DIpil Das

US Back-to-Class: Retail Outlook

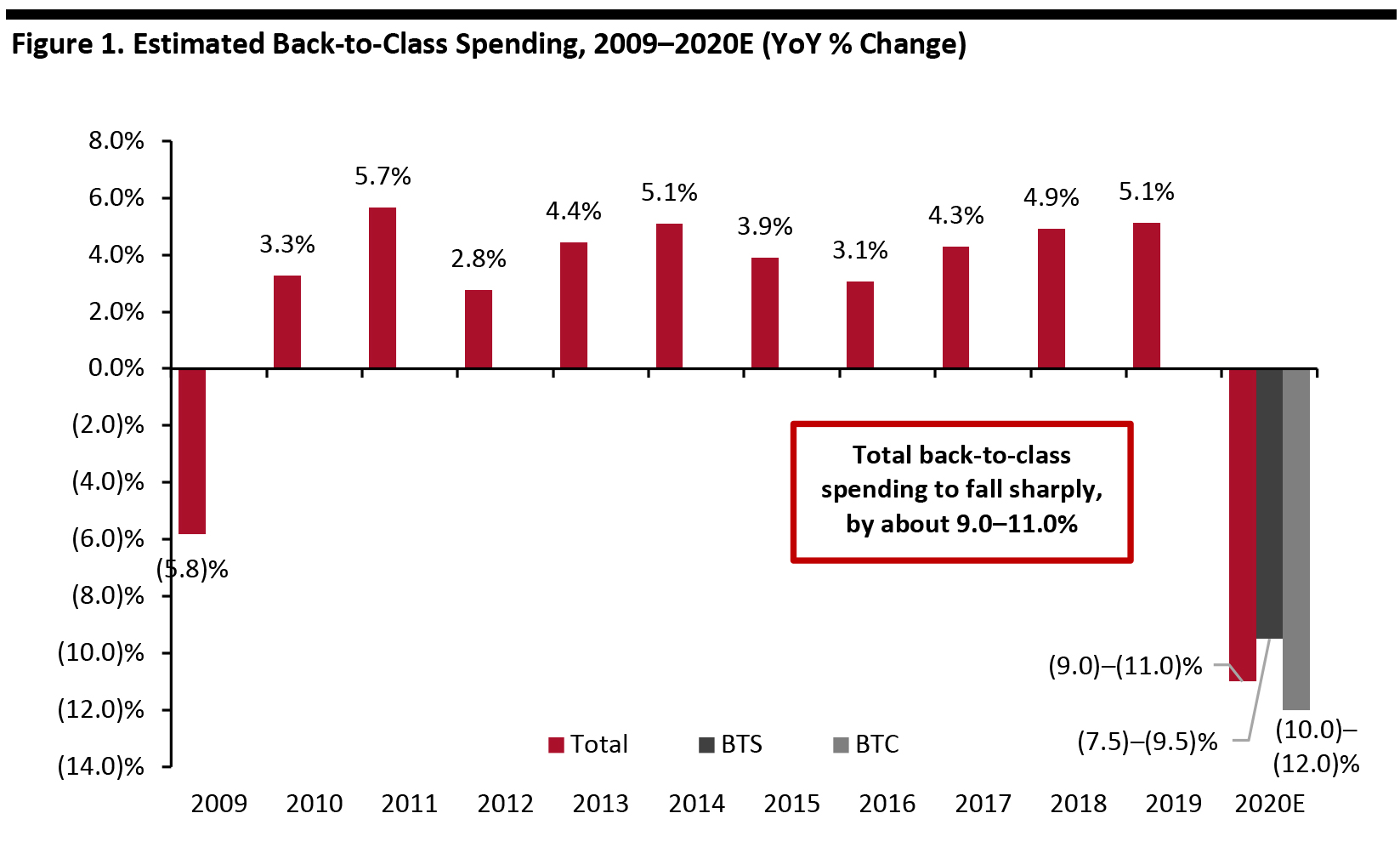

Coresight Research Estimate: Back-to-Class Spending To Decline by 9.0–11.0%

This year, we expect back-to-class retail spending to fall by 9.0–11.0% year over year. Our estimates are tracked to nonfood retail sales, as a large proportion of BTS and BTC spending include clothing, footwear, accessories, school supplies and electronics. BTC spending includes an element of spending on furniture and furnishings for dorm rooms as well. We expect BTS, which constitutes about 35% of total back-to-class spend, to fall by 7.5–9.5% and BTC to fall by 10.0–12.0%, reflecting greater likelihoods of deferred or remote studying by college students. Myriad factors make this a uniquely challenging time. The nearly two-month-long lockdown forced all nonessential businesses to shut, as people sheltered in place and many lost their jobs. Its repercussions still loom large across industries and the overall economy. Our estimates reflect the influence of four core market factors, which we detail later in this report:- Consumer concern—Parents are focused on health and safety amid Covid-19, which will affect what they spend on and how they shop.

- Exceptionally hard hits to nonfood retail sectors, which are likely to take many months to recover to pre-crisis levels—and in some cases (such as department stores) may not do so.

- Uncertainty around school and college reopening models, with the likelihood of a significant proportion of students learning remotely, or college students deferring a term.

- A harsh macroeconomic backdrop with record-high unemployment and savings-rate levels, and soft consumer sentiment.

Source: US Census Bureau/Coresight Research[/caption]

The retail spending estimate includes categories such as apparel, footwear, electronics, stationery, dorm or apartment furnishings (for BTC) and personal care items.

Source: US Census Bureau/Coresight Research[/caption]

The retail spending estimate includes categories such as apparel, footwear, electronics, stationery, dorm or apartment furnishings (for BTC) and personal care items.

