DIpil Das

We continue our weekly coverage of the US-China tariff issues with a focus on apparel. We begin by noting recent developments.

Recent Development of US-China Trade Issues

On June 18, China’s President Xi Jinping had a telephone call with US President Donald Trump. According to state-owned Xinhua News and CCTV news, President Trump said he looked forward to meeting President Xi during the G20 summit on June 28-29. Chinese media also asserted the US attaches great importance to US-China trade and hopes to solve the current differences as soon as possible.

Trump has stated the discussions, stalled since early May, would resume only if there were a meeting at the G20 meeting in Osaka. With the meeting confirmed, the US has said teams will begin discussing issues ahead of time.

China May Lose Competittive Position in the Long Term, But So far Remains the Dominant Supplier to the US

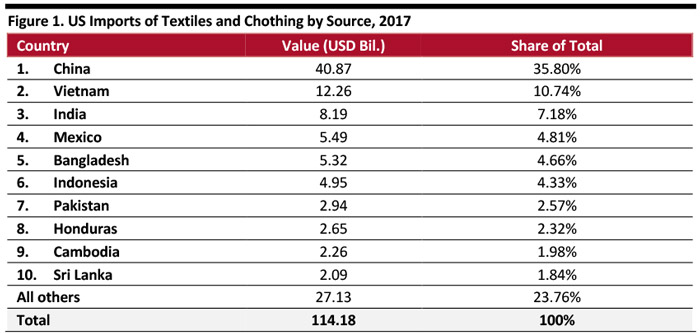

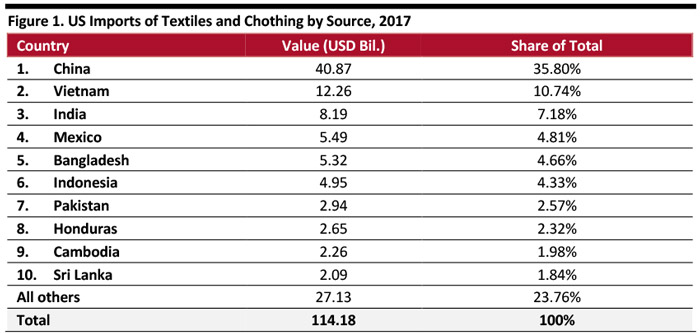

In 2017, the US imported apparel and textiles worth $40.9 billion from China, nearly 3.5 times the value of the $12.3 billion imported from second-largest source Vietnam, and nearly five times the value of the $8.2 billion imported from number three India.

The US is one of the largest apparel consumers in the world: Apparel accounted for 76% of all imports in the apparel and textiles category in 2017, according to the International Trade Administration’s Office of Textiles and Apparel (OTEXA).

[caption id="attachment_91515" align="aligncenter" width="700"] Source: World Integrated Trade Solution [/caption]

The tariffs appear to be having an impact on cost already. According to a report in Hong Kong’s South China Morning Post, a study by Dr. Sheng Lu, an Associate Professor of Fashion and Apparel Studies at the University of Delaware, found the average retail price of clothing manufactured in China was $25.70 per unit in the second quarter of 2018, only slightly higher than the average price for items produced in Vietnam. However, that has changed: The average price more than doubled to $69.50 per unit in early 2019.

Faced with the prospect of rising costs due to the tariffs, companies started shifting sourcing last year. A 2018 survey by the US Fashion Industry Association (USFIA) found companies had cut China sourcing from 30-50% of their total in 2017 to 11-30%.

Where Will The Apparel Companies Go For Sourcing?

While companies would love to quickly move sourcing to other countries, there are challenges. Many other countries can make basic items, but more complex pieces such as accessories and outerwear are trickier: Chinese factories have installed advanced equipment for such products, but most other countries have not.

Nonetheless, companies have been loking outside China, with many adopting a “China plus Vietnam plus many” sourcing strategy.

Source: World Integrated Trade Solution [/caption]

The tariffs appear to be having an impact on cost already. According to a report in Hong Kong’s South China Morning Post, a study by Dr. Sheng Lu, an Associate Professor of Fashion and Apparel Studies at the University of Delaware, found the average retail price of clothing manufactured in China was $25.70 per unit in the second quarter of 2018, only slightly higher than the average price for items produced in Vietnam. However, that has changed: The average price more than doubled to $69.50 per unit in early 2019.

Faced with the prospect of rising costs due to the tariffs, companies started shifting sourcing last year. A 2018 survey by the US Fashion Industry Association (USFIA) found companies had cut China sourcing from 30-50% of their total in 2017 to 11-30%.

