Introduction

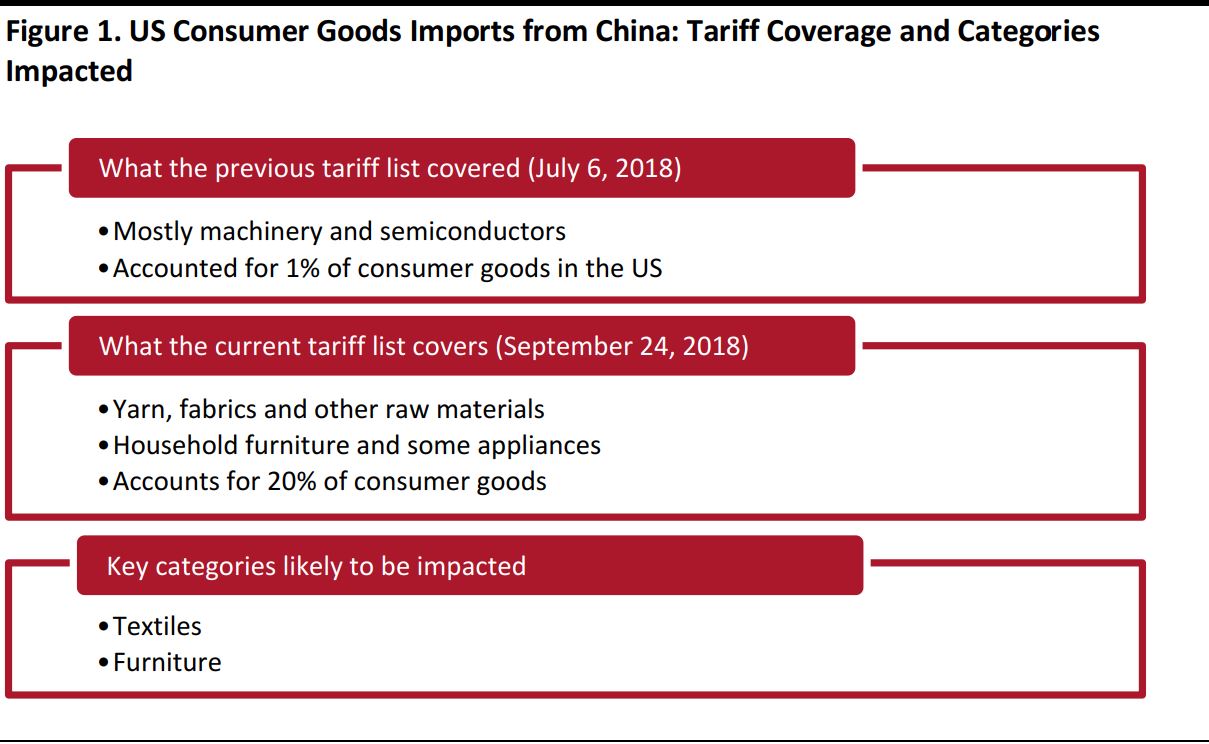

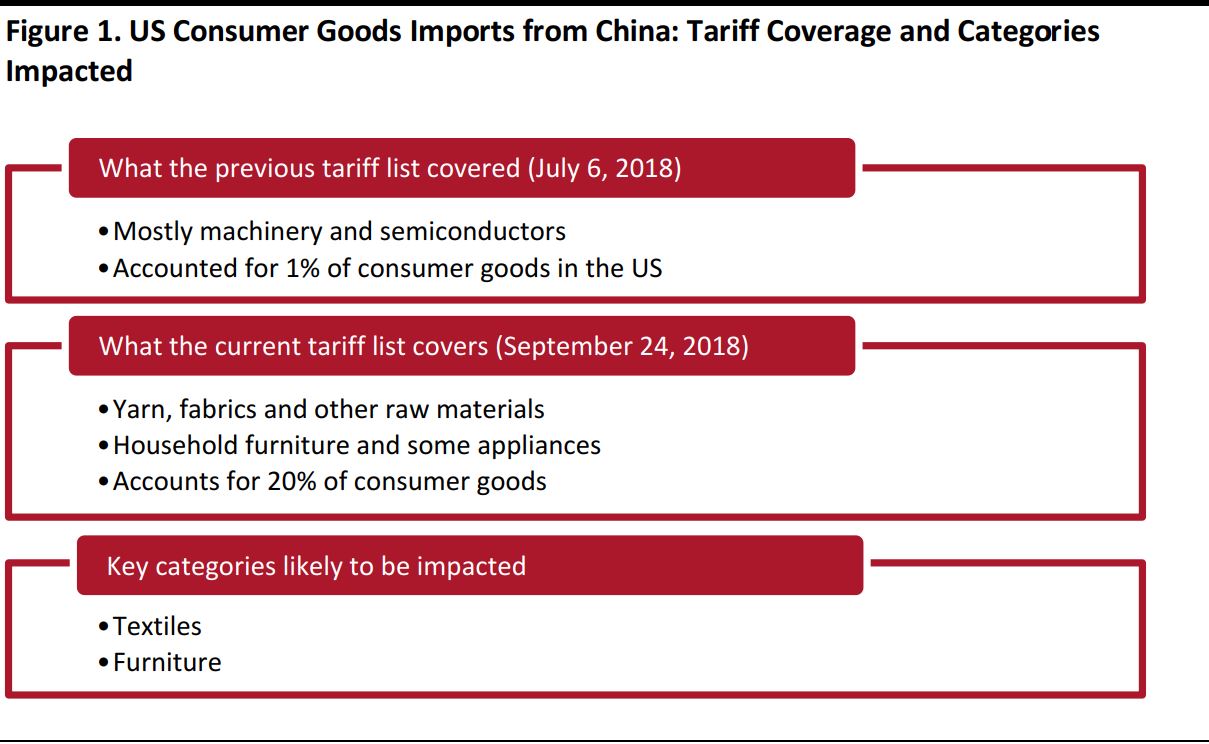

The tariff dispute between the US and China began in March 2018, when the US accused China of unfair trade practices and announced a 10% import tariff on Chinese goods worth $3 billion. The magnitude of tariffs has increased since then, with the US imposing a 10% tariff on Chinese goods worth $200 billion on September 24. In response, China announced a tariff in the range of 5%–10% on various US goods worth $60 billion on September 25, effective immediately.

US President Donald Trump recently announced that the US will raise the rate of tariffs further, to 25%, in January 2019, if the two countries are unable to reach a resolution regarding trade. Trump vowed to expand tariffs to cover

all goods imported from China if China moves ahead with its decision to impose tariffs of its own. This seems likely now, in light of retaliatory tariffs that China has imposed on the US.

In a previous report on this subject,

The Impact of Tariffs on US Retail, we discussed the implications of tariffs on the US retail economy. We also discussed the consumer goods covered under the tariffs. In this report, we discuss the impact of tariffs, or potential tariffs, on the US apparel and textiles, footwear, and furniture categories. We note China’s significance as a source of manufacturing for a number of major brands and retailers in each of these categories and also discuss China’s overall dominance as a sourcing destination.

Source: Office of the United States Trade Representative (USTR)/Coresight Research

Source: Office of the United States Trade Representative (USTR)/Coresight Research

