DIpil Das

We continue our weekly coverage of the US-China tariff dispute with a focus on footwear. We begin by noting recent developments, and readers can find a full timeline of the tariff dispute here.

Recent Development of the US-China Trade Dispute

On June 1, China increased tariffs on $60 billion worth of US goods, according to a statement from the Customs Tariff Commission of the State Council of China. This tarrif increase was announced on May 13 in response to the US increasing tariffs on $200 billion worth of Chinese goods from 10% to 25%.

On June 2, the State Council Information Office of the People’s Republic of China issued a white paper outlining China’s position on the issue, noting China’s principle that “China is open to negotiation, but will also fight to the end if needed.”

The white paper also asserted its view that the US tariffs harm others and are of no benefit to the US. Indeed, the tariffs have cut China’s exports to the US, which fell by 9.7% year on year in the first four months of 2019, dropping for five months in a row, the white paper said, citing data from China’s General Administration of Customs website.

And, as China has imposed tariffs of its own, US exports to China have also dropped for eight months in a row.

The WTO has lowered its forecast for global trade growth in 2019 from 3.7% to 2.6% due to the uncertainty around the US-China trade war.

Impact of Tariffs on the US Footwear Sector

On May 20, 173 shoe retailers, including leading brand such as Nike, Adidas, Foot Locker, Clarks, Dr Martens and Converse, signed a letter urging US President Trump not to raise tariffs on footwear. The letter said “adding a 25% tax increase on top of these tariffs would mean some working American families could pay a nearly 100% duty on their shoes.”

The Footwear Distributors and Retailers of America (FDRA) said a popular type of canvas “skate” sneaker that retails for $49.99 with a 25% tariff could cost $65.57 if new tariffs are imposed. The FDRA also said the price of a typical hunting boot would increase from $190 to $248.56 and a popular performance running shoe could jump from $150 to $206.25. Although the average US tariff on footwear is 11.3%, in some cases it can reach as high as 67.5%.

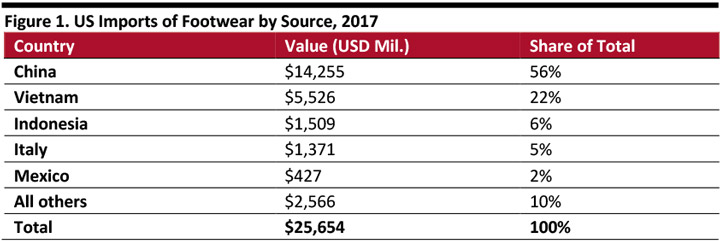

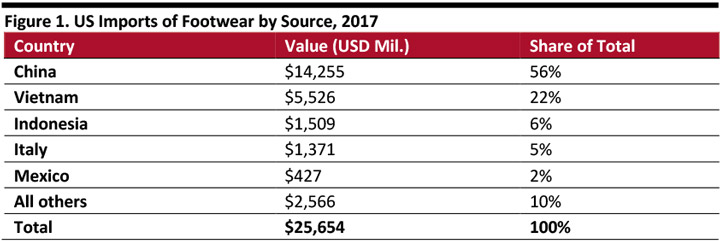

In recent years overall US footwear imports from China have been declining, but China still dominates the market with 56% of US footwear imports at the end of 2018, according to the US Department of Commerce. In 2017, the US imported $14.3 billion worth of footwear from China, nearly triple what it imported from Vietnam, the next largest footwear source.

The past week has also seen the US threaten to impose a 5% tariff on all imports from Mexico beginning June 10. As shown below, Mexico is a minor source of US footwear imports with only 2% by value in 2017, so we do not believe these tariffs will have a major impact on the sector.

[caption id="attachment_90049" align="aligncenter" width="720"] Source: US International Trade Commission/US Department of Commerce[/caption]

US footwear companies are already getting ready. “The shift has been under way,” Steve Lamar, Executive VP of American Apparel & Footwear Association, told Bloomberg. The talk of tariffs has created “a lot of anxiety” and companies are gauging how fast they can make more changes to their sourcing, according to Bloomberg.

We expect sourcing from Vietnam, Cambodia, Indonesia and Italy to grow. According the Commerce Department’s Office of Textiles & Apparel (OTEXA), footwear imports from Vietnam jumped 14.2% year over year to $619.48 million in Jan 2019, and shipments from Vietnam have increased in 32 of the last 33 months, according to FDRA. A number of Cambodian products continue to enjoy duty-free access to the US maket, making it an attractive sourcing location. The problem is: Infrastructure in Cambodia is years behind China.

But, factories in China have built up expertise and are able to deliver intricate manufacturing. When Balenciaga moved manufacturing to China, the company noted it did so because the country has “the savoir faire and capacities to produce a lighter shoe.”

These are a few of the many brands we expect to face challenges in managing higher tariffs – and what a few are doing already:

Source: US International Trade Commission/US Department of Commerce[/caption]

US footwear companies are already getting ready. “The shift has been under way,” Steve Lamar, Executive VP of American Apparel & Footwear Association, told Bloomberg. The talk of tariffs has created “a lot of anxiety” and companies are gauging how fast they can make more changes to their sourcing, according to Bloomberg.