1. Consumer Concern: Parents Are Focused on Health and Safety amid Covid-19

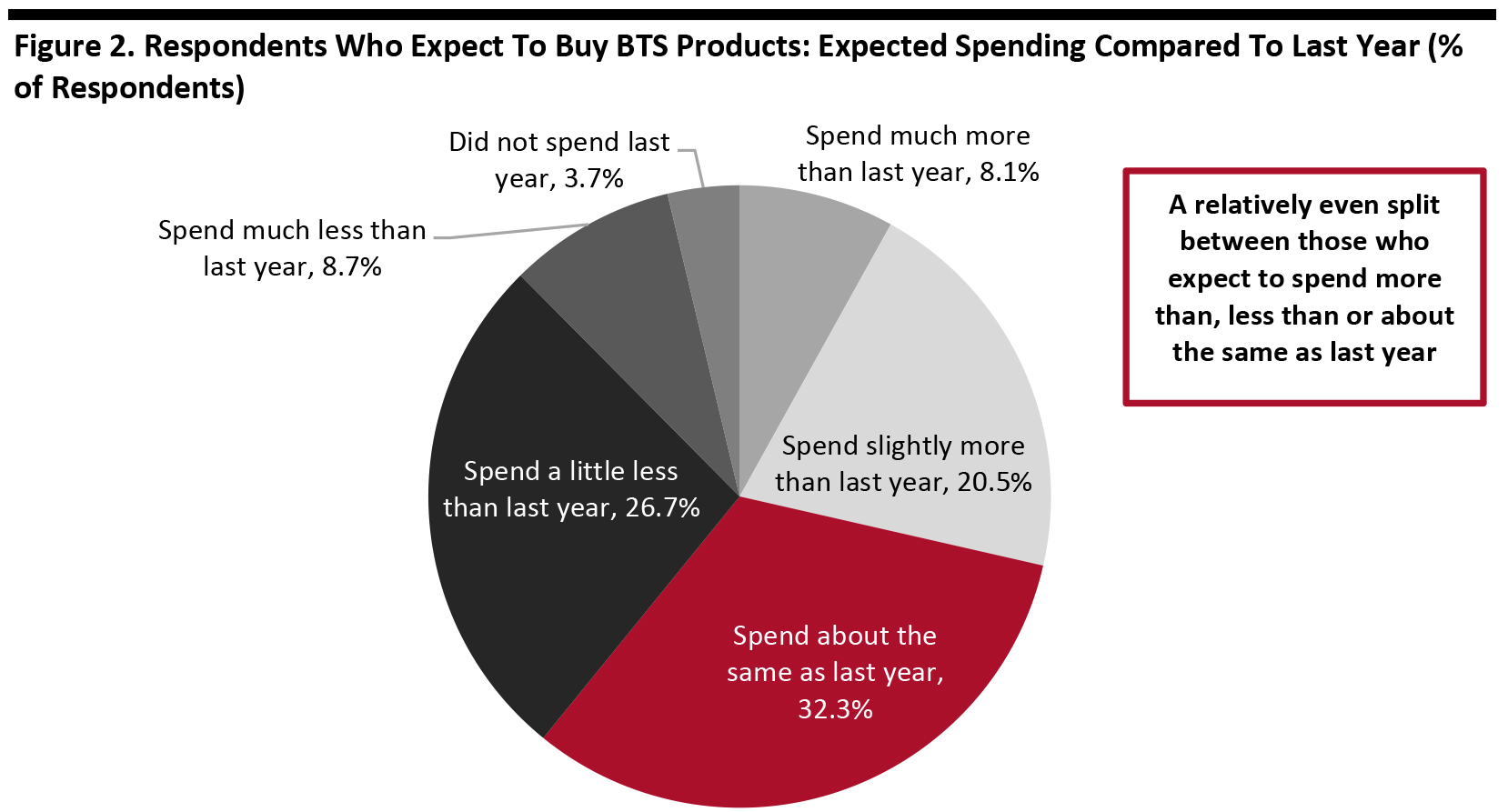

We surveyed US consumers on July 8, 2020 about their attitudes toward BTS and their expected shopping and spending behaviors. Around 40% of all respondents expect to buy BTS products this year. Over One-Quarter Expect To Spend More, while One-Third Expect To Spend the Same Among those who expect to shop for BTS, 35.4% expect to spend a little or much less than last year. While “spend less” options garnered a greater number of responses, plans to spend more or about the same seemed somewhat evenly split, despite the economic downturn: Around 32.3% of BTS shoppers stated that they expect to spend about the same as last year, and 28.6% expect to spend slightly or much more than last year. The relative strength of spending more may be supported by shoppers expecting to spend on nontraditional categories such as masks and hygiene products or products and services to support at-home learning. [caption id="attachment_113507" align="aligncenter" width="700"] Base: US Internet users aged 18+ who expect to buy BTS products this year

