Nitheesh NH

Introduction

The children’s and infants’ apparel and footwear market captured 7.7% of the total US apparel and footwear market in 2021 and comprises an important part of assortments by major brands and retailers including Adidas, Gap, Levi’s, NIKE, Ralph Lauren, Target and Walmart. In this report, we discuss the US children’s and infants’ apparel and footwear market, which we define as catering for those up to 14 years old. We present the market size and growth outlook, plus key market drivers, competitive landscape and major trends among brands and retailers looking to better serve the market.Market Performance and Outlook

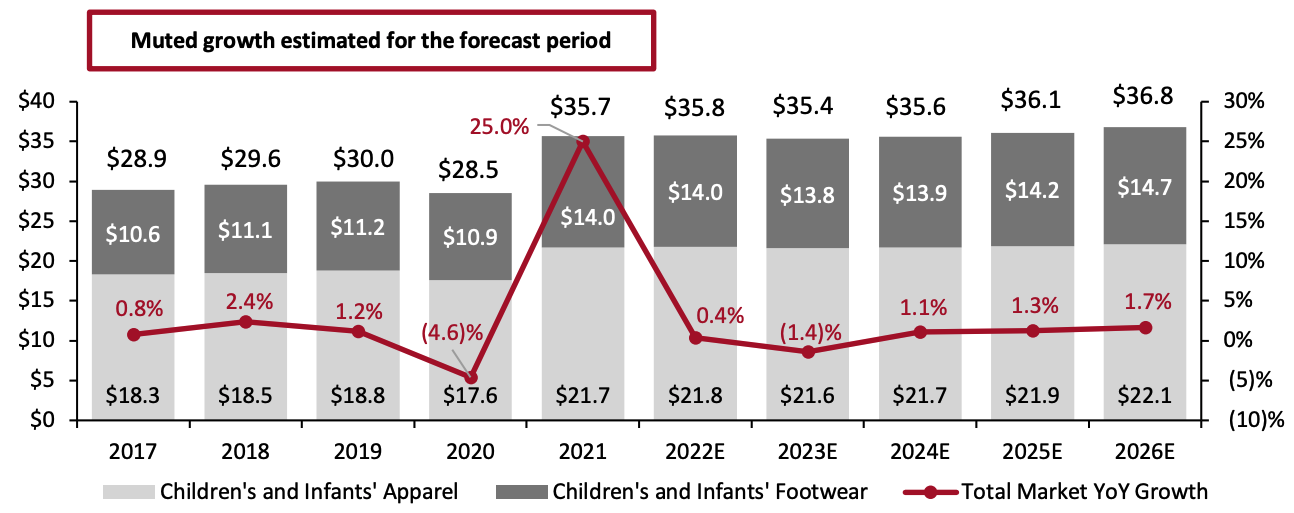

Market Overview We estimate that the US children’s and infants’ apparel and footwear market will grow 0.4% in 2022, as shown in Figure 1, which is marginally slower than our 0.5% growth expectations for the total apparel and footwear market. By category, we expect children’s and infants’ apparel sales to continue to dominate the total children’s and infants’ apparel and footwear market with an estimated $21.8 billion in sales in 2022, and accounting for 60.9% of the total market. Capturing the rest of the market, footwear will reach $14.0 billion in 2022, we estimate. We expect the market to see a low-single-digit decline in 2023 as pent-up demand and stimulus check savings dwindle. Compared to the total clothing and footwear market, which we model to decline by 2.3% in 2023, the children’s and infants’ apparel and footwear market will see a milder decline of 1.4%, reflecting its lower volatility due to a higher nondiscretionary component. We estimate that the market will fully normalize in 2024 and return to a low-single-digit annual growth rate in 2025 and 2026, similar to the rate seen before the crisis but still slower than the total clothing and footwear market.Figure 1. US Children’s and Infants’ Apparel and Footwear Market: Sales by Category (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_142563" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis/Coresight Research[/caption]

Source: Bureau of Economic Analysis/Coresight Research[/caption]

