Nitheesh NH

What’s the Story?

As part of Coresight Research’s US Back to School 2021 series, we explore consumer expectations to make purchases across multiple product categories this back-to-school (BTS) season. We consider demand for products related to in-person classes, such as apparel—assuming the threat of Covid-19 does not derail a return to in-person learning—as well as current consumer trends that are influencing the strategies and success of brands and retailers this season. Informing our analysis in this report are findings from a Coresight Research survey of US BTS shoppers conducted on July 21, 2021.Why It Matters

The BTS sales period, spanning June to September, is the second-biggest consumer spending season after the winter holidays: It presents a significant retail opportunity due to the 56.4 million-strong US student population, as recorded by the National Center for Education Statistics. Last year, the pandemic impacted how and where consumers shopped for the BTS season, how much they spent and the types of products they bought—with consumer focus on health and safety, school closures and a shift to online learning being core market drivers. The BTS season will be impacted in different ways by the economic environment this year amid lingering uncertainty and concern around the Covid-19 pandemic. Coresight Research expects a year-over-year increase of 14.5% in BTS spending this year, to an estimated $28.5 billion versus $24.9 billion last year.Popular Product Categories This Back-to-School Season: In Detail

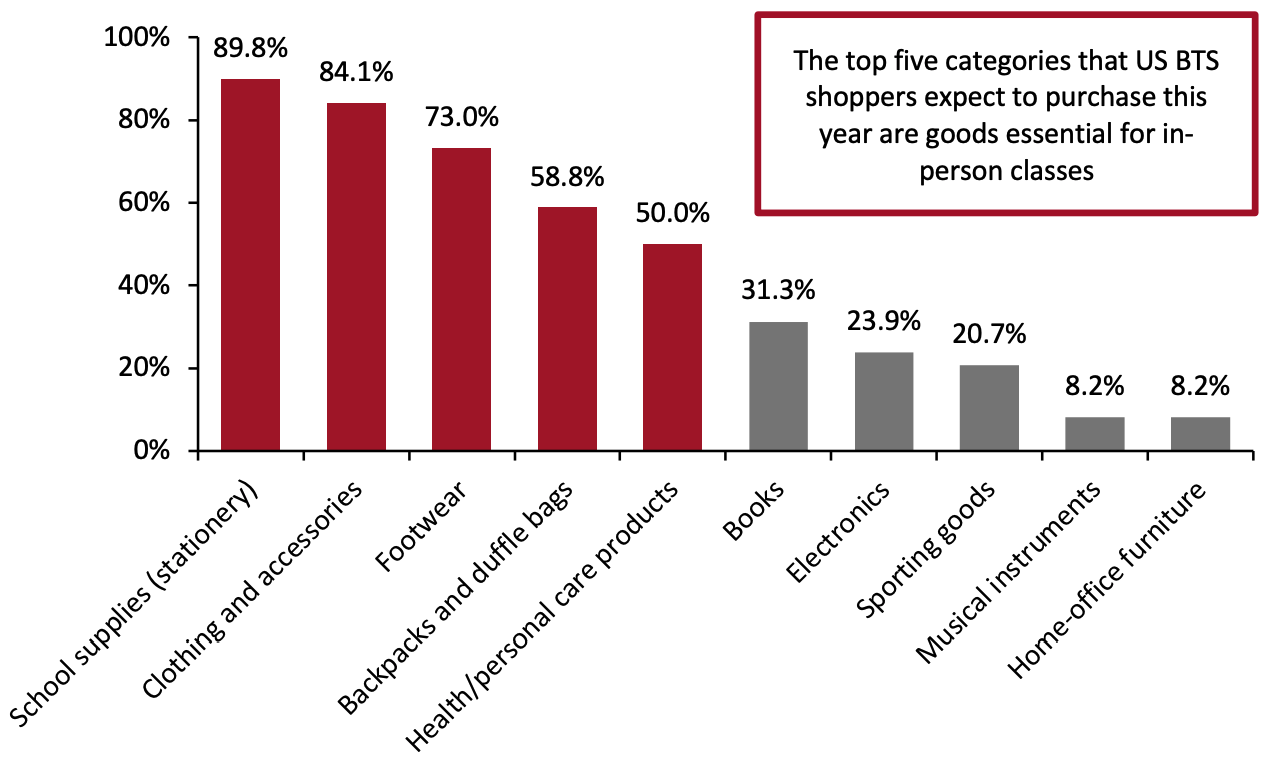

Top BTS Categories: Stationery and Apparel According to our survey, the top five categories that US BTS shoppers expect to purchase this year are goods essential for in-person classes—namely, school supplies (stationery), clothing and accessories, footwear, backpacks and duffle bags, and health/personal care products. More than half of all BTS shoppers expect to make purchases in each of these categories this season. We anticipate that demand for these products will support the recovery of overall BTS sales in 2021 from last year’s 5.1% year-over-year decline, according to Coresight Research estimates, which we primarily attribute to the shift to online learning. The most popular products are school supplies (stationery), which almost nine in 10 