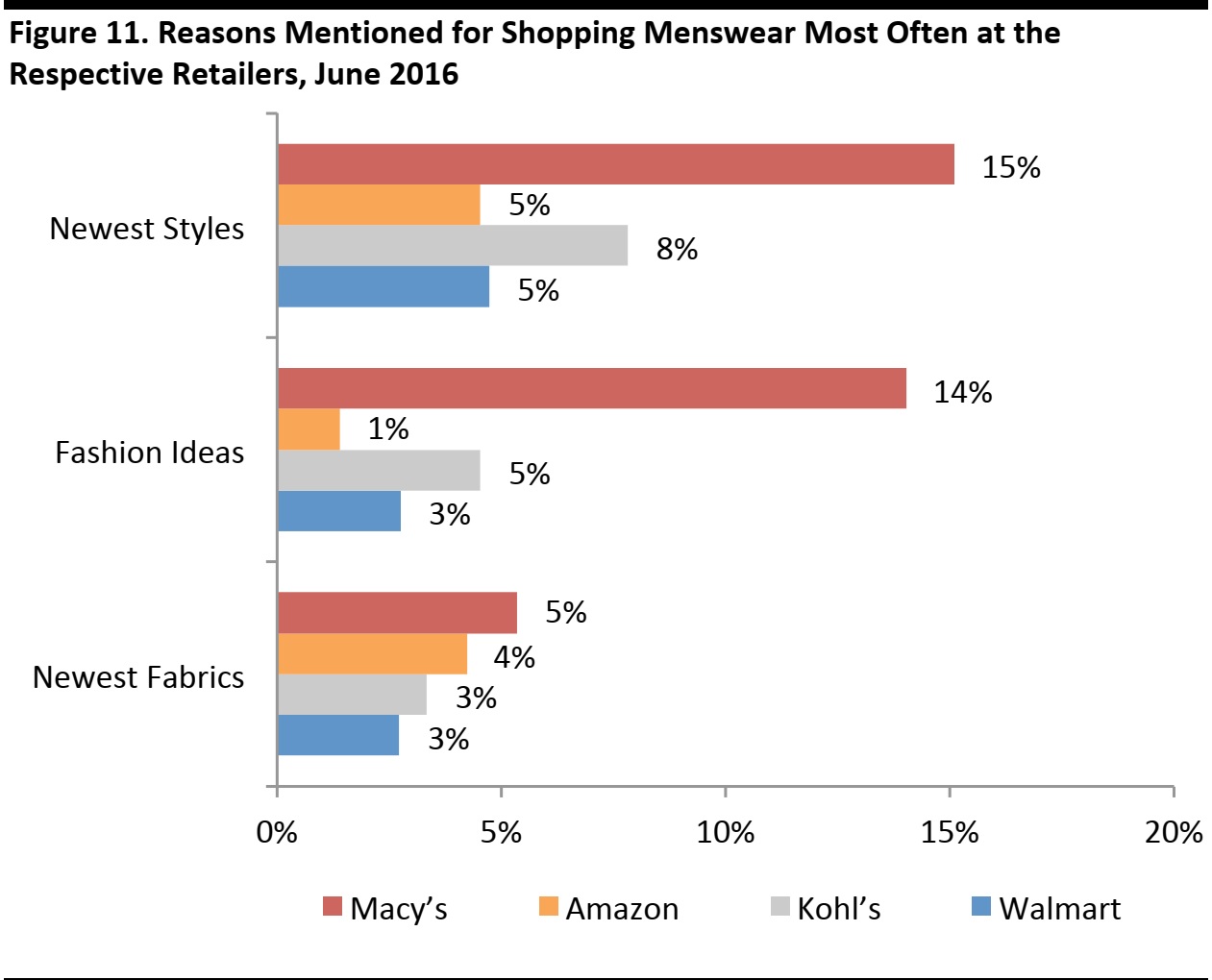

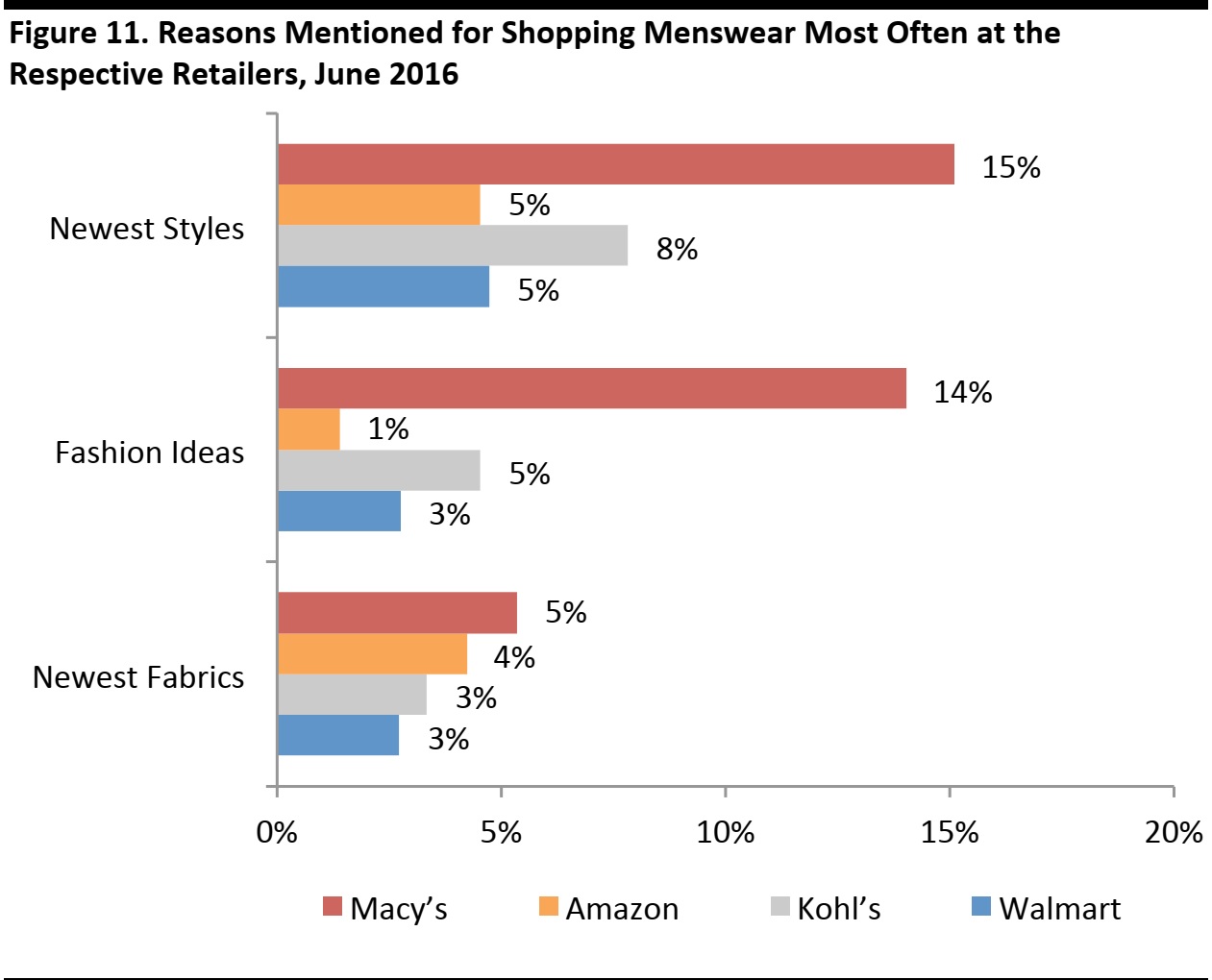

In addition, more Macy’s customers look for attributes related to the quality of selection, such as newest styles and fashion ideas, which were at 15.1% and 14.0%, respectively, than did Amazon’s customers, at 4.5% and 1.4%, respectively.

However, it is worth noting that Amazon has already begun pushing to the high-end fashion market. Apart from launching seven in-house clothing brands in February 2016, it has already featured a number of high-end fashion brands like Calvin Klein, Emporio Armani, Ralph Lauren and Versace.