Where Will The Apparel Companies Go For Sourcing?

While companies would love to quickly move sourcing to other countries, there are challenges. Many other countries can make basic items, but more complex pieces such as accessories and outerwear are trickier: Chinese factories have installed advanced equipment for such products, but most other countries have not.

Nonetheless, companies have been loking outside China, with many adopting a “China plus Vietnam plus many” sourcing strategy.

Source: World Integrated Trade Solution [/caption]

The tariffs appear to be having an impact on cost already. According to a report in Hong Kong’s South China Morning Post, a study by Dr. Sheng Lu, an Associate Professor of Fashion and Apparel Studies at the University of Delaware, found the average retail price of clothing manufactured in China was $25.70 per unit in the second quarter of 2018, only slightly higher than the average price for items produced in Vietnam. However, that has changed: The average price more than doubled to $69.50 per unit in early 2019.

Faced with the prospect of rising costs due to the tariffs, companies started shifting sourcing last year. A 2018 survey by the US Fashion Industry Association (USFIA) found companies had cut China sourcing from 30-50% of their total in 2017 to 11-30%.

Where Will The Apparel Companies Go For Sourcing?

While companies would love to quickly move sourcing to other countries, there are challenges. Many other countries can make basic items, but more complex pieces such as accessories and outerwear are trickier: Chinese factories have installed advanced equipment for such products, but most other countries have not.

Nonetheless, companies have been loking outside China, with many adopting a “China plus Vietnam plus many” sourcing strategy.

Source: World Integrated Trade Solution [/caption]

The tariffs appear to be having an impact on cost already. According to a report in Hong Kong’s South China Morning Post, a study by Dr. Sheng Lu, an Associate Professor of Fashion and Apparel Studies at the University of Delaware, found the average retail price of clothing manufactured in China was $25.70 per unit in the second quarter of 2018, only slightly higher than the average price for items produced in Vietnam. However, that has changed: The average price more than doubled to $69.50 per unit in early 2019.

Faced with the prospect of rising costs due to the tariffs, companies started shifting sourcing last year. A 2018 survey by the US Fashion Industry Association (USFIA) found companies had cut China sourcing from 30-50% of their total in 2017 to 11-30%.

Where Will The Apparel Companies Go For Sourcing?

While companies would love to quickly move sourcing to other countries, there are challenges. Many other countries can make basic items, but more complex pieces such as accessories and outerwear are trickier: Chinese factories have installed advanced equipment for such products, but most other countries have not.

Nonetheless, companies have been loking outside China, with many adopting a “China plus Vietnam plus many” sourcing strategy.

- Gap Inc. has factories around the world, such as China, Vietnam, Bangladesh, Cambodia, Colombia, Dominican Republic, Egypt, El Salvador, Haiti, Honduras, Sri Lanka and India. In 2017, Gap sourced 22% of its products in dollar value from China, while Vietnam accounted for 25%.

- Nike has 430 apparel factories in 41 countries — but 26% was made in China in its 2018 fiscal year, according to the company's annual report.

- Ralph Lauren sourced about 25% of its products from China in 2018, including a large percentage of its Polo and Lauren brands.

- G-III Apparel Group sourced 65% of its products from China in its 2018 fiscal year, down from 78% in fiscal year 2016, and the company hopes to further diversify sourcing.

- Chico’s FAS sourced 52% of its goods by value from China in its 2017 fiscal year. Moreover, the company sourced 23% of its products from a single supplier in China.

- The Children’s Place uses the China plus Vietnam plus many sourcing strategy. In addition to sourcing goods from China in 2017, the company also sourced 17% of its goods from Bangladesh, 13% from Vietnam, 12% from Indonesia and 11% from India.

- Ralph Lauren CEO Patrice Louvet told Bloomberg in May 2019 that tariffs would result in price increases for the average US consumer.

- Tadashi Yanai, the Founder and President of Japan’s Fast Retailing (parent to Uniqlo), said China playing a significant role in helping the retail giant in its high-volume turn-over model, according to The Fashion Law. Any additional costs would be passed on to consumers as a result.

- Everlane, a young luxury apparel brand, told The New York Times it is bracing for higher prices for the garments it makes in China. An Everlane cashmere sweater that retails for $100 could rise to $124 thanks to tariffs.

- CBS News also quoted Columbia Sportswear, Kenneth Cole, and other sportswear and clothing retailers saying they may be forced to raise prices if they face higher tariff-related costs.