DIpil Das

We continue our weekly coverage of the US-China tariff issues with a focus on recent developments in furniture.

Recent Development of US-China Trade Tensions

On June 10, US President Trump concluded that the tariff threat against Mexico had worked, emboldening him to claim “the China deal’s going to work out” in an interview on CNBC.

Trump has recently threatened to impose another round of tariffs on $300 billion worth of Chinese goods if a meeting with China’s leader Xi Jinping does not happen at the G20 summit in Japan this month. Chinese Foreign Ministry spokesman Geng Shuang said Beijing has noted the remarks and said “China doesn’t want a trade war, but we are not afraid of fighting it.” China have also been relatively quiet on the prospects of future talks.

Impact on Furniture

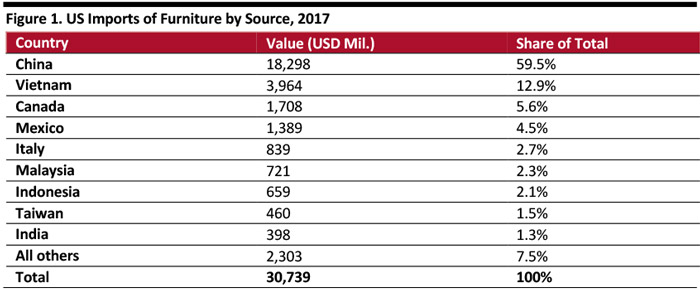

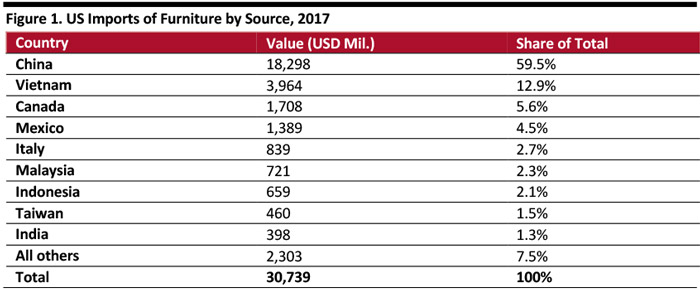

Although many countries export furniture to the US, China is dominant: China was the source of 59.5% of US furniture imports in 2017, up 19.3 percentage points from 2002 and with value growth from $5.4 billion to $18.3 billion. Aside from China, only Vietnam increased furniture exports to the US significantly, but it’s $3.96 billion in exports pales in comparison to China. Imports from Canada plummeted from 18.3% of the US total in 2002 to just 5.6% in 2017.

In short: The US depends on China to supply furniture, that dependence has grown dramatically in recent years and there are few other viable sources to fill the gap.

In 2018, the US imported $5.7 billion in wood furniture, $5.3 billion in upholstered furniture, $7.2 billion in metal and other furniture and almost $1 billion in mattresses from China, all for residential use, according to investment banking and advisory firm Mann, Armistead & Epperson.

[caption id="attachment_90575" align="aligncenter" width="700"] Source: HomeFurnishingsBusiness[/caption]

According to curbed.com, many fabricators, furniture manufacturers and designers say tariffs are an added pressure on the value chain: A $1 increase in production costs usually leads to a $4 to $6 increase in retail price. So, an extra 10% tariff on a product that costs $50 to make would lead to a retail price that’s $20 or $30 more. David French, the senior vice president of government relations at the National Retail Federation, tells Fortune, “we did a study on the impact of 25% tariffs on two segments, travel goods and furniture, and found that consumers would pay $6 billion more if they go into effect.”

Furniture retailers had been so far unwilling to raise prices to recover the tariff increase, but many are now saying they will:

Source: HomeFurnishingsBusiness[/caption]

According to curbed.com, many fabricators, furniture manufacturers and designers say tariffs are an added pressure on the value chain: A $1 increase in production costs usually leads to a $4 to $6 increase in retail price. So, an extra 10% tariff on a product that costs $50 to make would lead to a retail price that’s $20 or $30 more. David French, the senior vice president of government relations at the National Retail Federation, tells Fortune, “we did a study on the impact of 25% tariffs on two segments, travel goods and furniture, and found that consumers would pay $6 billion more if they go into effect.”

Furniture retailers had been so far unwilling to raise prices to recover the tariff increase, but many are now saying they will:

Source: HomeFurnishingsBusiness[/caption]

According to curbed.com, many fabricators, furniture manufacturers and designers say tariffs are an added pressure on the value chain: A $1 increase in production costs usually leads to a $4 to $6 increase in retail price. So, an extra 10% tariff on a product that costs $50 to make would lead to a retail price that’s $20 or $30 more. David French, the senior vice president of government relations at the National Retail Federation, tells Fortune, “we did a study on the impact of 25% tariffs on two segments, travel goods and furniture, and found that consumers would pay $6 billion more if they go into effect.”

Furniture retailers had been so far unwilling to raise prices to recover the tariff increase, but many are now saying they will:

Source: HomeFurnishingsBusiness[/caption]

According to curbed.com, many fabricators, furniture manufacturers and designers say tariffs are an added pressure on the value chain: A $1 increase in production costs usually leads to a $4 to $6 increase in retail price. So, an extra 10% tariff on a product that costs $50 to make would lead to a retail price that’s $20 or $30 more. David French, the senior vice president of government relations at the National Retail Federation, tells Fortune, “we did a study on the impact of 25% tariffs on two segments, travel goods and furniture, and found that consumers would pay $6 billion more if they go into effect.”

Furniture retailers had been so far unwilling to raise prices to recover the tariff increase, but many are now saying they will:

- Richard A. Galanti, CFO at Costco Wholesale Corp, said to Costco’s investors during an earnings call, “at the end of the day, prices will go up on things.” Costco shoppers will expect to spend more on an array of items including furniture, bikes, vacuums, and luggage.

- Jake Jabs, founder of American Furniture Warehouses (AFW), one of the largest furniture retailers in the state of Colorado, said many stores would be forced to pass on cost increases to consumers in May 2019 shortly after the 25% tariff on furniture became official.

- Francis O’Brien, owner of two Furniture Market retail stores Modesto, California, is adding a 3.75% fee the furniture he sells.