Market Factors

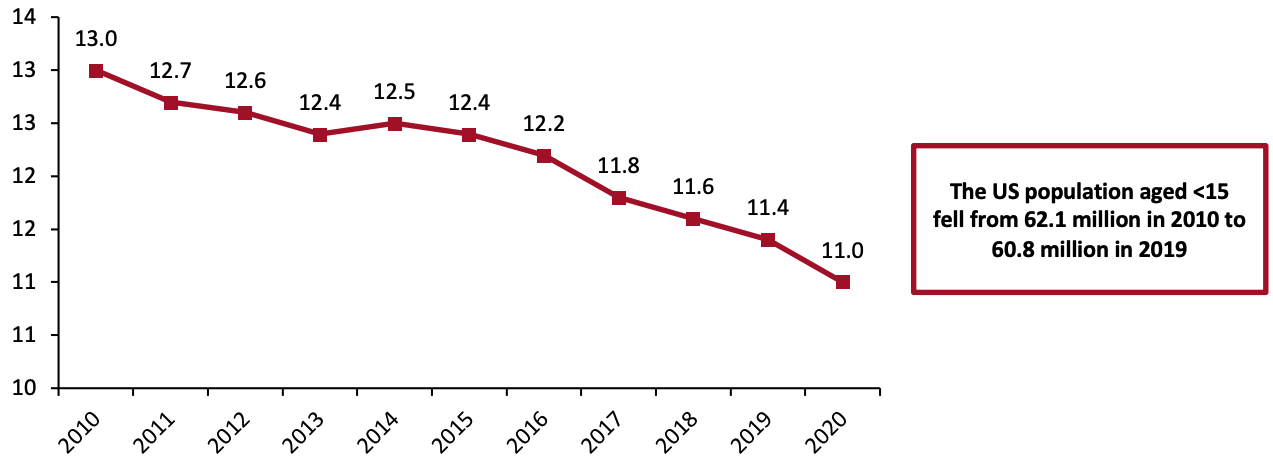

We identify five main market factors impacting the US children’s and infants’ apparel and footwear market. 1. Declining US Birth Rates Childrenswear retailers are battling a structural decline in the US birth rate. Data released by the National Center for Health Statistics in February 2022 indicate a continuous decline in US birth rates from 2010 to 2020, as shown in Figure 2. In absolute terms, the US population aged under 15 declined from 62.1 million in 2010 to 61.0 million in 2015 to 60.8 million in 2019 (latest), according to Census Bureau data. We are closely monitoring US birth rates and believe there may be a temporary bounceback in 2022. Many people postponed their weddings during the pandemic and are set to celebrate in 2022, indicating a potential birth rate rebound. Elevated pregnancy test sales are another leading indicator of the potential baby boom: Sales increased by 13% from June 2020 to November 2021, according to data from Nielsen and research by Bank of America. This compares with an average increase of 2% year over year from 2016 to 2019. Nevertheless, we still believe that birth rates will continue to decline over the long term. As a consequence, brands and retailers must seek to shore up sales by pulling levers such as compelling product innovation and brand collaboration—these can help companies build market share and drive up average selling prices.Figure 2. US Birth Rate (Births per Thousand Population) [caption id="attachment_142564" align="aligncenter" width="700"]

Source: National Center for Health Statistics/US Census Bureau[/caption]

2. Vaccinations and Children’s Return to Normal Behavior

2021 brought vaccine rollouts not only to adults, but also to children aged 5–17 years, widening the path out of the pandemic. In the US, 10.3% of US children aged 5–17 years have received at least one Covid-19 vaccine dose, and 9.9% of US children in the age group are fully vaccinated, according to the Centers for Disease Control and Prevention as of February 14, 2022.

The United States Food and Drug Administration is still reviewing the Covid-19 vaccine suitability for children aged under 5 years and expects to approve it for the market later in 2022. The US has also been easing Covid-19 lockdowns and allowed children to go back to school from September 2021—albeit with policies varying by state. Children returning to normal educational and social behaviors outside of the home is a short-term factor that will drive the sales of children’s and infant’s clothing and footwear in 2022.

3. Higher Apparel Renewal Demand Due to Body Growth

Children grow and adults don’t—for this reason, kidswear is a less volatile market than fashion-driven adult clothing and footwear, and it consequently suffered less amid the pandemic declines of 2020. While the children’s and infants’ apparel market declined by 6.1% in 2020 amid the pandemic, its decline was less severe than the men’s and women’s apparel market, which declined by 8.7% and 10.7% respectively. The “growth factor” means there is a greater nondiscretionary component in children’s and infants’ apparel and footwear than for adults that have largely finished growing, making the category more likely to sustain growth.