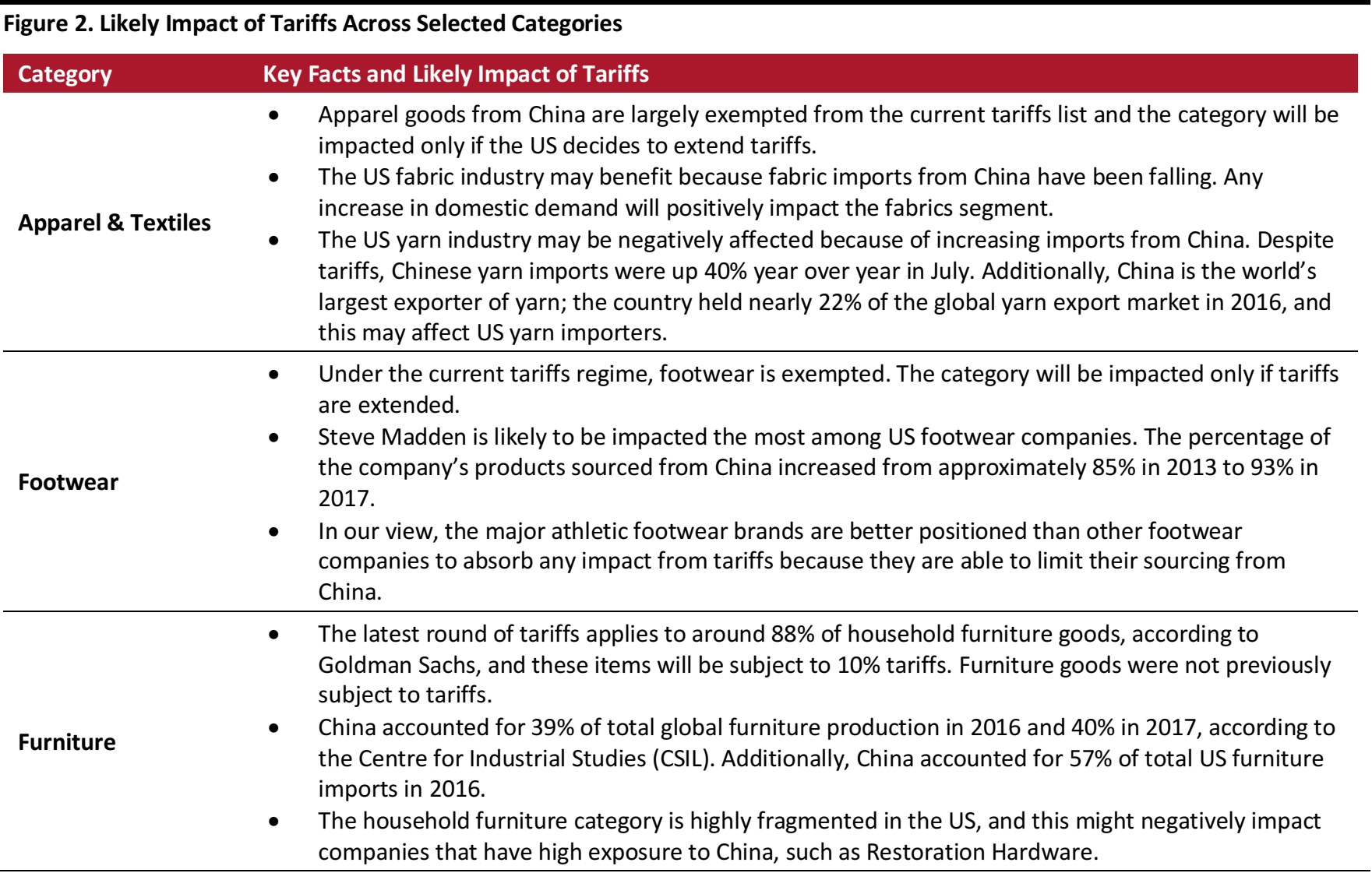

Tariffs Across Categories: A Summary

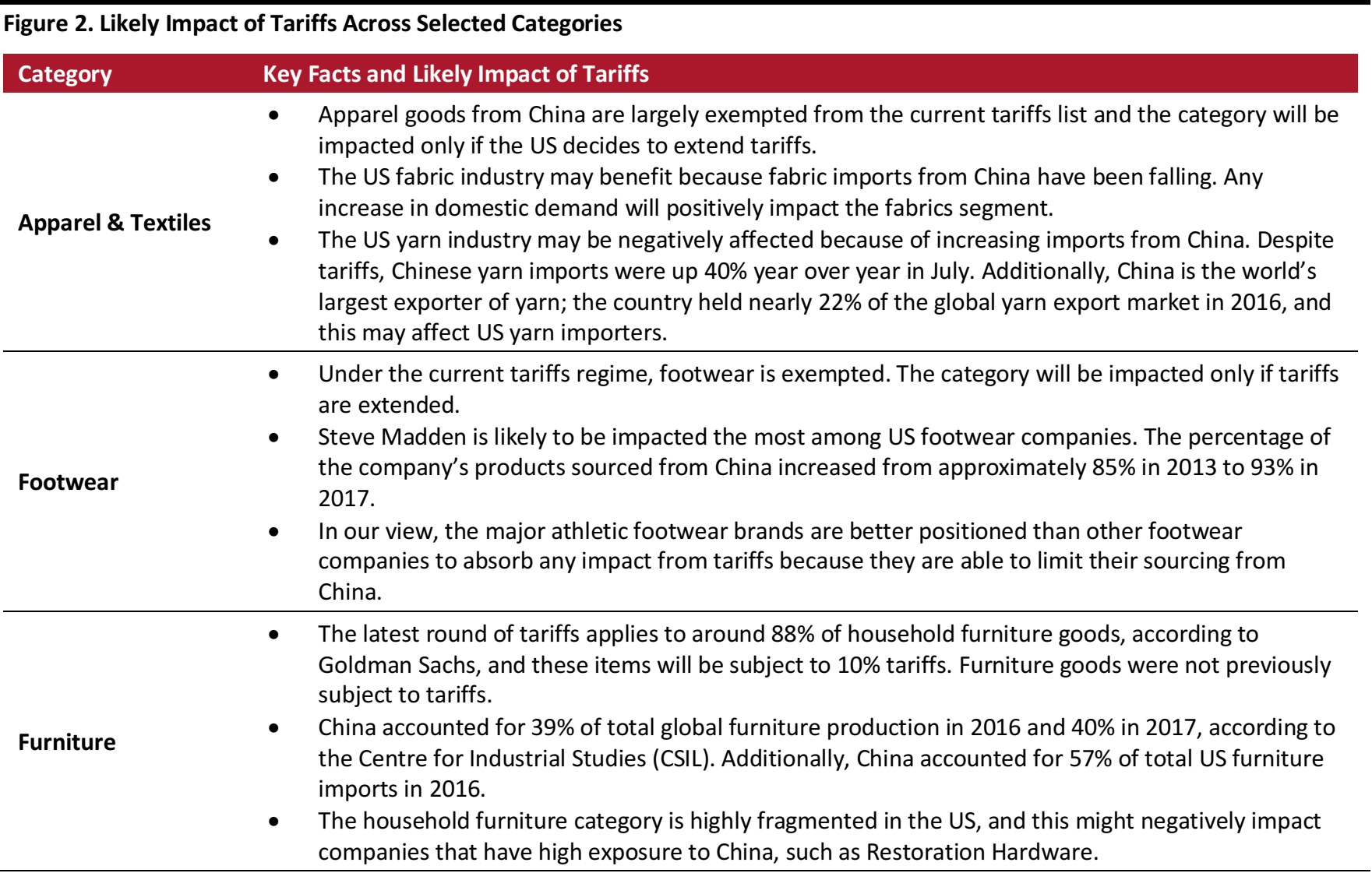

The recently announced tariffs appear to have direct implications for the fabrics and yarn categories and the furniture category is likely to see more severe effects than other consumer goods categories. Apparel and footwear are largely excluded from the current tariff coverage, but they could be impacted if tariffs are extended. The table below lists the impact of tariffs by category. We discuss these in detail in the subsequent sections of this report.

Source: CSIL/company reports/United States International Trade Commission (USITC)/Coresight Research

Source: CSIL/company reports/United States International Trade Commission (USITC)/Coresight Research

Retailers’ Exposure to Tariffs by Sector

In this section, we discuss the likely impact of tariffs or potential tariffs on the US apparel, footwear and furniture categories by analyzing how such tariffs could affect some of the companies operating in these categories.

Apparel

Apparel accounted for 76% of the total imports in the apparel and textiles category in 2017, according to the International Trade Administration’s Office of Textiles and Apparel (OTEXA). That indicates that the apparel segment will be more impacted than the textiles segment, should the US proceed with levying tariffs on all Chinese imports.

“China plus Vietnam plus many” has emerged as the most popular sourcing strategy for many companies in the US. China accounted for 11%–30% of all apparel and footwear goods imported to the US in 2018, down from 30%–50% previously, according to a survey conducted by the United States Fashion Industry Association (USFIA).

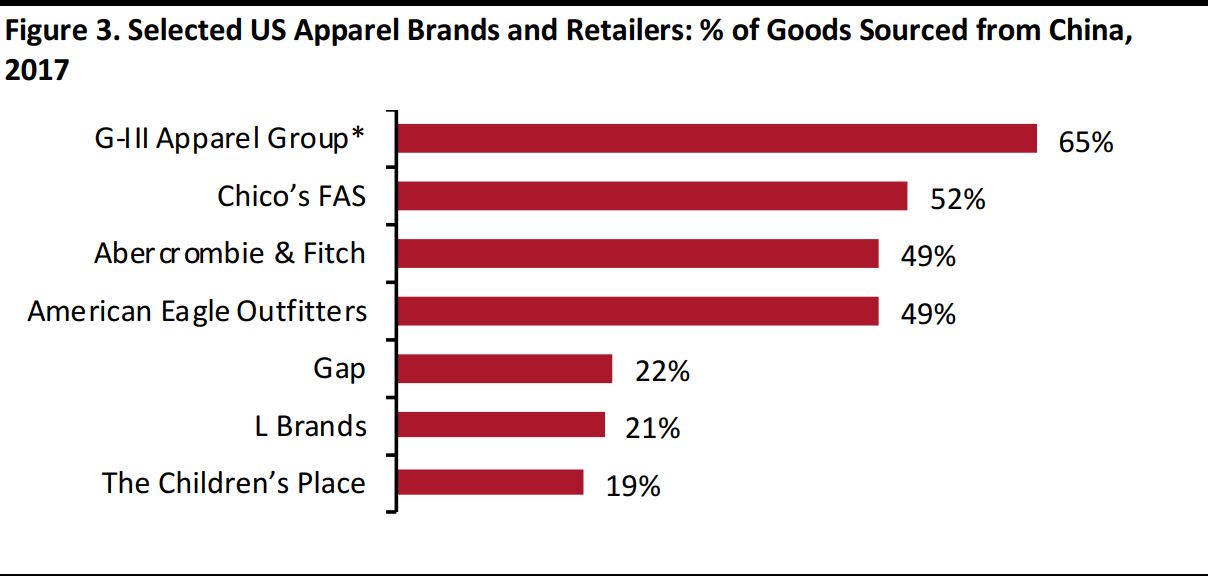

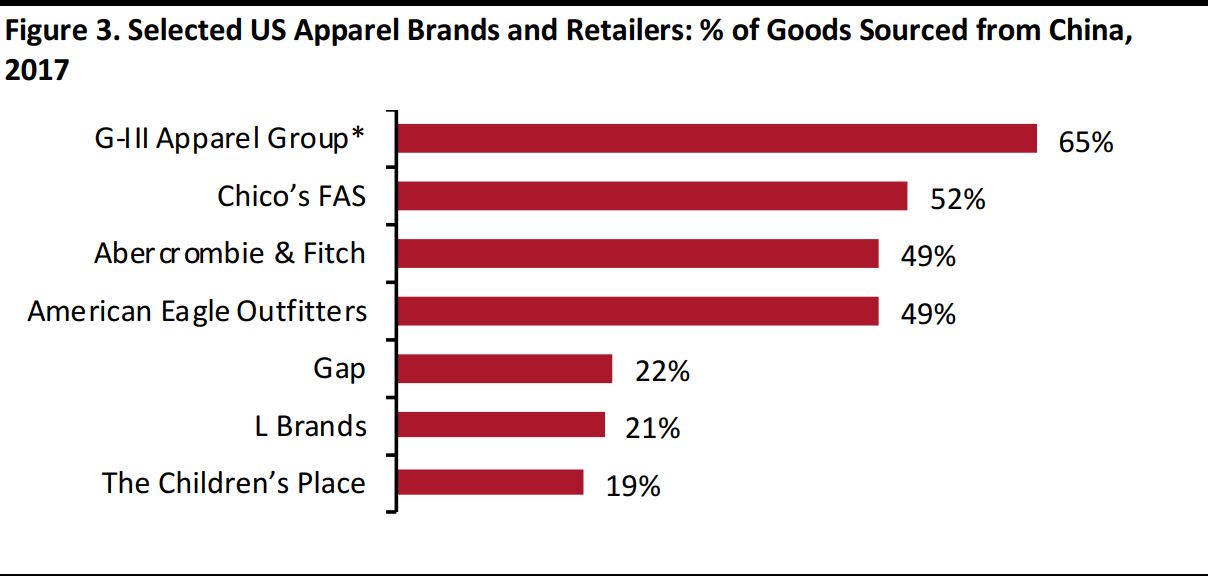

Our research on the sourcing practices of US apparel brands and retailers found that:

- G-III Apparel Group has the most substantial exposure to China of all the apparel companies we analyzed. In its 2018 fiscal year, the company sourced 65% of its products from China, down from 78% in fiscal year 2016. However, the company expects to diversify its manufacturing sources in order to better manage any eventualities.

- Chico’s FAS sourced goods worth 52% of its merchandise costs from China in its 2017 fiscal year. Moreover, the company sourced 23% of its products from a single supplier in China, which means that Chico’s faces higher risk than many of its peers due to lesser diversification.

- The Children’s Place uses the China plus Vietnam plus many sourcing strategy. In addition to sourcing goods from China in 2017, the company also sourced 17% of its goods from Bangladesh, 13% from Vietnam, 12% from Indonesia and 11% from India.

- In 2017, Gap sourced 22% of its products in dollar value from China, but Vietnam was the company’s largest sourcing destination, accounting for 25% of its products last year.

*For the company’s fiscal year ended January 2018

Source: Company reports/Coresight Research

*For the company’s fiscal year ended January 2018

Source: Company reports/Coresight Research

The highly price-competitive nature of the apparel market would make it difficult for many brands and retailers to fully pass on any substantial increase in input costs. That implies that some brands and retailers that source from China would incur a margin impact, should the US apply further tariffs to apparel. Companies that have instituted diversified sourcing practices, such as The Children’s Place, are better positioned to absorb any future costs associated with tariffs. But even companies that have altered their supply chains are likely to experience some cost increases, as China remains the largest sourcing country due to the size of its supply base, its skilled workforce, and the quality and variety of the end products it produces.

