albert Chan

What’s the Story?

As part of Coresight Research’s US Back to School 2021 series, we delve deeper into three factors shaping back-to-school (BTS) spending this season: the expansion the Child Tax Credit (CTC) under the US government’s American Rescue Plan 2021; the return of students to in-person classes; and school reopenings.

We analyze findings from a Coresight Research survey of US BTS shoppers conducted on July 21, 2021.

It is important to remember that the situation is still in flux due to the Covid-19 pandemic—most notably, the spread of the Delta variant—and so there is still uncertainty around what classes in the Fall will look like.

Why It Matters

The BTS sales period, spanning June to September, is the second-biggest consumer spending season after the winter holidays: It presents a significant retail opportunity due to the 56.4 million-strong US student population, as recorded by the National Center for Education Statistics.

Last year, the pandemic impacted how and where consumers shopped for the BTS season, how much they spent and the types of products they bought—with consumer focus on health and safety, school closures and a shift to online learning being core market drivers. The BTS season will be impacted in different ways by the economic environment this year as the US continues to recover from the Covid-19 pandemic.

Coresight Research expects a year-over-year increase of 14.5% in BTS spending this year, to an estimated $28.5 billion versus $24.9 billion last year.

Rising Covid-19 Cases Threaten To Derail a Return to Classes: In Detail

1. The Child Tax CreditConsumer spending on BTS is likely to be buoyed by the timely implementation of the American Rescue Plan—a stimulus bill that aims to support the recovery of the US economy from the Covid-19 pandemic—which expanded the Child Tax Credit (CTC) for 2021 as well as adjusting its model to send half of the credit out in advance monthly payments. The CTC will provide $3,600 to families for each child under six years old in 2021 (up from $2,000) and $3,000 for each child aged six to 17 (up from $2,000 and making 17-year-olds eligible). Eligible families with minor children began receiving their payments under the expanded CTC from July 15, 2021, and the monthly advance payments will run until the end of December 2021.

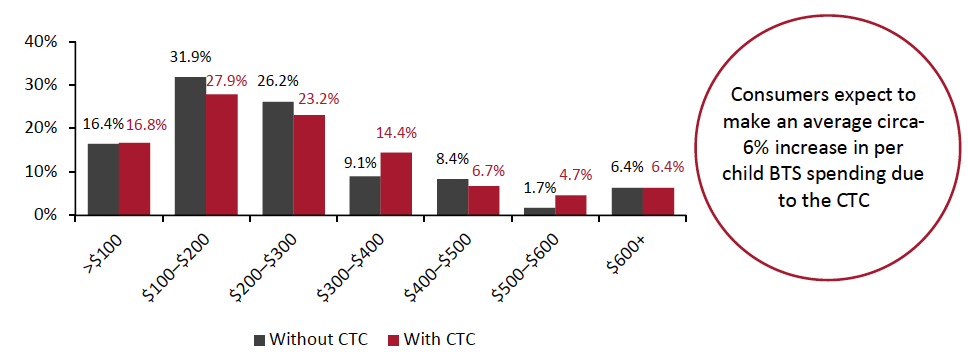

In our survey, we asked BTS shoppers what they expect they would spend without the benefit of CTC; we also asked them what they expect they would spend including the CTC tailwind. As charted below, this benefit tended to push up the proportion of respondents saying they would spend in higher bands such as $300–$400 and $500–$600 per child. Factoring in changes across all the spending bands, and using midpoint averages per band, our survey implies that consumers expect to make an average circa-6% increase in per child BTS spending due to the CTC.

Figure 1. BTS Shoppers: How Much Respondents Would Spend on BTS Shopping Per Child with CTC Benefits vs. without CTC Benefits (USD) [caption id="attachment_131644" align="aligncenter" width="700"]

Base: 298 US respondents aged 18+ who have children aged 5–18 and who expect to buy BTS products this year

Base: 298 US respondents aged 18+ who have children aged 5–18 and who expect to buy BTS products this yearSource: Coresight Research[/caption]