4. US Travel Recovery

The US travel industry—comprising both domestic and international trips—has been hit hard by the pandemic: Air travel declined by more than 90% at the peak of the crisis in 2020, according to data from the Transportation Security Administration. The recovery of travel in the US is now fully underway, with consumers beginning to unleash their pent-up demand for holidays and pandemic savings on experience spending. A gradual return to travel in 2022 will result in welcome gains for tourism-driven retail sectors and related apparel sectors such as children’s swimwear.

5. Inflation

We see inflation as an important driver of the US children’s and infants’ apparel and footwear market. The US inflation rate in the apparel and footwear sector rose by 5.3% in January 2022 compared to the same month in 2021, according to the Bureau of Labor Statistics. Raised prices will provide upward support to growth in spending on children’s and infants’ apparel and footwear in 2022.

Source: National Center for Health Statistics/US Census Bureau[/caption]

2. Vaccinations and Children’s Return to Normal Behavior

2021 brought vaccine rollouts not only to adults, but also to children aged 5–17 years, widening the path out of the pandemic. In the US, 10.3% of US children aged 5–17 years have received at least one Covid-19 vaccine dose, and 9.9% of US children in the age group are fully vaccinated, according to the Centers for Disease Control and Prevention as of February 14, 2022.

The United States Food and Drug Administration is still reviewing the Covid-19 vaccine suitability for children aged under 5 years and expects to approve it for the market later in 2022. The US has also been easing Covid-19 lockdowns and allowed children to go back to school from September 2021—albeit with policies varying by state. Children returning to normal educational and social behaviors outside of the home is a short-term factor that will drive the sales of children’s and infant’s clothing and footwear in 2022.

3. Higher Apparel Renewal Demand Due to Body Growth

Children grow and adults don’t—for this reason, kidswear is a less volatile market than fashion-driven adult clothing and footwear, and it consequently suffered less amid the pandemic declines of 2020. While the children’s and infants’ apparel market declined by 6.1% in 2020 amid the pandemic, its decline was less severe than the men’s and women’s apparel market, which declined by 8.7% and 10.7% respectively. The “growth factor” means there is a greater nondiscretionary component in children’s and infants’ apparel and footwear than for adults that have largely finished growing, making the category more likely to sustain growth.

4. US Travel Recovery

The US travel industry—comprising both domestic and international trips—has been hit hard by the pandemic: Air travel declined by more than 90% at the peak of the crisis in 2020, according to data from the Transportation Security Administration. The recovery of travel in the US is now fully underway, with consumers beginning to unleash their pent-up demand for holidays and pandemic savings on experience spending. A gradual return to travel in 2022 will result in welcome gains for tourism-driven retail sectors and related apparel sectors such as children’s swimwear.

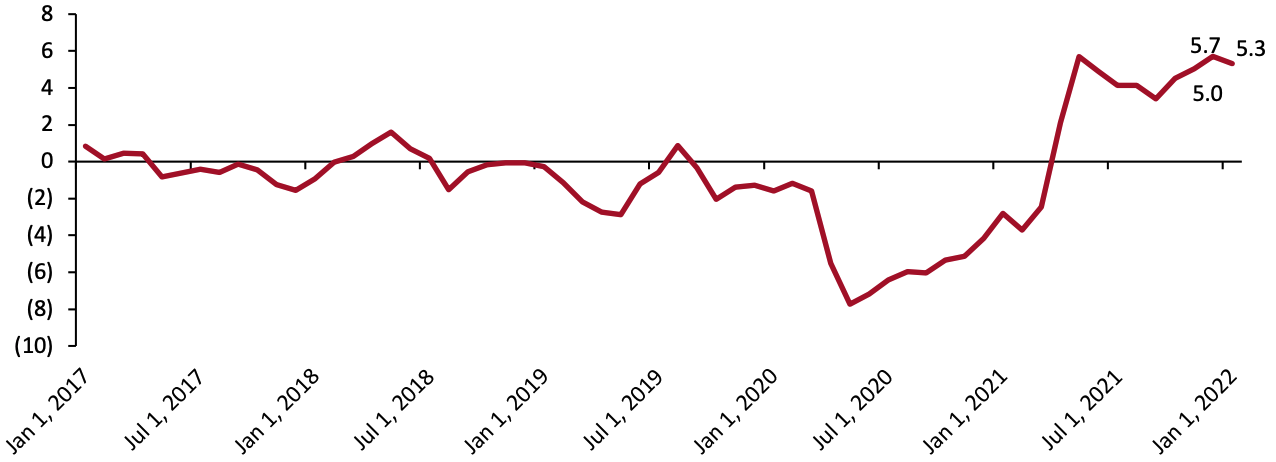

5. Inflation

We see inflation as an important driver of the US children’s and infants’ apparel and footwear market. The US inflation rate in the apparel and footwear sector rose by 5.3% in January 2022 compared to the same month in 2021, according to the Bureau of Labor Statistics. Raised prices will provide upward support to growth in spending on children’s and infants’ apparel and footwear in 2022.