Footwear

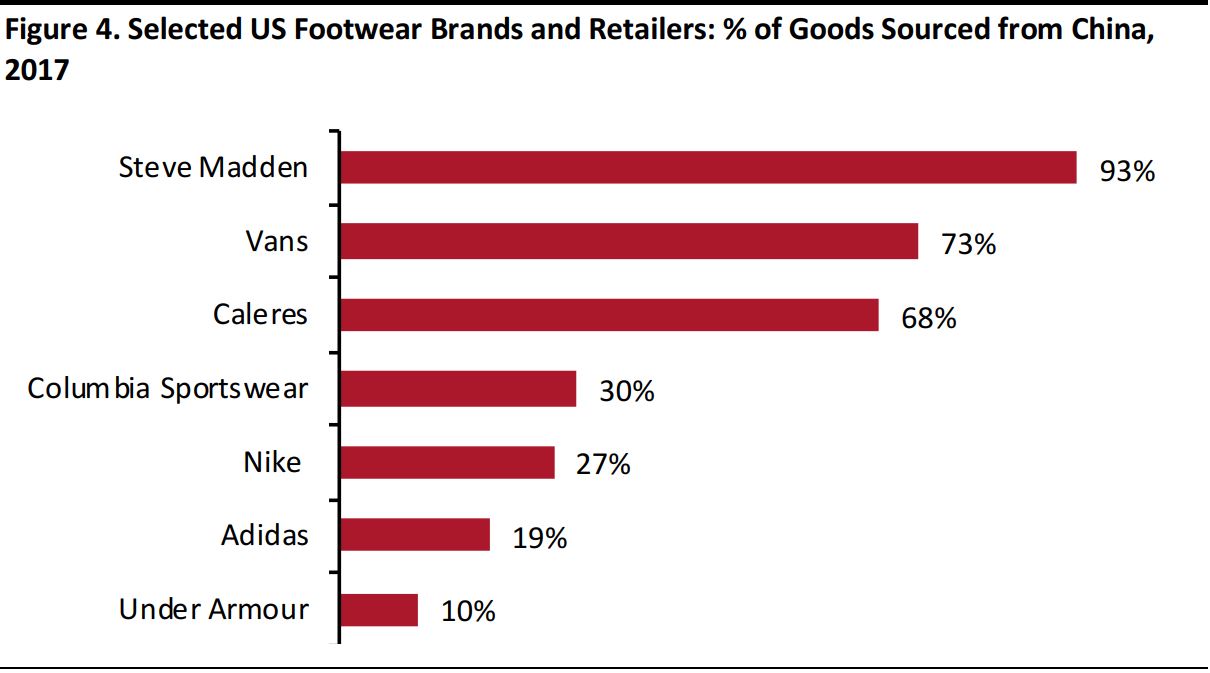

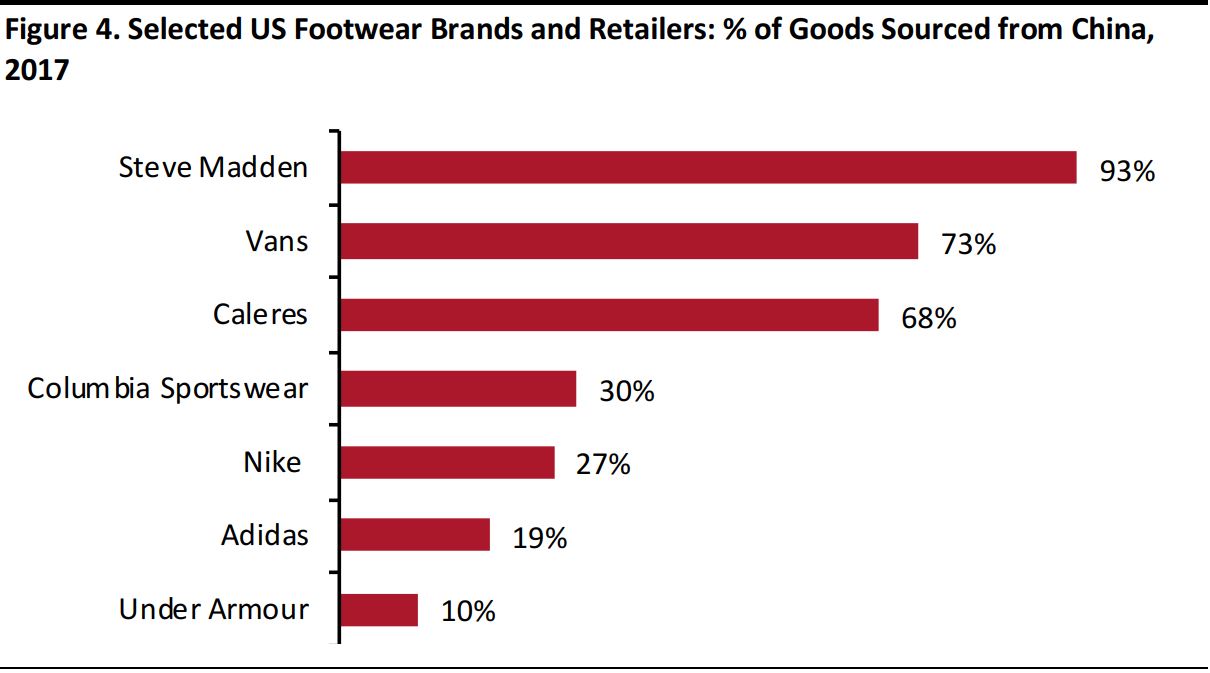

Many footwear companies will be impacted if US tariffs are extended to include all goods imported from China. Our research of the sourcing practices among major US footwear brands and retailers found that:

- Companies such as Steve Madden, which relies heavily on China, are likely to be particularly impacted if the US imposes further tariffs. The company increased its percentage of products sourced from China from approximately 85% in 2013 to 93% in 2017.

- Fully 98% of Vans’ footwear is manufactured outside the US. Vans sources approximately 73% of its footwear from China, which places the company at risk of increased prices if tariffs are extended.

- Sportswear companies Nike and Adidas have shifted a major chunk of their production to Vietnam and Cambodia in recent years. In 2012, Nike procured 32% of its footwear from China, but that share fell to 27% in 2017.

Source: Company reports/American Apparel & Footwear Association/Wedbush Securities

Source: Company reports/American Apparel & Footwear Association/Wedbush Securities

We expect major sportswear brands to be less impacted by any new tariffs than specialist footwear brands because many of the sportswear companies have diversified their sourcing in recent years and, so, have lower exposure to China. Vans is an exception, with its high, 73% exposure to China.

However, we still expect any potential tariffs to have some impact on sports footwear brands such as Nike, which owned 34 footwear factories in China as of August 2018. We expect Nike to continue operations in China because the country offers technical advancements in manufacturing and because Nike has already made significant investments in the country. It would be difficult for Nike to replicate operations at the same scale in other countries, as many have smaller average factory sizes.

Furniture

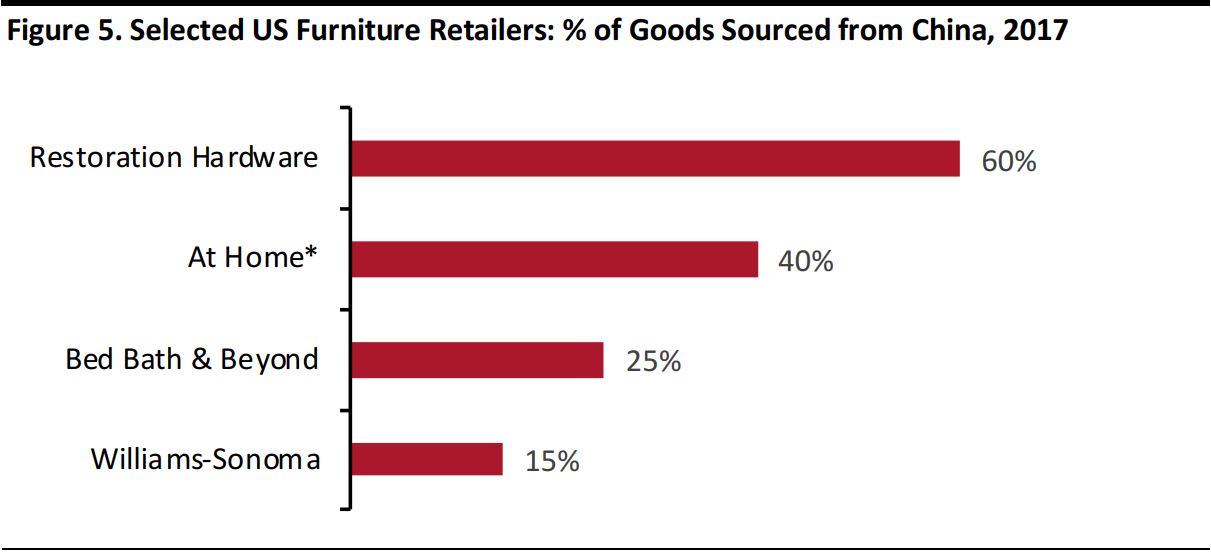

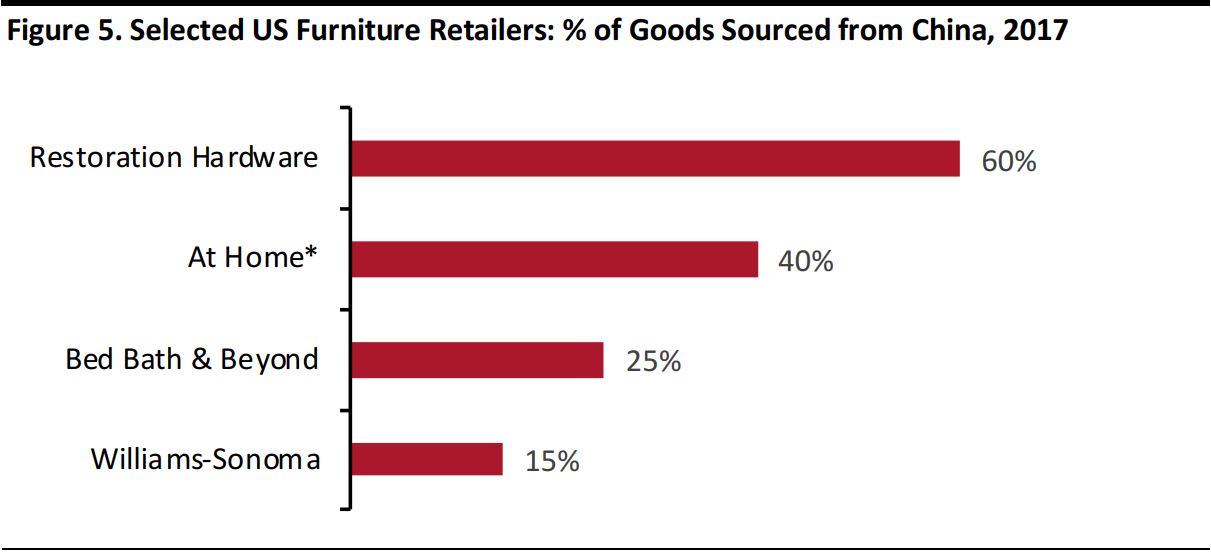

The latest round of US tariffs imposed a levy of 10% on approximately 88% of all household furniture goods, according to Goldman Sachs. Our research of the sourcing practices of major US household furniture companies found that:

- Restoration Hardware sourced 60% of its total products from China in 2017, although the company expects to reduce that percentage to around 45% in the future. The company said in its latest annual report that it will have to increase prices under the new tariffs regime and that doing so might cost it market share.

- At Home may face higher risk than is implied by its direct exposure to China. Although the company sources only about 40% of its products from China, it stated that many of its domestic vendors also source from China, which means that At Home’s domestic sourcing could become more expensive as well.

*Estimated based on the company’s statement that it sources 60% of its products abroad and given the total production value of the countries from which it sources.

Source: Company reports/Coresight Research

*Estimated based on the company’s statement that it sources 60% of its products abroad and given the total production value of the countries from which it sources.

Source: Company reports/Coresight Research

We expect the furniture category to be negatively impacted by tariffs. The household furniture market in the US is highly fragmented, which may encourage consumers to switch away from companies that choose to increase prices in response to tariffs because they have high exposure to China. If such companies hike prices to transfer their increased costs to shoppers, they risk losing market share to competitors that are less dependent on China.

