DIpil Das

What’s the Story?

In this report, we explore the current US businesswear market. We discuss the trends that we anticipate will shape the future businesswear market and the implications for retailers and brands—including the casualization of work environments, the advantages of the DTC model, the emergence of more comfortable and functional businesswear offerings, the place of rental and subscription business models in the market, and newer designs and size-inclusive offerings.Why It Matters

Many employees are facing drastic changes in the wake of the coronavirus, including job losses and working from home arrangements, which consequently changes the traditional business dress code. We have already seen more flexibility in workplace dress codes and increased diversity in businesswear design, sizes and functions. We estimate that total US consumer spending on clothing will decline by around 12% in 2020, but we anticipate businesswear will see much deeper declines than this average amid lockdowns and greater working from home. Against the exceptionally weak comparatives of 2020 and assuming an incremental return to working in offices, we expect the businesswear market to see positive growth in 2021. In a worst-case scenario of further lockdowns in 2021, the market could be broadly flat next year.What Is Businesswear?

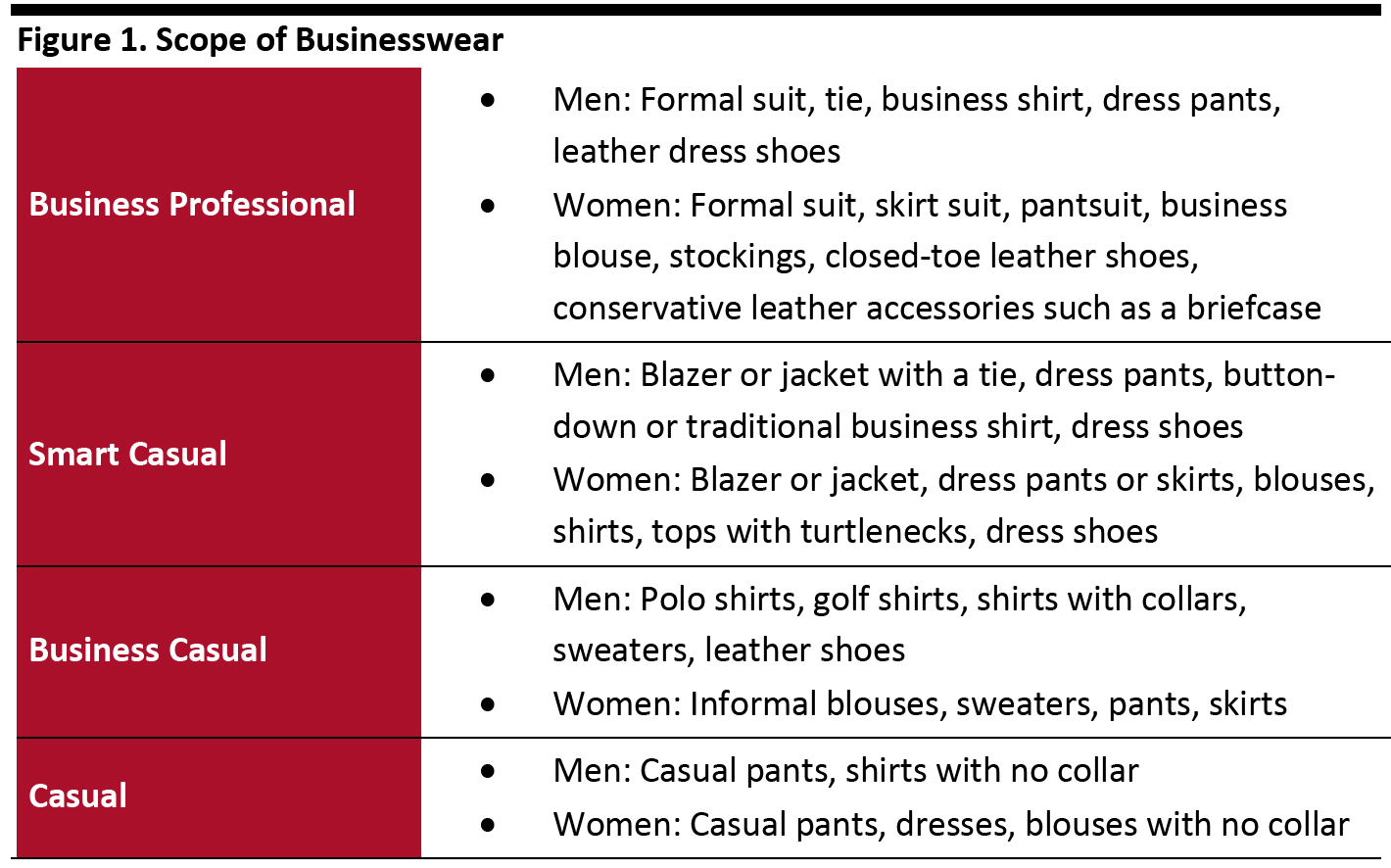

Businesswear Varies by Formality Businesswear refers to the clothing that employees wear to work. The formality of businesswear ranges from business professional to smart casual, business casual or casual, and can vary by job function, company, and industry. Here, we outline the scope of businesswear before discussing the market in detail: [caption id="attachment_116965" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Current State of The US Businesswear Market