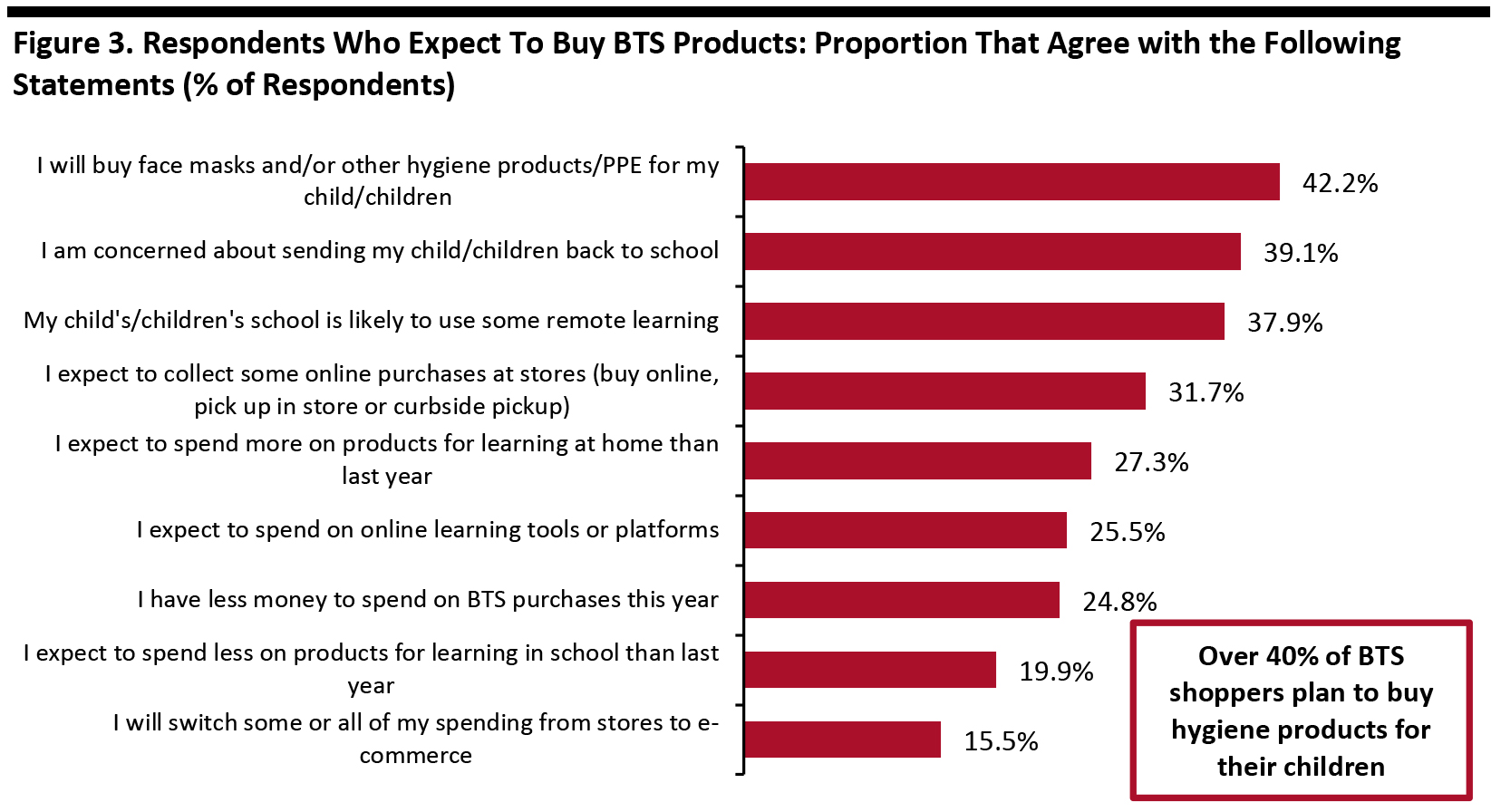

Base: US Internet users aged 18+ who expect to buy BTS products this year Source: Coresight Research [/caption] While the split between expectations does not indicate a strong decline in spending, our estimates need to be viewed in light of BTS shopping attitudes and behaviors and other factors such as uncertainty around reopenings and a harsh macroeconomic environment, all of which we explore in this report. Over Two-Fifths Will Buy Protective and Hygiene Products BTS shoppers are concerned about the evolving situation around the pandemic. When we asked these consumers about their attitudes and expected behaviors, we found:

- Around 42.2% of these consumers said they will buy face masks, other hygiene products or personal protective equipment (PPE)—the highest rate of agreement to any of the options.

- The second-highest level of agreement was related to worries about sending kids to school: Four in 10 are concerned about sending their children back to school.

- Our survey suggests a shift of BTS dollars from products for in-school learning to products for at-home learning: Some 27.3% expect to spend more on at-home learning products than last year—likely benefitting categories such as electronics and furniture—while 19.9% expect to spend less on in-school products, which we expect to hit apparel including sportswear.

- The market for digital learning is growing: Fully 25% expect to spend on online learning tools or platforms.

- Only 15.5% plan to switch some or all of their BTS shopping from stores to e-commerce this year, and about one-third expect to use contact-light collection options, including pickup-in-store or curbside-pickup services for online purchases.

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who expect to buy BTS products this year

Source: Coresight Research[/caption]

2. Back-to-Class Season Follows One of the Biggest Retail Sales Declines during Lockdown

This year’s back-to-class season is preceded by one of the deepest retail sales declines in history. As most states implemented lockdowns from around mid-March to June, and with only essential retailers operating stores, discretionary retail sales experienced a considerable slowdown during that period. We estimate some pent-up demand to prompt a cautious improvement in the coming few months—with the lifting of coronavirus restrictions having varied across the US from June—before settling at less than pre-crisis levels toward the end of the year. As back-to-class products—clothing, footwear, stationery, electronics and others—are part of discretionary retail sales, we expect purchases of these items to be severely hit. Other factors that fuel the retail sales growth engine, such as unemployment and consumer sentiment, remain fragile, indicating a slow recovery to the previous year’s levels, which we may not see until later in the year.3. Varied Reopening Models across States and Districts To Affect BTS and BTC Preparation