Also, due to China’s dominance in the global furniture manufacturing and export market, furniture companies have less flexibility than companies in other categories such as apparel to absorb the impact of tariffs. China accounted for 40% of the global furniture market in 2016, according to CSIL, which implies that furniture sellers are likely to be forced to pass on cost increases to consumers.

It is difficult to assess the impact of tariffs on individual players in the furniture category because, according to At Home, some US furniture companies that sell into the major retailers also source from China.

In the next section, we examine the apparel and textiles, footwear, and furniture trade between the US and China over the last five years.

US-China Trade: Apparel and Textiles

US tariffs on consumer goods have widened to include some apparel (mainly clothing manufactured from reptile leather, vulcanized rubber, composite leather and furskin); textiles such as silk, cotton, satin and wool fabrics; handbags; and luggage goods.

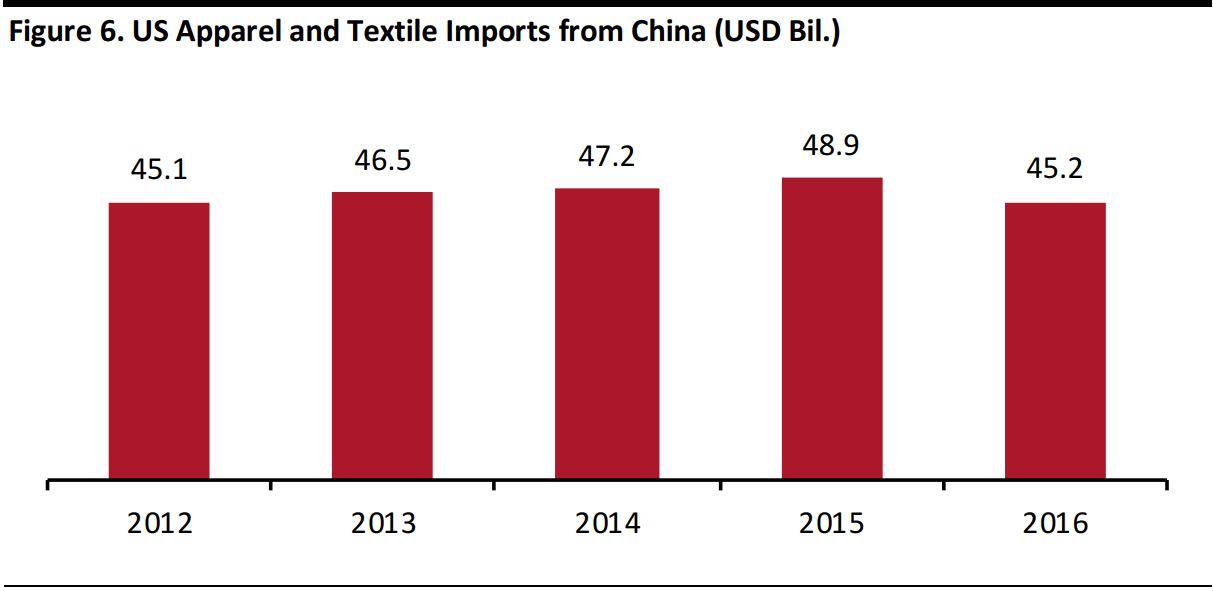

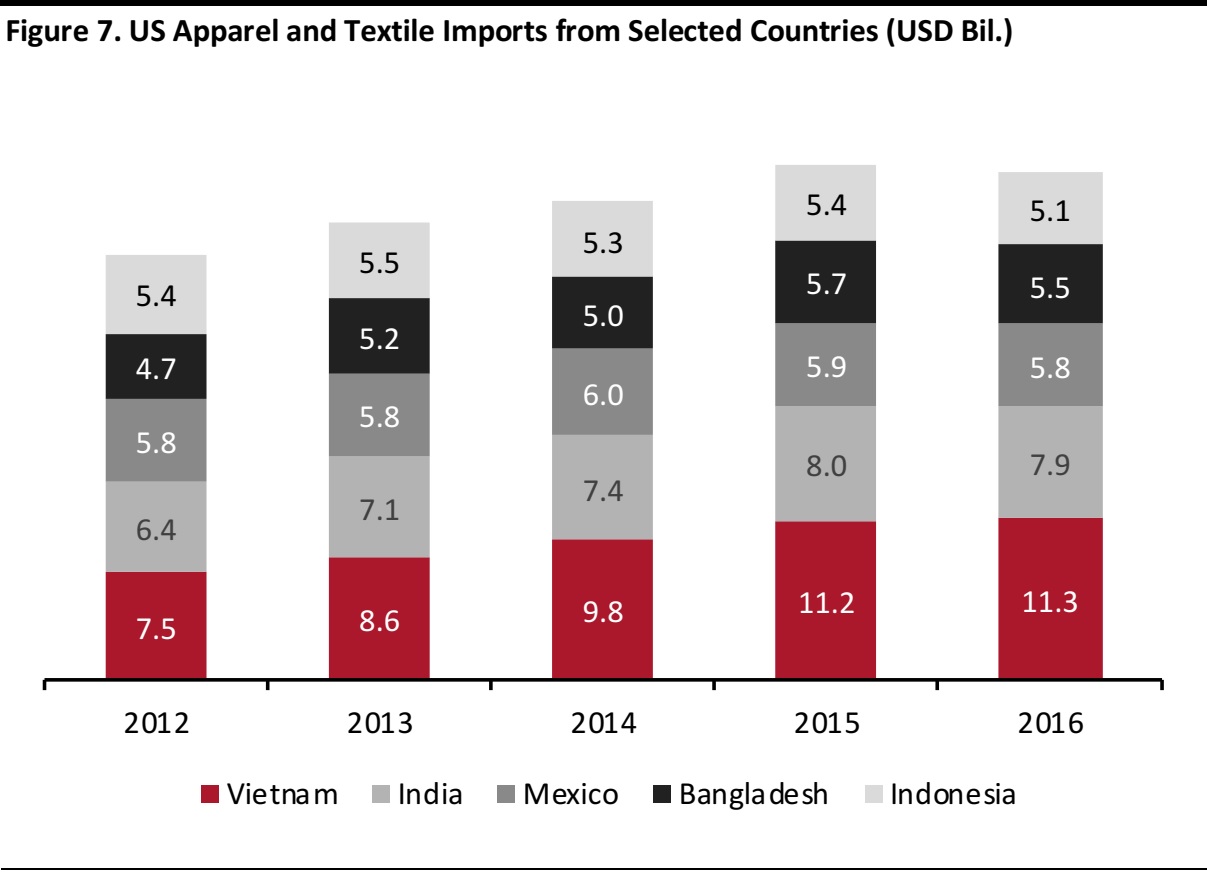

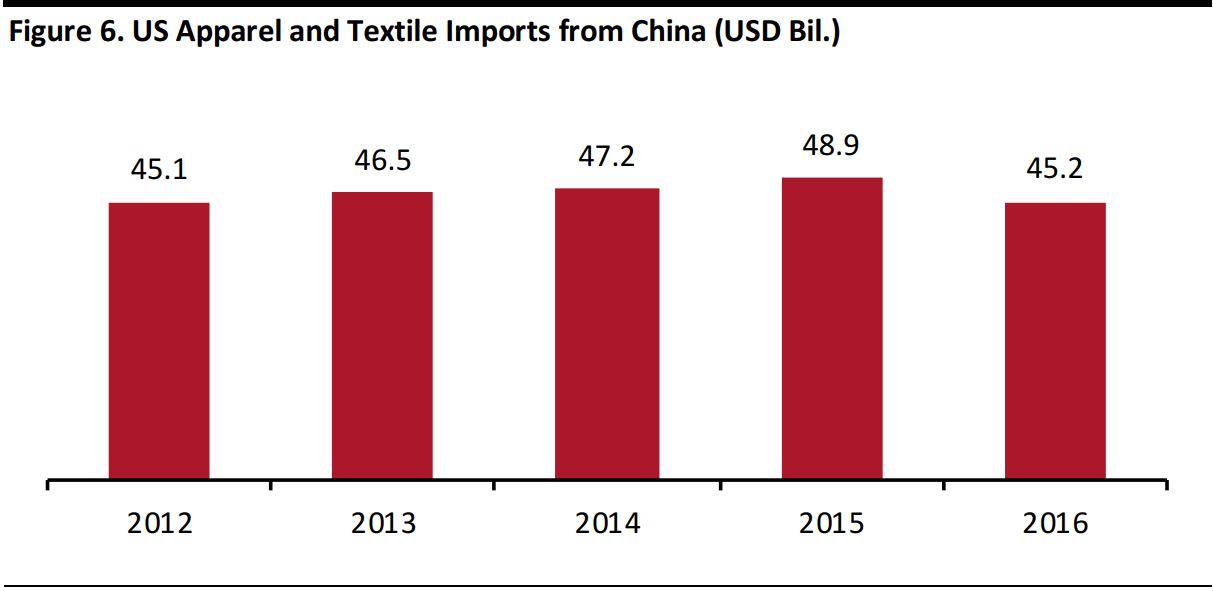

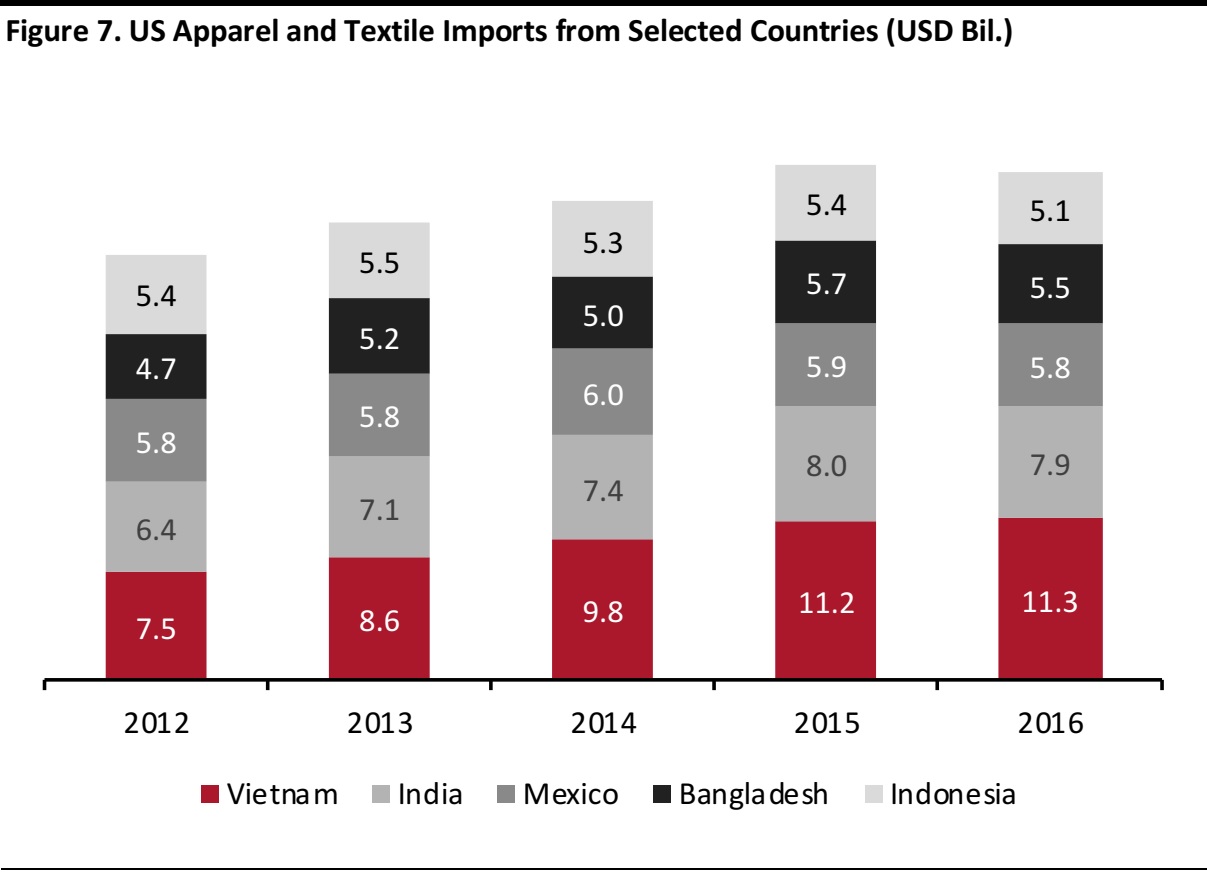

China is the largest trading partner of the US in the apparel and textiles category. According to data from the USITC, the US imported apparel and textiles worth $45.2 billion from China in 2016, four times more than it imported from its second-largest trading partner, Vietnam, that year.