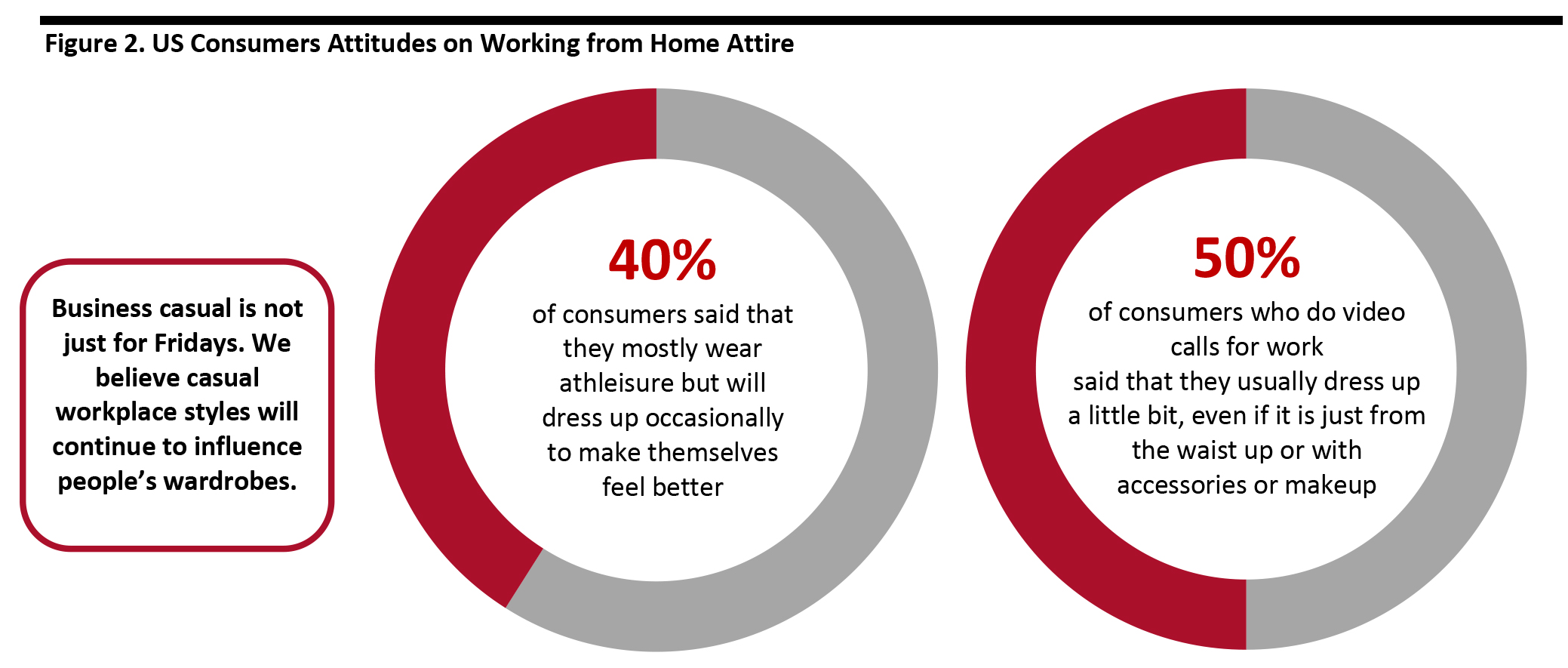

Working from Home Accelerated the Casualization of Workplace Dress Codes Business casual is no longer the privilege for Fridays. We have seen companies remove dress codes to allow employees to “dress down” in the office. Investment banks such as Morgan Stanley, Goldman Sachs and JPMorgan have all eased their business attire requirement, changing dress code from business to casual. Lockdowns and much higher rates of working from home are decimating a market already impacted by more gradual trends toward casualization. 66% of US employees are working remotely as a result of Covid-19, according to Clutch’s 2020 Remote Work Survey. Companies including Google, Facebook and Twitter are also taking steps to allow employees to work from home indefinitely or through 2021, which indicates that the trend will have long-term implications. We believe that the businesswear market is unlikely to return to a pre-crisis position in 2021. In a survey of 1,300 consumers that currently work from home conducted in July by Fashionista, a fashion consulting and news firm, around 40% said that they mostly wear athleisure but will dress up occasionally to make themselves feel better during the lockdown period. Of those who to do video calls for work, more than 50% reported that they usually dress up a little bit, even if it is just from the waist up or with accessories or makeup. We believe casual workplace styles will continue to influence consumer’s wardrobes and clothing choices through 2021 to 2023. [caption id="attachment_116966" align="aligncenter" width="700"] Base: 1,300 US consumers that work from home