BTS shoppers expect to buy this season. Although this category is likely to experience less fluctuation year over year than apparel—as students would have needed some stationery to work at home—spending is likely to be boosted by a return to in-person classes and a shift away from electronics this year, when devices took priority due to requirements for online learning (we discuss electronics in further detail in the next section).Figure 1. BTS Categories in Which BTS Shoppers Plan To Make Purchases in the BTS 2021 Season (% of Respondents) [caption id="attachment_131819" align="aligncenter" width="700"]

Base: US Internet users aged 18+ who have children aged 5–18 and who expect to buy BTS products this year

Base: US Internet users aged 18+ who have children aged 5–18 and who expect to buy BTS products this yearSource: Coresight Research[/caption] Greatest Declines in BTS Categories: Electronics and Home-Office Furniture The top three product categories discussed above—namely, school supplies, clothing and footwear—also saw the most favorable net difference (of more than 30 percentage points) in the proportions of consumers expecting to spend more this season than they did during BTS 2020 compared to the proportions that expect to spend less, which is a positive sales indicator for brands and retailers in these categories. The categories facing the greatest declines in sales are electronics and home-office furniture, which offered items essential to at-home, online learning in 2020. This season, 35.7% of BTS shoppers plan to spend less on electronics than they did last year, and 38.4% plan to spend less on home-office furniture—making these the least popular BTS categories we asked about, likely due to the anticipated end to online classes for most students this fall, as well as the stark comparison to last year’s high sales in both categories.

Figure 2. BTS Categories in Which BTS Shoppers Plan To Spend More/Less This Season Compared to BTS 2020 [wpdatatable id=1210]

*Percentage-point difference between the proportion of BTS shoppers planning to spend more and the proportion planning to spend less; the higher the number, the more positive the sales outlook for the category Base: US Internet users aged 18+ who have children aged 5–18 and who expect to buy BTS products this year Source: Coresight Research