Source: USITC

Source: USITC

The US trade in apparel and textiles with China is gradually declining. Given the new tariffs, Chinese imports of such products may decline further over the next few years as more US companies diversify their sourcing. Vietnam and Bangladesh have gained importance as sourcing destinations, with imports from both nations increasing since 2012.

Source: USITC

Source: USITC

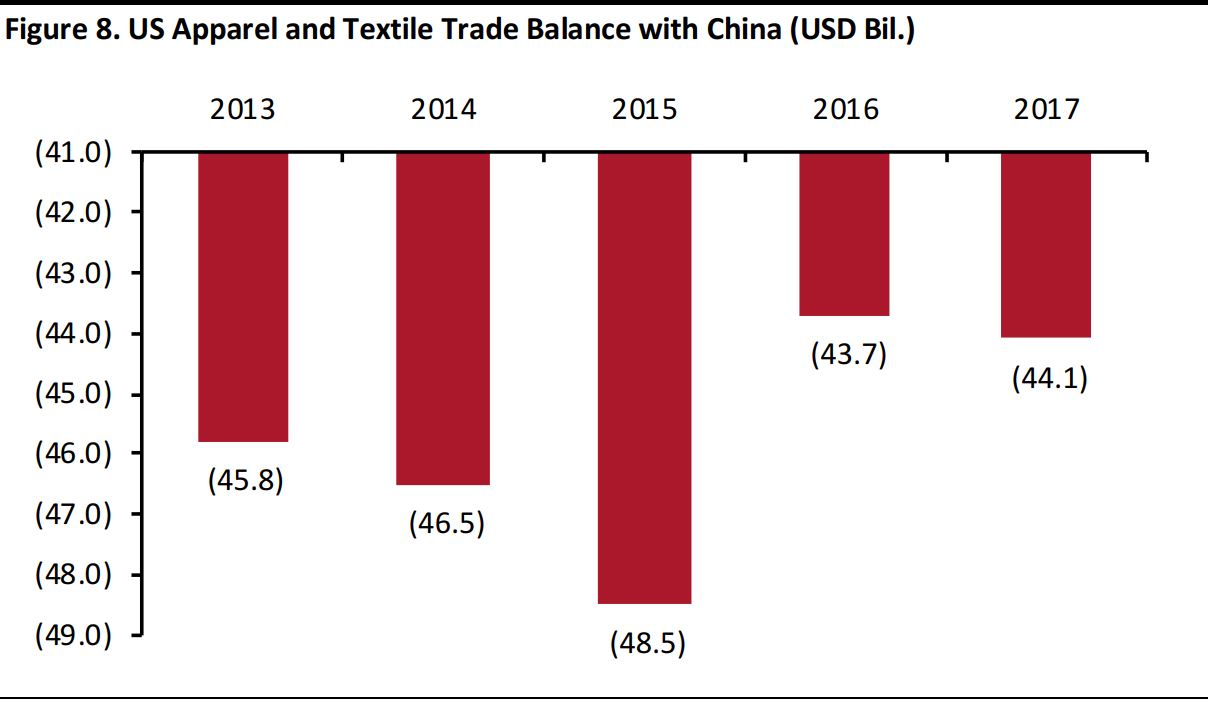

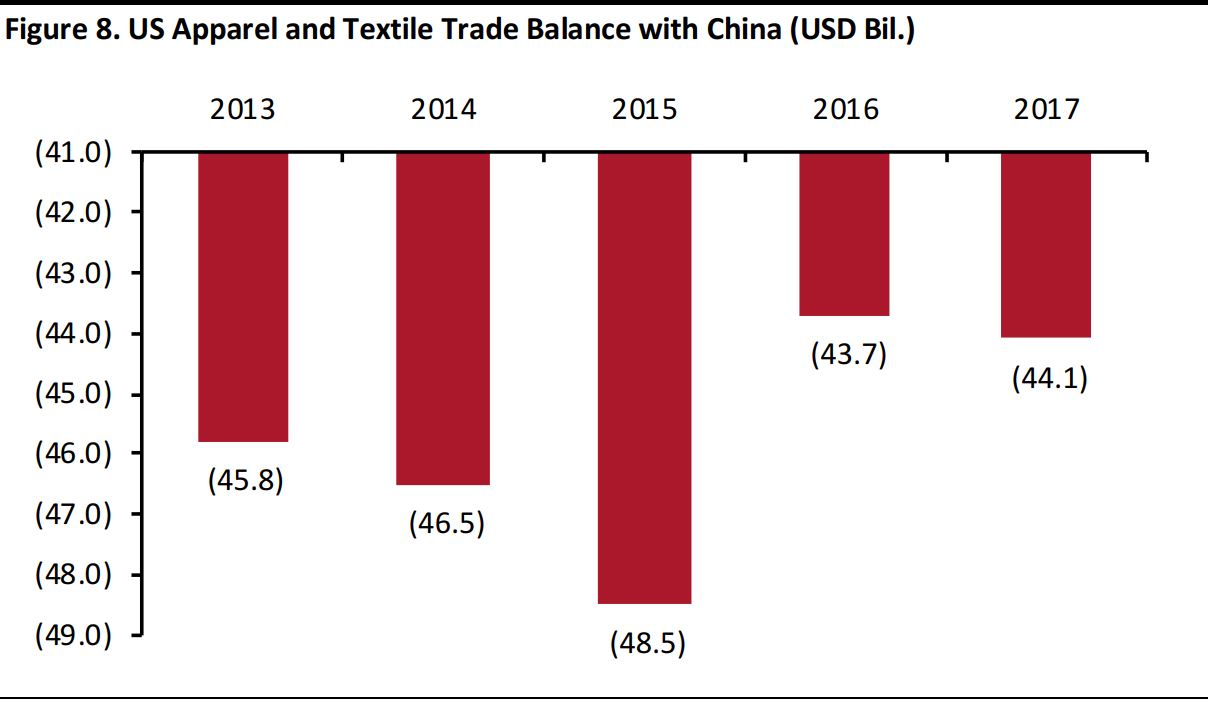

The US’s apparel and textiles trade deficit with China was $44.1 billion in 2017, down from a peak of $48.5 billion in 2015, according to OTEXA. The trade deficit in 2015 was the highest in the last decade due to the strengthening of the US dollar, which deterred other nations from importing from the US. US apparel and textiles imports increased from $47.7 billion in 2014 to $49.5 billion in 2015, whereas US exports declined from $1.2 billion to $1 billion during the same period.

Source: OTEXA

Source: OTEXA

In July 2018, the US trade deficit with China in apparel and textiles amounted to $24.8 billion, representing a 3% increase year over year. We expect that deficit to widen by the end of 2018 as increased tariffs put pressure on US importers to raise prices.

Apparel: China Plus Vietnam Plus Many as the Key Sourcing Strategy

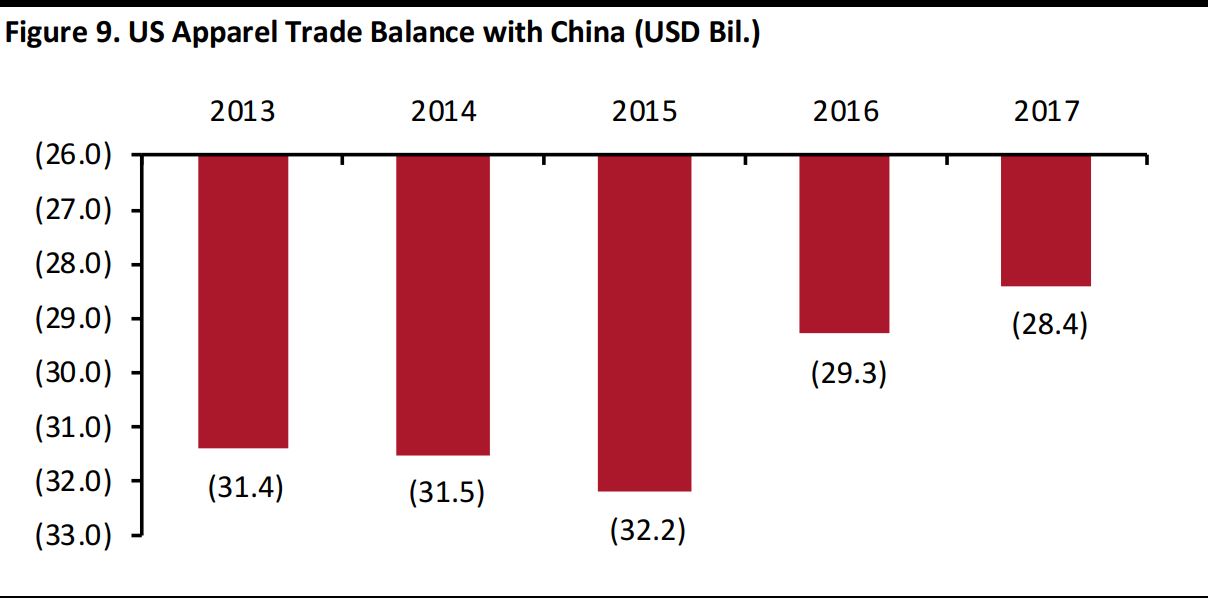

Apparel products account for the majority of the US’s total apparel and textile imports. Below, we note key trends in the apparel trade between the US and China.

What Has Happened

- Apparel products accounted for around 76% of total US apparel and textile imports from China in 2017.

- China accounted for 33.7% of US apparel imports in 2017, more than double the share of the US’s second-largest trading partner, Vietnam, which accounted for 14.4% of total apparel imports last year.

- The sourcing diversification trend is strengthening, and the US imported apparel from approximately 150 countries in 2017.