Note: Target universe = Men aged 18+

Sample size: N=3,373 (Jun 2016)

Source: Prosper Insights & Analytics, Monthly Consumer Survey

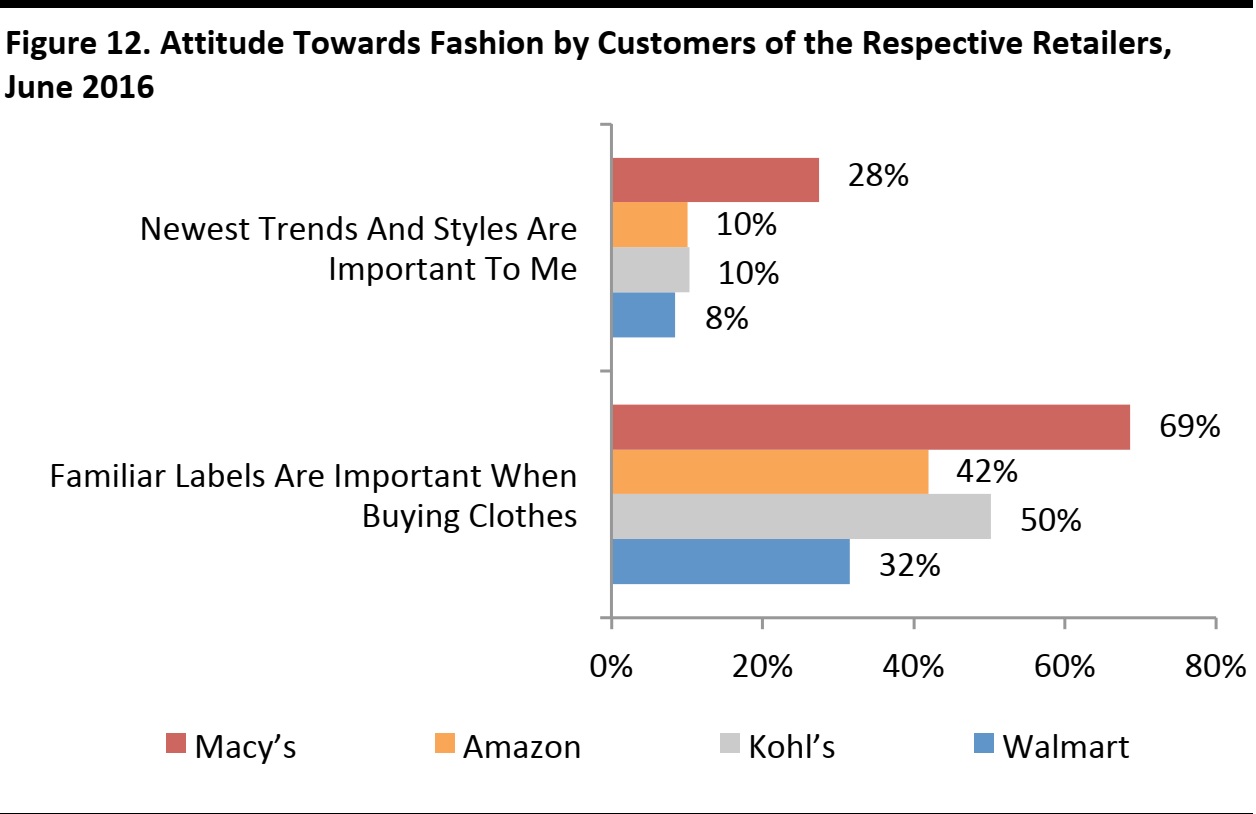

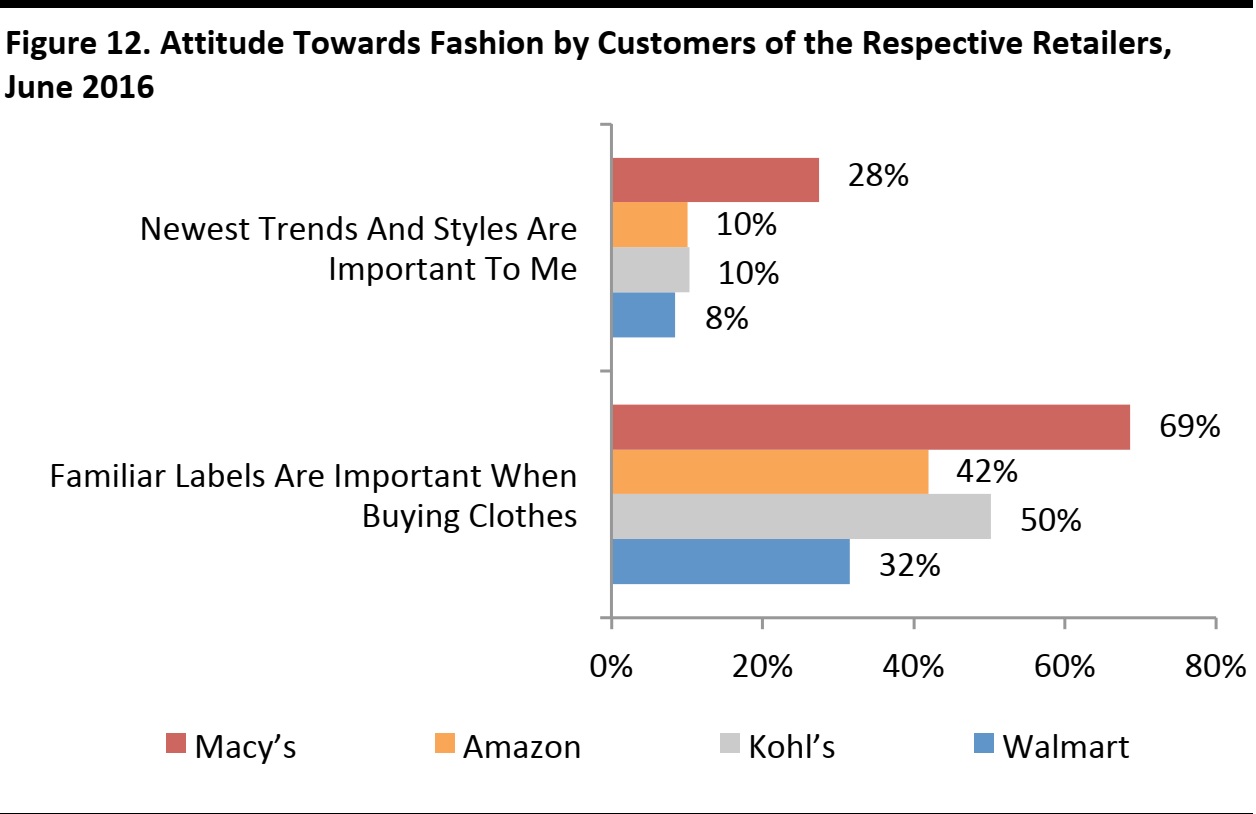

The difference in Macy’s customer base can be observed by its customers’ attitude towards fashion as well. When compared with customers of other retailers, more Macy’s customers stated that the newest trends and styles are important to them, mentioned by 27.5% of customers. In addition, 68.6% of Macy’s customers stated that familiar labels are important when buying clothes, higher than that of customers of other retailers.

Note: Target universe = Men aged 18+

Sample size: N=3,373 (Jun 2016)

Source: Prosper Insights & Analytics, Monthly Consumer Survey

About the Amazon Shopper Intelligence service

The Amazon Shopper Intelligence service combines Fung Global Retail & Technology analysis and commentary with input on thousands of US shoppers from Prosper. It includes:

- Over 10 years of data on Amazon shoppers as well as on leading retailers’ shoppers

- Prosper Shopper Preference Share (indicates how Amazon is growing as a preferred retailer for 11 different merchandise categories, and the reasons why)

- Retail positioning maps (plot retailers and their competitors based on the percentage of their shoppers who shop there for particular reasons)

- Net promoter scores

- Key demographics

Walmart: Captures Price-Sensitive Customers

Walmart: Captures Price-Sensitive Customers

Kohl’s: Promotions Plays an Important Role in Retaining its Customers

Kohl’s: Promotions Plays an Important Role in Retaining its Customers

Macy’s: An Edge on Quality and Style

Macy’s: An Edge on Quality and Style