Figure 3. Consumer Price Index: Apparel and Footwear (YoY % Change, Seasonally Adjusted) [caption id="attachment_142565" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

Competitive Landscape

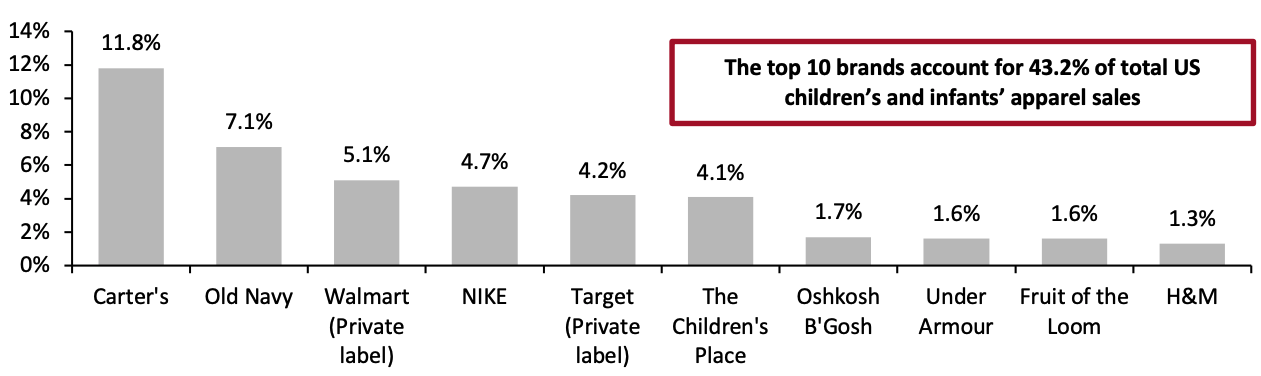

Apparel The US children’s and infants’ apparel market is fragmented, with the top 10 brands accounting for 43.2% of the total US children’s and infants’ apparel sales in 2021, according to data from Euromonitor International. We expect the market to remain fragmented over the next three to five years as the top brands continue to pick up shares from small brands. We attribute market fragmentation to apparel brands and retailers launching new children’s and infants’ lines to capture their own share of the growth. We also expect to see an increase in digitally native children’s and infants’ apparel and footwear brands, which will also contribute to fragmentation.Figure 4. Top 10 US Children’s and Infants’ Apparel Brands: Market Share, 2021 (%) [caption id="attachment_142566" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Footwear

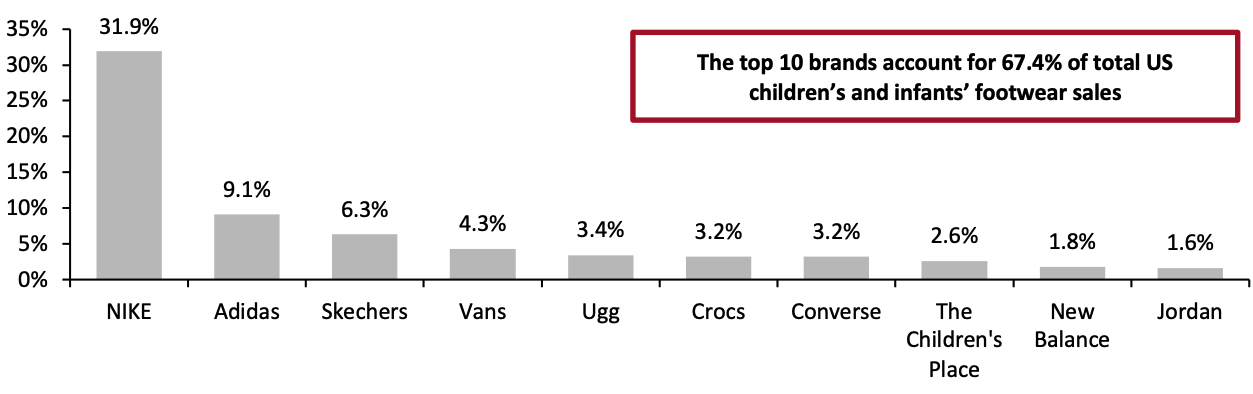

The US children’s and infants’ footwear market is relatively concentrated compared to the children’s and infants’ apparel market, with the top 10 brands accounting for 67.4% of total US children’s and infants’ footwear sales in 2021, according to data from Euromonitor International. We expect the market to concentrate further over the next three to five years as top players gain further dominance.