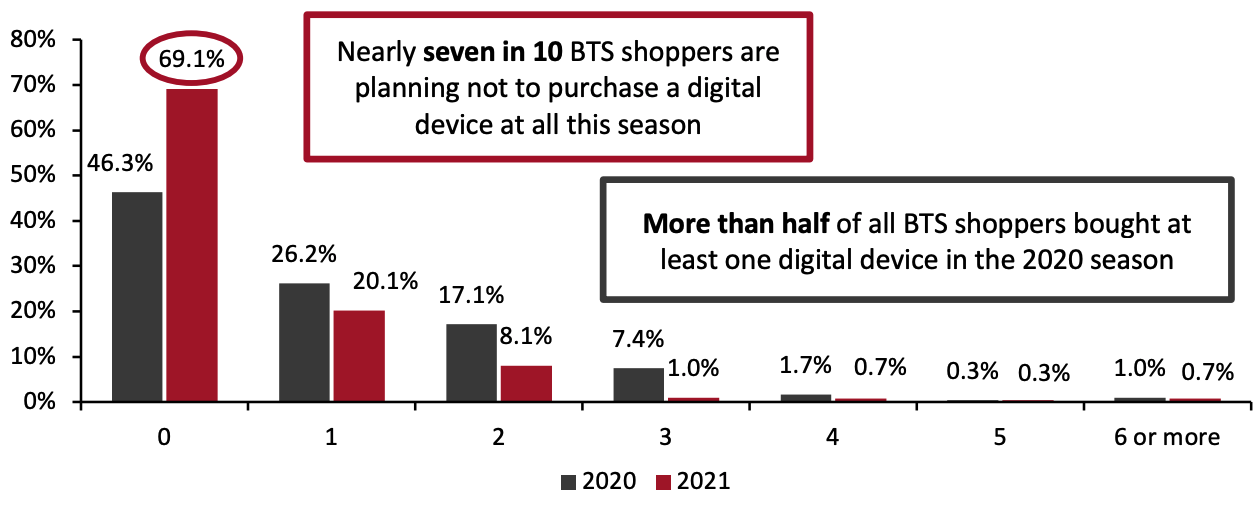

Focusing on electronics, we asked BTS shoppers about their plans to purchase digital devices this season—and we compare these findings against the number of devices that respondents reported to have purchased in the 2020 BTS season:- The proportion of consumers not planning to purchase a digital device this season is 22.8 percentage points higher than the proportion that did not buy a device in the year-ago period.

- Overall, it appears that consumers are purchasing fewer digital devices this year compared to 2020. Some 27.5% of BTS shoppers reported that they plan to buy two or more digital devices this year, versus the 10.4% that purchased at least two devices last year.

Figure 3. Number of Digital Devices That BTS Shoppers Purchased During BTS 2020 vs. Plans To Purchase This Season (% of Respondents) [caption id="attachment_131820" align="aligncenter" width="700"]

Base: US Internet users aged 18+ who have children aged 5–18 and who expect to buy BTS products this year