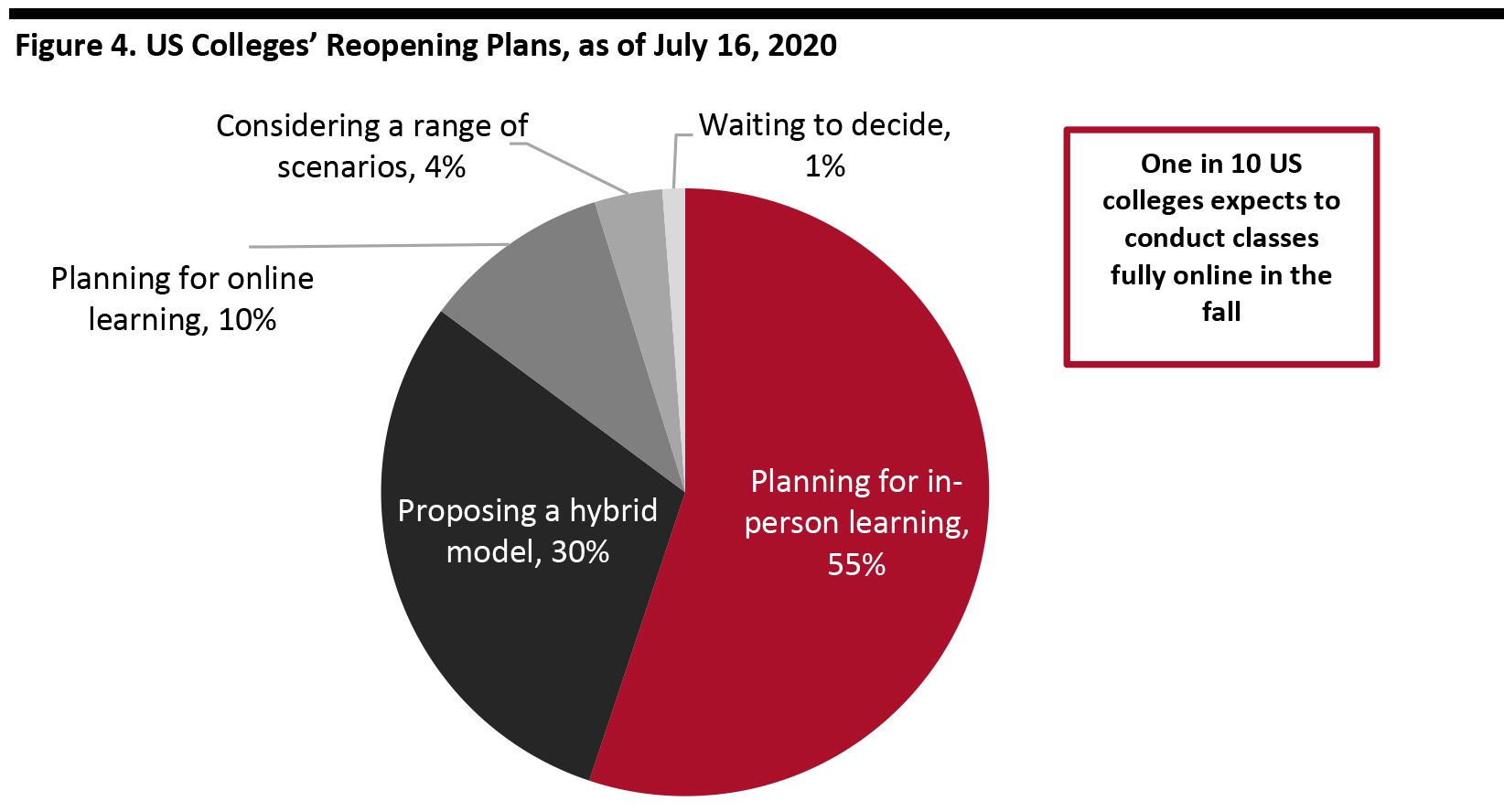

The containment of the coronavirus will, to a large extent, determine the reopening model that schools and colleges will choose to use. At least 40 states have said that they plan to reopen in the fall, recommending the following reopening models and leaving the decision to the discretion of individual schools and districts. The decisions are likely to be made closer to the reopening dates, after local threats of infection are assessed. 1. In-person learning: This is in the case of the state or school community experiencing a low number of new coronavirus cases. Arizona, for example, has delayed reopening to August 17, when it typically opens in early August, to be able to have students back for in-person classes. Should schools or colleges choose to use this method, they will need to implement several operational procedures, including but not limited to the below:- Social distancing measures implemented across all areas and facilities of the premises, and on school buses

- Spaced out desks within classrooms

- Limited class and staff group sizes

- Limited or no class assemblies, field trips, sports and extracurricular activities

- Students and teachers to wear masks or face shields. Some public health guidance frameworks include all employees wearing full PPE while on premises.