Base: 1,300 US consumers that work from home Source: Fashionista [/caption] Casual Dress Culture During the Pandemic: Impact on Businesswear Retailers Men’s Wearhouse, Jos. A. Bank, Brooks Brothers, Ann Taylor and Loft are among the brands that have entered Chapter 11 bankruptcy in recent weeks. These businesswear brands have experienced significant sales decline due to the recent shift to working from home during the pandemic and the more gradual casualization of workplace dress codes.

- Ann Taylor and Loft are brands under the Ascena Retail Group, which filed for bankruptcy on July 23, 2020. The shutdown of Ascena’s retail stores resulted in a significant reduction in net sales in the third quarter of Fiscal 2020. The premium fashion department, which consists of Ann Taylor and LOFT brands, reported net sales of $297.3 million in the third quarter of fiscal year 2020, down 45.9% compared to $549.5 million in the three months ended May 4, 2019.

- Anthropologie is known for offering more structured apparel geared for work and smart events. Feeling the impacts of the pandemic, the brand’s apparel team is adjusting its offerings toward more casual, less structured looks to resonate with current customers.

- Brooks Brothers, the legacy menswear and womenswear brand sold by Marks & Spencer to Retail Brand Alliance in 2001, filed for bankruptcy on July 8, 2020 due to the impacts of the pandemic. The company’s sales were flat between 2017 and 2019 at around $1 billion, due to business fashion turning more casual and increased online competition.

- Tailored Brands, the parent company of Men’s Wearhouse and Jos. A. Bank, filed for bankruptcy on August 2, 2020 as the pandemic led to a dramatic decline in sales. For the three months ended May 2, 2020, the company reported a net sales decrease of 60.4% year over year to $286.7 million. Subsidiary brand Men’s Wearhouse reported net sales of $166.4 million, down 61.1% year over year. The Jos. A. Bank brand, known for both its off-the-rack and custom-made men's suits, reported net sales of $71.6 million, down 57.1% year over year.

- Ross Stores stated on its earnings call that the consumer is increasingly shopping in the home and casual apparel categories, including active wear and athletic wear. The company reported that it will continue to focus on these areas.

- TJX Companies reported traditional casual and career-related apparel as weak categories in its recent quarter report.

- Sales of dress shoes such as heels, oxfords and loafers have also dropped, in favor of more casual and comfortable options such as sneakers, flats and flip flops. There are also fewer occasions to wear dress shoes and so shoppers have less motivation to buy a new pair.

- Jimmy Choo, luxury fashion brand, has seen customers turn to relaxed footwear styles, with strong sales performance in sandals, flat and active categories and soft sales in heels.

- Steven Madden reported on its July 29 earnings call that the company is stuck with excess dress shoe inventory. The company stated that dress shoe penetration has dropped from year-ago levels and believes the trend will be coming into the year, so the company has pivoted more towards casual styles.

The Future of the Businesswear Market

Work-leisure Wear Is Gaining Popularity The casualization of working environments is driving perceptions of what constitutes acceptable work wear. Over the next three years, work-leisure apparel is expected to become more mainstream. Businesswear that has adapted to this shift to or incorporates work-leisure products is likely to witness higher uptakes.- Lululemon is well known as an athletic apparel retailer but has recently expanded to sell products that suit office settings, such as its “On The Move Pant” launched in November 2019. The trousers feature classic ankle-length styles, with wrinkle-free, machine-washable and quick-dry properties—designed to help office workers stay comfortable on their commutes as well as at their desks. Lululemon’s strategy in transforming itself into a work-appropriate brand also includes adapting its logos. On its athletic apparel, the brand’s logo is normally prominently displayed, but logos are subtly blended in for smarter apparel pieces, such as the women’s “City Trek Trouser” or the “Commission Pant Slim Warpstreme” in the men’s section.