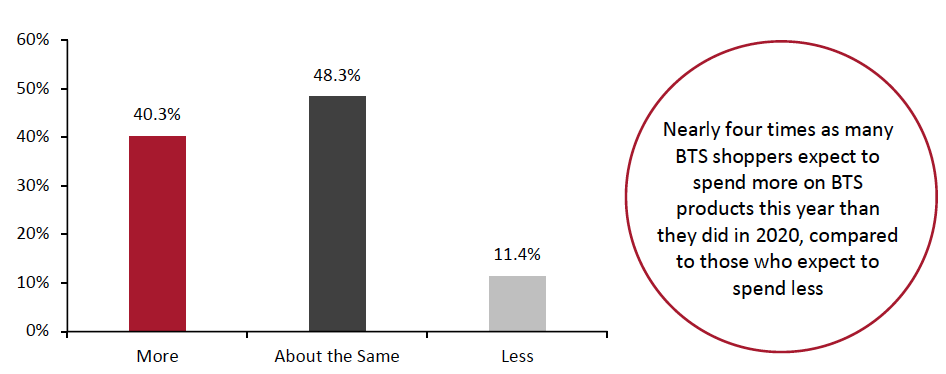

Looking at the overall trend, nearly four times as many BTS shoppers expect to spend more on BTS products this year than they did in 2020, compared to those who expect to spend less, according to our survey (see Figure 2)—setting up total BTS spend for substantial year-over-year growth.

Figure 2. BTS Shoppers: Expectations To Spend More/Less/the Same on BTS Products in 2021 Compared to the 2020 BTS Season (% of Respondents) [caption id="attachment_131645" align="aligncenter" width="700"]

Base: 298 US respondents aged 18+ who have children aged 5–18 and who expect to buy BTS products this year

Base: 298 US respondents aged 18+ who have children aged 5–18 and who expect to buy BTS products this yearSource: Coresight Research[/caption] 2. A Return to In-Person Classes

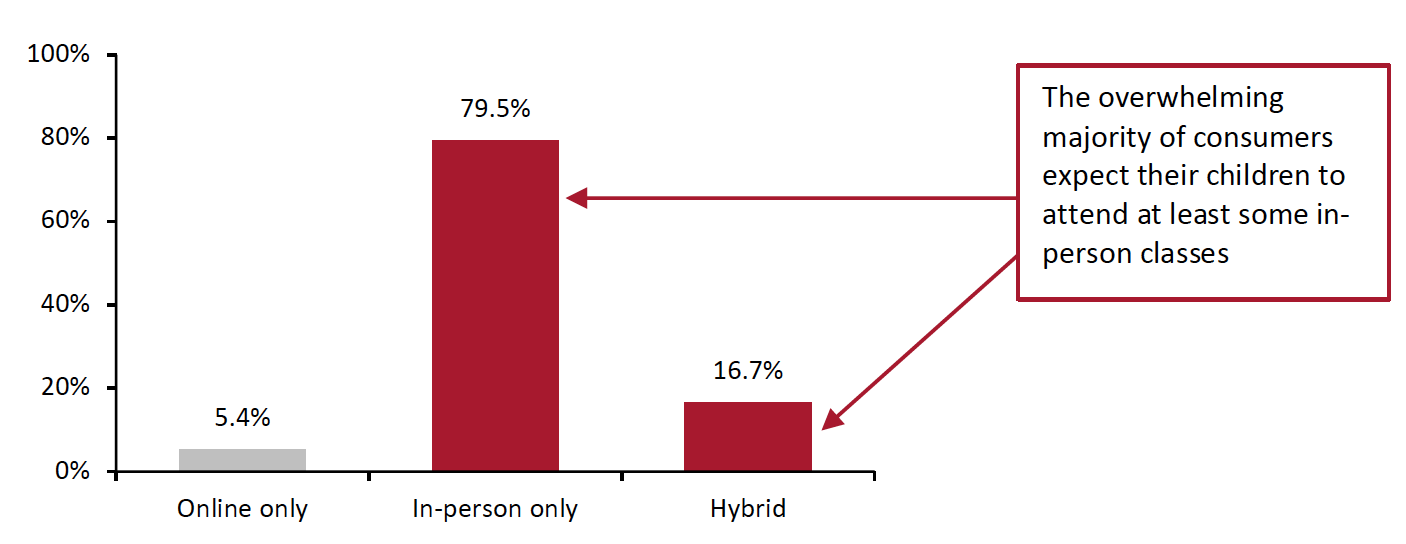

The bounceback in BTS spending this year—and the product categories that will be in demand—will depend on the attendance of in-person classes. According to our survey, almost four in five US BTS shoppers with children aged five to 18 plan to send their children back to school for exclusively in-person classes, and a further 16.7% expect their children to have a hybrid online-offline model of learning in fall (see Figure 3).

Figure 3. All Respondents: Expectations for Their Children To Attend Classes in Fall 2021 (% of Respondents) [caption id="attachment_131691" align="aligncenter" width="700"]

Percentages do not sum to 100 as respondents were free to make multiple selections reflecting different attendance types for different children in multi-child households

Percentages do not sum to 100 as respondents were free to make multiple selections reflecting different attendance types for different children in multi-child householdsBase: 336 US respondents aged 18+ who have children aged 5–18

Source: Coresight Research[/caption]

It is likely that the proportion of BTS shoppers expecting a return to in-person classes may decrease by the fall due to the current spread of the Covid-19 Delta variant, which is impacting consumer sentiment and behavior—something we are watching closely in our weekly US Consumer Tracker series of survey-led reports. School reopenings also remain uncertain, which we discuss in the next section of this report.