- Staggered start, finish and lunch times, or have lunch within classrooms

- Avoidance of sharing learning equipment, stationery, art supplies, toys, books, games and learning aids. Some frameworks have also suggested to avoid the use of drinking water fountains.

- Regular and frequent cleaning and disinfection of common areas and high-contact surfaces

Source: The Chronicle of Higher Education[/caption]

Guidelines for remote learning include:

Source: The Chronicle of Higher Education[/caption]

Guidelines for remote learning include:

- Providing learning devices and technological accessories to school students

- Providing Wi-Fi hotspots or dongles based on students’ needs

- Providing pre-packed coursework

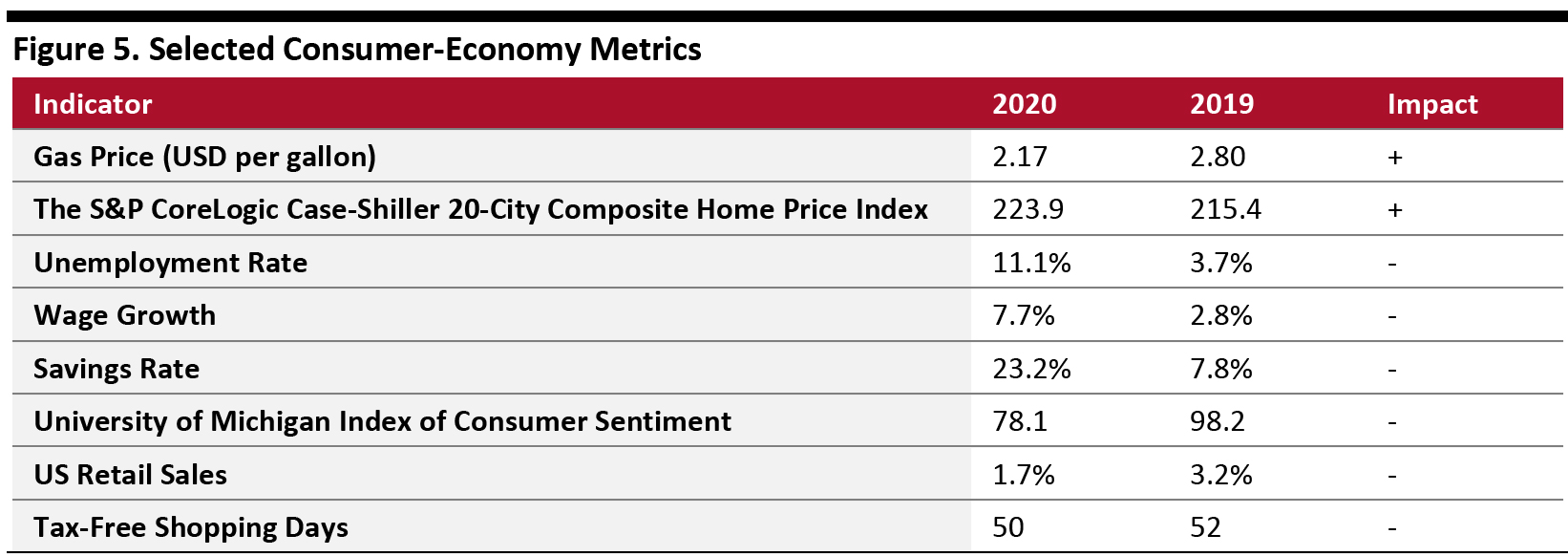

4. Gloomy Economic Backdrop

As the uncertainty on reopening models lies ahead, several macroeconomic factors are weighing on consumer spending. Looming recession, consumer wariness and job losses form the backdrop for this year’s back-to-class season. There have been some positive economic indicators for the back-to-class season, including:- Lower gas prices: $2.17 per gallon in June versus $2.80 in June last year, as demand dropped amid lockdowns across the US

- A higher S&P CoreLogic Case-Shiller 20-City Composite Home Price Index: Up 3.9% in April to 223.9, from 215.4 last year, indicating resiliency in the demand for home ownership despite the pandemic. In ordinary times, higher house prices encourage homeowners to spend—although these are not ordinary times.