Lululemon’s “On The Move Pant” launched in November 2019

Lululemon’s “On The Move Pant” launched in November 2019 Source: Lululemon [/caption]

- ADAY launched as a fast-fashion apparel brand and is now entering the work-leisure space. The company’s “Something Borrowed Shirt”, a series of white dress shirts, have undergone over 15 iterations since launch, based on customer feedback. Since it was first introduced, the shirt has sold out 12 times and has had an overall waitlist of over 3,500 customers, according to the company. In February 2020, the company launched its first line of suits featuring stretchy, wrinkle-free fabric. The suits will be formal pieces that can be dressed up or down to suit the customer, according to Nina Faulhaber, ADAY’s co-founder.

Left: ADAY’s “Something Borrowed Shirt”; Right: ADAY’s slim-fitting blazer with a removable belt

Left: ADAY’s “Something Borrowed Shirt”; Right: ADAY’s slim-fitting blazer with a removable belt Source: ADAY [/caption] Technology-Enabled Businesswear: More Functional and Comfortable Apparel manufacturers are making work wear using advanced technologies that ensure comfort, versatility and durability. Temperature-regulating technology is now increasingly used for businesswear apparel items.

- Ministry of Supply is working with MIT’s Self-Assembly Lab to develop a business-casual sweater that adapts to the wearer’s body temperature and eliminates the need for wearing an extra sweater or coat in the office. The sweater will use materials made of polymers that react when exposed to heat. The inner structure of the sweater will contain materials that can trap heat when the wearer is cold.

- Banana Republic is developing a Slim Smart-Weight Performance Suit Jacket that features similar technology. Defined as COOLMAX technology by the company, the jacket is breathable and wrinkle-resistant thanks to the quick-drying, temperature regulating COOLMAX fibers designed to keep the wearer comfortable.

- Perry Ellis is a global lifestyle brand that continues to change the industry through apparel, accessories and fragrances that adapt to work, life and play. All of the company’s clothing items are washable, including its suit range, and have an easy-care component. Using completely washable and machine dryable fabrics makes customer’s work lives easier to manage.

Perry Ellis feature more than ten styles of washable suits

Perry Ellis feature more than ten styles of washable suits Source: Perry Ellis [/caption]

Despite Declines, Opportunities Remain in the Businesswear Market

DTC and Online Sales As physical businesswear retailers closed doors and filed for bankruptcy during the pandemic, digital businesswear business appear to be weathering the impacts with more success. Because of their digital nature, they were better disposed to interface with consumers online, function with leaner supply chains and are less exposed to traffic declines at physical shopping locations.- Indochino, a menswear retailer offering made-to-measure businesswear covering suits, shirts, jackets, vests, chinos and outerwear is one of the DTC businesswear brands to survive the crisis. The company launched a virtual shopping function during the pandemic to better serve online customers. The company has 43 physical showrooms in the US that operate an appointment-only service, which the company explained also helps to control the flow of traffic to physical locations.

- Tailored Brands is seeking ways to expand its online presence to survive the filed bankruptcies of its subsidiary brand Men’s Wearhouse. Tailored Brands has been hit hard by the pandemic due to the shift away from in-person services. The company partnered with 3DLOOK in August 2020 to work on several roll-out phases for a virtual body measurement service. It is also planning a remote fitting platform where consumers can simply scan a QR code, open up a selfie tool and use a voice feature to take a photo of themselves for the fit assessment.

Plus-Size Offering

Brands and retailers that carry businesswear have expanded their plus-size offerings to better serve this market segment and utilize areas of opportunity in a declining market.- Eloquii offers plus-size Stretch Blazers made from Camden stretch fabrics in size 14–28.

- J.Crew Factory offers cotton work blazers for sizes up to 24.

- Lane Bryant offers blazers in size 12-28.

- Torrid offers button front blouses up to size 6X.

- Bombfell is a men’s clothing subscription box offering a range of workwear styles.

- Rent the Runway provides designer businesswear items available for rental at acceptable prices, between $50 and $250.

- Stitch Fix creates a style profile for consumers based on their tastes, fits and price ranges through a user quiz. Customers can then pay a $20 styling fee to try on stylists’ picks at home before purchasing them. Stitch Fix also has a specific web page with suggestions on how customers can learn tips for dressing appropriately.

What We Think

Implications for Apparel Brands and Retailers That Carry Businesswear- Impacted by the pandemic and shifting office wear dress codes, the US businesswear market is showing signs of serious decline. As comfort has become the key consumer priority it is important for apparel retailers and brands to rethink their businesswear clothing offerings and incorporate adapted work-leisure styles.

- There are opportunities for DTC businesswear brands, brands that offer plus-size apparel and subscription model brands to grow through digital channels. A lean supply chain is important for brands in the current volatile retail environment.

- We are seeing more innovation in businesswear. Brands and retailers can design more functional apparel or work with technology partners to suit consumer’s changing needs and encourage sales growth.