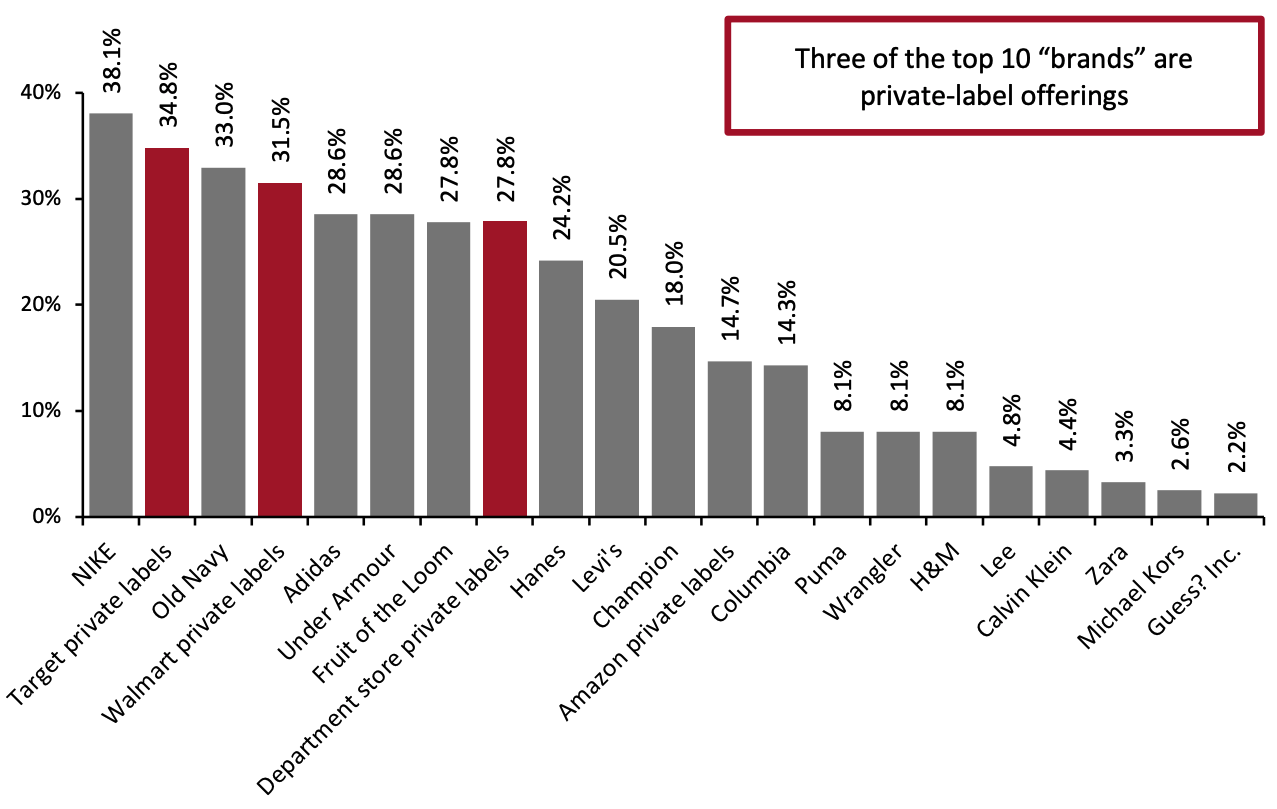

Base: US Internet users aged 18+ who have children aged 5–18 and who expect to buy BTS products this yearSource: Coresight Research[/caption] Top Brands and Retailers for BTS Shopping New trends in fashion and increased need for a wardrobe refresh following a year of online learning will likely shape consumer purchases in the apparel and footwear category this season. Waistlines for the average consumer and their children have expanded. According to a February 2021 survey by the American Psychological Association, consumers have gained an average of 29 pounds since the pandemic started, and based on a recent study published in the Journal of Pediatrics in May 2021, obesity rates among children have increased across all age groups—increasing by 1.0% among 13–17-year-olds and by 2.6% for children aged five to nine. Although demand for children’s clothing each BTS season is typically driven by a child’s natural growth every year, the extra weight that children put on during the pandemic may prompt the need for additional wardrobe changes. The shift toward more comfortable clothes—marked by increased demand for athleisure and casualwear during pandemic-led lockdowns—is continuing amid Covid-19 recovery in the US, with fashion trends favoring comfort as consumers resume their social activities. We expect this trend to translate into schoolwear preferences, too. In fact, sportswear brand NIKE topped the list of the most popular clothing, accessories and footwear brands (including retailer brands) from which BTS shoppers plan to make apparel purchases this season, according to our survey. Three of the top 10 “brands” are private labels—from Target, Walmart and department stores. Amazon’s private labels—tending to be newer and less well-known—rank slightly lower but still prominently.

Figure 4. Brands from Which BTS Shoppers Plan To Purchase Clothing, Accessories and Footwear This Season (% of Respondents) [caption id="attachment_131821" align="aligncenter" width="700"]

Respondents could select more than one option

Respondents could select more than one optionBase: US Internet users aged 18+ who expect to buy clothing, footwear and accessories this BTS season

Source: Coresight Research[/caption] Target, Old Navy and Walmart were the only other apparel brands or retailers to see shares of more than 30% of BTS apparel shoppers—indicating that comfort and value remain key priorities among consumers. In their BTS campaigns this season, NIKE, Old Navy and Target feature athletic, comfortable and/or loose styles of clothing (see images below). [caption id="attachment_131822" align="aligncenter" width="580"]

Source: NIKE[/caption]

[caption id="attachment_131823" align="aligncenter" width="580"]

Source: NIKE[/caption]

[caption id="attachment_131823" align="aligncenter" width="580"] Source: Old Navy[/caption]

[caption id="attachment_131824" align="aligncenter" width="580"]

Source: Old Navy[/caption]

[caption id="attachment_131824" align="aligncenter" width="580"] Source: Target[/caption]