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Footwear

The US children’s and infants’ footwear market is relatively concentrated compared to the children’s and infants’ apparel market, with the top 10 brands accounting for 67.4% of total US children’s and infants’ footwear sales in 2021, according to data from Euromonitor International. We expect the market to concentrate further over the next three to five years as top players gain further dominance.

Figure 5. Top 10 US Children’s and Infants’ Footwear Brands: Market Share, 2021 (%) [caption id="attachment_142567" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

Figure 6. Selected List of Brands and Retailers Reporting on Children’s and Infants’ Apparel and Footwear in 2021

| Retailer/Brand | Details |

| Carter’s | Carter’s reported in October 2021 that its revenues in the first three quarters of fiscal 2021 grew 14.8%, compared to only 2.8% growth in fiscal 2020. Carter’s believes that the US Government’s proposed legislation on enhancing child tax credits and childcare support, (which is still under discussion but very likely to be approved) will reverse the decline in US births and fuel further growth for the company. |

| Gap | Gap reported in November 2021 that the company sustained the sales growth trend in its kids and baby category sales in the first half of 2021 with strong back-to-school season performance. |

| NIKE | NIKE reported in September 2021 that sell-through in its kids’ business in the first quarter of fiscal 2022 was up almost 30%. The company reported in October 2021 that it is investing more into businesses serving kids. |

| Ralph Lauren | Ralph Lauren reported on its earnings call in February 2022 that the company has been growing shares in its kids’ category for a couple of quarters. |

| Walmart | Walmart reported in August 2021 that it had a strong back-to-school season, including its apparel business, stationery business and other businesses such as lunch boxes and backpacks. |

| Target | Target reported in August that its kids’ business delivered comps in the low 20% range in the second quarter of fiscal 2022. |

Source: Company reports

Themes We Are Watching

In this section, we discuss key themes among brands and retailers looking to better serve the children’s and infants’ apparel and footwear market. Growth of Digitally Native Children’s and Infants’ Brands Digitally native vertical brands (DNVBs) are seeing success within the US apparel and footwear market, especially given the pandemic-accelerated shift to e-commerce. We estimate that the US apparel and footwear DNVB market grew 20.0% to $8.4 billion in 2021. In Figure 7, we present a range of key children’s and infants’ apparel and footwear DNVBs in the US market.Figure 7. Selected DNVBs in Children’s and Infants’ Apparel and Footwear [wpdatatable id=1780]

Source: Company reports/ZoomInfo

Digitally native brands for children and infants such as Dopple and Kidpik are operating successfully in the market with an offering outside of selling own-brand products.- Founded in 2017 and headquartered in New York, Dopple offers a childrenswear subscription box. Dopple completed a seed funding round in April 2021 led by Bullpen Capital for a reported $9.5 million. The company saw success in 2020 amid the pandemic, which it attributes to its subscription model and the decline in traditional wholesale retail.

- Founded in 2016 and headquartered in New York, Kidpik is also a subscription-based childrenswear company. The company filed for an initial public offering in October 2021. The company listed sales of nearly $17 million in 2020, compared to $13.5 million for sales in 2019, indicating the resilience of the subscription-based model during the pandemic.