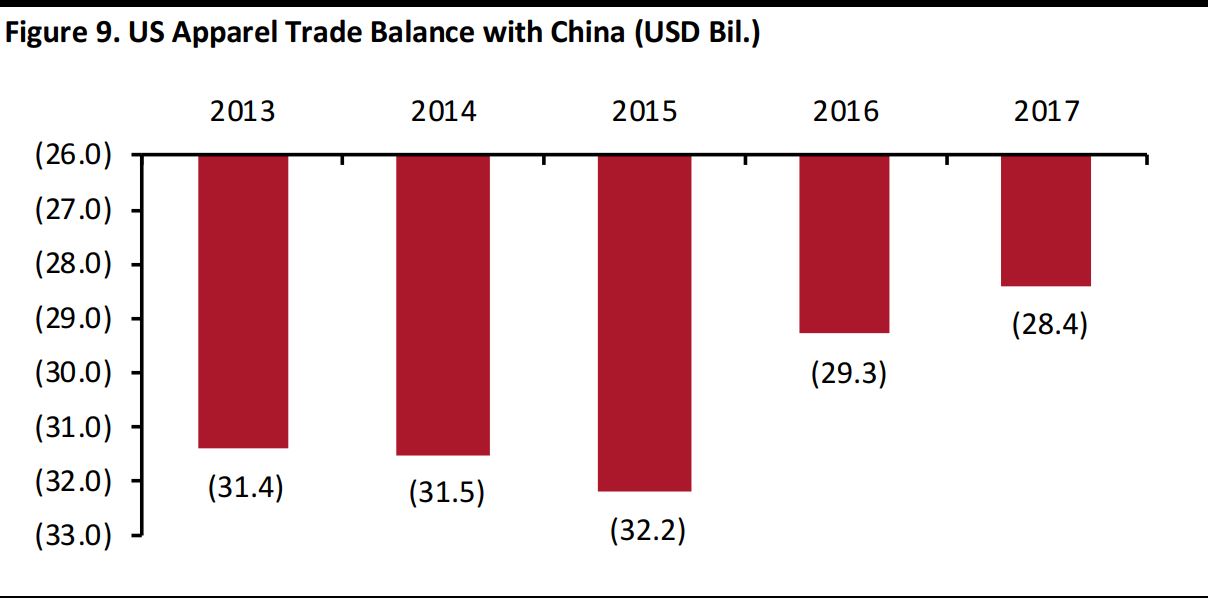

- The US trade deficit with China in apparel is improving. It fell from $29.3 billion in 2016 to $28.4 billion in 2017.

- The US has steadily increased its exports to China while reducing its import dependence on the country. The trend has been complemented by many US companies diversifying their sourcing to safeguard themselves.

What We Expect

- We expect the US’s apparel and textiles trade deficit with China to narrow further. The deficit was down 1% year over year in July 2018. From 2013 to 2017, the US increased its apparel exports to China from $47 million to $89 million.

- Apparel goods are largely exempted from the current US tariffs. The exceptions include some specialty articles such as apparel made from furskin, but if the tariffs are extended to include all apparel products, many US companies may face increased input prices in the short run.

- Over the longer term, we expect US companies to further diversify their sourcing among China’s competitors. We note that some products that are “Made in China” cannot be produced elsewhere. US retailers that sell such imports will face increased prices for them, according to the USFIA’s 2018 Fashion Industry Benchmarking Study.

Source: OTEXA

Source: OTEXA

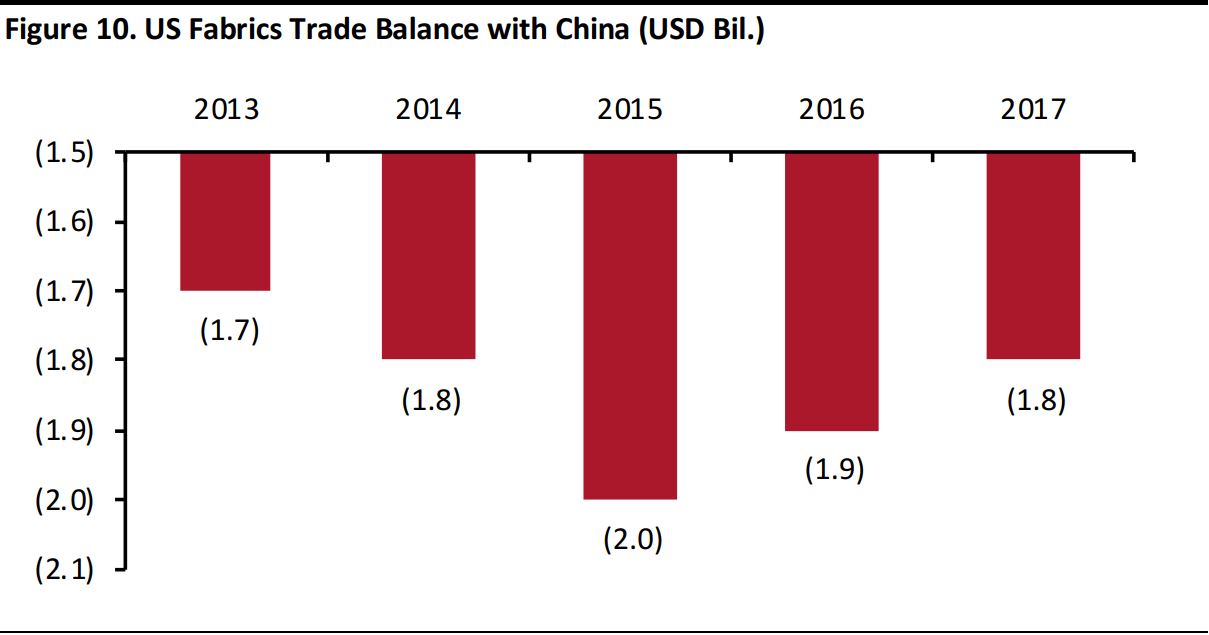

Fabrics: Falling Deficit in Light of Steady Exports

Fabrics are included in the latest list of goods imported from China that are subject to tariffs.

What Has Happened

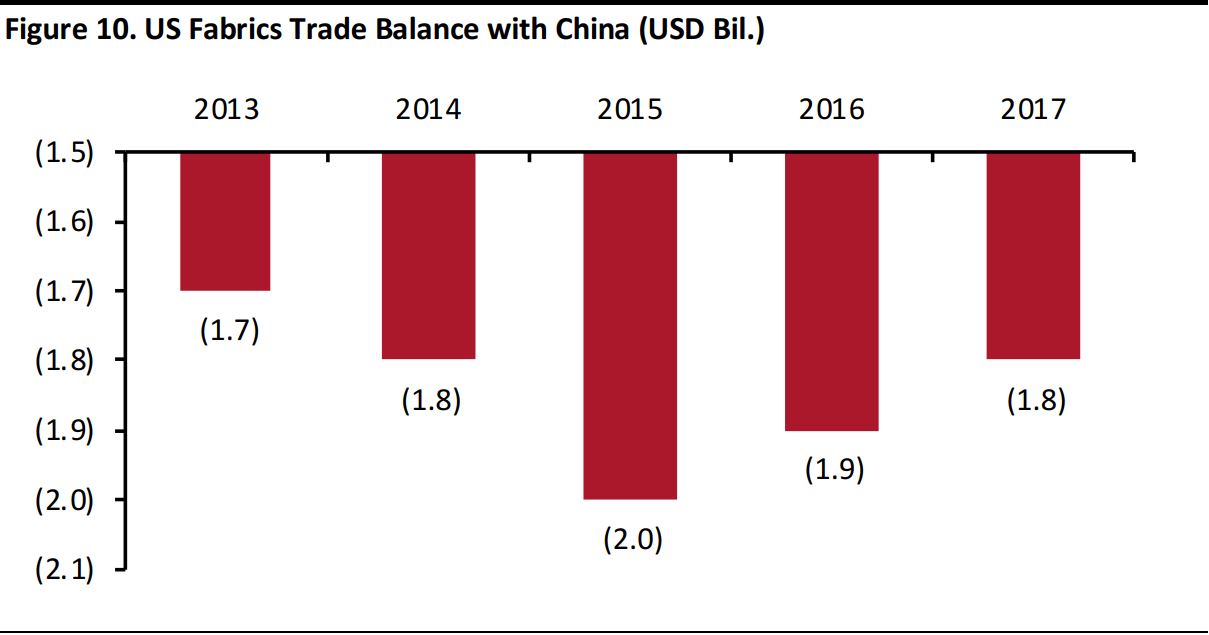

- The US fabrics trade deficit with China reached a peak of $2 billion in 2015, its highest value since 1990, before narrowing to $1.8 billion in 2017. US fabric exports to China were up 13% year over year in July 2018.

- The US fabrics trade deficit with China has improved since 2009, but fabric imports have not fallen as significantly as imports of other categories such as apparel and yarn.

- The US imported fabrics worth $2.4 billion from China in 2015. That figure decreased marginally, to $2.3 billion, in 2017.

- The fabrics deficit has narrowed since 2015 as the US textiles industry has thrived, boosting exports.

What We Expect

- The US fabrics industry is likely to benefit from the tariffs, given the steady stream of exports to China. Such exports increased from $351 million in 2014 to $453 million in 2017.