However, should the charted expectations be approximately accurate, it will mark an increase from the 53% of students learning in person at the end of the last school year, as reported by the Center for American Progress. A widespread return to classes would drive demand for BTS products—particularly in categories that were less needed during online classes in 2020, such as apparel and footwear (we will discuss BTS spending expectations by category in the next report in this series).

3. Uncertainty Around School ReopeningsA return to classes will be contingent on school reopenings, but the spread of the Covid-19 Delta variant leads to the possibility of closures and so is weighing heavily on consumers’ BTS purchase decisions.

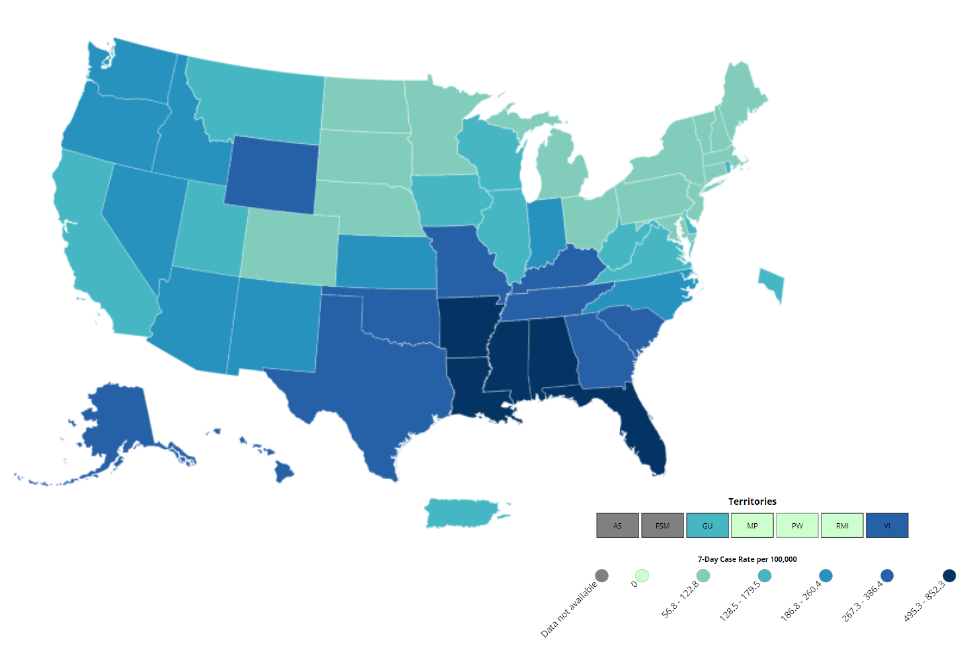

This is especially true in the South: As of August 9, 2021, the seven-day average of Covid-19 cases totaled over 600 in the worst-hit states of Florida, Louisiana and Mississippi, according to the Centers for Disease Control and Prevention (CDC).

Figure 4. US Covid-19 Seven-Day Case Rate per 100,000 People, by State/Territory, as of August 9, 2021 [caption id="attachment_131647" align="aligncenter" width="972"]

Source: Centers for Disease Control and Prevention[/caption]

Source: Centers for Disease Control and Prevention[/caption]

Schools will likely offer online learning options for their students if the safety concerns are too great to provide in-person classes. Even prior to the increased spread of the Delta variant, our July 21 survey saw 27.9% of BTS shoppers report that they are “concerned about sending [their] child/children back to school.” We expect hybrid learning options to become more common if the pandemic situation worsens.

Consumer concern around Covid-19 as it relates to the BTS season extends to the purchasing of health and personal care products. Our survey found that 49.3% of BTS shoppers plan to purchase such products as part of their BTS shopping, and 24.5% of shoppers plan to spend more in this category than they did in the 2020 shopping season—with only 16.8% planning to spend less on health/personal care items than last year (see Figure 6).

The proportion of BTS shoppers planning to purchase health and personal care products will likely have increased already, following the CDC’s recommendation on July 27, 2021, that the US population returns to wearing masks indoors as well as the spread of the Delta variant, as discussed above.

What We Think

BTS sales this year are fraught with unpredictability due to the status of school reopenings, although 79.5% of consumers expect to send their children back to school for in-person classes, as of July 21, 2021. The ambiguity around whether schools will open or whether we will again see online classes become the norm casts a shadow over consumer willingness to spend on in-person goods, even with the boost to consumer wallets from the CTC.