- Higher unemployment rate: June’s unemployment rate came in at 11.1%, improving from 13.3% in May but far higher than the 3.7% in the year-ago period. The last three months’ unemployment rates were record highs since the Second World War.

- Increased wage growth reflects extent of job losses: Average weekly wages were up 7.7% in May from 2.8% a year earlier and 7.4% in April, but this figure distorts the economic picture. As per the Bureau of Labor Statistics, the numerator used to compute this figure is average weekly wages calculated from estimates for component industries, each of which receive a “weight” based on their levels of activity during the period considered. This implies that variabilities in employment in high-wage versus low-wage industries as well as wage-rate changes influence the earnings averages. The denominator is the number of all employees or jobs held during the period. There were substantial job losses among lower-paid workers in April, and this brought down the denominator considerably while also inflating the numerator, skewing the ultimate value toward higher-wage industries and depicting increased wage growth.

- Increased savings: The savings rate in May jumped to 23.2% versus 7.8% in May last year, indicating a tightening of purse strings. As jobs are uncertain, people seem to want to save more and spend less, and this could affect the season’s purchases.

- Muted consumer sentiment: The University of Michigan Index of Consumer Sentiment fell to 78.1 in June versus 98.2 a year ago, underscoring low spending proclivity.

- Slow recovery in retail sales growth: US retail sales, excluding automobiles and gasoline, were down 5.2% in April when lockdowns were in full operation, and recovered to 1.7% in May as lockdowns began to gradually lift—but this is slow growth versus 3.2% a year ago and is far from the pre-crisis levels of 6.4% growth in March and 7.7% in February.

- Fewer tax-free shopping days: Two days fewer than in 2019, due to Florida dropping two tax days this year. In order for consumers to reap the benefits of the existing tax holidays, they need to be in a position to spend on the categories these holidays are for, such as clothing, books, school suppliers and computers, which is conditional on schools reopening and how they reopen.

Source: US Energy Information Administration/S&P Dow Jones Indices/US Bureau of Labor Statistics/US Bureau of Economic Analysis/University of Michigan/US Census Bureau/Federation of Tax Administrators/Coresight Research[/caption]

The federal stimulus package rolled out in March included one-time payments of $1,200 to individual taxpayers, $2,400 to married couples and $500 for each child under 17. However, this may not be adequate to boost overall spending during the back-to-class season as consumers may have already spent the money to offset existing reductions in income that households experienced from salary reductions and job losses.

Source: US Energy Information Administration/S&P Dow Jones Indices/US Bureau of Labor Statistics/US Bureau of Economic Analysis/University of Michigan/US Census Bureau/Federation of Tax Administrators/Coresight Research[/caption]

The federal stimulus package rolled out in March included one-time payments of $1,200 to individual taxpayers, $2,400 to married couples and $500 for each child under 17. However, this may not be adequate to boost overall spending during the back-to-class season as consumers may have already spent the money to offset existing reductions in income that households experienced from salary reductions and job losses.

Brands’ and Retailers’ Back-to-Class Planning

The past season left retailers with considerable unsold inventory, but many hope to enter the season with clean inventories. Several retailers have announced plans for BTS and BTC assortments in the hope that the forthcoming season will be more encouraging than the quarter that is behind us.- American Eagle Outfitters expects to enter fall strong with new BTS inventory in July. Management noted that it is planning conservatively for the season, and its “team worked diligently to right-size the merchandise.”

- On its first-quarter conference call, Hanesbrandsreported that it expects a good BTS season and that its reopened stores are actively planning for it.

- Kohl’s CEO Jill Timm stated at Cowen’s 2020 New Retail Ecosystem Summit in early June that the retailer has pulled forward some BTS inventory receipts for the end of June and early July in order to offer freshness to shoppers as we go into the BTS and holiday seasons.

- Ross Stores noted on its conference call in May that it will wait to buy BTS inventory closer to the season to understand what the scenario will be like in terms of school reopenings and whether it will be a “traditional” BTS season.

- VF Corporation’s Executive Chairman Steven Rendle noted at the Stifel 2020 Virtual Cross Sector Insight Conference in early June that the company is positive about its forward view of BTS and holiday merchandise.