Source: OTEXA

Source: OTEXA

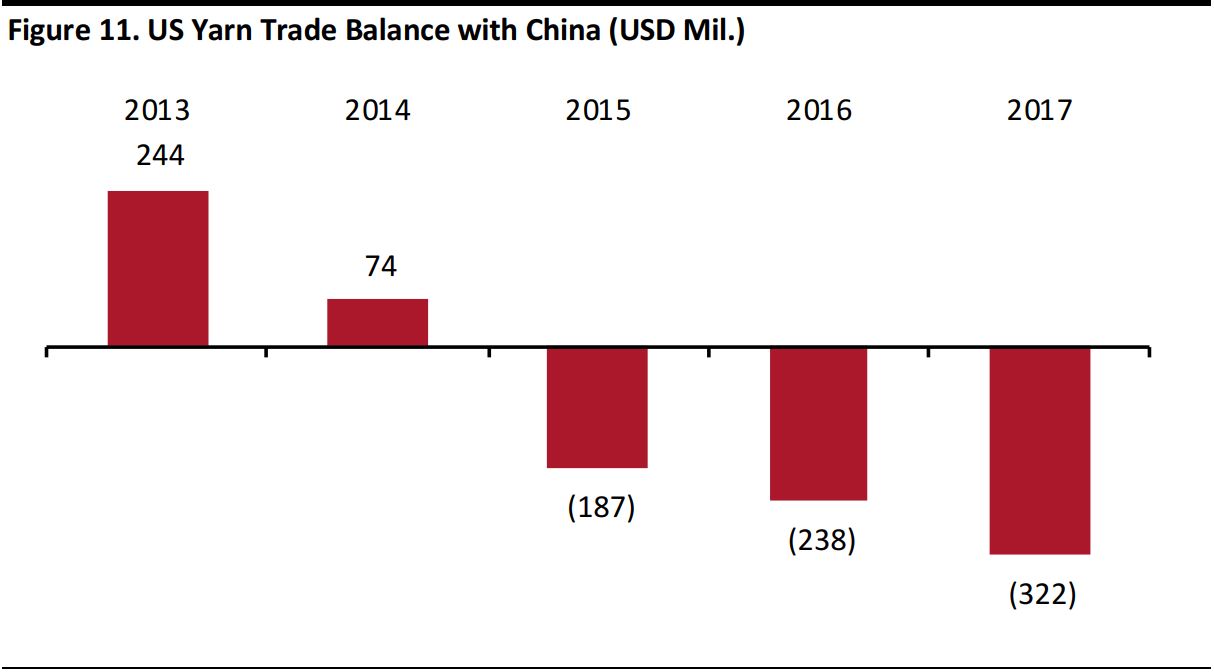

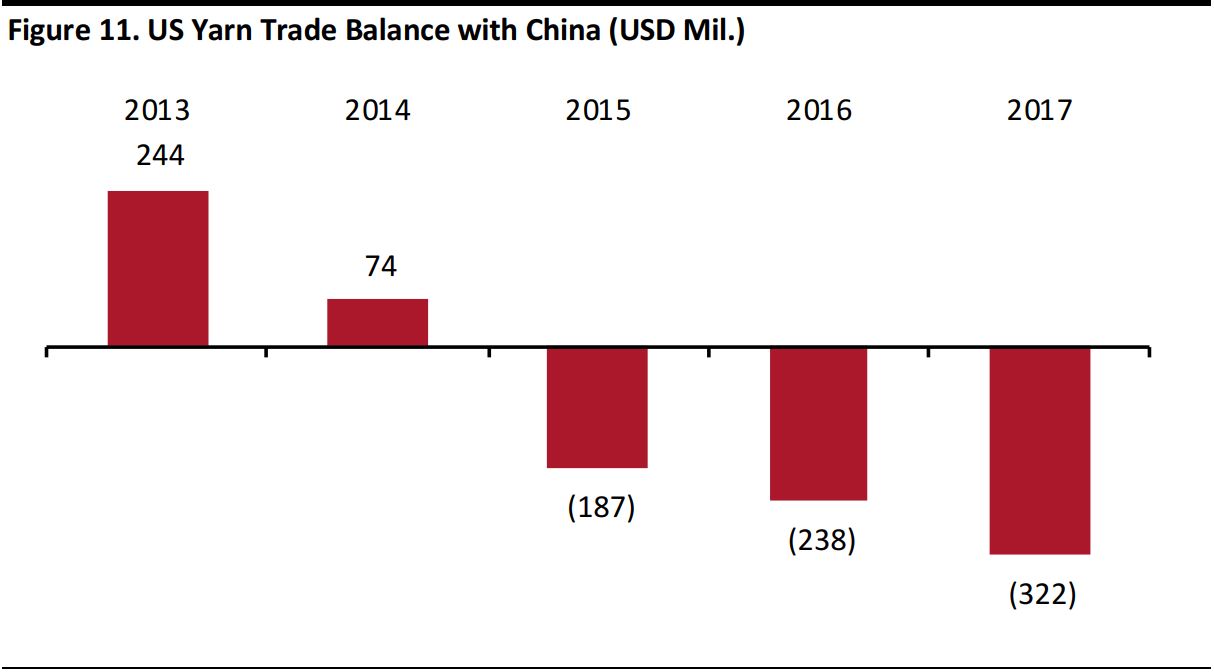

Yarn: Exports to China on a Decline Since 2013

Along with fabrics, yarn is extensively covered in the latest list of goods subject to tariffs. The US registered a surplus in its yarn trade with China until 2014.

What Has Happened

- The US yarn trade deficit can largely be attributed to declining US exports to China. US yarn exports to the country dropped from $835 million in 2013 to $330 million in 2017, falling at a CAGR of 26%. US yarn imports from China increased from $593 million to $653 million during the same period, growing at a CAGR of 2.5%.

- We can infer that the trade deficit in the category is primarily due to US yarn manufacturers losing their competitive edge in the Chinese market in the context of falling exports.

- China has imposed tariffs of its own on all categories of US yarn, which will deter US yarn manufacturers from exporting more of their products to China.

- In July 2018, US yarn exports to China fell by 32% year over year, while yarn imports from China increased by 16%.

What We Expect

- Among all apparel and textiles categories, we expect yarn to be the most severely affected by the current tariffs.

- The US yarn trade deficit with China was $322 million in 2017, and we expect that to increase as the new tariffs kick in, since the Chinese yarn market is highly competitive and sees falling imports due to very low prices in China. The country is the world’s largest exporter of yarn, accounting for approximately 22% of the export market in 2016, and this may put additional pressure on the US’s rising deficit with China.

Source: OTEXA

Source: OTEXA

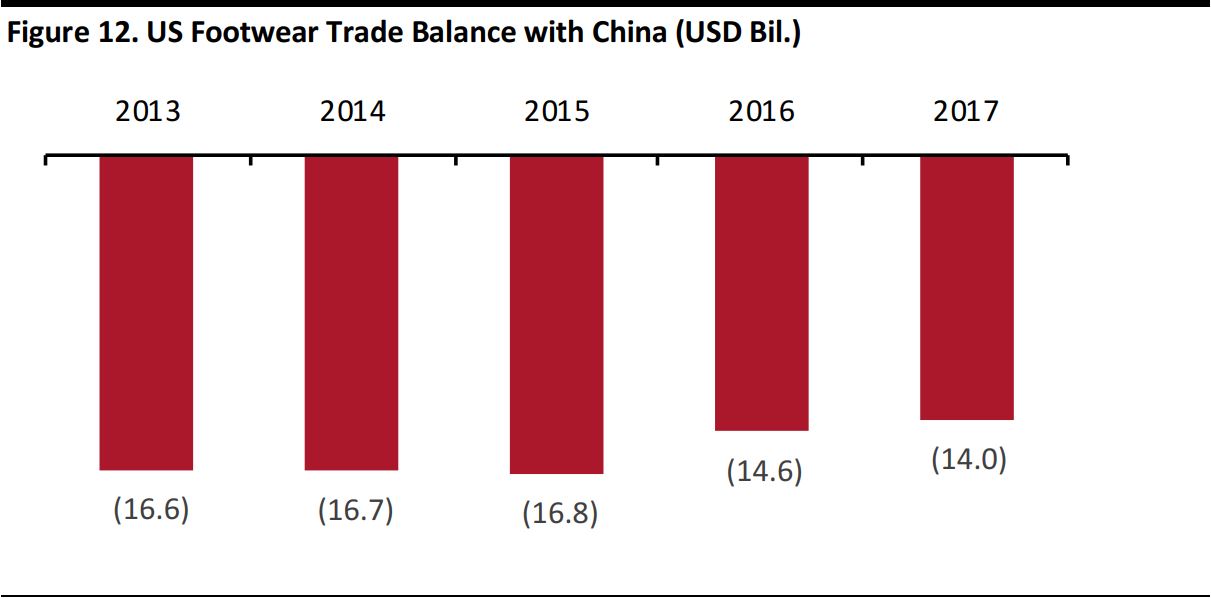

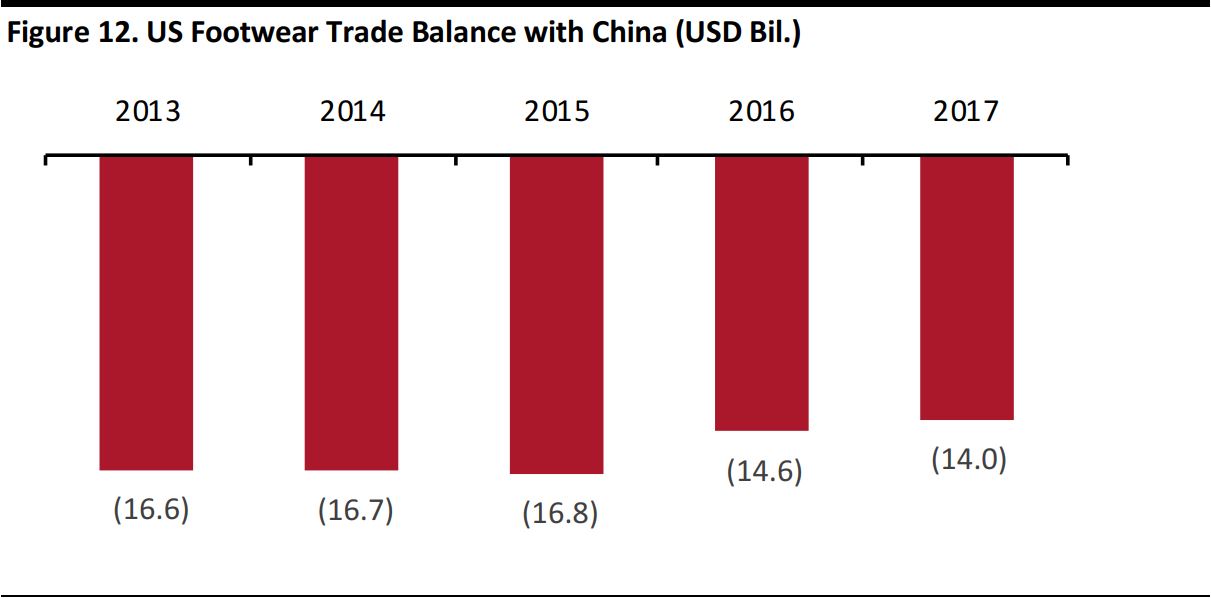

US-China Trade: Footwear

In 2017, the US imported $25.1 billion worth of footwear from other countries.

What Has Happened

- China exported footwear worth $14 billion to the US in 2017, making it the leader in footwear exports to the US, with a 56% share.

- The US footwear trade deficit with China was $14 billion in 2017 (roughly equivalent to the import value), which implies that US footwear exports to China have been negligible.

- The US imported 1.7 billion pairs of shoes from China in 2017. Vietnam, the second-largest footwear exporter to the US, exported 405 million pairs of shoes to the US last year, according to the Footwear Distributors and Retailers of America.

What We Expect

- Footwear is exempted from tariffs on the latest list, but if the US government adds shoes to the list, footwear prices are likely to rise, given that China accounts for such a large share of category imports to the US.

