Tariffs Timeline

In early March, US President Donald Trump announced tariffs of 25% on steel and 10% on aluminum imported into the US from China and other countries.

On Monday, April 2, China responded with tariffs of up to 25% across 128 US product categories that include fruit, pork, steel pipes, and ethanol.

On Tuesday, April 3, the US revealed plans to apply a 25% tariff to 1,333 product categories imported from China for sale in the US. These products include industrial machinery and parts thereof, electronic components, specialist electronic equipment, and medical devices. This plan will be open to public consultation.

On Wednesday, April 4, China announced that it plans to impose tariffs of 25% on $50 billion worth of US exports across 106 categories that include chemicals, cars, and soybeans.

On Thursday, April 5, Trump said that he had instructed the US Trade Representative to consider whether additional tariffs on $100 billion worth of imports would be appropriate and to identify products on which it could impose those tariffs.

On Friday, April 6, China’s Ministry of Commerce responded by stating that it “does not want to fight a trade war, but [is] not afraid to fight a trade war.”

What Could Be Next?

Tariffs have so far largely been limited to industrial machinery, parts and components, automobiles, and agricultural products. Chinese consumers may see higher prices on some food products imported from the US, but, otherwise, US and Chinese retailers and their shoppers are likely to see a limited direct impact from the tariffs announced so far.

If the US imposes tariffs on a further $100 billion of goods, as suggested on April 5, retailers’ relative insulation could end. In particular, tariffs on apparel and footwear would represent a step-up in the trade dispute and would likely result in a significant cost increase for many retailers.

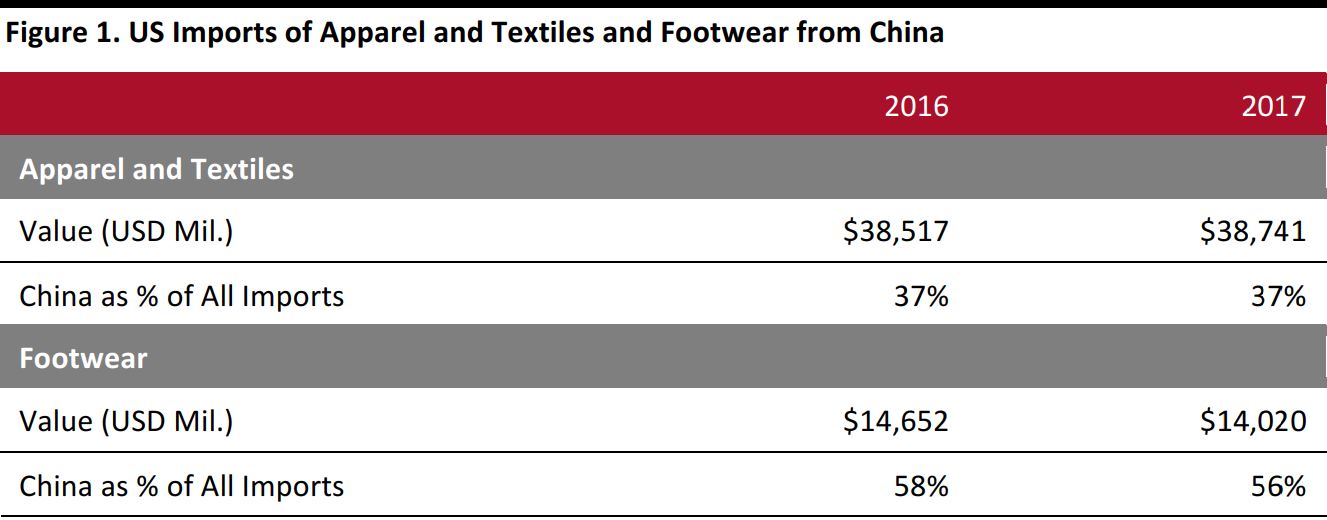

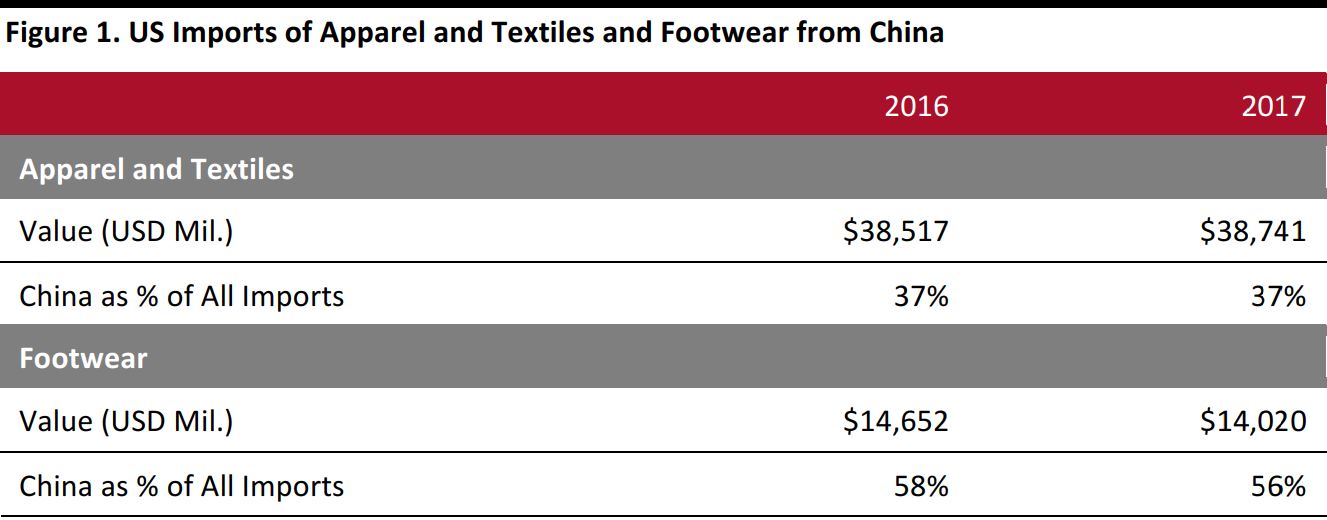

In 2017, China accounted for some 37% of US imports of apparel and textiles and fully 56% of US imports of footwear, by value.

Source: US Department of Commerce International Trade Administration

US apparel is a highly competitive market in which nontraditional retailers are growing rapidly at the expense of legacy midmarket retailers. These nontraditional retailers include Amazon; European fashion retailers such as Inditex, ASOS, Boohoo.com, and Primark; and off-pricers such as T.J.Maxx. We think that the level of competition in the market would limit the ability of many domestic specialty retailers and department stores to meaningfully increase prices if the US imposes tariffs on Chinese apparel and footwear and that any such tariffs would therefore likely result in margin erosion for these types of retailers. Indeed, any hike in prices by midmarket retailers risks accelerating shoppers’ migration to price-competitive rivals such as off-pricers and e-commerce retailers.