We expect sourcing from Vietnam, Cambodia, Indonesia and Italy to grow. According the Commerce Department’s Office of Textiles & Apparel (OTEXA), footwear imports from Vietnam jumped 14.2% year over year to $619.48 million in Jan 2019, and shipments from Vietnam have increased in 32 of the last 33 months, according to FDRA. A number of Cambodian products continue to enjoy duty-free access to the US maket, making it an attractive sourcing location. The problem is: Infrastructure in Cambodia is years behind China.

But, factories in China have built up expertise and are able to deliver intricate manufacturing. When Balenciaga moved manufacturing to China, the company noted it did so because the country has “the savoir faire and capacities to produce a lighter shoe.”

These are a few of the many brands we expect to face challenges in managing higher tariffs – and what a few are doing already:

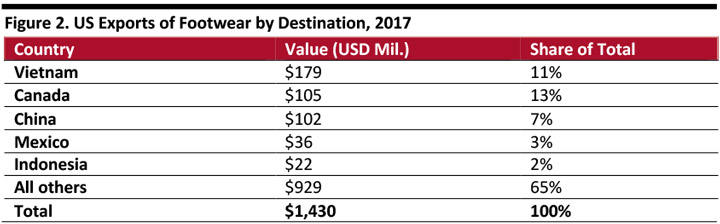

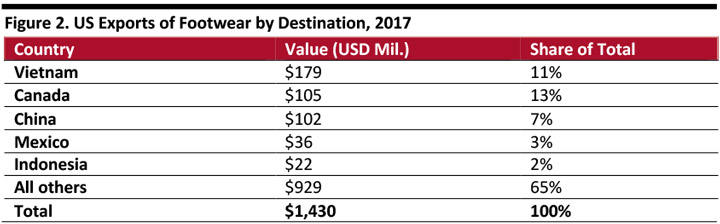

Source: United States International Trade Commission/US Department of Commerce[/caption]

According to China’s May 13 announcement, the list of US products subject to additional tariffs include a number of footwear products:

Source: United States International Trade Commission/US Department of Commerce[/caption]

According to China’s May 13 announcement, the list of US products subject to additional tariffs include a number of footwear products:

Source: US International Trade Commission/US Department of Commerce[/caption]

US footwear companies are already getting ready. “The shift has been under way,” Steve Lamar, Executive VP of American Apparel & Footwear Association, told Bloomberg. The talk of tariffs has created “a lot of anxiety” and companies are gauging how fast they can make more changes to their sourcing, according to Bloomberg.

We expect sourcing from Vietnam, Cambodia, Indonesia and Italy to grow. According the Commerce Department’s Office of Textiles & Apparel (OTEXA), footwear imports from Vietnam jumped 14.2% year over year to $619.48 million in Jan 2019, and shipments from Vietnam have increased in 32 of the last 33 months, according to FDRA. A number of Cambodian products continue to enjoy duty-free access to the US maket, making it an attractive sourcing location. The problem is: Infrastructure in Cambodia is years behind China.

But, factories in China have built up expertise and are able to deliver intricate manufacturing. When Balenciaga moved manufacturing to China, the company noted it did so because the country has “the savoir faire and capacities to produce a lighter shoe.”

These are a few of the many brands we expect to face challenges in managing higher tariffs – and what a few are doing already:

Source: US International Trade Commission/US Department of Commerce[/caption]

US footwear companies are already getting ready. “The shift has been under way,” Steve Lamar, Executive VP of American Apparel & Footwear Association, told Bloomberg. The talk of tariffs has created “a lot of anxiety” and companies are gauging how fast they can make more changes to their sourcing, according to Bloomberg.

We expect sourcing from Vietnam, Cambodia, Indonesia and Italy to grow. According the Commerce Department’s Office of Textiles & Apparel (OTEXA), footwear imports from Vietnam jumped 14.2% year over year to $619.48 million in Jan 2019, and shipments from Vietnam have increased in 32 of the last 33 months, according to FDRA. A number of Cambodian products continue to enjoy duty-free access to the US maket, making it an attractive sourcing location. The problem is: Infrastructure in Cambodia is years behind China.

But, factories in China have built up expertise and are able to deliver intricate manufacturing. When Balenciaga moved manufacturing to China, the company noted it did so because the country has “the savoir faire and capacities to produce a lighter shoe.”

These are a few of the many brands we expect to face challenges in managing higher tariffs – and what a few are doing already:

- Steve Madden relies heavily on China, and increased products sourced from China to 93% in 2017.

- Vans sources approximately 73% of its footwear from China.

- Nike and Adidas have shifted a major chunk of their production to Vietnam and Cambodia in recent years. In 2017, Adidas CEO said 44% of the brands’ shoes were made in Vietnam. That same year, Nike procured just 19% of its footwear from China, down from 32% five years earlier.

Source: United States International Trade Commission/US Department of Commerce[/caption]

According to China’s May 13 announcement, the list of US products subject to additional tariffs include a number of footwear products:

Source: United States International Trade Commission/US Department of Commerce[/caption]

According to China’s May 13 announcement, the list of US products subject to additional tariffs include a number of footwear products:

- The list of US products subject to a tariff increase from 10% to 25% includes sports boots, leather upper sports shoes with rubber and plastic bottoms, leather upper boots, short boots, etc.

- The list of US products subject to a tariff increase from 10% to 20% includes boots with rubber and plastic bottoms, medium and short waterproof boots, rollers and skates.

- The list of US products subject to a tariff increase from 5% to 10% includes other leather boots with metal heads and other shoe parts.