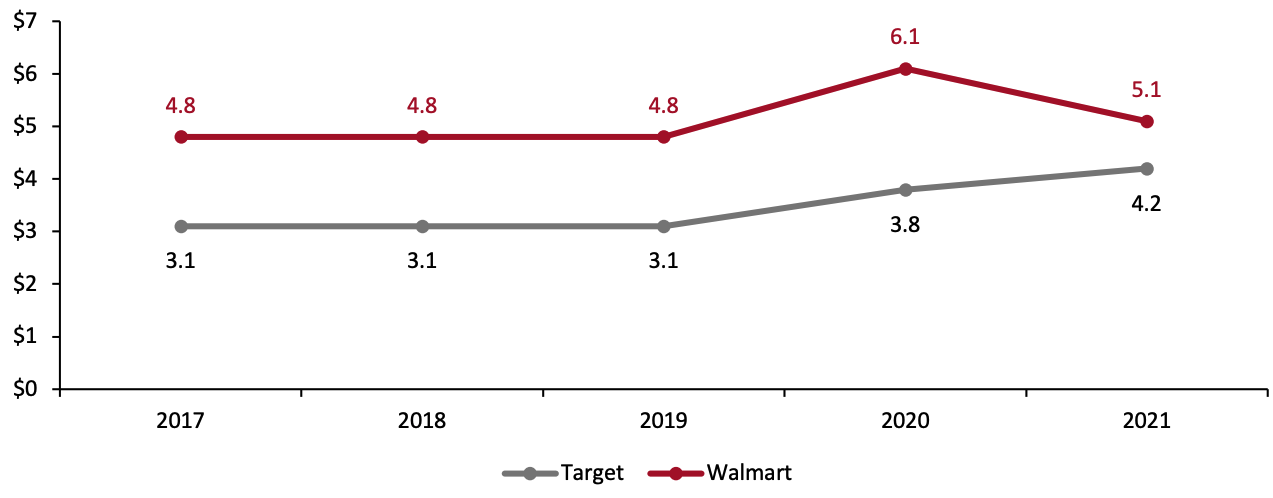

Figure 8. Target’s and Walmart’s Children’s and Infants’ Apparel Private Labels: Market Share (%) [caption id="attachment_142568" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

The Rise of Children’s Streetwear

We are seeing brands and retailers launching children’s streetwear collections, driven largely by the growing number of millennial parents and their desire to buy creative clothing for their children. We believe that momentum in streetwear will be echoed in the children’s streetwear market, presenting opportunities for both traditional and innovative childrenswear brands and retailers.

In Figure 9, we present a range of key streetwear launches in the US children’s and infants’ apparel and footwear market.

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

The Rise of Children’s Streetwear

We are seeing brands and retailers launching children’s streetwear collections, driven largely by the growing number of millennial parents and their desire to buy creative clothing for their children. We believe that momentum in streetwear will be echoed in the children’s streetwear market, presenting opportunities for both traditional and innovative childrenswear brands and retailers.

In Figure 9, we present a range of key streetwear launches in the US children’s and infants’ apparel and footwear market.

Figure 9. Selected Streetwear Launches in Children’s and Infants’ Apparel and Footwear

| Date | Launches |

| January 25, 2022 | Apparel brand PRIME, subsidiary of streetwear brand Public Culture, launches a new childrenswear line, featuring T-shirts in different styles and 16 different colorways. |

| November 14, 2021 | Italian luxury fashion label Off White ventures into kidswear with its first collection. Available in the US market, the assortment includes logo T-shirts and varsity jackets, among other items. |

| May 5, 2021 | Ssense, a multibrand retailer specializing in designer fashion and high-end streetwear, launches Ssense Kids, featuring gender-neutral assortment of apparel, accessories and footwear for children. |

| September 8, 2021 | US children’s apparel brand OshKosh B'gosh teams up with streetwear brand Kith on a 28-piece capsule collection of “casual yet style-forward” apparel and accessories for children. |

| April 30, 2021 | Los Angeles-based luxury fashion brand Fear of God launches a unisex children’s collection with hoodies, T-shirts and sweatpants. |

Source: Company reports

What We Think

Implications for Apparel and Footwear Brands/Retailers- The US children’s and infants’ apparel and footwear market is swimming against a tide of dwindling birth rates yielding declines in the US child population. As a result, we expect, at best, muted total market growth in the coming few years.

- DNVBs are seeing success within the US children’s and infants’ apparel and footwear market. We believe opportunities exist for brands and retailers that have a strong digital presence and alternative business models, such as subscription and direct-to-consumer.

- Faced with increased competition and a declining consumer base (as measured by the child population), longer-standing brands and retailers must shore up sales through building market share and driving up average selling prices. Compelling product innovation and brand collaboration are among the levers that these companies can pull.

- We believe children’s streetwear is an exciting aspect of the market, driven by the growing number of millennial parents and their desire for creativity in childrenswear. We recommend that traditional childrenswear brands and retailers collaborate with streetwear brands or launch apparel collections that feature streetwear styles to keep up with the trend.