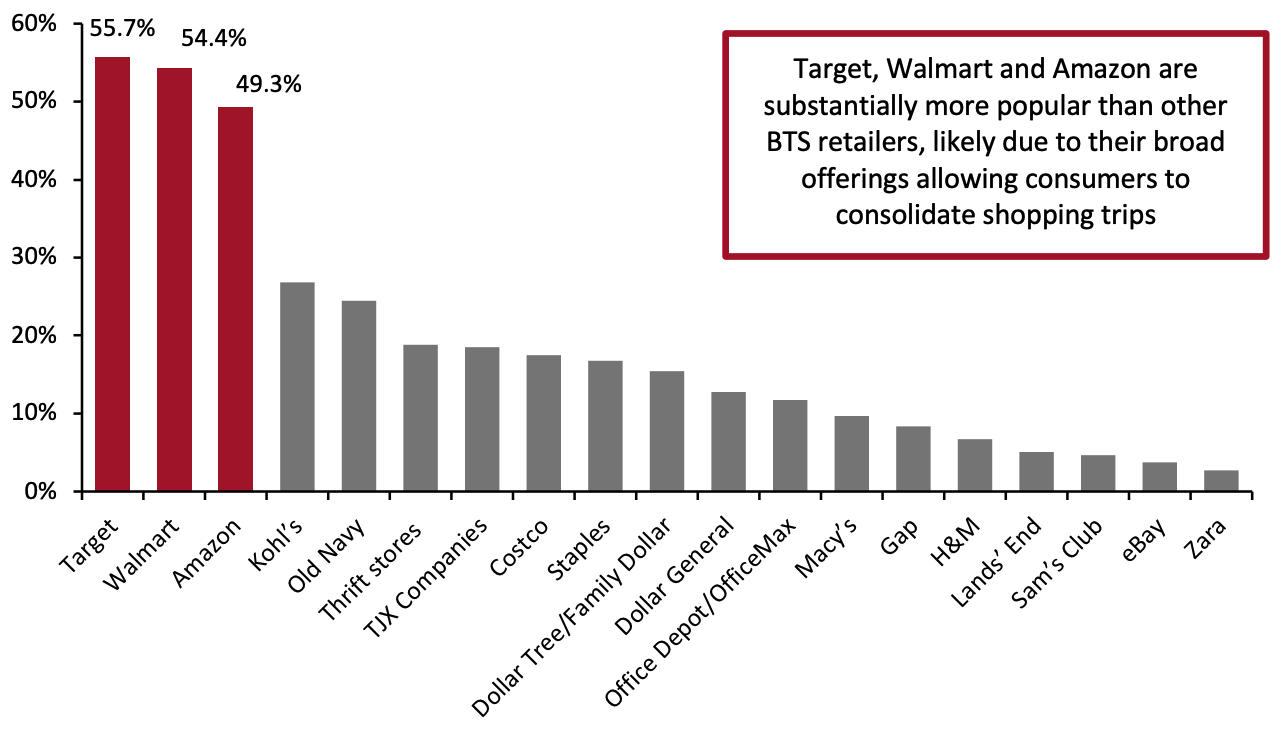

Across all categories, Target, Walmart and Amazon are the most popular retailers among BTS shoppers, with more than half of our survey respondents planning to make BTS purchases at these retailers. All three offer a variety of products from the top BTS categories (see earlier in this report), which enables consumers to have a one-stop shopping experience. Continued uncertainty amid the spread of the Delta variant is likely causing many consumers to consolidate their shopping trips (and thus reduce exposure to multiple public places), leading them to favor stores with a wide selection of BTS good and other products (for everyday purchases) rather than specialty stores. Delta concern will also be driving some consumers to shop more online than they would otherwise have done, and Target’s and Walmart’s competitive advantages include sophisticated omnichannel propositions. As shown in Figure 4, private labels add further consumer appeal.

Source: Target[/caption]

Across all categories, Target, Walmart and Amazon are the most popular retailers among BTS shoppers, with more than half of our survey respondents planning to make BTS purchases at these retailers. All three offer a variety of products from the top BTS categories (see earlier in this report), which enables consumers to have a one-stop shopping experience. Continued uncertainty amid the spread of the Delta variant is likely causing many consumers to consolidate their shopping trips (and thus reduce exposure to multiple public places), leading them to favor stores with a wide selection of BTS good and other products (for everyday purchases) rather than specialty stores. Delta concern will also be driving some consumers to shop more online than they would otherwise have done, and Target’s and Walmart’s competitive advantages include sophisticated omnichannel propositions. As shown in Figure 4, private labels add further consumer appeal.

Figure 5. Retailers from Which BTS Shoppers Plan To Make Purchases in Any Product Category This Season (% of Respondents) [caption id="attachment_131825" align="aligncenter" width="700"]

Base: US Internet users aged 18+ who expect to buy BTS products this year

Base: US Internet users aged 18+ who expect to buy BTS products this yearSource: Coresight Research[/caption]