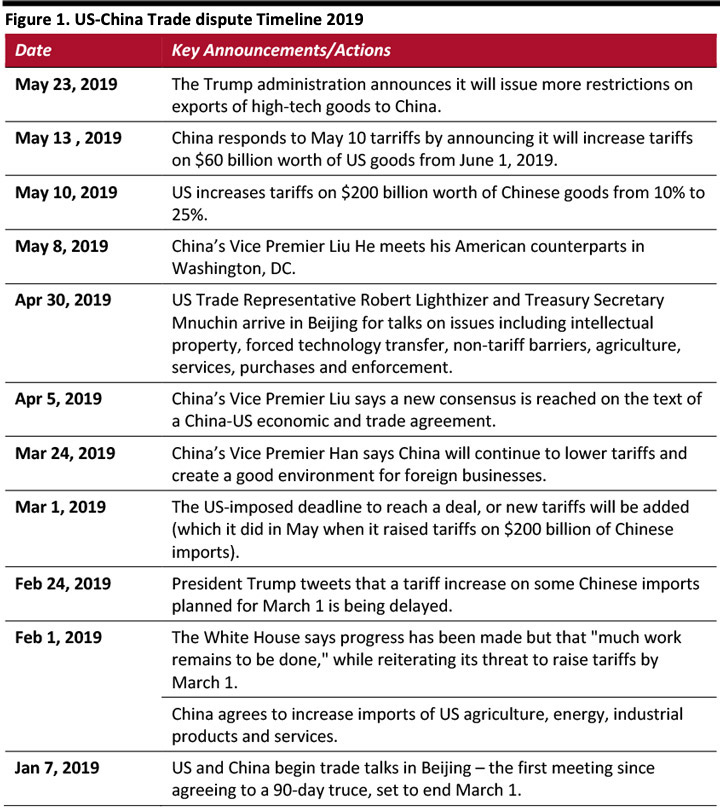

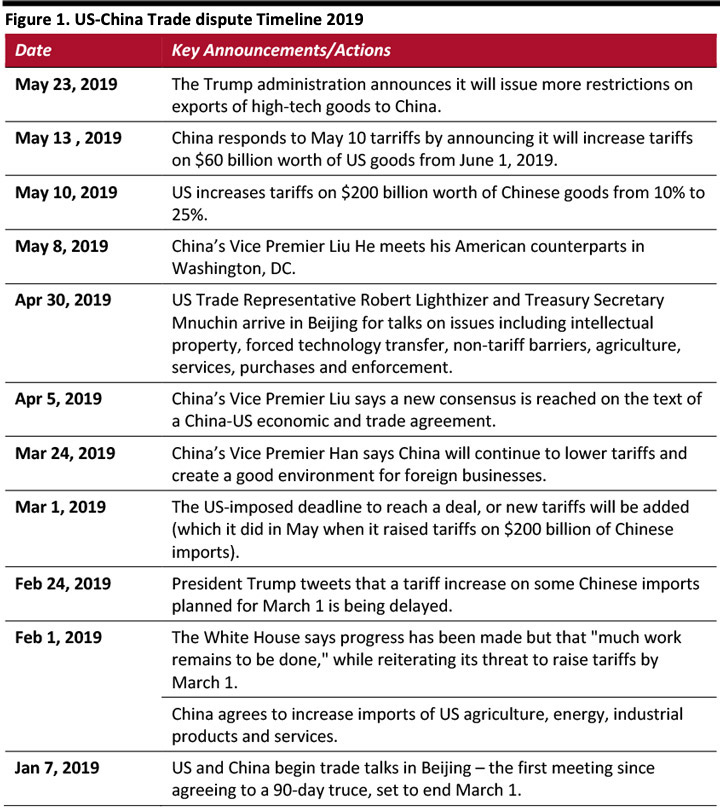

How the tariff battles escalated into a dispute: A timeline

The trade dispute between China and the US has been going on for

over a year. In January 2018, US President Donald Trump stated his intention to fix China’s “longtime abuse of the broken international system and unfair practices.” Since then, the tariff war has seen

a number of skirmishes.

We look back at how it started, what goods it impacts and how we think it will impact various industries.

[caption id="attachment_90126" align="aligncenter" width="720"]

Source: Ministry of Finance of the PRC/Bloomberg/Xinhua News/China Briefing/CNBC/South China Morning Post/ Coresight Research

Source: Ministry of Finance of the PRC/Bloomberg/Xinhua News/China Briefing/CNBC/South China Morning Post/ Coresight Research[/caption]

The lastest tariffs and how retail categories will be impacted

In May, US President Trump increased tariffs on $200 billion worth of Chinese goods from 10% to 25%, and said the US would impose 25% tariffs on an additional $325 billion worth of Chinese goods “shortly.” Soon after the US increased tariffs on $200 billion worth of Chinese goods on May 10, Beijing said it would increase tariffs on nearly $60 billion worth of US goods on May 13. Financial markets fell, with the S&P 500 index shedding more than 2.4% in one day and more than 4% in May.

There are currently more than 2,000 US imports affected by China’s tariffs, including beef, lamb, pork, vegetables, seasoning, juice, cooking oil, tea, coffee, refrigerators, textiles, furniture, and electronic devices such as microwaves and printers, and liquefied natural gas. The Trump administration is also taking steps to restrict exports of high-tech goods to China, according to Politico.com.

According to a report released on May 22 by the American Chamber of Commerce in Shanghai, 74.9% of almost 250 respondents to a survey undertaken May 16-20 said the increases in tariffs are having a negative impact on their business. Of the survey participants, 61.6% were manufacturing-related, 25.5% were in the services sector, 3.8% were in retail and distribution and 9.6% came from other industries.

If the US increases tariffs to 25% and extends the tariffs to cover all goods imported from China, apparel and footwear will be among the categories most impacted. On May 20, more than 270 shoe retailers asked the White House to stop the escelation. According to trade organization Footwear Distributors and Retailers of America, a 25% tariff on footwear could cost shoppers more than $7 billion each year.

The tariffs on textiles and furniture will increase inflationary pressure across the supply chain, and we think the category in which consumers are most likely to see higher prices is furniture. According to curbed.com, many fabricators, furniture manufacturors and designers have already started sourcing from new locations. Also, some have explained tariffs are an added pressure - a $1 increase in production costs usually leads to a $4 to $6 increase in retail price; so an extra 10% tariff on a product that costs $50 to make would lead to a retail price that’s $20 or $30 more.

[caption id="attachment_90126" align="aligncenter" width="720"]

[caption id="attachment_90126" align="aligncenter" width="720"] Source: Ministry of Finance of the PRC/Bloomberg/Xinhua News/China Briefing/CNBC/South China Morning Post/ Coresight Research[/caption]

Source: Ministry of Finance of the PRC/Bloomberg/Xinhua News/China Briefing/CNBC/South China Morning Post/ Coresight Research[/caption]