Source: OTEXA

Source: OTEXA

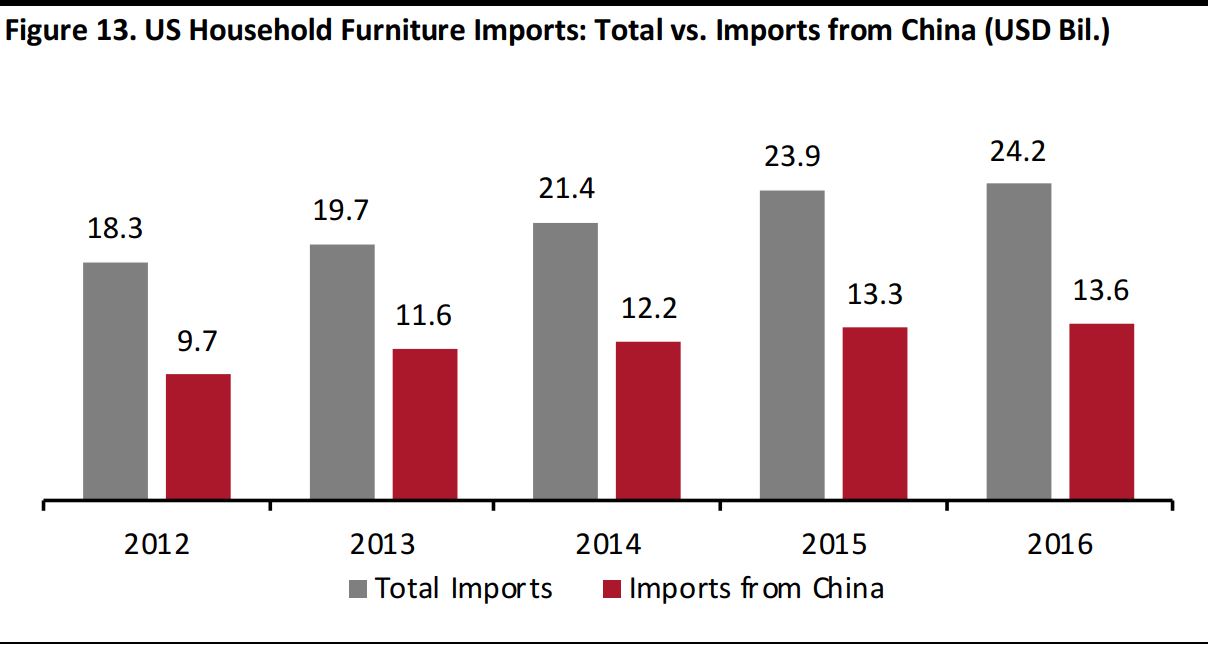

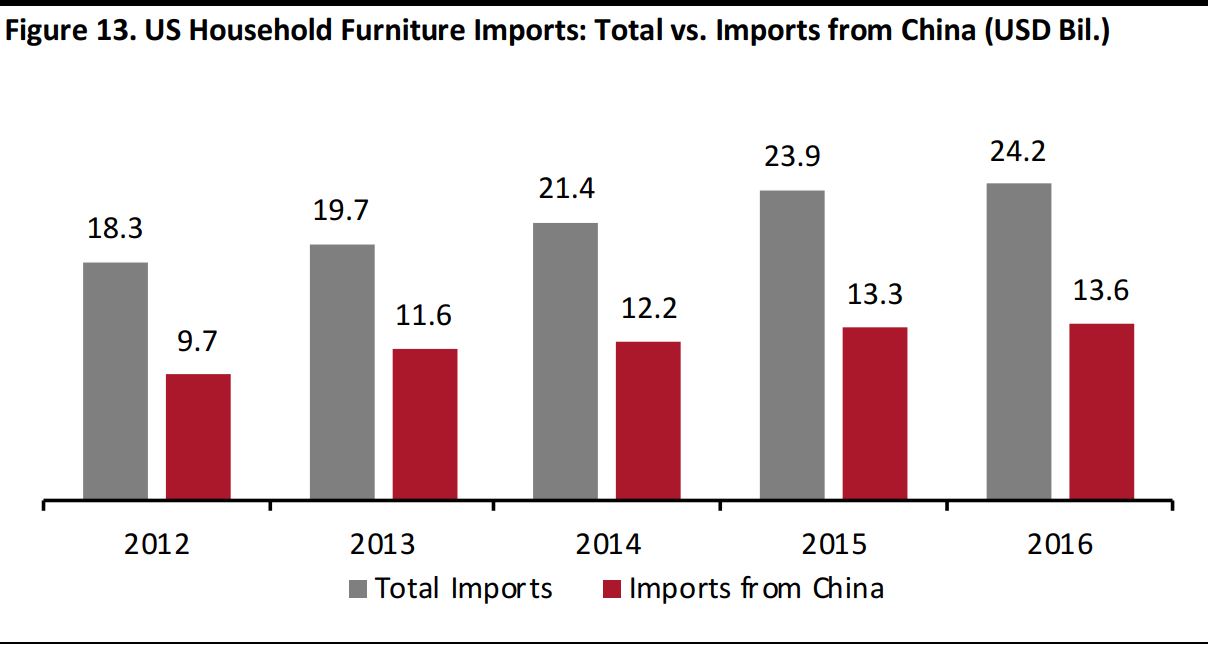

US-China Trade: Household Furniture

Household durables such as furniture and appliances are included on the latest list of Chinese goods subject to tariffs. The home appliances and fittings covered are categorized under home furnishings.

What Has Happened

- China is the largest exporter of furniture to the US. In 2016, total US furniture imports equaled $24.2 billion and imports from China accounted for $13.6 billion, or 57%, of the total.

Source: Furniture Today

Source: Furniture Today

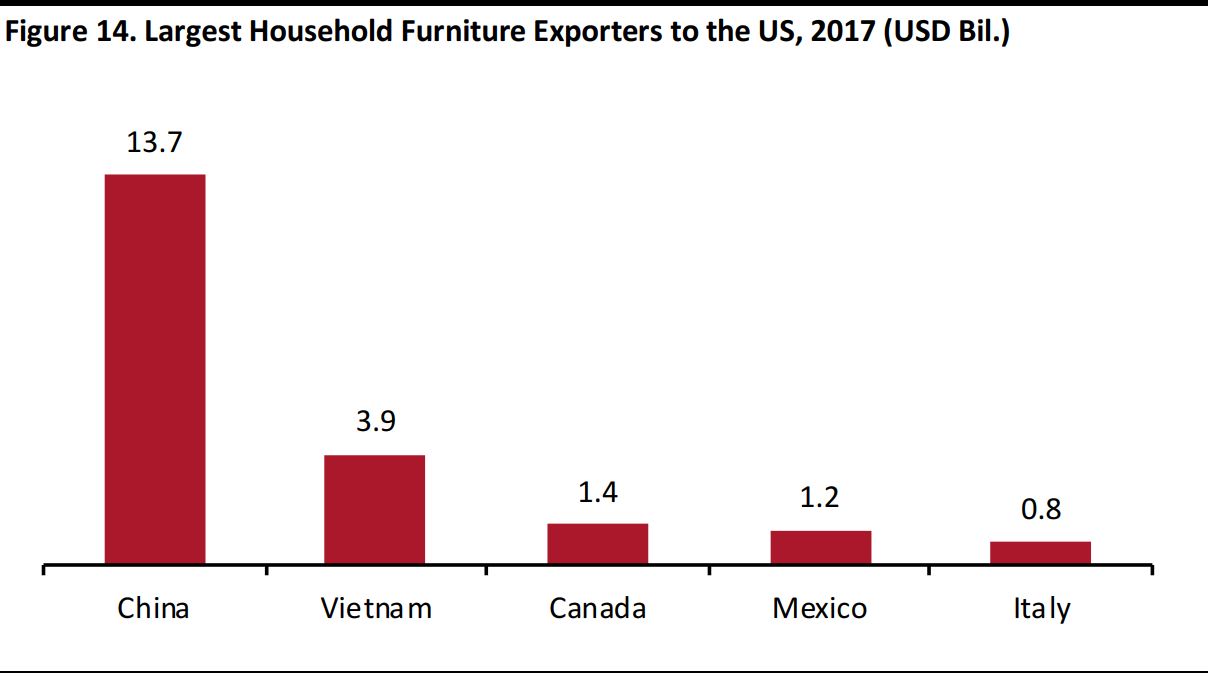

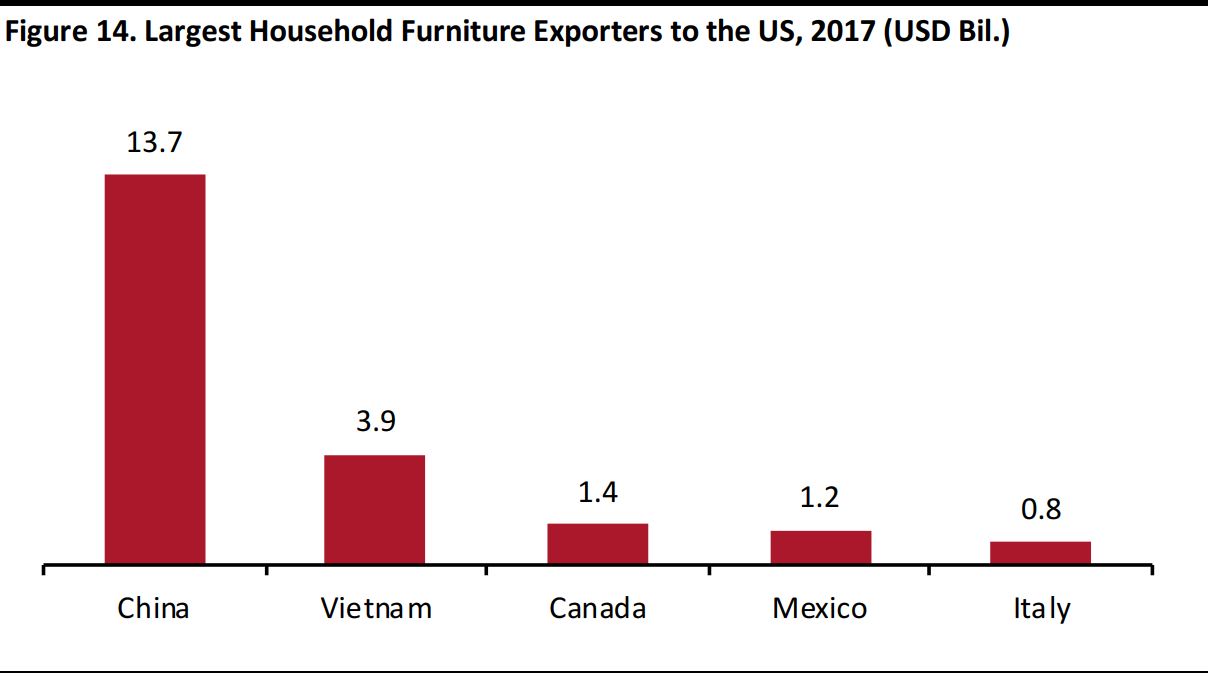

- In 2017, China’s household furniture exports to the US were more than four times higher than those of Vietnam, the second-largest furniture exporter to the US.

Source: Statista/Furniture Today

Source: Statista/Furniture Today

What We Expect

- US furniture retailers are highly dependent on Chinese furniture imports, which are cheaper than those from other exporting nations such as Vietnam and Canada. Accordingly, US consumers could see tariffs impact the price of furniture more than the price of items in other categories, such as apparel.

- In addition to being price-competitive, China is also the largest furniture producer and exporter in the world. The country accounted for 39% of total global furniture production in 2016 and 40% in 2017, according to CSIL.

- Vietnam and Canada each accounted for only 2% of total global furniture production in 2016. China’s strength in furniture manufacturing is likely to work to its benefit, enabling it to impact furniture prices in the international market.

Impact of Tariffs on the 2018 Holiday Season

We do not expect the recently enacted tariffs to affect prices in US stores this holiday season. But it is too early to assess the full implications of the tariffs, as orders that are subject to duties will take time to filter through to retailers’ shelves: retailers order consumer goods such as furniture and raw materials such as yarn and fabrics well in advance. Although pressure will soon be felt across the supply chain, we expect the retail sector to see only a negligible impact from the recently enacted tariffs over the remainder of the year.

What We Think

In time, we expect the tariffs on textiles and furniture to increase inflationary pressure across the supply chain, and we think that the category where consumers are most likely to see higher prices is furniture.

If the US increases the tariffs rate to 25% and extends the tariffs to cover all goods imported from China, apparel and footwear will be among the categories most impacted. Retailers that have diversified their sourcing arrangements would be best placed in that scenario, while those sourcing primarily from China would have to choose between passing on cost increases to shoppers in a highly price-competitive market or absorbing costs at the expense of margins. China may be losing some of its export share to other countries that offer low-cost manufacturing, but it remains a vital source of imports for many US companies.

China’s scale of production and its efficiency make it the preferred destination for sourcing across various categories. We expect US companies to continue sourcing from China, although possibly at a reduced scale, unless the US tariffs increase considerably.

Source: Office of the United States Trade Representative (USTR)/Coresight Research

Source: Office of the United States Trade Representative (USTR)/Coresight Research Source: CSIL/company reports/United States International Trade Commission (USITC)/Coresight Research

Source: CSIL/company reports/United States International Trade Commission (USITC)/Coresight Research *For the company’s fiscal year ended January 2018

Source: Company reports/Coresight Research

*For the company’s fiscal year ended January 2018

Source: Company reports/Coresight Research Source: Company reports/American Apparel & Footwear Association/Wedbush Securities

Source: Company reports/American Apparel & Footwear Association/Wedbush Securities *Estimated based on the company’s statement that it sources 60% of its products abroad and given the total production value of the countries from which it sources.

Source: Company reports/Coresight Research

*Estimated based on the company’s statement that it sources 60% of its products abroad and given the total production value of the countries from which it sources.

Source: Company reports/Coresight Research  Source: USITC

Source: USITC Source: USITC

Source: USITC Source: OTEXA

Source: OTEXA Source: OTEXA

Source: OTEXA

Source: OTEXA

Source: OTEXA Source: OTEXA

Source: OTEXA Source: OTEXA

Source: OTEXA Source: Furniture Today

Source: Furniture Today Source: Statista/Furniture Today

Source: Statista/Furniture Today